Micron Technology, Inc. (Nasdaq: MU) today announced results for

its third quarter of fiscal 2021, which ended June 3, 2021.

Fiscal Q3 2021 highlights

- Revenue of $7.42 billion versus $6.24 billion for the prior

quarter and $5.44 billion for the same period last year

- GAAP net income of $1.74 billion, or $1.52 per diluted

share

- Non-GAAP net income of $2.17 billion, or $1.88 per diluted

share

- Operating cash flow of $3.56 billion versus $3.06 billion for

the prior quarter and $2.02 billion for the same period last

year

“Micron set multiple market and product revenue

records in our third quarter and achieved the largest sequential

earnings improvement in our history,” said Micron Technology

President and CEO Sanjay Mehrotra. “Our industry-leading 1α DRAM

and 176-layer NAND now represent a meaningful portion of our

production, and Micron is in the best position ever to capitalize

on the long-term demand trends across the data center, intelligent

edge and user devices.”

|

Quarterly Financial Results |

|

| |

|

GAAP(1) |

|

|

Non-GAAP(2) |

|

|

(in millions, except per share amounts) |

FQ3-21 |

FQ2-21 |

FQ3-20 |

FQ3-21 |

FQ2-21 |

FQ3-20 |

|

Revenue |

$ |

7,422 |

|

$ |

6,236 |

|

$ |

5,438 |

|

$ |

7,422 |

|

$ |

6,236 |

|

$ |

5,438 |

|

| Gross

margin |

|

3,126 |

|

|

1,649 |

|

|

1,763 |

|

|

3,185 |

|

|

2,054 |

|

|

1,804 |

|

| percent of

revenue |

|

42.1 |

% |

|

26.4 |

% |

|

32.4 |

% |

|

42.9 |

% |

|

32.9 |

% |

|

33.2 |

% |

| Operating

expenses |

|

1,327 |

|

|

986 |

|

|

875 |

|

|

821 |

|

|

797 |

|

|

823 |

|

| Operating

income |

|

1,799 |

|

|

663 |

|

|

888 |

|

|

2,364 |

|

|

1,257 |

|

|

981 |

|

| percent of

revenue |

|

24.2 |

% |

|

10.6 |

% |

|

16.3 |

% |

|

31.9 |

% |

|

20.2 |

% |

|

18.0 |

% |

| Net income

attributable to Micron |

|

1,735 |

|

|

603 |

|

|

803 |

|

|

2,173 |

|

|

1,128 |

|

|

941 |

|

| Diluted

earnings per share |

|

1.52 |

|

|

0.53 |

|

|

0.71 |

|

|

1.88 |

|

|

0.98 |

|

|

0.82 |

|

Investments in capital expenditures, net(2) were

$2.04 billion for the third quarter of 2021, which resulted in

adjusted free cash flows(2) of $1.52 billion. Micron ended the

quarter with cash, marketable investments, and restricted cash of

$9.82 billion, for a net cash(2) position of $3.10 billion.

Business Outlook

The following table presents Micron’s guidance for

the fourth quarter of 2021:

|

FQ4-21 |

GAAP(1)

Outlook |

Non-GAAP(2)

Outlook |

|

Revenue |

$8.2 billion ± $200 million |

$8.2 billion ± $200 million |

| Gross

margin |

46.0% ±

1% |

47.0% ±

1% |

| Operating

expenses |

$955

million ± $25 million |

$900

million ± $25 million |

| Diluted

earnings per share |

$2.23 ±

$0.10 |

$2.30 ±

$0.10 |

Further information regarding Micron’s business

outlook is included in the prepared remarks and slides, which have

been posted at investors.micron.com.

Investor Webcast

Micron will host a conference call on Wednesday,

June 30, 2021, at 2:30 p.m. MT, to discuss its third quarter

financial results and provide forward-looking guidance for its

fourth quarter. A live webcast of the call will be available online

at investors.micron.com. A webcast replay will be available for one

year after the call. For Investor Relations and other company

updates, follow @MicronTech on Twitter at

twitter.com/MicronTech.

About Micron Technology, Inc.

We are an industry leader in innovative memory and

storage solutions transforming how the world uses information to

enrich life for all. With a relentless focus on our customers,

technology leadership, and manufacturing and operational

excellence, Micron delivers a rich portfolio of high-performance

DRAM, NAND, and NOR memory and storage products through our Micron®

and Crucial® brands. Every day, the innovations that our people

create fuel the data economy, enabling advances in artificial

intelligence and 5G applications that unleash opportunities — from

the data center to the intelligent edge and across the client and

mobile user experience. To learn more about Micron Technology, Inc.

