LifeVantage Corporation (Nasdaq: LFVN) today reported financial

results for its fourth quarter and full fiscal year ended

June 30, 2021.

Fourth Quarter Fiscal 2021 Summary*:

- Revenue of $54.8

million, a decrease of 7.7% from the prior year period and an

increase of 6.2% sequentially;

- Total active accounts decreased 5.0% compared to the prior

period while increasing 1.2% sequentially to 170,000. The year over

year decline includes a decline in distributors of 13.7%, partially

offset by an increase of 0.9% in customers. Compared to the third

quarter of fiscal 2021, the number of distributors was flat and

customers grew by 1.9%;

- Earnings per diluted

share were $0.35, up 34.6% over the prior year period and up 191.7%

sequentially;

- Adjusted earnings

per diluted share were $0.31, up 10.7% compared to $0.28 in the

prior year period and up 55.0% sequentially; and

- Adjusted EBITDA

decreased 19.3% to $6.6 million compared to the prior period and

increased 37.9% sequentially.

* All comparisons are on a year over year basis and compare the

fourth quarter of fiscal 2021 to the fourth quarter of fiscal 2020,

unless otherwise noted.

Fiscal Year 2021 Summary**:

- Revenue decreased

5.5% to $220.2 million;

- Revenue in the

Americas decreased 7.0% and revenue in Asia/Pacific & Europe

decreased 1.6%;

- Earnings per diluted

share were $0.90, compared to $0.79 in fiscal 2020;

- Adjusted earnings

per diluted share were $1.00, compared to $0.86 in fiscal

2020;

- Adjusted EBITDA

increased 3.7% to $24.8 million;

- Repurchased 1.2

million, or $11.9 million, of common shares; and

- Strong balance sheet

with $23.2 million of cash and no debt.

**All growth rates compare fiscal 2021 to fiscal 2020.

“Fourth quarter revenues results were in line with our

expectations and earnings were slightly ahead as we continued to

focus on our core strategies for driving long-term growth and

operational improvement. Adjusted earnings per share increased 11%

despite an 8% decline in net sales,“ said Steve Fife, Chief

Executive Officer and Chief Financial Officer of LifeVantage. “The

sequential improvement in the number of customers was particularly

encouraging and the first positive inflection in the past year. Our

initiatives to drive active account growth through distributor

enrollment and increased retention continue to gain traction and we

expect to show further progress over the next several quarters.

Consumers continue prioritizing health and wellness, which we

believe creates a compelling long-term growth outlook for

LifeVantage based on our proven products, strong balance sheet and

deeply committed management team.”

Fourth Quarter Fiscal 2020 Results

For the fourth fiscal quarter ended June 30, 2021, the

Company reported revenue of $54.8 million, a 7.7% decrease over the

fourth quarter of fiscal 2020. Revenue in the Americas for the

fourth quarter of fiscal 2021 decreased 9.6% compared to the fourth

quarter of fiscal 2020 and revenue in the Asia/Pacific & Europe

region decreased 3.3% compared to the fourth quarter of fiscal

2020. Revenue for the fourth quarter of fiscal 2021 was positively

impacted $0.8 million, or 1.3%, by foreign currency fluctuations

associated with revenue generated in international markets when

compared to the fourth quarter of fiscal 2020.

Gross profit for the fourth quarter of fiscal 2021 was $45.0

million, or 82.1% of revenue, compared to $49.9 million, or 84.1%

of revenue, for the same period in fiscal 2020. The decrease in

gross margin as a percentage of revenue is primarily due to

increased shipping expenses to customers due to COVID-19, decreased

fee revenues as a result of fewer in-person distributor events

being held during the current year period due to the COVID-19

pandemic, and shifts in geographic and product sales mix.

