Merit Medical Systems, Inc. (NASDAQ: MMSI), a leading manufacturer

and marketer of proprietary medical devices used in interventional,

diagnostic and therapeutic procedures, particularly in cardiology,

radiology, oncology, critical care and endoscopy, today announced

revenue of $280.3 million for the quarter ended June 30, 2021, an

increase of 28.4% compared to the quarter ended June 30, 2020.

Constant currency revenue, organic* for the second quarter of 2021

was up 25.5% compared to the prior year period.

Merit’s GAAP gross margin for the second quarter

of 2021 was 44.3%, compared to GAAP gross margin of 38.6% for the

prior year period. Merit’s non-GAAP gross margin* for the second

quarter of 2021 was 48.7%, compared to non-GAAP gross margin* of

44.7% for the prior year period.

Merit’s GAAP net income for the second quarter

of 2021 was $4.9 million, or $0.09 per share, compared to a GAAP

net loss of ($19.1) million, or ($0.34) per share, for the second

quarter of 2020. Merit’s non-GAAP net income* for the second

quarter of 2021 was $35.3 million, or $0.62 per share, compared to

non-GAAP net income* of $17.4 million, or $0.31 per share, for the

prior year period.

Merit’s revenue by operating segment and product

category for the three and six-month periods ended June 30, 2021,

compared to the corresponding periods in 2020, was as follows

(unaudited; in thousands, except for percentages):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months Ended |

|

|

|

Six Months Ended |

| |

|

|

|

June 30, |

|

|

|

June 30, |

| |

% Change |

|

|

2021 |

|

2020 |

|

% Change |

|

2021 |

|

2020 |

|

Cardiovascular |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Peripheral Intervention |

45.4 |

% |

|

$ |

105,600 |

|

$ |

72,635 |

|

24.3 |

% |

$ |

198,514 |

|

$ |

159,710 |

|

Cardiac Intervention |

29.8 |

% |

|

|

85,653 |

|

|

66,005 |

|

15.7 |

% |

|

160,390 |

|

|

138,596 |

|

Custom Procedural Solutions |

7.3 |

% |

|

|

48,636 |

|

|

45,319 |

|

1.2 |

% |

|

94,057 |

|

|

92,940 |

|

OEM |

14.8 |

% |

|

|

32,403 |

|

|

28,218 |

|

6.8 |

% |

|

60,337 |

|

|

56,475 |

| Total |

28.3 |

% |

|

|

272,292 |

|

|

212,177 |

|

14.6 |

% |

|

513,298 |

|

|

447,721 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Endoscopy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Endoscopy devices |

29.7 |

% |

|

|

8,033 |

|

|

6,194 |

|

12.5 |

% |

|

15,940 |

|

|

14,175 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

28.4 |

% |

|

$ |

280,325 |

|

$ |

218,371 |

|

14.6 |

% |

$ |

529,238 |

|

$ |

461,896 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

“We delivered better-than-expected revenue

results for the second quarter, driven by strong execution and

improving customer demand trends as the global recovery continues

to progress,” said Fred P. Lampropoulos, Merit’s Chairman and Chief

Executive Officer. “Other financial results for the second quarter

were impressive as well; the combination of our strong top-line

growth, and contributions from our multi-year strategic initiatives

undertaken as part of our Foundations for Growth Program, resulted

in significant expansion in our non-GAAP margins* and growth in our

non-GAAP net income* and non-GAAP EPS* of 103% and 100%,

respectively, year-over-year.”

Mr. Lampropoulos continued: “We are pleased with

the strong financial results we have delivered over the first half

of 2021 and remain optimistic in our outlook for measured

improvement in the operating environment as we move through the

remainder of 2021. We have updated our 2021 guidance as a result of

our better-than-expected second quarter results and a more

favorable outlook for growth in the second half of 2021. We now

expect total revenue growth, on a constant currency basis*, of

approximately 9% to 10% year-over-year and, importantly, excluding

the impact of divestitures and product sales that uniquely

benefitted from pandemic-related demand trends in 2020, our

constant currency revenue guidance* now reflects growth of

approximately 12% to 13% in 2021. We also continue to expect

profitability improvement and notable free cash flow* generation

driven by strong execution and contributions from our multi-year

strategic initiatives undertaken as part of our Foundations for

Growth Program.”

As of June 30, 2021, Merit had cash on hand of

approximately $70.0 million, long term debt obligations of

approximately $293 million, and available borrowing capacity of

$444 million, compared to cash on hand of approximately $56.9

million, long term debt obligations of $352 million, and available

borrowing capacity of $389 million as of December 31, 2020.

Updated Fiscal Year 2021 Financial Guidance

Based upon information currently available to

Merit’s management, Merit is updating net revenue expectations for

the year ending December 31, 2021. Absent material

acquisitions, non-recurring transactions or other factors beyond

Merit’s control, Merit now forecasts the following:

|

|

|

|

|

|

|

|

|

Financial Measure |

|

|

Prior Guidance |

|

|

Revised Guidance |

| |

|

|

|

|

|

|

| Net Sales |

|

|

$994 - $1,014 million |

|

|

$1,060 - $1,070 million |

| |

|

|

|

|

|

|

| GAAP |

|

|

|

|

|

|

|

Net Income |

|

|

$47.3 - $55.9 million |

|

|

$43.2 - $51.8 million |

|

Earnings Per Share |

|

|

$0.83 - $0.98 |

|

|

$0.75 - $0.91 |

| |

|

|

|

|

|

|

| Non-GAAP |

|

|

|

|

|

|

|

Net Income |

|

|

$104.8 - $112.7 million |

|

|

$118.8 - $127.1 million |

|

Earnings Per Share |

|

|

$1.84 - $1.98 |

|

|

$2.07 - $2.22 |

|

|

|

|

|

|

|

|

The updated net revenue range continues to

assume a benefit from the changes in foreign currency exchange

rates in the range of approximately $10.5 million to $11.5 million.

