Minerva Neurosciences Reports Second Quarter 2020 Financial Results and Business Updates

August 03 2020 - 7:30AM

Minerva Neurosciences, Inc. (NASDAQ: NERV), a clinical-stage

biopharmaceutical company focused on the development of therapies

to treat central nervous system (CNS) disorders, today reported key

business updates and financial results for the quarter ended June

30, 2020.

Clinical Pipeline Update

Roluperidone

On May 29, 2020, the Company announced that the Phase 3 trial of

roluperidone to treat negative symptoms in schizophrenia did not

meet its primary (reduction in PANSS Marder Negative Symptoms

Factor Score or NSFS) and key secondary (improvement in the

Personal and Social Performance Scale Total Score or PSP)

endpoints.

Although limited inferences can be drawn from these data,

unadjusted statistically significant separations from placebo were

observed in NSFS at Week 4 for both doses and at Week 8 for the 64

mg dose. The 64 mg dose was statistically significantly

different from placebo as measured by change in PSP at all other

assessment timepoints.

The patients receiving active treatment showed numerically

superior improvements in NSFS to placebo, and a higher number of

responders as measured by NSFS and total PANSS scores was observed

in the roluperidone treatment groups. The reduction in

negative symptoms scores in the 64 mg arm of roluperidone

translated into functional improvement as measured by

PSP.

Roluperidone was generally well tolerated, and Phase 3 safety

data were consistent with such data from the Phase 2b trial.

“We continue our in-depth analyses of the Phase 3 trial with

roluperidone and will be contacting the U.S. Food and Drug

Administration to request a meeting to discuss our plans regarding

the next steps in the clinical development of roluperidone,” said

Dr. Remy Luthringer, Executive Chairman and Chief Executive Officer

of Minerva. “Although the trial did not meet its primary endpoint

due, we believe, to an unexpected high placebo response, we are

encouraged by the study results. The consistency of reduction

in overall negative symptoms and in the most important subtypes of

these symptoms is similar to that observed in the previous Phase 2b

study.”

“The integrated analysis of the Phase 2b and Phase 3 data show a

highly significant separation between the two doses of roluperidone

and placebo throughout the treatment period,” said Dr.

Luthringer. “We believe the improvement in negative symptoms

and the resulting functional improvement support the potential of

roluperidone. This finding will help guide our discussions

with the FDA regarding this potential treatment for negative

symptoms, which remain one of the most important causes of everyday

disability and a critical unmet need for patients with this

disease.”

Seltorexant

On July 1, 2020, the Company announced that it exercised its

right to opt out of its agreement with Janssen Pharmaceutica NV

(Janssen) for the future development of seltorexant

(MIN-202). As a result, the Company will collect a royalty on

worldwide sales of seltorexant in all indications in the mid-single

digits, with no financial obligations to Janssen.

“With respect to seltorexant, the decision to opt out of our

agreement with Janssen at this stage of the program enables us to

retain a meaningful financial interest in the future revenue stream

of a compound with significant commercial potential while

eliminating the Company’s financial obligations to a substantial

Phase 3 program encompassing major depressive disorder and

insomnia,” said Dr. Luthringer. “Furthermore, opting out will

help align our human and financial resources with our primary focus

on defining a path to approval of our lead compound,

roluperidone.”

Second Quarter 2020 Financial Results

- Cash Position: Cash, cash equivalents,

restricted cash and marketable securities as of June 30, 2020 were

approximately $35.3 million.

- R&D Expenses: Research and development

(R&D) expenses were $5.8 million in the second quarter of 2020,

compared to $8.3 million in the second quarter of 2019, a

decrease of approximately $2.5 million.For the six months ended

June 30, 2020, R&D expenses were $13.8 million, compared to

$19.9 million for the six months ended June 30, 2019, a decrease of

approximately $6.1 million.The decreases in R&D expenses during

the quarter and six months ended June 30, 2020 primarily reflect

lower development expenses for the Phase 3 clinical trial of

roluperidone and the Phase 2b clinical trial of MIN-117.The Company

expects R&D expenses to decrease during 2020, as it has

completed the MIN-117 clinical trial and the 12-week, double-blind

portion of the Phase 3 clinical trial of roluperidone.

- G&A Expenses: General and administrative

(G&A) expenses were $5.9 million in the second quarter of 2020,

compared to $4.6 million in the second quarter of 2019, an increase

of approximately $1.3 million.For the six months ended June 30,

2020, G&A expenses were $10.1 million, compared to $9.3 million

for the same period in 2019, an increase of approximately $0.8

million.The increases in G&A expenses during the quarter and

six months ended June 30, 2020 were primarily due to increases in

non-cash stock-based compensation expenses and severance

benefits.

