UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

MONDELĒZ INTERNATIONAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

SHAREHOLDER ENGAGEMENT Spring 2022

FORWARD-LOOKING STATEMENTS This presentation contains a number of

forward-looking statements. Words, and variations of words, such as “will,” “expect,” “may,” ”position” and similar expressions are intended to identify our forward-looking statements, including, but

not limited to, statements about: our future performance, including our future revenue growth; our strategy to accelerate consumer-centric growth, drive operational excellence and create a winning growth culture; and our environmental, social and

governance strategies, goals and initiatives. These forward-looking statements involve risks and uncertainties, many of which are beyond our control, and many of these risks and uncertainties are currently amplified by and may continue to be

amplified by the COVID-19 pandemic, including the spread of new variants of COVID-19 such as Omicron. Important factors that could cause our actual results to differ materially from those described in our forward-looking statements include, but are

not limited to, the impact of ongoing or new developments in the war in Ukraine, related current and future sanctions imposed by governments and other authorities, and related impacts on our business, growth, reputation, prospects, financial

condition, operating results (including components of our financial results), cash flows and liquidity; uncertainty about the effectiveness of efforts by health officials and governments to control the spread of COVID-19 and inoculate and treat

populations impacted by COVID-19; uncertainty about the reimposition or lessening of restrictions imposed by governments intended to mitigate the spread of COVID-19 and the magnitude, duration, geographic reach and impact on the global economy of

COVID-19; the ongoing, and uncertain future, impact of the COVID-19 pandemic on our business, growth, reputation, prospects, financial condition, operating results (including components of our financial results), cash flows and liquidity; risks from

operating globally including in emerging markets; changes in currency exchange rates, controls and restrictions; volatility of commodity and other input costs and availability of commodities; weakness in economic conditions; weakness in consumer

spending; pricing actions; tax matters including changes in tax laws and rates, disagreements with taxing authorities and imposition of new taxes; use of information technology and third party service providers; unanticipated disruptions to our

business, such as malware incidents, cyberattacks or other security breaches, and our compliance with privacy and data security laws; global or regional health pandemics or epidemics, including COVID-19; competition and our response to channel

shifts and pricing and other competitive pressures; promotion and protection of our reputation and brand image; changes in consumer preferences and demand and our ability to innovate and differentiate our products; the restructuring program and our

other transformation initiatives not yielding the anticipated benefits; changes in the assumptions on which the restructuring program is based; management of our workforce and shifts in labor availability; consolidation of retail customers and

competition with retailer and other economy brands; changes in our relationships with customers, suppliers or distributors; compliance with legal, regulatory, tax and benefit laws and related changes, claims or actions; the impact of climate change

on our supply chain and operations; strategic transactions; significant changes in valuation factors that may adversely affect our impairment testing of goodwill and intangible assets; perceived or actual product quality issues or product recalls;

failure to maintain effective internal control over financial reporting or disclosure controls and procedures; volatility of and access to capital or other markets, the effectiveness of our cash management programs and our liquidity; pension costs;

the expected discontinuance of London Interbank Offered Rates and transition to any other interest rate benchmark; and our ability to protect our intellectual property and intangible assets. There may be other factors not presently known to us or

which we currently consider to be immaterial that could cause our actual results to differ materially from those projected in any forward-looking statements we make. We disclaim and do not undertake any obligation to update or revise any

forward-looking statement in this presentation except as required by applicable law or regulation. ABOUT OUR ESG GOALS Reported performance against our quantitative ESG goals covers the period from January 1, 2021 to December 31, 2021, and includes

manufacturing facilities under our direct and indirect control, and excludes acquisitions since 2018, unless stated otherwise. Where quantitative goals are linked to revenue, coverage is for all Mondelēz Internation al revenue (excluding

acquisitions since 2018) except Venezuela, for which results are excluded from our consolidated financial statements. Where quantitative goals are linked to operations, coverage is for all operations under the control of our integrated supply chain

function (excluding acquisitions since 2018); data for external manufacturing includes estimations. Our 2015 acquisition of Enjoy Life Foods is included only in our reporting for our packaging innovation goal. In addition, historical, current and

forward-looking sustainability- related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future. The

information included in, and any issues identified as material for purposes of, this document may not be considered material for SEC reporting purposes. In the context of this disclosure, the term “material” is distinct from, and should

not be confused with, such term as defined for SEC reporting purposes. NON-GAAP FINANCIAL MEASURES All results shared with this presentation are non-GAAP unless noted that we are referring to our results on a GAAP basis. Please see GAAP to non-GAAP

reconciliations at the end of this presentation for comparable GAAP measures. Refer to the definitions of these measures in our earnings release for Q1 2022 located at www.mondelezinternational.com/investors. 2

