false2024Q3MARRIOTT INTERNATIONAL INC /MD/0001048286December 31xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:puremar:lawsuitmar:segment00010482862024-01-012024-09-3000010482862024-10-280001048286us-gaap:ManagementServiceBaseMember2024-07-012024-09-300001048286us-gaap:ManagementServiceBaseMember2023-07-012023-09-300001048286us-gaap:ManagementServiceBaseMember2024-01-012024-09-300001048286us-gaap:ManagementServiceBaseMember2023-01-012023-09-300001048286us-gaap:FranchiseMember2024-07-012024-09-300001048286us-gaap:FranchiseMember2023-07-012023-09-300001048286us-gaap:FranchiseMember2024-01-012024-09-300001048286us-gaap:FranchiseMember2023-01-012023-09-300001048286us-gaap:ManagementServiceIncentiveMember2024-07-012024-09-300001048286us-gaap:ManagementServiceIncentiveMember2023-07-012023-09-300001048286us-gaap:ManagementServiceIncentiveMember2024-01-012024-09-300001048286us-gaap:ManagementServiceIncentiveMember2023-01-012023-09-300001048286mar:FeeServiceMember2024-07-012024-09-300001048286mar:FeeServiceMember2023-07-012023-09-300001048286mar:FeeServiceMember2024-01-012024-09-300001048286mar:FeeServiceMember2023-01-012023-09-300001048286mar:OwnedLeasedandOtherMember2024-07-012024-09-300001048286mar:OwnedLeasedandOtherMember2023-07-012023-09-300001048286mar:OwnedLeasedandOtherMember2024-01-012024-09-300001048286mar:OwnedLeasedandOtherMember2023-01-012023-09-300001048286mar:ReimbursementsMember2024-07-012024-09-300001048286mar:ReimbursementsMember2023-07-012023-09-300001048286mar:ReimbursementsMember2024-01-012024-09-300001048286mar:ReimbursementsMember2023-01-012023-09-3000010482862024-07-012024-09-3000010482862023-07-012023-09-3000010482862023-01-012023-09-3000010482862024-09-3000010482862023-12-310001048286us-gaap:TrademarksAndTradeNamesMember2024-09-300001048286us-gaap:TrademarksAndTradeNamesMember2023-12-310001048286mar:ContractAcquisitionCostsAndOtherMember2024-09-300001048286mar:ContractAcquisitionCostsAndOtherMember2023-12-310001048286mar:LoyaltyProgramMember2024-09-300001048286mar:LoyaltyProgramMember2023-12-310001048286mar:ContractServicesExcludingLoyaltyProgramMember2024-09-300001048286mar:ContractServicesExcludingLoyaltyProgramMember2023-12-310001048286mar:LoyaltyProgramMember2024-01-012024-09-300001048286mar:LoyaltyProgramMember2023-01-012023-09-3000010482862022-12-3100010482862023-09-300001048286us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001048286mar:PerformanceBasedRestrictedStockUnitsRSUsMember2024-01-012024-09-300001048286us-gaap:GuaranteeOfIndebtednessOfOthersMember2024-09-300001048286mar:GuaranteeOperatingProfitMember2024-09-300001048286us-gaap:GuaranteeTypeOtherMember2024-09-300001048286mar:GuaranteeOperatingProfitMembermar:NotYetInEffectConditionMember2024-09-300001048286mar:SheratonGrandChicagoHotelMembermar:BuildingandLandLeaseholdMember2017-12-310001048286mar:SheratonGrandChicagoHotelMemberus-gaap:LandMember2024-09-300001048286mar:SheratonGrandChicagoHotelMembermar:BuildingandLandLeaseholdMember2024-09-300001048286mar:SheratonGrandChicagoHotelMember2024-09-300001048286mar:SheratonGrandChicagoHotelMember2023-12-310001048286mar:ClassActionLawsuitsRelatedToDataSecurityIncidentMember2018-11-302018-11-300001048286mar:ClassActionLawsuitsRelatedToDataSecurityIncidentMember2024-09-300001048286mar:SeriesPSeniorNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesPSeniorNotesMember2024-09-300001048286mar:SeriesPSeniorNotesMember2023-12-310001048286mar:SeriesRNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesRNotesMember2024-09-300001048286mar:SeriesRNotesMember2023-12-310001048286mar:SeriesVNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesVNotesMember2024-09-300001048286mar:SeriesVNotesMember2023-12-310001048286mar:SeriesWNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesWNotesMember2024-09-300001048286mar:SeriesWNotesMember2023-12-310001048286mar:SeriesXNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesXNotesMember2024-09-300001048286mar:SeriesXNotesMember2023-12-310001048286mar:SeriesAANotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesAANotesMember2024-09-300001048286mar:SeriesAANotesMember2023-12-310001048286mar:SeriesCCNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesCCNotesMember2024-09-300001048286mar:SeriesCCNotesMember2023-12-310001048286mar:SeriesEENotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesEENotesMember2024-09-300001048286mar:SeriesEENotesMember2023-12-310001048286mar:SeriesFFNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesFFNotesMember2024-09-300001048286mar:SeriesFFNotesMember2023-12-310001048286mar:SeriesGGNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesGGNotesMember2024-09-300001048286mar:SeriesGGNotesMember2023-12-310001048286mar:SeriesHHNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesHHNotesMember2024-09-300001048286mar:SeriesHHNotesMember2023-12-310001048286mar:SeriesIINotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesIINotesMember2024-09-300001048286mar:SeriesIINotesMember2023-12-310001048286mar:SeriesJJNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesJJNotesMember2024-09-300001048286mar:SeriesJJNotesMember2023-12-310001048286mar:SeriesKKNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesKKNotesMember2024-09-300001048286mar:SeriesKKNotesMember2023-12-310001048286mar:SeriesLLNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesLLNotesMember2024-09-300001048286mar:SeriesLLNotesMember2023-12-310001048286mar:SeriesMMNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesMMNotesMember2024-09-300001048286mar:SeriesMMNotesMember2023-12-310001048286mar:SeriesNNNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesNNNotesMember2024-09-300001048286mar:SeriesNNNotesMember2023-12-310001048286mar:SeriesOONotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesOONotesMember2024-09-300001048286mar:SeriesOONotesMember2023-12-310001048286mar:SeriesPPNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesPPNotesMember2024-09-300001048286mar:SeriesPPNotesMember2023-12-310001048286mar:SeriesQQNotesMemberus-gaap:SeniorNotesMember2024-09-300001048286mar:SeriesQQNotesMember2024-09-300001048286mar:SeriesQQNotesMember2023-12-310001048286mar:SeriesPPNotesMemberus-gaap:SeniorNotesMember2024-08-310001048286mar:SeriesQQNotesMemberus-gaap:SeniorNotesMember2024-08-310001048286mar:SeriesPPAndQQNotesMemberus-gaap:SeniorNotesMember2024-08-012024-08-310001048286mar:SeriesNNNotesMemberus-gaap:SeniorNotesMember2024-02-290001048286mar:SeriesOONotesMemberus-gaap:SeniorNotesMember2024-02-290001048286mar:SeriesNNAndOONotesMemberus-gaap:SeniorNotesMember2024-02-012024-02-290001048286us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-09-300001048286us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-09-300001048286us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001048286us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001048286us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001048286mar:AccumulatedGainLossOtherAdjustmentsMember2023-12-310001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001048286us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-09-300001048286mar:AccumulatedGainLossOtherAdjustmentsMember2024-01-012024-09-300001048286us-gaap:AccumulatedTranslationAdjustmentMember2024-09-300001048286mar:AccumulatedGainLossOtherAdjustmentsMember2024-09-300001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001048286us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001048286mar:AccumulatedGainLossOtherAdjustmentsMember2022-12-310001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001048286us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-09-300001048286mar:AccumulatedGainLossOtherAdjustmentsMember2023-01-012023-09-300001048286us-gaap:AccumulatedTranslationAdjustmentMember2023-09-300001048286mar:AccumulatedGainLossOtherAdjustmentsMember2023-09-300001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001048286us-gaap:CommonStockMember2023-12-310001048286us-gaap:AdditionalPaidInCapitalMember2023-12-310001048286us-gaap:RetainedEarningsMember2023-12-310001048286us-gaap:TreasuryStockCommonMember2023-12-3100010482862024-01-012024-03-310001048286us-gaap:RetainedEarningsMember2024-01-012024-03-310001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001048286us-gaap:CommonStockMember2024-01-012024-03-310001048286us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001048286us-gaap:TreasuryStockCommonMember2024-01-012024-03-310001048286us-gaap:CommonStockMember2024-03-3100010482862024-03-310001048286us-gaap:AdditionalPaidInCapitalMember2024-03-310001048286us-gaap:RetainedEarningsMember2024-03-310001048286us-gaap:TreasuryStockCommonMember2024-03-310001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-3100010482862024-04-012024-06-300001048286us-gaap:RetainedEarningsMember2024-04-012024-06-300001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001048286us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001048286us-gaap:TreasuryStockCommonMember2024-04-012024-06-300001048286us-gaap:CommonStockMember2024-04-012024-06-300001048286us-gaap:CommonStockMember2024-06-3000010482862024-06-300001048286us-gaap:AdditionalPaidInCapitalMember2024-06-300001048286us-gaap:RetainedEarningsMember2024-06-300001048286us-gaap:TreasuryStockCommonMember2024-06-300001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001048286us-gaap:RetainedEarningsMember2024-07-012024-09-300001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001048286us-gaap:CommonStockMember2024-07-012024-09-300001048286us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001048286us-gaap:TreasuryStockCommonMember2024-07-012024-09-300001048286us-gaap:CommonStockMember2024-09-300001048286us-gaap:AdditionalPaidInCapitalMember2024-09-300001048286us-gaap:RetainedEarningsMember2024-09-300001048286us-gaap:TreasuryStockCommonMember2024-09-300001048286us-gaap:CommonStockMember2022-12-310001048286us-gaap:AdditionalPaidInCapitalMember2022-12-310001048286us-gaap:RetainedEarningsMember2022-12-310001048286us-gaap:TreasuryStockCommonMember2022-12-3100010482862023-01-012023-03-310001048286us-gaap:RetainedEarningsMember2023-01-012023-03-310001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001048286us-gaap:CommonStockMember2023-01-012023-03-310001048286us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001048286us-gaap:TreasuryStockCommonMember2023-01-012023-03-310001048286us-gaap:CommonStockMember2023-03-3100010482862023-03-310001048286us-gaap:AdditionalPaidInCapitalMember2023-03-310001048286us-gaap:RetainedEarningsMember2023-03-310001048286us-gaap:TreasuryStockCommonMember2023-03-310001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100010482862023-04-012023-06-300001048286us-gaap:RetainedEarningsMember2023-04-012023-06-300001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001048286us-gaap:CommonStockMember2023-04-012023-06-300001048286us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001048286us-gaap:TreasuryStockCommonMember2023-04-012023-06-300001048286us-gaap:CommonStockMember2023-06-3000010482862023-06-300001048286us-gaap:AdditionalPaidInCapitalMember2023-06-300001048286us-gaap:RetainedEarningsMember2023-06-300001048286us-gaap:TreasuryStockCommonMember2023-06-300001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001048286us-gaap:RetainedEarningsMember2023-07-012023-09-300001048286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001048286us-gaap:CommonStockMember2023-07-012023-09-300001048286us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001048286us-gaap:TreasuryStockCommonMember2023-07-012023-09-300001048286us-gaap:CommonStockMember2023-09-300001048286us-gaap:AdditionalPaidInCapitalMember2023-09-300001048286us-gaap:RetainedEarningsMember2023-09-300001048286us-gaap:TreasuryStockCommonMember2023-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:USAndCanadaSegmentMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:EMEASegmentMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:GreaterChinaMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:APECMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:USAndCanadaSegmentMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:EMEASegmentMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:GreaterChinaMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:APECMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:USAndCanadaSegmentMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:EMEASegmentMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:GreaterChinaMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:APECMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:USAndCanadaSegmentMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:EMEASegmentMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:GreaterChinaMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:APECMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMember2024-07-012024-09-300001048286us-gaap:CorporateNonSegmentMember2024-07-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:USAndCanadaSegmentMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:EMEASegmentMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:GreaterChinaMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:APECMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:USAndCanadaSegmentMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:EMEASegmentMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:GreaterChinaMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:APECMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:USAndCanadaSegmentMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:EMEASegmentMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:GreaterChinaMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:APECMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:USAndCanadaSegmentMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:EMEASegmentMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:GreaterChinaMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:APECMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMember2023-07-012023-09-300001048286us-gaap:CorporateNonSegmentMember2023-07-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:USAndCanadaSegmentMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:EMEASegmentMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:GreaterChinaMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:APECMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:USAndCanadaSegmentMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:EMEASegmentMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:GreaterChinaMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:APECMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:USAndCanadaSegmentMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:EMEASegmentMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:GreaterChinaMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:APECMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:USAndCanadaSegmentMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:EMEASegmentMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:GreaterChinaMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:APECMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMember2024-01-012024-09-300001048286us-gaap:CorporateNonSegmentMember2024-01-012024-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:USAndCanadaSegmentMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:EMEASegmentMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:GreaterChinaMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMembermar:APECMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:FeeServiceMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:USAndCanadaSegmentMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:EMEASegmentMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:GreaterChinaMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMembermar:APECMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:OwnedLeasedandOtherMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:USAndCanadaSegmentMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:EMEASegmentMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:GreaterChinaMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMembermar:APECMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:ReimbursementsMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:USAndCanadaSegmentMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:EMEASegmentMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:GreaterChinaMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMembermar:APECMember2023-01-012023-09-300001048286us-gaap:OperatingSegmentsMember2023-01-012023-09-300001048286us-gaap:CorporateNonSegmentMember2023-01-012023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

