Filed Pursuant to Rule 424(b)(5)

Registration No. 333-219434

Prospectus Supplement

(to Prospectus dated August 11, 2017)

9,375,000 Units, Each Consisting of One

Share of Common Stock

and 0.5 of a Warrant to Purchase One

Share of Common Stock

We are offering up to 9,375,000 units (each a “Unit”)

at a purchase price of $1.60 per Unit. Each Unit consists of one share of our common stock and 0.5 of a warrant to purchase one

share of our common stock at an exercise price of $1.75 per share (each a “Warrant”). Each Warrant will be exercisable

immediately and will expire five years from the date of issuance.

The shares of common stock and the Warrants included in the

Units can only be purchased together in this offering, but the securities contained in the Units will be issued separately and

will be immediately separable upon issuance.

We are also offering the shares of common

stock that are issuable from time to time upon exercise of the Warrants being offered by this prospectus.

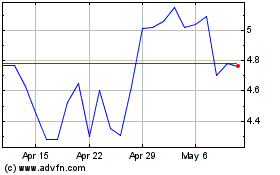

Our common stock is listed on The Nasdaq

Capital Market, or Nasdaq, under the symbol “MBRX.” On April 22, 2019, the last reported sale price of our common stock

on Nasdaq was $2.98 per share. There is no established public trading

market for the Warrants, and we do not expect a market to develop. We do not intend to apply for listing of the Warrants on any

securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Warrants

will be limited.

We are an “emerging growth company”

under the federal securities laws and are subject to reduced public company reporting requirements for this prospectus and future

filings.

Investing in our securities involves a high degree of risk.

See “Risk Factors” beginning on page S-6 of this prospectus supplement and the risk factors incorporated by reference

into this prospectus supplement and the accompanying prospectus.

We are selling the Units directly to the

investors. We have retained Oppenheimer & Co. Inc. to act as our sole placement agent in connection with this offering. The

placement agent may engage one or more sub-placement agents or selected dealers to assist with this offering. The placement agent

is not purchasing the securities offered by us and is not required to sell any specific number or dollar amount of securities but

has agreed to use its reasonable best efforts to solicit offers to purchase the Units. There are no arrangements to place the funds

raised in this offering in an escrow, trust or similar account. We have agreed to pay the placement agent a fee of 6% of the aggregate

gross proceeds in this offering. We have also agreed to issue to the placement agent warrants to purchase up to 562,500 shares

of our common stock, which equates to 6.0% of the number of shares of our common stock to be issued and sold in this offering,

and to reimburse the placement agent for certain expenses. See “Plan of Distribution” beginning on page S-11 of this

prospectus supplement for more information regarding these arrangements.

|

|

|

Per Unit

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

1.60

|

|

|

$

|

15,000,000

|

|

|

Placement agent fees

(1)

|

|

$

|

0.096

|

|

|

$

|

900,000

|

|

|

Proceeds, before expenses, to us

|

|

$

|

1.504

|

|

|

$

|

14,100,000

|

|

|

|

(1)

|

The placement agent will

receive compensation in addition to the cash commission set forth above. See “Plan of Distribution” beginning on page

S-11 of this prospectus supplement for more information regarding the compensation payable to the placement agent.

|

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy

of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

Delivery of the securities offered hereby

is expected to be made on or about April 25, 2019, subject to the satisfaction of certain conditions.

Oppenheimer & Co.

The date of this prospectus supplement is

April 23, 2019

TABLE OF CONTENTS

About This Prospectus Supplement

This prospectus supplement and the accompanying

prospectus are part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”)

utilizing a “shelf” registration process. Each time we conduct an offering to sell securities under the accompanying

prospectus we will provide a prospectus supplement that will contain specific information about the terms of that offering, including

the price, the amount of securities being offered and the plan of distribution. The shelf registration statement was initially

filed with the SEC on July 24, 2017, and was declared effective by the SEC on August 21, 2017. This prospectus supplement describes

the specific details regarding this offering and may add, update or change information contained in the accompanying prospectus.

The accompanying prospectus provides general information about us and our securities, some of which, such as the section entitled

“Plan of Distribution,” may not apply to this offering. This prospectus supplement and the accompanying prospectus

are an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to

do so. We are not making offers to sell or solicitations to buy our common stock in any jurisdiction in which an offer or solicitation

is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is

unlawful to make an offer or solicitation.

If information in this prospectus supplement

is inconsistent with the accompanying prospectus or the information incorporated by reference with an earlier date, you should

rely on this prospectus supplement. This prospectus supplement, together with the base prospectus, the documents incorporated by

reference into this prospectus supplement and the accompanying prospectus and any free writing prospectus we have authorized for

use in connection with this offering include all material information relating to this offering. We have not, and the placement

agent has not, authorized anyone to provide you with different or additional information and you must not rely on any unauthorized

information or representations. You should assume that the information appearing in this prospectus supplement, the accompanying

prospectus, the documents incorporated by reference in this prospectus supplement and the accompanying prospectus and any free

writing prospectus we have authorized for use in connection with this offering is accurate only as of the respective dates of those

documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should

carefully read this prospectus supplement, the accompanying prospectus and the information and documents incorporated herein by

reference herein and therein, as well as any free writing prospectus we have authorized for use in connection with this offering,

before making an investment decision. See “Incorporation by Reference” and “Where You Can Find More Information”

in this prospectus supplement and in the accompanying prospectus.

No action is being taken in any jurisdiction

outside the United States to permit a public offering of these securities or possession or distribution of this prospectus supplement

or the accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement and the accompanying

prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as

to this offering and the distribution of this prospectus supplement and the accompanying prospectus applicable to that jurisdiction.

This prospectus supplement and the accompanying

prospectus contain summaries of certain provisions contained in some of the documents described herein which are summaries only

and are not intended to be complete. Reference is made to the actual documents for complete information. All of the summaries are

qualified in their entirety by the full text of the actual documents, some of which have been filed or will be filed and incorporated

by reference herein. See “Where You Can Find More Information” in this prospectus supplement. We further note that

the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference into this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to

such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not

be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate

only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately

representing the current state of our affairs.

This prospectus supplement and the accompanying

prospectus contain and incorporate by reference certain market data and industry statistics and forecasts that are based on Company-sponsored

studies, independent industry publications and other publicly available information. Although we believe these sources are reliable,

estimates as they relate to projections involve numerous assumptions, are subject to risks and uncertainties, and are subject to

change based on various factors, including those discussed under “Risk Factors” in this prospectus supplement and the

accompanying prospectus and under similar headings in the documents incorporated by reference herein and therein. Accordingly,

investors should not place undue reliance on this information.

