0001819576

Liquidia Corporation

false

--12-31

FY

2020

10,000,000

10,000,000

0

0

0

0

0.001

0.001

80,000,000

40,000,000

43,336,277

43,336,277

28,231,267

28,231,267

2

0

0

0

106,274

106,274

0.0168

0.0168

1

0

0

1.85

3.14

3.64

8.00

10.04

4

0

0

0

0

0

0

4

50,000

10

00018195762020-01-012020-12-31

iso4217:USD

00018195762020-06-30

xbrli:shares

00018195762021-03-15

thunderdome:item

00018195762020-12-31

00018195762019-12-31

iso4217:USDxbrli:shares

0001819576us-gaap:ServiceMember2020-01-012020-12-31

0001819576us-gaap:ServiceMember2019-01-012019-12-31

0001819576lqda:CollaborationMember2020-01-012020-12-31

0001819576lqda:CollaborationMember2019-01-012019-12-31

00018195762019-01-012019-12-31

0001819576us-gaap:CommonStockMember2018-12-31

0001819576us-gaap:AdditionalPaidInCapitalMember2018-12-31

0001819576us-gaap:RetainedEarningsMember2018-12-31

00018195762018-12-31

0001819576srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:CommonStockMember2018-12-31

0001819576srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AdditionalPaidInCapitalMember2018-12-31

0001819576srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2018-12-31

0001819576srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-31

0001819576us-gaap:CommonStockMember2019-01-012019-12-31

0001819576us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-31

0001819576us-gaap:RetainedEarningsMember2019-01-012019-12-31

0001819576us-gaap:CommonStockMember2019-12-31

0001819576us-gaap:AdditionalPaidInCapitalMember2019-12-31

0001819576us-gaap:RetainedEarningsMember2019-12-31

0001819576us-gaap:CommonStockMember2020-01-012020-12-31

0001819576us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-31

0001819576us-gaap:RetainedEarningsMember2020-01-012020-12-31

0001819576us-gaap:CommonStockMember2020-12-31

0001819576us-gaap:AdditionalPaidInCapitalMember2020-12-31

0001819576us-gaap:RetainedEarningsMember2020-12-31

xbrli:pure

0001819576lqda:MergerWithRareGenLLCMember2020-11-192020-12-31

0001819576lqda:MergerWithRareGenLLCMemberlqda:RaregenCommonUnitsConvertedToHoldcoCommonUnitsMember2020-11-182020-11-18

0001819576lqda:MergerWithRareGenLLCMemberlqda:HoldbackSharesMember2020-11-182020-11-18

0001819576lqda:MergerWithRareGenLLCMember2020-11-18

0001819576lqda:MergerWithRareGenLLCMembersrt:MaximumMember2020-11-18

0001819576lqda:MergerWithRareGenLLCMember2020-11-182020-11-18

0001819576srt:ScenarioPreviouslyReportedMember2019-01-012019-12-31

0001819576lqda:CashHeldOnDepositMemberus-gaap:CreditConcentrationRiskMemberlqda:PacificWesternBankMember2020-01-012020-12-31

0001819576lqda:GlaxoSmithKlineMember2020-01-012020-12-31

0001819576lqda:GlaxoSmithKlineMember2019-01-012019-12-31

0001819576us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberlqda:GlaxoSmithKlineMember2020-01-012020-12-31

0001819576us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberlqda:GlaxoSmithKlineMember2019-01-012019-12-31

0001819576lqda:SandozMember2020-01-012020-12-31

0001819576lqda:SandozMember2019-01-012019-12-31

0001819576us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberlqda:SandozMember2020-01-012020-12-31

0001819576us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberlqda:SandozMember2019-01-012019-12-31

0001819576us-gaap:AccountingStandardsUpdate201602Member2019-01-01

utr:Y

0001819576lqda:LabAndBuildToSuitEquipmentMembersrt:MinimumMember2020-01-012020-12-31

0001819576lqda:LabAndBuildToSuitEquipmentMembersrt:MaximumMember2020-01-012020-12-31

0001819576us-gaap:OfficeEquipmentMember2020-01-012020-12-31

0001819576us-gaap:FurnitureAndFixturesMember2020-01-012020-12-31

0001819576us-gaap:ComputerEquipmentMember2020-01-012020-12-31

0001819576us-gaap:LeaseholdImprovementsMember2020-01-012020-12-31

0001819576lqda:SandozMember2018-08-012018-08-01

0001819576us-gaap:EmployeeStockOptionMember2020-01-012020-12-31

0001819576us-gaap:EmployeeStockOptionMember2019-01-012019-12-31

0001819576us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-31

0001819576us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-31

0001819576us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlqda:PacificWesternBankNoteAandRLSAMember2020-12-31

0001819576us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlqda:PacificWesternBankNoteAandRLSAMember2020-12-31

0001819576us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlqda:PacificWesternBankNoteAandRLSAMember2020-12-31

0001819576us-gaap:CarryingReportedAmountFairValueDisclosureMemberlqda:PacificWesternBankNoteAandRLSAMember2020-12-31

0001819576us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlqda:PacificWesternBankNoteAandRLSAMember2019-12-31

0001819576us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlqda:PacificWesternBankNoteAandRLSAMember2019-12-31

0001819576us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlqda:PacificWesternBankNoteAandRLSAMember2019-12-31

0001819576us-gaap:CarryingReportedAmountFairValueDisclosureMemberlqda:PacificWesternBankNoteAandRLSAMember2019-12-31

0001819576lqda:MergerWithRareGenLLCMemberlqda:ContractAcquisitionCostsMember2020-11-18

0001819576lqda:MergerWithRareGenLLCMemberlqda:ContractAcquisitionCostsMember2020-01-012020-12-31

0001819576lqda:MergerWithRareGenLLCMemberlqda:ContractAcquisitionCostsMember2020-12-31

0001819576lqda:MergerWithRareGenLLCMember2020-01-012020-12-31

0001819576lqda:MergerWithRareGenLLCMember2020-12-31

0001819576lqda:SandozMemberMember2020-12-31

0001819576lqda:HendersonMemberlqda:LiquidiaPAHMemberlqda:UTCAndSmithsMedicalLitigationMember2020-11-18

0001819576lqda:PBMMemberlqda:LiquidiaCorporationMember2020-11-18

0001819576lqda:MergerWithRareGenLLCMemberus-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-31

0001819576lqda:MergerWithRareGenLLCMember2019-01-012019-12-31

0001819576lqda:UnderwrittenPublicOfferingMember2020-06-292020-06-29

0001819576lqda:UnderwrittenPublicOfferingMember2020-06-29

0001819576lqda:UnderwrittenPublicOfferingMember2020-07-022020-07-02

0001819576us-gaap:PrivatePlacementMember2019-12-232019-12-23

0001819576us-gaap:PrivatePlacementMember2019-12-23

0001819576lqda:JefferiesLlcMemberlqda:ATMAgreementMember2019-08-012019-08-31

0001819576lqda:ATMAgreementMember2020-01-012020-12-31

0001819576lqda:ATMAgreementMember2019-01-012019-12-31

00018195762019-03-012019-03-31

00018195762019-03-31

0001819576lqda:WarrantsToPurchaseCommonStockMember2020-01-012020-12-31

0001819576lqda:WarrantsToPurchaseCommonStockMember2019-01-012019-12-31

0001819576lqda:WarrantsToPurchaseCommonStockMember2019-12-31

0001819576lqda:WarrantsToPurchaseCommonStockMember2020-12-31

0001819576lqda:The2020PlanMember2020-11-30

0001819576lqda:The2020PlanMember2020-11-012020-11-30

0001819576lqda:The2020PlanMemberus-gaap:SubsequentEventMember2021-01-012021-01-01

