MercadoLibre, Inc. (Nasdaq: MELI) (http://www.mercadolibre.com),

Latin America’s leading e-commerce technology company, today

reported financial results for the quarter ended December 31, 2019.

Pedro Arnt, Chief Financial Officer of

MercadoLibre, Inc., commented, “We are proud to announce the fourth

quarter 2019 with a sustained momentum that gives us the confidence

to move on to a phase of continuing to prioritize growth, but with

a greater focus on driving cost efficiencies and scale benefits

through the P&Ls of our larger more consolidated businesses.

This will be one of our objectives for the upcoming year. We

believe we are investing appropriately behind growth, building

superior experiences and products for our consumers and merchants,

and continuing committed to our long term goal of disrupting both

commerce and finance in Latin America. We are also proud to invite

you to check our sustainability report, also available for the

first time along with the annual report.”

Fourth Quarter 2019 Business

Highlights

- Total payment volume (“TPV”) through Mercado Pago reached $8.7

billion, a year-over-year increase of 63.5% in USD and 98.5% on an

FX neutral basis. Total payment transactions increased 127.2%

year-over-year, totaling 285.5 million transactions for the

quarter.

- Mercado Pago delivered successful execution in off-platform

payments (online and offline) through merchant services, mobile

point-of-sale (“MPOS”) devices and its mobile wallet business. On a

consolidated basis, off-platform TPV grew 121.3% year-over-year in

USD and 175.8% on an FX neutral basis.

- Off-platform TPV reached $4.7 billion in transactions and 209.4

million payments.

- Our MPOS business continues to be one of the fastest growing

non-marketplace business units. On a consolidated basis, MPOS TPV

grew 126.1% on an FX neutral basis.

- Mobile wallet surpassed for the first time the 1 billion mark,

delivering this quarter $1.3 billion in transactions on a

consolidated basis. Our mobile wallet consumer base grew by 29.4%

compared to the third quarter, reaching 7.9 million active payers

during the quarter. TPV from mobile wallet in Argentina, Brazil and

Mexico continues to grow by triple digits year-over-year.

- Our asset management product, Mercado Fondo, is available in

Argentina and Brazil, where we offer our entire suite of FinTech

solutions: MPOS devices, QR code in-store payments, mobile wallet

and asset management. Mercado Fondo has invested almost 90% and 60%

of customer funds in Mercado Pago in Brazil and Argentina,

respectively.

- Gross merchandise volume (“GMV”) increased to $3.9 billion,

representing a 19.7% and 39.7% increase in USD and on an FX neutral

basis, respectively.

- Items sold reached 109.5 million, growing 28.0%

year-over-year.

- Unique buyers numbers continue to accelerate, growing 26.7%

year-over-year versus 25.7% in the third quarter.

- Live listings offered on MercadoLibre’s marketplace reached

274.0 million, a 50.5% year-over-year increase.

- Mobile gross merchandise volume grew 253.2% year-over-year on

an FX neutral basis, reaching 68.7% of GMV.

- Items shipped through Mercado Envios reached 92.6 million, a

47.1% year-over-year increase, driven primarily by optimizations in

our free shipping program.

The tables below present our gross billings, amounts

paid by us in connection with our free shipping service and net

revenues.

The Company presents net revenues net of amounts

paid in connection with the Company’s free shipping initiative,

when the Company acts as an agent. For the three-month period ended

December 31st, 2019 the Company incurred $56.8 million of shipping

subsidies that have been netted from revenues.