FORM 10-Q

_________________________________________________

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File No. 1-13881

_________________________________________________

MARRIOTT INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 52-2055918 |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer

Identification No.) |

| | | | | | |

| 7750 Wisconsin Avenue | | Bethesda | | Maryland | | 20814 |

(Address of principal executive offices) | | (Zip Code) |

(Registrant’s telephone number, including area code) (301) 380-3000

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

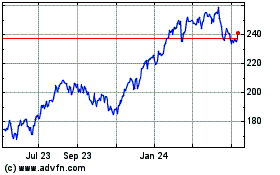

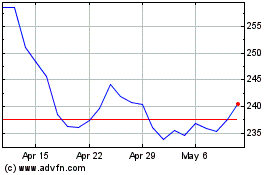

| Class A Common Stock, $0.01 par value | | MAR | | Nasdaq Global Select Market |

| | | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ý | | Accelerated filer | | ¨ |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | ☐ |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 277,893,432 shares of Class A Common Stock, par value $0.01 per share, outstanding at October 28, 2024.

MARRIOTT INTERNATIONAL, INC.

FORM 10-Q TABLE OF CONTENTS

| | | | | | | | |

| | | Page No. |

| | |

| Part I. | | |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | |

| | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Part II. | | |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 2. | | |

| | |

| Item 5. | | |

| | |

| | |

| | |

| Item 6. | | |

| | |

| | |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in millions, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| | September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| REVENUES | | | | | | | |