(Nasdaq: MU), visit micron.com.

© 2021 Micron Technology, Inc. All rights

reserved. Micron, the Micron logo, and all other Micron trademarks

are the property of Micron Technology, Inc. All other trademarks

are the property of their respective owners.

Forward-Looking Statements

This press release contains forward-looking

statements regarding our industry, our strategic position, the

completion of and timing for closing the pending sale of our Lehi

facility, and our financial and operating results. These forward-

looking statements are subject to a number of risks and

uncertainties that could cause actual results to differ materially.

Please refer to the documents we file with the Securities and

Exchange Commission, specifically our most recent Form 10-K and

Form 10-Q. These documents contain and identify important factors

that could cause our actual results to differ materially from those

contained in these forward-looking statements. These certain

factors can be found at www.micron.com/certainfactors. Although we

believe that the expectations reflected in the forward- looking

statements are reasonable, we cannot guarantee future results,

levels of activity, performance, or achievements. We are under no

duty to update any of the forward-looking statements after the date

of this release to conform these statements to actual results.

|

(1 |

) |

GAAP represents U.S. Generally Accepted Accounting Principles. |

|

(2 |

) |

Non-GAAP represents GAAP excluding the impact of certain

activities, which management excludes in analyzing our operating

results and understanding trends in our earnings, adjusted free

cash flow, net cash, and business outlook. Further information

regarding Micron’s use of non-GAAP measures and reconciliations

between GAAP and non-GAAP measures are included within this press

release. |

MICRON TECHNOLOGY, INC. CONSOLIDATED

STATEMENTS OF OPERATIONS(In millions, except per share

amounts) (Unaudited)