Unless otherwise stated or the context

requires otherwise, all references in this prospectus supplement to the “Company,” “we,” “us,”

“our”, “MBI” and “Moleculin” refer to Moleculin Biotech, Inc., a Delaware corporation, and

its wholly-owned subsidiary.

Prospectus Supplement Summary

This summary highlights information contained elsewhere in

this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein. This summary

does not contain all of the information that you should consider before deciding to invest in our securities. You should read this

entire prospectus supplement and the accompanying prospectus carefully, including the section entitled “Risk Factors”

beginning on page S-6 and our consolidated financial statements and the related notes and the other information incorporated by

reference into this prospectus supplement and the accompanying prospectus, before making an investment decision.

Our Company

We are a clinical stage pharmaceutical

company focused on the treatment of highly resistant cancers. We have three core technologies, all of which are based on discoveries

made at M.D. Anderson Cancer Center, or MD Anderson. We have three drugs in four clinical trials in the US and Poland. Our clinical

stage drugs are Annamycin, believed by management to be a “Next Generation” Anthracycline, being studied for the treatment

of relapsed or refractory acute myeloid leukemia, or AML, and WP1066, an Immune/Transcription Modulator targeting brain tumors,

pancreatic cancer and AML. Additionally, a third drug, WP1220 (a molecule similar to WP1066), was approved for a clinical trial

in January 2019 in Poland for the topical treatment of cutaneous T-cell lymphoma. We are also engaged in preclinical development

of additional drug candidates, including additional Immune/Transcription Modulators, as well as Metabolism/Glycosylation Inhibitors.

We believe that our Next Generation Anthracycline,

Annamycin, is unlike any currently approved anthracyclines, as it is designed to avoid multidrug resistance mechanisms with little

to no cardiotoxicity – hence the use of the term “Next Generation.” Annamycin has preliminary clinical data suggesting

its potential to become the first successful therapy suitable for the majority of relapsed or refractory AML patients and is currently

in two Phase I/II clinical trials.

WP1066 is one of several Immune/Transcription

Modulators designed to stimulate the immune response to tumors by inhibiting the errant activity of Regulatory T-Cells (TRegs)

while also inhibiting key oncogenic transcription factors, including p-STAT3, c-Myc and HIF-1α. These transcription factors

are widely sought targets that may also play a role in the inability of immune checkpoint inhibitors to affect more resistant tumors.

We are also developing new compounds designed

to exploit the potential uses of inhibitors of glycolysis such as 2-deoxy-D-glucose, or 2-DG, which we believe may provide an opportunity

to cut off the fuel supply of tumors by taking advantage of their high level of dependence on glucose in comparison to healthy

cells. A key drawback to 2-DG is its lack of drug-like properties, including a short circulation time and poor tissue/organ distribution

characteristics. Our lead Metabolism/Glycosylation Inhibitor, WP1122, is a prodrug of 2-DG that appears to improve the drug-like

properties of 2-DG by increasing its circulation time and improving tissue/organ distribution. New research also points to the

potential for 2-DG to be capable of enhancing the usefulness of checkpoint inhibitors. Considering that 2-DG lacks sufficient drug-like

properties to be practical in a clinical setting, we believe WP1122 may also become an important drug to potentiate checkpoint

inhibitors.

Our principal executive office is located

at 5300 Memorial Drive, Suite 950, Houston, Texas 77007. Our website address is www.moleculin.com. Information contained in, or

accessible through, our website does not constitute part of this prospectus supplement and inclusions of our website address in

this prospectus supplement are inactive textual references only.

Recent Developments

On March 19, 2019, we announced that the

first two patients had been enrolled in our European clinical trial of WP1220 for the topical treatment of cutaneous T-cell lymphoma

(“CTCL”). The trial is targeting CTCL with a topical p-STAT3 inhibitor. We expect preliminary data with respect to

the trial to be available during 2019.

On March 26, 2019, we announced positive

interim safety and efficacy data from two ongoing open label, single arm Phase 1/2 studies of Annamycin. In the first study, being

conducted in the United States, four patients had completed treatment at 100 mg/m2 with no significant adverse events related to

Annamycin, and the study would proceed to the next higher dose of 120 mg/m2. The second trial, taking place in Poland, started

at a 120 mg/m2 dose of Annamycin and had treated three patients. The first patient treated in that trial received a single course

of Annamycin and his bone marrow blasts reduced from 60% to 11%. One patient had experienced grade 2 mucositis (which resolved

to grade 1 within 2 days) and no other adverse events related to Annamycin had been reported. Trial results for the other two patients

treated in Poland will not be known until the second quarter of this year.

On March 29, 2019 we consummated an underwritten

offering (the “March 2019 Offering) of 5,250,000 units, consisting of an aggregate of 5,250,000 shares of our common stock

and warrants to purchase up to 2,625,000 shares of our common stock at a public offering price of $1.00 per unit for estimated

net proceeds of $4.65 million. The warrants issued in the March 2019 Offering have an exercise price of $1.10 per share (subject

to adjustment in certain circumstances), are immediately exercisable and will expire five years from the date of issuance.

On April 11, 2019, we announced we had

entered into an agreement with Emory University to conduct a Phase 1 clinical trial of WP1066 in children with recurrent or refractory

malignant brain tumors. The study will be conducted at the Aflac Cancer & Blood Disorders Center at Children's Healthcare of

Atlanta.

On April 17, 2019, we announced that our

ongoing sponsored research at The University of Texas MD Anderson Cancer Center had demonstrated that Annamycin is able to significantly

improve survival in an aggressive form of triple negative breast cancer metastasized to the lungs in animal models.

On April 18, 2019, we announced that the

U.S. Food and Drug Administration (“FDA”) had granted our request for Fast Track Designation for Annamycin for the

treatment of relapsed or refractory acute myeloid leukemia.

Implications of Being an Emerging Growth

Company

We are an “emerging growth company,”

as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, enacted in April 2012, and we may remain an emerging company

for up to five years from the closing of our IPO in May 2016. For so long as we remain an emerging growth company, we are permitted

and intend to rely on certain exemptions from various public company reporting requirements, including not being required to have

our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section

404(b) of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports

and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and

any golden parachute payments not previously approved.