| |

|

|

|

|

|

|

| |

|

|

In Millions (*) |

|

|

|

|

Q4

2019 |

|

|

Q4

2018 |

| |

Brazil |

$ |

463.8 |

|

$ |

358.1 |

| Gross |

Argentina |

$ |

139.5 |

|

$ |

99.0 |

| Billings |

Mexico |

$ |

96.3 |

|

$ |

50.4 |

| |

Others |

$ |

31.5 |

|

$ |

28.7 |

| |

Total |

$ |

731.1 |

|

$ |

536.2 |

| |

|

|

In Millions (*) |

|

|

|

|

Q4 2019 |

|

|

Q4 2018 |

|

|

Brazil |

$ |

(35.5) |

|

$ |

(92.7) |

| Free Shipping |

Argentina |

$ |

(7.0) |

|

$ |

(8.2) |

| service cost |

Mexico |

$ |

(11.5) |

|

$ |

(4.9) |

| |

Others |

$ |

(2.8) |

|

$ |

(2.3) |

| |

Total |

$ |

(56.8) |

|

$ |

(108.1) |

| |

|

|

In Millions (*) |

|

|

|

|

Q4 2019 |

|

|

Q4 2018 |

| |

Brazil |

$ |

428.3 |

|

$ |

265.4 |

| Net |

Argentina |

$ |

132.4 |

|

$ |

90.8 |

| Revenues |

Mexico |

$ |

84.8 |

|

$ |

45.5 |

| |

Others |

$ |

28.7 |

|

$ |

26.3 |

| |

Total |

$ |

674.3 |

|

$ |

428.0 |

*The tables above may not total due to rounding.

Fourth Quarter 2019

Financial Highlights

- Net revenues for the fourth quarter were $674.3 million, a

year-over-year increase of 57.5% in USD and 84.4% on an FX neutral

basis.

- Enhanced marketplace revenues increased 55.3% year-over-year in

USD and 79.7% on an FX neutral basis, while non-marketplace

revenues increased 60.0% year-over-year in USD and 89.7% on an FX

neutral basis.

- Gross profit was $308.3 million with a margin of 45.7%,

compared to 47.8% in the fourth quarter of 2018.

- Total operating expenses were $377.2 million, an increase of

83.5% year-over-year in USD. As a percentage of revenues, operating

expenses were 55.9%, compared to 48.0% during the fourth quarter of

2018. On a sequential basis the 479 bps of margin improvement in

operating expenses, 222 bps were the result of an improvement in

bad debt and 203 bps in a lower investment in Maketing.

- Our marketing expenses increased $3.2 million

quarter-over-quarter, while Bad debt improved by $11.6 million

quarter-over-quarter during the quarter.

- Loss from operations was $68.9 million, compared to a loss of

$81.9 million during the prior quarter. As a percentage of

revenues, the loss from operations reached 10.2%.

- Interest income was $26.9 million, a 88.4% increase

year-over-year, as a result of equity offering during 2019, which

generated more invested volume and interest gain, and a higher

float in Argentina.

- The Company incurred $21.2 million in financial expenses this

quarter, mainly attributable to secured financial loans and

interest expenses from our trusts related to our factoring business

in Argentina.

- Net loss before taxes was $63.0 million, up from a loss of $6.8

million during the fourth quarter of 2018.

- Income tax gain was $9.0 million.

- Net loss was $54.0 million, resulting in basic net loss per

share of $1.11, due to the investment in marketing, which accounted

for $146.6 million.

The following

table summarizes certain key performance metrics for the twelve and

three months periods ended December 31, 2019 and 2018.

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Year ended December 31, (*) |

|

|

Three-months period ended December 31,

(*) |

| (in millions) |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

| Other data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Number of confirmed registered

users at end of period |

|

320.6 |

|

|

267.4 |

|

|

320.6 |

|

|

267.4 |

|

| Number of confirmed new

registered users during period |

|

53.2 |

|

|

55.5 |

|

|

14.6 |

|

|

18.8 |

|

| Gross merchandise volume |

$ |

13,997.4 |

|

$ |

12,504.9 |

|

$ |

3,871.3 |

|

$ |

3,233.0 |

|

| Number of successful items

sold |

|

378.9 |

|

|

334.7 |

|

|

109.5 |

|

|

85.6 |

|

| Number of successful items

shipped |

|

306.9 |

|

|

221.7 |

|

|

92.6 |

|

|

62.1 |

|

| Total payment volume |

$ |

28,389.9 |

|

$ |

18,455.9 |

|

$ |

8,668.2 |

|

$ |

5,302.1 |

|

| Total volume of payments on

marketplace |

$ |

13,051.7 |

|

$ |

11,274.5 |

|

$ |

3,658.0 |

|

$ |

2,950.4 |

|

| Total payment

transactions |

|

838.0 |

|

|

389.3 |

|

|

285.5 |

|

|

125.6 |

|

| Unique buyers |

|

44.2 |

|

|

37.4 |

|

|

24.1 |

|

|

19.0 |

|

| Unique sellers |

|

11.2 |

|

|

10.8 |

|

|

4.2 |

|

|

4.1 |

|

| Capital expenditures |

$ |

141.4 |

|

$ |

102.0 |

|

$ |

40.6 |

|

$ |

21.5 |

|

| Depreciation and

amortization |

$ |

73.3 |

|

$ |

45.8 |

|

$ |

20.8 |

|

$ |

11.9 |

|

(*) Figures have been calculated using rounded

amounts. Growth calculations based on this table may not total due

to rounding.