| |

3rd

Qtr. |

2nd

Qtr. |

3rd

Qtr. |

Nine Months

Ended |

|

|

June 3, 2021 |

March 4, 2021 |

May 28, 2020 |

June 3, 2021 |

May 28, 2020 |

|

|

|

|

|

|

|

|

Revenue |

$ |

7,422 |

|

$ |

6,236 |

|

$ |

5,438 |

|

$ |

19,431 |

|

$ |

15,379 |

|

| Cost of

goods sold |

|

4,296 |

|

|

4,587 |

|

|

3,675 |

|

|

12,920 |

|

|

10,895 |

|

|

Gross margin |

|

3,126 |

|

|

1,649 |

|

|

1,763 |

|

|

6,511 |

|

|

4,484 |

|

| |

|

|

|

|

|

| Research and

development |

|

670 |

|

|

641 |

|

|

649 |

|

|

1,958 |

|

|

1,970 |

|

| Selling,

general, and administrative |

|

230 |

|

|

214 |

|

|

216 |

|

|

658 |

|

|

650 |

|

| Restructure

and asset impairments |

|

453 |

|

|

5 |

|

|

4 |

|

|

466 |

|

|

10 |

|

| Other

operating (income) expense, net |

|

(26 |

) |

|

126 |

|

|

6 |

|

|

101 |

|

|

8 |

|

|

Operating income |

|

1,799 |

|

|

663 |

|

|

888 |

|

|

3,328 |

|

|

1,846 |

|

| |

|

|

|

|

|

| Interest

income |

|

8 |

|

|

10 |

|

|

23 |

|

|

28 |

|

|

101 |

|

| Interest

expense |

|

(46 |

) |

|

(42 |

) |

|

(51 |

) |

|

(136 |

) |

|

(144 |

) |

| Other

non-operating income (expense), net |

|

45 |

|

|

4 |

|

|

10 |

|

|

62 |

|

|

55 |

|

| |

|

1,806 |

|

|

635 |

|

|

870 |

|

|

3,282 |

|

|

1,858 |

|

| |

|

|

|

|

|

| Income tax

(provision) benefit |

|

(65 |

) |

|

(48 |

) |

|

(68 |

) |

|

(164 |

) |

|

(144 |

) |

| Equity in

net income (loss) of equity method investees |

|

(6 |

) |

|

16 |

|

|

3 |

|

|

23 |

|

|

6 |

|

|

Net income |

|

1,735 |

|

|

603 |

|

|

805 |

|

|

3,141 |

|

|

1,720 |

|

| |

|

|

|

|

|

| Net income

attributable to noncontrolling interests |

|

— |

|

|

— |

|

|

(2 |

) |

|

— |

|

|

(21 |

) |

|

Net income attributable to Micron |

$ |

1,735 |

|

$ |

603 |

|

$ |

803 |

|

$ |

3,141 |

|

$ |

1,699 |

|

|

|

|

|

|

|

|

| Earnings per

share |

|

Basic |

$ |

1.55 |

|

$ |

0.54 |

|

$ |

0.72 |

|

$ |

2.81 |

|

$ |

1.53 |

|

|

Diluted |

|

1.52 |

|

|

0.53 |

|

|

0.71 |

|

|

2.75 |

|

|

1.50 |

|

|

|

|

|

|

|

|

| Number of

shares used in per share calculations |

|

|

|

|

|

|

Basic |

|

1,121 |

|

|

1,120 |

|

|

1,111 |

|

|

1,119 |

|

|

1,110 |

|

|

Diluted |

|

1,145 |

|

|

1,144 |

|

|

1,129 |

|

|

1,141 |

|

|

1,131 |

|

MICRON TECHNOLOGY, INC. CONSOLIDATED

BALANCE SHEETS(In millions) (Unaudited)

| |

June

3, |

March

4, |

September

3, |

|

| As

of |

2021 |

2021 |

2020 |

|

|

Assets |

|

| Cash and

equivalents |

$ |

7,759 |

$ |

6,507 |

$ |

7,624 |

|

| Short-term

investments |

|

590 |

|

677 |

|

518 |

|

|

Receivables |

|

4,231 |

|

3,353 |

|

3,912 |

|

|

Inventories |

|

4,537 |

|

4,743 |

|

5,373 |

|

| Assets held

for sale |

|

966 |

|

1,461 |

|

— |

|

| Other

current assets |

|

478 |

|

538 |

|

538 |

|

|

Total current assets |

|

18,561 |

|

17,279 |

|

17,965 |

|

| Long-term

marketable investments |

|

1,399 |

|

1,316 |

|

1,048 |

|

| Property,

plant, and equipment |

|

32,209 |

|

31,848 |

|

31,031 |

|

| Operating

lease right-of-use assets |

|

558 |

|

575 |

|

584 |

|

| Intangible

assets |

|

350 |

|

342 |

|

334 |

|

| Deferred tax

assets |

|

822 |

|

726 |

|

707 |

|

|

Goodwill |

|

1,228 |

|

1,228 |

|

1,228 |

|

| Other

noncurrent assets |

|

816 |

|

821 |

|

781 |

|

|

Total assets |

$ |

55,943 |

$ |

54,135 |

$ |

53,678 |

|

| |

|

|

|

|

Liabilities and equity |

|

|

|

| Accounts

payable and accrued expenses |

$ |

4,427 |

$ |

4,550 |

$ |

5,817 |

|

| Current

debt |

|

297 |

|

323 |

|

270 |

|

| Other

current liabilities |

|

738 |

|

560 |

|

548 |

|

|

Total current liabilities |

|

5,462 |

|

5,433 |

|

6,635 |

|

| Long-term

debt |

|

6,418 |

|

6,298 |

|

6,373 |

|

| Noncurrent

operating lease liabilities |

|

513 |

|

528 |

|

533 |

|

| Noncurrent

unearned government incentives |

|

722 |

|

661 |

|

643 |

|

| Other

noncurrent liabilities |

|

569 |

|

552 |

|

498 |

|

|

Total liabilities |

|

13,684 |

|

13,472 |

|

14,682 |

|

|

|

|

|

|

| Commitments

and contingencies |

|

|

|

| Shareholders’

equity |

|

Common stock |

120 |

|

|

120 |

|

|

|

119 |

|

|

Additional capital |

9,285 |

|

|

9,234 |

|

|

|

8,917 |

|

|

Retained earnings |

36,452 |

|

|

34,723 |

|

|

|

33,384 |

|

|

Treasury stock |

(3,645 |

) |

|

(3,495 |

) |

|

|

(3,495 |

) |

|

Accumulated other comprehensive income (loss) |

|

|

47 |

|

|

81 |

|

|

|

71 |

|

|

Total equity |

|

|

42,259 |

|

|

40,663 |

|

|

|

38,996 |

|

|

Total liabilities and equity |

$ |

55,943 |

$ |

|

54,135 |

$ |

|

|

53,678 |

|

MICRON TECHNOLOGY, INC. CONSOLIDATED

STATEMENTS OF CASH FLOWS(In millions) (Unaudited)

