Statement of Changes in Beneficial Ownership (4)

November 13 2020 - 2:11PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Harrison Deborah Marriott |

2. Issuer Name and Ticker or Trading Symbol

MARRIOTT INTERNATIONAL INC /MD/

[

MAR

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) __X__ Other (specify below)

Member of 13(d) group |

|

(Last)

(First)

(Middle)

10400 FERNWOOD ROAD |

3. Date of Earliest Transaction

(MM/DD/YYYY)

11/11/2020 |

|

(Street)

BETHESDA, MD 20817

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 11/11/2020 | | S | | 35000.0000 | D | $116.1902 (1) | 74154.0000 | D | |

| Class A Common Stock | 11/11/2020 | | S | | 8700.0000 | D | $116.4700 (2) | 27285.0000 | I | By Spouse (3) |

| Class A Common - Restricted Stock Units | | | | | | | | 2238.0000 | D | |

| Class A Common Stock-Dir. Def. Stock Comp Plan-1 | | | | | | | | 3437.0000 | D | |

| Class A Common Stock | | | | | | | | 20000.0000 | I | AES JWM Gen Trust (3) |

| Class A Common - Restricted Stock Units | | | | | | | | 10698.0000 | I | By Spouse (3) |

| Class A Common Stock - Deferred Stock Bonus Award | | | | | | | | 38.0000 | I | By Spouse (3) |

| Class A Common Stock | | | | | | | | 130000.0000 | I | DMH 2020 Annuity Trust (3) |

| Class A Common Stock | | | | | | | | 60000.0000 | I | DMH JWM Gen Trust (3) |

| Class A Common Stock | | | | | | | | 60000.0000 | I | DSM JWM Gen Trust (3) |

| Class A Common Stock | | | | | | | | 2110.0000 | I | HMH 2014 Trust (3) |

| Class A Common Stock | | | | | | | | 20000.0000 | I | JRJ JWM Gen Trust (3) |

| Class A Common Stock | | | | | | | | 24227118.0000 | I | JWM Family Enterprises (3) |

| Class A Common Stock | | | | | | | | 60000.0000 | I | JWM III JWM Gen Trust (3) |

| Class A Common Stock | | | | | | | | 70203.0000 | I | JWM III Trustee 1 (3) |

| Class A Common Stock | | | | | | | | 60636.0000 | I | JWM III Trustee 2 (3) |

| Class A Common Stock | | | | | | | | 48327.0000 | I | JWM III Trustee 3 (3) |

| Class A Common Stock | | | | | | | | 251000.0000 | I | JWM Insurance Trust (3) |

| Class A Common Stock | | | | | | | | 34920.0000 | I | MCH Investments, LLC (3) |

| Class A Common Stock | | | | | | | | 44762.0000 | I | MCH Irrev. Trust (3) |

| Class A Common Stock | | | | | | | | 4310.0000 | I | PWH 2014 Trust (3) |

| Class A Common Stock | | | | | | | | 20000.0000 | I | SBM JWM Gen Trust (3) |

| Class A Common Stock | | | | | | | | 90561.0000 | I | SMH Investments, LLC (3) |

| Class A Common Stock | | | | | | | | 209210.0000 | I | The Harrison Generation Trust (3) |

| Class A Common Stock | | | | | | | | 64248.0000 | I | Trustee 8 (3) |

| Class A Common Stock | | | | | | | | 58993.0000 | I | Trustee 9 (3) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Represents the weighted average sale price. The highest price at which shares were sold was $116.43 and the lowest price at which shares were sold was $116.05 |

| (2) | Represents the weighted average sale price. The highest price at which shares were sold was $116.485 and the lowest price at which shares were sold was $116.461. |

| (3) | The Reporting Person disclaims beneficial ownership of the reported securities except to the extent of her pecuniary interest therein. |

Remarks:

dmharrisonsecpoa.txt |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Harrison Deborah Marriott

10400 FERNWOOD ROAD

BETHESDA, MD 20817 | X |

|

| Member of 13(d) group |

Signatures

|

| Andrew P.C. Wright, Attorney-in-Fact | | 11/13/2020 |

| **Signature of Reporting Person | Date |

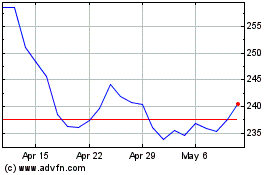

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

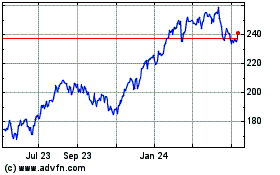

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Apr 2023 to Apr 2024