Current Report Filing (8-k)

October 03 2019 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 1, 2019

MANITEX INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Michigan

|

|

001-32401

|

|

42-1628978

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

9725 Industrial Drive, Bridgeview, Illinois 60455

(Address of Principal Executive Offices) (Zip Code)

(708) 430-7500

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

|

MNTX

|

|

The NASDAQ Stock Market LLC

|

|

Preferred Share Purchase Rights

|

|

N/A

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

|

On October 1, 2019, Manitex International, Inc. (the “Company”)

entered into an employment agreement, dated effective as of October 1, 2019, with Laura R. Yu, the Company’s Chief Financial Officer (the “Yu Agreement”).

Pursuant to the Yu Agreement, Ms. Yu will serve as Chief Financial Officer of the Company for a term commencing on October 1, 2019 and continuing

through December 31, 2020. The employment term will automatically extend for one-year periods at the end of the then-current term, unless either party notifies the other party in writing of non-renewal at least 90 days prior to the expiration of the then-current term. Ms. Yu’s annual base salary will be reviewed annually by the Compensation Committee, and she will be eligible to receive

annual cash incentives payable upon achievement of performance goals established by the Compensation Committee. Ms. Yu will also be entitled to employee benefits that the Company provides to employees generally, including medical benefits,

participation in retirement plans and paid vacation time.

If the Company terminates Ms. Yu without “just cause” (as defined in the Yu

Agreement) or if the Company chooses not to renew the Yu Agreement at the end of its then-current term, Ms. Yu will be entitled to a severance payment of twelve (12) months’ salary plus certain additional benefits for twelve

(12) months and the payment of then vested or unvested Company equity incentive awards. If she is terminated for just cause or if she resigns, she is entitled to no severance payment. If Ms. Yu is involuntarily terminated without just

cause or “good reason” (as defined in the Yu Agreement) within 6 months prior to and in anticipation of, or 24 months following, a “change in control” (as defined in the Yu Agreement), then Ms. Yu will be entitled to receive

a payment equal to two times her annual base salary at the time of termination plus two times the average of her bonus received in the prior two years, as well as a pro rata bonus for the fiscal year during which the change of control occurs, and

certain continued benefits for a period of two years.

The foregoing descriptions of the Yu Agreement is qualified in its entirety by reference to the

full text of the Yu Agreement, which is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

MANITEX INTERNATIONAL, INC.

|

|

|

|

|

By:

|

|

/s/ Steve Filipov

|

|

Name:

|

|

Steve Filipov

|

|

Title:

|

|

Chief Executive Officer

|

Date: October 3, 2019

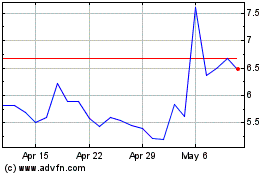

Manitex (NASDAQ:MNTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Manitex (NASDAQ:MNTX)

Historical Stock Chart

From Apr 2023 to Apr 2024