MONDELĒZ INTERNATIONAL TO LEAD THE FUTURE OF SNACKING We are one of the

world’s largest snack companies, with a strong portfolio of brands enjoyed in over 150 countries 1 2021 BUSINESS OVERVIEW REVENUE BY MARKET AND CATEGORY North America Europe Cheese & Beverages Grocery 4% 28.9% 38.8% 9 global brands and 60+

local jewel brands 7% Gum & Candy 10% Biscuits ~79,000 employees worldwide $28.7B 47% 2021 NET REVENUES Latin America AMEA Snacking is a $1.2T consumer behavior 9.8% Chocolate 22.5% 32% OUR STRATEGY HAS TRANSFORMED MONDELĒZ INTERNATIONAL

INTO A HIGHER GROWTH, MORE AGILE COMPANY CULTURE GROWTH EXECUTION We are accelerating consumer-centric We are driving operational excellence in We are building a winning growth culture growth by taking a broader approach to sales execution,

marketing, and supply chain that leverages local commercial expertise, snacking, balancing our investment across and generating continuous cost and quality invests in talent and key capabilities while both global and local brands, transforming

improvement across the business enabling the business to move with greater our marketing and investing in key markets speed and agility 3 1 Revenue breakdowns are based on 2021 net revenues.

CONSISTENT RESULTS DEMONSTRATE SUSTAINABLE LONG-TERM GROWTH Effective

execution of our consumer-led growth strategy led to a strong 2021, positioning Mondelēz International for continued and accelerated growth 1 OVER 4% ORGANIC NET REVENUE CAGR FROM 2018 THROUGH 2021 TOTAL SHAREHOLDER RETURN 18.2% VOLUME-LED

PROFiTABLE GROWTH LOCAL-FiRST APPROACH 14.2% Pivoting from a cost and percentage Simplifying model to make decisions margin focus to a volume-led growth closer to the consumer to increase and profit dollar focus clarity and accountability 8.0%

CONSUMER-CENTRiC FOCUS ALiGNED INCENTiVES Developing a culture that is consumer- Better aligning our incentives to our strategy to stimulate growth-driving centric and increasingly agile MDLZ Performance Peer S&P 500 behaviors and a winning

culture 2 Group Median 4 1 Annualized total shareholder return during Dirk Van de Put’s tenure (11/20/2017 – 12/31/2021). 2 See 2022 Proxy Statement for companies in the Performance Peer Group.

���� PROPOSAL 1: ELECTiON OF THE TEN DiRECTOR

NOMiNEES DIVERSE PERSPECTIVES AND EXPERTISE ENABLE STRONG BOARD OVERSIGHT Our director nominees’ considerable leadership experience at global companies and diverse backgrounds enable highly effective, independent Board oversight and rigorous

decision making Lewis W.K. Booth Charles E. Bunch Ertharin Cousin Lois D. Juliber Jorge S. Mesquita Joined 2016 Joined 2012 Joined 2022 Joined 2007 Joined 2012 Retired Exec. Former EVP & CFO, Founder, President Former Vice Chairman Former CEO,

BlueTriton Chairman, Ford Motor Company and CEO, Food Systems & COO, Colgate- Brands PPG Industries For The Future Institute Palmolive Company Patrick T. Siewert Jane Hamilton Christiana S. Shi Michael A. Todman Dirk Van de Put Joined 2012

Nielsen Joined 2017 Joined 2016 Joined 2020 1 Lead Director Joined 2021 Former President, Former Vice Chairman & CEO, COO and CFO, Managing Director & Direct-to-Consumer, Chairman, Whirlpool Mondelēz International Ralph Lauren Partner,

The Carlyle Nike, Inc. Corporation Group 2 2 TENURE DIVERSITY AGE DIVERSITY GENDER DIVERSITY ETHNIC DIVERSITY 3 3 3 60s Female Black 6 2 4 1 1 50s 6 8 3 0-3 4-6 7-9 10 Male White years years years years+ 70s 5 1 Mr. Siewert will become Lead Director

following the Annual Meeting. 2 As of March 14, 2022.

