Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

July 11 2019 - 6:05AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-220882

Issuer Free Writing Prospectus dated July 10, 2019

Relating to Preliminary Prospectus Supplement dated July 10, 2019

PRICING TERM SHEET

DATED JULY 10, 2019

4.185% SENIOR NOTES DUE 2027

4.663% SENIOR NOTES DUE 2030

The information in this pricing term sheet supplements Micron Technology, Inc.’s (“Micron”) preliminary prospectus supplement, dated July 10, 2019 (the “Preliminary Prospectus Supplement”), and supplements and supersedes the information in the Preliminary Prospectus Supplement to the extent supplementary to or inconsistent with the information in the Preliminary Prospectus Supplement. Terms used herein but not defined herein shall have the respective meanings as set forth in the Preliminary Prospectus Supplement.

|

Issuer:

|

|

Micron Technology, Inc. (NASDAQ: MU)

|

|

|

|

|

|

Securities Offered:

|

|

$900 million aggregate principal amount of 4.185% Senior Notes due 2027 (the “2027 notes”)

|

|

|

|

$850 million aggregate principal amount of 4.663% Senior Notes due 2030 (the “2030 notes” and, together with the 2027 notes, the “notes”)

|

|

|

|

|

|

Maturity Date:

|

|

February 15, 2027 in respect of the 2027 notes

|

|

|

|

February 15, 2030 in respect of the 2030 notes

|

|

|

|

|

|

Interest Rate:

|

|

4.185% per year on the principal amount of 2027 notes

|

|

|

|

4.663% per year on the principal amount of 2030 notes

|

|

|

|

|

|

Interest Payment Dates:

|

|

February 15 and August 15, beginning February 15, 2020, accruing from July 12, 2019

|

|

|

|

|

|

Record Dates:

|

|

January 31 and July 31

|

|

|

|

|

|

Price to Public:

|

|

99.995% for the 2027 notes

|

|

|

|

99.994% for the 2030 notes

|

|

|

|

|

|

Underwriting Discount:

|

|

.400% per 2027 note

|

|

|

|

.450% per 2030 note

|

|

|

|

|

|

Spread to Treasury:

|

|

+225 basis points for the 2027 notes

|

|

|

|

+260 basis points for the 2030 notes

|

|

|

|

|

|

Benchmark:

|

|

UST 1.875% due June 30, 2026 (yielding: 1.935%) for the 2027 notes

|

|

|

|

UST 2.375% due May 15, 2029 (yielding: 2.063%) for the 2030 notes

|

|

|

|

|

|

Ratings:*

|

|

Baa3 (Stable) (Moody’s Investors Service, Inc.)

|

|

|

|

BBB- (Stable) (Fitch Ratings Inc.)

|

|

|

|

BB+ (Positive) (Standard & Poor’s Ratings Services)

|

1

|

Pricing Date:

|

|

July 10, 2019

|

|

|

|

|

|

Closing Date:

|

|

July 12, 2019

|

|

|

|

|

|

CUSIP Numbers:

|

|

595112BP7 for the 2027 notes

|

|

|

|

595112BQ5 for the 2030 notes

|

|

|

|

|

|

ISIN Numbers:

|

|

US595112BP79 for the 2027 notes

|

|

|

|

US595112BQ52 for the 2030 notes

|

|

|

|

|

|

Denominations:

|

|

$2,000 and multiples of $1,000 in excess thereof

|

|

|

|

|

|

Joint Book-Running Managers:

|

|

Goldman Sachs & Co. LLC

|

|

|

|

J.P. Morgan Securities LLC

|

|

|

|

Wells Fargo Securities, LLC

|

|

|

|

ANZ Securities, Inc.

|

|

|

|

BNP Paribas Securities Corp.

|

|

|

|

Citigroup Global Markets Inc.

|

|

|

|

Credit Agricole Securities (USA) Inc.

|

|

|

|

Credit Suisse Securities (USA) LLC

|

|

|

|

HSBC Securities (USA) Inc.

|

|

|

|

ICBC Standard Bank Plc

|

|

|

|

Mizuho Securities USA LLC

|

|

|

|

MUFG Securities Americas Inc.

|

|

|

|

Morgan Stanley & Co. LLC

|

|

|

|

|

|

Co-Managers:

|

|

Academy Securities, Inc.

|

|

|

|

The Williams Capital Group, L.P.

|

|

|

|

|

|

Net Proceeds:

|

|

Micron estimates that the net proceeds from the offering, after deducting underwriting discounts and estimated offering fees and expenses, will be approximately $1.739 billion.

|

|

|

|

|

|

Redemption at Micron’s Option:

|

|

Micron may redeem some or all of the notes of each series, at any time or from time to time prior to the applicable Par Call Date, at a redemption price equal to the greater of (i) 100% of the principal amount of the notes of that series to be redeemed and (ii) the sum of the present values of the remaining scheduled payments of principal and interest thereon that would be due if the notes of such series matured on the applicable Par Call Date (exclusive of interest accrued to the date of redemption), discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the then current Treasury Rate plus 35 basis points for the 2027 notes and 40 basis points for the 2030 notes, plus, in each case, accrued and unpaid interest, if any, on the amount being redeemed to, but excluding, the date of redemption.

|

|

|

|

|

|

|

|

In addition, Micron may redeem any 2027 notes or 2030 notes on or after the applicable Par Call Date at a redemption price

|

2

|

|

|

equal to 100% of the principal amount of the notes redeemed, plus accrued and unpaid interest, if any, to, but excluding, the date of redemption.

|

|

|

|

|

|

|

|

“Par Call Date” means (i) December 15, 2026 with respect to any 2027 notes (two months prior to the maturity date of the 2027 notes) and (ii) November 15, 2029 with respect to any 2030 notes (three months prior to the maturity date of the 2030 notes).

|

* Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

ICBC Standard Bank Plc is restricted in its U.S. securities dealings under the United States Bank Holding Company Act and may not underwrite, subscribe, agree to purchase or procure purchasers to purchase notes that are offered or sold in the United States. Accordingly, ICBC Standard Bank Plc shall not be obligated to, and shall not, underwrite, subscribe, agree to purchase or procure purchasers to purchase notes that may be offered or sold by other underwriters in the United States. ICBC Standard Bank Plc shall offer and sell the notes constituting part of its allotment solely outside the United States.

The issuer has filed a registration statement (including a prospectus) and a prospectus supplement with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the prospectus supplement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and prospectus supplement if you request it by calling Goldman Sachs & Co. LLC toll free at 1-866-471-2526, J.P. Morgan Securities LLC at 212-834-4533 or Wells Fargo Securities, LLC toll free at 1-800-645-3751.

Any legends, disclaimers or other notices that may appear below are not applicable to this communication and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of this communication having been sent via Bloomberg or another system.

3

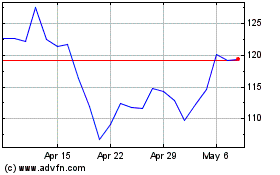

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Apr 2023 to Apr 2024