Commissions and incentives expense for the fourth quarter of

fiscal 2021 was $25.6 million, or 46.7% of revenue, compared to

$28.9 million, or 48.7% of revenue, for the same period in fiscal

2020. The decrease in commissions and incentives expense as a

percentage of revenue is due mainly to the timing and magnitude of

promotional and incentive activities as compared to the prior year

quarter.

Selling, general and administrative expense (SG&A) for the

fourth quarter of fiscal 2021 was $12.8 million, or 23.4% of

revenue, compared to $14.8 million, or 25.0% of revenue, for the

same period in fiscal 2020. Adjusted for nonrecurring expenses,

which are detailed in the GAAP to non-GAAP reconciliation tables

included at the end of this press release, adjusted non-GAAP

SG&A expense for the fourth quarter of fiscal 2021 was $13.6

million, or 24.8% of revenue, compared to adjusted non-GAAP

SG&A expense for the fourth quarter of fiscal 2020 of $14.3

million, or 24.1% of revenue. The year over year decrease in

non-GAAP SG&A expense was primarily due to decreased stock and

incentive compensation expenses due to performance against current

year bonus targets as well as the departure of executives during

the current year period.

Operating income for the fourth quarter of fiscal 2021 was $6.6

million, or 12.0% of revenue, compared to $6.2 million, or 10.5% of

revenue, for the fourth quarter of fiscal 2020. Accounting for the

non-GAAP adjustments noted previously, adjusted non-GAAP operating

income for the fourth quarter of fiscal 2021 was $5.8 million, or

10.6% of revenue, compared to $6.7 million, or 11.3% of revenue,

for the fourth quarter of fiscal 2020.

Net income for the fourth quarter of fiscal 2021 was $4.9

million, or $0.35 per diluted share. This compares to net income

for the fourth quarter of fiscal 2020 of $3.8 million, or $0.26 per

diluted share. Accounting for the non-GAAP adjustments noted

previously, net of tax, adjusted non-GAAP net income for the fourth

quarter of fiscal 2021 increased 4.6% to $4.3 million, or $0.31 per

diluted share. Accounting for the non-GAAP adjustments noted

previously, net of tax, adjusted non-GAAP net income for the fourth

quarter of fiscal 2020 was $4.1 million, or $0.28 per diluted

share. The Company’s effective tax rate decreased to 24.3% in the

fourth quarter of fiscal 2021 compared to 37.2% in the prior year

period. The decrease in the tax rate in the current year period

positively impacted adjusted earnings per share by approximately

$0.05.

Adjusted EBITDA decreased 19.3% to $6.6 million for the fourth

quarter of fiscal 2021, compared to $8.2 million for the comparable

period in fiscal 2020.

Fiscal 2021 Full Year Results

For the fiscal year ended June 30, 2021, the Company

reported net revenue of $220.2 million, a decrease of 5.5% compared

to $232.9 million for fiscal 2020. In fiscal 2021, revenue in the

Americas decreased 7.0% and revenue in Asia/Pacific & Europe

decreased 1.6%. Revenue for fiscal 2020 was positively impacted

$2.6 million, or 1.1%, by foreign currency fluctuations associated

with revenue generated in international markets when compared to

fiscal year 2020.

Gross profit during fiscal 2021 was $182.0

million, or 82.7% of revenue, compared to $195.0 million, or 83.7%

of revenue, for fiscal 2020. The decrease in gross margin as a

percentage of revenue is primarily due to increased shipping

expenses as global demand for shipping increased significantly due

to the COVID-19 pandemic.

Commissions and incentives expense for fiscal 2021 was $103.5

million, or 47.0% of revenue, compared to $111.6 million, or 47.9%

of revenue, for fiscal 2020. Commissions and incentives expense as

a percentage of revenue decreased as a result of the cancellation

of incentive events during the year due to the COVID 19 pandemic

and associated travel and meeting restrictions as well as the

continued refinement and the timing and magnitude of our various

promotional and incentive programs during the year.

