Current Report Filing (8-k)

December 01 2021 - 7:39AM

Edgar (US Regulatory)

0000891103false00008911032021-12-012021-12-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 1, 2021

MATCH GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-34148

|

59-2712887

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

8750 North Central Expressway, Suite 1400

Dallas, TX 75231

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (214) 576-9352

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of exchange on which registered

|

|

Common Stock, par value $0.001

|

|

MTCH

|

|

The Nasdaq Stock Market LLC

|

|

|

|

|

|

(Nasdaq Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

Match Group today announced the settlement of Rad, et al. v. IAC/InterActiveCorp, et al. and related arbitrations. Under the terms of the settlement agreement, Match Group will pay plaintiffs $441 million, and plaintiffs will dismiss all claims presently on trial and in arbitration related to the 2017 Tinder valuation. We intend to pay the settlement from cash on hand.

The parties issued the following media statement on the settlement: "The parties are pleased to announce that they have settled the valuation lawsuit presently on trial in New York Supreme Court and the related valuation arbitration."

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

MATCH GROUP, INC.

|

|

|

|

|

|

|

By:

|

/s/ Jared F. Sine

|

|

|

|

Jared F. Sine

|

|

|

|

Chief Business Affairs Officer and Legal Officer Secretary

|

Date: December 1, 2021

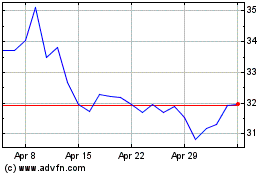

Match (NASDAQ:MTCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

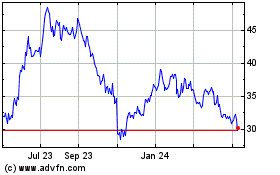

Match (NASDAQ:MTCH)

Historical Stock Chart

From Apr 2023 to Apr 2024