MercadoLibre, Inc. Announces Pricing of Follow-on Offering

March 13 2019 - 1:20AM

MercadoLibre, Inc. (NASDAQ: MELI), Latin America’s leading

e-commerce technology company, today announced the pricing of an

underwritten public offering of approximately US$1 billion of

common stock at a public offering price of $480 per share. In

addition, the underwriters have a 30-day option to purchase up to

$150 million of additional shares of common stock.

Goldman Sachs, J.P. Morgan and Morgan Stanley are acting as

joint bookrunners for the offering.

An automatically effective registration statement relating to

these securities was filed with the Securities and Exchange

Commission on March 11, 2019. The offering is being made only by

means of an effective shelf registration statement, including a

prospectus supplement and the accompanying prospectus, copies of

which may be obtained, when available, from Goldman Sachs & Co.

LLC, Attention: Prospectus Department, 200 West Street, New York,

NY 10282, telephone: (866) 471-2526 or

email: prospectusny@ny.email.gs.com, J.P. Morgan

Securities LLC, Attention: Broadridge Financial Solutions, 1155

Long Island Avenue, Edgewood, NY 11717,

email: prospectus-eq_fi@jpmchase.com or Morgan Stanley

& Co. LLC, Attention: Prospectus Department, 180 Varick Street,

2nd Floor, New York, NY 10014.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

CONTACT:MercadoLibre, Inc.Investor

Relationsinvestor@mercadolibre.com http://investor.mercadolibre.com

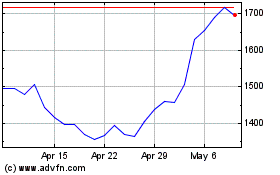

MercadoLibre (NASDAQ:MELI)

Historical Stock Chart

From Mar 2024 to Apr 2024

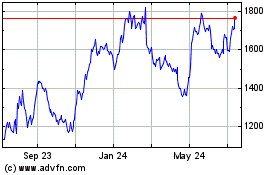

MercadoLibre (NASDAQ:MELI)

Historical Stock Chart

From Apr 2023 to Apr 2024