As

filed with the Securities and Exchange Commission on July 23, 2021

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

LIFEMD,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

76-0238453

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(I.R.S.

Employer

Identification

Number)

|

800

Third Avenue, Suite 2800

New

York, NY 10022

(855)

743-6478

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Justin

Schreiber

800

Third Avenue, Suite 2800

New

York, NY 10022

Telephone:

(855) 743-6478

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Joseph

M. Lucosky, Esq.

Lawrence

Metelitsa, Esq.

Lucosky

Brookman LLP

101

Wood Avenue South, 5th Floor

Iselin,

NJ 08830

(732)

395-4400

APPROXIMATE

DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. [ ]

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. [X]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. [ ]

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer

|

[ ]

|

|

Accelerated

filer

|

[ ]

|

|

Non-accelerated

filer

|

[X]

|

|

Smaller

reporting company

|

[X]

|

|

|

|

|

Emerging

growth company

|

[ ]

|

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount of Shares to be Registered (1)

|

|

|

Proposed

Maximum

Offering

Price per

Share (2)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

|

Amount of

Registration

Fee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, $0.001 par value per share, issuable upon exercise of the Warrants

|

|

|

1,500,000

|

|

|

$

|

9.22

|

|

|

$

|

13,830,000

|

|

|

$

|

1,508.86

|

|

|

Total

|

|

|

1,500,000

|

|

|

$

|

9.22

|

|

|

$

|

13,830,000

|

|

|

$

|

1,508.86

|

|

|

(1)

|

Pursuant

to Rule 416 under the Securities Act of 1933, as amended, the shares of Common Stock (as defined below) being registered hereunder

include such indeterminate number of shares of Common Stock as may be issuable with respect to the shares of Common Stock being registered

hereunder as a result of stock splits, stock dividends or similar transactions.

|

|

|

|

|

(2)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act. Based on the average

of the high and low reported trading prices of Common Stock as reported on the Nasdaq Capital Market on July 20, 2021.

|

|

|

|

|

(3)

|

Represents

the maximum number of shares of common stock that the Registrant expects could be issuable upon the exercise of the Warrants (as

defined below), all of which were acquired by the Selling Stockholder.

|

|

|

|

|

(4)

|

Paid

herewith.

|

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek

an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to Completion, dated July 23, 2021.

PROSPECTUS

LIFEMD,

INC.

1,500,000

Shares of Common Stock

This

prospectus relates to the resale, from time to time, of up to 1,500,000 shares (the “Shares”) of our common stock, par value

$0.001 per share (“Common Stock”), underlying the Warrants (as defined herein) held by the selling stockholder identified

in this prospectus under “Selling Stockholder” (the “Offering”) pursuant to the June 2021 Financing (as defined

herein). We will receive proceeds from any warrants that are exercised through the payment of the exercise price in cash. The Selling

Stockholder will bear all commissions and discounts, if any, attributable to the sale of the Shares. We will bear all costs, expenses

and fees in connection with the registration of the Shares.

No

securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of

the offering of such securities.

INVESTING

IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 6 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED

IN THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

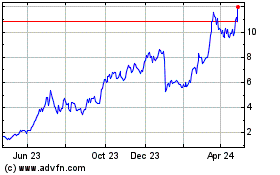

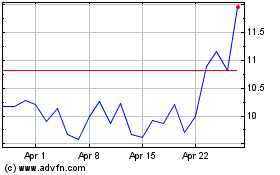

Our

Common Stock is listed on The NASDAQ Capital Market under the symbol “LFMD”. On July 20, 2021, the last reported sale

price of our Common Stock on The NASDAQ Capital Market was $9.22 per share.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 in this prospectus for a

discussion of information that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is July 23, 2021.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”).

You should read this prospectus and the information and documents incorporated by reference carefully. Such documents contain important

information you should consider when making your investment decision. See “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” in this prospectus.