Year-over-year USD Revenue Growth Rates

by Quarter

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Net Revenues |

Q4’18 |

|

|

Q1’19 |

|

Q2’19 |

|

Q3’19 |

|

Q4’19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brazil |

34 |

|

% |

|

64 |

|

% |

74 |

% |

77 |

% |

61 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Argentina |

(16 |

) |

% |

|

(8 |

) |

% |

14 |

% |

39 |

% |

46 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mexico |

157 |

|

% |

|

220 |

|

% |

267 |

% |

146 |

% |

86 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Year-over-year Local Currency Revenue

Growth Rates by Quarter

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Net Revenues |

Q4’18 |

|

|

Q1’19 |

|

Q2’19 |

|

Q3’19 |

|

Q4’19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brazil |

58 |

% |

|

91 |

% |

89 |

% |

77 |

% |

74 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Argentina |

77 |

% |

|

83 |

% |

115 |

% |

119 |

% |

133 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mexico |

170 |

% |

|

227 |

% |

261 |

% |

153 |

% |

80 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Conference Call and Webcast

The Company will host a conference call and

audio webcast on February 10th, 2020 at 4:30 p.m. Eastern Time. The

conference call may be accessed by dialing (877) 303-7209 / (970)

315-0420 (Conference ID –5176529–) and requesting inclusion in the

call for MercadoLibre. The live conference call can be accessed via

audio webcast at the investor relations section of the Company's

website, at http://investor.mercadolibre.com. An archive of the

webcast will be available for one week following the conclusion of

the conference call.

Definition of Selected Operational

Metrics

Gross Billings - Total accrued fees,

commissions, interest, and other sales received from users.

Foreign Exchange (“FX”) Neutral – Calculated by

using the average monthly exchange rate of each month of 2018 and

applying it to the corresponding months in the current year, so as

to calculate what the results would have been had exchange rates

remained constant. Intercompany allocations are excluded from this

calculation. These calculations do not include any other

macroeconomic effect such as local currency inflation effects or

any price adjustment to compensate local currency inflation or

devaluations.

Gross merchandise volume – Measure of the total

U.S. dollar sum of all transactions completed through the Mercado

Libre Marketplace, excluding Classifieds transactions.

Total payment transactions – Measure of the

number of all transactions paid for using Mercado Pago.

Total volume of payments on marketplace -

Measure of the total U.S. dollar sum of all marketplace

transactions paid for using Mercado Pago, excluding shipping and

financing fees.

Total payment volume– Measure of total U.S.

dollar sum of all transactions paid for using Mercado Pago,

including marketplace and non-marketplace transactions.

Enhanced Marketplace - Revenues from the

Enhanced Marketplace service, include the final value fees and

shipping fees charged to the Company’s customers.

Items sold – Measure of the number of items that

were sold/purchased through the Mercado Libre Marketplace,

excluding Classifieds items.

Items shipped – Measure of the number of items

that were shipped through our shipping service.

Local Currency Growth Rates – Refer to FX

Neutral definition.

Net income margin – Defined as net income as a

percentage of net revenues.

New confirmed registered users – Measure of the

number of new users who have registered on the Mercado Libre

Marketplace and confirmed their registration, excluding Classifieds

users.

Operating margin – Defined as income from

operations as a percentage of net revenues.

Total confirmed registered users – Measure of

the cumulative number of users who have registered on the Mercado

Libre Marketplace and confirmed their registration, excluding

Classifieds users.

Unique Buyers – New or existing users with at

least one purchase made in the period, including Classifieds

users.

Unique Sellers – New or existing users with at

least one new listing in the period, including Classifieds

users.

About MercadoLibre

Founded in 1999, MercadoLibre is the largest

online commerce ecosystem in Latin America, serving as an

integrated regional platform and as a provider of the necessary

online and technology- based tools that allow businesses and

individuals to trade products and services in the region. The

Company enables commerce through its marketplace platform

(including online classifieds for motor vehicles, vessels,

aircraft, services and real estate), which allows users to buy and

sell in most of Latin America.

