LifeMD, Inc. (NASDAQ: LFMD), a leading direct-to-patient telehealth

company, reported results for the third quarter ended September 30,

2022. All figure comparisons are to the same year-ago quarter

unless otherwise noted. Management will host a conference call

today, November 10, 2022, at 4:30 p.m. Eastern Time to discuss the

results.

Q3 2022 Financial Highlights

- Record revenue of $31.4 million, up

26%.

- Consolidated Gross Margin of 85%, up

from 80% in the same year-ago period. Gross profit totaled $26.7

million.

- 93% of revenue generated by

subscriptions.

- Consolidated Adjusted EBITDA loss

reduced to $889,000 in the third quarter; remain on track to

achieve consolidated Adjusted EBITDA profitability in the fourth

quarter 2022.

- Adjusted EPS $(0.03), up 91% versus

same year-ago period and a 86% sequential improvement versus the

prior quarter (see definition of this non-GAAP financial measure

and reconciliation to GAAP, below).

Q3 and Recent Operational Highlights

- Continued leverage of Selling and

Marketing expenses, with third quarter expenses as a percentage of

revenue reducing to 55%, a 1,700-basis point improvement versus the

prior quarter and a 2,600-basis point improvement versus the same

year-ago period.

- Virtual primary care business saw

average daily patient acquisition increase by 440% from prior

quarter with strong retention and high patient satisfaction

scores.

- Telehealth active subscribers

increased 36% to approximately 176,000.

- Reduced blended telehealth Customer

Acquisition Costs (CAC) by 18% versus year-ago period and by 8%

sequentially versus prior quarter.

- Executed an agreement with our third

pharmaceutical partner using LifeMD’s technology and affiliated

medical group for 4 additional branded prescription

medications.

- In final stages of WorkSimpli

divestiture process. Actively in negotiations and received interest

from multiple bidders.

- WorkSimpli active subscribers

increased by 45% to approximately 150,000 worldwide

subscribers.

- WorkSimpli performance remains on a

tremendous trajectory with third quarter results producing 57%

year-over-year revenue growth with mid-teens EBITDA margins.

WorkSimpli remains on track to deliver 2023 EBITDA margins of

25%-plus coupled with significant growth in revenue.

Key Performance Metrics

| |

|

|

|

|

|

| ($ in

000s) |

|

Three Months Ended September 30 |

|

Y-o-Y |

| Key Performance

Metrics |

|

|

2022 |

|

|

2021 |

|

|

% Growth |

| Revenue |

|

|

|

|

|

|

Telehealth |

|

$ |

21,365 |

|

$ |

18,541 |

|

|

15 |

% |

| WorkSimpli |

|

$ |

10,047 |

|

$ |

6,406 |

|

|

57 |

% |

| Total

Revenue |

|

$ |

31,412 |

|

$ |

24,947 |

|

|

26 |

% |

| |

|

|

|

|

|

| Subscription Revenue as % of

Total |

|

|

93% |

|

|

92% |

|

|

1 |

% |

| |

|

|

|

|

|

| Telehealth Volume |

|

|

|

|

|

| Total Telehealth Orders |

|

|

220,933 |

|

|

255,138 |

|

|

-13 |

% |

| Total Active Subscribers |

|

|

175,944 |

|

|

129,100 |

|

|

36 |

% |

| WorkSimpli |

|

|

|

|

|

| Active Subscribers |

|

|

149,905 |

|

|

103,395 |

|

|

45 |

% |

Management Commentary“During the third quarter,

LifeMD made significant progress against our top strategic and

operational priorities. We came significantly closer this quarter

toward our goal of achieving consolidated Adjusted EBITDA

profitability by the fourth quarter 2022, performing even better

than our profitability expectations and reducing our consolidated

Adjusted EBITDA loss to under $(1) million for the quarter. This

significant improvement in profitability was driven by

strengthening unit economics, reduced CAC’s and improved efficiency

brought by scale. In addition, our WorkSimpli business continued to

exponentially grow both top and bottom-line results driven by 45%

growth in active subscribers versus prior year, while achieving

record profitability,” said Justin Schreiber, Chairman & CEO of

LifeMD. “Additionally, beyond our core direct-to-consumer

telehealth businesses, we continue to successfully build out our

Business-to-Business operation, leveraging our best-in-class

healthcare marketing and patient service capabilities to partner

directly with pharmaceutical clients. We recently executed an

agreement with our third client in this vertical and have a robust

pipeline of additional deals under discussion that we expect to

become accretive to our 2023 results. We have also made sizeable

progress in the WorkSimpli process and are currently in late-stage

negotiations after attracting interest from multiple bidders. We

remain laser-focused though on maximizing value for our

shareholders from this asset as the fundamentals of this business

continue to support tremendous future profitability and free cash

flow growth that is accretive to LifeMD overall.”