The Offering

|

Securities offered by us

|

Up to 9,375,000 Units. Each Unit consists of one share of our common stock and 0.5 of a Warrant to purchase one share of our common stock. Each Warrant included in the Units will have an exercise price of $1.75 per share, will be immediately exercisable and will expire five years from the date of issuance. This prospectus supplement also relates to the offering of the shares of our common stock issuable upon exercise of the Warrants.

|

|

|

|

|

Common stock to be outstanding after this offering

|

43,759,030 assuming the sale of all of the Units offered hereby and assuming no exercise of the Warrants

|

|

|

|

|

Use of Proceeds

|

We expect to use the net proceeds of this offering for our planned clinical trials, preclinical programs, for other research and development activities and for general corporate purposes. See “Use of Proceeds” on page S-8 prospectus supplement for a more complete description of the intended use of proceeds from this offering.

|

|

|

|

|

Risk Factors

|

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-6 of this prospectus supplement and the risk factors incorporated by reference into this prospectus supplement and the accompanying prospectus.

|

|

|

|

|

Nasdaq Capital Market Symbol

|

MBRX. There is no established public trading market for the Warrants, and we do not expect a market to develop. We do not intend to apply for listing of the Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Warrants will be limited.

|

The number of shares of common stock expected to be outstanding

after this offering is based on 34,384,030 shares of common stock outstanding as of April 22, 2019 and excludes, as of that date,

the following:

|

|

•

|

2,794,000 shares of common stock issuable upon the exercise of outstanding stock options, vested and unvested, with a weighted-average

exercise price of $2.61 per share;

|

|

|

•

|

410,020 shares of common stock issuable upon the exercise of outstanding Series A, vested Series C and underwriter warrants

from our February 14, 2017 follow-on offering with a weighted-average exercise price of $1.50 per share;

|

|

|

•

|

250,000 shares of common stock issuable upon the exercise of outstanding warrants under a consulting agreement with a weighted

average price of $2.76;

|

|

|

•

|

107,802 shares of common stock issuable upon the exercise of outstanding underwriter warrants issued on May 1, 2016 related

to our IPO with an exercise price of $7.50 per share;

|

|

|

•

|

up to an aggregate of 1,706,000 shares of common stock reserved for future issuance under our 2015 Stock Plan, as amended;

|

|

|

•

|

2,273,700 shares of our common stock issuable upon the exercise of the warrants issued in our February 2018 private placement;

|

|

|

•

|

710,212 shares of our common stock issuable upon the exercise of the warrants issued in our June 2018 private placement;

|

|

|

•

|

up to 32,779 shares of common stock issuable upon the exercise of the warrants issuable to the placement agent in our June

2018 offering;

|

|

|

•

|

2,625,000 shares of common stock issuable upon the exercise of the warrants issued in the March 2019 Offering;

|

|

|

•

|

367,500 shares of common stock issuable upon the exercise of the warrants issuable to the representative of the underwriters

in the March 2019 Offering;

|

|

|

•

|

4,687,500 shares of our common stock issuable upon the exercise of the warrants included in the Units; and

|

|

|

•

|

562,500 shares of common stock issuable upon the exercise of the warrants issuable to the placement agent

in this offering.

|

Risk Factors

An investment in our securities involves

risks. We urge you to consider carefully the risks described below, and in the documents incorporated by reference in this prospectus

supplement and the accompanying prospectus, before making an investment decision, including those risks identified under “Item

IA. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2018, which is incorporated by reference

in this prospectus supplement and which may be amended, supplemented or superseded from time to time by other reports that we subsequently

file with the SEC. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow

could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part

of your investment. Please also read carefully the section below entitled “Cautionary Note Regarding Forward-Looking Statements”.

Risks Related to this Offering

You will experience immediate and substantial

dilution in the book value per share of the common stock you purchase in the offering.

Because the public offering price Unit

being offered is substantially higher than the net tangible book value per share of our outstanding common stock, you will suffer

immediate and substantial dilution in the net tangible book value of the common stock included in the Unit you purchase in this

offering. Investors purchasing Units in this offering will incur immediate dilution of $1.10 per share, after giving effect to

the sale of an aggregate of 9,375,000 Units at the public offering price set forth on the cover page of this prospectus supplement,

assuming no exercise of the Warrants included in the Units, no value is attributed to the Warrants and such Warrants are classified

and accounted for as equity, after deducting the underwriting discount and estimated offering expenses payable by us. See “Dilution”

on page S-9 of this prospectus supplement for a more detailed discussion of the dilution you will incur if you purchase Units in

this offering.

In addition, we may choose to raise additional

capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future

operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the

issuance of these securities could result in further dilution to our stockholders or result in downward pressure on the price of

our common stock

Our management will have broad discretion

over the use of the net proceeds from this offering, you may not agree with how we use the proceeds, and the proceeds may not be

invested successfully.

Our management will have broad discretion

in the application of the net proceeds from this offering, and our stockholders will not have the opportunity as part of their

investment decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors

that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently

intended use. The failure by our management to apply these funds effectively could harm our business. See “Use of Proceeds”

on page S-8 of this prospectus supplement for a description of our proposed use of proceeds from this offering.

We will require additional capital funding,

the receipt of which may impair the value of our common stock.

Our future capital requirements depend

on many factors, including our research, development, sales and marketing activities. We will need to raise additional capital

through public or private equity or debt offerings or through arrangements with strategic partners or other sources in order to

continue to develop our drug candidates. There can be no assurance that additional capital will be available when needed or on

terms satisfactory to us, if at all. To the extent we raise additional capital by issuing equity securities, our stockholders may

experience substantial dilution and the new equity securities may have greater rights, preferences or privileges than our existing

common stock.

Our independent registered public accounting

firm has indicated that our recurring losses from operations raise substantial doubt about our ability to continue as a going concern.

As described in their audit report, our

auditors have included an explanatory paragraph that states that we had an accumulated deficit of $26.4 million at December 31,

2018 and have not generated any revenue from operations. These conditions raise substantial doubt about our ability to continue

as a going concern. Our consolidated financial statements do not include any adjustments that might result from the outcome of

this uncertainty. If we cannot continue as a viable entity, our securityholders may lose some or all of their investment in our

company.

We do not intend to pay dividends in

the foreseeable future.

We have never paid cash dividends on our

common stock and currently do not plan to pay any cash dividends in the foreseeable future.

There is no public market for the Warrants

being offered by us in this offering.

There is no established public trading

market for the Warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend

to apply to list the Warrants on any national securities exchange or other nationally recognized trading system, including the

Nasdaq Capital Market. Without an active market, the liquidity of the Warrants will be limited.

Holders of Warrants purchased in this

offering will have no rights as common stockholders until such holders exercise their Warrants and acquire our common stock.

Until holders of Warrants acquire shares

of our common stock upon exercise thereof, such holders will have no rights with respect to the shares of our common stock underlying

the Warrants. Upon exercise of the Warrants, the holders will be entitled to exercise the rights of a common stockholder only as

to matters for which the record date occurs after the exercise date.

The Warrants are speculative in nature.