|

|

|

June 3, |

|

|

May 28, |

|

|

Nine months ended |

|

2021 |

|

|

2020 |

|

| Cash

flows from operating activities |

|

|

|

|

|

|

| Net

income |

$ |

3,141 |

|

$ |

1,720 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities |

|

|

|

Depreciation expense and amortization of intangible assets |

|

4,593 |

|

|

4,083 |

|

|

Amortization of debt discount and other costs |

|

22 |

|

|

20 |

|

|

Noncash restructure and asset impairment |

|

446 |

|

|

(7 |

) |

|

Stock-based compensation |

|

285 |

|

|

239 |

|

|

(Gain) loss on debt prepayments, repurchases, and conversions |

|

1 |

|

|

(40 |

) |

|

Change in operating assets and liabilities |

|

|

|

Receivables |

|

(340 |

) |

|

(461 |

) |

|

Inventories |

|

814 |

|

|

(248 |

) |

|

Accounts payable and accrued expenses |

|

(309 |

) |

|

700 |

|

|

Deferred income taxes, net |

|

(94 |

) |

|

26 |

|

|

Other |

|

25 |

|

|

3 |

|

|

Net cash provided by operating activities |

|

8,584 |

|

|

6,035 |

|

| |

|

|

| Cash

flows from investing activities |

|

|

| Expenditures

for property, plant, and equipment |

|

(8,015 |

) |

|

(5,943 |

) |

| Purchases of

available-for-sale securities |

|

(1,919 |

) |

|

(793 |

) |

| Proceeds

from maturities of available-for-sale securities |

|

1,024 |

|

|

636 |

|

| Proceeds

from sales of available-for-sale securities |

|

473 |

|

|

1,157 |

|

| Proceeds

from government incentives |

|

335 |

|

|

140 |

|

| Other |

|

47 |

|

|

(48 |

) |

|

Net cash provided by (used for) investing activities |

|

(8,055 |

) |

|

(4,851 |

) |

| |

|

|

| Cash

flows from financing activities |

|

|

| Repayments

of debt |

|

(1,344 |

) |

|

(4,286 |

) |

| Payments on

equipment purchase contracts |

|

(139 |

) |

|

(49 |

) |

| Acquisition

of noncontrolling interest in IMFT |

|

— |

|

|

(744 |

) |

| Proceeds

from issuance of debt |

|

1,188 |

|

|

5,000 |

|

| Other |

|

(142 |

) |

|

(56 |

) |

|

Net cash provided by (used for) financing activities |

|

(437 |

) |

|

(135 |

) |

| |

|

|

| Effect of

changes in currency exchange rates on cash, cash equivalents, and

restricted cash |

|

44 |

|

|

(8 |

) |

| |

|

|

| Net increase

(decrease) in cash, cash equivalents, and restricted cash |

|

136 |

|

|

1,041 |

|

| Cash, cash

equivalents, and restricted cash at beginning of period |

|

7,690 |

|

|

7,279 |

|

| Cash, cash

equivalents, and restricted cash at end of period |

$ |

7,826 |

|

$ |

8,320 |

|

MICRON TECHNOLOGY, INC. NOTES

(Unaudited)

Inventory

Effective as of the beginning of the second

quarter of 2021, we changed our method of inventory costing from

average cost to FIFO. This change in accounting principle is

preferable because in an environment with continuously changing

production costs FIFO more closely matches the actual cost of goods

sold with the revenues from sales of those specific units, better

represents the actual cost of inventories remaining on hand at any

period- end, and improves comparability with our semiconductor

industry peers. The change to FIFO was not material to any prior

periods, nor was the cumulative effect of $133 million material to

the second quarter of 2021. As such, prior periods were not

retrospectively adjusted, and the cumulative effect was reported as

an increase to cost of goods sold for the second quarter of 2021 of

$133 million, with an offsetting reduction to beginning

inventories. This charge resulted in a corresponding reduction to

operating income, a $128 million reduction to net income, and an

$0.11 reduction to diluted earnings per share for both the second

quarter and first nine months of 2021.