The Company is listed on NASDAQ (Nasdaq: MELI)

following its initial public offering in 2007.

For more information about the Company visit:

http://investor.mercadolibre.com.

The MercadoLibre, Inc. logo is available at

https://resource.globenewswire.com/Resource/Download/6ab227b7-693f-4b17-b80c-552ae45c76bf?size=0

Forward-Looking Statements

Any statements herein regarding MercadoLibre,

Inc. that are not historical or current facts are forward-looking

statements. These forward-looking statements convey MercadoLibre,

Inc.’s current expectations or forecasts of future events.

Forward-looking statements regarding MercadoLibre, Inc. involve

known and unknown risks, uncertainties and other factors that may

cause MercadoLibre, Inc.’s actual results, performance or

achievements to be materially different from any future results,

performances or achievements expressed or implied by the

forward-looking statements. Certain of these risks and

uncertainties are described in the “Risk Factors,” “Forward-Looking

Statements” and “Cautionary Note Regarding Forward-Looking

Statements” sections of MercadoLibre, Inc.’s annual report on Form

10-K for the year ended December 31, 2019, and any of MercadoLibre,

Inc.’s other applicable filings with the Securities and Exchange

Commission. Unless required by law, MercadoLibre, Inc. undertakes

no obligation to publicly update or revise any forward-looking

statements to reflect circumstances or events after the date

hereof.

MercadoLibre, Inc.Consolidated

Balance Sheets(In thousands

of U.S. dollars, except par value)

| |

|

|

|

| |

December 31, |

|

December 31, |

| |

|

2019 |

|

|

|

2018 |

|

|

Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

1,384,740 |

|

|

$ |

440,332 |

|

|

Restricted cash and cash equivalents |

|

66,684 |

|

|

|

24,363 |

|

|

Short-term investments (522,798 and 284,317 held in guarantee) |

|

1,597,241 |

|

|

|

461,541 |

|

|

Accounts receivable, net |

|

35,446 |

|

|

|

35,153 |

|

|

Credit cards receivable, net |

|

379,969 |

|

|

|

360,298 |

|

|

Loans receivable, net |

|

182,105 |

|

|

|

95,778 |

|

|

Prepaid expenses |

|

45,309 |

|

|

|

27,477 |

|

|

Inventory |

|

8,626 |

|

|

|

4,612 |

|

|

Other assets |

|

88,736 |

|

|

|

61,569 |

|

|

Total current assets |

|

3,788,856 |

|

|

|

1,511,123 |

|

| Non-current assets: |

|

|

|

|

Long-term investments |

|

263,983 |

|

|

|

276,136 |

|

|

Loans receivable, net |

|

6,439 |

|

|

|

— |

|

|

Property and equipment, net |

|

244,257 |

|

|

|

165,614 |

|

|

Operating lease right-of-use assets |

|

200,449 |

|

|

|

— |

|

|

Goodwill |

|

87,609 |

|

|

|

88,883 |

|

|

Intangible assets, net |

|

14,275 |

|

|

|

18,581 |

|

|

Deferred tax assets |

|

117,582 |

|

|

|

141,438 |

|

|

Other assets |

|

58,241 |

|

|

|

37,744 |

|

|

Total non-current assets |

|

992,835 |

|

|

|

728,396 |

|

|

Total assets |

$ |

4,781,691 |

|

|

$ |

2,239,519 |

|

| |

|

|

|

|

Liabilities |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable and accrued expenses |

