UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 001-34487

|

LIGHTBRIDGE CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

91-1975651

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

11710 Plaza America Drive, Suite 2000 Reston, VA 20190

(Address of principal executive offices) (Zip Code)

(571) 730-1200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

LTBR

|

The Nasdaq Capital Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer

|

☐

|

Accelerated Filer

|

☐

|

|

Non-Accelerated Filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

At June 30, 2019, the aggregate market value of shares held by non-affiliates of the registrant (based upon the closing sale price of such shares on the Nasdaq Capital Market on June 30, 2019) was $24,657,692.

At March 2, 2020 there were 3,304,526 shares of the registrant’s common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

TABLE OF CONTENTS

EXPLANATORY NOTE

This Amendment No. 1 to Form 10-K (the “Amendment”) amends the Annual Report on Form 10-K for the fiscal year ended December 31, 2019 originally filed with the U.S. Securities and Exchange Commission on March 18, 2020 (the “Original Filing”) by Lightbridge Corporation (“Company,” “we,” or “us”). We are filing the Amendment to present the information required by Part III of Form 10-K as we do not anticipate filing our definitive proxy statement within 120 days of December 31, 2019. In addition, the Company is revising Item 1A. “Risk Factors” to add a risk factor regarding the coronavirus (COVID-19) pandemic. The reference on the cover page of the Original Filing to the incorporation by reference of portions of the Company’s definitive proxy statement into Part III of the Original Filing is hereby deleted.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (“Exchange Act”), Part III, Items 10 through 14 of the Original Filing are hereby amended and restated in their entirety. In addition, new certifications by our principal executive officer and principal financial officer are filed as exhibits to this Amendment, as required by Rule 12b-15 under the Exchange Act. No other changes have been made to the Original Filing other than that described above. This Amendment does not reflect subsequent events occurring after the original filing date of the Original Filing or amend, modify or otherwise update in any way the financial statements, consents or any other disclosures made in the Original Filing in any way other than as required to reflect the amendments discussed above. Accordingly, this Amendment should be read in conjunction with the Original Filing and the Company’s other filings with the SEC subsequent to the filing of the Original Filing.

PART I

ITEM 1A — Risk Factors

Our business and operations may be adversely affected by the recent coronavirus (COVID-19) outbreak.

We face various risks related to the recent outbreak of coronavirus (COVID-19), which has been declared a “pandemic” by the World Health Organization. The disease has spread across the globe and is impacting economic activity worldwide. The full impact of COVID-19 is unknown and rapidly evolving. Public health pandemics such as COVID-19 pose the risk that we, our employees, our research and development providers and other entities with whom we do business may be prevented or impaired from conducting ordinary course business activities for an indefinite period of time, including due to shutdowns necessitated for the health and well-being of our employees, the employees of other entities, or shutdowns that may be requested or mandated by governmental authorities.

While it is not possible at this time to estimate the scope and severity of the impact that COVID-19 could have on our business, the continued spread of COVID-19, the measures taken by the governments of countries affected, actions taken to protect employees, actions taken to continue operations, and the impact on business and economic activity in affected countries could adversely affect our financial condition, results of operations and cash flows. Among other things, our research and development activities may be delayed, and our ability to continue to raise capital through sales of our equity securities may be impaired. The extent to which COVID-19 impacts our business will depend on the severity, location and duration of the spread of COVID-19, and the actions undertaken by local and world governments and health officials to contain the virus or treat its effects, and the actions undertaken by the leadership and employees of our Company as well as those of other entities.

PART III

Item 10. Directors and Executive Officers and Corporate Governance

Directors And Executive Officers

Set forth below are the names of our current directors and executive officers, their ages, all positions and offices that they hold with us, the period during which they have served as such, and their business experience during at least the last five years.

|

Name

|

|

Age

|

|

Position with Lightbridge

|

|

Director Since

|

|

Seth Grae

|

|

57

|

|

President and CEO

|

|

April 2006

|

|

Thomas Graham, Jr.

|

|

86

|

|

Chairman

|

|

April 2006

|

|

Victor E. Alessi

|

|

80

|

|

Director

|

|

August 2006

|

|

Daniel B. Magraw

|

|

73

|

|

Director

|

|

October 2006

|

|

Kathleen Kennedy Townsend

|

|

68

|

|

Director

|

|

October 2013

|

|

Larry Goldman

|

|

63

|

|

Chief Financial Officer

|

|

—

|

|

Andrey Mushakov

|

|

43

|

|

Executive Vice President, Nuclear Operations

|

|

—

|

|

Name

|

Position with Lightbridge and Principal Occupations

|

|

Seth Grae

|

Mr. Grae was named the President and Chief Executive Officer of the Company on March 17, 2006 and, effective April 2, 2006, became a director of the Company. Mr. Grae has led Lightbridge’s business efforts to develop and deploy advanced nuclear fuel technologies and to provide comprehensive advisory services based on safety, non-proliferation, and transparency for emerging commercial nuclear power programs.

Mr. Grae is a member of the Civil Nuclear Energy Advisory Committee to the U.S. Secretary of Commerce and the board of directors of the Nuclear Energy Institute and the Virginia Nuclear Energy Consortium. He is a member of the Nuclear Security Working Group, the Nuclear Energy and National Security Coalition, the Working Group on Climate, Nuclear, and Security Affairs of the Council on Strategic Risks, and is a member the Dean’s Advisory Council at the Washington College of Law at American University. Mr. Grae has served as Vice Chair of the Governing Board of the Bulletin of the Atomic Scientists, as Co-Chair of the American Bar Association’s Arms Control and Disarmament Committee, and as a member of the Board of Directors of the Lawyers Alliance for World Security. He earned a B.A. (cum laude) from Brandeis University; an M.B.A. and an L.L.M. in international law (with honors) from Georgetown University; and a J.D. from American University.

|

|

Thomas Graham, Jr.

|

Ambassador Graham became a director of the Company on April 2, 2006, and Executive Chairman of the Board of Directors (the “Board”) on April 4, 2006. Ambassador Graham resigned from the position of Executive Chairman of the Board and assumed the role of non-executive Chairman of the Board on April 8, 2020. Ambassador Graham served as a member of the board of directors of Thorium Power, Inc., from 1997 until the merger with the Company. He is one of the world’s leading experts on nuclear non-proliferation and has served as a senior U.S. diplomat involved in the negotiation of every major international arms control and non-proliferation agreement involving the United States during the period from 1970 to 1997, including the Strategic Arms Limitations Talks (the Interim Agreement on Strategic Offensive Arms and the Anti- Ballistic Missile Treaty and the SALT II Treaty), the Strategic Arms Reduction Talks (START Treaty), the Intermediate Nuclear Forces Treaty, the Nuclear Non-Proliferation Treaty Extension, the Conventional Armed Forces in Europe Treaty, and the Comprehensive Test Ban Treaty. In 1993, Ambassador Graham served as the Acting Director of the U.S. Arms Control and Disarmament Agency (“ACDA”), and for seven months in 1994 served as the Acting Deputy Director. From 1994 through 1997, he served as the Special Representative of the President of the United States for Arms Control, Non-Proliferation and Disarmament with the rank of Ambassador, and in this capacity successfully led U.S. government efforts to achieve the permanent extension of the Nuclear Non-Proliferation Treaty in 1995. He also served for 15 years as the general counsel of ACDA.