SG&A expense for fiscal 2021 was $60.8 million, or 27.6% of

revenue, compared to $67.9 million, or 29.2% of revenue, for fiscal

2020. Adjusted for nonrecurring expenses and recoveries, which are

detailed in the GAAP to non-GAAP reconciliation tables included at

the end of this press release, adjusted non-GAAP SG&A expense

for fiscal 2021 was $59.2 million, or 26.9% of revenue, compared to

adjusted non-GAAP SG&A expense for fiscal 2020 of $66.7

million, or 28.6% of revenue. The year over year decrease in

non-GAAP SG&A expense was primarily due to the cancellation of

in-person events and decreased travel expenses related to the

restrictions associated with the COVID-19 pandemic, as well as

lower stock and incentive compensation expense due to performance

against current year bonus targets as well as the departure of

executives during the current year.

Operating income for fiscal 2021 was $17.6 million, or 8.0% of

revenue, compared to $15.5 million, or 6.6% of revenue, for fiscal

2020. Accounting for non-GAAP adjustments noted previously,

adjusted non-GAAP operating income for fiscal 2021 was $19.2

million, or 8.7% of revenue, compared to $16.7 million, or 7.2% of

revenue, for fiscal 2020.

Net income for fiscal 2021 was $12.9 million, or $0.90 per

diluted share, compared to $11.5 million, or $0.79 per diluted

share for fiscal 2020. Accounting for the non-GAAP adjustments

noted previously, net of tax, adjusted non-GAAP net income for

fiscal 2021 increased 14.4% to $14.3 million, or $1.00 per diluted

share. This compares to adjusted non-GAAP net income for fiscal

2020 of $12.5 million, or $0.86 per diluted share. On a non-GAAP

basis, the Company’s effective tax rate increased to 24.1% in

fiscal 2021 compared to an effective tax rate of 21.6% in the prior

year. The increase in the current year tax rate negatively impacted

adjusted earnings per share by approximately $0.03.

Adjusted EBITDA increased 3.7% to $24.8 million for fiscal 2021,

compared to $24.0 million for fiscal 2020.

Balance Sheet & Liquidity

The Company generated $16.3 million of cash from operations

during fiscal 2021 compared to $18.3 million during fiscal 2020.

The Company's cash and cash equivalents at June 30, 2021 were

$23.2 million, compared to $22.1 million at June 30, 2020. The

Company had no debt outstanding at June 30, 2021 and 2020,

respectively. During the fourth quarter of fiscal 2021, the Company

repurchased approximately 0.5 million common shares for $3.9

million under its share repurchase program.

Fiscal Year 2022 Guidance

The Company expects to generate revenue in the range of $225

million to $235 million in fiscal year 2022 and adjusted EBITDA of

$22 million to $24 million, with adjusted earnings per share in the

range of $0.83 to $0.87, which assumes a full year tax rate of

approximately 26%. This guidance reflects the current trends in the

business and the Company’s current view as to the impact of the

COVID-19 pandemic on its business. The Company's guidance for

adjusted non-GAAP EBITDA and adjusted non-GAAP earnings per diluted

share excludes any non-operating or non-recurring expenses that may

materialize during fiscal 2022. The Company is not providing

guidance for GAAP earnings per diluted share for fiscal 2022 due to

the potential occurrence of one or more non-operating, one-time

expenses, which the Company does not believe it can reliably

predict.

Conference Call Information

The Company will hold an investor conference call today at 2:30

p.m. MST (4:30 p.m. EST). Investors interested in participating in

the live call can dial (877) 705-6003 from the U.S. International

callers can dial (201) 493-6725. A telephone replay will be

available approximately two hours after the call concludes and will

be available through Thursday, August 26, 2021, by dialing (844)

512-2921 from the U.S. and entering confirmation code 13721246, or

(412) 317-6671 from international locations, and entering

confirmation code 13721246.

There will also be a simultaneous, live webcast available on the

Investor Relations section of the Company's web site at

http://investor.lifevantage.com/events-and-presentations or

directly at http://public.viavid.com/index.php?id=145578.The

webcast will be archived for approximately 30 days.

