By Elizabeth Koh and Asa Fitch

With much of the world in lockdown, internet users are logging

billions of hours of additional screen time as daily life goes

virtual.

That increase has seen data centers beef up their infrastructure

to meet demand, a trend that is bolstering the businesses that make

components for the servers that store data and power the world's

Zoom calls, Amazon sprees and Netflix binges.

Some of the world's biggest memory chip makers, South Korea's

Samsung Electronics Co. and SK Hynix Inc. and Boise, Idaho-based

Micron Technology Inc., say that boost has been welcome in an

otherwise challenging environment. At Micron, sales in its February

quarter fell but were near the high end of management's guidance

range due partly to data-center demand. At SK Hynix, average

selling prices for some chips rose slightly in the last quarter,

pushed by demand for servers.

Intel Corp., the largest U.S. chip maker, said last week that

data-center sales surged by 43% in its first quarter, driven by

demand for its computer-processing units. Demand for other

processors for personal computers have also gone up as people buy

equipment for remote working, Intel said.

To some extent, the rising demand for data-center equipment

merely counters falling demand for other electronic components as

coronavirus craters the global economy. Analysts still expect a

decline in semiconductor sales globally this year, but for now

demand remains strong.

The increased spending on memory chips has been led by

heavyweight cloud providers such as Amazon.com Inc. and Microsoft

Corp., which have both seen dramatic increases in usage.

Suppliers are adapting fast. SK Hynix, which makes DRAM and NAND

flash memory chips, said Thursday that it planned to raise

production and increase sales of certain memory chips.

Micron Chief Executive Sanjay Mehrotra said last month that he

was shifting production capacity away from chips for smartphones

and cars toward data-center products. Prices for digital storage

and memory are holding up since the start of the pandemic.

While the memory-chip bump may be temporary, suppliers to the

cloud can expect the rising demand to last "at least as long as the

shutdowns," said Kuba Stolarski, an analyst at market-research firm

IDC. As people become more accustomed to conducting daily life

online, that usage may stick, he said.

In March, internet users world-wide logged an extra 5 billion

hours of screen time on the 100 most popular websites, such as

Google and Facebook, according to analytics firm SimilarWeb. That

marked a 13% increase from February and the largest monthly rise in

recent years.

Businesses are seeking more cloud services to support remote

work and increased screen time.

Zoom Video Communications Inc., whose video chat rooms host

meetings and cocktail parties, is adding capacity through servers

and other equipment in its data centers and cloud services, as it

also addresses privacy and security concerns raised amid a massive

surge in users.

YouTube, Amazon and Netflix Inc.--which alone added a record

15.77 million new monthly subscribers in the last quarter--have

throttled their streaming speeds in Europe along with

competitors.

Many data centers deliberately operate at less than peak

capacity to account for surges in traffic or potential new clients

who might move their business into the cloud. That buffer has kept

users from hitting serious issues including sustained outages

during the pandemic, industry experts said.

But with no signs that usage will let up, the largest cloud

companies, such as Amazon Web Services and Microsoft Azure, are

working to maintain that buffer, said Andrew Perlmutter, the chief

strategy officer for ITRenew Inc., which refurbishes and resells

data-center equipment.

Besides increasing purchases, some major cloud providers are

keeping older equipment longer and using software to more

efficiently manage data, Mr. Perlmutter said.

Chip companies focused solely on the data-center market have

done particularly well during the crisis. Inphi Corp., for example,

a California-based maker of semiconductor networking components

that go into data-center equipment, on Tuesday said sales were

higher than initially expected in the first quarter as a result of

faster upgrades of equipment and demand for more bandwidth.

The boom time for chip makers may be brief, given the industry's

sensitivity to supply and demand, analysts say. Some cloud

providers are buying up inventory now in anticipation of a second

coronavirus wave, potentially denting sales later in the year, they

said.

A deeper hit to the world's economy could sting, warned Jin-Seok

Cha, SK Hynix's head of finance and vice president. "If the

economic downturn is prolonged, we cannot discount the possibility

that even server demand could weaken," he said.

Write to Elizabeth Koh at Elizabeth.Koh@wsj.com and Asa Fitch at

asa.fitch@wsj.com

(END) Dow Jones Newswires

April 28, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

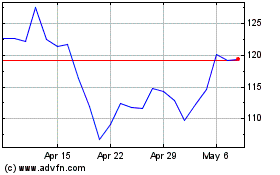

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Apr 2023 to Apr 2024