The prior guidance range assumed growth of approximately 3.1% to

5.2% year over year and a benefit from changes in foreign currency

exchange rates in the range of approximately $8.0 million to $8.5

million.

The updated fiscal year 2021 net revenue

guidance range assumes:

- Net revenue from the cardiovascular

segment of between $1,028 million and $1,038 million, representing

an increase of approximately 10% to 11% year-over-year as compared

to net revenue of $934.2 million for the twelve months ended

December 31, 2020. The prior guidance assumed growth of

approximately 3.1% to 5.2% year-over-year.

- Net revenue from the endoscopy

segment of between $32.5 million and $32.7 million, representing an

increase of approximately 9.6% to 10.2% year-over-year as compared

to net revenue of $29.7 million for the twelve months ended

December 31, 2020. The prior guidance assumed growth of

approximately 4% to 7% year-over-year.

Merit’s financial guidance for the year

ending December 31, 2021 is subject to risks and uncertainties

identified in this release and Merit’s filings with the U.S.

Securities and Exchange Commission (the “SEC”).

CONFERENCE CALL

Merit will hold its investor conference call

(conference ID 3993753) today, Thursday, July 29, 2021, at

5:00 p.m. Eastern (4:00 p.m. Central, 3:00 p.m.

Mountain, and 2:00 p.m. Pacific). The domestic telephone

number is (844) 578-9672 and the international number is (508)

637-5656. A live webcast and slide deck will also be available at

merit.com.CONSOLIDATED BALANCE SHEETS(in

thousands)