���� PROPOSAL 1: ELECTiON OF THE TEN DiRECTOR

NOMiNEES ROBUST BOARD OVERSIGHT OF E&S RISKS AND OPPORTUNITIES • Reviews ESG strategy and progress, including environmental and social sustainability at least twice annually • Reviews progress against Diversity, Equity &

Inclusion goals at least twice annually DiRECTORS • Receives reports from Board committees, including on the topics outlined below WORLD-CLASS ENVIRONMENTAL & SOCIAL World-Class HUMAN CAPITAL MANAGEMENT SAFETY AND SECURITY SUSTAINABILITY

Safety Overseen by People & Overseen by Audit Committee Overseen by Governance, Membership Compensation Committee & Sustainability Committee The Audit Committee oversees the pursuit of a zero incident, zero defect safety The People &

Compensation Committee The Governance, Membership & culture, as well as information security and oversees talent sourcing, employee Sustainability Committee oversees our ESG cybersecurity risk management development and diversity policies

framework Key initiatives and progress include: Key areas of safety and security risk The Committee oversees policies and oversight include: programs related to corporate citizenship, Published EEO-1 disclosure & environmental & social

sustainability, and 1 DE&I goals public policy including: 1 Occupational health Implementing gender equality 2 Sustainability & environmental initiatives throughout business 1 2 Personal safety responsibility Developing diverse “early

3 2 Food labeling, marketing & packaging career stage” talent 3 Process safety Appointed Chief Global Information technology and 4 3 Philanthropic & political activities 4 Diversity Officer cybersecurity 6

���� PROPOSAL 2: ADViSORY VOTE TO APPROVE

EXECUTiVE COMPENSATiON FOR OUR LiSTED OFFiCERS INCENTIVE COMPENSATION PROGRAMS TARGET STRETCH PERFORMANCE PAY ELEMENT VEHICLE 2021 PERFORMANCE METRICS 2021 OUTCOMES Cash Market competitive to retain key talent Our 2021 Incentive Plan outcomes

reflect BASE SALARY our Board’s approach to setting targets as stretch goals, which would also reflect 80% Financial Performance Metrics above average performance within • Organic Volume Growth (15%) +/- 30pp our industry if achieved

• Organic Net Revenue Growth (15%) market • Defined Gross Profit Dollars (30%) ANNUAL share • Defined Operating Income (20%) 100% At-Risk Cash overlay • Free Cash Flow (20%) • Financial Performance Metrics earned

INCENTIVE at 89% of target 20% Strategic Key Progress Indicators (KPIs) • Includes sustainability/recyclability and other metrics • Strategic KPIs earned at 100% related to growth, execution and culture (corporate), 125% (Europe), 133%

(AMEA) of target • 25% Organic Net Revenue Growth 75% Performance Share Units • Total annual incentive (for CEO and 3-year cliff vest • 25% Adjusted EPS Growth NEOs) earned at 91%-149% 1-year holding requirement post vest •

50% Relative Total Shareholder Return 25% Stock Options LONG-TERM 2019-2021 PSUs earned at 160% of target, 3-year ratable vest reflecting: Stock Price 1-year holding requirement after INCENTIVE • Above target Organic Net Revenue exercise

Growth • Above target Adj. EPS growth • Cap PSU payout at target if TSR is negative at end of performance period th • Above median performance (55 percentile) to achieve target payout on Relative TSR • 67th percentile

annualized relative TSR Annual KPIs – Growth Annual KPIs – Execution Annual KPIs – Culture ALIGNMENT WITH • Priority Market Share • Pricing to Offset COGS • Depth of Talent • Productivity • Women in

Leadership • Growth Channel Progress STRATEGY • Well-being Revenue Growth • Recyclability/Sustainability • Employee Engagement 7