$ |

372,309 |

|

|

$ |

266,759 |

|

|

Funds payable to customers |

|

894,057 |

|

|

|

640,954 |

|

|

Salaries and social security payable |

|

101,841 |

|

|

|

60,406 |

|

|

Taxes payable |

|

60,247 |

|

|

|

31,058 |

|

|

Loans payable and other financial liabilities |

|

186,138 |

|

|

|

132,949 |

|

|

Operating lease liabilities |

|

23,259 |

|

|

|

— |

|

|

Other liabilities |

|

114,469 |

|

|

|

34,098 |

|

|

Total current liabilities |

|

1,752,320 |

|

|

|

1,166,224 |

|

| Non-current liabilities: |

|

|

|

|

Salaries and social security payable |

|

26,803 |

|

|

|

23,161 |

|

|

Loans payable and other financial liabilities |

|

631,353 |

|

|

|

602,228 |

|

|

Operating lease liabilities |

|

176,673 |

|

|

|

— |

|

|

Deferred tax liabilities |

|

99,952 |

|

|

|

91,698 |

|

|

Other liabilities |

|

12,627 |

|

|

|

19,508 |

|

|

Total non-current liabilities |

|

947,408 |

|

|

|

736,595 |

|

|

Total liabilities |

$ |

2,699,728 |

|

|

$ |

1,902,819 |

|

| |

|

|

|

| Commitments and

contingencies |

|

|

|

| |

|

|

|

| Redeemable convertible

preferred stock, $0.001 par value, 40,000,000 shares |

|

|

|

| authorized, 100,000 shares

issued and outstanding at December 31, 2019 |

$ |

98,843 |

|

|

$ |

— |

|

| |

|

|

|

|

Equity |

|

|

|

| |

|

|

|

|

Common stock, $0.001 par value, 110,000,000 shares authorized, |

|

|

|

|

49,709,955 and 45,202,859 shares issued and outstanding at December

31, |

|

|

|

|

2019 and December 31, 2018 |

$ |

50 |

|

|

$ |

45 |

|

|

Additional paid-in capital |

|

2,067,869 |

|

|

|

224,800 |

|

|

Treasury stock |

|

(720 |

) |

|

|

— |

|

|

Retained earnings |

|

322,592 |

|

|

|

503,432 |

|

|

Accumulated other comprehensive loss |

|

(406,671 |

) |

|

|

(391,577 |

) |

|

Total Equity |

|

1,983,120 |

|

|

|

336,700 |

|

|

Total Liabilities, Redeemable convertible preferred stock and

Equity |

$ |

4,682,848 |

|

|

$ |

2,239,519 |

|

MercadoLibre, Inc.Consolidated

Statements of IncomeFor the twelve and

three-month periods ended December 31, 2019 and

2018(In thousands of U.S. dollars, except for

share data)

| |

|

|

|

|

|

|

|

| |

Year Ended December 31, |

|

Three Months Ended December 31, |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| Net revenues |

$ |

2,296,314 |

|

|

$ |

1,439,653 |

|

|

$ |

674,271 |

|

|

$ |

428,019 |

|

| Cost of net revenues |

|

(1,194,191 |

) |

|

|

(742,645 |

) |

|

|

(365,924 |

) |

|

|

(223,236 |

) |

| Gross profit |

|

1,102,123 |

|

|

|

697,008 |

|

|

|

308,347 |

|

|

|

204,783 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Product and technology development |

|

(223,807 |

) |

|

|

(146,273 |

) |

|

|

(58,020 |

) |

|

|

(38,963 |

) |

|

Sales and marketing |

|

(834,022 |

) |

|

|

(482,447 |

) |

|

|

(269,751 |

) |

|

|

(140,035 |

) |

|

General and administrative |

|

(197,455 |

) |

|

|

(137,770 |

) |

|

|

(49,463 |

) |

|

|

(26,605 |

) |

|

Total operating expenses |

|

(1,255,284 |

) |

|

|

(766,490 |

) |

|

|

(377,234 |

) |

|

|

(205,603 |

) |

| Loss from operations |

|

(153,161 |

) |

|

|

(69,482 |

) |

|

|

(68,887 |

) |

|

|

(820 |

) |

| |

|

|

|

|

|

|

|

| Other income (expenses): |

|

|

|

|

|

|

|

|

Interest income and other financial gains |

|

113,523 |

|

|

|

42,039 |

|

|

|

26,933 |

|

|

|

14,292 |

|

|

Interest expense and other financial losses |

|

(65,876 |

) |

|

|

(56,249 |

) |

|

|

(21,187 |

) |

|

|

(16,443 |

) |

|

Foreign currency (losses) gains |

|

(1,732 |

) |

|

|

18,240 |

|

|

|

167 |

|

|

|

(3,862 |

) |

| Net loss before income tax

(expense) gain |

|

(107,246 |

) |

|

|

(65,452 |

) |

|

|

(62,974 |

) |

|

|

(6,833 |

) |

| |

|

|

|

|

|

|

|

| Income tax (expense) gain |

|

(64,753 |

) |

|

|

28,867 |

|

|

|

8,976 |

|

|

|

4,496 |

|

| Net loss |

$ |

(171,999 |

) |

|

$ |

(36,585 |

) |

|

$ |

(53,998 |

) |

|

$ |

(2,337 |

) |

| |

|

|

|

|

|

|

|

| |

Year Ended December 31, |

|

Three Months Ended December 31, |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| Basic