Beginning in the second quarter of 2021, we

changed the classification of spare parts for equipment to better

align with the manner in which they are used in operations. As a

result, we now present spare parts as other current assets and no

longer as a component of raw materials inventories. This

reclassification was applied on a retrospective basis. As a result,

$256 million of spare parts were presented in other current assets

as of June 3, 2021, and we reclassified spare parts from

inventories to other current assets of $270 million and $234

million in the accompanying balance sheets as of March 4, 2021 and

September 3, 2020, respectively.

Lehi, Utah, Fab and 3D

XPoint Change

In the second quarter of 2021, we updated our

portfolio strategy to further strengthen our focus on memory and

storage innovations for the data center market. In connection

therewith, we determined that there was insufficient market

validation to justify the ongoing investments required to

commercialize 3D XPointTM at scale. Accordingly, we ceased

development of 3D XPoint technology and engaged in discussions with

potential buyers for the sale of our facility located in Lehi that

was dedicated to 3D XPoint production. As a result, we classified

the property, plant, and equipment as held-for-sale and ceased

depreciating the assets. On June 30, 2021, we announced that we

have entered into a definitive agreement to sell our Lehi facility

to Texas Instruments for cash consideration of $900 million. The

sale is anticipated to close later this calendar year.

In the third quarter of 2021, we recognized a

charge of $435 million included in restructure and asset

impairments (and a tax benefit of $104 million included in income

tax (provision) benefit) to write down the assets held for sale to

the expected consideration, net of estimated selling costs, to be

realized from the sale of these assets and liabilities. The

impairment charge was based on Level 3 inputs including expected

consideration and the composition of assets included in the sale,

which were derived from the agreement with TI. In the second

quarter of 2021, we also recognized a charge of $49 million to cost

of goods sold to write down 3D XPoint inventory due to our decision

to cease further development of this technology.

As of June 3, 2021, the significant balances of

assets held-for-sale in connection with our Lehi facility were as

follows:

|

|

|

June 3, |

|

|

As of |

|

2021 |

|

|

Property, plant, and equipment |

$ |

1,343 |

|

| Other

current assets |

|

52 |

|

|

Impairment |

|

(435 |

) |

|

Lehi assets held for sale |

$ |

960 |

|

As of June 3, 2021, we also had a $51 million

finance lease obligation included in the current portion of

long-term debt and $12 million of other liabilities that we expect

to transfer with the sale. The expected cash consideration, net of

estimated selling expenses, approximates the carrying value of the

net assets and liabilities expected to transfer in the sale, after

giving effect to the impairment charge discussed above.

MICRON TECHNOLOGY, INC. RECONCILIATION OF

GAAP TO NON-GAAP MEASURES(In millions, except per share

amounts)