0001819576lqda:The2020PlanMemberus-gaap:SubsequentEventMember2021-01-01

0001819576lqda:The2020PlanMember2020-12-31

0001819576lqda:The2018PlanMember2018-12-31

0001819576lqda:The2018PlanMember2019-01-012019-01-01

0001819576lqda:The2018PlanMember2019-01-01

0001819576lqda:The2018PlanMember2020-01-012020-01-01

0001819576lqda:The2018PlanMember2020-01-01

0001819576lqda:The2018PlanMember2019-12-31

0001819576lqda:The2018PlanMember2020-12-31

0001819576lqda:The2016PlanMember2020-12-31

0001819576lqda:The2004PlanMember2020-12-31

0001819576srt:ChiefExecutiveOfficerMember2020-12-012020-12-31

0001819576srt:ChiefExecutiveOfficerMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2020-12-012020-12-31

0001819576srt:ChiefExecutiveOfficerMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2020-12-012020-12-31

0001819576srt:ChiefExecutiveOfficerMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2020-12-012020-12-31

0001819576srt:ChiefExecutiveOfficerMemberlqda:SharebasedPaymentArrangementTrancheOneTwoThreeAndFourMember2020-12-012020-12-31

0001819576us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-12-31

0001819576us-gaap:ResearchAndDevelopmentExpenseMember2019-01-012019-12-31

0001819576us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-31

0001819576us-gaap:GeneralAndAdministrativeExpenseMember2019-01-012019-12-31

0001819576us-gaap:EmployeeStockOptionMember2020-01-012020-12-31

0001819576us-gaap:EmployeeStockOptionMember2019-01-012019-12-31

0001819576us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-31

0001819576us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-31

0001819576us-gaap:EmployeeStockOptionMember2020-12-31

0001819576us-gaap:RestrictedStockUnitsRSUMember2020-12-31

0001819576srt:MinimumMember2020-01-012020-12-31

0001819576srt:MaximumMember2020-01-012020-12-31

0001819576lqda:PriceRangeOneMember2020-01-012020-12-31

0001819576lqda:PriceRangeOneMember2020-12-31

0001819576lqda:PriceRangeTwoMember2020-12-31

0001819576lqda:PriceRangeTwoMember2020-01-012020-12-31

0001819576lqda:PriceRangeThreeMember2020-01-012020-12-31

0001819576lqda:PriceRangeThreeMember2020-12-31

0001819576lqda:PriceRangeFourMember2020-01-012020-12-31

0001819576lqda:PriceRangeFourMember2020-12-31

0001819576lqda:PriceRangeFiveMember2020-01-012020-12-31

0001819576lqda:PriceRangeFiveMember2020-12-31

0001819576lqda:PriceRangeSixMember2020-12-31

0001819576lqda:PriceRangeSixMember2020-01-012020-12-31

0001819576lqda:PriceRangeSevenMember2020-01-012020-12-31

0001819576lqda:PriceRangeSevenMember2020-12-31

0001819576us-gaap:RestrictedStockUnitsRSUMemberlqda:EmployeesMember2020-01-012020-12-31

0001819576us-gaap:RestrictedStockUnitsRSUMember2019-12-31

0001819576lqda:TheESPPMember2019-05-31

0001819576us-gaap:CommonStockMember2020-02-28

0001819576lqda:TheESPPMember2020-02-282020-02-28

0001819576lqda:TheESPPMember2020-03-012020-08-31

0001819576us-gaap:CommonStockMember2020-08-31

0001819576lqda:TheESPPMember2020-08-312020-08-31

0001819576lqda:TheESPPMember2020-12-31

0001819576lqda:TheESPPMember2020-01-012020-12-31

0001819576us-gaap:RoyaltyMember2019-01-012019-12-31

0001819576us-gaap:RoyaltyMember2020-01-012020-12-31

0001819576lqda:GskInhaled1Member2015-09-012015-09-30

0001819576lqda:GskInhaled1Member2016-02-012016-02-29

0001819576lqda:GskInhaled1Member2019-01-012019-12-31

0001819576lqda:SandozMemberlqda:PromotionAgreementMember2020-01-012020-12-31

0001819576lqda:SandozMemberlqda:PromotionAgreementMember2019-01-012019-12-31

0001819576lqda:GskInhaledMemberlqda:NonrefundablePaymentsMilestonesMember2020-01-012020-12-31

0001819576lqda:GskInhaledMemberlqda:NonrefundablePaymentsMilestonesMember2019-01-012019-12-31

0001819576lqda:GskInhaledMemberlqda:NonrefundablePaymentsUpfrontPaymentsMember2020-01-012020-12-31

0001819576lqda:GskInhaledMemberlqda:NonrefundablePaymentsUpfrontPaymentsMember2019-01-012019-12-31

0001819576lqda:GskInhaledMember2020-01-012020-12-31

0001819576lqda:GskInhaledMember2019-01-012019-12-31

0001819576lqda:ResearchAndDevelopmentServicesMember2020-01-012020-12-31

0001819576lqda:ResearchAndDevelopmentServicesMember2019-01-012019-12-31

0001819576lqda:LabAndBuildToSuitEquipmentMember2020-12-31

0001819576lqda:LabAndBuildToSuitEquipmentMember2019-12-31

0001819576us-gaap:OfficeEquipmentMember2020-12-31

0001819576us-gaap:OfficeEquipmentMember2019-12-31

0001819576us-gaap:FurnitureAndFixturesMember2020-12-31

0001819576us-gaap:FurnitureAndFixturesMember2019-12-31

0001819576us-gaap:ComputerEquipmentMember2020-12-31

0001819576us-gaap:ComputerEquipmentMember2019-12-31

0001819576us-gaap:LeaseholdImprovementsMember2020-12-31

0001819576us-gaap:LeaseholdImprovementsMember2019-12-31

0001819576us-gaap:ConstructionInProgressMember2020-12-31

0001819576us-gaap:ConstructionInProgressMember2019-12-31

0001819576lqda:ConstructionInProgressLeaseholdImprovementsMember2018-12-31

0001819576lqda:ConstructionInProgressBuildToSuitEquipmentMember2018-12-31

0001819576lqda:ConstructionInProgressLabEquipmentMember2018-12-31

0001819576us-gaap:ConstructionInProgressMember2018-12-31

0001819576lqda:ConstructionInProgressLeaseholdImprovementsMember2019-01-012019-12-31

0001819576lqda:ConstructionInProgressBuildToSuitEquipmentMember2019-01-012019-12-31

0001819576lqda:ConstructionInProgressLabEquipmentMember2019-01-012019-12-31

0001819576us-gaap:ConstructionInProgressMember2019-01-012019-12-31

0001819576lqda:ConstructionInProgressLeaseholdImprovementsMember2019-12-31

0001819576lqda:ConstructionInProgressBuildToSuitEquipmentMember2019-12-31

0001819576lqda:ConstructionInProgressLabEquipmentMember2019-12-31

0001819576lqda:ConstructionInProgressLeaseholdImprovementsMember2020-01-012020-12-31

0001819576lqda:ConstructionInProgressBuildToSuitEquipmentMember2020-01-012020-12-31

0001819576lqda:ConstructionInProgressLabEquipmentMember2020-01-012020-12-31

0001819576us-gaap:ConstructionInProgressMember2020-01-012020-12-31

0001819576lqda:ConstructionInProgressLeaseholdImprovementsMember2020-12-31

0001819576lqda:ConstructionInProgressBuildToSuitEquipmentMember2020-12-31

0001819576lqda:ConstructionInProgressLabEquipmentMember2020-12-31

0001819576us-gaap:DomesticCountryMember2020-12-31

0001819576us-gaap:StateAndLocalJurisdictionMember2020-12-31

utr:sqft

0001819576lqda:PrimaryBuildingInMorrisvilleNorthCarolinaMember2020-12-31

0001819576lqda:PrimaryBuildingInMorrisvilleNorthCarolinaMember2018-11-30

00018195762019-06-30

0001819576us-gaap:InterestExpenseMember2020-01-012020-12-31

0001819576us-gaap:InterestExpenseMember2019-01-012019-12-31

0001819576lqda:AgreementWithLGMPharmaLLCMember2020-12-31

0001819576lqda:PacificWesternBankNoteAandRLSAMember2020-12-31

0001819576lqda:PacificWesternBankNoteAandRLSAMember2019-12-31

0001819576lqda:PacificWesternBankNoteAandRLSAMember2018-10-31

0001819576lqda:PacificWesternBankNoteAandRLSAMember2018-10-012018-10-31

0001819576lqda:UncPromissoryNoteMember2018-10-012018-10-31

0001819576lqda:PacificWesternBankNoteAandRLSAMember2019-05-012019-05-31

0001819576lqda:PacificWesternBankNoteAandRLSAMember2019-05-31

0001819576lqda:PacificWesternBankNoteAandRLSAMembersrt:MaximumMember2018-10-262018-10-26