EPS |

|

|

|

|

|

|

|

|

Basic net loss |

|

|

|

|

|

|

|

|

Available to shareholders per common share |

$ |

(3.71 |

) |

|

$ |

(0.82 |

) |

|

$ |

(1.11 |

) |

|

$ |

(0.05 |

) |

|

Weighted average of outstanding common shares |

|

48,692,906 |

|

|

|

44,529,614 |

|

|

|

49,709,955 |

|

|

|

45,202,859 |

|

| Diluted

EPS |

|

|

|

|

|

|

|

|

Diluted net loss |

|

|

|

|

|

|

|

|

Available to shareholders per common share |

$ |

(3.71 |

) |

|

$ |

(0.82 |

) |

|

$ |

(1.11 |

) |

|

$ |

(0.05 |

) |

|

Weighted average of outstanding common shares |

|

48,692,906 |

|

|

|

44,529,614 |

|

|

|

49,709,955 |

|

|

|

45,202,859 |

|

| |

|

|

|

|

|

|

|

MercadoLibre, Inc.Consolidated

Statement of Cash FlowsFor the years

ended December 31, 2019 and 2018

| |

|

|

|

| |

Year Ended December 31, |

| |

|

2019 |

|

|

|

2018 |

|

| |

|

| Cash flows from

operations: |

|

|

|

|

Net loss |

$ |

(171,999 |

) |

|

$ |

(36,585 |

) |

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

Unrealized devaluation loss, net |

|

44,326 |

|

|

|

11,131 |

|

|

Depreciation and amortization |

|

73,320 |

|

|

|

45,792 |

|

|

Accrued interest |

|

(54,309 |

) |

|

|

(17,811 |

) |

|

Non cash interest, convertible notes amortization of debt discount

and amortization of debt issuance costs and other charges |

|

86,694 |

|

|

|

11,408 |

|

|

Stock-based compensation expense - restricted shares |

|

395 |

|

|

|

— |

|

|

LTRP accrued compensation |

|

51,662 |

|

|

|

27,525 |

|

|

Deferred income taxes |

|

16,453 |

|

|

|

(92,585 |

) |

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(507 |

) |

|

|

(27,105 |

) |

|

Credit cards receivable |

|

(29,315 |

) |

|

|

42,655 |

|

|

Prepaid expenses |

|

(17,956 |

) |

|

|

(23,342 |

) |

|

Inventory |

|

(4,148 |

) |

|

|

(3,015 |

) |

|

Other assets |

|

(49,390 |

) |

|

|

(17,617 |

) |

|

Payables and accrued expenses |

|

143,495 |

|

|

|

90,123 |

|

|

Funds payable to customers |

|

267,293 |

|

|

|

175,398 |

|

|

Other liabilities |

|

45,452 |

|

|

|

28,202 |

|

|

Interest received from investments |

|

49,625 |

|

|

|

16,733 |

|

|

Net cash provided by operating activities |

|

451,091 |

|

|

|

230,907 |

|

| Cash flows from investing

activities: |

|

|

|

|

Purchase of investments |

|

(4,490,678 |

) |

|

|

(3,176,078 |

) |

|

Proceeds from sale and maturity of investments |

|

3,353,606 |

|

|

|

2,662,800 |

|

|

Payment for acquired businesses, net of cash acquired |

|

— |

|

|

|

(4,195 |

) |

|

Purchases of intangible assets |

|

(72 |

) |

|

|

(192 |

) |

|

Changes in principal loans receivable, net |

|

(173,848 |

) |

|

|

(57,232 |

) |

|

Advance for property and equipment |

|

— |

|

|

|

(4,426 |

) |

|

Purchases of property and equipment |

|

(136,798 |

) |

|

|

(93,136 |

) |

|

Net cash used in investing activities |

|

(1,447,790 |

) |

|

|

(672,459 |

) |

| Cash flows from financing

activities: |

|

|

|

|

Funds received from the issuance of convertible notes |

|

— |

|

|

|

880,000 |

|

|

Transaction costs from the issuance of convertible notes |

|

— |

|

|

|

(16,264 |

) |

|

Payments on convertible note |

|

(25 |

) |

|

|

(348,123 |

) |

|

Purchase of convertible note capped calls |

|

(96,367 |

) |

|

|

(148,943 |

) |

|

Unwind of convertible note capped calls |

|

— |

|

|

|

136,108 |

|

|

Proceeds from loans payable and other financial liabilities |

|

629,891 |

|

|

|

236,873 |

|

|

Payments on loans payable and other financing liabilities |

|

(472,897 |

) |

|

|

(123,822 |

) |

|

Dividends paid |

|

— |

|

|

|