| |

|

|

|

|

|

| |

June 30, |

|

|

|

| |

2021 |

|

December 31, |

| |

(Unaudited) |

|

2020 |

| ASSETS |

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

69,672 |

|

|

$ |

56,916 |

|

|

Trade receivables, net |

|

153,443 |

|

|

|

146,641 |

|

|

Other receivables |

|

8,376 |

|

|

|

7,774 |

|

|

Inventories |

|

194,524 |

|

|

|

198,019 |

|

|

Prepaid expenses and other assets |

|

16,541 |

|

|

|

13,120 |

|

|

Prepaid income taxes |

|

3,683 |

|

|

|

3,688 |

|

|

Income tax refund receivables |

|

3,543 |

|

|

|

3,549 |

|

|

Total current assets |

|

449,782 |

|

|

|

429,707 |

|

| |

|

|

|

|

|

| Property and equipment,

net |

|

373,801 |

|

|

|

382,728 |

|

| Intangible assets, net |

|

342,792 |

|

|

|

367,915 |

|

| Goodwill |

|

362,810 |

|

|

|

363,533 |

|

| Deferred income tax

assets |

|

4,614 |

|

|

|

4,597 |

|

| Operating lease right-of-use

assets |

|

70,767 |

|

|

|

78,240 |

|

| Other assets |

|

37,827 |

|

|

|

37,676 |

|

| Total Assets |

$ |

1,642,393 |

|

|

$ |

1,664,396 |

|

| |

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

Trade payables |

$ |

53,809 |

|

|

$ |

49,837 |

|

|

Accrued expenses |

|

135,013 |

|

|

|

111,944 |

|

|

Current portion of long-term debt |

|

7,500 |

|

|

|

7,500 |

|

|

Current operating lease liabilities |

|

11,721 |

|

|

|

12,903 |

|

|

Income taxes payable |

|

2,561 |

|

|

|

2,820 |

|

|

Total current liabilities |

|

210,604 |

|

|

|

185,004 |

|

| |

|

|

|

|

|

| Long-term debt |

|

284,900 |

|

|

|

343,722 |

|

| Deferred income tax

liabilities |

|

33,271 |

|

|

|

33,312 |

|

| Long-term income taxes

payable |

|

347 |

|

|

|

347 |

|

| Liabilities related to

unrecognized tax benefits |

|

1,016 |

|

|

|

1,016 |

|

| Deferred compensation

payable |

|

17,055 |

|

|

|

16,808 |

|

| Deferred credits |

|

1,869 |

|

|

|

1,923 |

|

| Long-term operating lease

liabilities |

|

65,841 |

|

|

|

70,941 |

|

| Other long-term

obligations |

|

35,056 |

|

|

|

52,748 |

|

|

Total liabilities |

|

649,959 |

|

|

|

705,821 |

|

| |

|

|

|

|

|

| Stockholders' Equity |

|

|

|

|

|

|

Common stock |

|

623,591 |

|

|

|

606,224 |

|

|

Retained earnings |

|

373,677 |

|

|

|

357,803 |

|

|

Accumulated other comprehensive loss |

|

(4,834 |

) |

|

|

(5,452 |

) |

|

Total stockholders' equity |

|

992,434 |

|

|

|

958,575 |

|

| Total Liabilities and

Stockholders' Equity |

$ |

1,642,393 |

|

|

$ |

1,664,396 |

|

| |

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF INCOME

(LOSS)(Unaudited; in thousands except per share

amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

NET SALES |

$ |

280,325 |

|

|

$ |

218,371 |

|

|

$ |

529,238 |

|

|

$ |

461,896 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| COST OF SALES |

|

156,186 |

|

|

|

134,155 |

|

|

|

293,205 |

|

|

|

273,896 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

124,139 |

|

|

|

84,216 |

|

|

|

236,033 |

|

|

|

188,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

91,563 |

|

|

|

66,767 |

|

|

|

172,587 |

|

|

|

145,575 |

|

|

Research and development |

|

17,593 |

|

|

|

14,026 |

|

|

|

33,867 |

|

|

|

28,898 |

|

|

Legal settlement |

|

— |

|

|

|

18,200 |

|

|

|

— |

|

|

|

18,200 |

|

|

Impairment charges |

|

4,283 |

|

|

|

3,875 |

|

|

|

4,283 |

|

|

|

7,720 |

|

|

Contingent consideration expense |

|

1,805 |

|

|

|

343 |

|

|

|

2,207 |

|

|

|

5,240 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

115,244 |

|

|

|

103,211 |

|

|

|

212,944 |

|

|

|

205,633 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| INCOME (LOSS) FROM

OPERATIONS |

|

8,895 |

|

|

|

(18,995 |

) |

|

|

23,089 |

|

|

|

(17,633 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

92 |

|

|

|

88 |

|

|

|

564 |

|

|

|

167 |

|

|

Interest expense |

|

(1,386 |

) |

|

|

(2,715 |

) |

|

|

(2,923 |

) |

|

|

(5,859 |

) |

|

Other expense - net |

|

(736 |

) |

|

|

(678 |

) |

|

|

(1,171 |

) |

|

|

(967 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total other expense — net |

|

(2,030 |

) |

|

|

(3,305 |

) |

|

|

(3,530 |

) |

|

|

(6,659 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| INCOME (LOSS) BEFORE INCOME

TAXES |

|

6,865 |

|

|

|

(22,300 |

) |

|

|

19,559 |

|

|

|

(24,292 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| INCOME TAX EXPENSE

(BENEFIT) |

|

1,949 |

|

|

|

(3,242 |

) |

|

|

3,685 |

|

|

|

(2,080 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME (LOSS) |

$ |

4,916 |

|

|

$ |

(19,058 |

) |

|

$ |

15,874 |

|

|

$ |

(22,212 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS (LOSS) PER COMMON

SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.09 |

|

|

$ |

(0.34 |

) |

|

$ |

0.28 |

|

|

$ |

(0.40 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

$ |

0.09 |

|

|

$ |

(0.34 |

) |

|

$ |

0.28 |

|

|

$ |

(0.40 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE SHARES

OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

56,061 |

|

|

|

55,406 |

|

|

|

55,890 |

|

|

|

55,326 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

57,277 |

|

|

|

55,406 |

|

|

|

57,128 |

|

|

|

55,326 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

Although Merit’s financial statements are

prepared in accordance with accounting principles generally

accepted in the United States of America (“GAAP”), Merit’s

management believes that certain non-GAAP financial measures

referenced in this release provide investors with useful

information regarding the underlying business trends and

performance of Merit’s ongoing operations and can be useful for

period-over-period comparisons of such operations. Non-GAAP

financial measures used in this release include:

- constant

currency revenue;

- constant

currency revenue, organic;

- core

revenue;

- non-GAAP gross

margin;

- non-GAAP

operating income and margin;

- non-GAAP net

income;

- non-GAAP

earnings per share; and

- free cash

flow.

Merit’s management team uses these non-GAAP

financial measures to evaluate Merit’s profitability and

efficiency, to compare operating and financial results to prior

periods, to evaluate changes in the results of its operating

segments, and to measure and allocate financial resources

internally. However, Merit’s management does not consider such

non-GAAP measures in isolation or as an alternative to measures

determined in accordance with GAAP.

Readers should consider non-GAAP measures used

in this release in addition to, not as a substitute for, financial

reporting measures prepared in accordance with GAAP. These non-GAAP

financial measures generally exclude some, but not all, items that

may affect Merit’s net income. In addition, they are subject to

inherent limitations as they reflect the exercise of judgment by

management about which items are excluded. Merit believes it is

useful to exclude such items in the calculation of non-GAAP

earnings per share, non-GAAP gross margin, non-GAAP operating

income and margin, and non-GAAP net income (in each case, as

further illustrated in the reconciliation tables below) because

such amounts in any specific period may not directly correlate to

the underlying performance of Merit’s business operations and can

vary significantly between periods as a result of factors such as

acquisition or other extraordinary transactions, non-cash expenses

related to amortization or write-off of previously acquired

tangible and intangible assets, certain severance expenses,

expenses resulting from non-ordinary course litigation or

administrative proceedings and resulting settlements, corporate

transformation expenses, governmental proceedings or changes in tax

or industry regulations, gains or losses on disposal of certain

assets, and debt issuance costs. Merit may incur similar types of

expenses in the future, and the non-GAAP financial information

included in this release should not be viewed as a statement or

indication that these types of expenses will not recur.

Additionally, the non-GAAP financial measures used in this release

may not be comparable with similarly titled measures of other

companies. Merit urges readers to review the reconciliations of its

non-GAAP financial measures to the comparable GAAP financial

measures, and not to rely on any single financial measure to

evaluate Merit’s business or results of operations.