���� PROPOSAL 4: PROPOSAL ON RACiAL EQUiTY AUDiT

OUR COMMITMENT TO DIVERSITY, EQUITY AND INCLUSION (DEI) Mondelēz International takes seriously our commitment to advancing racial equality and diversity, equity and inclusion among our colleagues, culture and communities. We believe our

well-established process and framework to address racial equality and DEI already fulfill the objectives of this proposal o Recently completed third-party Diversity & Inclusion Advisory Review in the US to assess progress (see slide 11 for

details) Continuously evolving and o Established history of programs addressing racial justice across operations, including 10 years of our Cocoa Life program, which enhancing our approach helps improve the livelihoods of cocoa farmers o Board

conducts bi-annual reviews of DEI strategy with Chief Global Diversity Officer o Directors have strong DEI skillsets, including a new director with extensive experience in food equity Strong Board oversight o Robust shareholder engagement, including

on DEI topics, with regular Board updates on feedback o Disclosure of our racial and gender representation goals and progress, as well as our consolidated EEO-1 statement Transparent reporting o Regular review and disclosure of gender pay equity

globally and racial pay equity in US on our progress o Each business unit maintains short- and long-term goals on three strategic DEI pillars o Founding member of International Food & Beverage Alliance, with global commitments to the World

Health Organization on Leading in responsible and nutrition and responsible food marketing inclusive marketing o Board oversight of efforts to promote responsible marketing and improve representation in marketing o In 2021, contributed $2.7 million

to scholarships, internships and community support to advance racial equality through Supporting communities through diversity and inclusion initiatives philanthropy and volunteering o Colleagues encouraged to engage and drive change through

Employee Resource Groups o Working with The Recycling Partnership since 2021 to focus on improving recycling practices in communities through education Direct investment in research and direct action; in addition, joined the Film and Flexible

Coalition of the organization to expand focus into flexible packaging o Our partnership will expand further through the TRP Inclusion Fund where we join their strategic efforts to deliver an equitable and education recycling system with a goal of

providing Black people and people of color equal access to recycling services 8

���� PROPOSAL 4: PROPOSAL ON RACiAL EQUiTY AUDiT

BOARD-LEVEL DEI OVERSIGHT AND KEY INITIATIVES Our Board values diversity, equity and inclusion, and together our Board and People and Compensation Committee provide robust oversight of our DEI strategy BOARD-LEVEL OVERSIGHT FULL BOARD OVERSIGHT ROLE

OF PEOPLE AND COMPENSATION COMMITTEE • Review of key human resources policies and practices related to our objectives and • Review of DEI strategy, stakeholder interests, risks and programs for diversity progress with our Chief Global

Diversity Officer at least • Review of our performance against our DEI initiatives twice annually • Oversight of DEI priorities, including talent acquisition and development practices and pay equity matters • Embrace and encourage

our DEI culture, including as a • Oversight of the incorporation of specific DEI metrics in our executive compensation signatory to the Board Diversity Action Alliance program • Ensure our Board continues to benefit from the diversity of

perspectives provided by directors from ROLE OF GOVERNANCE, MEMBERSHIP AND SUSTAINABILITY COMMITTEE diverse backgrounds by actively seeking out women and minority director candidates • Monitor issues, trends and internal and external factors

and relationships, including related to racial equity, that may affect our public image and reputation KEY INITIATIVES $1 Billion Goal <1% 100% Goal Progressing on our goal of $1 billion in Less than 1% difference in pay between men Driving human

rights due diligence system diverse supplier spend with minority and and women according to our 2021 global pay coverage in own operations & tier-1 suppliers 1 women-owned businesses globally by 2024 equity analysis; pay for white and non-white

with goal of 100% by 2025 employees in the U.S. is at parity 9 1 2021 global pay equity analysis conducted with the support of a third-party expert and encompassed 81 countries and over 32,000 salaried employees.

���� PROPOSAL 4: PROPOSAL ON RACiAL EQUiTY

AUDiT BUILDING A DIVERSE WORKFORCE We are committed to a workplace that reflects the diversity of our consumers and aims to attract, develop and nurture 1 diverse talent. In response to investor feedback, we published for the first time our

consolidated EEO-1 Report in May 2021 OUR GOALS 2X% 2X% Include specific DEI metrics as a part of By 2024, double % U.S. Black the strategic scorecard within our Annual By 2024, double % of women in representation in management, over 2020 Incentive

Plan for our CEO and other leadership roles, over 2018 base base senior leaders At the end of 2021, Black employees At the end of 2021, women held 39% of In 2021 our leadership team continued held 5.1% of U.S. management roles executive leadership

roles to work on building a winning culture, (defined as Director and above) as (defined as the Mondelēz Leadership achieving performance ahead of compared to 3.2% at the end of 2020, a Team plus one level below) expectations on DEI in

leadership KPIs 1.9 percentage point increase 10 1 Note that the EEO-1 categories are not necessarily representative of how our industry or workforce is organized. 2021 PROGRESS