LifeMD CFO Marc Benathen, commented: “During the quarter, we

executed extremely well against our initiative to achieve

consolidated Adjusted EBITDA profitability by the fourth quarter

2022, exceeding even our own expectations for bottom-line

performance. In doing so, we reduced our consolidated Adjusted

EBITDA loss to under $1 million. While we experienced a slight

sequential decline in telehealth revenue versus the second quarter,

this was intentional and a result of the continued work we’ve done

to re-focus our growth efforts on our most profitable offerings

that will drive long-term margin expansion and growth. In doing so,

we cut back all activities related to consumer offerings that did

not meet our profitability thresholds which while eliminating some

short-term growth ensures that we maintain a base of patients and

offerings that will drive continued growth at high levels of

profitability. As previously guided in the second quarter, this

reset process will continue to play out through year-end with a

return to higher levels of growth supported by strong bottom-line

margins in 2023 and beyond. In addition, our WorkSimpli subsidiary

continued to post record results ahead of our own expectations on

both the top and bottom-line including achieving EBITDA margins in

the mid-teens. We are increasingly bullish on the financial and

cash flow growth for WorkSimpli as we work through the late stages

of the current process with a focus on maximizing long-term

shareholder value. In addition to WorkSimpli, we currently have

access to additional non-dilutive financing options that can

further augment liquidity. We expect to consummate a transaction

before the end of the year.”

Q3 2022 Financial Summary

- Revenue for the quarter ended September 30, 2022 increased 26%

to $31.4 million from $24.9 million in 2021. The increase in

revenues was attributable to a 15% increase in telehealth revenue

and a 57% increase in WorkSimpli revenue versus the year-ago

period.

- Gross profit increased by 35% to $26.7 million, compared to

$19.9 million in the prior year. Gross margins reached 85% on a

consolidated basis for the third quarter ended September 30, 2022.

Gross margins for the telehealth business totaled 79%.

- Net loss attributable to common stockholders was $8.1 million

or $(0.26) per share, as compared to a net loss attributable to

common stockholders of $14.4 million or $(0.54) per share in the

prior year.

- Adjusted EBITDA, a non-GAAP financial measure, totaled a loss

of $889,000, an improvement of 90% versus the same year-ago period

and 87% sequentially versus the prior quarter. (see definition of

this non-GAAP financial measure and reconciliation to GAAP,

below).

- Adjusted EPS, a non-GAAP financial measure, totaled a loss of

$(0.03) per share, compared to an adjusted EPS loss of $(0.34) in

the same year-ago period. Adjusted EPS improved 87% sequentially

versus the prior quarter (see definition of this non-GAAP financial

measure and reconciliation to GAAP, below).

Financial GuidanceFor the Fourth Quarter 2022,

the Company expects:

- Consolidated Revenue to total between $33.0 million and $34.0

million

- Consolidated Adjusted EBITDA between $0 million and $2 million,

reflecting Adjusted EBITDA margins of between 0% and 6%

Conference CallLifeMD’s management will host a

conference call today, November 10, 2022 at 4:30 pm Eastern Time to

discuss the company’s financial results and outlook, followed by a

question-and-answer period. Details for the call are as

follows:

|

Toll-free dial-in number: |

1-800-218-2154 |

| International dial-in

number: |

1-720-543-0214 |

| Conference ID: |

1668855 |

| Webcast: |

https://viavid.webcasts.com/starthere.jsp?ei=1580105&tp_key=82ee8cfb68 |

The conference call will be webcast live and available for

replay via a link provided in the Investors section of the

company’s website at ir.lifemd.com. Please call the conference

telephone number five minutes prior to the start time. An operator

will register your name and organization.

Listeners are encouraged to review the Company's periodic

reports filed with the U.S. Securities and Exchange Commission,

including the discussion of risk factors, historical results of

operations and financial condition as provided in these

reports.

About LifeMDLifeMD is a 50-state

direct-to-patient telehealth company with a portfolio of brands

that offer virtual primary care, diagnostics, and specialized

treatment for men’s and women’s health, allergy & asthma, and

dermatological conditions. By leveraging its proprietary technology

platform, 50-state affiliated medical group, and nationwide

mail-order pharmacy network, LifeMD is increasing access to

top-notch healthcare that is affordable to anyone. To learn more,

go to LifeMD.com.