Constant Currency Revenue

Merit’s constant currency revenue is prepared by

converting the current-period reported revenue of subsidiaries

whose functional currency is a currency other than the U.S. dollar

at the applicable foreign exchange rates in effect during the

comparable prior-year period, and adjusting for the effects of

hedging transactions on reported revenue, which are recorded in the

U.S. The constant currency revenue adjustments of ($6.2) million

and ($10.0) million to reported revenue for the three and six-month

periods ended June 30, 2021 were calculated using the

applicable average foreign exchange rates for the three and

six-month periods ended June 30, 2020, respectively.

Constant Currency Revenue, Organic

Merit’s constant currency revenue, organic, is

defined, with respect to prior fiscal year periods, as GAAP

revenue. With respect to current fiscal year periods, constant

currency revenue, organic, is defined as constant currency revenue

(as defined above), less revenue from certain acquisitions. For the

three and six-month periods ended June 30, 2021, Merit’s

constant currency revenue, organic, excludes revenues attributable

to the acquisition of KA Medical, LLC in November 2020.

Core Revenue

For the three and six-month periods ended June 30, 2020, Merit’s

core revenue excludes revenues attributable to its distribution

agreement with NinePoint Medical, Inc., which was suspended during

the first quarter of 2020, revenues attributable to the manufacture

of Merit’s Hypotube product which was divested in August 2020,

revenues attributable to the ITL Healthcare Pty Ltd (“ITL”)

procedure pack business in Australia which was closed in December

2020, and revenue attributable to sales of the CulturaTM

nasopharyngeal swabs and test kits (which benefited from high

demand in 2020 resulting from the COVID-19 pandemic but which are

not expected to contribute significant revenue in the future).

With respect to the three and six-month periods ended June 30,

2021, core revenue is defined as constant currency revenue, organic

(as defined above), less revenue attributable to sales of the

Cultura nasopharyngeal swabs and test kits, and revenue

attributable to the final sales of products from the closed ITL

procedure pack business in the first quarter of 2021.

Non-GAAP Gross Margin

Non-GAAP gross margin is calculated by reducing

GAAP cost of sales by amounts recorded for amortization of

intangible assets, certain inventory write-offs, and inventory

mark-up related to acquisitions, divided by reported net sales.

Non-GAAP Operating Income and Margin

Non-GAAP operating income is calculated by

adjusting GAAP operating income (loss) for certain items which are

deemed by Merit’s management to be outside of core operations and

vary in amount and frequency among periods, such as expenses

related to new acquisitions, non-cash expenses related to

amortization or write-off of previously acquired tangible and

intangible assets, certain severance expenses, performance-based

stock compensation expenses, corporate transformation expenses,

expenses resulting from non-ordinary course litigation or

administrative proceedings and resulting settlements, governmental

proceedings or changes in industry regulations, as well as other

items referenced in the tables below. Non-GAAP operating margin is

calculated by dividing non-GAAP operating income by reported net

sales.

Non-GAAP Net Income

Non-GAAP net income is calculated by adjusting

GAAP net income (loss) for the items set forth in the definition of

non-GAAP operating income above, as well as for expenses related to

debt issuance costs, gains or losses on disposal of certain assets,

changes in tax regulations, and other items set forth in the tables

below.

Non-GAAP EPS

Non-GAAP EPS is defined as non-GAAP net income

divided by the diluted shares outstanding for the corresponding

period.

Free Cash Flow

Free cash flow is defined as cash flow from

operations calculated in accordance with GAAP, less capital

expenditures calculated in accordance with GAAP, as set forth in

the consolidated statement of cash flows.

Non-GAAP Financial Measure Reconciliations

The following tables set forth supplemental

financial data and corresponding reconciliations of non-GAAP

financial measures to Merit’s corresponding financial measures

prepared in accordance with GAAP, in each case, for the three and

six-month periods ended June 30, 2021 and 2020. The

non-GAAP income adjustments referenced in the following tables do

not reflect non-performance-based stock compensation expense of

approximately $1.8 million and $2.4 million for the three-month

periods ended June 30, 2021 and 2020, respectively, and

approximately $4.4 million and $4.7 million for the six-month

periods ended June 30, 2021 and 2020.

Reconciliation of GAAP Net Income (Loss) to

Non-GAAP Net Income(Unaudited; in thousands except per

share amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

June 30, 2021 |

| |

Pre-Tax |

|

Tax Impact |

|

After-Tax |

|

Per Share Impact |

|

GAAP net income |

$ |

6,865 |

|

$ |

(1,949 |

) |

|

$ |

4,916 |

|

$ |

0.09 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Sales |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangibles |

|

10,631 |

|

|

(2,640 |

) |

|

|

7,991 |

|

|

0.14 |

|

Inventory write-off (a) |

|

1,620 |

|

|

(202 |

) |

|

|

1,418 |

|

|

0.02 |

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Contingent consideration expense |

|

1,805 |

|

|

6 |

|

|

|

1,811 |

|

|

0.03 |

|

Impairment charges |

|

4,283 |

|

|

(481 |

) |

|

|

3,802 |

|

|

0.07 |

|

Amortization of intangibles |

|

1,788 |

|

|

(448 |

) |

|

|

1,340 |

|

|

0.02 |

|

Performance-based share-based compensation (b) |

|

1,343 |

|

|

(168 |

) |

|

|

1,175 |

|

|

0.02 |

|

Corporate transformation and restructuring (c) |

|

7,316 |

|

|

(1,816 |

) |

|

|

5,500 |

|

|

0.10 |

|

Acquisition-related |

|

826 |

|

|

(205 |

) |

|

|

621 |

|

|

0.01 |

|

Medical Device Regulation expenses (d) |

|

1,013 |

|

|

(251 |

) |

|

|

762 |

|

|

0.01 |

|

Other (e) |

|

6,236 |

|

|

(355 |

) |

|

|

5,881 |

|

|

0.10 |

|

Other (Income) Expense |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of long-term debt issuance costs |