| Base management fees | $ | 312 | | | $ | 306 | | | $ | 955 | | | $ | 917 | |

| Franchise fees | 812 | | | 748 | | | 2,318 | | | 2,126 | |

| Incentive management fees | 159 | | | 143 | | | 563 | | | 537 | |

| Gross fee revenues | 1,283 | | | 1,197 | | | 3,836 | | | 3,580 | |

| Contract investment amortization | (26) | | | (23) | | | (76) | | | (66) | |

| Net fee revenues | 1,257 | | | 1,174 | | | 3,760 | | | 3,514 | |

| Owned, leased, and other revenue | 381 | | | 363 | | | 1,133 | | | 1,109 | |

| Cost reimbursement revenue | 4,617 | | | 4,391 | | | 13,778 | | | 12,995 | |

| 6,255 | | | 5,928 | | | 18,671 | | | 17,618 | |

| OPERATING COSTS AND EXPENSES | | | | | | | |

Owned, leased, and other - direct | 300 | | | 293 | | | 882 | | | 861 | |

| Depreciation, amortization, and other | 45 | | | 46 | | | 137 | | | 138 | |

| General, administrative, and other | 276 | | | 239 | | | 785 | | | 681 | |

Restructuring and merger-related charges | 9 | | | 13 | | | 25 | | | 52 | |

| Reimbursed expenses | 4,681 | | | 4,238 | | | 13,827 | | | 12,740 | |

| 5,311 | | | 4,829 | | | 15,656 | | | 14,472 | |

| OPERATING INCOME | 944 | | | 1,099 | | | 3,015 | | | 3,146 | |

| Gains and other income, net | 7 | | | 28 | | | 15 | | | 33 | |

| | | | | | | |

| Interest expense | (179) | | | (146) | | | (515) | | | (412) | |

| Interest income | 11 | | | 7 | | | 30 | | | 21 | |

| Equity in earnings | 3 | | | 1 | | | 8 | | | 9 | |

| INCOME BEFORE INCOME TAXES | 786 | | | 989 | | | 2,553 | | | 2,797 | |

| Provision for income taxes | (202) | | | (237) | | | (633) | | | (562) | |

| NET INCOME | $ | 584 | | | $ | 752 | | | $ | 1,920 | | | $ | 2,235 | |

| EARNINGS PER SHARE | | | | | | | |

| Earnings per share – basic | $ | 2.08 | | | $ | 2.52 | | | $ | 6.71 | | | $ | 7.36 | |

| Earnings per share – diluted | $ | 2.07 | | | $ | 2.51 | | | $ | 6.69 | | | $ | 7.32 | |

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| Net income | $ | 584 | | | $ | 752 | | | $ | 1,920 | | | $ | 2,235 | |

Other comprehensive income (loss) | | | | | | | |

| Foreign currency translation adjustments | 209 | | | (139) | | | (62) | | | (132) | |

| Other adjustments, net of tax | (18) | | | 6 | | | (5) | | | 12 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total other comprehensive income (loss), net of tax | 191 | | | (133) | | | (67) | | | (120) | |

| Comprehensive income | $ | 775 | | | $ | 619 | | | $ | 1,853 | | | $ | 2,115 | |

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions)

| | | | | | | | | | | |

| (Unaudited) | | |

| September 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets | | | |

| Cash and equivalents | $ | 394 | | | $ | 338 | |

| Accounts and notes receivable, net | 2,920 | | | 2,712 | |

| Prepaid expenses and other | 259 | | | 261 | |

| | | |

| 3,573 | | | 3,311 | |

| Property and equipment, net | 1,624 | | | 1,581 | |

| Intangible assets | | | |

| Brands | 5,902 | | | 5,907 | |

| Contract acquisition costs and other | 3,595 | | | 3,283 | |

| Goodwill | 8,890 | | | 8,886 | |

| 18,387 | | | 18,076 | |

| Equity method investments | 307 | | | 308 | |

| Notes receivable, net | 144 | | | 138 | |

| Deferred tax assets | 629 | | | 673 | |

| Operating lease assets | 879 | | | 929 | |

| Other noncurrent assets | 666 | | | 658 | |

| $ | 26,209 | | | $ | 25,674 | |

LIABILITIES AND STOCKHOLDERS’ DEFICIT | | | |

| Current liabilities | | | |

| Current portion of long-term debt | $ | 960 | | | $ | 553 | |

| Accounts payable | 807 | | | 738 | |

| Accrued payroll and benefits | 1,288 | | | 1,390 | |

| Liability for guest loyalty program | 3,402 | | | 3,328 | |

| Accrued expenses and other | 2,061 | | | 1,753 | |

| 8,518 | | | 7,762 | |

| Long-term debt | 12,671 | | | 11,320 | |

| Liability for guest loyalty program | 3,969 | | | 3,678 | |

| Deferred tax liabilities | 185 | | | 209 | |

| Deferred revenue | 1,064 | | | 1,018 | |

| Operating lease liabilities | 831 | | | 887 | |

| Other noncurrent liabilities | 1,392 | | | 1,482 | |

Stockholders’ deficit | | | |

| Class A Common Stock | 5 | | | 5 | |

| Additional paid-in-capital | 6,125 | | | 6,051 | |

| Retained earnings | 16,251 | | | 14,838 | |

| Treasury stock, at cost | (24,088) | | | (20,929) | |

| Accumulated other comprehensive loss | (714) | | | (647) | |

| (2,421) | | | (682) | |

| $ | 26,209 | | | $ | 25,674 | |

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended |

| | September 30, 2024 | | September 30, 2023 |

| OPERATING ACTIVITIES | | | |

| Net income | $ | 1,920 | | | $ | 2,235 | |

| Adjustments to reconcile to cash provided by operating activities: | | | |

| Depreciation, amortization, and other | 213 | | | 204 | |

| Stock-based compensation | 173 | | | 147 | |

| Income taxes | (96) | | | (107) | |

| Liability for guest loyalty program | 365 | | | 109 | |

| Contract acquisition costs | (256) | | | (134) | |

| Restructuring and merger-related charges | 24 | | | 42 | |

| Working capital changes | (162) | | | (141) | |

| | | |

| Other | 250 | | | 64 | |

| Net cash provided by operating activities | 2,431 | | | 2,419 | |

| INVESTING ACTIVITIES | | | |

| Capital and technology expenditures | (408) | | | (318) | |

| Asset acquisition | — | | | (102) | |

| Dispositions | 4 | | | 61 | |

| Loan advances | (10) | | | (77) | |

| Loan collections | 10 | | | 35 | |

| Other | 15 | | | 38 | |

| Net cash used in investing activities | (389) | | | (363) | |

| FINANCING ACTIVITIES | | | |

| Commercial paper/Credit Facility, net | (648) | | | 100 | |

| Issuance of long-term debt | 2,948 | | | 1,918 | |

| Repayment of long-term debt | (556) | | | (332) | |

| Issuance of Class A Common Stock | 73 | | | 29 | |

| | | |

| Dividends paid | (506) | | | (435) | |

| Purchase of treasury stock | (3,176) | | | (2,988) | |

| Stock-based compensation withholding taxes | (127) | | | (105) | |

| Other | — | | | (25) | |

| Net cash used in financing activities | (1,992) | | | (1,838) | |

INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | 50 | | | 218 | |

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, beginning of period (1) | 366 | | | 525 | |

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, end of period (1) | $ | 416 | | | $ | 743 | |

| | | |

| | | |

| | | |

| | | |

| | | |

(1)The 2024 amounts include beginning restricted cash of $28 million at December 31, 2023, and ending restricted cash of $22 million at September 30, 2024, which we present in the “Prepaid expenses and other” and “Other noncurrent assets” captions of our Balance Sheets.

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1. BASIS OF PRESENTATION

The condensed consolidated financial statements present the results of operations, financial position, and cash flows of Marriott International, Inc. and subsidiaries (referred to in this report as “we,” “us,” “Marriott,” or the “Company”). In order to make this report easier to read, we also refer throughout to (1) our Condensed Consolidated Financial Statements as our “Financial Statements,” (2) our Condensed Consolidated Statements of Income as our “Income Statements,” (3) our Condensed Consolidated Balance Sheets as our “Balance Sheets,” (4) our Condensed Consolidated Statements of Cash Flows as our “Statements of Cash Flows,” (5) our properties, brands, or markets in the United States and Canada as “U.S. & Canada,” and (6) our properties, brands, or markets in our Caribbean & Latin America, Europe, Middle East & Africa, Greater China, and Asia Pacific excluding China regions, as “International.” In addition, references throughout to numbered “Notes” refer to these Notes to Condensed Consolidated Financial Statements, unless otherwise stated.

These Financial Statements have not been audited. We have condensed or omitted certain information and disclosures normally included in financial statements presented in accordance with U.S. generally accepted accounting principles (“GAAP”). The financial statements in this report should be read in conjunction with the consolidated financial statements and notes thereto in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (“2023 Form 10-K”). Certain terms not otherwise defined in this Form 10-Q have the meanings specified in our 2023 Form 10-K.

Preparation of financial statements that conform with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements, the reported amounts of revenues and expenses during the reporting periods, and the disclosures of contingent liabilities. Accordingly, ultimate results could differ from those estimates.