(6,624 |

) |

|

Payment of finance lease obligations |

|

(1,929 |

) |

|

|

(323 |

) |

|

Common Stock repurchased |

|

(720 |

) |

|

|

— |

|

|

Dividends paid of preferred stock |

|

(2,844 |

) |

|

|

— |

|

|

Proceeds from issuance of convertible redeemable preferred stock,

net |

|

98,688 |

|

|

|

— |

|

|

Proceeds from issuance of common stock, net |

|

1,867,215 |

|

|

|

— |

|

| Net cash provided by financing

activities |

|

2,021,012 |

|

|

|

608,882 |

|

| Effect of exchange rate

changes on cash, cash equivalents, restricted cash and cash

equivalents |

|

(37,584 |

) |

|

|

(90,895 |

) |

| Net increase in cash, cash

equivalents, restricted cash and cash equivalents |

|

986,729 |

|

|

|

76,435 |

|

| Cash, cash equivalents,

restricted cash and cash equivalents, beginning of the year |

|

464,695 |

|

|

|

388,260 |

|

| Cash, cash equivalents,

restricted cash and cash equivalents, end of the year |

$ |

1,451,424 |

|

|

$ |

464,695 |

|

Financial results of reporting

segments

| |

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended December 31, 2019 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Brazil |

|

Argentina |

|

Mexico |

|

Other Countries |

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

| Net revenues |

$ |

428,327 |

|

|

$ |

132,440 |

|

|

$ |

84,825 |

|

|

$ |

28,679 |

|

|

$ |

674,271 |

|

|

| Direct costs |

|

(373,417 |

) |

|

|

(107,790 |

) |

|

|

(135,840 |

) |

|

|

(34,242 |

) |

|

|

(651,289 |

) |

|

| Direct contribution |

|

54,910 |

|

|

|

24,650 |

|

|

|

(51,015 |

) |

|

|

(5,563 |

) |

|

|

22,982 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Operating expenses and

indirect costs of net revenues |

|

|

|

|

|

|

|

|

|

(91,869 |

) |

|

| Loss from operations |

|

|

|

|

|

|

|

|

|

(68,887 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| Other income (expenses): |

|

|

|

|

|

|

|

|

|

|

|

Interest income and other financial gains |

|

|

|

|

|

|

|

|

|

26,933 |

|

|

|

Interest expense and other financial losses |

|

|

|

|

|

|

|

|

|

(21,187 |

) |

|

|

Foreign currency gains |

|

|

|

|

|

|

|

|

|

167 |

|

|

| Net loss before income tax

gain |

|

|

|

|

|

|

|

|

$ |

(62,974 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended December 31, 2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Brazil |

|

Argentina |

|

Mexico |

|

Other Countries |

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

| Net revenues |

$ |

265,353 |

|

|

$ |

90,800 |

|

|

$ |

45,529 |

|

|

$ |

26,337 |

|

|

$ |

428,019 |

|

|

| Direct costs |

|

(218,497 |

) |

|

|

(68,783 |

) |

|

|

(63,550 |

) |

|

|

(22,397 |

) |

|

|

(373,227 |

) |

|

| Direct contribution |

|

46,856 |

|

|

|

22,017 |

|

|

|

(18,021 |

) |

|

|

3,940 |

|

|

|

54,792 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Operating expenses and

indirect costs of net revenues |

|

|

|

|

|

|

|

|

|

(55,612 |

) |

|

| Loss from operations |

|

|

|

|

|

|

|

|

|

(820 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| Other income (expenses): |

|

|

|

|

|

|

|

|

|

|

|

Interest income and other financial gains |

|

|

|

|

|

|

|

|

|

14,292 |

|

|

|

Interest expense and other financial losses |

|

|

|

|

|

|

|

|

|

(16,443 |

) |

|

|

Foreign currency losses |

|

|

|

|

|

|

|

|

|

(3,862 |

) |

|

| Net loss before income tax

gain |

|

|

|

|

|

|

|

|

$ |

(6,833 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

To supplement our consolidated financial

statements presented in accordance with U.S. GAAP, we use

foreign exchange (“FX”) neutral measures.