|

151 |

|

|

(37 |

) |

|

|

114 |

|

|

0.00 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income |

$ |

43,877 |

|

$ |

(8,546 |

) |

|

$ |

35,331 |

|

$ |

0.62 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Diluted shares |

|

|

|

|

|

|

|

|

|

|

57,277 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

June 30, 2020 |

| |

Pre-Tax |

|

Tax Impact |

|

After-Tax |

|

Per Share Impact |

|

GAAP net loss |

$ |

(22,300 |

) |

|

$ |

3,242 |

|

|

$ |

(19,058 |

) |

|

$ |

(0.34 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Sales |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangibles |

|

12,807 |

|

|

|

(3,300 |

) |

|

|

9,507 |

|

|

|

0.17 |

|

|

Inventory write-off (a) |

|

345 |

|

|

|

(104 |

) |

|

|

241 |

|

|

|

0.00 |

|

|

Inventory mark-up related to acquisitions |

|

146 |

|

|

|

(37 |

) |

|

|

109 |

|

|

|

0.00 |

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Contingent consideration expense |

|

343 |

|

|

|

45 |

|

|

|

388 |

|

|

|

0.01 |

|

|

Impairment charges |

|

3,875 |

|

|

|

(1,100 |

) |

|

|

2,775 |

|

|

|

0.05 |

|

|

Amortization of intangibles |

|

1,975 |

|

|

|

(533 |

) |

|

|

1,442 |

|

|

|

0.03 |

|

|

Performance-based share-based compensation (b) |

|

1,064 |

|

|

|

(140 |

) |

|

|

924 |

|

|

|

0.02 |

|

|

Corporate transformation and restructuring (c) |

|

1,676 |

|

|

|

(477 |

) |

|

|

1,199 |

|

|

|

0.02 |

|

|

Acquisition-related |

|

340 |

|

|

|

(84 |

) |

|

|

256 |

|

|

|

0.00 |

|

|

Medical Device Regulation expenses (d) |

|

303 |

|

|

|

(78 |

) |

|

|

225 |

|

|

|

0.00 |

|

|

Other (e) |

|

20,492 |

|

|

|

(1,226 |

) |

|

|

19,266 |

|

|

|

0.34 |

|

|

Other (Income) Expense |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of long-term debt issuance costs |

|

151 |

|

|

|

(39 |

) |

|

|

112 |

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income |

$ |

21,217 |

|

|

$ |

(3,831 |

) |

|

$ |

17,386 |

|

|

$ |

0.31 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Diluted shares (f) |

|

|

|

|

|

|

|

|

|

|

56,250 |

|

____________________________Note: Certain per share impacts may

not sum to totals due to rounding.

Reconciliation of GAAP Net Income (Loss) to

Non-GAAP Net Income(Unaudited; in thousands except per

share amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Six Months Ended |

| |

June 30, 2021 |

| |

Pre-Tax |

|

Tax Impact |

|

After-Tax |

|

Per Share Impact |

|

GAAP net income |

$ |

19,559 |

|

$ |

(3,685 |

) |

|

$ |

15,874 |

|

$ |

0.28 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Sales |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangibles |

|

21,310 |

|

|

(5,292 |

) |

|

|

16,018 |

|

|

0.28 |

|

Inventory write-off (a) |

|

1,620 |

|

|

(202 |

) |

|

|

1,418 |

|

|

0.02 |

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Contingent consideration expense |

|

2,207 |

|

|

14 |

|

|

|

2,221 |

|

|

0.04 |

|

Impairment charges |

|

4,283 |

|

|

(481 |

) |

|

|

3,802 |

|

|

0.07 |

|

Amortization of intangibles |

|

3,604 |

|

|

(902 |

) |

|

|

2,702 |

|

|

0.05 |

|

Performance-based share-based compensation (b) |

|

2,359 |

|

|

(287 |

) |

|

|

2,072 |

|

|

0.04 |

|

Corporate transformation and restructuring (c) |

|

12,761 |

|

|

(3,162 |

) |

|

|

9,599 |

|

|

0.17 |

|

Acquisition-related |

|

5,608 |

|

|

(1,390 |

) |

|

|

4,218 |

|

|

0.07 |

|

Medical Device Regulation expenses (d) |

|

1,394 |

|

|

(346 |

) |

|

|

1,048 |

|

|

0.02 |

|

Other (e) |

|

6,375 |

|

|

(389 |

) |

|

|

5,986 |

|

|

0.10 |

|

Other (Income) Expense |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of long-term debt issuance costs |

|

302 |

|

|

(75 |

) |

|

|

227 |

|

|

0.00 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income |

$ |

81,382 |

|

$ |

(16,197 |

) |

|

$ |

65,185 |

|

$ |

1.14 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Diluted shares |

|

|

|

|

|

|

|

|

|

|

57,128 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Six Months Ended |

| |

June 30, 2020 |

| |

Pre-Tax |

|

Tax Impact |

|

After-Tax |

|

Per Share Impact |

|

GAAP net loss |

$ |

(24,292 |

) |

|

$ |

2,080 |

|

|

$ |

(22,212 |

) |

|

$ |

(0.40 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Sales |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangibles |

|

25,624 |

|

|

|

(6,604 |

) |

|

|

19,020 |

|

|

|

0.34 |

|

|

Inventory write-off (a) |

|

1,776 |

|

|

|

(472 |

) |

|

|

1,304 |

|

|

|

0.02 |

|

|

Inventory mark-up related to acquisitions |

|

146 |

|

|

|

(37 |

) |

|

|

109 |

|

|

|

0.00 |

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Contingent consideration expense |

|

5,240 |

|

|

|

66 |

|

|

|

5,306 |

|

|

|

0.09 |

|

|

Impairment charges |

|

7,720 |

|

|

|

(1,193 |

) |

|

|

6,527 |

|

|

|

0.12 |

|

|

Amortization of intangibles |

|

4,157 |

|

|

|

(1,124 |

) |

|

|

3,033 |

|

|

|

0.05 |

|

|

Performance-based share-based compensation (b) |

|

1,511 |

|

|

|

(192 |

) |

|

|

1,319 |

|

|

|

0.02 |

|

|

Corporate transformation and restructuring (c) |

|

3,452 |

|

|

|

(920 |

) |

|

|

2,532 |

|

|

|

0.05 |

|

|

Acquisition-related |

|

647 |

|

|

|

(164 |

) |

|

|

483 |

|

|

|

0.01 |

|

|

Medical Device Regulation expenses (d) |

|

603 |

|

|

|

(155 |

) |

|

|

448 |

|

|

|

0.01 |

|

|

Other (e) |

|

22,075 |

|

|

|

(1,634 |

) |

|

|

20,441 |

|

|

|

0.36 |

|

|

Other (Income) Expense |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of long-term debt issuance costs |

|

302 |

|

|

|

(78 |

) |

|

|

224 |

|

|

|

0.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income |

$ |

48,961 |

|

|

$ |

(10,427 |

) |

|

$ |

38,534 |

|

|

$ |

0.69 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Diluted shares (f) |

|

|

|

|

|

|

|

|

|

|

56,133 |

|

____________________________Note: Certain per

share impacts may not sum to totals due to rounding

Reconciliation of Reported Operating Income (Loss) to

Non-GAAP Operating Income(Unaudited; in thousands except

percentages)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Three Months Ended |

|

Six Months Ended |

|

Six Months Ended |

| |

June 30, 2021 |

|

June 30, 2020 |

|

June 30, 2021 |

|

June 30, 2020 |

| |

Amounts |

|

% Sales |

|

Amounts |

|

% Sales |

|

Amounts |

|

% Sales |

|

Amounts |

|

% Sales |

| Net Sales as Reported |

$ |

280,325 |

|

|

|

|

$ |

218,371 |

|

|

|

|

|

$ |

529,238 |

|

|

|

|

$ |

461,896 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Operating Income (Loss) |