Ambassador Graham worked on the negotiation of the Chemical Weapons Convention and the Biological Weapons Convention. He drafted the implementing legislation for the Biological Weapons Convention and managed the Senate approval of the ratification of the Geneva Protocol banning the use in war of chemical and biological weapons. Mr. Graham served as a member of the International Advisory Board for the nuclear program of the United Arab Emirates from 2009 through its termination in October 2017. He is also Chairman of the Board of CanAlaska Uranium Ltd. of Vancouver, Canada (TSX: CVV), a uranium exploration company. In 2019, he was selected as Co-chair of the Nuclear Energy and National Security Coalition, a subsidiary of the Atlantic Council and was elected to the Editorial Board of the Marine Corps University Press.

Ambassador Graham received an A.B. in 1955 from Princeton University and a J.D. in 1961 from Harvard Law School. He is a member of the Kentucky, the District of Columbia, and the New York Bar Associations and is a member of the Council on Foreign Relations. He chaired the Committee on Arms Control and Disarmament of the American Bar Association from 1986-1994. Ambassador Graham received the Trainor Award for Distinction in Diplomacy from Georgetown University in 1995 and the World Order Under Law award from the International Law Section of the American Bar Association in 2007. He has taught at a number of universities as an adjunct professor including the University of Virginia Law School, Georgetown University Law Center, Georgetown University School of Foreign Service, the University of Washington, the University of Tennessee, Stanford University, and Oregon State University. He has published ten books including non-fiction books, such as Disarmament Sketches in 2002, Spy Satellites in 2007, The Alternate Route: Nuclear Weapon Free Zones and Seeing the Light, the Case for Nuclear Power in the 21st Century in 2017, and Unending Crisis in 2012, as well as a historical novel, Sapphire, A Tale of the Cold War in 2014.

|

|

Victor E. Alessi

|

Dr. Alessi became a director of the Company on August 23, 2006. Dr. Alessi, who holds a Ph.D. in nuclear physics, is President Emeritus of the United States Industry Coalition (“USIC”), an organization dedicated to facilitating the commercialization of technologies of the New Independent States (“NIS”) of the former Soviet Union through cooperation with its members. He has held such position since August 1, 2006. Prior to becoming President Emeritus, Dr. Alessi held the positions of CEO and President of USIC since 1999. Previously, he was President of DynMeridian, a subsidiary of DynCorp, specializing in arms control, non-proliferation, and international security affairs. Before joining DynMeridian in early 1996, Dr. Alessi was the Executive Assistant to the Director, U.S. Arms Control and Disarmament Agency (“ACDA”). At ACDA he resolved inter-bureau disputes and advised the director on all arms control and non-proliferation issues. Dr. Alessi served as Director of the Office of Arms Control and Nonproliferation in the Department of Energy (“DOE”) prior to his work at ACDA, overseeing all DOE arms control and non-proliferation activities. As a senior DOE representative, Dr. Alessi participated in U.S. efforts that led to successful conclusion of the Intermediate Nuclear Forces (“INF”), Conventional Forces in Europe, Threshold Test Ban, Peaceful Nuclear Explosions, Open Skies, Strategic Arms Reductions Talks Treaties, and the Chemical Weapons Convention. In this role, he was instrumental in implementing the U.S. unilateral nuclear initiative in 1991 and was a member of the U.S. delegation discussing nuclear disarmament with Russia and other states of the former Soviet Union. He was in charge of DOE’s support to the U.N. Special Commission on Iraq, to the Nunn-Lugar Initiative, and represented DOE in discussions on the Comprehensive Test Ban (“CTB”) with the other nuclear weapons states before the CTB negotiations began in Geneva in 1994. Dr. Alessi served as the U.S. board member to the International Science and Technology Center in Moscow since its founding in 1992 until 2011, and as a member of the Board of Directors of Valley Forge Composite Technologies, Inc. from 2008 until 2013. He is also the former U.S. board member to the Science and Technology Center in Ukraine. Dr. Alessi is a 1963 graduate of Fordham University, where he also earned a licentiate in Philosophy (“Ph.L.”) in 1964. He studied nuclear physics at Georgetown University, receiving his M.S. in 1968 and Ph.D. in 1969.

|

|

Daniel B. Magraw

|

Mr. Magraw became a director of the Company on October 23, 2006. Mr. Magraw is a leading expert on international environmental law and policy, as well as on international human rights. Mr. Magraw is a Senior Fellow and Professorial Lecturer at the Foreign Policy Institute at Johns Hopkins School of Advanced International Studies and President Emeritus of the Center for International Environmental Law (“CIEL”). He is also a member of the Advisory Committee to the Law Library of Congress and serves as a consultant to the United Nations.

Mr. Magraw was the President and CEO of CIEL from 2002-2010. From 1992-2001, he was Director of the International Environmental Law Office of the U.S. Environmental Protection Agency, during which time he also served at the White House (2000-2001) and as Acting Assistant Administrator of the EPA’s Office of International Activities. He was a member of the Trade and Environment Policy Advisory Committee to the Office of the U.S. Trade Representative (“TEPAC”) from 2002-2010, chaired the American Bar Association (“ABA”) Section of International Law’s Task Force on Carta de Foresta, was a member of the U.S. Department of State Study Group on International Business Transactions, and was chair of the 15,000-member Section of International Law and Practice of the ABA. He practiced international law, constitutional law, and bankruptcy law at Covington & Burling in Washington, DC from 1978-1983.

Mr. Magraw is a widely published author in the field of international law and has received many awards. He graduated from Harvard University with High Honors in Economics, where he was student body president, and from the University of California, Berkeley Law School, where he was editor-in-chief of the law review.

While working as an economist for the Peace Corps in India from 1968 to 1972, Mr. Magraw helped develop and managed the largest and most successful cooperative of its type (wholesale, retail, furniture manufacturing, and food processing) in India. In 1996, Mr. Magraw became a member of the Board of Directors of Thorium Power, Inc., which is now a wholly-owned subsidiary of the Company.

|

|

Kathleen Kennedy Townsend

|

Ms. Townsend became a director of the Company in October 2013. Ms. Townsend has a long history of accomplishment in the public arena, and for the last decade in the private sector. She has been a Managing Director at the Rock Creek Group, an investment management company and is now Senior Advisor. Ms. Townsend is also the Director of Retirement Security, Retirement Security for All, and serves on the Board of Directors for the Pension Rights Center (a nonprofit consumer advocacy organization), CanAlaska Uranium Ltd. (TSX: CVV) (a Canadian uranium exploration company) Lakson Investments Ltd.

As the State of Maryland’s first woman Lt. Governor, Ms. Townsend was in charge of a multimillion-dollar budget and had oversight of major cabinet departments, including Economic Development and Transportation, State Police, Public Safety, and Correction and Juvenile Justice. Prior to being elected Lt. Governor, Ms. Townsend served as Deputy Assistant Attorney General of the United States. In that role, she led the planning to put 100,000 police officers into the community and began the Police Corps, a program to give college scholarships to young people who pledge to work as police officers for four years after graduation.

Prior to serving at the Department of Justice, Ms. Townsend spent seven years as the founder and director of the Maryland Student Service Alliance, where she led the fight to make Maryland the first-and only-state to make service a graduation requirement.