The Warrants do not confer any rights of

common stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the

right to acquire shares of common stock at a fixed price for a limited period of time. Specifically, commencing on the date of

issuance, holders of the Warrants may exercise their right to acquire the common stock and pay an exercise price of $1.75 per share,

subject to certain adjustments, prior to five years from the date of issuance, after which date any unexercised Warrants will expire

and have no further value. Moreover, following this offering, the market value of the Warrants, if any, is uncertain and there

can be no assurance that the market value of the Warrants will equal or exceed their imputed offering price. The Warrants will

not be listed or quoted for trading on any market or exchange. There can be no assurance that the market price of the common stock

will ever equal or exceed the exercise price of the Warrants, and consequently, it may not ever be profitable for holders of the

Warrants to exercise the Warrants.

Cautionary Note Regarding Forward-Looking

Statements

This prospectus supplement, the accompanying

prospectus and the documents we have filed with the SEC that are incorporated by reference herein and therein contain forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). Forward-looking statements concern our current plans, intentions, beliefs, expectations and statements

of future economic performance. Statements containing terms such as “will,” “may,” “believe,”

“do not believe,” “plan,” “expect,” “intend,” “estimate,” “anticipate”

and other phrases of similar meaning are considered to be forward-looking statements.

Forward-looking statements include, but

are not limited to, statements about:

|

|

·

|

our ability to obtain additional funding to develop our product candidates;

|

|

|

·

|

the effects of future government shutdowns on our ability to raise financing;

|

|

|

·

|

the need to obtain regulatory approval of our product candidates;

|

|

|

·

|

the success of our clinical trials through all phases of clinical development;

|

|

|

·

|

our ability to complete our clinical trials in a timely fashion and within our expected budget;

|

|

|

·

|

compliance with obligations under intellectual property licenses with third parties;

|

|

|

·

|

any delays in regulatory review and approval of product candidates in clinical development;

|

|

|

·

|

our ability to commercialize our product candidates;

|

|

|

·

|

market acceptance of our product candidates;

|

|

|

·

|

competition from existing products or new products that may emerge;

|

|

|

·

|

potential product liability claims;

|

|

|

·

|

our dependency on third-party manufacturers to supply or manufacture our product candidates;

|

|

|

·

|

our ability to establish or maintain collaborations, licensing or other arrangements;

|

|

|

·

|

the ability of our sublicense partners to successfully develop our product candidates in accordance

with our sublicense agreements;

|

|

|

·

|

our ability and third parties’ abilities to protect intellectual property rights;

|

|

|

·

|

our ability to adequately support future growth; and

|

|

|

·

|

our ability to attract and retain key personnel to manage our business effectively.

|

Forward-looking statements are based on

our assumptions and are subject to known and unknown risks and uncertainties that could cause actual results to differ materially

from those reflected in or implied by these forward-looking statements. Factors that might cause actual results to differ include,

among others, those set forth under “Risk Factors” in this prospectus supplement and those discussed in “Management’s

Discussion and Analysis of Financial Condition and Results of Operation” in our most recent Annual Report on Form 10-K and

in our future reports filed with the SEC, all of which are incorporated by reference herein. Readers are cautioned not to place

undue reliance on any forward-looking statements contained in this prospectus supplement, the accompanying prospectus or the documents

we have filed with the SEC that are incorporated by reference herein and therein, which reflect management’s views and opinions

only as of their respective dates. We assume no obligation to update forward-looking statements to reflect actual results, changes

in assumptions or changes in other factors affecting such forward-looking statements, except to the extent required by applicable

securities laws.

You should carefully read this prospectus

supplement, the accompanying prospectus and the information incorporated herein by reference as described under the heading “Incorporation

of Documents by Reference,” and the documents that we reference in this prospectus supplement and the accompanying prospectus

and have filed as exhibits to the registration statement of which this prospectus supplement and the accompanying prospectus are

a part with the understanding that our actual future results, levels of activity, performance and achievements may be materially

different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

Use of Proceeds

We estimate that the net proceeds from

this offering will be approximately $14.0 million, after deducting the estimated placement agent fees and estimated offering expenses

payable by us, assuming all of the Units offered hereby are sold. This estimate excludes the proceeds, if any, from exercise of

the Warrants sold in this offering. If all of the Warrants sold in this offering were to be exercised in cash at an exercise price

of $1.75 per share, we would receive additional proceeds of approximately $8.2 million. We cannot predict when or if these Warrants

will be exercised. It is possible that these Warrants may expire and may never be exercised.

We intend to use the net proceeds from

this offering for our planned clinical trials, preclinical programs, for other research and development activities and for general

corporate purposes. This represents our best estimate of the manner in which we will use the net proceeds we receive from this

offering based upon the current status of our business, but we have not reserved or allocated amounts for specific purposes and

we cannot specify with certainty how or when we will use any of the net proceeds. Amounts and timing of our actual expenditures

will depend on numerous factors. Our management will have broad discretion in applying the net proceeds from this offering.

Dividend Policy

We have never declared or paid any cash dividends on our capital

stock, and we do not currently intend to pay any cash dividends on our common stock for the foreseeable future. We expect to retain

future earnings, if any, to fund the development and growth of our business. Any future determination to pay dividends on our common

stock will be at the discretion of our board of directors and will depend upon, among other factors, our results of operations,

financial condition, capital requirements and any contractual restrictions.

Dilution

If you invest in our Units in this offering,

your interest will be diluted immediately to the extent of the difference between the public offering price per Unit and the pro

forma as adjusted net tangible book value per share of our common stock immediately after this offering.

Our net tangible book value as of December

31, 2018 was approximately $3.1 million, or approximately $0.11 per share. Net tangible book value is determined by subtracting

our total liabilities from our total tangible assets, and net tangible book value per share is determined by dividing our net tangible

book value by the number of shares of our common stock outstanding. After giving effect to the March 2019 Offering, our pro forma

net tangible book value was approximately $7.8 million or approximately $0.23 per share. After giving further effect to the sale

of 9,375,000 Units in this offering at the public offering price of $1.60 per Unit, assuming no exercise of the Warrants included

in the Units, no value is attributed to such Warrants and such Warrants are classified and accounted for as equity, and after deducting

the placement agent fees and estimated offering expenses payable by us, our pro forma as adjusted net tangible book value as of