|

|

3rd Qtr. June 3,

2021 |

2nd Qtr. March 4,

2021 |

3rd Qtr. May 28,

2020 |

|

GAAP gross margin |

$ |

3,126 |

|

$ |

1,649 |

|

$ |

1,763 |

|

|

Stock-based compensation |

|

45 |

|

|

57 |

|

|

34 |

|

|

Inventory accounting policy change to FIFO |

|

— |

|

|

133 |

|

|

— |

|

|

Change in inventory cost absorption |

|

— |

|

|

160 |

|

|

— |

|

|

3D XPoint inventory write-down |

|

— |

|

|

49 |

|

|

— |

|

|

Other |

|

14 |

|

|

6 |

|

|

7 |

|

|

Non-GAAP gross margin |

$ |

3,185 |

|

$ |

2,054 |

|

$ |

1,804 |

|

| |

|

|

|

| GAAP

operating expenses |

$ |

1,327 |

|

$ |

986 |

|

$ |

875 |

|

|

Stock-based compensation |

|

(53 |

) |

|

(55 |

) |

|

(48 |

) |

|

Patent license charges |

|

— |

|

|

(128 |

) |

|

— |

|

|

Restructure and asset impairments |

|

(453 |

) |

|

(5 |

) |

|

(4 |

) |

|

Other |

|

— |

|

|

(1 |

) |

|

— |

|

|

Non-GAAP operating expenses |

$ |

821 |

|

$ |

797 |

|

$ |

823 |

|

| |

|

|

|

| GAAP

operating income |

$ |

1,799 |

|

$ |

663 |

|

$ |

888 |

|

|

Stock-based compensation |

|

98 |

|

|

112 |

|

|

82 |

|

|

Inventory accounting policy change to FIFO |

|

— |

|

|

133 |

|

|

— |

|

|

Change in inventory cost absorption |

|

— |

|

|

160 |

|

|

— |

|

|

3D XPoint inventory write-down |

|

— |

|

|

49 |

|

|

— |

|

|

Patent license charges |

|

— |

|

|

128 |

|

|

— |

|

|

Restructure and asset impairments |

|

453 |

|

|

5 |

|

|

4 |

|

|

Other |

|

14 |

|

|

7 |

|

|

7 |

|

|

Non-GAAP operating income |

$ |

2,364 |

|

$ |

1,257 |

|

$ |

981 |

|

| |

|

|

|

| GAAP

net income attributable to Micron |

$ |

1,735 |

|

$ |

603 |

|

$ |

803 |

|

|

Stock-based compensation |

|

98 |

|

|

112 |

|

|

82 |

|

|

Inventory accounting policy change to FIFO |

|

— |

|

|

133 |

|

|

— |

|

|

Change in inventory cost absorption |

|

— |

|

|

160 |

|

|

— |

|

|

3D XPoint inventory write-down |

|

— |

|

|

49 |

|

|

— |

|

|

Patent license charges |

|

— |

|

|

128 |

|

|

— |

|

|

Restructure and asset impairments |

|

453 |

|

|

5 |

|

|

4 |

|

|

Amortization of debt discount and other costs |

|

7 |

|

|

8 |

|

|

4 |

|

|

Other |

|

15 |

|

|

7 |

|

|

9 |

|

|

Estimated tax effects of above and other tax adjustments |

|

(135 |

) |

|

(77 |

) |

|

39 |

|

|

Non-GAAP net income attributable to Micron |

$ |

2,173 |

|

$ |

1,128 |

|

$ |

941 |

|

| |

|

|

|

| GAAP

weighted-average common shares outstanding - Diluted |

|

1,145 |

|

|

1,144 |

|

|

1,129 |

|

|

Adjustment for stock-based compensation and capped calls |

|

9 |

|

|

10 |

|

|

13 |

|

|

Non-GAAP weighted-average common shares outstanding -

Diluted |

|

1,154 |

|

|

1,154 |

|

|

1,142 |

|

| |

|

|

|

| GAAP

diluted earnings per share |

$ |

1.52 |

|

$ |

0.53 |

|

$ |

0.71 |

|

|

Effects of the above adjustments |

|

0.36 |

|

|

0.45 |

|

|

0.11 |

|

|

Non-GAAP diluted earnings per share |

$ |

1.88 |

|

$ |

0.98 |

|

$ |

0.82 |

|

RECONCILIATION OF GAAP TO NON-GAAP

MEASURES, Continued

|

|

|

3rd Qtr. June 3,

2021 |

|

2nd Qtr. March 4,

2021 |

3rd Qtr. May 28,

2020 |

|

|

|

|

|

|

GAAP net cash provided by operating

activities |

$ |

3,560 |

|

$ |

3,057 |

|

$ |

2,023 |

|

| Investments

in capital expenditures, net |

|

|

|

|

Expenditures for property, plant, and equipment, net(1) |

|

(2,185 |

) |

|

(3,000 |

) |

|

(1,937 |

) |

|

Payments on equipment purchase contracts |

|

(16 |

) |

|

(26 |

) |

|

(20 |

) |

|

Amounts funded by partners |

|

159 |

|

|

143 |

|

|

35 |

|

|

Adjusted free cash flow |

$ |

1,518 |

|

$ |

174 |

|

$ |

101 |

|

(1) Expenditures for property, plant, and

equipment, net include proceeds from sales of property, plant, and

equipment of $74 million for the third quarter of 2021, $18 million

for the second quarter of 2021, and $7 million for the third

quarter of 2020.