0001819576lqda:PacificWesternBankNoteAandRLSAMember2018-10-262018-10-26

0001819576lqda:PacificWesternBankNoteAandRLSAMember2019-01-012019-12-31

0001819576lqda:PacificWesternBankNoteAandRLSAMember2020-07-03

0001819576lqda:TermLoanFacilityMemberus-gaap:SubsequentEventMember2021-02-26

0001819576lqda:TermALoanMemberus-gaap:SubsequentEventMember2021-03-012021-03-01

0001819576lqda:PacificWesternBankNoteAandRLSAMemberus-gaap:SubsequentEventMember2021-03-012021-03-01

0001819576lqda:LiquidiaPAHAndSandozMemberlqda:UTCAndSmithsMedicalLitigationMemberus-gaap:PendingLitigationMember2020-11-062020-11-06

0001819576lqda:TermALoanMemberus-gaap:SubsequentEventMember2021-02-262021-02-26

0001819576lqda:TermBLoanMemberus-gaap:SubsequentEventMember2021-02-26

0001819576lqda:TermCLoanMemberus-gaap:SubsequentEventMember2021-02-26

0001819576lqda:TermLoanFacilityMemberus-gaap:SubsequentEventMemberus-gaap:PrimeRateMember2021-02-262021-02-26

0001819576lqda:TermLoanFacilityMembersrt:MinimumMemberus-gaap:SubsequentEventMember2021-02-26

0001819576lqda:TermLoanFacilityMembersrt:ScenarioForecastMember2021-03-31

0001819576lqda:TermLoanFacilityMembersrt:ScenarioForecastMember2021-06-30

0001819576lqda:TermLoanFacilityMembersrt:ScenarioForecastMember2021-09-30

0001819576lqda:TermLoanFacilityMembersrt:ScenarioForecastMember2021-12-31

0001819576lqda:TermLoanFacilityMembersrt:ScenarioForecastMember2022-03-31

0001819576lqda:TermLoanFacilityMembersrt:ScenarioForecastMember2022-06-30

0001819576lqda:TermLoanFacilityMemberus-gaap:SubsequentEventMember2021-02-262021-02-26

0001819576lqda:WarrantsInConnectionWithTheLoanAgreementMemberus-gaap:SubsequentEventMember2021-02-26

0001819576lqda:WarrantsInConnectionWithTheLoanAgreementMemberus-gaap:SubsequentEventMember2021-02-262021-02-26

0001819576lqda:WarrantsToVestInConnectionWithTermCLoanFundingDateMemberus-gaap:SubsequentEventMember2021-02-26

0001819576lqda:WarrantsToVestInConnectionWithTermBLoanFundingDateMemberus-gaap:SubsequentEventMember2021-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-39724

LIQUIDIA CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

85-1710962

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.)

|

|

419 Davis Drive, Suite 100

Morrisville, North Carolina

|

|

27560

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (919) 328-4400

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.001 par value per share

|

LQDA

|

The Nasdaq Stock Market LLC

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer ☐

|

Accelerated Filer ☐

|

Non-accelerated Filer ☒

|

Smaller Reporting Company ☒

|

|

|

|

|

Emerging Growth Company ☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

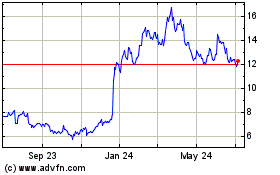

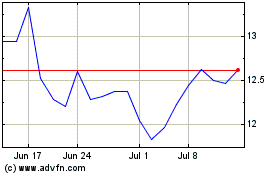

The aggregate market value of common stock held by non-affiliates of the registrant on June 30, 2020, which was the last business day of the registrant’s most recently completed second fiscal quarter, was $212,930,004 based on a $8.42 closing price per share as reported on the Nasdaq Capital Market.

As of March 15, 2021, there were 43,336,277 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Liquidia Corporation Definitive Proxy Statement with respect to the 2021 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A within 120 days after the end of the fiscal year ended December 31, 2020 are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent stated therein. Except with respect to information specifically incorporated by reference in the Form 10-K, each document incorporated by reference herein is deemed not to be filed as part hereof.

LIQUIDIA CORPORATION

|

PART I

|

|

3

|

|

|

|

|

|

Item 1.

|

Business

|

3

|

|

|

|

|

|

Item 1A.

|

Risk Factors

|

22

|

|

|

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

50

|

|

|

|

|

|

Item 2.

|

Properties

|

50

|

|

|

|

|

|

Item 3.

|

Legal Proceedings

|

50

|

|

|

|

|

|

Item 4.

|

Mine Safety Disclosures

|

51

|

|

|

|

|

|

PART II

|

|

52

|

|

|

|

|

|

Item 5.

|

Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

52

|

|

|

|

|

|

Item 6.

|

Selected Financial Data

|

52

|

|

|

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

53

|

|

|

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

62

|

|

|

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

62

|

|

|

|

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

62

|

|

|

|

|

|

Item 9A.

|

Controls and Procedures

|

63

|

|

|

|

|

|

Item 9B.

|

Other Information

|

64

|

|

|

|

|

|

PART III

|

|

65

|

|

|

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

65

|

|

|

|

|

|

Item 11.

|

Executive Compensation

|

65

|

|

|

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

66

|

|

|

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

67

|

|

|

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

67

|

|

|

|

|

|

PART IV

|

|

68

|

|

|

|

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

68

|

|

|

|

|

|

Item 16.

|

Form 10-K Summary

|

70

|

This Annual Report on Form 10-K, or this Annual Report, includes our trademarks, trade names and service marks, such as Liquidia, the Liquidia logo and PRINT, or Particle Replication In Non-wetting Templates, which are protected under applicable intellectual property laws and are the property of Liquidia Corporation. This Annual Report also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this Annual Report may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements. All statements other than statements of historical facts contained in this Annual Report may be forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, but are also contained elsewhere in this Annual Report. In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “would,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

|

|

●

|

those identified and disclosed in our public filings with the U.S. Securities and Exchange Commission (“SEC”) including, but not limited to (i) the timing of and our ability to obtain and maintain regulatory approvals for our product candidates, including plans regarding our anticipated resubmission of the NDA for LIQ861 following our receipt of a Complete Response Letter in November 2020 from the U.S. Food and Drug Administration (“FDA”) and the potential for, and timing regarding, eventual FDA approval of and our ability to commercially launch, LIQ861, including the potential impact of regulatory review, approval, and exclusivity developments which may occur for competitors; (ii) the timeline or outcome related to our current patent litigation with United Therapeutics pending in the U.S. District Court for the District of Delaware or its inter partes review with the Patent Trial and Appeal Board of the U.S. Patent and Trademark Office; (iii) our ability to predict, foresee, and effectively address or mitigate future developments resulting from the COVID-19 pandemic or other global shutdowns, which could include a negative impact on the availability of key personnel, the temporary closure of our facility or the facilities of our business partners, suppliers, third-party service providers or other vendors, or delays in payments or purchasing decisions, or the interruption of domestic and global supply chains, liquidity and capital or financial markets; and (iv) our ability to continue operations as a going concern without obtaining additional funding;

|

|

|

●

|

successfully integrating our and Liquidia PAH, LLC’s (formerly known as RareGen, LLC) businesses, and avoiding problems which may result in our company not operating as effectively and efficiently as expected;