The accompanying Financial Statements reflect all normal and recurring adjustments necessary to present fairly our financial position as of September 30, 2024 and December 31, 2023, the results of our operations for the three and nine months ended September 30, 2024 and September 30, 2023, and cash flows for the nine months ended September 30, 2024 and September 30, 2023. Interim results may not be indicative of fiscal year performance because of seasonal and short-term variations. We have eliminated all material intercompany transactions and balances between entities consolidated in these Financial Statements.

NOTE 2. EARNINGS PER SHARE

The table below illustrates the reconciliation of the earnings and number of shares used in our calculations of basic and diluted earnings per share, the latter of which uses the treasury stock method to calculate the dilutive effect of the Company’s potential common stock:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| (in millions, except per share amounts) | September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| Computation of Basic Earnings Per Share | | | | | | | |

| Net income | $ | 584 | | | $ | 752 | | | $ | 1,920 | | | $ | 2,235 | |

| Shares for basic earnings per share | 281.5 | | | 298.6 | | | 285.9 | | | 303.9 | |

| Basic earnings per share | $ | 2.08 | | | $ | 2.52 | | | $ | 6.71 | | | $ | 7.36 | |

| Computation of Diluted Earnings Per Share | | | | | | | |

| Net income | $ | 584 | | | $ | 752 | | | $ | 1,920 | | | $ | 2,235 | |

| Shares for basic earnings per share | 281.5 | | | 298.6 | | | 285.9 | | | 303.9 | |

| Effect of dilutive securities | | | | | | | |

| Stock-based compensation | 0.9 | | | 1.5 | | | 1.0 | | | 1.4 | |

| Shares for diluted earnings per share | 282.4 | | | 300.1 | | | 286.9 | | | 305.3 | |

| Diluted earnings per share | $ | 2.07 | | | $ | 2.51 | | | $ | 6.69 | | | $ | 7.32 | |

NOTE 3. STOCK-BASED COMPENSATION

We granted 0.8 million restricted stock units (“RSUs”) during the 2024 first three quarters to certain officers and employees, and those units vest generally over four years in equal annual installments commencing one year after the grant date. We also granted 0.1 million performance-based RSUs (“PSUs”) in the 2024 first three quarters to certain executives, which are earned subject to continued employment and the satisfaction of certain performance and market conditions based on the degree of achievement of pre-established targets for 2026 adjusted EBITDA performance and relative total stockholder return over the 2024 to 2026 performance period. RSUs, including PSUs, granted in the 2024 first three quarters had a weighted average grant-date fair value of $226 per unit.

We recorded stock-based compensation expense for RSUs and PSUs of $54 million in the 2024 third quarter, $47 million in the 2023 third quarter, $148 million in the 2024 first three quarters, and $129 million in the 2023 first three quarters. Deferred compensation costs for unvested awards for RSUs and PSUs totaled $224 million at September 30, 2024 and $171 million at December 31, 2023.

NOTE 4. INCOME TAXES

Our effective tax rate increased to 25.7 percent for the 2024 third quarter compared to 23.9 percent for the 2023 third quarter, primarily due to a shift in earnings to jurisdictions with higher tax rates.

Our effective tax rate increased to 24.8 percent for the 2024 first three quarters compared to 20.1 percent for the 2023 first three quarters, primarily due to the prior year release of tax reserves and a shift in earnings to jurisdictions with higher tax rates.

We paid cash for income taxes, net of refunds, of $729 million in the 2024 first three quarters and $669 million in the 2023 first three quarters.

NOTE 5. COMMITMENTS AND CONTINGENCIES

Guarantees

We present the maximum potential amount of our future guarantee fundings and the carrying amount of our liability for our debt service, operating profit, and other guarantees (excluding contingent purchase obligations) for which we are the primary obligor at September 30, 2024 in the following table:

| | | | | | | | | | | | | | |

(in millions) Guarantee Type | | Maximum Potential Amount of Future Fundings | | Recorded Liability for Guarantees |

| Debt service | | $ | 62 | | | $ | 6 | |

| Operating profit | | 146 | | | 91 | |

| Other | | 20 | | | 4 | |

| | $ | 228 | | | $ | 101 | |

Our maximum potential guarantees listed in the preceding table include $58 million of operating profit guarantees that will not be in effect until the underlying properties open and we begin to operate the properties or certain other events occur.

Contingent Purchase Obligation

Sheraton Grand Chicago. In 2017, we granted the owner a one-time right to require us to purchase the leasehold interest in the land and the hotel for $300 million in cash (the “put option”). In the 2021 third quarter, we entered into an amendment with the owner to move the exercise period of the put option from the 2022 first half to the 2024 first half. In January 2024, the owner exercised the put option, and we exercised our option to purchase, at the same time the put transaction closes, the fee simple interest in the underlying land for an additional $200 million in cash, resulting in an expected total cash payment of approximately $500 million. The closing is expected to occur in the 2024 fourth quarter. We account for the put option as a guarantee, and our recorded liability (reflected in the “Accrued expenses and other” caption of our Balance Sheets) was $300 million at September 30, 2024 and December 31, 2023.

Starwood Data Security Incident

Description of Event

On November 30, 2018, we announced a data security incident involving unauthorized access to the Starwood reservations database (the “Data Security Incident”). Working with leading security experts, we determined that there was unauthorized access to the Starwood network since 2014 and that an unauthorized party had copied information from the Starwood reservations database and taken steps towards removing it. We discontinued use of the Starwood reservations database for business operations at the end of 2018.

Litigation, Claims, and Government Investigations

Following our announcement of the Data Security Incident, approximately 100 lawsuits were filed by consumers and others against us in U.S. federal, U.S. state and Canadian courts related to the incident. The plaintiffs in the cases that remain pending, who generally purport to represent various classes of consumers, generally claim to have been harmed by alleged actions and/or omissions by the Company in connection with the Data Security Incident and assert a variety of common law and statutory claims seeking monetary damages, injunctive relief, costs and attorneys’ fees, and other related relief. The active U.S. cases are consolidated in the U.S. District Court for the District of Maryland (the “District Court”), pursuant to orders of the U.S. Judicial Panel on Multidistrict Litigation (the “MDL”). The District Court granted in part and denied in part class certification of various U.S. groups of consumers. In August 2023, the U.S. Court of Appeals for the Fourth Circuit (the “Fourth Circuit”) vacated the District Court’s class certification decision because the District Court failed to first consider the effect of a class-action waiver signed by all putative class members. On remand, after briefing, the District Court issued an order reinstating the same classes that had previously been certified. We promptly petitioned the Fourth Circuit, seeking leave to appeal that ruling. The Fourth Circuit granted that petition on January 18, 2024, oral argument was held on November 1, 2024, and we await a decision. A case brought by the City of Chicago (which is consolidated in the MDL proceeding) also remains pending. The Canadian cases have effectively been consolidated into a single case in the province of Ontario. We dispute the allegations in these lawsuits and are vigorously defending against such claims.

In addition, various U.S. federal, U.S. state and foreign governmental authorities made inquiries, opened investigations, or requested information and/or documents related to the Data Security Incident and related matters. Most of these matters have been resolved or no longer appear to be active. In October 2024, we reached final resolutions with the Federal Trade Commission and the Attorney General offices from 49 states and the District of Columbia (the “AG Offices”). Among other terms, the resolution with the AG Offices includes a $52 million monetary payment, which we have fully accrued for as of September 30, 2024, and which is not material to our Financial Statements. We do not expect the terms of these resolutions to have a material impact on our current or ongoing operations.

While we believe it is reasonably possible that we may incur losses in excess of the amounts recorded associated with the above described MDL proceedings and unresolved regulatory investigations related to the Data Security Incident, it is not possible to reasonably estimate the amount of such losses or range of loss in excess of the amounts recorded that might result from adverse judgments, settlements, fines, penalties or other resolution of these proceedings and investigations based on: (1) in the case of the above described MDL proceedings, the current stage of these proceedings, the absence of specificity as to alleged damages, the uncertainty as to the certification of a class or classes and the size of any certified class, and the lack of resolution of significant factual and legal issues, and (2) uncertainty regarding unresolved inquiries, investigations, or requests for information and/or documents.

Other Legal Proceedings

During the 2024 third quarter, we recorded certain expenses related to settled and ongoing claims brought against the Company regarding the use of copyrighted music. These amounts are not material to our Financial Statements. While we believe it is reasonably possible that we may incur losses in excess of the amounts already recorded for the unresolved claims, we are currently unable to reasonably estimate the amount of losses or range of

loss in excess of the amounts recorded. At this time, we do not expect these claims or resolutions to have a material impact on the Company’s financial position or operations.