Cautionary Note Regarding Forward Looking

StatementsThis news release includes forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended; Section 21E of the Securities Exchange Act of

1934, as amended; and the safe harbor provision of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements contained in this news release may be identified by the

use of words such as: “believe,” “expect,” “anticipate,” “project,”

“should,” “plan,” “will,” “may,” “intend,” “estimate,” predict,”

“continue,” and “potential,” or, in each case, their negative or

other variations or comparable terminology referencing future

periods. Examples of forward-looking statements include, but are

not limited to, statements regarding our financial outlook and

guidance, short and long-term business performance and operations,

future revenues and earnings, regulatory developments, legal events

or outcomes, ability to comply with complex and evolving

regulations, market conditions and trends, new or expanded products

and offerings, growth strategies, underlying assumptions, and the

effects of any of the foregoing on our future results of operations

or financial condition.

Forward-looking statements are not historical facts and are not

assurances of future performance. Rather, these statements are

based on our current expectations, beliefs, and assumptions

regarding future plans and strategies, projections, anticipated and

unanticipated events and trends, the economy, and other future

conditions, including the impact of any of the aforementioned on

our future business. As forward-looking statements relate to the

future, they are subject to inherent risk, uncertainties, and

changes in circumstances and assumptions that are difficult to

predict, including some of which are out of our control.

Consequently, our actual results, performance, and financial

condition may differ materially from those indicated in the

forward-looking statements. These risks and uncertainties include,

but are not limited to, “Risk Factors” identified in our filings

with the Securities and Exchange Commission, including, but not

limited to, our most recently filed Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and any amendments thereto. Even if

our actual results, performance, or financial condition are

consistent with forward-looking statements contained in such

filings, they may not be indicative of our actual results,

performance, or financial condition in subsequent periods.

Any forward-looking statement made in the news release is based

on information currently available to us as of the date on which

this release is made. We undertake no obligation to update or

revise any forward-looking statement, whether as a result of new

information, future events, or otherwise, except as may be required

under applicable law or regulation.

Company Contact LifeMD, Inc. Marc Benathen,

CFOmarc@lifemd.com

Tables to Follow++++++

|

LIFEMD, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(Unaudited) |

| |

|

|

|

|

|

| |

September 30, 2022 |

|

December 31, 2021 |

| |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

Cash |

$ |

5,836,823 |

|

|

$ |

41,328,039 |

|

|

Accounts receivable, net |

|

2,538,118 |

|

|

|

980,055 |

|

|

Product deposit |

|

108,051 |

|

|

|

203,556 |

|

|

Inventory, net |

|

3,676,131 |

|

|

|

1,616,600 |

|

|

Other current assets |

|

814,576 |

|

|

|

793,190 |

|

|

Total Current Assets |

|

12,973,699 |

|

|

|

44,921,440 |

|

| |

|

|

|

|

|

| Non-current Assets |

|

|

|

|

|

|

Equipment, net |

|

533,561 |

|

|

|

233,805 |

|

|

Right of use asset, net |

|

1,289,250 |

|

|

|

1,752,448 |

|

|

Capitalized software, net |

|

7,991,836 |

|

|

|

2,995,789 |

|

|

Goodwill |

|

5,654,665 |

|

|

|

- |

|

|

Intangible assets, net |

|

4,918,550 |

|

|

|

19,761 |

|

| Total Non-current Assets |

|

20,387,862 |

|

|

|

5,001,803 |

|

| |

|

|

|

|

|

| Total Assets |

$ |

33,361,561 |

|

|

$ |

49,923,243 |

|

| |

|

|

|

|

|

|

LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS' (DEFICIT)

EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

10,797,544 |

|

|

$ |

9,059,214 |

|

|

Accrued expenses |

|

11,082,354 |

|

|

|

11,595,605 |

|

|

Notes payable, net |

|

- |

|

|

|

63,400 |

|

|

Current operating lease liabilities |

|

702,237 |

|

|

|

607,490 |

|

|

Deferred revenue |

|

2,353,152 |

|

|

|

1,499,880 |

|

|

Total Current Liabilities |

|

24,935,287 |

|

|

|

22,825,589 |

|

|

|

|

|

|

|

|

| Long-term Liabilities |

|

|

|

|

|

|

Noncurrent operating lease liabilities |

|

705,702 |

|

|

|

1,178,544 |

|

|

Contingent consideration |

|

3,120,250 |

|

|

|

100,000 |

|

|

Purchase price payable |

|

1,517,381 |

|

|

|

- |

|

|

Total Liabilities |

|

30,278,620 |

|

|

|

24,104,133 |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

| Mezzanine Equity |

|

|

|

|

|

|

Preferred Stock, $0.0001 par value; 5,000,000 shares

authorized |

|

|

|

|

|

|

Series B Preferred Stock, $0.0001 par value; 5,000 shares

authorized, 3,500 and 3,500 shares issued and outstanding,

liquidation value approximately, $1,272 and $1,175 per share as of

September 30, 2022 and December 31, 2021, respectively |

|

4,451,137 |

|

|

|

4,110,822 |

|

|

|

|

|

|

|

|

| Stockholders’ (Deficit)