December 31, 2018 would have been approximately $21.7 million, or approximately $0.50 per share. This represents an immediate increase

in pro forma net tangible book value of approximately $0.27 per share to our existing stockholders and an immediate dilution of

approximately $1.10 per share to new investors participating in this offering. The following table illustrates this dilution on

a per share basis:

|

Public offering price per Unit

|

|

|

|

|

|

$

|

1.60

|

|

|

Net tangible book value per share as of December 31, 2018

|

|

$

|

0.11

|

|

|

|

|

|

|

Increase in net tangible value per share attributable to the March 2019 Offering

|

|

$

|

0.12

|

|

|

|

|

|

|

Pro forma net tangible book value per share after March 2019 Offering

|

|

$

|

0.23

|

|

|

|

|

|

|

Increase in pro forma net tangible value per share attributable to this offering

|

|

$

|

0.27

|

|

|

|

|

|

|

Pro forma as adjusted net tangible book value per share after giving effect to this offering

|

|

|

|

|

|

$

|

0.50

|

|

|

Dilution per share to new investors participating in this offering

|

|

|

|

|

|

$

|

1.10

|

|

The number of shares of common stock to be outstanding after

this offering is based on 28,528,663 shares of common stock outstanding as of December 31, 2018, 33,778,663 shares on a pro forma

basis after giving effect to the March 2019 Offering, and excludes, as of that date, the following:

|

|

•

|

2,794,000 shares of common stock issuable upon the exercise of outstanding stock options, vested and unvested, with a weighted-average

exercise price of $2.61 per share;

|

|

|

•

|

410,020 shares of common stock issuable upon the exercise of outstanding Series A, vested Series C and underwriter warrants

from our February 14, 2017 follow-on offering with a weighted-average exercise price of $1.50 per share;

|

|

|

•

|

250,000 shares of common stock issuable upon the exercise of outstanding warrants under a consulting agreement with a weighted

average price of $2.76;

|

|

|

•

|

107,802 shares of common stock issuable upon the exercise of outstanding underwriter warrants issued on May 1, 2016 related

to our IPO with an exercise price of $7.50 per share;

|

|

|

•

|

up to an aggregate of 1,706,000 shares of common stock reserved for future issuance under our 2015 Stock Plan, as amended;

|

|

|

•

|

2,273,700 shares of our common stock issuable upon the exercise of the warrants issued in our February 2018 private placement;

|

|

|

•

|

710,212 shares of our common stock issuable upon the exercise of the warrants issued in our June 2018 private placement;

|

|

|

•

|

up to 32,779 shares of common stock issuable upon the exercise of the warrants issuable to the placement agent in our June

2018 offering;

|

|

|

•

|

2,625,000 shares of common stock issuable upon the exercise of the warrants issued in the March 2019 Offering;

|

|

|

•

|

367,500 shares of common stock issuable upon the exercise of the warrants issuable to the representative of the underwriters

in the March 2019 Offering;

|

|

|

•

|

4,687,500 shares of our common stock issuable upon the exercise of the warrants included in the Units; and

|

|

|

•

|

562,500 shares of common stock issuable upon the exercise of the warrants issuable to the placement agent in this offering.

|

The above illustration of dilution per share to investors participating

in this offering assumes no exercise of outstanding options or warrants to purchase our common stock. The exercise of outstanding

options or warrants, having an exercise or conversion price less than the offering price would increase dilution to investors participating

in this offering. In addition, we may choose to raise additional capital depending on market conditions, our capital requirements

and strategic considerations, even if we believe we have sufficient funds for our current or future operating plans. To the extent

that additional capital is raised through our sale of equity or convertible debt securities, the issuance of these securities could

result in further dilution to our stockholders.

Description of the Securities We are

Offering

We are offering Units, each Unit consisting

of one share of our common stock and 0.5 of a Warrant to purchase one share of our common stock. The shares of common stock and

the Warrants included in the Units can only be purchased together in this offering, but the securities contained in the Units will

be issued separately and will be immediately separable upon issuance. We are also registering the shares of common stock included

in the Units and the shares of common stock issuable from time to time upon exercise of Warrants included in the Units offered

hereby.

Common Stock

The material terms and provisions of our

common stock are described under the caption “Description of Common Stock” starting on page 4 of the accompanying prospectus.

Warrants

The following summary of certain terms

and provisions of the Warrants is not complete and is subject to, and qualified in its entirety by, the provisions of the Warrants.

Prospective investors should carefully review the terms and provisions of the form of Warrant for a complete description of the

terms and conditions of the Warrants.

Duration and Exercise Price

Each Warrant included in the Units will

have an exercise price of $1.75 per share, will be immediately exercisable and will expire five years from the date of issuance.

The exercise price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event

of stock dividends, stock splits, reorganizations or similar events affecting our common stock and the exercise price. The Warrants

will be issued separately from the common stock included in the Units. 0.5 of a Warrant to purchase one share of our common stock

will be included in each Unit purchased in this offering.

Cashless Exercise

If, at the time a holder exercises its

Warrants, a registration statement registering the issuance of the shares of common stock underlying the Warrants under the Securities

Act is not then effective or available for the issuance of such shares, then in lieu of making the cash payment otherwise contemplated

to be made to us upon such exercise in payment of the aggregate exercise price, the holder will be permitted to receive upon such

exercise (either in whole or in part) the net number of shares of common stock determined according to a formula set forth in the

Warrants.

Exercisability

The Warrants will be exercisable, at the

option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full

for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed

above). A holder (together with its affiliates) may not exercise any portion of a Warrant to the extent that the holder would own

more than 4.99% of the outstanding common stock immediately after exercise, except that upon at least 61 days' prior notice from

the holder to us, the holder may increase the amount of ownership of outstanding stock after exercising the holder's Warrants up

to 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage

ownership is determined in accordance with the terms of the Warrants. Purchasers of Warrants in this offering may also elect prior

to the issuance of Warrants to have the initial exercise limitation set at 9.99% of our outstanding common stock.

Fractional Shares

No fractional shares of common stock will

be issued upon the exercise of the Warrants. Rather, the number of shares of common stock to be issued will be rounded to the nearest

whole number.

Transferability

Subject to applicable laws, a Warrant may

be transferred at the option of the holder upon surrender of the Warrant to us together with the appropriate instruments of transfer.

Exchange Listing

We do not intend to list the Warrants on

any securities exchange or nationally recognized trading system. The common stock issuable upon exercise of the Warrants is currently

listed on the Nasdaq Capital Market.

Right as a Stockholder

Except as otherwise provided in the Warrants

or by virtue of such holder’s ownership of shares of our common stock, the holders of the Warrants do not have the rights

or privileges of holders of our common stock, including any voting rights, until they exercise their Warrants.