|

8,895 |

|

3.2 |

% |

|

|

(18,995 |

) |

|

(8.7 |

) |

% |

|

|

23,089 |

|

4.4 |

% |

|

|

(17,633 |

) |

|

(3.8 |

) |

% |

|

Cost of Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangibles |

|

10,631 |

|

3.8 |

% |

|

|

12,807 |

|

|

5.8 |

|

% |

|

|

21,310 |

|

4.0 |

% |

|

|

25,624 |

|

|

5.6 |

|

% |

|

Inventory write-off (a) |

|

1,620 |

|

0.6 |

% |

|

|

345 |

|

|

0.2 |

|

% |

|

|

1,620 |

|

0.3 |

% |

|

|

1,776 |

|

|

0.5 |

|

% |

|

Inventory mark-up related to acquisitions |

|

— |

|

— |

|

|

|

146 |

|

|

0.1 |

|

% |

|

|

— |

|

— |

|

|

|

146 |

|

|

0.0 |

|

% |

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent consideration expense |

|

1,805 |

|

0.6 |

% |

|

|

343 |

|

|

0.2 |

|

% |

|

|

2,207 |

|

0.4 |

% |

|

|

5,240 |

|

|

1.1 |

|

% |

|

Impairment charges |

|

4,283 |

|

1.5 |

% |

|

|

3,875 |

|

|

1.8 |

|

% |

|

|

4,283 |

|

0.8 |

% |

|

|

7,720 |

|

|

1.7 |

|

% |

|

Amortization of intangibles |

|

1,788 |

|

0.6 |

% |

|

|

1,975 |

|

|

0.9 |

|

% |

|

|

3,604 |

|

0.7 |

% |

|

|

4,157 |

|

|

0.9 |

|

% |

|

Performance-based share-based compensation (b) |

|

1,343 |

|

0.5 |

% |

|

|

1,064 |

|

|

0.5 |

|

% |

|

|

2,359 |

|

0.4 |

% |

|

|

1,511 |

|

|

0.3 |

|

% |

|

Corporate transformation and restructuring (c) |

|

7,316 |

|

2.6 |

% |

|

|

1,676 |

|

|

0.8 |

|

% |

|

|

12,761 |

|

2.4 |

% |

|

|

3,452 |

|

|

0.7 |

|

% |

|

Acquisition-related |

|

826 |

|

0.3 |

% |

|

|

340 |

|

|

0.1 |

|

% |

|

|

5,608 |

|

1.1 |

% |

|

|

647 |

|

|

0.1 |

|

% |

|

Medical Device Regulation expenses (d) |

|

1,013 |

|

0.4 |

% |

|

|

303 |

|

|

0.1 |

|

% |

|

|

1,394 |

|

0.3 |

% |

|

|

603 |

|

|

0.1 |

|

% |

|

Other (e) |

|

6,236 |

|

2.2 |

% |

|

|

20,492 |

|

|

9.4 |

|

% |

|

|

6,375 |

|

1.2 |

% |

|

|

22,075 |

|

|

4.8 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Operating Income |

$ |

45,756 |

|

16.3 |

% |

|

$ |

24,371 |

|

|

11.2 |

|

% |

|

$ |

84,610 |

|

16.0 |

% |

|

$ |

55,318 |

|

|

12.0 |

|

% |

___________________________Note: Certain percentages may not sum

to totals due to rounding

|

a) |

Represents the write-off of inventory related to the divestiture or

exit of certain businesses or product lines. |

| b) |

Represents performance-based

share-based compensation expense, including stock-settled and

cash-settled awards. |

| c) |

Includes severance related to

corporate initiatives, write-offs and valuation adjustments of

other long-term assets associated with restructuring activities,

expenses related to Merit’s Foundations for Growth program, and

other transformation costs. |

| d) |

Represents incremental expenses

incurred to comply with the Medical Device Regulation (“MDR”) in

Europe. |

| e) |

The 2021 periods include accrued

contract termination costs of $6.1 million to renegotiate certain

terms of an acquisition agreement and costs to comply with Merit’s

settlement agreement with the U.S. Department of Justice. The 2020

periods include a settlement of $18.2 million with the U.S.

Department of Justice (“DOJ”) to fully resolve the DOJ’s

investigation, costs incurred in responding to the DOJ inquiry,

activist shareholder recovery fees, and expense from abandoned

patents. |

| f) |

For the three and six-months

periods ended June 30, 2020, the non-GAAP net income per diluted

share calculation includes approximately 844,000 and 807,000

shares, respectively, that were excluded from the GAAP net loss per

diluted share calculation. |

Reconciliation of Reported Revenue to Constant Currency

Revenue (Non-GAAP), Constant Currency Revenue, Organic (Non-GAAP),

and Core Revenue (Non-GAAP)(Unaudited; in thousands

except percentages)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

|

|

Six Months Ended |

| |

|

|

June 30, |

|

|

|

June 30, |

| |

% Change |

|

2021 |

|

|

2020 |

|

|

% Change |

|

2021 |

|

|

2020 |

|

|

Reported Revenue |

28.4 |

% |

$ |

280,325 |

|

|

$ |

218,371 |

|

|

14.6 |

% |

$ |

529,238 |

|

|

$ |

461,896 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Impact of foreign

exchange |

|

|

|

(6,173 |

) |

|

|

— |

|

|

|

|

|

(9,999 |

) |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Constant Currency Revenue

(a) |

25.5 |

% |

$ |

274,152 |

|

|

$ |

218,371 |

|

|

12.4 |

% |

$ |

519,239 |

|

|

$ |

461,896 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: Revenue from certain

acquisitions |

|

|

|

(72 |

) |

|

|

— |

|

|

|

|

|

(110 |

) |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Constant Currency Revenue,

Organic (a) |

25.5 |

% |

$ |

274,080 |

|

|

$ |

218,371 |

|

|

12.4 |

% |

$ |

519,129 |

|

|

$ |

461,896 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: Revenue from

Cultura |

|

|

|

(512 |

) |

|

|

(4,566 |

) |

|

|

|

|

(1,451 |

) |

|

|

(4,566 |

) |

| Less: Revenue from certain

dispositions |

|

|

|

— |

|

|

|

(2,171 |

) |

|

|

|

|

(179 |

) |

|

|

(5,700 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core Revenue (a) |

29.3 |

% |

$ |

273,568 |

|

|

$ |

211,634 |

|

|

14.6 |

% |

$ |

517,499 |

|

|

$ |

451,630 |

|

___________________________(a) A non-GAAP

financial measure. For a definition of this and other non-GAAP

financial measures, see the Non-GAAP Financial Measures section

above in this release.

Reconciliation of Reported Gross Margin to Non-GAAP

Gross Margin (Non-GAAP)(Unaudited; as a percentage of

reported revenue)

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

|

| |

June 30, |

|

June 30, |

|

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

| Reported Gross Margin |

44.3 |

% |

38.6 |

% |

44.6 |

% |

40.7 |

% |

| |

|

|

|

|

|

|

|

|

| Add back impact of: |

|

|

|

|

|

|

|

|

|

Amortization of intangibles |

3.8 |

% |

5.9 |

% |

4.0 |

% |

5.6 |

% |

|

Inventory write-off (a) |

0.6 |

% |

0.1 |

% |

0.3 |

% |

0.4 |

% |

|

Inventory mark-up related to acquisitions |

— |

|

0.1 |

% |

— |

|

0.0 |

% |

| |

|

|

|

|

|

|

|

|

| Non-GAAP Gross Margin |

48.7 |

% |

44.7 |

% |

48.9 |

% |

46.7 |

% |

___________________________Note: Certain percentages may not sum

to totals due to rounding

(a) Represents the write-off of inventory

related to the divestiture or exit of certain businesses or product

lines.