Equity |

|

|

|

|

|

|

Series A Preferred Stock, $0.0001 par value; 1,610,000 shares

authorized, 1,400,000 shares issued and outstanding, liquidation

value approximately $27.27 and $25.62 per share as of September 30,

2022 and December 31, 2021, respectively |

|

140 |

|

|

|

140 |

|

|

Common Stock, $0.01 par value; 100,000,000 shares authorized,

31,457,775 and 30,704,434 shares issued, 31,354,735 and 30,601,394

outstanding as of September 30, 2022 and December 31, 2021,

respectively |

|

314,578 |

|

|

|

307,045 |

|

|

Additional paid-in capital |

|

177,131,586 |

|

|

|

164,517,634 |

|

|

Accumulated deficit |

|

(177,851,083 |

) |

|

|

(141,921,085 |

) |

|

Treasury stock, 103,040 and 103,040 shares, at cost |

|

(163,701 |

) |

|

|

(163,701 |

) |

|

Total LifeMD, Inc. Stockholders’ (Deficit) Equity |

|

(568,480 |

) |

|

|

22,740,033 |

|

| Non-controlling interest |

|

(799,716 |

) |

|

|

(1,031,745 |

) |

|

Total Stockholders’ (Deficit) Equity |

|

(1,368,196 |

) |

|

|

21,708,288 |

|

|

Total Liabilities, Mezzanine Equity and Stockholders’ (Deficit)

Equity |

$ |

33,361,561 |

|

|

$ |

49,923,243 |

|

|

|

|

|

|

|

|

|

LIFEMD, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Telehealth revenue, net |