About LifeVantage Corporation

LifeVantage Corporation (Nasdaq: LFVN) is a pioneer in

nutrigenomics, the study of how nutrition and naturally occurring

compounds affect human genes to support good health. The Company

engages in the identification, research, development, formulation

and sale of advanced nutrigenomic activators, dietary supplements,

nootropics, pre- and pro-biotics, weight management, skin and hair

care, bath & body, and targeted relief products. The Company’s

line of scientifically-validated dietary supplements includes its

flagship Protandim® family of products, LifeVantage® Omega+,

ProBio, and Daily Wellness dietary supplements, TrueScience® is the

Company's line of skin, hair, bath & body, and targeted relief

products. The Company also markets and sells Petandim®, its

companion pet supplement formulated to combat oxidative stress in

dogs, Axio® its nootropic energy drink mixes, and PhysIQ™, its

smart weight management system. LifeVantage was founded in 2003 and

is headquartered in Lehi, Utah. For more information, visit

www.lifevantage.com.

Forward Looking Statements

This document contains forward-looking statements made pursuant

to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Words and expressions reflecting optimism,

satisfaction or disappointment with current prospects, as well as

words such as "believe," "will," "hopes," "intends," "estimates,"

"expects," "projects," "plans," "anticipates," "look forward to,"

"goal," “may be,” and variations thereof, identify forward-looking

statements, but their absence does not mean that a statement is not

forward-looking. Examples of forward-looking statements include,

but are not limited to, statements we make regarding executing

against and the benefits of our key initiatives, future growth,

including geographic and product expansion, and expected financial

performance. Such forward-looking statements are not guarantees of

performance and the Company's actual results could differ

materially from those contained in such statements. These

forward-looking statements are based on the Company's current

expectations and beliefs concerning future events affecting the

Company and involve known and unknown risks and uncertainties that

may cause the Company's actual results or outcomes to be materially

different from those anticipated and discussed herein. These risks

and uncertainties include, among others, further deterioration to

the global economic and operating environments as a result of

future COVID-19 developments, as well as those discussed in greater

detail in the Company's Annual Report on Form 10-K and the

Company's Quarterly Report on Form 10-Q under the caption "Risk

Factors," and in other documents filed by the Company from time to

time with the Securities and Exchange Commission. The Company

cautions investors not to place undue reliance on the

forward-looking statements contained in this document. All

forward-looking statements are based on information currently

available to the Company on the date hereof, and the Company

undertakes no obligation to revise or update these forward-looking

statements to reflect events or circumstances after the date of

this document, except as required by law.

About Non-GAAP Financial Measures

We define Non-GAAP EBITDA as earnings before interest expense,

income taxes, depreciation and amortization and Non-GAAP Adjusted

EBITDA as earnings before interest expense, income taxes,

depreciation and amortization, stock compensation expense, other

income, net, and certain other adjustments. Non-GAAP EBITDA and

Non-GAAP Adjusted EBITDA may not be comparable to similarly titled

measures reported by other companies. We define Non-GAAP Net Income

as GAAP net income less certain tax adjusted non-recurring one-time

expenses incurred during the period and Non-GAAP Earnings per Share

as Non-GAAP Net Income divided by weighted-average shares

outstanding.

We are presenting Non-GAAP EBITDA, Non-GAAP Adjusted EBITDA,

Non-GAAP Net Income and Non-GAAP Earnings Per Share because

management believes that they provide additional ways to view our

operations when considered with both our GAAP results and the

reconciliation to net income, which we believe provides a more

complete understanding of our business than could be obtained

absent this disclosure. Non-GAAP EBITDA, Non-GAAP Adjusted EBITDA,

Non-GAAP Net Income and Non-GAAP Earnings Per Share are presented

solely as supplemental disclosure because: (i) we believe these

measures are a useful tool for investors to assess the operating

performance of the business without the effect of these items; (ii)

we believe that investors will find this data useful in assessing

shareholder value; and (iii) we use Non-GAAP EBITDA, Non-GAAP

Adjusted EBITDA, Non-GAAP Net Income and Non-GAAP Earnings Per

Share internally as benchmarks to evaluate our operating

performance or compare our performance to that of our competitors.