This non-GAAP measure should not be considered

in isolation or as a substitute for measures of performance

prepared in accordance with U.S. GAAP and may be

different from non-GAAP measures used by other companies. In

addition, this non-GAAP measure is not based on any comprehensive

set of accounting rules or principles. Non-GAAP measures have

limitations in that they do not reflect all of the amounts

associated with our results of operations as determined in

accordance with U.S. GAAP. This non-GAAP financial

measure should only be used to evaluate our results of operations

in conjunction with the most comparable U.S. GAAP

financial measures.

Reconciliation of this non-GAAP financial

measure to the most comparable U.S. GAAP financial

measures can be found in the tables included in this quarterly

report.

The Company believes that reconciliation of FX

neutral measures to the most directly comparable GAAP measure

provides investors an overall understanding of our current

financial performance and its prospects for the future.

Specifically, we believe this non-GAAP measure provide useful

information to both management and investors by excluding the

foreign currency exchange rate impact that may not be indicative of

our core operating results and business outlook.

The FX neutral measures were calculated by using

the average monthly exchange rates for each month during 2018 and

applying them to the corresponding months in 2019, so as to

calculate what our results would have been had exchange rates

remained stable from one year to the next. The table below excludes

intercompany allocation FX effects. Finally, this measure does not

include any other macroeconomic effect such as local currency

inflation effects, the impact on impairment calculations or any

price adjustment to compensate local currency inflation or

devaluations.

The following table sets forth the FX neutral

measures related to our reported results of the operations for the

three-month period ended December 31, 2019:

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three-month Periods Ended December 31, (*) |

| |

As reported |

|

FX Neutral Measures |

|

As reported |

|

|

|

(In millions, except percentages) |

|

2019 |

|

|

|

2018 |

|

|

Percentage Change |

|

|

2019 |

|

|

|

2018 |

|

|

Percentage Change |

| |

(Unaudited) |

|

|

|

(Unaudited) |

|

|

| Net revenues |

$ |

674.3 |

|

|

$ |

428.0 |

|

|

57.5 |

% |

|

$ |

789.4 |

|

|

$ |

428.0 |

|

|

84.4 |

% |

| Cost of net revenues |

|

(365.9 |

) |

|

|

(223.2 |

) |

|

63.9 |

% |

|

|

(435.0 |

) |

|

|

(223.2 |

) |

|

94.9 |

% |

| Gross profit |

|

308.3 |

|

|

|

204.8 |

|

|

50.6 |

% |

|

|

354.4 |

|

|

|

204.8 |

|

|

73.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

(377.2 |

) |

|

|

(205.6 |

) |

|

83.5 |

% |

|

|

(451.9 |

) |

|

|

(205.6 |

) |

|

119.8 |

% |

| Loss from operations |

|

(68.9 |

) |

|

|

(0.8 |

) |

|

8311.3 |

% |

|

|

(97.5 |

) |

|

|

(0.8 |

) |

|

11805.7 |

% |

(*) The table above may not total due to rounding.

CONTACT: MercadoLibre, Inc.

Investor Relations

investor@mercadolibre.com

http://investor.mercadolibre.com

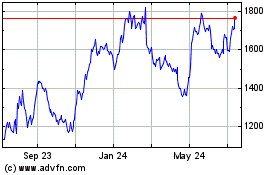

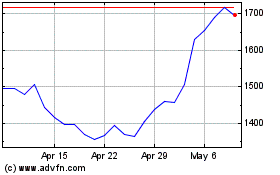

MercadoLibre (NASDAQ:MELI)

Historical Stock Chart

From Mar 2024 to Apr 2024

MercadoLibre (NASDAQ:MELI)

Historical Stock Chart

From Apr 2023 to Apr 2024