$ |

21,365,178 |

|

|

$ |

18,540,897 |

|

|

$ |

66,231,202 |

|

|

$ |

47,623,822 |

|

| WorkSimpli revenue, net |

|

10,047,291 |

|

|

|

6,406,302 |

|

|

|

24,682,602 |

|

|

|

17,835,100 |

|

|

Total revenues, net |

|

31,412,469 |

|

|

|

24,947,199 |

|

|

|

90,913,804 |

|

|

|

65,458,922 |

|

| Cost of

revenues |

|

|

|

|

|

|

|

|

|

|

|

| Cost of telehealth

revenue |

|

4,502,919 |

|

|

|

4,969,306 |

|

|

|

14,042,112 |

|

|

|

12,113,336 |

|

| Cost of WorkSimpli

revenue |

|

213,923 |

|

|

|

127,181 |

|

|

|

558,216 |

|

|

|

314,428 |

|

|

Total cost of revenues |

|

4,716,842 |

|

|

|

5,096,487 |

|

|

|

14,600,328 |

|

|

|

12,427,764 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

26,695,627 |

|

|

|

19,850,712 |

|

|

|

76,313,476 |

|

|

|

53,031,158 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

| Selling and marketing

expenses |

|

17,200,859 |

|

|

|

20,293,935 |

|

|

|

60,928,649 |

|

|

|

61,372,815 |

|

| General and administrative

expenses |

|

12,476,760 |

|

|

|

10,695,663 |

|

|

|

38,029,907 |

|

|

|

28,194,305 |

|

| Goodwill impairment

charge |

|

- |

|

|

|

- |

|

|

|

2,735,000 |

|

|

|

- |

|

| Other operating expenses |

|

1,525,645 |

|

|

|

818,404 |

|

|

|

4,804,623 |

|

|

|

2,264,257 |

|

| Customer service expenses |

|

1,488,428 |

|

|

|

505,880 |

|

|

|

3,428,098 |

|

|

|

1,274,392 |

|

| Development costs |

|

821,636 |

|

|

|

128,134 |

|

|

|

1,951,039 |

|

|

|

561,793 |

|

|

Total expenses |

|

33,513,328 |

|

|

|

32,442,016 |

|

|

|

111,877,316 |

|

|

|

93,667,562 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

loss |

|

(6,817,701 |

) |

|

|

(12,591,304 |

) |

|

|

(35,563,840 |

) |

|

|

(40,636,404 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

(132,235 |

) |

|

|

(1,824,777 |

) |

|

|

(432,405 |

) |

|

|

(2,866,150 |

) |

| Change in fair value of

contingent consideration |

|

(248,000 |

) |

|

|

- |

|

|

|

2,487,000 |

|

|

|

- |

|

| Gain on debt forgiveness |

|

- |

|

|

|

- |

|

|

|

63,400 |

|

|

|

184,914 |

|

| Net loss |

|

(7,197,936 |

) |

|

|

(14,416,081 |

) |

|

|

(33,445,845 |

) |

|

|

(43,317,640 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable

to noncontrolling interests |

|

83,737 |

|

|

|

(62,706 |

) |

|

|

154,464 |

|

|

|

(531,182 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable

to LifeMD, Inc. |

|

(7,281,673 |

) |

|

|

(14,353,375 |

) |

|

|

(33,600,309 |

) |

|

|

(42,786,458 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock dividends |

|

(776,563 |

) |

|

|

- |

|

|

|

(2,329,688 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable

to LifeMD, Inc. common stockholders |

$ |

(8,058,236 |

) |

|

$ |

(14,353,375 |

) |

|

$ |

(35,929,997 |

) |

|

$ |

(42,786,458 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic loss per share

attributable to LifeMD, Inc. common stockholders |

$ |

(0.26 |

) |

|

$ |

(0.54 |

) |

|

$ |

(1.17 |

) |

|

$ |

(1.66 |

) |

| Diluted loss per share

attributable to LifeMD, Inc. common stockholders |

$ |

(0.26 |

) |

|

$ |

(0.54 |

) |

|

$ |

(1.17 |

) |

|

$ |

(1.66 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

30,935,643 |

|

|

|

26,684,591 |

|

|

|

30,830,533 |

|

|

|

25,820,478 |

|

|

Diluted |

|

30,935,643 |

|

|

|

26,684,591 |

|

|

|

30,830,533 |

|

|

|

25,820,478 |

|

| |

|

|

|

|

|

|

|

|

|

|

LIFEMD, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2022 |

|

|

2021 |

|

2022 |

|

|

2021 |

| |

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(7,197,936 |

) |

|

|

$ |

(14,416,081 |

) |

|

$ |

(33,445,845 |

) |

|

|

$ |

(43,317,640 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of debt discount |

|

- |

|

|

|

|

1,567,677 |

|

|

|

- |

|

|

|

|

2,090,236 |

|

|

Amortization of capitalized software |

|

770,873 |

|

|

|

|

114,062 |

|

|

|

1,746,899 |

|

|

|

|

177,926 |

|

|

Amortization of intangibles |

|

325,495 |

|

|

|

|

617 |

|

|

|

666,782 |

|

|

|

|

340,457 |

|

|

Accretion of consideration payable |

|

37,373 |

|

|

|

|

- |

|

|

|

172,741 |

|

|

|

|

- |

|

|

Depreciation of fixed assets |

|

43,761 |

|

|

|

|

2,865 |

|

|

|

117,008 |

|

|

|

|

2,865 |

|

|

Gain on forgiveness of debt |

|

- |

|

|

|

|

- |

|

|

|

(63,400 |

) |

|

|

|

(184,914 |

) |

|

Change in fair value of contingent consideration |

|

248,000 |

|

|

|

|

- |

|

|

|

(2,487,000 |

) |

|

|

|

- |

|

|

Goodwill impairment charge |

|

- |

|

|

|

|

- |

|

|

|

2,735,000 |

|

|

|

|

- |

|

|

Operating lease payments |

|

172,836 |

|

|

|

|

24,588 |

|

|

|

463,198 |

|

|

|

|

73,767 |

|

|

Stock compensation expense |

|

3,336,213 |

|

|

|

|

3,110,816 |

|

|

|

11,850,000 |

|

|

|

|

7,983,891 |

|

|

Stock issued for legal settlement |

|

816,000 |

|

|

|

|

- |

|

|

|

816,000 |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in Assets and Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