NOTE 6. LONG-TERM DEBT

We provide detail on our long-term debt balances, net of discounts, premiums, and debt issuance costs, in the following table as of September 30, 2024 and year-end 2023:

| | | | | | | | | | | |

| (in millions) | September 30, 2024 | | December 31, 2023 |

| Senior Notes: | | | |

Series P Notes, interest rate of 3.8%, face amount of $350, maturing October 1, 2025 (effective interest rate of 4.0%) | $ | 349 | | | $ | 349 | |

Series R Notes, interest rate of 3.1%, face amount of $750, maturing June 15, 2026 (effective interest rate of 3.3%) | 748 | | | 748 | |

Series V Notes, interest rate of 3.8%, face amount of $318, maturing March 15, 2025 (effective interest rate of 2.8%) | 319 | | | 321 | |

Series W Notes, interest rate of 4.5%, face amount of $278, maturing October 1, 2034 (effective interest rate of 4.1%) | 288 | | | 288 | |

Series X Notes, interest rate of 4.0%, face amount of $450, maturing April 15, 2028 (effective interest rate of 4.2%) | 447 | | | 447 | |

Series AA Notes, interest rate of 4.7%, face amount of $300, maturing December 1, 2028 (effective interest rate of 4.8%) | 298 | | | 298 | |

Series CC Notes, interest rate of 3.6%, face amount of $550, matured April 15, 2024 (effective interest rate of 3.9%) | — | | | 545 | |

Series EE Notes, interest rate of 5.8%, face amount of $600, maturing May 1, 2025 (effective interest rate of 6.0%) | 599 | | | 598 | |

Series FF Notes, interest rate of 4.6%, face amount of $1,000, maturing June 15, 2030 (effective interest rate of 4.8%) | 991 | | | 990 | |

Series GG Notes, interest rate of 3.5%, face amount of $1,000, maturing October 15, 2032 (effective interest rate of 3.7%) | 989 | | | 988 | |

Series HH Notes, interest rate of 2.9%, face amount of $1,100, maturing April 15, 2031 (effective interest rate of 3.0%) | 1,092 | | | 1,091 | |

Series II Notes, interest rate of 2.8%, face amount of $700, maturing October 15, 2033 (effective interest rate of 2.8%) | 695 | | | 694 | |

Series JJ Notes, interest rate of 5.0%, face amount of $1,000, maturing October 15, 2027 (effective interest rate of 5.4%) | 989 | | | 987 | |

Series KK Notes, interest rate of 4.9%, face amount of $800, maturing April 15, 2029 (effective interest rate of 5.3%) | 787 | | | 785 | |

Series LL Notes, interest rate of 5.5%, face amount of $450, maturing September 15, 2026 (effective interest rate of 5.9%) | 446 | | | 445 | |

Series MM Notes, interest rate of 5.6%, face amount of $700, maturing October 15, 2028 (effective interest rate of 5.9%) | 692 | | | 691 | |

Series NN Notes, interest rate of 4.9%, face amount of $500, maturing May 15, 2029 (effective interest rate of 5.3%) | 491 | | | — | |

Series OO Notes, interest rate of 5.3%, face amount of $1,000, maturing May 15, 2034 (effective interest rate of 5.6%) | 979 | | | — | |

Series PP Notes, interest rate of 4.8%, face amount of $500, maturing March 15, 2030 (effective interest rate of 5.0%) | 495 | | | — | |

Series QQ Notes, interest rate of 5.4%, face amount of $1,000, maturing March 15, 2035 (effective interest rate of 5.5%) | 986 | | | — | |

| Commercial paper | 769 | | | 1,421 | |

| Credit Facility | — | | | — | |

| Finance lease obligations | 126 | | | 131 | |

| Other | 56 | | | 56 | |

| $ | 13,631 | | | $ | 11,873 | |

| Less current portion | (960) | | | (553) | |

| $ | 12,671 | | | $ | 11,320 | |

We paid cash for interest, net of amounts capitalized, of $350 million in the 2024 first three quarters and $266 million in the 2023 first three quarters.

In August 2024, we issued $500 million aggregate principal amount of 4.800 percent Series PP Notes due March 15, 2030 (the “Series PP Notes”) and $1.0 billion aggregate principal amount of 5.350 percent Series QQ

Notes due March 15, 2035 (the “Series QQ Notes”). We will pay interest on the Series PP Notes and Series QQ Notes in March and September of each year, commencing in March 2025. Net proceeds from the offering of the Series PP Notes and Series QQ Notes were approximately $1.480 billion, after deducting the underwriting discount and expenses, and were made available for general corporate purposes, including working capital, capital expenditures, acquisitions, stock repurchases, or repayment of outstanding indebtedness.

In February 2024, we issued $500 million aggregate principal amount of 4.875 percent Series NN Notes due May 15, 2029 (the “Series NN Notes”) and $1.0 billion aggregate principal amount of 5.300 percent Series OO Notes due May 15, 2034 (the “Series OO Notes”). We pay interest on the Series NN Notes and Series OO Notes in May and November of each year. Net proceeds from the offering of the Series NN Notes and Series OO Notes were approximately $1.468 billion, after deducting the underwriting discount and expenses, and were made available for general corporate purposes, including working capital, capital expenditures, acquisitions, stock repurchases, or repayment of outstanding indebtedness.

We are party to a $4.5 billion multicurrency revolving credit agreement (as amended, the “Credit Facility”). Available borrowings under the Credit Facility support our commercial paper program and general corporate needs. U.S. dollar borrowings under the Credit Facility bear interest at SOFR (the Secured Overnight Financing Rate) plus a spread based on our public debt rating. We also pay quarterly fees on the Credit Facility at a rate based on our public debt rating. We classify outstanding borrowings under the Credit Facility and outstanding commercial paper borrowings (which generally have short-term maturities of 45 days or less) as long-term based on our ability and intent to refinance the outstanding borrowings on a long-term basis. The Credit Facility expires on December 14, 2027.

NOTE 7. FAIR VALUE OF FINANCIAL INSTRUMENTS

We believe that the fair values of our current assets and current liabilities approximate their reported carrying amounts. We present the carrying amounts and the fair values of noncurrent financial assets and liabilities that qualify as financial instruments in the following table:

| | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 |

| (in millions) | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

Notes receivable | $ | 144 | | | $ | 142 | | | $ | 138 | | | $ | 131 | |

| Total noncurrent financial assets | $ | 144 | | | $ | 142 | | | $ | 138 | | | $ | 131 | |

| | | | | | | |

| Senior Notes | $ | (11,762) | | | $ | (11,720) | | | $ | (9,720) | | | $ | (9,393) | |

| Commercial paper | (769) | | | (769) | | | (1,421) | | | (1,421) | |

| | | | | | | |

| | | | | | | |

| Total noncurrent financial liabilities | $ | (12,531) | | | $ | (12,489) | | | $ | (11,141) | | | $ | (10,814) | |

See Note 12. Fair Value of Financial Instruments and the “Fair Value Measurements” caption of Note 2. Summary of Significant Accounting Policies of our 2023 Form 10-K for more information on the input levels we use in determining fair value.

