Form SCHEDULE 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

February 06 2025 - 8:05PM

Edgar (US Regulatory)

Exhibit 99.1

Edward and Ludmila Smolyansky

Request Lifeway Foods Inc. NASDAQ (LWAY) CEO Julie Smolyansky Immediately

Withdraws Her Lawsuit Against Edward Smolyansky. Reiterate and Reaffirm Singular Goal Amid Ongoing Activism Battle

| ● | Summarizes

recent filings and next steps, previews upcoming proxy schedule |

| ● | Reaffirms and updates previously

stated goal |

CHICAGO, Jan. 3, 2025 /PRNewswire/ -- Edward and

Ludmila Smolyansky ("Founding Shareholders"), who together exercise sole voting control with respect to approximately 28%

of the outstanding shares of common stock of Lifeway Foods, Inc. (“Lifeway” or the “Company”), today requested

that Lifeway’s Board of Directors force its CEO and Chairperson, Julie Smolyansky to immediately withdraw her most recent lawsuit

filed in Cook County, IL against the Company’s largest individual shareholder Edward Smolyansky.

On December 23, 2024, Lifeway’s Compensation Committee, led by director

Jason Scher, awarded what was described as a $2 million “retention bonus.” The Smolyanskys believe this was yet another desperate

leverage tactic to enable Julie Smolyansky to continue to fund her war against the Founding Shareholders. Directors Scher and Pol Sikar

in particular, given their decades old family ties to Julie Smolyansky and her spouse and former jeweler, Jason Burdeen, have deep and

conflicting personal motives that run contra to those of the rest of the Company’s shareholders. They have and will continue to

use any means available to preserve their employment. These obvious conflicts are presented at www.lifebacktolifeway.com.

Additionally, the Smolyanskys intend to expand their ongoing investigation, which began in 2019 and which followed the departure of two

CFOs in 2018 alone and ultimately led to the departures of two independent directors and the Company’s general counsel shortly thereafter.

Edward Smolyansky said, “Lifeway seems determined to plunge the Company

deeper and deeper into litigation this time via proxy by Julie. We look forward to providing all shareholders a fully transparent accounting

of the inner workings of America’s Worst Governed Publicly Traded Company.”

Ludmila Smolyansky stated, “When we read that they cut a check to

Julie for $2 million, I said ‘she’ll sue Edward next month.’” Mrs. Smolyansky continued, “Predictably, on

January 23, Julie filed suit. In anticipation of this, on January 3, I began to sell some of my shares to defend Edward against these

cowards. I have no choice, as Lifeway’s legal counsel has refused to provide the adequate paperwork to Edward to monetize his holdings

in LWAY as permitted under our 1999 Shareholders Agreement between our family member and Group Danone.”

The activist campaign that The Smolyanskys launched in 2022 has produced

significant increases in the value of Lifeway’s share price, yet Julie and her Board seem determined to obstruct the ability to

monetize these assets and prohibit making significant charitable contributions. For example, last May, the charitable arm of the Founding

Shareholders’ new organization, Pure Culture Organics, announced

its commitment to the Ann & Robert H. Lurie Children's Hospital of Chicago.

Ludmila Smolyansky stated “While my daughter’s Board can attempt

to interfere with our philanthropic efforts, these are mere speed bumps on the road to our singular goal, fresh new management and new

independent slate of Directors.

Edward Smolyansky, President of Pure Culture Organics, added, “I

just think Julie is a tad bit jealous and insecure about my new company’s success and portrayal in the media. Sibling rivalry was

never her strong suit.”

For more information and update to date news connect with Edward on LinkedIn@

Edward

Smolyansky and visit www.lifebacktolifeway.com to learn more about the Proxy Campaign.

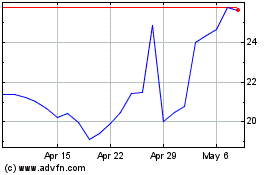

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Jan 2025 to Feb 2025

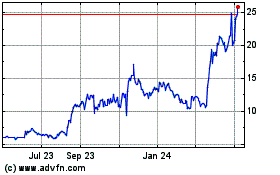

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Feb 2024 to Feb 2025