Fundamental Transaction

In the event of a fundamental transaction,

as described in the Warrants and generally including any reorganization, recapitalization or reclassification of our common stock,

the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with

or into another person, the acquisition of at least 50% of our outstanding common stock, or any person or group becoming the beneficial

owner of at least 50% of the voting power represented by our outstanding common stock, the holders of the Warrants will be entitled

to receive upon exercise of the Warrants the kind and amount of securities, cash or other property that the holders would have

received had they exercised the Warrants immediately prior to such fundamental transaction. In addition, in the event of a fundamental

transaction which is approved by our Board, the holders of the Warrants have the right to require us or a successor entity to redeem

the Warrants for cash in the amount of the Black-Scholes value of the unexercised portion of the Warrants on the date of the consummation

of the fundamental transaction. In the event of a fundamental transaction which is not approved by our Board, the holders of the

Warrants have the right to require us or a successor entity to redeem the Warrants for the consideration paid in the fundamental

transaction in the amount of the Black Scholes value of the unexercised portion of the Warrants on the date of the consummation

of the fundamental transaction payable at our option in either shares of our common stock (or, in certain cases, in the securities

of the successor entity) or cash.

Plan of Distribution

We have engaged Oppenheimer & Co. Inc.

to act as our sole placement agent pursuant to a placement agent agreement in connection with this offering, dated as of April

23, 2109 by and between Oppenheimer & Co. Inc. (the “Placement Agent”) and us, in connection with this offering.

The placement agent is not purchasing or selling any of the securities we are offering by this prospectus supplement but has agreed

to use its reasonable best efforts to arrange for the sale of the Units offered by this prospectus supplement. The placement agent

may retain sub-agents and selected dealers in connection with this offering.

We have entered into subscription agreements,

each dated April 23, 2019, directly with several investors who have agreed to purchase the Units in this offering. The subscription

agreements and the placement agent agreement provide that the obligations of the placement agent and the investors are subject

to certain conditions precedent, including, among other things, the absence of any material adverse change in our business and

the receipt of customary opinions and closing certificates.

We currently anticipate that the closing

of this offering will take place on or about April 25, 2019, subject to customary closing conditions. On the closing date, the

following will occur:

|

|

●

|

we will receive funds in the amount of the aggregate purchase price;

|

|

|

|

|

|

|

●

|

the placement agent will receive the placement agent fees in accordance with the terms of the placement agent agreement; and

|

|

|

|

|

|

|

●

|

we will deliver the shares of our common stock and Warrants to the investors.

|

We have agreed to pay the placement agent

a placement agent fee in cash equal to 6.0%, or $900,000, of the gross proceeds from the sale of the Units in this offering. The

following table shows the per Unit and total placement agent fees we will pay in connection with the sale of the Units offered

hereby, assuming the purchase of all of the Units we are offering.

|

|

Per unit placement agent fee

|

|

$

|

0.096

|

|

|

|

Total placement agent fees payable by us

|

|

$

|

900,000

|

|

In addition, we have agreed to reimburse

the placement agent at the closing for its legal fees and expenses in connection with this offering in the amount of $75,000. We

have also agreed to issue to the placement agent warrants to purchase up to 562,500 shares of our common stock, which equates

to 6.0% of the number of shares of our common stock to be issued and sold in this offering, at an exercise price of $1.75 per share.

The placement agent warrants have been deemed compensation by the Financial Industry Regulatory Authority, Inc. (“FINRA”)

and are therefore shall not be sold, transferred, assigned, pledged, or hypothecated, or be the subject of any hedging, short sale,

derivative, put or call transaction that would result in the effective economic disposition of the securities by any person for

a period of 180 days immediately following the date of effectiveness or commencement of sales of the public offering, pursuant

to Rule 5110(g)(1) of FINRA’s Rules. We have also agreed, subject to certain conditions, to provide the placement agent with a right of first

refusal to act as sole book-running underwriter, sole-lead initial purchaser, sole-lead placement agent, or sole-lead selling agent,

as the case may be, on any financing for us on or before January 25, 2020.

We estimate the total expenses of this

offering (including the expenses reimbursable to the placement agent) payable by us, excluding the placement agent fee, will be

approximately $125,000.

We have agreed to indemnify the placement

agent and certain other persons against certain liabilities relating to or arising out of the placement agent’s activities

under the placement agency agreement. We have also agreed to contribute to payments the placement agent may be required to make

in respect of such liabilities.

The placement agent may be deemed to be

an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit

realized on the resale of the shares sold by it while acting as principal might be deemed to be underwriting discounts or commissions

under the Securities Act. As an underwriter, the placement agent would be required to comply with the requirements of the Securities

Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation

M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares of common stock by

the placement agent acting as principal. Under these rules and regulations, the placement agent:

|

|

●

|

must not engage in any stabilization activity in connection with our securities; and

|

|

|

|

|

|

|

●

|

must not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution.

|

A copy of the form of the subscription

agreement we entered into with the investors will be included as an exhibit to our Current Report on Form 8-K that will be filed

with the Securities and Exchange Commission in connection with the consummation of this offering.

We and our executive officers and directors have agreed to a

90-day “lock-up” with respect to shares of our common stock and other securities beneficially owned, including securities

that are convertible into, or exchangeable or exercisable for, shares of our common stock. Subject to certain exceptions, during

such lock-up period following the date of this prospectus supplement, we and our executive officers and directors may not offer,

sell, pledge or otherwise dispose of these securities without the prior written consent of the placement agent.

The placement agent and its affiliates have provided in the

past and may provide from time to time in the future certain commercial banking, financial advisory, investment banking and other

services for us and our affiliates in the ordinary course of their business, for which they may receive customary fees and commissions.

In addition, from time to time, the placement agent and its affiliates may effect transactions for their own account or the accounts

of customers, and hold on behalf of itself or its customers, long or short positions in our debt or equity securities or loans,

and may do so in the future. The placement agent served as the representative of the several underwriters in connection with the

March 2019 Offering and received an underwriting discount of $321,370 and an expense reimbursement of $115,000 in connection therewith.

In addition, we issued to the placement agent five-year warrants to purchase up to 367,500 share of our common stock at an exercise

price of $1.10 per share. We also agreed, subject to certain conditions, to provide the placement agent. with a right of first

refusal to act as sole book-running underwriter, sole-lead initial purchaser, sole-lead placement agent, or sole-lead selling agent,

as the case may be, on any financing for us on or before September 29, 2019.

Roth Capital Partners, LLC and Maxim Group LLC acted as financial

advisors to us in connection with the offering and will receive customary financial advisory fees in connection therewith. Roth

Capital Partners, LLC and Maxim Group LLC are not engaged in, nor affiliated with any entity that is engaged in, the solicitation

or distribution of this offering.

Legal Matters

The validity of the securities offered hereby will be passed

upon for us by Schiff Hardin LLP, Washington, DC. Lowenstein Sandler LLP, New York, New York, is acting as counsel for the

placement

agent

in connection with this offering.