(24,491 |

) |

|

|

|

115,121 |

|

|

|

(1,558,063 |

) |

|

|

|

(969,053 |

) |

|

Product deposit |

|

332,790 |

|

|

|

|

479,816 |

|

|

|

95,505 |

|

|

|

|

(95,183 |

) |

|

Inventory |

|

(710,889 |

) |

|

|

|

27,023 |

|

|

|

(2,052,363 |

) |

|

|

|

(322,836 |

) |

|

Other current assets |

|

58,629 |

|

|

|

|

(242,122 |

) |

|

|

(21,386 |

) |

|

|

|

(534,479 |

) |

|

Change in operating lease liability |

|

(167,644 |

) |

|

|

|

(23,432 |

) |

|

|

(378,095 |

) |

|

|

|

(68,085 |

) |

|

Deferred revenue |

|

360,650 |

|

|

|

|

54,043 |

|

|

|

853,272 |

|

|

|

|

519,101 |

|

|

Accounts payable |

|

(1,026,708 |

) |

|

|

|

(2,406,968 |

) |

|

|

1,827,103 |

|

|

|

|

(1,150,858 |

) |

|

Accrued expenses |

|

(150,954 |

) |

|

|

|

4,172,834 |

|

|

|

(2,303,466 |

) |

|

|

|

8,195,255 |

|

|

Net cash used in operating activities |

|

(2,776,002 |

) |

|

|

|

(7,419,141 |

) |

|

|

(20,966,110 |

) |

|

|

|

(27,259,550 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for capitalized software costs |

|

(2,220,018 |

) |

|

|

|

(779,160 |

) |

|

|

(6,742,946 |

) |

|

|

|

(1,731,507 |

) |

|

Purchase of equipment |

|

(21,546 |

) |

|

|

|

(51,989 |

) |

|

|

(378,877 |

) |

|

|

|

(70,105 |

) |

|

Purchase of intangible assets |

|

- |

|

|

|

|

(22,231 |

) |

|

|

(4,000,500 |

) |

|

|

|

(22,231 |

) |

|

Acquisition of business, net of cash acquired |

|

- |

|

|

|

|

- |

|

|

|

(1,012,395 |

) |

|

|

|

- |

|

|

Net cash used in investing activities |

|

(2,241,564 |

) |

|

|

|

(853,380 |

) |

|

|

(12,134,718 |

) |

|

|

|

(1,823,843 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash proceeds from private placement offering, net |

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

|

13,495,270 |

|

|

Proceeds from issuance of debt instruments |

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

|

15,000,000 |

|

|

Cash proceeds from sale of common stock under ATM |

|

- |

|

|

|

|

493,481 |

|

|

|

- |

|

|

|

|

493,481 |

|

|

Cash proceeds from exercise of options |

|

- |

|

|

|

|

54,000 |

|

|

|

90,400 |

|

|

|

|

820,750 |

|

|

Cash proceeds from exercise of warrants |

|

- |

|

|

|

|

168,610 |

|

|

|

38,500 |

|

|

|

|

480,609 |

|

|

Preferred stock dividends |

|

(776,563 |

) |

|

|

|

- |

|

|

|

(2,329,688 |

) |

|

|

|

- |

|

|

Proceeds from notes payable |

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

|

963,965 |

|

|

Repayment of notes payable |

|

- |

|

|

|

|

(374,834 |

) |

|

|

- |

|

|

|

|

(1,494,784 |

) |

|

Contingent consideration payment for ResumeBuild |

|

(62,500 |

) |

|

|

|

- |

|

|

|

(93,750 |

) |

|

|

|

- |

|

| Purchase of membership

interest of WorkSimpli |

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

|

(300,000 |

) |

| Reduction of membership

interest of WorkSimpli |

|

12,150 |

|

|

|

|

- |

|

|

|

12,150 |

|

|

|

|

- |

|

|

Distributions to non-controlling interest |

|

(36,000 |

) |

|

|

|

(36,000 |

) |

|

|

(108,000 |

) |

|

|

|

(108,000 |

) |

|

Net cash (used in) provided by financing activities |

|

(862,913 |

) |

|

|

|

305,257 |

|

|

|

(2,390,388 |

) |

|

|

|

29,351,291 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (decrease) increase in cash |

|

(5,880,479 |

) |

|

|

|

(7,967,264 |

) |

|

|

(35,491,216 |

) |

|

|

|

267,898 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash at beginning of period |

|

11,717,302 |

|

|

|

|

17,414,237 |

|

|

|

41,328,039 |

|

|

|

|

9,179,075 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash at end of period |

$ |

5,836,823 |

|

|

|

$ |

9,446,973 |

|

|

$ |

5,836,823 |

|

|

|

$ |

9,446,973 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash paid for interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid during the period for interest |

$ |

- |

|

|

|

$ |

- |

|

|

$ |

- |

|

|

|

$ |

120,062 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash investing and financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashless exercise of options |

