Current Report Filing (8-k)

August 18 2021 - 6:01AM

Edgar (US Regulatory)

0001235468false00012354682021-08-132021-08-1700012354682021-08-052021-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 13, 2021

LIQUIDITY SERVICES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

0-51813

|

|

52-2209244

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

6931 Arlington Road, Suite 200, Bethesda, MD

|

|

20814

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (202) 467-6868

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

LQDT

|

Nasdaq

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging Growth Company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Departure of Certain Executive Officers

On August 13, 2021, Liquidity Services, Inc. (the “Company”) announced selected changes to its marketing department to support its go to market activities to acquire new customers. As part of the new organizational structure, the position of Chief Marketing Officer of the Company, was eliminated and, accordingly, Mr. Nicholas Rozdilsky was terminated without cause effective the same date. The Company thanks Mr. Rozdilsky for his contributions to the Company’s development and wishes him well in his future endeavors.

The Company promoted Mr. Anthony Long to VP, Marketing, which is an expanded role for Mr. Long with responsibility for the Company’s centralized brand strategy, demand generation, communications and digital marketing. Previously, Mr. Long served as the Company’s Director, Search and Digital Marketing since September 2018. Prior to that Mr. Long served for a year as Head of Marketing for Willing.com and prior to that as Head of Demand Generation for Vistaprint Digital. Mr. Long holds a bachelor of arts degree in Sociology from Harvard University. Mr. Long will report directly to Mr. William P. Angrick, III, Chairman and CEO of the Company.

Further, to better integrate and optimize marketing technology into our platform, Mr. Stephen Weiskircher, the Company’s Chief Technology Officer, will assume Mr. Rozdilsky’s responsibilities for data analytics and product management.

Pursuant to the terms of the Executive Employment Agreement dated as of November 5, 2019 by and between Mr. Rozdilsky and the Company, the Company will pay a severance to Mr. Rozdilsky in the amount of $222,997.50, which severance payment is conditioned on his executing a separation and release of claims agreement with the Company. The severance payment will be reduced for applicable taxes and withholdings. Mr. Rozdilsky may exercise his vested options to purchase shares of the Company’s common stock issued under the Company’s Third Amended and Restated 2006 Omnibus Long-Term Incentive Plan for the twelve-month period following his termination of employment. Mr. Rozdilsky will also remain subject to that certain Employment Agreement Regarding Confidentiality, Intellectual Property, and Competitive Activities, made by and between Mr. Rozdilsky and the Company, dated as of April 23, 2018.

Item 9.01. Financial Statements and Exhibits.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIQUIDITY SERVICES, INC.

|

|

|

(Registrant)

|

|

|

|

|

Date: August 17, 2021

|

By:

|

/s/ Mark A. Shaffer

|

|

|

Name:

|

Mark A. Shaffer

|

|

|

Title:

|

Chief Legal Officer and

Corporate Secretary

|

3

Exhibit Index

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

4

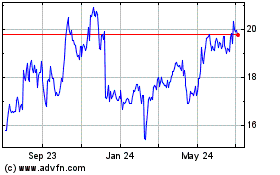

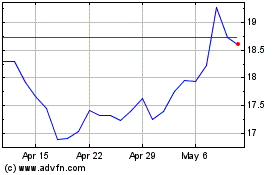

Liquidity Services (NASDAQ:LQDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Liquidity Services (NASDAQ:LQDT)

Historical Stock Chart

From Apr 2023 to Apr 2024