Experts

The audited financial statements incorporated by reference in

this prospectus and elsewhere in the registration statement have been incorporated by reference in reliance upon the reports of

Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

Incorporation by Reference

The SEC allows us to “incorporate by reference”

into this prospectus supplement the information in other documents that we file with it. This means that we can disclose important

information to you by referring you to those documents. The information incorporated by reference is considered to be a part of

this prospectus supplement, and information in documents that we file later with the SEC will automatically update and supersede

information contained in documents filed earlier with the SEC or contained in this prospectus supplement. We incorporate by reference

in this prospectus supplement the documents listed below and any future filings that we may make with the SEC under Sections 13(a),

13(c), 14, or 15(d) of the Exchange Act prior to the termination of the offering under this prospectus supplement; provided, however,

that we are not incorporating, in each case, any documents or information deemed to have been furnished and not filed in accordance

with SEC rules:

|

|

·

|

Our Annual Report on Form 10-K for the year ended December 31, 2018 (filed on February 21, 2019);

|

|

|

·

|

Our Current Reports on Form 8-K filed on February 5, 2019; February 7, 2019; March 14, 2019; March 28, 2019; and April 23,

2019;

|

|

|

·

|

Our Definitive Proxy Statement on Schedule 14A filed on April 16, 2019; and

|

|

|

·

|

the description of our common stock, par value $0.001 per share contained in our Registration Statement on Form 8-A, dated

and filed with the SEC on April 28, 2016, and any amendment or report filed with the SEC for the purpose of updating the description.

|

All reports and other documents we subsequently file pursuant

to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, including all such documents

we may file with the SEC after the date of this prospectus supplement and accompanying prospectus, but excluding any information

furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus supplement and deemed

to be part of this prospectus supplement from the date of the filing of such reports and documents.

You may obtain a copy of any or all of the documents referred

to above, which may have been or may be incorporated by reference into this prospectus supplement, including exhibits, at no cost

to you by writing or telephoning us at the following address: Attention: Corporate Secretary, 5300 Memorial Drive, Suite 950, Houston,

Texas 77007, telephone (713) 300-5160..

Where You Can Find More Information

This prospectus supplement and the accompanying prospectus are

part of a registration statement on Form S-3 we filed with the SEC under the Securities Act and do not contain all the information

set forth or incorporated by reference in the registration statement. Whenever a reference is made in this prospectus supplement

or the accompanying prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you

should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated

by reference into this prospectus supplement or the accompanying prospectus for a copy of such contract, agreement or other document.

Because we are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly and current

reports, proxy statements and other information with the SEC. You may read and copy information filed by us with the SEC at the

SEC’s public reference section, 100 F Street, N.E., Washington, D.C. 20549. Information regarding the operation of the public

reference section can be obtained by calling 1-800-SEC-0330. The SEC also maintains an Internet site at http://www.sec.gov that

contains reports, statements and other information about issuers, such as us, who file electronically with the SEC.

PROSPECTUS

$75,000,000

Moleculin Biotech, Inc.

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

We may from time to time

issue up to $75,000,000 aggregate dollar amount of common stock, preferred stock, debt securities, warrants or units of securities.

We will specify in the accompanying prospectus supplement the terms of the securities to be offered and sold. We may sell these

securities directly to you, through underwriters, dealers or agents we select, or through a combination of these methods. We will

describe the plan of distribution for any particular offering of these securities in the applicable prospectus supplement. This

prospectus may not be used to sell our securities unless it is accompanied by a prospectus supplement.

Our common stock is listed

on The NASDAQ Capital Market and traded under the symbol “MBRX”. On August 9, 2017, the closing price of the common

stock, as reported on NASDAQ was $2.87 per share.

As of August 1, 2017,

the aggregate market value of our outstanding common stock held by non-affiliates was approximately $35,633,714, based on 20,261,904

shares of outstanding common stock, of which approximately 13,148,972 shares are held by non-affiliates, and a per share price

of $2.71 based on the closing sales price of our common stock on August 1, 2017. As of the date hereof, we have not offered any

securities pursuant to General Instruction I.B.6 of Form S-3 during the prior 12 calendar month period that ends on and includes

the date hereof.

Investing in our securities

is highly speculative and involves a high degree of risk. You should purchase these securities only if you can afford a complete

loss of your investment. You should carefully consider the risks and uncertainties described under the heading “Risk Factors”

beginning on page 3 of this prospectus before making a decision to purchase our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 21, 2017.

Table

of Contents

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, utilizing

a “shelf” registration process. Under this shelf registration process, we may sell the securities described in this

prospectus in one or more offerings up to a total dollar amount of $75,000,000.

We

have provided to you in this prospectus a general description of the securities we may offer. Each time we sell securities under

this shelf registration process, we will provide a prospectus supplement that will contain specific information about the terms

of that offering. That prospectus supplement may include additional risk factors or other special considerations applicable to

the securities being offered. We may also add, update or change in the prospectus supplement any of the information contained

in this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus

supplement, you should rely on the information in the prospectus supplement, provided that if a statement in any document is inconsistent

with a statement in another document having a later date — for example, a document incorporated by reference in this prospectus

or any prospectus supplement — the statement in the document having the later date modifies or supersedes the earlier statement.

You should read both this prospectus and the prospectus supplement together with the additional information described under “Where

You Can Find More Information.”

The

registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information

about us and the securities offered under this prospectus. The registration statement, including the exhibits, can be read at

the SEC website or at the SEC offices mentioned under the heading “Where You Can Find More Information.”

You

should rely only on the information incorporated by reference or provided in this prospectus and the accompanying prospectus supplement.

We have not authorized anyone to provide you with different information. We are not making an offer to sell or soliciting an offer

to buy these securities in any jurisdiction in which the offer or solicitation is not authorized or in which the person making

the offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make the offer or solicitation. You

should not assume that the information in this prospectus or the accompanying prospectus supplement is accurate as of any date

other than the date on the front of the document.

Unless

the context requires otherwise, references to the “Company,” “MBI,” “we,” “our,”

and “us,” refer to Moleculin Biotech, Inc. and its subsidiaries.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities offered in

this offering. We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange

Commission. You may read and copy the registration statement and any other documents we have filed at the Securities and Exchange

Commission’s Public Reference Room 100 F Street, N.E., Washington, D.C. 20549. Please call the Securities and Exchange Commission

at 1-800-SEC-0330 for further information on the Public Reference Room. Our Securities and Exchange Commission filings are also

available to the public at the Securities and Exchange Commission’s Internet site at www.sec.gov.

This

prospectus is part of the registration statement and does not contain all of the information included in the registration statement.