She has been appointed Special Advisor at the Department of State, and a Research Professor at the McCourt School of Public Policy at Georgetown University, where she focuses on retirement security. She is a Woodrow Wilson Fellow. She taught foreign policy at the University of Pennsylvania and the University of Maryland, Baltimore County and has been a visiting Fellow at the Kennedy School of Government at Harvard. In the mid-1980s, she founded the Robert F. Kennedy Human Rights Award.

She chaired the Center for Popular Democracy, which builds the strength and capacity of democratic organizations. Ms. Townsend is also a member of the Council of Foreign Relations and the Inter-American Dialogue. For the last eight years she has been Vice-Chair of the Future of Science conference held in Venice Italy and for the last four years Vice-Chair of Science for Peace held in Milan.

Ms. Townsend has chaired the Institute of Human Virology founded by Dr. Robert Gallo, which treats over 700,000 patients in Africa as part of the PEPFAR program, has chaired the Robert Kennedy Memorial and has been on the Board of Directors of the John F. Kennedy Library Foundation. Previously, she served on a number of boards including the Export-Import Bank, Johns Hopkins School of Advanced International Studies, the Wilderness Society, the Points of Light Foundation, the National Catholic Reporter and the Institute for Women’s Policy Research, and the Baltimore Urban League.

An honors graduate of Harvard University, Ms. Townsend received her law degree from the University of New Mexico, where she was a member of the law review. She has received fourteen honorary degrees. A member of the bar in Maryland, Connecticut, and Massachusetts, she is also a certified broker-dealer.

Ms. Townsend’s book, Failing America’s Faithful: How Today’s Churches Mixed God with Politics and Lost Their Way was published by Warner Books in March 2007.

|

|

Larry Goldman

|

Mr. Goldman, a certified public accountant, was appointed the Chief Financial Officer of the Company on September 1, 2018. Prior to his appointment, Mr. Goldman had been working with Lightbridge as a consultant since 2006 and served as our Chief Accounting Officer since 2015. From 1985 to 2004, Mr. Goldman was an Audit Assurance Partner for Livingston Wachtell & Co., LLP, a New York City CPA firm with over 20 years of assurance, tax and advisory services. Since September 2004, Mr. Goldman had also provided consulting services to numerous public companies on various financial projects and has government contracting accounting experience.

Mr. Goldman has an M.S. degree in Taxation from Pace University and Bachelor’s degree in Business Administration with a concentration in Accounting. Mr. Goldman is a member of the New York State Society of CPAs and the American Institute of Certified Public Accountants, where he had served on the SEC Practice Committee and a Management Consulting Committee. He has also been published in the New York CPA Journal.

|

|

Andrey Mushakov

|

Dr. Mushakov oversees the nuclear fuel technology division of Lightbridge Corporation and is an expert in cost modeling and the economics of the nuclear fuel cycle. He has been with Lightbridge since 2000, and in 2018 was named executive vice president for nuclear operations.

In 2009, Dr. Mushakov led Lightbridge’s efforts to establish its Russian Branch Office in Moscow and oversaw its successful operation from 2009 to 2014 when Lightbridge made a decision to move its critical path fuel development and demonstration activities out of Russia due to increased political risk. In 2014-2015, Dr. Mushakov spearheaded an effort within Lightbridge to establish cooperation agreements with Canadian Nuclear Laboratories in Canada, BWXT in the United States, and the Institute for Energy Technology in Norway. More recently, he oversaw a successful effort that resulted in a voucher award from the U.S. Department of Energy’s (DOE) Gateway for Accelerated Innovation in Nuclear (GAIN) program to support development of Lightbridge fuel in collaboration with Idaho National Laboratory (INL). The scope of the project includes experiment design for irradiation of Lightbridge metallic fuel material samples in the Advanced Test Reactor (ATR) at INL.

Dr. Mushakov has been a featured speaker at international conferences and panels on nuclear fuel technology, including the Wharton Energy Conference and the World Nuclear Fuel Cycle Conference.

He earned a Ph.D. in economics from St. Petersburg State University of Economics and Finance, an M.S. degree in management from Hult International Business School, and a B.S. degree in banking and finance from the Financial University under the Government of the Russian Federation.

|

Corporate Governance

Our current corporate governance practices and policies are designed to promote stockholder value. We are committed to the highest standards of corporate ethics and diligent compliance with financial accounting and reporting rules. Our Board provides independent leadership in the exercise of its responsibilities. Our management oversees a system of internal controls and compliance with corporate policies and applicable laws and regulations, and our employees operate in a climate of responsibility, candor, and integrity.

Corporate Governance Guidelines

We and our Board are committed to high standards of corporate governance as an important component in building and maintaining stockholder value. To this end, we regularly review our corporate governance policies and practices to ensure that they are consistent with the high standards of other companies. We also closely monitor guidance issued or proposed by the SEC, as well as the emerging best practices of other companies. The current corporate governance guidelines are available on the Company’s website www.ltbridge.com. Printed copies of our corporate governance guidelines may be obtained, without charge, by contacting the Corporate Secretary, Lightbridge Corporation, 11710 Plaza America Drive, Suite 2000, Reston, VA 20190 USA.

The Board and Committees of the Board

The Company is governed by the Board that currently consists of five members: Seth Grae, Thomas Graham, Victor Alessi, Kathleen Kennedy Townsend and Daniel Magraw. The Board has established four Committees: the Audit Committee, the Compensation Committee, the Governance and Nominating Committee and the Executive Committee. Each of the Audit Committee, Compensation Committee and Governance and Nominating Committee are comprised entirely of independent directors. From time to time, the Board may establish other committees. The Board met four times in 2019. The Board has adopted a written charter for each of its committees which are available on the Company’s website www.ltbridge.com. Printed copies of these charters may be obtained, without charge, by contacting the Corporate Secretary, Lightbridge Corporation, 11710 Plaza America Drive, Suite 2000, Reston, VA 20190 USA. Each director attended at least 75% of all meetings of the Board of Directors and each committee on which he or she served during 2019. Pursuant to the Company’s corporate governance guidelines, directors are encouraged to attend the annual meeting of stockholders, and two directors attended the Company’s 2019 annual meeting.

Governance Structure

The Company has chosen to separate the roles of the Chairman of the Board and the Chief Executive Officer. We have chosen to implement such a governance structure to allow our Chief Executive Officer the ability to focus the majority of his time and efforts on the day-to-day operations of the Company. We believe that this governance structure has served the Company’s stockholders well over the years.

We encourage our stockholders to learn more about our Company’s governance practices at our website, www.ltbridge.com.

The Board’s Role in Risk Oversight

The Board oversees that the assets of the Company are properly safeguarded, that the appropriate financial and other controls are maintained, and that the Company’s business is conducted wisely and in compliance with applicable laws and regulations and proper governance. Included in these responsibilities is the Board’s oversight of the various risks facing the Company. In this regard, the Board seeks to understand and oversee critical business risks. The Board does not view risk in isolation. Risks are considered in virtually every business decision and as part of the Company’s business strategy. The Board recognizes that it is neither possible nor prudent to eliminate all risk. Indeed, purposeful and appropriate risk-taking is essential for the Company to be competitive on a global basis and to achieve its objectives.

While the Board oversees risk management, Company management is charged with managing risk. The Company has robust internal processes and a strong internal control environment to identify and manage risks and to communicate with the Board. The Board and the Audit Committee monitor and evaluate the effectiveness of the internal controls and the risk management program at least annually. Management communicates routinely with the Board, Board committees and individual directors on the significant risks identified and how they are being managed. Directors are free to, and indeed often do, communicate directly with senior management.