|

|

|

●

|

the possibility that the expected benefits of the recently completed merger transaction with RareGen, LLC (the “Merger Transaction”), will not be realized within the expected timeframe or at all, including without limitation, anticipated revenue, expenses, earnings and other financial results, and growth and expansion of our operations, and the anticipated tax treatment;

|

|

|

●

|

our ability to retain, attract and hire key personnel;

|

|

|

●

|

prevailing economic, market and business conditions;

|

|

|

●

|

the cost and availability of capital and any restrictions imposed by lenders or creditors;

|

|

|

●

|

changes in the industry in which we operate;

|

|

|

●

|

the failure to renew, or the revocation of, any license or other required permits;

|

|

|

●

|

unexpected charges or unexpected liabilities arising from a change in accounting policies, or the effects of acquisition accounting varying from our expectations;

|

|

|

●

|

the risk that the credit ratings of our company or our subsidiaries may be different from what the companies expect, which may increase borrowing costs and/or make it more difficult for us to pay or refinance our debts and require us to borrow or divert cash flow from operations in order to service debt payments;

|

|

|

●

|

fluctuations in interest rates;

|

|

|

●

|

the effects on the businesses of the companies resulting from uncertainty surrounding the Merger Transaction, including with respect to customers, suppliers, licensees, collaborators, business partners, employees, other third parties or the diversion of management’s time and attention, that could affect our financial performance;

|

|

|

●

|

adverse outcomes of pending or threatened litigation or governmental investigations, if any, unrelated to the Merger Transaction;

|

|

|

●

|

the effects on the companies of future regulatory or legislative actions, including changes in healthcare, environmental and other laws and regulations to which we are subject;

|

|

|

●

|

conduct of and changing circumstances related to third-party relationships on which we rely, including the level of credit worthiness of counterparties;

|

|

|

●

|

the volatility and unpredictability of the stock market and credit market conditions;

|

|

|

●

|

conditions beyond our control, such as disaster, global pandemics such as COVID-19, or acts of war or terrorism;

|

|

|

●

|

variations between the stated assumptions on which forward-looking statements are based and our actual experience;

|

|

|

●

|

other legislative, regulatory, economic, business, and/or competitive factors;

|

|

|

●

|

our plans to develop and commercialize our product candidates;

|

|

|

●

|

our planned clinical trials for our product candidates;

|

|

|

●

|

the timing of the availability of data from our clinical trials;

|

|

|

●

|

the timing of our planned regulatory filings;

|

|

|

●

|

the timing of and our ability to obtain and maintain regulatory approvals for our product candidates;

|

|

|

●

|

the clinical utility of our product candidates and their potential advantages compared to other treatments;

|

|

|

●

|

our commercialization, marketing and distribution capabilities and strategy;

|

|

|

●

|

our ability to establish and maintain arrangements for the manufacture of our product candidates and the sufficiency of our current manufacturing facilities to produce development and commercial quantities of our product candidates;

|

|

|

●

|

our ability to establish and maintain collaborations;

|

|

|

●

|

our estimates regarding the market opportunities for our product candidates;

|

|

|

●

|

our intellectual property position and the duration of our patent rights;

|

|

|

●

|

our estimates regarding future expenses, capital requirements and needs for additional financing; and

|

|

|

●

|

our expected use of proceeds from prior public offerings and the period over which such proceeds, together with cash, will be sufficient to meet our operating needs.

|

You should refer to the “Risk Factors” section of this Annual Report on Form 10-K for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements, including, but not limited to, the impact of the COVID-19 outbreak on our company and our financial condition and results of operations. The forward-looking statements in this Annual Report are only predictions, and we may not actually achieve the plans, intentions or expectations included in our forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements.

These forward-looking statements speak only as of the date of this Annual Report. While we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should therefore not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Annual Report on Form 10-K.

Unless the context otherwise requires, references in this Annual Report on Form 10-K to “we,” “us”, “our”, “Liquidia” and the “Company” refer to Liquidia Corporation, a Delaware corporation, and unless specified otherwise, include our wholly owned subsidiaries, Liquidia Technologies, Inc., a Delaware corporation, or Liquidia Technologies, and Liquidia PAH, LLC (formerly known as RareGen, LLC, or RareGen), a Delaware limited liability company, or Liquidia PAH.

PART I

Item 1. Business.

Overview

We are a biopharmaceutical company focused on the development, manufacturing and commercialization of products that address unmet patient needs, with current focus directed towards the treatment of pulmonary hypertension (PH). We operate as a single entity through our two wholly owned operating subsidiaries, Liquidia Technologies and Liquidia PAH (formerly known as RareGen).

We generate revenue pursuant to a Promotion Agreement between Liquidia PAH and Sandoz Inc. (“Sandoz”), sharing profit derived from the sale of the first-to-file fully substitutable generic treprostinil injection (“Treprostinil Injection”) in the United States. Liquidia PAH has the exclusive rights to conduct commercial activities to encourage the appropriate use of Treprostinil Injection. We employ a targeted sales force calling on physicians and hospital pharmacies involved in the treatment of pulmonary arterial hypertension (PAH), as well as key stakeholders involved in the distribution and reimbursement of Treprostinil Injection. Strategically, we believe that our commercial presence in the field will enable an efficient launch of LIQ861 upon approval, leveraging existing relationships and further validating our reputation as a company committed to supporting PAH patients.

We conduct research, development and manufacturing of novel products by applying our proprietary PRINT® technology, a particle engineering platform, to enable precise production of uniform drug particles designed to improve the safety, efficacy and performance of a wide range of therapies. We have development experience in inhaled therapies, vaccines, biologics, and implants, among others.

We are currently developing two product candidates for which we hold worldwide commercial rights: LIQ861 to treat PAH, and LIQ865 to treat post-operative pain and are evaluating formulations of additional molecules to support new product candidates.

Our most advanced development product, LIQ861, is an inhaled dry powder formulation of treprostinil designed to improve the therapeutic profile of treprostinil by enhancing deep lung delivery and achieving higher dose levels than current inhaled therapies while using a convenient, easy-to-use dry-powder inhaler (DPI). We submitted the New Drug Application (NDA) for LIQ861 in January 2020 and we are actively preparing our reply to the Complete Response Letter (CRL) issued by the U.S. Food and Drug Administration (FDA) in November 2020.

Our second product candidate, LIQ865, is designed to deliver sustained release of bupivacaine, a non-opioid anesthetic, to treat local post-operative pain for three to five days through a single administration. We have completed two Phase 1 clinical trials and additional toxicology studies to help enable continued clinical development in Phase 2 studies of LIQ865. We will seek to advance LIQ865 through a strategic collaboration with an external partner in order for Liquidia to focus its efforts on its lead asset, LIQ861, and commercial efforts to support Treprostinil Injection.

Merger with RareGen, LLC (now Liquidia PAH, LLC)

On November 18, 2020 (the “Closing Date”), we completed the previously announced acquisition contemplated by the Agreement and Plan of Merger, dated as of June 29, 2020, as amended by a Limited Waiver and Modification to the Merger Agreement, dated as of August 3, 2020 (the “Merger Agreement”) by and among Liquidia Corporation, Liquidia Technologies, RareGen (now Liquidia PAH), Gemini Merger Sub I, Inc. (“Liquidia Merger Sub”), Gemini Merger Sub II, LLC (“RareGen Merger Sub”), and PBM RG Holdings, LLC, as Members’ Representative. Pursuant to the Merger Agreement, Liquidia Merger Sub, a then-wholly owned subsidiary of Liquidia Corporation, merged with and into Liquidia Technologies (the “Liquidia Technologies Merger”) and RareGen Merger Sub, a then-wholly owned subsidiary of Liquidia Corporation, merged with and into RareGen (the “RareGen Merger” and, together with the Liquidia Technologies Merger, the “Merger Transaction”). Upon consummation of the Merger Transaction, the separate corporate existences of Liquidia Merger Sub and RareGen Merger Sub ceased and Liquidia Technologies and RareGen continued as wholly owned subsidiaries of Liquidia Corporation.

