Lyft Reports Strong Revenue Growth, $1.1 Billion Loss--3rd Update

May 07 2019 - 7:33PM

Dow Jones News

By Eliot Brown

Lyft Inc. posted strong growth in its first quarterly report as

a public company, with revenue nearly doubling from the year

before, even as losses continued to mount.

The San Francisco-based ride-hailing company reported revenue of

$776 million in the first three months of the year, up 95% from a

year earlier and better than many analysts expected.

Lyft's loss ballooned to $1.1 billion, largely due to $859

million of stock-based compensation -- an expense related to the

company's initial public offering in March. The company said its

adjusted loss was $211.5 million, versus $228.4 million a year

earlier. Analysts surveyed by FactSet expected an adjusted loss of

$274 million.

The results marked a solid debut for Lyft, which has aimed to

portray itself as the faster-growing ride-hailing service compared

with its much larger rival, Uber Technologies Inc. An IPO for Uber

is expected Friday, and Lyft got ahead of the event by also

announcing an extended partnership with Alphabet Inc.'s

self-driving car unit Waymo, which said Tuesday it is letting

people hail its robot taxis through the Lyft app in the Phoenix

area.

Uber's revenue growth -- roughly 20% in the first quarter -- has

been hampered by a barrage of competitors around the world. Still,

much of Lyft's growth appears to be a result of expansion of the

U.S. ride-hailing market, rather than stealing customers from Uber,

and that bodes well for both companies. Lyft's market share was

relatively stable in the first quarter, hovering around 30%,

according to Second Measure Inc., which analyzes a sample of U.S.

credit-card data.

Brian Roberts, Lyft's financial chief, told analysts on

Tuesday's earnings call that publicity from the company's March IPO

contributed to the 46% increase in the number of active riders for

the period to 20.5 million.

Lyft's share price seesawed in after-hours trading reflecting

the volatility of the stock and the challenge investors face in

valuing it. At 6 p.m. Eastern time, the shares were down about 0.3%

at $59.34, representing a drop of about 18% from their $72 debut

price.

A handful of downbeat analysts reports and rumors of high

short-selling interest in the company may have undermined investor

confidence in the stock.

The disappointing stock performance looms over Uber's impending

IPO, expected to be one of the largest ever for a technology

company, with a valuation up to $90 billion.

Lyft and Uber are among a parade of maturing Silicon Valley

startups that are heading to the public markets with historic

losses.

For Lyft and Uber, some investors have shown a willingness to

overlook the record-setting losses, betting that the market for

ride-hailing is going to rack up strong growth for years -- and

that both companies will eventually figure out how to become

profitable. Lyft estimated its losses will continue to mount,

exceeding $1.1 billion for the year, even before the stock-based

compensation charges.

Some of those losses have come as a result of rider and driver

subsidies -- a practice that continued in the first quarter as Lyft

showered discounts on riders ahead of its IPO. The company spent

$227 million on sales and marketing, excluding stock-based

compensation expenses, up 34% from the prior year. Sales and

marketing costs amounted to roughly 30% of revenue, down from 42% a

year earlier.

Lyft executives told analysts on the earnings call that the

recent uptick in rider discounts -- which Lyft started and Uber

matched -- has abated, and subsidies are falling. "This is the most

rational the market has been," John Zimmer, Lyft's president, said

on the call.

The company's stock-based compensation expenses exceeded what

many analysts expected. Lyft accounted for much of the costs in its

expenses for research and development, encompassing rich stock

awards for its software engineers.

Lyft expects revenue growth to slow in the second quarter and

the rest of 2019 in part because Lyft and Uber got a boost in

revenue in the second quarter of last year when they both raised

fares. Lyft projects revenue of at least $800 million in the second

quarter, up roughly 60% from a year ago, and as much as $3.3

billion for the year. Both amounts are above what analysts had been

expecting.

Write to Eliot Brown at eliot.brown@wsj.com

(END) Dow Jones Newswires

May 07, 2019 19:18 ET (23:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

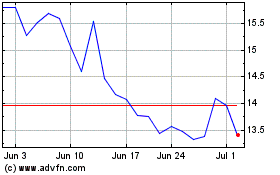

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Apr 2023 to Apr 2024