The Board implements its risk oversight function both as a whole and through committees. Much of the work is delegated to various committees, which meet regularly and report back to the full Board. All committees play significant roles in carrying out the risk oversight function. In particular:

|

|

·

|

The Audit Committee oversees risks related to the Company’s financial statements, the financial reporting process, accounting and legal matters. The Audit Committee oversees the internal audit function and the Company’s ethics programs, including the Code of Business Conduct and Ethics. The Audit Committee members meet separately with representatives of the independent auditing firm.

|

|

|

|

|

|

|

·

|

The Compensation Committee evaluates the risks and rewards associated with the Company’s compensation philosophy and programs. The Compensation Committee reviews and approves compensation programs with features that mitigate risk without diminishing the incentive nature of the compensation. Management discusses with the Compensation Committee the procedures that have been put in place to identify and mitigate potential risks in compensation.

|

Independent Directors

In considering and making decisions as to the independence of each of the directors of the Company, the Board considered transactions and relationships between the Company (and its subsidiaries) and each director (and each member of such director’s immediate family and any entity with which the director or family member has an affiliation such that the director or family member may have a material indirect interest in a transaction or relationship with such entity). The Board has determined that Mr. Alessi, Mr. Magraw and Ms. Townsend are independent as defined in applicable SEC and Nasdaq rules and regulations, and that each constitutes an “Independent Director” as defined in Nasdaq Listing Rule 5605. Such members constitute a majority of the entire Board.

Audit Committee

Our Audit Committee consists of Mr. Alessi, Mr. Magraw and Ms. Townsend, each of whom is “independent” as that term is defined under the Nasdaq listing standards. The Audit Committee oversees our accounting and financial reporting processes and the audits of the financial statements of the Company. Ms. Townsend is chair of the Audit Committee and a financial expert as that term is defined by the applicable SEC rules. The Audit Committee is responsible for, among other things:

|

|

·

|

selecting our independent auditors and pre-approving all auditing and non-auditing services permitted to be performed by our independent auditors;

|

|

|

|

|

|

|

·

|

reviewing with our independent auditors any audit problems or difficulties and management’s response;

|

|

|

|

|

|

|

·

|

reviewing and approving all proposed related-party transactions, as defined in Item 404 of Regulation S- K under the Securities Act of 1933, as amended;

|

|

|

|

|

|

|

·

|

discussing the annual audited financial statements with management and our independent auditors;

|

|

|

|

|

|

|

·

|

reviewing major issues as to the adequacy of our internal controls and any special audit steps adopted in light of significant internal control deficiencies;

|

|

|

|

|

|

|

·

|

annually reviewing and reassessing the adequacy of our Audit Committee charter;

|

|

|

|

|

|

|

·

|

meeting separately and periodically with management and our internal and independent auditors;

|

|

|

|

|

|

|

·

|

reporting regularly to the full Board; and

|

|

|

|

|

|

|

·

|

such other matters that are specifically delegated to our Audit Committee by our Board from time to time.

|

The Audit Committee met four times during 2019.

Compensation Committee

Our Compensation Committee consists of Mr. Alessi, Mr. Magraw and Ms. Townsend, each of whom is “independent” as that term is defined under the Nasdaq listing standards. Our Compensation Committee assists the Board in reviewing and approving the compensation structure of our directors and executive officers, including all forms of compensation to be provided to our directors and executive officers. The Compensation Committee is responsible for, among other things:

|

|

·

|

approving and overseeing the compensation package for our executive officers;

|

|

|

|

|

|

|

·

|

reviewing and making recommendations to the Board with respect to the compensation of our directors;

|

|

|

|

|

|

|

·

|

reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer, evaluating the performance of our Chief Executive Officer in light of those goals and objectives, and setting the compensation level of our Chief Executive Officer based on this evaluation; and

|

|

|

|

|

|

|

·

|

reviewing periodically and making recommendations to the Board regarding any long-term incentive compensation or equity plans, programs or similar arrangements, annual bonuses, employee pension and welfare benefit plans.

|

Under its charter, the Compensation Committee has sole authority to retain and terminate outside counsel, compensation consultants retained to assist the Compensation Committee in determining the compensation of the Chief Executive Officer or senior executive officers, or other experts or consultants, as it deems appropriate, including sole authority to approve the firms’ fees and other retention terms. The Compensation Committee may also form and delegate authority to subcommittees and may delegate authority to one or more designated members of the Compensation Committee. The Compensation Committee may from time to time seek recommendations from the executive officers of the Company regarding matters under the purview of the Compensation Committee, though the authority to act on such recommendations rests solely with the Compensation Committee.

The Compensation Committee met five times during 2019.

Governance and Nominating Committee

Our Governance and Nominating Committee consists of Mr. Alessi, Mr. Magraw and Ms. Townsend, each of whom is “independent” as that term is defined under the Nasdaq listing standards. The Governance and Nominating Committee assists the Board of Directors in identifying individuals qualified to become our directors and in determining the composition of the Board and its committees. The Governance and Nominating Committee is responsible for, among other things:

|

|

·

|

identifying and recommending to the Board nominees for election or re-election to the Board, or for appointment to fill any vacancy;

|

|

|

|

|

|

|

·

|

reviewing annually with the Board the current composition of the Board in light of the characteristics of independence, age, skills, experience and availability of service to us;

|

|

|

|

|

|

|

·

|

identifying and recommending to the Board the directors to serve as members of the Board’s committees; and

|

|

|

|

|

|

|

·

|

monitoring compliance with our Code of Business Conduct and Ethics.

|

Our Governance and Nominating Committee does not have a specific policy with regard to the consideration of candidates recommended by stockholders; however any nominees proposed by our stockholders will be considered on the same basis as nominees proposed by the Board. If you or another stockholder want to submit a candidate for consideration to the Board, you may submit your proposal to our Corporate Secretary:

|

|

·

|

by sending a written request by mail to:

|

Lightbridge Corporation

11710 Plaza America Drive, Suite 2000

Reston, VA 20190

Attention: Corporate Secretary

|

|

·

|

by calling our Corporate Secretary at 571-730-1200.

|

The Governance and Nominating Committee met four times during 2019.

Executive Committee

Our Executive Committee consists of Messrs. Alessi, Grae and Graham. The Executive Committee of the Company exercises the power of the Board between regular meetings of the Board and when timing is critical. The Executive Committee also assists the Board in fulfilling its oversight responsibility with respect to management-level staff, outside service providers, third-party vendors and sensitive information potentially subject to export controls.

Code of Ethics

The Board has adopted a Code of Business Conduct and Ethics that applies to the Company’s directors, officers and employees. A copy of this policy is available via our website at http://ir.ltbridge.com/corporate-governance.cfm. Printed copies of our Code of Business Conduct and Ethics may be obtained, without charge, by contacting the Corporate Secretary, Lightbridge Corporation, 11710 Plaza America Drive, Suite 2000, Reston, VA 20190 USA. During the fiscal year ended December 31, 2019, there were no waivers of our Code of Business Conduct and Ethics.