Following the Merger Transaction, Liquidia Corporation is the successor issuer to Liquidia Technologies pursuant to Rule 12g-3(a) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Pursuant to Rule 12g-3(a) under the Exchange Act, shares of Liquidia Corporation common stock, $0.001 par value per share (“Liquidia Corporation Common Stock”), are deemed to be registered under Section 12(b) of the Exchange Act, and Liquidia Corporation is subject to the informational requirements of the Exchange Act, and the rules and regulations promulgated thereunder. The Liquidia Corporation Common Stock is now listed on Nasdaq under the symbol “LQDA” following the removal from listing of Liquidia Technologies Common Stock by the Nasdaq Stock Market LLC.

On February 24, 2021, upon the filing of a Certificate of Amendment to its Certificate of Formation with the Secretary of State of Delaware, RareGen changed its name to Liquidia PAH.

Our Products and Candidates for PH

PH is divided into five groups based on the criteria of the World Health Organization (WHO) as defined at the 5th World Symposium on Pulmonary Hypertension in Nice, France. WHO Group I is comprised of individuals with PAH.

PAH is a rare, chronic, progressive disease caused by hardening and narrowing of the pulmonary arteries that can lead to right heart failure and eventually death, with an estimated prevalence in the United States of approximately 30,000 patients. There is currently no cure for PAH, so the goals of existing treatments are to alleviate symptoms, maintain or improve functional class, delay disease progression and improve quality of life. Drugs targeting the prostacyclin pathway are central to PAH therapy. Prostacyclin analogs, like treprostinil, have been developed for continuous infusion, either intravenously or subcutaneously, inhalation using a nebulizer and oral administration in the form of tablets. The maximal efficacy benefit of any one drug in the prostacyclin pathway is partially limited by its specific safety profile.

Delivering prostacyclin analogs locally to the lungs by inhalation has been effective and causes fewer systemic side effects. Inhalation of prostacyclin analogs supplements the endogenous production of prostacyclin where it is normally synthesized, near the targeted pulmonary arteries. As a result, inhalation of prostacyclin analogs helps avoid side effects related to off-target tissues and takes advantage of binding key prostacyclin receptors that are preferentially expressed in the lung. The only inhaled prostacyclin analogs approved by the FDA are Tyvaso® (treprostinil) and Ventavis® (iloprost), which both require nebulizers.

Parenteral delivery of prostacyclin analogs is considered the most effective treatments for PAH; however, the inconvenience of external pumps and side-effect profiles have limited their use to the most severely ill patients. Remodulin® (treprostinil) can be administered subcutaneously or intravenously. United Therapeutics reported that its class of treprostinil-based products generated net revenue of $1.48 billion in 2020, of which Tyvaso® contributed $483.3 million from predominately U.S. net sales and Remodulin® contributed $516.7 million with $64.3 million in net revenue coming from non-U.S. sales.

Prostacyclin based therapies have only been approved for WHO Group I patients; however, prostacyclin analogs may have utility in the treatment of PH in other categories. United Therapeutics is awaiting the potential FDA approval of Tyvaso® in 2021 for a sub-population of patients in WHO Group III with Interstitial Lung Disease (ILD), which they estimate to be 30,000 patients. If Tyvaso® is approved for additional indications, the market for inhaled treprostinil products may increase with an increased addressable patient population.

LIQ861, Treprostinil Powder for Inhalation to Treat PAH

Our lead product candidate, LIQ861, is an inhaled dry powder formulation of treprostinil designed using our PRINT technology to enhance deep lung delivery using a convenient DPI, the RS00 Model 8 DPI. This device and its variants have been used in at least eight marketed products globally since 2001, including Novartis’s Foradil Aerolizer® for the treatment of asthma and chronic obstructive pulmonary disease (COPD).

We believe LIQ861 can overcome the limitations of current inhaled therapies and has the potential to maximize the therapeutic benefits of inhaled treprostinil in treating PAH by safely delivering higher doses into the lungs. If approved, we believe LIQ861 will have the potential to increase the number of patients using the inhaled route of administration for PAH by providing the benefits of inhaled prostacyclin therapy earlier in a patient’s disease progression as well as delaying the burden of starting continuously infused agents.

We are developing LIQ861 under the 505(b)(2) regulatory pathway using the nebulized form of treprostinil, Tyvaso®, as the reference listed drug. This regulatory pathway allows us to rely in part on the FDA’s previous findings of efficacy and safety of Tyvaso® and the active ingredient treprostinil.

We submitted an NDA to the FDA for LIQ861 in January 2020, which was accepted for review in April 2020 and provided a Prescription Drug User Fee Act (PDUFA) goal date of November 24, 2020. On November 25, 2020, we announced the FDA issued a CRL, for our NDA for LIQ861. The CRL identified the need for additional information and clarification on chemistry, manufacturing and controls (CMC) data pertaining to the drug product and device biocompatibility. The FDA also reconfirmed the need to conduct on-site prior approval inspections (“PAIs”) of two U.S. manufacturing facilities before our NDA can be approved. The FDA noted it had been unable to conduct these inspections during the initial review cycle due to COVID-19 related travel restrictions. The CRL did not cite the need to conduct further clinical studies, nor did the FDA indicate that additional studies related to toxicology or clinical pharmacology would be necessary. We conducted a Type A meeting with the FDA on January 29, 2021, and we intend to respond to the CRL in mid-2021.

FDA approval and launch of LIQ861 are directly impacted by resolution of the CRL and the pending Hatch-Waxman litigation commenced by United Therapeutics on June 4, 2020. As a result, the FDA may not issue a final approval for the LIQ861 NDA until the expiration of a 30-month regulatory stay in October 2022 or earlier judgment unfavorable to United Therapeutics by the court. When the FDA is precluded from approving a 505(b)(2) application due to a 30-month stay, it is generally possible that the FDA could issue “tentative approval” of an NDA if all requirements for approval have been met. The FDA’s tentative approval can be subject to change based on new information that may come to FDA’s attention between such time as the tentative and final approval. A new drug product may not be marketed until the date of final approval.

Our NDA submission was based in part upon the results of our pivotal, open-label Phase 3 clinical trial, Investigation of the Safety and Pharmacology of Dry Powder Inhalation of Treprostinil, for LIQ861 (“INSPIRE”). The primary objective of the INSPIRE study was to evaluate the long-term safety of LIQ861 with a primary endpoint to assess safety and tolerability through Month 2. The study enrolled patients who have either (a) been under stable treatment with Tyvaso® (nebulizer-delivered treprostinil) for at least three months and transitioned to LIQ861 under the protocol (“Transition patients”), or (b) patients who had been under stable treatment with no more than two non-prostacyclin oral PAH therapies for at least three months and then had their treatment regimen supplemented with LIQ861 under the protocol (“Add-On patients”). Transition patients started at a dose comparable to their prior nebulized treprostinil dose and were titrated to higher doses as warranted by their clinical disease. Add-On patients started on a dose of 26.5 mcg of LIQ861, with most (>80%) titrating to a 79.5 mcg dose or higher within the first two months of treatment. Of the 121 patients enrolled in the study, 55 were Transition patients and 66 were Add-On patients.

LIQ861 was observed to be well-tolerated and treatment-emergent adverse events (TEAEs) were mostly mild to moderate in nature at Month 2 up to doses of 159 mcg of LIQ861, the highest dose studied at Month 2. Of the 121 PAH patients, 113, or 93%, completed their two-month visit. The most common reported TEAEs (reported in ≥ four percent) were cough (42%), headache (26%), throat irritation (16%), dizziness (11%), diarrhea (9%), chest discomfort (8%), nausea (7%), dyspnea (5%), flushing (5%) and oropharyngeal pain (4%). Durability of therapy with LIQ861 appeared to be favorable, with 96% of Transition patients and 91% of Add-On patients remaining on study drug at the Month 2 timepoint.