The use of Non-GAAP EBITDA, Non-GAAP Adjusted EBITDA, Non-GAAP Net

Income and Non-GAAP Earnings per Share has limitations and you

should not consider these measures in isolation from or as an

alternative to the relevant GAAP measure of net income prepared in

accordance with GAAP, or as a measure of profitability or

liquidity.

The tables set forth below present reconciliations of Non-GAAP

EBITDA, Non-GAAP Adjusted EBITDA, Non-GAAP Net Income and Non-GAAP

Earnings per Share, which are non-GAAP financial measures to Net

Income and Earnings per Share, our most directly comparable

financial measures presented in accordance with GAAP.

Investor Relations Contact:

Reed Anderson, ICR (646) 277-1260reed.anderson@icrinc.com

|

LIFEVANTAGE CORPORATION AND SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

| |

| |

As of |

| (In thousands, except per

share data) |

June 30, 2021 |

|

June 30, 2020 |

| ASSETS |

|

|

|

| Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

23,174 |

|

|

$ |

22,138 |

|

|

Accounts receivable |

2,925 |

|

|

2,610 |

|

|

Income tax receivable |

1,038 |

|

|

— |

|

|

Inventory, net |

16,145 |

|

|

13,888 |

|

|

Prepaid expenses and other |

4,772 |

|

|

5,232 |

|

|

Total current assets |

48,054 |

|

|

43,868 |

|

| |

|

|

|

|

Property and equipment, net |

11,123 |

|

|

7,170 |

|

|

Right-of-use assets |

13,700 |

|

|

956 |

|

|

Intangible assets, net |

719 |

|

|

851 |

|

|

Deferred income tax asset |

1,208 |

|

|

2,164 |

|

|

Equity securities |

2,205 |

|

|

2,205 |

|

|

Other long-term assets |

1,723 |

|

|

1,663 |

|

| TOTAL ASSETS |

$ |

78,732 |

|

|

$ |

58,877 |

|

| |

|

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

| Current liabilities |

|

|

|

|

Accounts payable |

$ |

6,744 |

|

|

$ |

3,521 |

|

|

Commissions payable |

8,138 |

|

|

9,219 |

|

|

Income tax payable |

830 |

|

|

784 |

|

|

Lease liabilities |

2,151 |

|

|

1,184 |

|

|

Other accrued expenses |

7,336 |

|

|

10,311 |

|

|

Current portion of long-term debt, net |

— |

|

|

— |

|

|

Total current liabilities |

25,199 |

|

|

25,019 |

|

| |

|

|

|

| Long-term lease

liabilities |

16,032 |

|

|

— |

|

| Other long-term

liabilities |

694 |

|

|

604 |

|

|

Total liabilities |

41,925 |

|

|

25,623 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders' equity |

|

|

|

|

Preferred stock — par value $0.0001 per share, 5,000 shares

authorized, no shares issued or outstanding |

— |

|

|

— |

|

|

Common stock — par value $0.0001 per share, 40,000 shares

authorized and 13,609 and 14,113 issued and outstanding as of

June 30, 2021 and 2020, respectively |

1 |

|

|

1 |

|

|

Additional paid-in capital |

129,048 |

|

|

126,416 |

|

|

Accumulated deficit |

(92,346 |

) |

|

(93,307 |

) |

|

Accumulated other comprehensive income |

104 |

|

|

144 |

|

|

Total stockholders’ equity |