NOTE 8. ACCUMULATED OTHER COMPREHENSIVE LOSS AND STOCKHOLDERS’ DEFICIT

The following tables detail the accumulated other comprehensive loss activity for the 2024 first three quarters and 2023 first three quarters:

| | | | | | | | | | | | | | | | | | | |

| (in millions) | Foreign Currency Translation Adjustments | | Other Adjustments | | | | Accumulated Other Comprehensive Loss |

| Balance at year-end 2023 | $ | (654) | | | $ | 7 | | | | | $ | (647) | |

Other comprehensive loss before reclassifications | (62) | | | (2) | | | | | (64) | |

| Reclassification adjustments | — | | | (3) | | | | | (3) | |

Net other comprehensive loss | (62) | | | (5) | | | | | (67) | |

| Balance at September 30, 2024 | $ | (716) | | | $ | 2 | | | | | $ | (714) | |

| | | | | | | | | | | | | | | | | | | | | |

| (in millions) | Foreign Currency Translation Adjustments | | Other Adjustments | | | | | | Accumulated Other Comprehensive Loss |

Balance at year-end 2022 | $ | (740) | | | $ | 11 | | | | | | | $ | (729) | |

Other comprehensive (loss) income before reclassifications | (129) | | | 11 | | | | | | | (118) | |

| Reclassification adjustments | (3) | | | 1 | | | | | | | (2) | |

Net other comprehensive (loss) income | (132) | | | 12 | | | | | | | (120) | |

| Balance at September 30, 2023 | $ | (872) | | | $ | 23 | | | | | | | $ | (849) | |

| | | | | | | | | |

The following tables detail the changes in common shares outstanding and stockholders’ deficit for the 2024 first three quarters and 2023 first three quarters:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share amounts) | | |

Common Shares Outstanding | | | Total | | Class A Common Stock | | Additional Paid-in-Capital | | Retained Earnings | | Treasury Stock, at Cost | | Accumulated Other Comprehensive Loss |

| 290.5 | | | Balance at year-end 2023 | $ | (682) | | | $ | 5 | | | $ | 6,051 | | | $ | 14,838 | | | $ | (20,929) | | | $ | (647) | |

| — | | | Net income | 564 | | | — | | | — | | | 564 | | | — | | | — | |

| — | | | Other comprehensive loss | (147) | | | — | | | — | | | — | | | — | | | (147) | |

| — | | | Dividends ($0.52 per share) | (151) | | | — | | | — | | | (151) | | | — | | | — | |

| 1.3 | | | Stock-based compensation plans | (36) | | | — | | | (73) | | | — | | | 37 | | | — | |

| (4.8) | | | Purchase of treasury stock | (1,164) | | | — | | | — | | | — | | | (1,164) | | | — | |

| 287.0 | | | Balance at March 31, 2024 | $ | (1,616) | | | $ | 5 | | | $ | 5,978 | | | $ | 15,251 | | | $ | (22,056) | | | $ | (794) | |

| — | | | Net income | 772 | | | — | | | — | | | 772 | | | — | | | — | |

| — | | | Other comprehensive loss | (111) | | | — | | | — | | | — | | | — | | | (111) | |

| — | | | Dividends ($0.63 per share) | (179) | | | — | | | — | | | (179) | | | — | | | — | |

| — | | | Stock-based compensation plans | 53 | | | — | | | 52 | | | — | | | 1 | | | — | |

| (4.1) | | | Purchase of treasury stock | (1,010) | | | — | | | — | | | — | | | (1,010) | | | — | |

| 282.9 | | | Balance at June 30, 2024 | $ | (2,091) | | | $ | 5 | | | $ | 6,030 | | | $ | 15,844 | | | $ | (23,065) | | | $ | (905) | |

| — | | | Net income | 584 | | | — | | | — | | | 584 | | | — | | | — | |

| — | | | Other comprehensive income | 191 | | | — | | | — | | | — | | | — | | | 191 | |

| — | | | Dividends ($0.63 per share) | (177) | | | — | | | — | | | (177) | | | — | | | — | |

| 0.2 | | | Stock-based compensation plans | 101 | | | — | | | 95 | | | — | | | 6 | | | — | |

| (4.5) | | | Purchase of treasury stock | (1,029) | | | — | | | — | | | — | | | (1,029) | | | — | |

| 278.6 | | | Balance at September 30, 2024 | $ | (2,421) | | | $ | 5 | | | $ | 6,125 | | | $ | 16,251 | | | $ | (24,088) | | | $ | (714) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Common Shares Outstanding | | | Total | | Class A Common Stock | | Additional Paid-in-Capital | | Retained Earnings | | Treasury Stock, at Cost | | Accumulated Other Comprehensive Loss |

| 310.6 | | | Balance at year-end 2022 | $ | 568 | | | $ | 5 | | | $ | 5,965 | | | $ | 12,342 | | | $ | (17,015) | | | $ | (729) | |

| — | | | Net income | 757 | | | — | | | — | | | 757 | | | — | | | — | |

| — | | | Other comprehensive income | 82 | | | — | | | — | | | — | | | — | | | 82 | |

| — | | | Dividends ($0.40 per share) | (124) | | | — | | | — | | | (124) | | | — | | | — | |

| 0.9 | | | Stock-based compensation plans | (34) | | | — | | | (59) | | | — | | | 25 | | | — | |

| (6.8) | | | Purchase of treasury stock | (1,109) | | | — | | | — | | | — | | | (1,109) | | | — | |

| 304.7 | | | Balance at March 31, 2023 | $ | 140 | | | $ | 5 | | | $ | 5,906 | | | $ | 12,975 | | | $ | (18,099) | | | $ | (647) | |

| — | | | Net income | 726 | | | — | | | — | | | 726 | | | — | | | — | |

| — | | | Other comprehensive loss | (69) | | | — | | | — | | | — | | | — | | | (69) | |

| — | | | Dividends ($0.52 per share) | (157) | | | — | | | — | | | (157) | | | — | | | — | |

| 0.1 | | | Stock-based compensation plans | 48 | | | — | | | 46 | | | — | | | 2 | | | — | |

| (5.2) | | | Purchase of treasury stock | (912) | | | — | | | — | | | — | | | (912) | | | — | |

| 299.6 | | | Balance at June 30, 2023 | $ | (224) | | | $ | 5 | | | $ | 5,952 | | | $ | 13,544 | | | $ | (19,009) | | | $ | (716) | |

| — | | | Net income | 752 | | | — | | | — | | | 752 | | | — | | | — | |

| — | | | Other comprehensive loss | (133) | | | — | | | — | | | — | | | — | | | (133) | |

| — | | | Dividends ($0.52 per share) | (154) | | | — | | | — | | | (154) | | | — | | | — | |

| 0.4 | | | Stock-based compensation plans | 56 | | | — | | | 44 | | | — | | | 12 | | | — | |

| (4.8) | | | Purchase of treasury stock | (958) | | | — | | | — | | | — | | | (958) | | | — | |

| 295.2 | | | Balance at September 30, 2023 | $ | (661) | | | $ | 5 | | | $ | 5,996 | | | $ | 14,142 | | | $ | (19,955) | | | $ | (849) | |

NOTE 9. CONTRACTS WITH CUSTOMERS

Our current and noncurrent liability for guest loyalty program increased by $365 million, to $7,371 million at September 30, 2024, from $7,006 million at December 31, 2023, primarily reflecting an increase in points earned by members. The increase was partially offset by $2,410 million of revenue recognized in the 2024 first three quarters, that was deferred as of December 31, 2023.

Our allowance for credit losses was $207 million at September 30, 2024 and $197 million at December 31, 2023.

NOTE 10. BUSINESS SEGMENTS

Beginning in the 2024 first quarter, we modified our segment structure as a result of a change in the way our chief operating decision maker (“CODM”) evaluates performance and allocates resources within the Company, resulting in the following four reportable business segments: (1) U.S. & Canada, (2) Europe, Middle East & Africa (“EMEA”), (3) Greater China, and (4) Asia Pacific excluding China (“APEC”). Our Caribbean & Latin America (“CALA”) operating segment does not meet the applicable accounting criteria for separate disclosure as a reportable business segment, and as such, we include its results in “Unallocated corporate and other.” We revised the prior period amounts shown in the tables below to conform to our current presentation.

We evaluate the performance of our operating segments using “segment profits,” which is based largely on the results of the segment without allocating corporate expenses, income taxes, indirect general, administrative, and other expenses, or certain restructuring and merger-related charges. We assign gains and losses, equity in earnings or losses, and direct general, administrative, and other expenses to each of our segments. “Unallocated corporate and other” includes a portion of our revenues (such as fees we receive from our credit card programs and vacation ownership licensing agreements), revenues and expenses for our Loyalty Program, general, administrative, and other expenses, certain restructuring and merger-related charges, equity in earnings or losses, and other gains or losses that we do not allocate to our segments, as well as results of our CALA operating segment.

Our CODM monitors assets for the consolidated Company but does not use assets by operating segment when assessing performance or making operating segment resource allocations.

