Marathon Digital Holdings Set to Join the Russell 2000® Index

June 15 2021 - 8:15AM

Marathon Digital Holdings, Inc.

(NASDAQ:MARA) ("Marathon"

or "Company"), one of the largest enterprise Bitcoin

self-mining companies in North America, is set to join the Russell

2000® Index at the conclusion of the 2021 Russell indices’ annual

reconstitution, effective after the U.S. stock markets open on June

28, 2021. The stock will also be automatically added to the

appropriate growth and value indexes.

Membership in the Russell 2000 Index, which remains in place for

one year, is based on membership in the broad-market Russell

3000® Index. Approximately $10.6 trillion in assets are

benchmarked against Russell’s U.S. indexes. Russell indexes are

widely used by investment managers and institutional investors for

index funds and as benchmarks for active investment strategies.

“Being added to the Russell 2000® Index demonstrates the immense

progress we have made transforming Marathon over the past year,”

said Fred Thiel, Marathon’s CEO. “We expect our inclusion in the

index to increase our visibility within the greater investment

community, which will benefit both new and existing shareholders as

we continue to build Marathon into one of the largest and most

environmentally conscious Bitcoin miners in North America.”

Russell indexes are part of FTSE Russell, a leading global index

provider. FTSE Russell determines membership for its Russell

indexes primarily by objective, market-capitalization rankings and

style attributes. For more information on the Russell 2000 Index

and the Russell indexes reconstitution, go to the “Russell

Reconstitution” section on the FTSE Russell website.

Investor NoticeInvesting in our securities

involves a high degree of risk. Before making an investment

decision, you should carefully consider the risks, uncertainties

and forward-looking statements described under "Risk Factors" in

Item 1A of our most recent Annual Report on Form 10-K for the

fiscal year ended December 31, 2020. If any of these risks were to

occur, our business, financial condition or results of operations

would likely suffer. In that event, the value of our securities

could decline, and you could lose part or all of your investment.

The risks and uncertainties we describe are not the only ones

facing us. Additional risks not presently known to us or that we

currently deem immaterial may also impair our business operations.

In addition, our past financial performance may not be a reliable

indicator of future performance, and historical trends should not

be used to anticipate results in the future. Future changes in the

network-wide mining difficulty rate or Bitcoin hashrate may also

materially affect the future performance of Marathon's production

of Bitcoin. Additionally, all discussions of financial metrics

assume mining difficulty rates as of June 2021. See "Safe Harbor"

below.

Forward-Looking StatementsStatements made in

this press release include forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements can be identified by the use of words

such as “may,” “will,” “plan,” “should,” “expect,” “anticipate,”

“estimate,” “continue,” or comparable terminology. Such

forward-looking statements are inherently subject to certain risks,

trends and uncertainties, many of which the Company cannot predict

with accuracy and some of which the Company might not even

anticipate and involve factors that may cause actual results to

differ materially from those projected or suggested. Readers are

cautioned not to place undue reliance on these forward-looking

statements and are advised to consider the factors listed above

together with the additional factors under the heading “Risk

Factors” in the Company's Annual Reports on Form 10-K, as may be

supplemented or amended by the Company's Quarterly Reports on Form

10-Q. The Company assumes no obligation to update or supplement

forward-looking statements that become untrue because of subsequent

events, new information or otherwise.

About FTSE Russell:FTSE Russell is a global

index leader that provides innovative benchmarking, analytics and

data solutions for investors worldwide. FTSE Russell calculates

thousands of indexes that measure and benchmark markets and asset

classes in more than 70 countries, covering 98% of the investable

market globally.

FTSE Russell index expertise and products are used extensively

by institutional and retail investors globally. Approximately $17.9

trillion is currently benchmarked to FTSE Russell indexes. For over

30 years, leading asset owners, asset managers, ETF providers and

investment banks have chosen FTSE Russell indexes to benchmark

their investment performance and create ETFs, structured products

and index-based derivatives.

A core set of universal principles guides FTSE Russell index

design and management: a transparent rules-based methodology is

informed by independent committees of leading market participants.

FTSE Russell is focused on applying the highest industry standards

in index design and governance and embraces the IOSCO Principles.

FTSE Russell is also focused on index innovation and customer

partnerships as it seeks to enhance the breadth, depth and reach of

its offering.

FTSE Russell is wholly owned by London Stock Exchange Group.

For more information, visit www.ftserussell.com.

About Marathon Digital HoldingsMarathon is a

digital asset technology company that mines cryptocurrencies with a

focus on the blockchain ecosystem and the generation of digital

assets.

Marathon Digital

Holdings Company Contact:Jason AssadTelephone:

678-570-6791Email: Jason@marathonpg.com

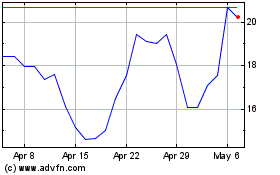

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Apr 2023 to Apr 2024