36,807 |

|

|

33,254 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

$ |

78,732 |

|

|

$ |

58,877 |

|

| |

|

|

|

|

|

|

|

|

LIFEVANTAGE CORPORATION AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

| |

|

|

|

|

|

|

|

| |

For the Three Months Ended June

30,(unaudited) |

|

Fiscal Year Ended June 30, |

| (In thousands, except per

share data) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Revenue, net |

$ |

54,777 |

|

|

$ |

59,368 |

|

|

$ |

220,181 |

|

|

$ |

232,915 |

|

| Cost of sales |

9,782 |

|

|

9,449 |

|

|

38,187 |

|

|

37,964 |

|

|

Gross profit |

44,995 |

|

|

49,919 |

|

|

181,994 |

|

|

194,951 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Commissions and incentives |

25,603 |

|

|

28,894 |

|

|

103,541 |

|

|

111,571 |

|

|

Selling, general and administrative |

12,811 |

|

|

14,816 |

|

|

60,838 |

|

|

67,914 |

|

|

Total operating expenses |

38,414 |

|

|

43,710 |

|

|

164,379 |

|

|

179,485 |

|

| Operating income |

6,581 |

|

|

6,209 |

|

|

17,615 |

|

|

15,466 |

|

| Other expense: |

|

|

|

|

|

|

|

|

Interest expense |

— |

|

|

(1 |

) |

|

(17 |

) |

|

(120 |

) |

|

Other expense, net |

(103 |

) |

|

(120 |

) |

|

(366 |

) |

|

(685 |

) |

|

Total other expense |

(103 |

) |

|

(121 |

) |

|

(383 |

) |

|

(805 |

) |

| Income before income taxes |

6,478 |

|

|

6,088 |

|

|

17,232 |

|

|

14,661 |

|

|

Income tax expense |

(1,571 |

) |

|

(2,264 |

) |

|

(4,338 |

) |

|

(3,112 |

) |

| Net income |

$ |

4,907 |

|

|

$ |

3,824 |

|

|

$ |

12,894 |

|

|

$ |

11,549 |

|

| Net income per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.36 |

|

|

$ |

0.27 |

|

|

$ |

0.92 |

|

|

$ |

0.82 |

|

|

Diluted |

$ |

0.35 |

|

|

$ |

0.26 |

|

|

$ |

0.90 |

|

|

$ |

0.79 |

|

| Weighted-average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

13,754 |

|

|

14,258 |

|

|

14,070 |

|

|

14,105 |

|

|

Diluted |

13,879 |

|

|

14,703 |

|

|

14,268 |

|

|

14,599 |

|

|

LIFEVANTAGE CORPORATION AND SUBSIDIARIES |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Revenue by Region |

|

|

|

|

|

|

|

|

| |

|

|

|

| |

Three Months Ended June 30,(unaudited) |

|

Fiscal Year Ended June 30, |

| (In thousands) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Americas |

$ |

37,677 |

|

|

69 |

% |

|

$ |

41,690 |

|

|

70 |

% |

|

$ |

154,655 |

|

|

70 |

|

% |

|

$ |

166,336 |

|

|

71 |

% |

| Asia/Pacific & Europe |

17,100 |

|

|

31 |

% |

|

17,678 |

|

|

30 |

% |

|

65,526 |

|

|

30 |

|

% |

|

66,579 |

|

|

29 |

% |

| Total |

$ |

54,777 |

|

|

100 |

% |

|

$ |

59,368 |

|

|

100 |

% |

|

$ |

220,181 |

|

|

100 |

|

% |

|

$ |

232,915 |

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Active Accounts(unaudited) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