- Net Income/Loss: Net income was $29.5 million

for the second quarter of 2020, or net income per share of $0.75

and $0.73 basic and diluted, respectively, as compared to a net

loss of $12.5 million, or a loss per share of $0.32 basic and

diluted for the second quarter of 2019. Net income was $17.4

million for the first six months of 2020, or net income per share

of $0.44 and $0.43 basic and diluted, respectively, as compared to

a net loss of $28.3 million, or a loss per share of $0.73 basic and

diluted for the first six months of 2019.As a result of opting out

of the agreement with Janssen, the Company recognized $41.2 million

in collaborative revenue during the second quarter of 2020 which

had previously been included on the balance sheet under deferred

revenue. This amount represents the $30 million payment made

by Janssen in 2017 and $11.2 million in previously accrued

collaborative expenses forgiven by Janssen upon the effective date

of the Amendment. The Company does not have any future

performance obligations under the agreement and will recognize any

future royalty revenues in the periods of the sale of products

related to the Agreement.

Conference Call Information:

Minerva Neurosciences will host a conference call and live audio

webcast today at 8:30 a.m. Eastern Time to discuss the quarter and

recent business activities. To participate, please dial (877)

312-5845 (domestic) or (765) 507-2618 (international) and refer to

conference ID 8687621.

The live webcast can be accessed under “Events and

Presentations” in the Investors and Media section of Minerva’s

website at ir.minervaneurosciences.com. The archived webcast

will be available on the website beginning approximately two hours

after the event for 90 days.

About Minerva Neurosciences:

Minerva’s portfolio of compounds includes: roluperidone

(MIN-101), in clinical development for schizophrenia; a potential

royalty stream from seltorexant (MIN-202 or JNJ-42847922), in

clinical development for insomnia and MDD; and MIN-301, in

pre-clinical development for Parkinson’s disease. Minerva’s common

stock is listed on the NASDAQ Global Market under the symbol

“NERV.” For more information, please visit

www.minervaneurosciences.com.

Forward-Looking Safe Harbor Statement

This press release contains forward-looking statements which are

subject to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, as amended. Forward-looking

statements are statements that are not historical facts, reflect

management’s expectations as of the date of this press release, and

involve certain risks and uncertainties. Forward-looking statements

include statements herein with respect to the timing and scope of

future clinical trials and results of clinical trials with

roluperidone (MIN-101); the clinical and therapeutic potential of

this compound; the likelihood of future sales and a royalty stream

from seltorexant; the timing and outcomes of future interactions

with U.S. and foreign regulatory bodies; our ability to

successfully develop and commercialize our therapeutic products;

the sufficiency of our current cash position to fund our

operations; and management’s ability to successfully achieve its

goals. These forward-looking statements are based on our current

expectations and may differ materially from actual results due to a

variety of factors including, without limitation, whether

roluperidone will advance further in the clinical trials process

and whether and when, if at all, it will receive final approval

from the U.S. Food and Drug Administration or equivalent foreign

regulatory agencies and for which indications; whether any of our

therapeutic products will be successfully marketed if approved;

whether any of our therapeutic product discovery and development

efforts will be successful; management’s ability to successfully

achieve its goals; our ability to raise additional capital to fund

our operations on terms acceptable to us; and general economic

conditions. These and other potential risks and uncertainties that

could cause actual results to differ from the results predicted are

more fully detailed under the caption “Risk Factors” in our filings

with the Securities and Exchange Commission, including our

Quarterly Report on Form 10-Q for the quarter ended June 30,

2020, filed with the Securities and Exchange Commission on

August 3, 2020. Copies of reports filed with the SEC are

posted on our website at www.minervaneurosciences.com. The

forward-looking statements in this press release are based on

information available to us as of the date hereof, and we disclaim

any obligation to update any forward-looking statements, except as

required by law.