Our NDA submission also include results from pharmacokinetic (PK) studies in healthy volunteers indicating that the 79.5 mcg dose of LIQ861 provides comparable PK with nine breaths of Tyvaso, the maximum recommended label dose of Tyvaso.

Clinical results from LIQ861 have been presented at various international scientific meetings such as the American Thoracic Society (ATS), International Society of Heart Lung Transplantation (ISHLT), Pulmonary Vascular Research Institute (PVRI), American College of Chest Physicians (ACCP) in 2019 and 2020.

We continued to treat patients who chose to remain on LIQ861 beyond the Month 2 timepoint of the primary endpoint. At the completion of the INSPIRE study, the patient with the longest duration of treatment had been on LIQ861 therapy for 18 months and the highest dosing reached in the INSPIRE study was 212 mcg of treprostinil given four times per day.

To provide for continuity of treatment, patients from INSPIRE were provided the opportunity to continue receiving treatment in an extension study, which is currently ongoing (LTI-302). Currently, more than 75 patients have now received therapy with LIQ861 for more than two years. We have also observed that more than 75 percent of patients who have been enrolled in the INSPIRE and extension studies have received LIQ861 doses of 100 mcg or more.

In addition to the studies submitted in the NDA for FDA review, we have been conducting a clinical study, known as LTI-201, at certain investigational sites in France and Germany to characterize the hemodynamic dose-response relationship to LIQ861. In December 2020, we decided to terminate the study earlier than planned due to challenges related to the COVID-19 pandemic. French sites were closed in the second quarter of 2020 and will not re-open for enrollment. German sites are no longer enrolling patients, but remain open as we transition patients from LIQ861 to currently approved therapies. We are considering conducting other clinical trials to generate additional data on LIQ861, including a clinical trial in pediatric patients.

Treprostinil Injection, a Generic Version of Remodulin®

Remodulin® is treprostinil administered through continuous intravenous and subcutaneous infusion, as approved by the FDA in 2002 and 2004, and marketed by United Therapeutics. Patients must use external pumps manufactured by third parties to deliver Remodulin®. Smiths Medical ASD, Inc. (“Smiths Medical”) manufactures the pumps used by most patients in the United States to administer Remodulin®, including the CADD-MS® 3 (MS-3) pump used to deliver subcutaneous Remodulin®, and the CADD-Legacy® pump to deliver intravenous Remodulin®. It is estimated that 3,000 patients are treated annually with branded Remodulin® which generated approximately $452 million in U.S. revenue in 2020 (and approximately $516.7 million in total, including approximately $64.3 million of non-U.S. sales), split between the two routes of administration.

There are serious side effects associated with Remodulin®. For example, when infused subcutaneously, Remodulin® causes varying degrees of infusion site pain and reaction, such as redness and swelling, in most patients. Patients who cannot tolerate the infusion site pain related to the use of subcutaneous Remodulin® may instead use intravenous Remodulin®. Intravenous Remodulin® is delivered continuously through a surgically implanted central venous catheter, similar to Flolan®, Veletri® and generic epoprostenol. Patients who receive therapy through implanted venous catheters have a risk of developing blood stream infections and a serious systemic infection known as sepsis. Other common side effects associated with both subcutaneous and intravenous Remodulin® include headache, diarrhea, nausea, jaw pain, vasodilation and edema.

In August 2018, Sandoz partnered with Liquidia PAH (then known as RareGen) on an exclusive basis to market and commercialize its generic Treprostinil Injection, which was subsequently launched as the first-to-file, fully-substitutable generic treprostinil for parenteral administration in March 2019. Liquidia PAH promotes the appropriate use of Treprostinil Injection for the treatment of PAH in the United States and works jointly with Sandoz on commercial strategy for the product. Sandoz retains all rights in and to Treprostinil Injection. As the Abbreviated New Drug Application (ANDA) holder, Sandoz maintains responsibility for compliance with FDA regulatory and healthcare laws including any regulatory communications with the FDA or any other regulatory authorities. In consideration for Liquidia PAH conducting certain responsibilities associated with the commercialization of Treprostinil Injection, Liquidia PAH receives a portion of the net profits generated from the sales of the product.

Treprostinil Injection contains the same active ingredient, same strength, same dosage forms and same inactive ingredient amounts as Remodulin®, and at the same service and support, but at a lower price. The treprostinil is supplied in 20 mL multi-dose vials in four strengths — containing 20 mg, 50 mg, 100 mg, or 200 mg (1 mg/mL, 2.5 mg/mL, 5 mg/mL or 10 mg/mL) of treprostinil, respectively.

Sandoz’s Treprostinil Injection, as well as competing generics approved by FDA from Teva Pharmaceuticals Industries Ltd (“Teva”), Par Pharmaceutical, Inc (“Par Pharmaceutical”), Dr. Reddy’s Laboratories Inc. (“Dr. Reddy’s”), and Alembic Pharmaceuticals, Ltd (“Alembic”), are currently used for intravenous administration only. In April 2019, Liquidia PAH and Sandoz alleged in outstanding litigation that Smiths Medical and United Therapeutics blocked access to cartridges necessary for administering the generic treprostinil through the CADD MS-3 pump manufactured by Smiths Medical for use in the administration of subcutaneous infusions of generic treprostinil. On November 6, 2020, Sandoz, Liquidia PAH and Smiths Medical entered into a binding settlement term sheet in order to resolve the outstanding litigation solely with respect to disputes between Smiths Medical, Liquidia PAH and Sandoz. Pursuant to the term sheet, Smiths Medical has paid $4.25 million to Sandoz and former RareGen members, and the parties have agreed to negotiate in good faith to reduce the term sheet to a definitive settlement agreement.

Sandoz, a Novartis division, is a global leader in generic pharmaceuticals and biosimilars. Sandoz’s purpose is to pioneer novel approaches to help people around the world access high-quality medicine. Sandoz’s broad portfolio of high-quality medicines, covering all major therapeutic areas, accounted for 2019 sales of $9.7 billion. Sandoz’s headquarters are in Holzkirchen, in Germany’s Greater Munich area.

LIQ865, sustained-release formulation of bupivacaine to treat post-surgical pain

LIQ865 is our proprietary injectable, sustained-release formulation of bupivacaine, a non-opioid pain medication. We have engineered the size and composition of the LIQ865 PRINT particles to release bupivacaine over three to five days through a single administration for the management of local post-operative pain after a surgical procedure.

We completed a Phase 1a clinical trial of LIQ865 in Denmark in 2017 and a Phase 1b clinical trial in the United States in 2018. Our Phase 1a trial was a randomized, double-blind, controlled, single ascending dose trial of two different PRINT formulations of bupivacaine, LIQ865A and LIQ865B. We observed a dose-response relationship in this trial, and all doses were well-tolerated. All adverse events were mild to moderate in severity, and most adverse events were limited locally at the site of injection, with most related to sensory block of underlying sensory branches of the saphenous nerve in the leg. The results from this trial helped inform our selection of LIQ865A for further investigation in the United States. We conducted our U.S. Phase 1b clinical trial in an experimental pain model in healthy male and female subjects with quantitative sensory testing after an injection of LIQ865. We observed that LIQ865 was well-tolerated across the range of doses. All adverse events were mild to moderate, and no dose-limiting toxicities were noted. The pharmacokinetic profile was similar to that observed in the Phase 1a trial. Pharmacodynamic effects were highly variable and inconclusive, which we associated with the experimental design of the pain model used in this Phase 1b trial.

We initiated Phase 2-enabling toxicology studies in 2019 to assess LIQ865 in multiple non-clinical tissue models. Results from a study to assess incision tensile strength after healing were acceptable and not statistically different from controls. A nonclinical study to examine soft tissue healing was also completed, and the results were acceptable and comparable to vehicle-treated, saline-treated, and Marcaine-treated sites. We believe this data supports progression to Phase 2 hernia repair studies.

