Statement of Changes in Beneficial Ownership (4)

May 11 2021 - 6:26PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Celaya Jorge |

2. Issuer Name and Ticker or Trading Symbol

LIQUIDITY SERVICES INC

[

LQDT

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chief Financial Officer |

|

(Last)

(First)

(Middle)

C/O LIQUIDITY SERVICES, INC., 6931 ARLINGTON ROAD, SUITE 200 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

5/7/2021 |

|

(Street)

BETHESDA, MD 20814

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 5/7/2021 | | M(1) | | 4023 | A | $6.69 (2) | 125810 | D | |

| Common Stock | 5/7/2021 | | S | | 14449 | D | $24.57 | 111361 | D | |

| Common Stock | 5/10/2021 | | S | | 68854 | D | $24.68 | 42507 | D | |

| Common Stock | 5/11/2021 | | S | | 14022 | D | $27.13 | 28485 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Employee Stock Grant | (3) | | | | | | | (4) | 10/1/2026 | Common Stock | 2085.0 | | 2085 | D | |

| Employee Stock Option | $8.3 | | | | | | | (5) | 3/3/2027 | Common Stock | 2473.0 | | 2473 | D | |

| Employee Stock Option | $4.47 | 5/7/2021 | | M (6) | | | 1268 | (7) | 12/11/2017 | Common Stock | 3380.0 | $0 | 2112 | D | |

| Employee Stock Grant | (3) | | | | | | | (8) | 10/1/2021 | Common Stock | 520.0 | | 520 | D | |

| Employee Stock Grant | (3) | | | | | | | (9) | 1/1/2023 | Common Stock | 2950.0 | | 2950 | D | |

| Employee Stock Option | $6.11 | 5/7/2021 | | M (6) | | | 2282 | (10) | 12/4/2028 | Common Stock | 17490.0 | $0 | 15208 | D | |

| Employee Stock Option | $6.69 | 5/7/2021 | | M (6) | | | 3375 | (11) | 12/3/2029 | Common Stock | 39375.0 | $0 | 36000 | D | |

| Employee Stock Grant | (3) | | | | | | | (12) | 1/1/2024 | Common Stock | 16987.0 | | 16987 | D | |

| Employee Stock Option | $9.46 | | | | | | | (13) | 12/1/2030 | Common Stock | 55050.0 | | 55050 | D | |

| Employee Stock Option | $9.46 | | | | | | | (14) | 12/1/2030 | Common Stock | 55050.0 | | 55050 | D | |

| Employee Stock Grant | (3) | | | | | | | (15) | 1/1/2025 | Common Stock | 9950.0 | | 9950 | D | |

| Employee Stock Grant | (3) | | | | | | | (16) | 1/1/2025 | Common Stock | 9950.0 | | 9950 | D | |

| Explanation of Responses: |

| (1) | The reporting person exercised 6,925 stock options on a share withhold basis. 2,902 shares were withheld to cover the cost of the options as well as related taxes resulting in a net amount of 4,023 shares acquired. |

| (2) | The reporting person exercised a total of 6,925 stock options, 1,268 of which had an exercise price of $4.47, 2,282 of which had an exercise price of $6.11, and 3,375 of which had an exercise price of $6.69. |

| (3) | Each restricted stock unit is the economic equivalent of one share of Liquidity Services, Inc. Common Stock. |

| (4) | These restricted stock units will vest, if at all, based on the issuer's achievement of certain financial milestones. |

| (5) | These options become exercisable, if at all, based on the issuer's achievement of certain financial milestones. |

| (6) | Represents the exercise of stock options. |

| (7) | 15/48th of this option grant vested on January 1, 2019 and thereafter, an additional 1/48th vests each month for thirty-three months. |

| (8) | Twenty-five percent of this restricted stock unit grant vested on January 1, 2019 and thereafter, an additional 1/4th vests on each of October 1, 2019, October 1, 2020, and October 1, 2021. |

| (9) | Twenty-five percent of this restricted stock unit grant vested on January 1, 2020 and thereafter, an additional 1/4th vests on each of January 1, 2021, January 1, 2022, and January 1, 2023. |

| (10) | 15/48th of this option grant vested on January 1, 2020 and thereafter, an additional 1/48th vests each month for thirty-three months. |

| (11) | 12/48th of this option grant vested on January 1, 2021 and thereafter, an additional 1/48th vests each month for thirty-six months. |

| (12) | Twenty-five percent of this restricted stock unit grant vested on January 1, 2021 and thereafter, an additional 1/4th vests on each of January 1, 2022, January 1, 2023 and January 1, 2024. |

| (13) | 12/48th of this option grant will vest on January 1, 2022 and thereafter, 1/48th will vest each month for thirty-six months. |

| (14) | This option becomes exercisable, if at all, based on the Issuer's achievement of certain stock price appreciation milestones. |

| (15) | These restricted stock units vest, if at all, based on the Issuer's achievement of certain stock price appreciation milestones. |

| (16) | Twenty-five percent of this restricted stock unit grant will vest on January 1, 2022 and thereafter, an additional 1/4th will vest on each of January 1, 2023, January 1, 2024 and January 1, 2025. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Celaya Jorge

C/O LIQUIDITY SERVICES, INC.

6931 ARLINGTON ROAD, SUITE 200

BETHESDA, MD 20814 |

|

| Chief Financial Officer |

|

Signatures

|

| /s/ Mark A. Shaffer, by power of attorney | | 5/11/2021 |

| **Signature of Reporting Person | Date |

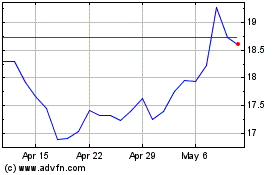

Liquidity Services (NASDAQ:LQDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

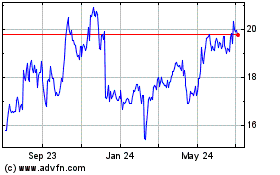

Liquidity Services (NASDAQ:LQDT)

Historical Stock Chart

From Apr 2023 to Apr 2024