Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 26 2021 - 9:48AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of May 2021

Commission

File Number: 001- 39258

METEN

EDTECHX EDUCATION GROUP LTD.

(Translation

of registrant’s name into English)

3rd

Floor, Tower A

Tagen

Knowledge & Innovation Center

2nd

Shenyun West Road, Nanshan District

Shenzhen,

Guangdong Province 518000

People’s

Republic of China

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Explanatory

Note

On

May 24, 2021, Meten EdtechX Education Group Ltd., a company incorporated under the laws of the Cayman Islands (the “Company”),

entered into an underwriting agreement (the “Underwriting Agreement”) with Aegis Capital Corp. (the “Underwriter”),

pursuant to which the Company agreed to sell to the Underwriter in a firm commitment public offering (the “Offering”) 40,000,000

ordinary shares, par value $0.0001 per share, of the Company (the “Shares”), for an offering price of $1.0 per share. The

Company also granted the Underwriter an option, for a period of 45 days after the closing of this Offering, to purchase an additional

6,000,000 ordinary shares to cover over-allotments. The Company expects to receive $40 million in gross proceeds from this Offering,

assuming no exercise of the over-allotment option, before deducting underwriting discounts and other related offering expenses.

The

Company issued press releases on May 21, 2021 to announce the proposed offering, on May 24, 2021 in connection with the pricing of the

Offering, and on May 26, 2021 in connection with the closing of the Offering. Copy of all press releases are furnished herewith as Exhibit

99.1, Exhibit 99.2 and Exhibit 99.3, respectively.

The

Shares were offered under the Company’s registration statement on Form F-3 (File No. 333-256087), filed with the Securities and

Exchange Commission on May 13, 2021 and was declared effective on May 21, 2021 (the “Registration Statement”). A final prospectus

supplement to the Registration Statement was filed with the Securities and Exchange Commission on May 25, 2021.

The

foregoing description of the Underwriting Agreement does not purport to be complete and is qualified in its entirety by reference to

the full text of the Underwriting Agreement, a copy of which is attached hereto as Exhibit 1.1. A copy of the opinion of Conyers Dill

& Pearman, as special counsel in the Cayman Islands to the Company, regarding the legality of the issuance and sale of the Shares

in the Offering is attached hereto as Exhibit 5.1.

Prior

to the completion of this Offering, the exercise price of the Company’s outstanding warrants was $2.50 per share, subject to a

“full-ratchet” anti-dilution protection with respect to subsequent equity sales in which any person will be entitled to acquire

ordinary shares at an effective price per share that is lower than the then exercise price of the warrants. As the Company offers its

ordinary shares at a per share price of $1.00 in this public offering, which is lower than $2.50 per share, the exercise price for the

Company’s warrants is reset to $1.00 per share. A copy of the notice to the warrant holders is attached hereto as Exhibit 99.4.

This

report shall not constitute an offer to sell or the solicitation to buy nor shall there be any sale of the securities in any state or

jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such state or jurisdiction.

This

current report on form 6-K is incorporated by reference into the Company’s registration statements on Form F-3 (File No. 333-256087)

and Form S-8 (File No. 333-251806 and File No. 333-248883).

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Dated:

May 26, 2021

|

|

Meten

EdtechX Education Group Ltd.

|

|

|

|

|

|

|

By:

|

/s/

Siguang Peng

|

|

|

Name:

|

Siguang

Peng

|

|

|

Title:

|

Chief

Executive Officer

|

3

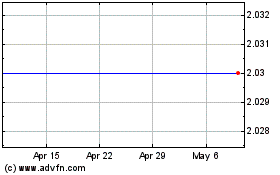

BTC Digital (NASDAQ:METX)

Historical Stock Chart

From Mar 2024 to Apr 2024

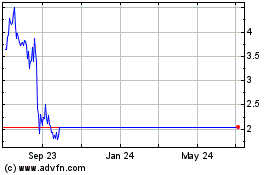

BTC Digital (NASDAQ:METX)

Historical Stock Chart

From Apr 2023 to Apr 2024