Segment Revenues

The following tables present our revenues disaggregated by segment and major revenue stream for the 2024 third quarter, 2023 third quarter, 2024 first three quarters, and 2023 first three quarters:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 |

| (in millions) | U.S. & Canada | | EMEA | | | | Greater China | | APEC | | Total |

| Gross fee revenues | $ | 747 | | | $ | 153 | | | | | $ | 62 | | | $ | 82 | | | $ | 1,044 | |

| Contract investment amortization | (19) | | | (3) | | | | | — | | | (2) | | | (24) | |

| Net fee revenues | 728 | | | 150 | | | | | 62 | | | 80 | | | 1,020 | |

| Owned, leased, and other revenue | 95 | | | 169 | | | | | 5 | | | 30 | | | 299 | |

| Cost reimbursement revenue | 3,773 | | | 316 | | | | | 75 | | | 120 | | | 4,284 | |

| Total reportable segment revenue | $ | 4,596 | | | $ | 635 | | | | | $ | 142 | | | $ | 230 | | | $ | 5,603 | |

Unallocated corporate and other | | | | | | | | | | | 652 | |

Total revenues | | | | | | | | | | | $ | 6,255 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| (in millions) | U.S. & Canada | | EMEA | | | | Greater China | | APEC | | Total |

| Gross fee revenues | $ | 690 | | | $ | 143 | | | | | $ | 71 | | | $ | 69 | | | $ | 973 | |

| Contract investment amortization | (16) | | | (4) | | | | | — | | | (1) | | | (21) | |

| Net fee revenues | 674 | | | 139 | | | | | 71 | | | 68 | | | 952 | |

| Owned, leased, and other revenue | 94 | | | 155 | | | | | 6 | | | 28 | | | 283 | |

| Cost reimbursement revenue | 3,565 | | | 309 | | | | | 83 | | | 103 | | | 4,060 | |

| Total reportable segment revenue | $ | 4,333 | | | $ | 603 | | | | | $ | 160 | | | $ | 199 | | | $ | 5,295 | |

Unallocated corporate and other | | | | | | | | | | | 633 | |

Total revenues | | | | | | | | | | | $ | 5,928 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 |

| (in millions) | U.S. & Canada | | EMEA | | | | Greater China | | APEC | | Total |

| Gross fee revenues | $ | 2,227 | | | $ | 425 | | | | | $ | 186 | | | $ | 243 | | | $ | 3,081 | |

| Contract investment amortization | (57) | | | (10) | | | | | — | | | (4) | | | (71) | |

| Net fee revenues | 2,170 | | | 415 | | | | | 186 | | | 239 | | | 3,010 | |

| Owned, leased, and other revenue | 314 | | | 444 | | | | | 18 | | | 98 | | | 874 | |

| Cost reimbursement revenue | 11,367 | | | 916 | | | | | 226 | | | 359 | | | 12,868 | |

| Total reportable segment revenue | $ | 13,851 | | | $ | 1,775 | | | | | $ | 430 | | | $ | 696 | | | $ | 16,752 | |

Unallocated corporate and other | | | | | | | | | | | 1,919 | |

Total revenues | | | | | | | | | | | $ | 18,671 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| (in millions) | U.S. & Canada | | EMEA | | | | Greater China | | APEC | | Total |

| Gross fee revenues | $ | 2,113 | | | $ | 381 | | | | | $ | 196 | | | $ | 199 | | | $ | 2,889 | |

| Contract investment amortization | (49) | | | (10) | | | | | — | | | (3) | | | (62) | |

| Net fee revenues | 2,064 | | | 371 | | | | | 196 | | | 196 | | | 2,827 | |

| Owned, leased, and other revenue | 327 | | | 419 | | | | | 15 | | | 95 | | | 856 | |

| Cost reimbursement revenue | 10,722 | | | 872 | | | | | 234 | | | 300 | | | 12,128 | |

| Total reportable segment revenue | $ | 13,113 | | | $ | 1,662 | | | | | $ | 445 | | | $ | 591 | | | $ | 15,811 | |

Unallocated corporate and other | | | | | | | | | | | 1,807 | |

Total revenues | | | | | | | | | | | $ | 17,618 | |

Segment Profits

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| (in millions) | September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| U.S. & Canada | $ | 617 | | | $ | 707 | | | $ | 2,029 | | | $ | 2,120 | |

| EMEA | 152 | | | 144 | | | 386 | | | 354 | |

| Greater China | 46 | | | 60 | | | 144 | | | 165 | |

| APEC | 66 | | | 58 | | | 200 | | | 171 | |

Unallocated corporate and other | 73 | | | 159 | | | 279 | | | 378 | |

| Interest expense, net of interest income | (168) | | | (139) | | | (485) | | | (391) | |

| Provision for income taxes | (202) | | | (237) | | | (633) | | | (562) | |

| Net income | $ | 584 | | | $ | 752 | | | $ | 1,920 | | | $ | 2,235 | |

NOTE 11. RESTRUCTURING CHARGES

Earlier this year, we launched a comprehensive initiative to enhance our effectiveness and efficiency across the Company.

In connection with these efforts, in the 2024 third quarter, we recorded an immaterial amount of charges for voluntary retirement benefits relating to our above-property organization in the “Restructuring and merger-related charges” and “Reimbursed expenses” captions of our Income Statements.

We anticipate total charges of approximately $100 million for employee termination benefits relating to our above-property organization. We expect to substantially complete this initiative by the end of the 2025 first quarter and expect the above-described charges to be recorded primarily in the 2024 fourth quarter.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Statement

All statements in this report are made as of the date this Form 10-Q is filed with the U.S. Securities and Exchange Commission (the “SEC”). We undertake no obligation to publicly update or revise these statements, whether as a result of new information, future events or otherwise. We make forward-looking statements in Management’s Discussion and Analysis of Financial Condition and Results of Operations and elsewhere in this report based on the beliefs and assumptions of our management and on information available to us through the date this Form 10-Q is filed with the SEC. Forward-looking statements include information related to our development pipeline; our expectations regarding rooms growth; our expectations regarding our ability to meet our liquidity requirements; our capital expenditures and other investment spending and reimbursement expectations; our expectations regarding future dividends and share repurchases; our expectations regarding certain claims, legal proceedings, settlements or resolutions; our comprehensive initiative to enhance our effectiveness and efficiency across the Company, including related plans and goals, anticipated charges and cost reductions, and other expected or potential benefits and outcomes; and other statements that are preceded by, followed by, or include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “foresees,” or similar expressions; and similar statements concerning anticipated future events and expectations that are not historical facts.

We caution you that these statements are not guarantees of future performance and are subject to numerous evolving risks and uncertainties that we may not be able to accurately predict or assess, including the risks and uncertainties we describe in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (“2023 Form 10-K”), Part II, Item 1A of this report, and other factors we describe from time to time in our periodic filings with the SEC.

BUSINESS AND OVERVIEW

Overview

We are a worldwide operator, franchisor, and licensor of hotel, residential, timeshare, and other lodging properties under more than 30 brand names. Under our asset-light business model, we typically manage or franchise

hotels, rather than own them. We discuss our operations in the following reportable business segments: (1) U.S. & Canada, (2) Europe, Middle East & Africa (“EMEA”), (3) Greater China, and (4) Asia Pacific excluding China (“APEC”). Our Caribbean & Latin America (“CALA”) operating segment does not meet the applicable criteria for separate disclosure as a reportable business segment, and as such, we include its results in “Unallocated corporate and other.”

Terms of our management agreements vary, but our management fees generally consist of base management fees and incentive management fees. Base management fees are typically calculated as a percentage of property-level revenue. Incentive management fees are typically calculated as a percentage of a hotel profitability measure, and, in many cases (particularly in our U.S. & Canada, Europe, and CALA regions), are subject to a specified owner return. Under our franchise and license agreements for most properties, franchise fees are calculated as a percentage of property-level revenue or a portion thereof. Additionally, we earn franchise fees for the use of our intellectual property, including primarily co-branded credit card fees, as well as timeshare and yacht fees, residential branding fees, franchise application and relicensing fees, and certain other non-hotel licensing fees.