���� PROPOSAL 4: PROPOSAL ON RACiAL EQUiTY

AUDiT REVIEW OF DIVERSITY & INCLUSION AT MONDELĒZ US Third-party review of Mondelēz US Diversity & Inclusion (D&I) program, commissioned by Internal Audit The review found that we have built a strong D&I framework and

roadmap and excel within the consumer packaged goods (CPG) industry in terms of Women in Leadership and Black Management representation. Overall, MDLZ was assessed at the ‘Established’ maturity level in line with the CPG industry average

US D&I PROGRAM MATURiTY ASSESSMENT 2021 2022+ CURRENT STRENGHTS KEY OPPORTUNITIES Basic Developing Established Advanced Leading GOVERNANCE & OPERATiNG MODEL GOVERNANCE & OPERATiNG MODEL Overall D&I • Evaluate D&I resource

needs • Robust D&I governance framework Function • Further enable People Managers to • Leadership support and alignment with Governance & advance progress on D&I priorities D&I roadmap Operating Model TALENT

MANAGEMENT • D&I goals established across talent lifecycle • Continue to set and track D&I objectives Talent Acquisition TALENT MANAGEMENT • Consider expanding D&I objective setting to all managerial levels •

Leading D&I programs in place (e.g., D&I Talent • Assess for potential equity barriers, if Management impact awards) any, in talent lifecycle LEARNiNG & DEVELOPMENT Learning & METRiCS & REPORTiNG Development • Quality

training content through the D&I • Enhance processes & controls for KPI learning hub calculation & reporting Metrics & METRiCS & REPORTiNG Reporting • Develop strategy to encourage self- reported data collection

• Quarterly reporting of D&I KPIs Mondelez Current CPG Industry Average based on Refinitiv ranking 11

���� PROPOSAL 4: PROPOSAL ON RACiAL EQUiTY

AUDiT EMPOWERING PEOPLE TO SNACK RIGHT We define our ESG goals and progress, including those related to DEI, through the lens of Snacking Made Right and are pursuing our ambition of building a more sustainable snacking company BUILDING A MORE

SUSTAINABLE SNACKING COMPANY 1 More sustainably sourced ingredients In May 2022, we plan to publish the 2021 edition of our Snacking Made Right 1 from empowered communities Report, highlighting how our differentiated approach to ESG drives global

progress and creates long-term value 2 We are constantly evaluating the impact that major societal issues such as 5 Decreasing impact safety, supply security, environmental footprint and consumer well-being have on climate on our business and use

them to shape our strategic initiatives Net zero & landscape packaging As we continue building a more sustainable snacking company, we remain waste focused on: 6 • More sustainably sourced ingredients from empowered communities Strong

Governance • Decreasing impact on climate and landscape • Diversity, equity and inclusion for colleagues, culture and communities • Products that meet evolving consumer snacking needs • Net zero packaging waste and circular

pack economy In September, we successfully launched our first green bond, the largest ever in the Packaged and Consumer Good industry at the time of issue. We intend to allocate proceeds to eligible projects that further our sustainability

objectives 4 3 Products meeting We are tracking adoption of standards such as those published by SASB and evolving snacking needs Diversity, equity & TCFD, and we disclose alignment indexes to SASB and TCFD on our website inclusion for

colleagues, culture & communities 1 Through Cocoa Life Program. 12

���� PROPOSAL 4: PROPOSAL ON RACiAL EQUiTY

AUDiT MORE SUSTAINABLE GROWTH THE RIGHT WAY FOR PEOPLE & PLANET Our purpose-led innovative approach, including our DEI goals, is integrated within our business strategy. We prioritize where we can have greater impact and focus on long-term more

sustainable outcomes ENViRONMENTAL SOCiAL REDUCiNG ENViRONMENTAL iMPACT & SOURCING SUSTAINABLY PROMOTiNG RiGHTS, COMMUNiTiES & WELL-BEiNG DiVERSiTY, EQUiTY CONSUMER EMPLOYEE iNGREDiENTS CLIMATE PACKAGING SOCiAL iMPACT & INCLUSiON