Whenever a reference is made in this prospectus to any of our contracts or other documents, the reference may not be complete

and, for a copy of the contract or document, you should refer to the exhibits that are a part of the registration statement.

INCORPORATION

BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus the information we file with it, which means that

we can disclose important information to you by referring you to those documents. Later information filed with the SEC will update

and supersede this information.

We

incorporate by reference the documents listed below, all filings filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of

the Exchange Act after the date of the initial registration statement of which this prospectus forms a part prior to effectiveness

of such registration statement, and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange

Act prior to the time that all securities covered by this prospectus have been sold or the offering is otherwise terminated; provided,

however, that we are not incorporating any information furnished under either Item 2.02 or Item 7.01 of any current

report on Form 8-K:

|

|

•

|

Our

Annual Report on Form 10-K for the year ended December 31, 2016 filed on April

3, 2017.

|

|

|

•

|

Our

Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2017 and

June 30, 2017.

|

|

|

•

|

Our

Definitive Proxy Statement on Schedule 14A filed on April 28, 2017.

|

|

|

•

|

Our

Current Reports on Form 8-K dated February 9, 2017; February 23, 2017; March 14,

2017; March 22, 2017; April 17, 2017; May 19, 2017; May 31, 2017; June 27, 2017; June

30, 2017; July 12, 2017; and July 27, 2017.

|

|

|

•

|

The

description of our common stock contained in our registration statement on Form 8-A

filed on April 28, 2016, and any amendment or report filed for the purpose of updating

that description.

|

An

updated description of our capital stock is included in this prospectus under “Description of Common Stock” and “Description

of Preferred Stock”.

We

will provide to each person, including any beneficial owner, to whom this prospectus is delivered, upon written or oral request,

at no cost to the requester, a copy of any and all of the information that is incorporated by reference in this prospectus. You

may request a copy of these filings, at no cost, by contacting us at:

Moleculin Biotech, Inc.

Attn: Corporate Secretary

2575 West Bellfort, Suite

333

Houston, TX 77054

Phone: 713-300-5160

ABOUT

MOLECULIN BIOTECH, INC.

Our Company

We are a preclinical-stage

pharmaceutical company organized as a Delaware corporation in July 2015 to focus on the development of anti-cancer drug candidates,

some of which are based on license agreements with The University of Texas System on behalf of the M.D. Anderson Cancer Center,

which we refer to as MD Anderson. Our lead drug candidate is liposomal Annamycin, which we refer to as Annamycin, an anthracycline

being studied for the treatment of relapsed or refractory acute myeloid leukemia, or AML. We have two other drug development projects

in process, one involving a collection of small molecules, which we refer to as the WP1066 Portfolio, focused on the modulation

of key regulatory transcription factors involved in the progression of cancer, and the WP1222 Portfolio, a suite of molecules

targeting the metabolic processes involved in cancer in general and glioblastoma (the most common form of brain tumor) in particular.

We also continue to sponsor ongoing research at MD Anderson in order to improve and expand our drug development pipeline.

We have been granted royalty-bearing,

worldwide, exclusive licenses for the patent and technology rights related to our WP1066 Portfolio and WP1122 Portfolio drug technologies,

as these patent rights are owned by MD Anderson. The Annamycin drug substance is no longer covered by any existing patent protection.

We intend to submit patent applications for formulation, synthetic process and reconstitution related to our Annamycin drug product

candidate, although there is no assurance that we will be successful in obtaining such patent protection. Independently from potential

patent protection, we have received Orphan Drug designation from the FDA for Annamycin for the treatment of AML, which would entitle

us to market exclusivity of 7 years from the date of approval of a New Drug Application (NDA) in the United States. If we submit

and receive approval for a New Drug Application (NDA) for Annamycin for the treatment of AML, we may then benefit from Orphan

Drug exclusivity, during which period FDA generally could not approve another Annamycin product for the same use. We also intend

to apply for similar status in the European Union (EU) where market exclusivity extends to 10 years from the date of Marketing

Authorization Application (MAA). Separately, the FDA may also grant market exclusivity of 5 years for newly approved new chemical

entities (of which Annamycin would be one), but there can be no assurance that such exclusivity will be granted.

Corporate Information

Our

corporate headquarters is located at 2575 West Bellfort, Suite 333, Houston, TX 77054. Our phone number is (713) 300-5160.

Our corporate website is www.moleculin.com. Information contained on our website or any other website does not constitute part

of this prospectus.

RISK FACTORS

Before making an investment

decision, you should consider the “Risk Factors” included under Item 1A. of our Annual Report on Form 10-K for the

period ended December 31, 2016 and in our updates to those Risk Factors in our Quarterly Reports on Form 10-Q, all of which are

incorporated by reference in this prospectus, as updated by our future filings with the SEC. The market or trading price of our

common stock could decline due to any of these risks. In addition, please read “Forward-Looking Statements” in this

prospectus, where we describe additional uncertainties associated with our business and the forward-looking statements included

or incorporated by reference in this prospectus. Please note that additional risks not currently known to us or that we currently

deem immaterial may also impair our business and operations. The accompanying prospectus supplement may contain a discussion of

additional risks applicable to an investment in us and the particular type of securities we are offering under that prospectus

supplement.

Forward-Looking

Statements

Some of the information

in this prospectus, and the documents we incorporate by reference, contain forward-looking statements within the meaning of the

federal securities laws. You should not rely on forward-looking statements in this prospectus, and the documents we incorporate

by reference. Forward-looking statements typically are identified by use of terms such as “anticipate,” “believe,”

“plan,” “expect,” “future,” “intend,” “may,” “will,” “should,”

“estimate,” “predict,” “potential,” “continue,” and similar words, although some

forward-looking statements are expressed differently. This prospectus, and the documents we incorporate by reference, may also

contain forward-looking statements attributed to third parties relating to their estimates regarding the markets we may enter

in the future. All forward-looking statements address matters that involve risk and uncertainties, and there are many important

risks, uncertainties and other factors that could cause our actual results to differ materially from the forward-looking statements

contained in this prospectus, and the documents we incorporate by reference.

You should also consider

carefully the statements under “Risk Factors” and other sections of this prospectus, and the documents we incorporate

by reference, which address additional facts that could cause our actual results to differ from those set forth in the forward-looking

statements. We caution investors not to place significant reliance on the forward-looking statements contained in this prospectus,

and the documents we incorporate by reference. We undertake no obligation to publicly update or review any forward-looking statements,

whether as a result of new information, future developments or otherwise.

USE OF PROCEEDS

We expect to use the net

proceeds from the sale of securities offered by this prospectus and the prospectus supplement for our clinical trials, if any,