| |

|

|

|

|

|

|

| CONDENSED

CONSOLIDATED BALANCE SHEET DATA |

|

(Unaudited) |

| |

June

30, |

December 31, |

|

|

2020 |

2019 |

| |

(in

thousands) |

|

ASSETS |

| Current

Assets: |

|

|

| Cash and

cash equivalents |

$ |

32,252 |

|

$ |

21,413 |

|

|

Marketable securities |

|

2,996 |

|

|

24,442 |

|

|

Restricted cash |

|

100 |

|

|

100 |

|

| Prepaid

expenses and other current assets |

|

543 |

|

|

1,182 |

|

| Total

current assets |

|

35,891 |

|

|

47,137 |

|

|

Equipment, net |

|

7 |

|

|

16 |

|

| Other

noncurrent assets |

|

15 |

|

|

15 |

|

| Operating

lease right-of-use assets |

|

184 |

|

|

262 |

|

|

In-process research and development |

|

15,200 |

|

|

15,200 |

|

|

Goodwill |

|

14,869 |

|

|

14,869 |

|

| Total

Assets |

$ |

66,166 |

|

$ |

77,499 |

|

| |

|

|

| LIABILITIES

AND STOCKHOLDERS' EQUITY |

| Current

Liabilities: |

|

|

| Accounts

payable |

$ |

3,138 |

|

$ |

2,317 |

|

| Accrued

expenses and other current liabilities |

|

4,080 |

|

|

4,139 |

|

| Operating

leases |

|

185 |

|

|

173 |

|

| Total

current liabilities |

|

7,403 |

|

|

6,629 |

|

| Long-Term

Liabilities: |

|

|

| Deferred

taxes |

|

1,803 |

|

|

1,803 |

|

| Deferred

revenue |

|

- |

|

|

41,176 |

|

|

Noncurrent operating leases |

|

16 |

|

|

111 |

|

| Total

liabilities |

|

9,222 |

|

|

49,719 |

|

|

Stockholders' Equity: |

|

|

| Common

stock |

|

4 |

|

|

4 |

|

|

Additional paid-in capital |

|

326,298 |

|

|

314,512 |

|

|

Accumulated deficit |

|

(269,358 |

) |

|

(286,736 |

) |

| Total

stockholders' equity |

|

56,944 |

|

|

27,780 |

|

| Total

Liabilities and Stockholders' Equity |

$ |

66,166 |

|

$ |

77,499 |

|

| |

|

|

| |

|

|

|

|

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(Unaudited) |

| |

|

Three Months

Ended June 30, |

|

Six Months

Ended June 30 |

| |

|

(in

thousands, except per share amounts) |

|

(in

thousands, except per share amounts) |

| |

|

2020 |

2019 |

|

2020 |

2019 |

| |

|

|

|

|

|

|

|

Collaborative revenue |

|

$ |

41,176 |

|

$ |

- |

|

|

$ |

41,176 |

|

$ |

- |

|

| Operating

expenses: |

|

|

|

|

|

|

| Research

and development |

|

|

5,767 |

|

|

8,320 |

|

|

|

13,849 |

|

|

19,926 |

|

| General

and administrative |

|

|

5,901 |

|

|

4,584 |

|

|

|

10,090 |

|

|

9,290 |

|

| Total

operating expenses |

|

|

11,668 |

|

|

12,904 |

|

|

|

23,939 |

|

|

29,216 |

|

| Gain

(loss) from operations |

|

|

29,508 |

|

|

12,904 |

|

|

|

17,237 |

|

|

29,216 |

|

| |

|

|

|

|

|

|

| Foreign

exchange losses |

|

|

(4 |

) |

|

(7 |

) |

|

|

(13 |

) |

|

(13 |

) |

|

Investment income |

|

|

25 |

|

|

434 |

|

|

|

154 |

|

|

925 |

|

| Net

income (loss) |

|

|

29,529 |

|

|

(12,477 |

) |

|

|

17,378 |

|

|

(28,304 |

) |

| |

|

|

|

|

|

|

| Net income (loss) per share,

basic |

|

$ |

0.75 |

|

$ |

(0.32 |

) |

|

$ |

0.44 |

|

$ |

(0.73 |

) |

| Weighted average shares

outstanding, basic |

|

|

39,483 |

|

|

39,025 |

|

|

|

39,330 |

|

|

38,997 |

|

| Net income (loss) per share,

diluted |

|

$ |

0.73 |

|

$ |

(0.32 |

) |

|

$ |

0.43 |

|

$ |

(0.73 |

) |

| Weighted average shares

outstanding, diluted |

|

|

40,278 |

|

|

39,025 |

|

|

|

40,145 |

|

|

38,997 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact:William B. BoniVP, Investor

Relations/Corp. CommunicationsMinerva Neurosciences, Inc.(617)

600-7376

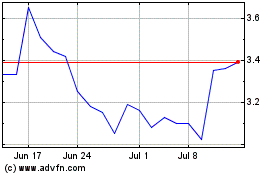

Minerva Neurosciences (NASDAQ:NERV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Minerva Neurosciences (NASDAQ:NERV)

Historical Stock Chart

From Apr 2023 to Apr 2024