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

June 3, |

|

|

March 4, |

|

|

September 3, |

|

|

As of |

|

2021 |

|

|

2021 |

|

|

2020 |

|

|

Cash and short-term investments |

$ |

8,349 |

|

$ |

7,184 |

|

$ |

8,142 |

|

| Current and

noncurrent restricted cash |

|

67 |

|

|

67 |

|

|

66 |

|

| Long-term

marketable investments |

|

1,399 |

|

|

1,316 |

|

|

1,048 |

|

| Current and

long-term debt |

|

(6,715 |

) |

|

(6,621 |

) |

|

(6,643 |

) |

| Net

cash |

$ |

3,100 |

|

$ |

1,946 |

|

$ |

2,613 |

|

The tables above reconcile GAAP to non-GAAP

measures of gross margin, operating expenses, operating income, net

income attributable to Micron, diluted shares, diluted earnings per

share, adjusted free cash flow, and net cash. The non-GAAP

adjustments above may or may not be infrequent or nonrecurring in

nature, but are a result of periodic or non-core operating

activities. We believe this non-GAAP information is helpful in

understanding trends and in analyzing our operating results and

earnings. We are providing this information to investors to assist

in performing analysis of our operating results. When evaluating

performance and making decisions on how to allocate our resources,

management uses this non-GAAP information and believes investors

should have access to similar data when making their investment

decisions. We believe these non-GAAP financial measures increase

transparency by providing investors with useful supplemental

information about the financial performance of our business,

enabling enhanced comparison of our operating results between

periods and with peer companies. The presentation of these adjusted

amounts varies from amounts presented in accordance with U.S. GAAP

and therefore may not be comparable to amounts reported by other

companies. Our management excludes the following items in analyzing

our operating results and understanding trends in our earnings:

- Stock-based compensation;

- Flow-through of business acquisition-related inventory

adjustments;

- Acquisition-related costs;

- Start-up and preproduction costs;

- Employee severance;

- Patent license charges;

- Restructure and asset impairments;

- Amortization of debt discount and other costs, including the

accretion of non-cash interest expense associated with our

convertible notes and other debt;

- Gains and losses from debt repurchases and conversions;

- Gains and losses from business acquisition activities;

- Initial impact of inventory accounting policy change to FIFO

and change in inventory cost absorption in the second quarter of

2021; and

- The estimated tax effects of above, non-cash changes in net

deferred income taxes, assessments of tax exposures, certain tax

matters related to prior fiscal periods, and significant changes in

tax law.

Non-GAAP diluted shares are adjusted for the

impact of additional shares resulting from the exclusion of stock-

based compensation from non-GAAP income. Non-GAAP diluted shares

also include the impact of capped calls, which are anti-dilutive in

GAAP earnings per share but are expected to mitigate the dilutive

effect of convertible notes, based on the average share price for

the period the capped calls were outstanding.

MICRON TECHNOLOGY, INC. RECONCILIATION OF

GAAP TO NON-GAAP OUTLOOK

|

FQ4-21 |

GAAP Outlook |

|

Adjustments |

|

Non-GAAP Outlook |

|

Revenue |

|

$8.2 billion ± $200 million |

|

— |

|

|

$8.2 billion ± $200 million |

| Gross margin |

46.0% ± 1% |

|

1% |

A |

|

47.0% ± 1% |

| Operating

expenses |

$955 million ± $25 million |

|

$55 million |

B |

|

$900 million ± $25 million |

| Diluted earnings

per share(1) |

$2.23 ± $0.10 |

|

$0.07 |

A, B, C |

|

$2.30 ± $0.10 |

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjustments |

|

|

|

|

|

| (in

millions) |

|

|

|

|

|

|

|

A Stock-based compensation – cost of goods

sold |

$ |

45 |

|

A Other – cost of goods sold |

|

|

|

6 |

| B

Stock-based compensation – research and development |

30 |

| B

Stock-based compensation – sales, general, and

administrative |

25 |

| C Tax

effects of the above items and non-cash changes in net deferred

income taxes |

|

|

|

|

(25) |

| |

|

|

|

|

|

$ |

81 |

(1) GAAP and non-GAAP earnings per share based on

approximately 1.15 billion diluted shares.

The tables above reconcile our GAAP to non-GAAP

guidance based on the current outlook. The guidance does not

incorporate the impact of any potential business combinations,

divestitures, restructuring activities, balance sheet valuation

adjustments, strategic investments, financing transactions, and

other significant transactions. The timing and impact of such items

are dependent on future events that may be uncertain or outside of

our control.

Contacts:

Farhan Ahmad

Investor Relations

farhanahmad@micron.com

(408) 834-1927

Erica Rodriguez Pompen

Media Relations

epompen@micron.com

(408) 834-1873

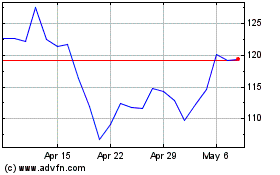

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Apr 2023 to Apr 2024