This

prospectus may be supplemented from time to time to add, to update or change information in this prospectus. Any statement contained

in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained

in a prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this

prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You may only

rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with

different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other

than the securities offered by this prospectus. This prospectus and any future prospectus supplement do not constitute an offer to sell

or a solicitation of an offer to buy any securities in any circumstances in which such offer or solicitation is unlawful. Neither the

delivery of this prospectus or any prospectus supplement nor any sale made hereunder shall, under any circumstances, create any implication

that there has been no change in our affairs since the date of this prospectus or such prospectus supplement or that the information

contained by reference to this prospectus or any prospectus supplement is correct as of any time after its date.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You

Can Find More Information.”

The

Selling Stockholder are offering the Shares only in jurisdictions where such offer is permitted. The distribution of this prospectus

and the sale of the Shares in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession

of this prospectus must inform themselves about, and observe any restrictions relating to, the distribution of this prospectus and the

sale of the Shares outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to

sell, or a solicitation of an offer to buy, the Shares by any person in any jurisdiction in which it is unlawful for such person to make

such an offer or solicitation. If there is any inconsistency between the information in this prospectus and the applicable prospectus

supplement, you should rely on the prospectus supplement. Before purchasing any securities, you should carefully read both this prospectus

and the applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find

More Information; Incorporation by Reference.”

We

have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. We will not make an offer to sell these securities in any jurisdiction where the offer or sale

is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this

prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as

of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations

and prospects may have changed since those dates.

When

we refer to “LifeMD,” “we,” “our,” “us” and the “Company” in this prospectus,

we mean LifeMD, Inc., unless otherwise specified. When we refer to “you,” we mean the holders of the applicable series of

securities.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, the documents that we incorporate by reference and any free writing prospectuses that we may authorize for use in connection

with this offering contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933,

as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These forward-looking

statements can generally be identified as such because the context of the statement will include words such as “may,” “will,”

“intend,” “plan,” “believe,” “anticipate,” “expect,” “estimate,”

“predict,” “potential,” “continue,” “likely,” or “opportunity,” the negative

of these words or words of similar import. Similarly, statements that describe our future plans, strategies, intentions, expectations,

objectives, goals or prospects are also forward-looking statements. Discussions containing these forward-looking statements may be found,

among other places, in the “Business” and “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” sections incorporated by reference from our most recent Annual Report on Form 10-K and our Quarterly Reports on

Form 10-Q for the quarterly periods ended subsequent to our filing of such Annual Report on Form 10-K, as well as any amendments thereto

reflected in subsequent filings with the SEC.

These

forward-looking statements are based largely on our expectations and projections about future events and future trends affecting our

business, and are subject to risks and uncertainties that could cause actual results to differ materially from those anticipated in the

forward-looking statements. The risks and uncertainties include, among others, those noted in the “Risk Factors” section

of this prospectus and in any applicable prospectus supplement or free writing prospectus, and those included in the documents that we

incorporate by reference herein and therein.

New

risks and uncertainties emerge from time to time, and it is not possible for us to predict all of the risks and uncertainties that could

have an impact on the forward-looking statements, including without limitation, risks and uncertainties relating to:

|

|

●

|

changes

in the market acceptance of our products;

|

|

|

●

|

increased

levels of competition;

|

|

|

●

|

changes

in political, economic or regulatory conditions generally and in the markets in which we operate;

|

|

|

●

|

our

relationships with our key customers;

|

|

|

●

|

our

ability to retain and attract senior management and other key employees;

|

|

|

●

|

our

ability to quickly and effectively respond to new technological developments;

|

|

|

●

|

our

ability to protect our trade secrets or other proprietary rights, operate without infringing upon the proprietary rights of others

and prevent others from infringing on our proprietary rights;

|

|

|

●

|

our

ability to successfully commercialize our products on a large enough scale to generate profitable operations;

|

|

|

●

|

business

interruptions resulting from geo-political actions, including war, and terrorism or disease outbreaks (such as the recent outbreak

of COVID-19, or the novel coronavirus);

|

|

|

●

|

our

ability to continue as a going concern;

|

|

|

●

|

our

need to raise additional funds in the future;

|

|

|

●

|

our

ability to successfully implement our business plan;

|

|

|

●

|

being

able to scale our telehealth platform built to improve the experience and medical care provided to patients across the country;

|

|

|

●

|

intellectual

property claims brought by third parties; and

|

|

|

●

|

the

impact of any industry regulation.