$ |

42 |

|

|

|

$ |

8,730 |

|

|

$ |

297 |

|

|

|

$ |

8,730 |

|

|

Consideration payable for Cleared acquisition |

$ |

- |

|

|

|

$ |

- |

|

|

$ |

8,079,367 |

|

|

|

$ |

- |

|

|

Consideration payable for ResumeBuild acquisition |

$ |

- |

|

|

|

$ |

- |

|

|

$ |

500,000 |

|

|

|

$ |

- |

|

|

Warrants issued for debt instruments |

$ |

- |

|

|

|

$ |

- |

|

|

$ |

- |

|

|

|

$ |

6,270,710 |

|

| Principal of Paycheck

Protection Program loans forgiven |

$ |

- |

|

|

|

$ |

- |

|

|

$ |

63,400 |

|

|

|

$ |

184,914 |

|

| Additional purchase of

membership interest in WorkSimpli issued in performance

options |

$ |

- |

|

|

|

$ |

- |

|

|

$ |

- |

|

|

|

$ |

144,002 |

|

| |

About the Use of Non-GAAP

Financial Measures:To supplement our financial information

presented in accordance with GAAP, we use Adjusted EBITDA and

Adjusted EPS as non-GAAP financial measures to clarify and enhance

an understanding of past performance. We believe that the

presentation of these financial measures enhances an investor’s

understanding of our financial performance. We further believe that

these financial measures are useful financial metrics to assess our

operating performance from period-to-period by excluding certain

items that we believe are not representative of our core business.

We use certain financial measures for business planning purposes

and in measuring our performance relative to that of our

competitors.

Adjusted EBITDA is defined as income

(loss) attributable to common shareholders before interest, taxes,

depreciation, amortization, accretion, financing transaction

expense, foreign currency translation, inventory valuation,

litigation costs, gain on debt forgiveness, preferred stock

dividends, acquisition costs, severance expenses, goodwill

impairment charges, change in fair value of contingent

consideration and stock-based compensation expense. We have

provided below a reconciliation of Adjusted EBITDA to Net loss

attributable to common shareholders, its most directly comparable

GAAP financial measure.

Adjusted EPS is defined as the diluted

net loss attributable to LifeMD, Inc common shareholders before

interest, taxes, depreciation, amortization, accretion, financing

transaction expense, foreign currency translation, inventory

valuation, litigation costs, preferred stock dividends, acquisition

costs, severance expenses, goodwill impairment charges, change in

fair value of contingent consideration and stock-based compensation

expense. We have provided below a reconciliation of Adjusted EPS to

Diluted loss per share attributable to LifeMD, Inc common

shareholders, its most directly comparable GAAP financial

measure.

We believe the above financial

measures are commonly used by investors to evaluate our performance

and that of our competitors. However, our use of the terms Adjusted

EBITDA and Adjusted EPS may vary from that of others in our

industry. Adjusted EBITDA and Adjusted EPS should not be considered

as an alternative to net loss before taxes, net loss per share,

operating loss or any other performance measures derived in

accordance with GAAP as measures of performance.

