UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1)

OR 13(E)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No.

1)

LOGICBIO Therapeutics,

INC.

(Name of Subject Company (Issuer))

CAMELOT MERGER SUB, INC.

(Offeror)

a wholly owned subsidiary of

ALEXION Pharmaceuticals,

INC.

(Parent of Offeror)

Common Stock, Par Value $0.0001 Per Share

(Title of Class of Securities)

54142F102

(CUSIP Number of Class of Securities)

Todd Spalding, Deputy General Counsel

Alexion Pharmaceuticals, Inc.

121 Seaport Boulevard

Boston, MA 02210

Tel. (475) 230-2596

(Name, Address and Telephone Number of Person Authorized

to

Receive Notices and Communications on Behalf of Filing Persons)

Copies to:

Sebastian L. Fain, Esq.

Freshfields Bruckhaus Deringer US LLP

601 Lexington Avenue, 31st Floor

New York, NY 10022

(212) 277-4000

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below

to designate any transactions to which the statement relates:

| |

x |

third-party tender offer

subject to Rule 14d-1. |

| |

¨ |

issuer tender offer subject

to Rule 13e-4. |

| |

¨ |

going-private transaction

subject to Rule 13e-3. |

| |

¨ |

amendment to Schedule 13D

under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting

the results of the tender offer. x

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision

| |

¨ |

Rule 13e-4(i) (Cross-Border

Issuer Tender Offer) |

| |

¨ |

Rule 14d-1(d) (Cross-Border

Third-Party Tender Offer) |

Amendment

No. 1 to Schedule TO

This Amendment No.

1 (this “Amendment”) amends and supplements the Tender Offer Statement on Schedule TO filed by Camelot Merger Sub,

Inc., a Delaware corporation (“Purchaser”), and a wholly owned subsidiary of Alexion Pharmaceuticals, Inc., a Delaware

corporation (“Parent”), with the U.S. Securities and Exchange Commission on October 18, 2022 (the “Schedule

TO”). The Schedule TO relates to the tender offer by Purchaser to purchase, subject to the prior satisfaction or waiver of

the Minimum Tender Condition, the Injunction Condition and the Key Employee Conditions (each, as discussed in the Offer to Purchase (as

defined below)) and the satisfaction or waiver of certain other conditions, any and all of the issued and outstanding shares of common

stock, par value $0.0001 per share (the “Shares”), of LogicBio Therapeutics, Inc., a Delaware corporation (the “Company”),

pursuant to the Agreement and Plan of Merger, dated as of October 3, 2022 (the “Merger Agreement”), by and among the

Company, Parent and Purchaser at a price of $2.07 per Share, to the seller in cash, without interest, less any applicable withholding

taxes, upon the terms and subject to the conditions described in the Offer to Purchase, dated October 18, 2022 (the “Offer to

Purchase”), and in the related Letter of Transmittal (which, together with the Offer to Purchase and other related materials,

each as amended, supplemented or otherwise modified from time to time prior to the date here, constitute the “Offer”),

which are annexed to and filed with the Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively.

Capitalized terms

used but not otherwise defined in this Amendment have the meanings given to them in the Offer to Purchase. Except as otherwise set forth

in this Amendment, the information set forth in the Schedule TO remains unchanged and is incorporated herein by reference to the extent

relevant to the items in this Amendment.

Items 1 through 9 and Item 11.

The disclosure in

the Offer to Purchase and Items 1 through 9 and Item 11 of the Schedule TO is amended and supplemented as set forth below:

The Offer and withdrawal

rights expired as scheduled at one minute following 11:59 p.m., New York City time, on Tuesday, November 15, 2022, and the Offer was

not extended. The Depositary has indicated that, as of the Offer Expiration Time, a total of 26,951,294 Shares (excluding the Shares tendered

pursuant to guaranteed delivery procedures that had not yet been “received,” as such terms are defined by Section 251(h)(6)

of the DGCL) were validly tendered (and not validly withdrawn) pursuant to the Offer, representing approximately 81.76% of the issued

and outstanding Shares as of the Offer Expiration Time. The number of Shares validly tendered (and not validly withdrawn) pursuant to

the Offer satisfied the Minimum Tender Condition. As all Offer Conditions, including the Injunction Condition and the Key Employee Conditions,

have been satisfied or waived, Purchaser has irrevocably accepted for payment all such Shares validly tendered (and not validly withdrawn)

pursuant to the Offer as of the Offer Expiration Time and will as promptly as practicable (and in any event within two business days)

after the Offer Acceptance Time pay for all such Shares in accordance with the Offer.

As a result of its

acceptance of the Shares validly tendered (and not validly withdrawn) pursuant to the Offer, Purchaser acquired a sufficient number of

Shares to complete the Merger without a vote of the stockholders of the Company pursuant to Section 251(h) of the DGCL. Accordingly,

on November 16, 2022, Purchaser expects to effect the Merger under Section 251(h) of the DGCL, pursuant to which Purchaser will merge

with and into the Company, with the Company surviving as a wholly owned subsidiary of Parent. At the Effective Time, each Share issued

and outstanding immediately prior to the Effective Time (other than Shares (i) irrevocably accepted for purchase by Purchaser in the

Offer, (ii) owned by the Company (including as treasury stock) or owned by any direct or indirect wholly owned subsidiary of the Company,

in each case immediately prior to the Effective Time, (iii) owned by Parent or Purchaser or any direct or indirect wholly owned subsidiary

of Parent or (iv) held by holders who were entitled to demand appraisal rights under Section 262 of the DGCL and have properly exercised

and perfected their respective demands for appraisal of such Shares in the time and manner provided in Section 262 of the DGCL and, as

of the Effective Time, have neither effectively withdrawn nor lost their rights to such appraisal and payment under the DGCL) will be

cancelled and converted into the right to receive the Merger Consideration. Shares described in clauses (i), (ii) and (iii) will be automatically

cancelled and retired and will cease to exist at the Effective Time and will not be exchangeable for the Merger Consideration. Shares

described in clause (iv) entitle their holders only to the rights granted to them under Section 262 of the DGCL.

At or as promptly

as practicable following the Effective Time, Parent intends to cause the Surviving Corporation to delist the Shares from The Nasdaq Global

Market, terminate the registration of the Shares under the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and suspend the Surviving Corporation’s reporting obligations under the Exchange Act.

Item 12. Exhibits.

Item 12 of the Schedule TO is hereby

amended and supplemented by adding the following exhibit:

** Filed herewith.

SIGNATURE

After due inquiry and to the best of

my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: November 16, 2022

| |

CAMELOT MERGER SUB, INC. |

| |

|

| |

By: |

/s/

David E. White |

| |

|

Name: David E. White |

| |

|

Title: Treasurer |

| |

|

|

| |

ALEXION PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/ Sean Christie |

| |

|

Name: Sean Christie |

| |

|

Title: Chief Financial and Administration Officer |

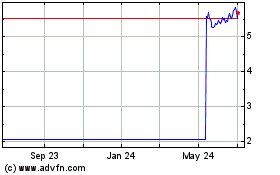

LogicBio Therapeutics (NASDAQ:LOGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

LogicBio Therapeutics (NASDAQ:LOGC)

Historical Stock Chart

From Apr 2023 to Apr 2024