As of June 30, |

|

|

|

|

|

|

|

|

| |

2021 |

|

2020 |

|

Change from Prior Year |

|

Percent Change |

|

|

|

|

| Active Independent

Distributors(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Americas |

41,000 |

|

|

65 |

% |

|

49,000 |

|

|

67 |

% |

|

(8,000 |

) |

|

(16.3 |

) |

% |

|

|

|

|

|

Asia/Pacific & Europe |

22,000 |

|

|

35 |

% |

|

24,000 |

|

|

33 |

% |

|

(2,000 |

) |

|

(8.3 |

) |

% |

|

|

|

|

|

Total Active Independent Distributors |

63,000 |

|

|

100 |

% |

|

73,000 |

|

|

100 |

% |

|

(10,000 |

) |

|

(13.7 |

) |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Active Customers(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Americas |

78,000 |

|

|

73 |

% |

|

83,000 |

|

|

78 |

% |

|

(5,000 |

) |

|

(6.0 |

) |

% |

|

|

|

|

|

Asia/Pacific & Europe |

29,000 |

|

|

27 |

% |

|

23,000 |

|

|

22 |

% |

|

6,000 |

|

|

26.1 |

|

% |

|

|

|

|

|

Total Active Customers |

107,000 |

|

|

100 |

% |

|

106,000 |

|

|

100 |

% |

|

1,000 |

|

|

0.9 |

|

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Active Accounts(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Americas |

119,000 |

|

|

70 |

% |

|

132,000 |

|

|

74 |

% |

|

(13,000 |

) |

|

(9.8 |

) |

% |

|

|

|

|

|

Asia/Pacific & Europe |

51,000 |

|

|

30 |

% |

|

47,000 |

|

|

26 |

% |

|

4,000 |

|

|

8.5 |

|

% |

|

|

|

|

|

Total Active Accounts |

170,000 |

|

|

100 |

% |

|

179,000 |

|

|

100 |

% |

|

(9,000 |

) |

|

(5.0 |

) |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Active

Independent Distributors have purchased product in the prior three

months for retail or personal consumption. |

| (2) Active

Customers have purchased product in the prior three months for

personal consumption only. |

| (3) Total Active

Accounts is the sum of Active Independent Distributors and Active

Customers. |

|

LIFEVANTAGE CORPORATION AND SUBSIDIARIES |

|

Reconciliation of GAAP Net Income to Non-GAAP EBITDA and

Non-GAAP Adjusted EBITDA: |

|

(Unaudited) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Fiscal Year Ended June 30, |