In a toxicology study to assess bone fracture healing, we observed dose-dependent delayed healing at the two LIQ865 doses studied; however, there were no adverse effects noted on surrounding soft tissues. We have completed an additional non-Good Laboratory Practice (“non-GLP”) study to investigate bone fracture healing using the same animal model with lower doses of LIQ865. This additional non-GLP study has established a no adverse effect level (NOAEL) on bone healing and provides evidence that LIQ865 could proceed into a GLP toxicology study to support Phase 2 clinical activities.

Considering our focus in advancing our lead asset, LIQ861, we will seek to advance LIQ865 through a strategic collaboration with an external partner. We believe LIQ865, if successfully developed and approved, has the potential to provide significantly longer local post-operative pain relief compared to currently marketed formulations of bupivacaine.

Our PRINT Technology

Both LIQ861 and LIQ865 are being developed using our proprietary PRINT particle engineering technology, which allows us to engineer and manufacture highly uniform drug particles with precise control over the size, three-dimensional geometric shape and chemical composition of the particles. By controlling these physical and chemical parameters of particles, PRINT enables us to engineer desirable pharmacological benefits into product candidates, including prolonged duration of drug release, increased drug loading, more convenient routes of administration, the ability to create novel combination products, enhanced storage and stability and the potential to reduce adverse side effects. Our manufacturing equipment and materials used in the production of our drug particles are proprietary and protected by our patent portfolio and trade secret know-how.

An example of the precise particle engineering enabled by PRINT technology is demonstrated in LIQ861. Each particle is designed to enhance delivery and deep-lung penetration with a precise size and highly uniform shape inspired by a naturally occurring pollen. LIQ861 PRINT particles have a one micrometer trefoil-shape measured by an inscribed one micrometer circle as shown in the figure below. In vitro studies suggest that the uniformity of size and shape allow our inhaled particles to target delivery into the lungs with less deposition in the upper airways. The figures below depict LIQ861, with the figure on the left showing size and shape consistency among particles and the figure on the right showing their trefoil shape:

Development, Regulatory and Commercial Strategy

We believe that our PRINT technology can be applied to a wide range of therapeutic areas, molecule types, routes of administration and novel or generic products. To date, our internal pipeline has focused on the development of improved and differentiated drug products containing FDA-approved active pharmaceutical ingredients (APIs) with established efficacy and safety profiles, which we believe are eligible for the 505(b)(2) regulatory pathway to seek marketing approval in the United States. The 505(b)(2) regulatory pathway can be capital efficient and potentially enable a shorter time to approval, subject to certain risks associated with this regulatory pathway. If our product candidates receive marketing approval, we plan to commercialize them in the United States either by ourselves or through partnership or licensing arrangements with other pharmaceutical companies. Outside of the United States, we may pursue regulatory approval and commercialization of our product candidates in collaboration with pharmaceutical companies with regional expertise. We intend to manufacture our product candidates using in-house capabilities. Where appropriate, we will rely on contract manufacturing organizations (CMOs) to produce, package and distribute our approved drug products on a commercial scale.

We intend to focus our commercial efforts initially on the U.S. market in the treatment of PAH. We have started to build a commercial presence with the acquisition and merger of Liquidia PAH (formerly RareGen) in November 2020. We employ a small, targeted sales force for Treprostinil Injection calling on physicians involved in the treatment of PAH in the US, as well as key stakeholders involved in the distribution and reimbursement of Treprostinil Injection. Strategically, we believe that our commercial presence in the field will enable an efficient launch of LIQ861 if and when we obtain approval, leveraging existing relationships and further validating our reputation as a company committed to supporting PAH patients. As we have success increasing the utilization of Treprostinil Injection and advancing LIQ861 to FDA approval, we will increase our efforts to pursue the highly concentrated target market of PAH centers of excellence and high prescribers of PAH therapies. Our physician call points within these sites of care will include cardiologists, pulmonologists and their supporting staff. We believe that we can effectively commercialize LIQ861, if approved, with an expanded specialty field team. We also expect to further develop our internal resources and functional areas to support other types of communication. For example, we may utilize medical science liaisons and reimbursement specialists to support the proper conveying of scientific and medical information, and healthcare economic information regarding, and utilization of, LIQ861.

Manufacturing and Supply

We operate from a 45,000 square foot facility in Morrisville, North Carolina in which we design, formulate and manufacture engineered drug particles using PRINT particle fabrication lines as well as supportive activity including research and development, analytical development, quality control and production of mold templates that enable our production processes. Our three operational PRINT particle fabrication lines are located within class ISO7 clean rooms that operate under applicable ISO and current good manufacturing practices (cGMP) air quality and environmental requirements. Our current operational fabrication lines are scaled and capable of producing the necessary materials to support our clinical trials and, if approved, commercial demand for our products. We utilize contract manufacturers to finish production and package our drug product for clinical and commercial use.

We depend on third-party suppliers for clinical supplies, including active pharmaceutical ingredients which are used in our product candidates. For example, we currently rely on a sole supplier, LGM Pharma, LLC, for treprostinil, the active pharmaceutical ingredient of LIQ861, and we currently rely on a sole supplier, Plastiape S.p.A (“Plastiape”), for RS00 Model 8 DPI, the DPI used to administer LIQ861. We also rely on a sole supplier, Xcelience LLC (now a Lonza Group Ltd company), for encapsulation and packaging services. If and when we receive marketing approval for our product candidates, we may, from time to time, rely on third-party CMOs to manufacture, package and distribute some or all of our approved drug products on a commercial scale.

Supply of Treprostinil Injection is managed directly by our partner Sandoz, who retains the ANDA, manages inventory and records gross revenue on product sales. Sandoz is either the manufacturer or contracted party for the entire supply chain. We collaborate with Sandoz on a regular basis to plan appropriate inventory production and management based on the demand for Treprostinil Injection and observations in the field. Additionally, we have engaged Carelife USA Inc. to develop a medication cartridge for use with CADD-MS® 3 (MS-3) ambulatory infusion pumps and enable subcutaneous administration of Treprostinil Injection when ready for commercial sale.

Our Collaboration and Licensing Agreements

Sandoz Promotion Agreement

RareGen (now Liquidia PAH) entered into a Promotion Agreement with Sandoz on August 1, 2018, as amended on May 8, 2020, which engaged Liquidia PAH on an exclusive basis to promote the appropriate use of Sandoz’s treprostinil, Treprostinil Injection, referred to as the “Product” in the Promotion Agreement, for the treatment of PAH in the United States, including its commonwealths, territories, possessions and military bases. Liquidia PAH works jointly with Sandoz on commercial strategy for Treprostinil Injection and has responsibility for identifying, manufacturing and developing medical devices, including pumps and cartridges, that may be used to administer the Product. Sandoz retains all rights in and to the Product. Sandoz is the holder of the ANDA for the Product. As the ANDA holder, Sandoz maintains responsibility for compliance with FDA regulatory and healthcare laws including any regulatory communications with the FDA or any other regulatory authorities.

Under the Promotion Agreement, Sandoz retains responsibility for: the specifications, manufacture and supply, distribution and future development of treprostinil; regulatory submission and interactions with the FDA pertaining to treprostinil, including maintaining all necessary regulatory approvals; reporting to the FDA or other regulatory authorities on matters relating to manufacturing, sale or promotion, such as any safety events involving treprostinil; internally reviewing and, as it determines appropriate, approving promotional materials developed by Liquidia PAH, and making submissions to the FDA’s Office of Prescription Drug Promotion; handling safety activities including adverse event reporting, and initiating and managing any recalls of treprostinil.