| |

|

|

|

|

|

|

|

|

Reconciliation of GAAP Net Loss to Adjusted

EBITDA |

|

|

(in whole numbers, unaudited) |

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

Net loss attributable to common shareholders |

$ |

(8,058,236 |

) |

|

$ |

(14,353,375 |

) |

|

$ |

(35,929,997 |

) |

|

$ |

(42,786,458 |

) |

| |

|

|

|

|

|

|

|

| Interest expense (excluding

debt discount and acceleration of debt) |

|

17,550 |

|

|

|

142,415 |

|

|

|

92,090 |

|

|

|

435,599 |

|

| Depreciation, amortization and

accretion expense |

|

1,177,502 |

|

|

|

117,544 |

|

|

|

2,703,430 |

|

|

|

521,248 |

|

| Amortization of debt

discount |

|

- |

|

|

|

1,567,677 |

|

|

|

- |

|

|

|

2,090,236 |

|

| Gain on debt forgiveness |

|

- |

|

|

|

- |

|

|

|

(63,400 |

) |

|

|

(184,914 |

) |

| Financing transactions

expense |

|

- |

|

|

|

186,682 |

|

|

|

152,015 |

|

|

|

1,259,072 |

|

| Litigation costs |

|

813,000 |

|

|

|

64,541 |

|

|

|

1,517,359 |

|

|

|

279,666 |

|

| Inventory valuation

adjustment |

|

- |

|

|

|

- |

|

|

|

230,661 |

|

|

|

- |

|

| Severance costs |

|

- |

|

|

|

- |

|

|

|

179,090 |

|

|

|

- |

|

| Acquisitions expenses |

|

- |

|

|

|

- |

|

|

|

265,153 |

|

|

|

- |

|

| Change in fair value of

contingent consideration |

|

248,000 |

|

|

|

- |

|

|

|

(2,487,000 |

) |

|

|

- |

|

| Goodwill impairment

charge |

|

- |

|

|

|

- |

|

|

|

2,735,000 |

|

|

|

- |

|

| Accrued interest on Series B

Convertible Preferred Stock |

|

114,685 |

|

|

|

114,685 |

|

|

|

340,315 |

|

|

|

340,315 |

|

| Foreign exchange (gain)

loss |

|

685,242 |

|

|

|

- |

|

|

|

685,242 |

|

|

|

- |

|

| Preferred dividends |

|

776,563 |

|

|

|

- |

|

|

|

2,329,688 |

|

|

|

- |

|

| Stock-based compensation

expense |

|

3,336,213 |

|

|

|

3,110,816 |

|

|

|

11,850,000 |

|

|

|

7,983,891 |

|

| |

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

(889,481 |

) |

|

$ |

(9,049,016 |

) |

|

$ |

(15,400,354 |

) |

|

$ |

(30,061,346 |

) |

| |

| |

|

|

|

|

|

|

|

|

Reconciliation of GAAP Diluted Loss per Share Attributable

to Common Shareholders to Adjusted EPS |

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

Diluted loss per share attributable to LifeMD, Inc. common

shareholders |

$ |

(0.26 |

) |

|

$ |

(0.54 |

) |

|

$ |

(1.17 |

) |

|

$ |

(1.66 |

) |

| |

|

|

|

|

|

|

|

| Adjustments to Reconcile GAAP

Diluted Loss Per Share to Adjusted EPS |

|

|

|

|

|

|

|

| Interest expense (excluding

debt discount and acceleration of debt) |

|

- |

|

|

|

0.01 |

|

|

|

- |

|

|

|

0.02 |

|

| Depreciation, amortization and

accretion expense |

|

0.04 |

|

|

|

- |

|

|

|

0.09 |

|

|

|

0.02 |

|

| Amortization of debt

discount |

|

- |

|

|

|

0.06 |

|

|

|

- |

|

|

|

0.08 |

|

| Gain on debt forgiveness |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Financing transactions

expense |

|

- |

|

|

|

0.01 |

|

|

|

- |

|

|

|

0.05 |

|

| Litigation costs |

|

0.03 |

|

|

|

- |

|

|

|

0.05 |

|

|

|

0.01 |

|

| Inventory valuation

adjustment |

|

- |

|

|

|

- |

|

|

|

0.01 |

|

|

|

- |

|

| Severance costs |

|

- |

|

|

|

- |

|

|

|

0.01 |

|

|

|

- |

|

| Acquisitions expenses |

|

- |

|

|

|

- |

|

|

|

0.01 |

|

|

|

- |

|

| Change in fair value of

contingent consideration |

|

0.01 |

|

|

|

- |

|

|

|

(0.08 |

) |

|

|

- |

|

| Goodwill impairment

charge |

|

- |

|

|

|

- |

|

|

|

0.09 |

|

|

|

- |

|

| Accrued interest on Series B

Convertible Preferred Stock |

|

- |

|

|

|

- |

|

|

|

0.01 |

|

|

|

0.01 |

|

| Foreign exchange (gain)

loss |

|

0.02 |

|

|

|

- |

|

|

|

0.02 |

|

|

|

- |

|

| Preferred dividends |

|

0.02 |

|

|

|

- |

|

|

|

0.08 |

|

|

|

- |

|

| Stock-based compensation

expense |

|

0.11 |

|

|

|

0.12 |

|

|

|

0.38 |

|

|

|

0.31 |

|

| |

| Adjusted EPS |

$ |

(0.03 |

) |

|

$ |

(0.34 |

) |

|

$ |

(0.50 |

) |

|

$ |

(1.16 |

) |

| |

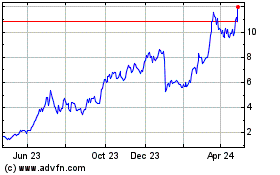

LifeMD (NASDAQ:LFMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

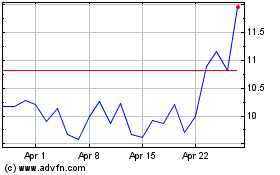

LifeMD (NASDAQ:LFMD)

Historical Stock Chart

From Apr 2023 to Apr 2024