ABOUT MERIT

Founded in 1987, Merit Medical

Systems, Inc. is a leading manufacturer and marketer of

proprietary medical devices used in interventional, diagnostic and

therapeutic procedures, particularly in cardiology, radiology,

oncology, critical care and endoscopy. Merit serves client

hospitals worldwide with a domestic and international sales force

and clinical support team totaling in excess of 500

individuals. Merit employs approximately 6,300 people

worldwide with facilities in South Jordan, Utah; Pearland, Texas;

Richmond, Virginia; Aliso Viejo, California; Maastricht and Venlo,

The Netherlands; Paris, France; Galway, Ireland; Beijing, China;

Tijuana, Mexico; Joinville, Brazil; Ontario, Canada; Melbourne,

Australia; Tokyo, Japan; Reading, United Kingdom; Johannesburg,

South Africa; and Singapore.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Statements contained in this release which are

not purely historical, including, without limitation, statements

regarding Merit’s forecasted plans, net sales, net income or loss

(GAAP and non-GAAP), operating income and margin (GAAP and

non-GAAP), gross margin (GAAP and non-GAAP), earnings per share

(GAAP and non-GAAP), free cash flow, and other financial measures,

the potential impact, scope and duration of, and Merit’s response

to, the COVID-19 pandemic and the potential for recovery from that

pandemic, future growth and profit expectations or forecasted

economic conditions, or the implementation of, and results achieved

through, Merit’s Foundations for Growth program or other expense

reduction initiatives, or the development and commercialization of

new products, are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, and are

subject to risks and uncertainties such as those described in

Merit’s Annual Report on Form 10-K for the year ended December 31,

2020 (the “2020 Annual Report”) and other filings with the SEC.

Such risks and uncertainties include inherent risks and

uncertainties relating to Merit’s internal models or the

projections in this release; risks and uncertainties associated

with the COVID-19 pandemic and Merit’s response thereto;

disruptions in Merit’s supply chain, manufacturing or sterilization

processes; risks relating to Merit’s potential inability to

successfully manage growth through acquisitions generally,

including the inability to effectively integrate acquired

operations or products or commercialize technology developed

internally or acquired through completed, proposed or future

transactions; negative changes in economic and industry conditions

in the United States or other countries; risks and uncertainties

associated with Merit’s information technology systems, including

the potential for breaches of security and evolving regulations

regarding privacy and data protection; governmental scrutiny and

regulation of the medical device industry, including governmental

inquiries, investigations and proceedings involving Merit;

litigation and other judicial proceedings affecting Merit;

restrictions on Merit’s liquidity or business operations resulting

from its debt agreements; infringement of Merit’s technology or the

assertion that Merit’s technology infringes the rights of other

parties; product recalls and product liability claims; changes in

customer purchasing patterns or the mix of products Merit sells;

expenditures relating to research, development, testing and

regulatory approval or clearance of Merit’s products and risks that

such products may not be developed successfully or approved for

commercial use; reduced availability of, and price increases

associated with, commodity components; the potential of fines,

penalties or other adverse consequences if Merit’s employees or

agents violate the U.S. Foreign Corrupt Practices Act or other laws

or regulations; laws and regulations targeting fraud and abuse in

the healthcare industry; potential for significant adverse changes

in governing regulations, including reforms to the procedures for

approval or clearance of Merit’s products by the U.S. Food &

Drug Administration or comparable regulatory authorities in other

jurisdictions; changes in tax laws and regulations in the United

States or other countries; termination of relationships with

Merit’s suppliers, or failure of such suppliers to perform;

fluctuations in exchange rates; concentration of a substantial

portion of Merit’s revenues among a few products and procedures;

development of new products and technology that could render

Merit’s existing or future products obsolete; market acceptance of

new products; volatility in the market price of Merit’s common

stock; modification or limitation of governmental or private

insurance reimbursement policies; changes in healthcare policies or

markets related to healthcare reform initiatives; failure to comply

with applicable environmental laws; changes in key personnel; work

stoppage or transportation risks; failure to introduce products in

a timely fashion; price and product competition; availability of

labor and materials; fluctuations in and obsolescence of inventory;

and other factors referenced in the 2020 Annual Report and other

materials filed with the SEC. All subsequent forward-looking

statements attributable to Merit or persons acting on its behalf

are expressly qualified in their entirety by these cautionary

statements. Actual results will likely differ, and may differ

materially, from anticipated results. Financial estimates are

subject to change and are not intended to be relied upon as

predictions of future operating results. Those estimates and all

other forward-looking statements included in this document are made

only as of the date of this document, and except as otherwise

required by applicable law, Merit assumes no obligation to update

or disclose revisions to estimates and all other forward-looking

statements.

TRADEMARKS

Unless noted otherwise, trademarks and

registered trademarks used in this release are the property of

Merit Medical Systems, Inc. and its subsidiaries in the United

States and other jurisdictions.

|

Contacts: |

|

| PR/Media Inquiries:Teresa Johnson

Merit Medical |

Investor Inquiries:Mike

Piccinino, CFA, IRCWestwicke - ICR |

| +1-801-208-4295 |

+1-443-213-0509 |

| tjohnson@merit.com |

mike.piccinino@westwicke.com |

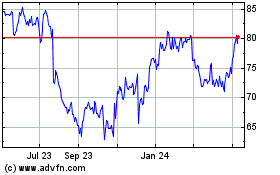

Merit Medical Systems (NASDAQ:MMSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

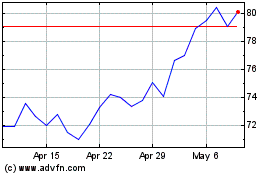

Merit Medical Systems (NASDAQ:MMSI)

Historical Stock Chart

From Apr 2023 to Apr 2024