Stockholder Communication with the Board of Directors

Stockholders may communicate with the Board, including non-management directors, by sending a letter to our Board, c/o Corporate Secretary, Lightbridge Corporation, 11710 Plaza America Drive, Suite 2000, Reston, VA 20190 USA, for submission to the Board or committee or to any specific director to whom the correspondence is directed. Stockholders communicating through this means should include with the correspondence evidence, such as documentation from a brokerage firm, that the sender is a current record or beneficial stockholder of the Company. All communications received as set forth above will be opened by the Corporate Secretary or his designee for the sole purpose of determining whether the contents contain a message to one or more of our directors. Any contents that are not advertising materials, promotions of a product or service, patently offensive materials or matters deemed, using reasonable judgment, inappropriate for the Board will be forwarded promptly to the chairman of the Board, the appropriate committee, or the specific director, as applicable.

Item 11. Executive Compensation

Compensation Discussion and Analysis

In this section, we discuss our compensation philosophy and describe the compensation program for our senior executives. We also explain how the Compensation Committee determines compensation for our senior executives and its rationale for specific 2019 decisions. In addition, we discuss numerous changes the Committee has made to our program over the past several years to advance its fundamental objective: aligning our executive compensation with the long-term interests of our stockholders.

The Compensation Discussion and Analysis describes the compensation of the following named executive officers (“NEOs”):

|

Name

|

|

Title

|

|

Seth Grae

|

|

President, Chief Executive Officer, and Director

|

|

Andrey Mushakov

|

|

Executive Vice President, Nuclear Operations

|

|

Larry Goldman

|

|

Chief Financial Officer

|

Executive Summary

Our executive compensation program is designed to attract and retain qualified management personnel, to align our management’s interests with that of our stockholders, and to reward exceptional organizational and individual performance. Performance of our executives is evaluated based on financial and non-financial goals that balance achievement of short-terms goals related to the continued development of the Company’s fuel technology and business and long-term goals that seek to maximize stockholder value.

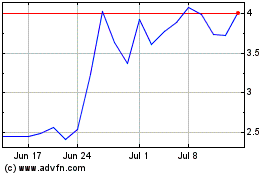

2019 Say-on-Pay Results and 2020 Compensation Changes

At our 2019 annual meeting of stockholders, our advisory vote on executive compensation (the “say-on-pay vote”) received approval from 56.4% of the votes cast at the meeting, which was lower than the prior year’s 66.1% approval. The Compensation Committee was very concerned with this low level of stockholder support for our executive pay programs. While we have maintained a pay for performance philosophy in the past (more variable than fixed pay, annual incentives based on achievement of specific objectives, the use of appreciation-based stock options, etc.), the Committee felt it was critical to reach out directly to stockholders in order to understand the basis for the low say-on-pay support. As such, we met with stockholders and constituents to discuss executive compensation, corporate governance, and related matters. As part of this process, we contacted all of our shareholders that held greater than 10,000 shares of our stock, accounting for approximately 18% of our shares outstanding. The tables below summarize what we heard, and the actions taken by the Company in response.

|

What We Heard During Our Stockholder Outreach

|

|

•

|

Stockholders were generally satisfied with the actions of management and the direction of the Company; however, they were disappointed by the decline in our stock price over the course of fiscal 2019 and reflected that disappointment in the say-on-pay vote.

|

|

•

|

Lightbridge executives and employees should own more shares of the Company’s common stock to align their interests better with the interests of stockholders.

|

|

•

|

Stockholders stressed the importance of pay-for-performance alignment and the need to further increase the rigor of the targets used within the program.

|

|

•

|

Stockholders understood the Compensation Committee’s rationale for 2019 compensation decisions, appreciated the expanded compensation disclosure in our 2019 proxy statement and were generally supportive of our compensation programs and overall design.

|

|

What We Did in Response to What We Heard

|

|

As part of our Board of Directors’ commitment to engagement with our stockholders, we evaluate and respond to the views voiced by our stockholders on a regular basis. This dialogue with our stockholders has led to the reaffirmation of, or enhancements to, certain of our corporate governance and executive compensation practices, which our Board believes are in the best interest of our Company and our stockholders, including:

|

|

|

•

|

Strengthen Pay and Performance Alignment: The Compensation Committee plans to adopt strategic milestone goals intended to align executives with long-term shareholder value creation in early 2020 and use those goals to determine 2020 annual incentive awards at the end of the year.

|

|

|

•

|

Encourage Executive and Employee Stock Ownership: In early 2020, the Board adopted the Lightbridge Corporation Employee Stock Purchase Plan (the “ESPP”). The ESPP facilitates executive and employee ownership of Lightbridge stock by permitting all Lightbridge employees to purchase shares through payroll deductions. The Board expects all of our named executives to participate in the ESPP, and all of the ESPP shares will be acquired on the open market.

|

|

|

•

|

Highlighting Pay and Performance Relationship: In 2019, we added disclosure to our proxy statement regarding the realizable value of equity compensation granted to our CEO (see below), in light of the difference between the amount reported in the total compensation column of the Summary Compensation Table and the value actually realized by our CEO. We continue to provide this disclosure in this Amendment to more clearly illustrate the alignment of CEO pay outcomes and shareholder value.

|

|

|

•

|

Maintained Stockholder Aligned LTI Program: The Company continued with stock option grants as our sole form of long-term incentives in 2019. Stock options provide no value to employees unless Lightbridge’s share price increases from the share price on the date of grant. The Company significantly reduced the grant-date value of stock options provided to the CEO and other NEOs in 2019 given the challenging operating environment, share price performance, and limited share pool.

|

|

|

•

|

Continued Outreach to Stockholders: Continuing to refine our stockholder engagement process to connect with our stockholders.

|

2019 Accomplishments

The Company achieved significant strategic goals during 2019 including, without limitation:

|

|

·

|

Awarded a voucher from the U.S. Department of Energy’s (DOE) Gateway for Accelerated Innovation in Nuclear (GAIN) program to support development of Lightbridge Fuel™ in collaboration with Idaho National Laboratory (INL). The scope of the project includes experiment design for irradiation of Lightbridge metallic fuel material samples in the Advanced Test Reactor at INL. The project is anticipated to commence in the first half of 2020. The total project value is approximately $846,000, with three-quarters of this amount funded by DOE for the scope performed by INL.

|

|

|

|

|

|

|

·

|

Demonstrated co-extrusion manufacturing process using surrogate materials to full commercial length for large light water reactors (12-ft long), as well as for small modular reactors (6-ft long). The surrogate materials were designed to simulate the flow stresses, temperatures and extrusion pressures expected in the manufacture of the Lightbridge Fuel™ rods utilizing a uranium-zirconium alloy.

|

|

|

|

|

|

|

·

|

Expanded our patent portfolio by successfully obtaining 20 new patents in 2019 and as of our 10-K filing an additional 12 patents in the United States and other key countries. The new patents will help safeguard the Company’s intellectual property, which is an integral element of the Company’s plans to monetize Lightbridge Fuel™.

|

Philosophy of Our Compensation Program

Our compensation program is centered around a philosophy that focuses on management retention, alignment of interests between management and stockholders, and pay for performance. We believe this philosophy allows us to compensate our NEOs competitively, while simultaneously ensuring continued development and achievement of key business strategy goals. The Compensation Committee firmly believes that our pay-for-performance philosophy should recognize both short- and long-term performance and should include both cash and equity compensation arrangements that are supported by strong corporate governance, including active and effective oversight by the Compensation Committee.