| (In thousands) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

GAAP Net income |

$ |

4,907 |

|

|

$ |

3,824 |

|

|

$ |

12,894 |

|

|

$ |

11,549 |

|

| Interest expense |

— |

|

|

1 |

|

|

17 |

|

|

120 |

|

| Provision for income

taxes |

1,571 |

|

|

2,264 |

|

|

4,338 |

|

|

3,112 |

|

| Depreciation and

amortization(1) |

817 |

|

|

824 |

|

|

3,460 |

|

|

2,777 |

|

| Non-GAAP EBITDA: |

7,295 |

|

|

6,913 |

|

|

20,709 |

|

|

17,558 |

|

| Adjustments: |

|

|

|

|

|

|

|

| Stock compensation

expense |

(79 |

) |

|

838 |

|

|

2,036 |

|

|

4,919 |

|

| Other expense, net |

103 |

|

|

120 |

|

|

366 |

|

|

685 |

|

| Other adjustments(2) |

(700 |

) |

|

334 |

|

|

1,736 |

|

|

806 |

|

| Total adjustments |

(676 |

) |

|

1,292 |

|

|

4,138 |

|

|

6,410 |

|

| Non-GAAP Adjusted EBITDA |

$ |

6,619 |

|

|

$ |

8,205 |

|

|

$ |

24,847 |

|

|

$ |

23,968 |

|

| |

|

|

|

|

|

|

|

| (1) Includes

$101,000 of accelerated depreciation related to a change in lease

term and $335,000 leasehold depreciation for the fiscal year ended

June 30, 2021. Includes $152,000 and $456,000 of accelerated

depreciation related to a change in lease term for the three months

and fiscal year ended June 30, 2020. |

| |

|

|

|

|

|

|

|

| (2) Other adjustments

breakout: |

|

|

|

|

|

|

|

|

Lease abandonment |

$ |

— |

|

|

$ |

— |

|

|

$ |

495 |

|

|

$ |

— |

|

|

Class-action lawsuit expenses, net of recoveries |

$ |

(1,002 |

) |

|

$ |

334 |

|

|

$ |

(144 |

) |

|

$ |

703 |

|

|

Executive team severance expenses, net |

160 |

|

|

— |

|

|

851 |

|

|

— |

|

|

Executive team recruiting and transition expenses |

142 |

|

|

— |

|

|

534 |

|

|

— |

|

|

Other nonrecurring legal and accounting expenses |

— |

|

|

— |

|

|

— |

|

|

103 |

|

|

Insurance reimbursement |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Change in estimate of accrued import liabilities |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Total adjustments |

$ |

(700 |

) |

|

$ |

334 |

|

|

$ |

1,736 |

|

|

$ |

806 |

|

|

LIFEVANTAGE CORPORATION AND SUBSIDIARIES |

|

Reconciliation of GAAP Net Income to Non-GAAP Net Income

and Non-GAAP Adjusted EPS: |

|

(Unaudited) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Fiscal Year Ended June 30, |

| (In thousands) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

GAAP Net income |

$ |

4,907 |

|

|

$ |

3,824 |

|

|

$ |

12,894 |

|

|

$ |

11,549 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Executive team severance expenses, net(1) |

83 |

|

|

— |

|

|

269 |

|

|

— |

|

|

Executive team recruiting and transition expenses |

142 |

|

|

— |

|

|

534 |

|

|

— |

|

|

Lease abandonment(2) |

— |

|

|

— |

|

|

830 |

|

|

— |

|

|

Class-action lawsuit expenses, net of recoveries |

(1,002 |

) |

|

334 |

|

|

(144 |

) |

|

703 |

|

|

Other nonrecurring legal and accounting expenses |

— |

|

|

— |

|

|

— |

|

|

103 |

|

|

Accelerated depreciation related to change in lease term |

— |

|

|

152 |

|

|

101 |

|

|

456 |

|

|

Tax impact of adjustments |

188 |

|

|

(181 |

) |

|

(192 |

) |

|

(323 |

) |

| Total adjustments, net of

tax |

(589 |

) |

|

305 |

|

|

1,398 |

|

|

939 |

|

| Non-GAAP Net Income |

$ |

4,318 |

|

|

$ |

4,129 |

|

|

$ |

14,292 |

|

|

$ |

12,488 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Fiscal Year Ended June 30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Diluted earnings per share, as

reported |

$ |

0.35 |

|

|

$ |

0.26 |

|

|

$ |

0.90 |

|

|

$ |

0.79 |

|

|

Total adjustments, net of tax |

(0.04 |

) |

|

0.02 |

|

|

0.10 |

|

|

0.06 |

|

| Diluted earnings per share, as

adjusted(3) |

$ |

0.31 |

|

|

$ |

0.28 |

|

|

$ |

1.00 |

|

|

$ |

0.86 |

|

| |

|

|

|

|

|

|

|

| (1) Net of $77,000

and $582,000 of compensation expense benefit related to unvested

stock award reversals for the three months and fiscal year ended

June 30, 2021 |

| (2) Includes

remaining lease rent expense of $495,000 and leasehold depreciation

of $335,000 for the fiscal year ended June 30, 2021. |

| (3) May not add due

to rounding. |

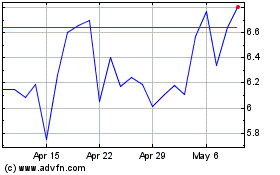

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

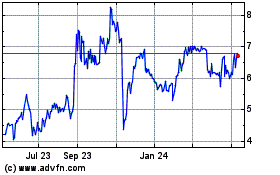

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Apr 2023 to Apr 2024