Liquidia PAH’s activities and obligations related to regulatory matters conducted under the Promotion Agreement include: promotional and non-promotional activities, including sales and marketing activities for treprostinil, and engagement of healthcare professionals for advisory boards; developing, with prior written approval from Sandoz, marketing and educational materials consistent with FDA approved labeling and applicable laws; notifying Sandoz of notices from governmental authorities about adverse event reports or regulatory inquiries related to the safety of treprostinil, product complaints or alleged defects, unsolicited requests for off-label medical information; providing certain data and information to Sandoz in order to fulfill its transparency and reporting obligations under the Physician Payment Sunshine Act; complying with applicable laws relevant to the activities conducted under the Promotion Agreement; establishing a compliance program and mechanism for disclosure of any violations of Liquidia PAH policies and procedures and submission of an annual report and certification to Sandoz of its compliance activities; and managing, with oversight and participation from Sandoz, negotiations and arrangements for managed care activities.

The Promotion Agreement, unless earlier terminated, initially extends until the eight (8)-year anniversary of the first commercial sale of the Product by Sandoz, which occurred on or about March 25, 2019. The Promotion Agreement automatically renews for successive two-year terms unless earlier terminated.

Liquidia PAH paid Sandoz an initial payment of $10 million on August 1, 2018 and, upon the successful quality release by Sandoz of 9,000 units of the Product on August 3, 2018, Liquidia PAH paid Sandoz an additional $10 million as further consideration for the right to conduct the activities as contemplated in the Promotion Agreement and to receive a portion of the “Net Profits” (as defined in the Promotion Agreement). The portion of Net Profits are allocated to Liquidia PAH as follows: (i) for that portion of aggregate Net Profits less than or equal to $500 million, Liquidia PAH shall receive between 50-80% of all such Net Profits; and (ii) for that portion of aggregate Net Profits greater than $500 million, Liquidia PAH shall receive 75% of all such Net Profits.

Liquidia PAH and Sandoz may terminate the Promotion Agreement for cause upon a number of customary events, such as a material breach of the Promotion Agreement that remains uncured, complete withdrawal of marketing approval of the Product or upon the filing or institution of bankruptcy, reorganization, liquidation or receivership proceedings with respect to the other party. Further, either party may terminate the Promotion Agreement upon written notice to the other party at any time after the initial eight (8) year term in the event Sandoz is then procuring 100% of its supply of Product from a single third party upon (a) expiration of the supply agreement with such third party and (b) Sandoz’s failure, after exercise of commercially reasonable efforts, to secure continued supply of the Product from such third party or other third parties within 12 months of the termination of such supply agreement. Liquidia PAH and Sandoz also each have a right to terminate the Promotion Agreement on not more than 90 days’ written notice in the event that Net Profits in the last calendar year are less than $5 million.

Sandoz may terminate the Promotion Agreement on not more than 90 days’ written notice after the conclusion of any full 12-month calendar year in the event that Net Profits in such calendar year are less than or equal to 10% of the net sales in such calendar year; provided, however, that Sandoz may not terminate the Promotion Agreement in such instance unless and until (i) aggregate amounts received by Liquidia PAH under the sharing of Net Profits have reached $32.5 million, or (ii) both (x) Net Profits or the profit margin were adversely affected in such calendar year by any temporary event or circumstance and (z) the joint steering committee makes a determination that such profit margin deficiency is not likely to continue in the subsequent calendar year. Sandoz may also terminate the Promotion Agreement upon a change of control of Liquidia PAH.

Liquidia PAH may terminate the Promotion Agreement on not more than 90 days’ written notice after the conclusion of any full 12-month calendar year in the event that Liquidia PAH’s share of the Net Profits in such calendar year are less than or equal to Liquidia PAH’s operating expenses relating to the Product for such calendar year; provided, however, that Liquidia PAH may not terminate the Promotion Agreement in such instance unless and until (i) aggregate amounts received by Sandoz under the share of Net Profits have reached $28.125 million, or (ii) both (x) Net Profits or its operating expenses relating to the Product were adversely affected in such calendar year by a temporary event or circumstance and (z) the joint steering committee makes a determination that Liquidia PAH’s share of the Net Profits is not likely to continue to be less than its operating expenses relating to the Product in the subsequent calendar year.

The University of North Carolina at Chapel Hill

In December 2008, we entered into the Amended and Restated License Agreement with The University of North Carolina at Chapel Hill (“UNC”) for the use of certain patent rights and technology relating to initial innovations of our PRINT technology (the “UNC License”). Under the terms of the UNC License, we have an exclusive license to such patent rights and technology for our drug products. The UNC License grants us the right to grant sublicenses to the technology as well as control the litigation of any infringement claim instituted by or against us in respect of the licensed patent rights. We are also responsible for the costs of all expenses associated with the prosecution and maintenance of the patents and patent applications. Such filings and prosecution will be carried out by UNC and in UNC’s name but under our control.

Under the UNC License, we are required to pay UNC royalties equal to a low single digit percentage of all net sales of our drug products whose manufacture, use or sale includes any use of the technology or patent rights covered by the UNC License, as well as tiered royalty percentages ranging in the low single digits of sales by our sublicensees for any product covered by rights under a sublicense agreement granted pursuant to the UNC License. Under the UNC License, we are also required to pay UNC certain fees other than royalties that we collect and are attributable to UNC sublicensed intellectual property. We also reimburse UNC for its costs of procuring and maintaining the patents we license from UNC. Effective November 2017, we satisfied all substantive milestones associated with our UNC License other than semi-annual and annual reporting-based milestones that continue through the term of the UNC License. The UNC License expires (i) on the expiration of the last to expire patent included in the patent rights or (ii) if no patents mature from such patent rights, in December 2028.

We have the right to terminate the UNC License upon a specified period of prior written notice. UNC may terminate the UNC License in certain circumstances, including if we fail to pay royalty or other payments on time or if we fail to sublicense in accordance with the terms of the UNC License. Upon termination of the UNC License, we must pay any royalty obligations due upon termination.

Aerie Pharmaceuticals

We have also exclusively licensed our PRINT technology to Aerie Pharmaceuticals, Inc., which in 2017 acquired most of the assets of Envisia Therapeutics, Inc., an entity which we formed in 2013, for broad usage in the design and commercialization of small molecule and biologic ophthalmic therapies.

GlaxoSmithKline

Previously, we had collaborated with GlaxoSmithKline plc (“GSK”) on the use of our PRINT technology in respiratory disease. In June 2012, we entered into an Inhaled Collaboration and Option Agreement (the “GSK ICO Agreement”) with GSK to collaborate on research regarding the application of our PRINT technology to specified inhaled therapies. Pursuant to the GSK ICO Agreement, we granted GSK exclusive options and licenses to further develop and commercialize such inhaled therapies using our PRINT technology. In September 2015, GSK exercised its option to obtain an exclusive, worldwide license to certain of our know-how and patents relating to our PRINT technology for the purpose of developing inhaled therapeutics. In connection with the grant of this license, we received a one-time option exercise fee and were also entitled to continued research and development funding, certain milestone payments, and tiered royalties on the worldwide sales of the licensed products. In February 2016, we received a payment from GSK upon the achievement of a clinical development milestone related to the development of an inhaled antiviral for viral exacerbations in COPD. However, in July 2018, GSK notified us of its plans to discontinue development of this compound after completion of the related Phase 1 clinical trial.

In June 2019, we and GSK executed an amendment to the collaboration agreement providing us with rights to develop and commercialize three specified molecular entities for application in inhaled programs using our PRINT technology at our sole expense. This amendment also provides a mechanism for us to acquire rights to develop and commercialize further molecular entities for inhaled applications. New inhaled programs developed under this amendment would carry milestone and royalty payments due to GSK upon initiation of Phase 3 studies and subsequent commercialization, respectively.

In January 2020, we notified GSK of our intent to terminate the GSK ICO Agreement based upon GSK's lack of continued performance under the original agreement, which we believe constitutes a material breach of the agreement. In February 2020, we received a letter from GSK disputing our basis for termination. The parties are currently attempting to resolve the dispute pursuant to the terms of the GSK ICO Agreement and are discussing a possible amendment to this agreement.

Intellectual Property

The proprietary nature and protection of our product candidates, their methods of use and our platform technology that enables our product candidates are an important part of our business strategy of rapidly developing and commercializing new medicines that address areas of significant unmet medical needs.