To that end, we have implemented the following policies and practices:

|

|

·

|

Significant “At-Risk” Compensation. A significant portion of NEO target compensation is granted in equity (i.e. stock options) and is “at-risk”. As such, 50% of CEO target compensation in 2019 was performance based.

|

|

|

|

|

|

|

·

|

Short-Term Incentive Compensation. The short-term incentive compensation component of our compensation program includes an annual bonus, payable in cash and/or equity awards, upon the achievement of specific planned performance goals. Such bonus serves as a vehicle for incentivizing and motivating our employees towards achieving annual strategic performance objectives. Given the challenging operating environment in 2019, actual bonus payout for the CEO was 64% lower than the amount of the 2018 actual bonus.

|

|

|

·

|

Long-Term Incentive Compensation. The long-term incentive compensation component of our compensation program consists of stock options that vest over multiple years. This is a vehicle for long-term retention of NEOs that aligns their long-term incentive compensation with stock performance. Given the challenging operating environment in 2019, the grant-date value of the CEO and other NEOs’ stock option grants was 82% lower than the grant-date values provided in 2018.

|

|

|

|

|

|

|

·

|

Fixed Compensation. The fixed compensation elements of our compensation program include a base salary and retirement, health, life, and disability insurance benefits.

|

|

|

|

|

|

|

·

|

No Perquisites. We do not provide any perquisites, whether cash or otherwise, to our NEOs.

|

Pay for Performance and Realizable Compensation

One way to demonstrate our pay-for-performance alignment is to review “realizable pay,” which is an updated valuation of the compensation that could be realized by our executives, as compared to the value of compensation awarded as reported in our Summary Compensation Table, which immediately follows this Compensation Discussion and Analysis. Because a significant amount of our executive compensation includes long-term equity incentive compensation, the amount of compensation that an executive can “realize” based on prior awards fluctuates over time based on our stock price.

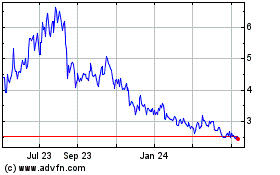

The accompanying compensation chart illustrates the 5-year aggregate realizable pay for Mr. Grae, our Chief Executive Officer, valued at the end of 2019, in contrast to the five-year aggregate total direct compensation amount reflected under the reporting requirements for the Summary Compensation Table. The value of equity awards included in the Summary Compensation Table is based on the grant date fair value of such awards, which is highly dependent on the price and volatility of our common stock at the time of grant. The equity awards made to Mr. Grae in prior years were therefore valued highly, in relative terms, at the time of grant for purposes of the Summary Compensation Table. Recent declines in our stock price, however, led to actual and “realizable” compensation for Mr. Grae that is 37% lower than the amounts shown in the Summary Compensation Table and long-term incentive realizable value that is 99% lower than the grant-date fair value over the aggregate 2015-2019 period. We believe the chart below provides a useful supplemental perspective to assist our stockholders in understanding our executive compensation program, as it demonstrates how the value of compensation realizable by our CEO is tied to the performance of the Company.

Summary Compensation Table compensation consists of (i) actual base salary; (ii) actual bonus received; and (iii) the fair value of all long-term incentive awards on the date of grant, calculated in accordance with the reporting requirements for the Summary Compensation Table. Realizable pay consists of (i) actual base salary; (ii) actual bonus received; and (iii) the in-the-money portion of long-term incentive awards granted in each year from 2015 to 2019 valued on December 31, 2019.

Objectives of Our Compensation Plan

The Compensation Committee has outlined the following objectives for compensation of our NEOs and considers such objectives in making compensation decisions:

|

Objective

|

|

Description

|

|

Attraction and Retention

|

|

We provide competitive compensation to our NEOs and tie a significant portion of compensation to time-based vesting requirements, helping to ensure that we can continue to attract key management personnel and retain such personnel.

|

|

Pay for Performance

|

|

A significant portion of each NEO’s compensation is “at-risk” or variable, based on our performance and stock price.

|

|

Pay Mix

|

|

We use a variety of fixed-pay and incentive compensation forms, including cash, stock and options.

|

|

Competitive Packages

|

|

We evaluate our compensation program in an effort to provide a competitive compensation package to each NEO that takes into account their responsibilities, performance and organization.

|

How Executive Compensation is Determined

Role of the Compensation Committee

The Compensation Committee of the Board oversees the Company’s executive compensation programs. Additionally, the Compensation Committee is charged with the review and approval of all annual compensation decisions relating to the NEOs and the Company’s other officers.

The Compensation Committee is composed entirely of independent, non-management members of the Board. Each member of the Compensation Committee is both a “non-employee director” within the meaning of Rule 16b-3 of the Exchange Act, and an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code. No Compensation Committee member participates in any of the Company’s employee compensation programs. Each year the Company reviews any and all relationships that each director has with the Company, and the Board of Directors subsequently reviews these findings. The responsibilities of the Compensation Committee, as stated in its charter, include the following:

|

|

·

|

review and make such recommendations to the Board of Directors as the Compensation Committee deems advisable with regard to all incentive-based compensation plans and equity-based plans;

|

|

|

|

|

|

|

·

|

review and approve the corporate goals and objectives that may be relevant to the compensation of the Company’s NEOs;

|

|

|

|

|

|

|

·

|

evaluate the performance of the NEOs in light of the goals and objectives that were set and determine and approve the compensation of the NEOs based on such evaluation; and

|

|

|

|

|

|

|

·

|

review and approve the recommendations of the CEO with regard to the compensation of all officers of the Company other than the CEO.

|

Role of Compensation Consultant

Pursuant to its charter, the Compensation Committee is authorized to engage, retain and terminate any consultant, as well as approve the consultant’s fees, scope of work and other terms of retention. For both 2018 and 2019, the Committee retained Pay Governance LLC as its independent advisor. Pay Governance advises and consults with the Committee on compensation issues and the composition of the Company’s peer group, and keeps the Committee apprised of competitive practices related to executive compensation. Pay Governance assisted the Committee in the design, structure and implementation of the current annual executive compensation program, and, at the direction of the Committee, compensation levels, trends and practices. Pay Governance does not determine the exact amount or form of executive compensation for any executive officers. Pay Governance reports directly to the Committee, and a representative of Pay Governance, when requested, attends meetings of the Committee, is available to participate in executive sessions and communicates directly with the Committee Chair or its members outside of meetings. Pay Governance does no other work for the Company.

Role of Management

The Compensation Committee considers input from the CEO when making executive compensation decisions for the other officers and employees of the Company. The CEO’s input is useful because the CEO reviews and observes the performance of the officers and employees at the Company. The Compensation Committee and Board of Directors approve the compensation of the CEO.

Performance Goals

The Compensation Committee believes that a significant portion of each NEO’s compensation should be tied to the Company’s performance. The Company measures performance based on certain operational and financial objectives as described on page 17 (e.g., regulatory licensing, expansion of patent portfolio, and additional capital raises). Performance goals have changed from time to time and will continue to change as the condition of the Company and its fuel technology evolve.