Performance Measures

We believe Revenue per Available Room (“RevPAR”), which we calculate by dividing property level room revenue by total rooms available for the period, is a meaningful indicator of our performance because it measures the period-over-period change in room revenues. RevPAR may not be comparable to similarly titled measures, such as revenues, and should not be viewed as necessarily correlating with our fee revenue. We also believe occupancy and average daily rate (“ADR”), which are components of calculating RevPAR, are meaningful indicators of our performance. Occupancy, which we calculate by dividing total rooms sold by total rooms available for the period, measures the utilization of a property’s available capacity. ADR, which we calculate by dividing property level room revenue by total rooms sold, measures average room price and is useful in assessing pricing levels. RevPAR, occupancy, and ADR statistics are on a systemwide basis for comparable properties, unless otherwise stated. Unless otherwise stated, all changes refer to year-over-year changes for the comparable period. Comparisons to prior periods are on a constant U.S. dollar basis, which we calculate by applying exchange rates for the current period to the prior comparable period. We believe constant dollar analysis provides valuable information regarding our properties’ performance as it removes currency fluctuations from the presentation of such results.

We define our comparable properties as our properties that were open and operating under one of our hotel brands since the beginning of the last full calendar year (since January 1, 2023 for the current period) and have not, in either the current or previous year: (1) undergone significant room or public space renovations or expansions, (2) been converted between company-operated and franchised, or (3) sustained substantial property damage or business interruption. Our comparable properties also exclude MGM Collection with Marriott Bonvoy, Design Hotels, The Ritz-Carlton Yacht Collection, and timeshare properties.

Business Trends

We saw solid global RevPAR growth during the 2024 third quarter and 2024 first three quarters compared to the same periods in 2023. For the 2024 third quarter, worldwide RevPAR increased 3.0 percent, reflecting ADR growth of 2.5 percent and occupancy improvement of 0.3 percentage points. For the 2024 first three quarters, worldwide RevPAR increased 4.0 percent, reflecting ADR growth of 2.7 percent and occupancy improvement of 0.9 percentage points. The increase in RevPAR in the 2024 third quarter and 2024 first three quarters was primarily driven by strong year-over-year demand growth in nearly all of our regions.

In the U.S. & Canada, where demand has normalized, RevPAR increased 2.6 percent in the 2024 first three quarters, led by strong group business.

In EMEA, RevPAR growth of 9.4 percent in the 2024 first three quarters was driven by strong demand across the region, strengthened by the 2024 Paris Olympics and other special events. In APEC, RevPAR increased 13.3 percent in the 2024 first three quarters, driven by strong growth in ADR and occupancy, including an increase in inbound demand into the region. In CALA, RevPAR increased 9.3 percent in the 2024 first three quarters, driven by strong demand throughout the region. In Greater China, RevPAR declined 2.7 percent in the 2024 first three

quarters and 7.9 percent in the 2024 third quarter due to lower domestic demand as a result of macro-economic conditions, severe weather, and an increase in outbound travel.

Earlier this year, we launched a comprehensive initiative to enhance our effectiveness and efficiency across the Company. At this point in the process, we expect this initiative to yield $80 million to $90 million of annual general and administrative cost reductions beginning in 2025. These efforts are also anticipated to deliver cost savings to our owners and franchisees.

As part of these efforts, we implemented a voluntary retirement program for certain above-property associates in the 2024 third quarter, and we also expect that some above-property roles in the organization will be eliminated or redefined going forward. We anticipate charges for employee termination benefits related to the above efforts primarily in the 2024 fourth quarter and expect to substantially complete this initiative by the end of the 2025 first quarter.

Starwood Data Security Incident

On November 30, 2018, we announced a data security incident involving unauthorized access to the Starwood reservations database (the “Data Security Incident”). We are currently unable to reasonably estimate the range of total possible financial impact to the Company from the Data Security Incident in excess of the expenses already recorded; however, we do not believe this incident will impact our long-term financial health. See Note 5 for additional information related to legal proceedings and governmental investigations related to the Data Security Incident.

System Growth and Pipeline

At the end of the 2024 third quarter, our system had 9,068 properties (1,674,600 rooms), compared to 8,785 properties (1,597,380 rooms) at year-end 2023 and 8,675 properties (1,581,002 rooms) at the end of the 2023 third quarter. In the 2024 first three quarters, we added over 77,200 net rooms, including the addition of approximately 37,000 rooms from our exclusive, long-term strategic licensing agreement with MGM Resorts International.

At the end of the 2024 third quarter, we had approximately 3,800 hotels and 585,000 rooms in our development pipeline, which includes roughly 34,000 rooms approved for development but not yet under signed contracts. More than 220,000 rooms in the pipeline, or 38 percent, including rooms from our long-term licensing agreement with Sonder Holdings Inc. that we announced in August 2024, were under construction at the end of the 2024 third quarter. Fifty-six percent of the rooms in our development pipeline are located outside U.S. & Canada.

We currently expect full year 2024 net rooms growth to be around 6.5 percent.

Properties and Rooms

The following table shows our properties and rooms by ownership type.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Properties | | Rooms |

| September 30, 2024 | | September 30, 2023 | | vs. September 30, 2023 | | September 30, 2024 | | September 30, 2023 | | vs. September 30, 2023 |

Managed | 1,999 | | | 2,039 | | | (40) | | | (2) | % | | 572,731 | | | 573,991 | | | (1,260) | | | — | % |

Franchised/Licensed/Other (1) | 6,888 | | | 6,466 | | | 422 | | | 7 | % | | 1,074,361 | | | 980,969 | | | 93,392 | | | 10 | % |

Owned/Leased | 50 | | | 51 | | | (1) | | | (2) | % | | 13,108 | | | 13,432 | | | (324) | | | (2) | % |

Residential | 131 | | | 119 | | | 12 | | | 10 | % | | 14,400 | | | 12,610 | | | 1,790 | | | 14 | % |

Total | 9,068 | | | 8,675 | | | 393 | | | 5 | % | | 1,674,600 | | | 1,581,002 | | | 93,598 | | | 6 | % |

(1)In addition to franchised, includes timeshare, The Ritz-Carlton Yacht Collection, and certain license and other agreements.

Lodging Statistics

The following tables present RevPAR, occupancy, and ADR statistics for comparable properties. Systemwide statistics include data from our franchised properties, in addition to our company-operated properties.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| Three Months Ended September 30, 2024 and Change vs. Three Months Ended September 30, 2023 |

| RevPAR | | Occupancy | | Average Daily Rate |

| 2024 | | vs. 2023 | | 2024 | | vs. 2023 | | 2024 | | vs. 2023 |

| Comparable Company-Operated Properties | | | | | | | | | | | | |

| U.S. & Canada | $ | 174.62 | | | 3.1 | % | | 71.1 | % | | 0.3 | % | pts. | | $ | 245.46 | | | 2.7 | % |

| Europe | $ | 265.98 | | | 9.2 | % | | 77.7 | % | | 0.3 | % | pts. | | $ | 342.42 | | | 8.9 | % |

| Middle East & Africa | $ | 98.15 | | | 7.2 | % | | 64.9 | % | | 1.5 | % | pts. | | $ | 151.29 | | | 4.7 | % |

| | | | | | | | | | | | |

| Greater China | $ | 84.71 | | | (8.4) | % | | 71.1 | % | | 0.2 | % | pts. | | $ | 119.09 | | | (8.6) | % |

Asia Pacific excluding China | $ | 115.85 | | | 8.9 | % | | 72.8 | % | | 2.7 | % | pts. | | $ | 159.05 | | | 4.8 | % |

| | | | | | | | | | | | |

Caribbean & Latin America | $ | 140.89 | | | 9.0 | % | | 63.0 | % | | 1.6 | % | pts. | | $ | 223.53 | | | 6.2 | % |

International - All (1) | $ | 120.81 | | | 3.7 | % | | 70.7 | % | | 1.2 | % | pts. | | $ | 170.92 | | | 2.0 | % |

Worldwide (2) | $ | 143.66 | | | 3.4 | % | | 70.9 | % | | 0.8 | % | pts. | | $ | 202.69 | | | 2.2 | % |

| Comparable Systemwide Properties | | | | | | | | | | | | |

| U.S. & Canada | $ | 136.15 | | | 2.1 | % | | 73.0 | % | | (0.2) | % | pts. | | $ | 186.48 | | | 2.3 | % |

| Europe | $ | 191.93 | | | 9.5 | % | | 77.3 | % | | 2.7 | % | pts. | | $ | 248.42 | | | 5.8 | % |