WELL-BEING WELL-BEiNG Signature sourcing Combat climate Strive for net zero Empower programs: Cocoa Promote human Champion Build a culture change through waste packaging consumers with Life, Harmony rights across our diversity, equity & which

enhances end-to-end through less and contemporary Well- Wheat and value chain and inclusion for our the safety, approach to our better packaging being options and sustainable Palm enable Colleagues, physical & mental goal to reach net and

improved choices, mindful Oil building empowered Culture & well-being of our zero emissions systems aiming for snacking habits and resilient communities Communities colleagues across scopes 1, 2 a circular pack portion control landscapes &

and 3 by 2050 economy supply chains GOVERNANCE: PROMOTING ACCOUNTABiLiTY, STRONG BOARD OVERSiGHT, TRANSPARENCY, STAKEHOLDER ENGAGEMENT, ALIGNED iNCENTiVES 13

���� PROPOSAL 4: PROPOSAL ON RACiAL EQUiTY

AUDiT 2021 SUSTAINABILITY PERFORMANCE DASHBOARD Building on our strong 2020 results, we continued to make good progress on our sustainability goals in 2021 as we work toward our 2025 goals and develop plans and goals for 2030 2021 Actual 2025 Target

-10% in end-to-end 1 In process • CO Emissions Reduction in end-to-end CO e emissions 2 2e CO2e emissions vs 2018 Environmental Impact -28% -15% vs 2018 • Waste Reduction in food waste in internal manufacturing -6.4% -10% vs 2018 •

Water Reduction in absolute water usage in priority sites 95% • 100% packaging designed to be recyclable Net Zero Packaging designed to be recyclable • -5% virgin plastic vs 2020 • Packaging Packaging Waste In process • -25%

rigid virgin plastic vs 2020 • 5% recycled content Cocoa volume for chocolate brands sourced through 2 75% 100% • Cocoa Cocoa Life Sustainable Ingredients Maintain 100% Palm Oil 100% • Palm Oil Maintain 100% RSPO certification

volume RSPO certified Social Child Labor Monitoring & Remediation Systems (CLMRS) 61% • Human Rights 100% coverage in Cocoa Life communities in West Africa Sustainability 1 Target of -10% includes all Scopes 1/2/3; we have reduced Scopes 1

& 2 by -23% in 2021 vs. 2018; we are in the process of incorporating and validating our Scope 3 14 interventions into our carbon model for future reporting. 2 +7pp vs 2020.

���� PROPOSAL 4: PROPOSAL ON RACiAL EQUiTY

AUDiT COMPREHENSIVE PACKAGING STRATEGY TO ADDRESS SYSTEMIC CHALLENGES MONDELĒZ INTERNATiONAL PACKAGiNG OVERViEW Our ambition is to reduce our overall packaging footprint, design our packaging to be recyclable and support the development of

infrastructure to physically recycle our packaging. Many of our snacks use lightweight protective plastic packaging. This results in us using 60% less packaging per 1 point of revenue than our peer average. It also brings benefits such as helping

reduce transportation emissions and prolonging food shelf-life. MONDELĒZ INTERNATiONAL GLOBAL SUSTAiNABLE WORKiNG WiTH iNDUSTRY PARTNERS TO PACKAGiNG STRATEGY DRiVE SYSTEMiC CHANGE Industry-wide collaboration is needed to achieve scalable

impact. We work with multiple partners to identify solutions, and advocate for complete infrastructure development. PARTNERSHiP EXAMPLES • Working together with The Recycling Partnership (TRP) to help communities improve recycling practices

• Supporter of TRP’s Inclusion Fund to help provide people of color equal access to recycling by researching potential barriers and solutions, and providing recycling infrastructure and education resources • US and Canadian

Plastics Pact founding members • Establishing new goals, driving innovation and industry partnerships, advocating for infrastructure establishment and inclusion of flexibles • Joined with focus on proactive engagement in public policy on

infrastructure development in US • Development of legislative solutions; industry coalition advocating for legislative change 1 Source: EMF Global Commitment 2021 report, 2020 data metric tons plastic, public data on 2020 revenue. Peer 2018

EMF large FMCG founding members. 15

���� PROPOSAL 4: PROPOSAL ON RACiAL EQUiTY

AUDiT DEEP CORPORATE AND BRAND PARTNERSHIPS AND ALLIANCES Actively engaged with leading organizations; third-party recognition for diversity and inclusion, transparency and accountability 2021 CPA-ZICKLIN TRENDSETTER 16