Peer Group Analysis

The Company has historically evaluated its compensation program against the programs at other companies in order to ensure its compensation program is competitive. With the assistance of Pay Governance, the peer companies were reviewed and updated in 2019 based on (i) revenue scope within a reasonable range, (ii) market capitalization within a reasonable range of the Company’s market capitalization, (iii) R&D expenditure within a reasonable range of the Company’s R&D expenditure, and (iv) companies focused on nuclear, energy, or renewable energy technologies and services. The peer group used for 2019 compensation purposes consisted of:

|

|

•

|

Altimmune, Inc.

|

|

•

|

Arrowhead Pharmaceuticals, Inc.

|

|

|

•

|

Ecology & Environment, Inc.

|

|

•

|

Gevo, Inc.

|

|

|

•

|

GSE Systems, Inc.

|

|

•

|

Maxwell Technologies, Inc.

|

|

|

•

|

Perma-Fix Environmental Services, Inc.

|

|

•

|

Research Frontiers Incorporated

|

|

|

•

|

Spherix Incorporated

|

|

•

|

Superconductor Technologies Inc.

|

|

|

•

|

TRC Companies

|

|

•

|

US Ecology, Inc.

|

In December 2019, the Compensation Committee adopted a revised peer group of companies with the assistance of Pay Governance for purposes of establishing 2020 compensation. In particular, two companies included in the 2019 peer group were acquired, and Pay Governance recommended the removal of four other companies based on their significantly different scopes and differences in business models or commercial maturity relative to Lightbridge. The 2020 peer group consists of the following companies:

|

|

•

|

Aemetis, Inc.

|

|

•

|

Altimmune, Inc.

|

|

|

•

|

American Superconductor Corporation

|

|

•

|

Capstone Turbine Corporation

|

|

|

•

|

Centrus Energy Corp.

|

|

•

|

CVD Equipment Corporation

|

|

|

•

|

Envision Solar International, Inc.

|

|

•

|

Gevo, Inc.

|

|

|

•

|

GSE Systems, Inc.

|

|

•

|

NVE Corporation

|

|

|

•

|

Ocean Power Technologies, Inc.

|

|

•

|

Perma-Fix Environmental Services

|

|

|

•

|

Research Frontiers Incorporated

|

|

•

|

Superconductor Technologies Inc.

|

|

|

•

|

Uranium Energy Corp.

|

|

•

|

Westwater Resources, Inc.

|

The Company traditionally targeted all elements of its compensation programs to provide a competitive compensation opportunity at the median range of companies whose compensation is used in our peer group.

Executive Compensation Elements

Overview and Compensation Mix

The following table illustrates the principal elements of the Company’s executive compensation program, each of which is evaluated and updated on an annual basis by the Compensation Committee:

|

Pay Element

|

|

Characteristics

|

|

Primary Objective

|

|

Base Salary

|

|

Annual fixed cash compensation

|

|

Attract and retain qualified and high performing executives.

|

|

Short-Term Compensation

|

|

Annual performance-based bonus payable in cash or equity awards

|

|

Incentivize our NEOs to achieve short-term goals

|

|

Long-Term Compensation

|

|

Incentive stock options

|

|

Retain our NEOs and align their interests with the interests of our stockholders

|

Target Compensation Mix for CEO and other Named Executive Officers

Half of all target compensation for the CEO and other NEOs is performance based.

In addition to the above-mentioned elements, the Company also provides a retirement, health and welfare benefit component to the executive compensation program.

The 2019 and 2020 compensation mix for the Company’s NEOs demonstrates the Company’s philosophy regarding significant long term and performance-based compensation. The following is a summary of the components of the compensation policy for the Company’s NEOs.

Fixed Compensation

Base Salary. The Compensation Committee establishes base salaries for our executives based on the scope of their responsibilities and takes into account competitive market compensation paid by comparable companies. The Company believes that a competitive compensation program will enhance its ability to attract and retain senior executives. In each case, the Compensation Committee takes into account each officer’s (i) current and prior compensation, (ii) scope of responsibilities, (iii) experience, (iv) comparable market salaries and (v) the Company’s achievement of performance goals (both financial and non-financial). The Compensation Committee also (i) has the opportunity to meet with the officers at various times during the year, which allows the Compensation Committee to form its own assessment of each individual’s performance and (ii) reviews reports of the CEO presented to the Compensation Committee, evaluating each of the other officers, including a review of their contributions and performance over the past year, strengths, weaknesses, development plans and succession potential.

In December 2019, after taking into account the above-mentioned factors, historical base salaries, the performance of the NEOs and the Company’s need to preserve capital, the Compensation Committee approved a 3% increase in the base salaries of Mr. Grae, Dr. Mushakov and Mr. Goldman, as follows:

|

Name and Title

|

|

2018

Base

Salary

|

|

|

2019

Base

Salary

|

|

|

2018 to

2019

Increase

|

|

|

2020

Base

Salary

|

|

|

2019 to

2020

Increase

|

|

|

Seth Grae, President and CEO

|

|

$

|

460,416

|

|

|

$

|

473,046

|

|

|

|

2.7

|

%

|

|

$

|

487,237

|

|

|

|

3.0

|

%

|

|

Andrey Mushakov, EVP, Nuclear Operations

|

|

$

|

287,159

|

|

|

$

|

295,036

|

|

|

|

2.7

|

%

|

|

$

|

303,887

|

|

|

|

3.0

|

%

|

|

Larry Goldman, CFO

|

|

$

|

219,129

|

|

|

$

|

272,950

|

|

|

|

24.6

|

%

|

|

$

|

281,139

|

|

|

|

3.0

|

%

|

For more information about the 2019 base salaries for each of our NEOs, please see the 2019 Summary Compensation Table below.

Retirement, Health, Life, and Disability Insurance Benefits

The Company offers a variety of health and other insurance and retirement programs to all eligible employees. The NEOs generally are eligible for the same benefit programs on the same basis as the rest of the Company’s employees. The Company’s health insurance programs include medical, dental, and vision coverage. In addition to the foregoing, the NEOs are eligible to participate in a defined contribution profit sharing plan (the “401(k)”) that is administered by a committee of trustees appointed by the Company. Substantially all employees are eligible to participate in the 401(k) plan. In 2019, the Company made 100% matching contributions for all full-time employees with immediate vesting.

Perquisites

We do not provide any perquisites, whether cash or otherwise, to our NEOs. We feel that our executive compensation program, particularly given the Company’s capital needs, provides our NEOs with competitive compensation such that we do not need to provide any perquisites to achieve the goals of our executive compensation program.

Short-Term Incentive Compensation

The Compensation Committee has established a short-term incentive (STI) program pursuant to which each of the NEOs could earn a cash or stock-based bonus on the achievement of individualized or Company-wide performance expectations. The target value of the award was established at 50% of base salary in the case of each of Mr. Grae, Dr. Mushakov and Mr. Goldman.

The Compensation Committee annually determines the actual payout of short-term incentive awards based on pre-determined performance goals and their subjective performance of Lightbridge and each individual’s contribution to the Company’s development milestones as described on page 17 (e.g., regulatory licensing, expansion of patent portfolio, and additional capital raises).

Lightbridge’s Compensation Committee approved the annual incentive payments to Lightbridge’s NEOs as described in the bonus column of the Summary Compensation Table based on the milestones summarized above and the Committee’s assessment of each individual executive’s contribution to Lightbridge’s operational progress in 2019. Lightbridge’s 2019 bonus payouts for the CEO and other NEOs were significantly below target bonus amounts or 2018 actual bonus payouts based on the challenging operating environment for the Company during the year.

|

Name and Title

|

|

2018

Actual Cash

Bonus

|

|

|

2019

Target Bonus

(50% of Salary)

|

|

|

2019 Actual Cash Bonus

($ Value)

|

|

|

2019 Actual Cash Bonus

(% of Target)

|

|

|

Year-Over

Year Change

(2018-2019)

|

|

|

Seth Grae, President and CEO

|

|

$

|

401,859

|

|

|

$

|

236,523

|

|

|

$

|

146,171

|

|

|

|

61.8

|

%

|

|

|

-63.6%

|

|

|

Andrey Mushakov, EVP, Nuclear Operations

|

|

$

|

250,638

|

|

|

$

|

147,518

|

|

|

$

|

91,166

|

|

|

|

61.8

|

%

|

|

|

-63.6%

|

|

|

Larry Goldman, CFO

|

|

$

|

165,625

|

|

|

$

|

136,475

|

|

|

$

|

84,342

|

|

|

|

61.8

|

%

|

|

|

-49.1%

|

|

Long-Term Incentive Compensation

Lightbridge delivers long-term incentives to NEOs exclusively through stock option awards granted each year. Stock options align the financial interests of our executives with Lightbridge’s stockholders because executives only realize value on stock options when Lightbridge’s share price appreciates. Stock option grants in 2019 were significantly below target stock option grants for 2019 or actual grants provided in 2018 given the very challenging operating environment for the Company.

|

Name and Title

|

|

2018 Option

Grant Date

Value

|

|

|

2019 Option Grant Date Value

(50% of Salary)

|

|

|

2019 Actual

Option Grant

Date Value

|

|

|

2019 Option

Grant Date Value

(% of Target)

|

|

|

Year-Over

Year Change

(2018-2019)

|

|

|

Seth Grae, President and CEO

|

|

$

|

235,235

|

|

|

$

|

236,523

|

|

|

$

|

41,770

|

|

|

|

17.7

|

%

|

|

|

-82.3%

|

|

|

Andrey Mushakov, EVP, Nuclear Operations

|

|

$

|

146,715

|

|

|

$

|

147,518

|

|

|

$

|

26,051

|

|

|

|

17.7

|

%

|

|

|

-82.3%

|

|

|

Larry Goldman, CFO

|

|

$

|

135,732

|

|

|

$

|

136,475

|

|

|

$

|

24,103

|

|

|

|

17.7

|

%

|

|

|

-82.3%

|

|

For 2020, Lightbridge is reporting 5-year realizable pay for the CEO on page 16 of the Compensation Discussion and Analysis, which illustrates that the stock option awards granted to the CEO in the past five years currently have very limited realizable value. The outstanding stock options continue to provide potential for financial gains for executives if Lightbridge’s share price appreciates, and thus significant motivation to move Lightbridge’s operations towards commercial success.

Employment Agreements

On August 8, 2018, the Company entered into employment agreements with each of Mr. Grae, Dr. Mushakov and Mr. Goldman, which in the case of Mr. Grae and Dr. Mushakov replaced employment agreements entered into during 2006, and which in the case of Mr. Goldman became effective September 1, 2018. The employment agreements provide for an initial annual base salary of $459,268, $286,443 and $265,000 for each of Mr. Grae, Dr. Mushakov and Mr. Goldman, respectively, and establish a target annual bonus of 50% of base salary for each executive with the amount of any such bonus to be determined by the Compensation Committee on the achievement of performance goals that are established by the Compensation Committee. In addition, each of Mr. Grae, Dr. Mushakov and Mr. Goldman is eligible to earn an annual long-term incentive award, subject to the Compensation Committee’s discretion to grant such awards, based upon a target award opportunity equal to 50% of base salary, and subject to attainment of such goals, criteria or targets established by the Compensation Committee in respect of each such calendar year.

Each employment agreement provides that if the executive’s employment is terminated or not extended by the Company without “cause,” or terminated by the executive for “good reason” (each as defined in the employment agreement), then, subject to the terms and conditions of the employment agreement, the executive will be entitled to certain severance payments and benefits. In the case of Mr. Grae, the employment agreement provides for payments equal to two times Mr. Grae’s base salary and target bonus for the calendar year in which the termination occurs, payable over 12 months, plus an amount equal to the prorated target bonus for the current year, payable in a lump sum. However, if such termination occurs upon or within 24 months of a “change of control” (as defined in the employment agreement), Mr. Grae will receive a lump sum payment equal to three times his base salary and target bonus for the calendar year in which the termination occurs, plus an amount equal to the prorated target bonus for the current year, and all of Mr. Grae’s equity awards will immediately fully vest, with any outstanding performance-based equity awards becoming fully vested based on the target level of performance. In the case of Dr. Mushakov and Mr. Goldman, the employment agreements provide for payments equal to the executive’s base salary and target bonus for the calendar year in which the termination occurs, payable over 12 months, plus an amount equal to the prorated target bonus for the current year, payable in a lump sum. However, if such termination occurs upon or within 24 months of a “change of control,” each of Dr. Mushakov and Mr. Goldman will receive a lump sum payment equal to two times his base salary and target bonus for the calendar year in which the termination occurs, plus an amount equal to the prorated target bonus for the current year, and all of the executive’s equity awards will immediately fully vest, with any outstanding performance based equity awards becoming fully vested based on the target level of performance.

Each employment agreement has an initial five-year term and will automatically be extended for additional one-year terms upon the expiration of the initial term unless either party provides notice of non-renewal to the other. The employment agreements provide standard benefits and contain routine confidentiality, non-competition, non-solicitation and non-disparagement provisions.

Tax Considerations

The Compensation Committee considers the anticipated tax treatment to the Company when determining executive compensation and routinely seeks to structure its executive compensation program in a way that preserves the deductibility of compensation payments and benefits. It should be noted, however, that there are many factors which are considered by the Compensation Committee in determining executive compensation and, similarly, there are many factors that may affect the deductibility of executive compensation. In order to maintain the flexibility to be able to compensate NEOs in a manner designed to promote varying corporate goals, the Compensation Committee has not adopted a strict policy that all executive compensation must be deductible.

Report of the Compensation Committee

The Compensation Committee has reviewed and discussed the foregoing Compensation Discussion and Analysis with management, and based on review and discussions, the Compensation Committee recommended to the Board the Compensation Discussion and Analysis be included in this Amendment.

Members of the Compensation Committee:

Victor E. Alessi

Daniel B. Magraw

Kathleen Kennedy Townsend

2019 Summary Compensation Table

The following table sets forth information concerning all cash and non-cash compensation awarded to, earned by or paid to our NEOs for services rendered in all capacities during the noted periods.

|

Name

|

|

Year

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Option

Awards

($)(1)

|

|

|

All Other

Compensation

($)(2)

|

|

|

Total

($)

|

|

|

Seth Grae

|

|

2019

|

|

|

475,411

|

|

|

|

146,171

|

|

|

|

41,770

|

|

|

|

25,000

|

|

|

|

688,352

|

|

|

CEO, President and Director

|

|

2018

|

|

|

460,416

|

|

|

|

401,859

|

|

|

|

235,235

|

|

|

|

13,228

|

|

|

|

1,110,738

|

|

|

Andrey Mushakov

|

|

2019

|

|

|

296,511

|

|

|

|

91,166

|

|

|

|

26,051

|

|

|

|

19,000

|

|

|

|

432,728

|

|

|

Executive Vice President, Nuclear Operations