���� PROPOSAL 5: PROPOSAL REQUiRiNG iNDEPENDENT

CHAiR OF THE BOARD STRONG INDEPENDENT LEAD DIRECTOR WITH ROBUST RESPONSIBILITIES Maintaining flexibility in Board leadership structure is in Patrick T. Siewert the best interest of shareholders Independent Lead Director (following the 2022 AGM)

ü By-Laws provide necessary flexibility for Board to make thoughtful decisions about appropriate leadership structure Managing Director & Partner, The Carlyle Group ü Robust Lead Director role with substantive leadership

responsibilities Director Since 2012 ü Corporate governance structures and processes consistent with best practices that promote effective oversight and accountability ü Continued strong performance under existing leadership structure As

part of our thoughtful succession process, the Board voted to appoint Patrick Siewert as Independent Lead Director following the Annual Meeting Lead Director’s significant authority and responsibilities protect shareholder interests by

promoting strong management oversight and accountability ü Serves as a liaison between the independent directors and the Chairman and CEO ü Seeks input from independent directors and advises Chairman and CEO on schedule, agenda topics and

content of related briefing materials for Board meetings ü Reviews and approves meeting agendas and content of Board briefing materials ü Reviews and approves allocation of time between Board and committee meetings ü Presides at Board

meetings at which the Chairman and CEO is not present, including executive sessions of the independent directors ü Calls meetings of the independent directors or of the Board as needed ü Facilitates effective communication and interaction

between the Board and management ü Serves as an ex officio non-voting member of all Board committees ü Provides input into the design of the annual Board, committee and director self-evaluation process ü Works with the Governance

Committee to develop recommendations for committee structure, membership, rotations and chairs ü Available for consultation and direct communication with our major shareholders ü Performs such other duties as the Board may delegate from

time to time 17

WE REQUEST YOUR CONTINUED SUPPORT The Board values the trust that you place

in us when you invest in Mondelēz International and we are committed to delivering on your expectations. We encourage you to vote with us at the 2022 Annual Meeting ELECTION OF DIRECTOR NOMINEES – RECOMMEND FOR ü Our Board’s

extensive and diverse experience enables robust, independent oversight ü Demonstrated commitment to refreshment ensures our Board is equipped to create long-term value SAY ON PAY – RECOMMEND FOR ü Our compensation structure is

closely aligned with our strategy and reflects shareholder feedback ü Pay outcomes reward long-term value creation and progress against our KPIs SHAREHOLDER PROPOSAL – RECOMMEND AGAINST PROPOSAL ON RACIAL EQUITY AUDIT X Our Board and

leadership are committed to advancing racial equality and diversity, equity and inclusion X Our existing actions to address racial equality and DEI internally and externally already fulfill the objectives of Z this proposal SHAREHOLDER PROPOSAL

– RECOMMEND AGAINST PROPOSAL REQUIRING INDEPENDENT CHAIR X Current By-Laws provide flexibility for our Board to make thoughtful decisions about the appropriate leadership structure for the Company X Our Lead Director role is robust and

includes substantive leadership responsibilities 18

GAAP TO NON-GAAP RECONCILIATION Net Revenues to Organic Net Revenue (in

millions of U.S. dollars) (unaudited) For the Twelve Months Ended December 31 2019 2020 2021 3 Year CAGR Reported (GAAP) $ 25,868 $ 26,581 $ 28,720 Divestitures (55) - (35) Acquisitions (88) (445) (254) Currency 1,154 637 (462) Organic (Non-GAAP) $

26,879 $ 26,773 $ 27,969 For the Twelve Months Ended December 31 2018 2019 2020 Reported (GAAP) $ 25,938 $ 25,868 $ 26,581 Divestitures (126) (55) - Organic (Non-GAAP) $ 25,812 $ 25,813 $ 26,581 % Change Reported (GAAP) (0.3)% 2.8 % 8.0 % 3.4 %

Organic (Non-GAAP) 4.1 % 3.7 % 5.2 % 4.3 % 19 19

BUILDING A MORE SUSTAINABLE SNACKING COMPANY Strong Promoting DEI, Robust

board Impactful DEI & financial oversight & sustainability rights, communities performance governance agenda & well-being practices 20

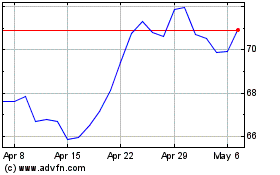

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Apr 2023 to Apr 2024