|

In

addition, past financial and/or operating performance is not necessarily a reliable indicator of future performance, and you should not

use our historical performance to anticipate results or future period trends. We can give no assurances that any of the events anticipated

by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial

condition. Except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events

or circumstances that arise after the filing of this prospectus or any applicable prospectus supplement or free writing prospectus, or

documents incorporated by reference herein and therein, that include forward-looking statements.

Prospectus

Summary

This

summary highlights certain information about us, this offering and information appearing elsewhere in this prospectus and in the

documents we incorporate by reference. This summary is not complete and does not contain all of the information that you should

consider before investing in our securities. To fully understand this offering and its consequences to you, you should read this

entire prospectus carefully, including the information referred to under the heading “Risk Factors” in this prospectus

beginning on page 6, the financial statements and other information incorporated by reference in this prospectus when making

an investment decision. This is only a summary and may not contain all the information that is important to you. You should

carefully read this prospectus, including the information incorporated by reference therein, and any other offering materials,

together with the additional information described under the heading “Where You Can Find More

Information”

The

Company

The

following is a summary of what we believe to be the most important aspects of our business and the offering of our securities under this

prospectus. We urge you to read this entire prospectus, including the more detailed consolidated financial statements, notes to the consolidated

financial statements and other information incorporated by reference from our other filings with the SEC or included in any applicable

prospectus supplement. Investing in our securities involves risks. Therefore, carefully consider the risk factors set forth in any prospectus

supplements and in our most recent annual and quarterly filings with the SEC, as well as other information in this prospectus and any

prospectus supplements and the documents incorporated by reference herein or therein, before purchasing our securities. Each of the risk

factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment

in our securities.

Business

Overview and Strategy

LifeMD

is a direct-to-patient telehealth technology company that provides a smarter, cost-effective and convenient way for a provider’s

patients to access healthcare. We believe the traditional model of visiting a doctor’s office, receiving a physical prescription,

visiting a local pharmacy, and returning to see a doctor for follow up care or prescription refills is inefficient, costly to patients,

and discourages many patients from seeking much needed medical care. The U.S. healthcare system is undergoing a paradigm shift, thanks

to new technologies and the emergence of direct-to-patient healthcare. Direct-to-patient telemedicine technology companies, like our

company, connect consumers to licensed healthcare professionals for care across numerous indications, including concierge care, men’s

sexual health and dermatology, among others.

Our

telemedicine platform helps patients access their licensed providers for diagnoses, virtual care, and prescription medications, often

delivered on a recurring basis. In addition to our telemedicine technology offerings, we sell nutritional supplements and other over-the-counter

products. Many of our products are available on a subscription or membership basis, where a patient can subscribe to receive regular

shipments of prescribed medications or products. This creates convenience and often discounted pricing opportunities for patients and

recurring revenue streams for us. Our customer acquisition strategy combines strategic brand-building media placements and direct response

advertising methods across highly scalable marketing channels (i.e., national TV, streaming TV, streaming audio, podcast, print, magazines,

online search, social media, and digital).

Since

inception, we have helped more than 300,000 customers and patients, providing them greater access to high-quality, convenient, and affordable

care in all 50 states. Our telemedicine technology revenue increased 208% in 2020 vs. the prior year. Total revenue from recurring subscriptions

is approximately 70%. In addition to our telehealth technology business, we own 85.6% of PDFSimpli, a rapidly growing SaaS platform for

converting, signing, editing and sharing PDF documents. This business has also seen 165% year over year growth, with recurring revenue

of 100%.

Many

people can relate to the hassle and inconvenience of seeking medical care. We believe that telemedicine platforms like ours will fundamentally

shift how a provider’s patients access healthcare in the U.S., by necessity and by preference. With the average wait time to see

a physician in the U.S. now at greater than 29 days, according to a 2018 Merritt Hawkins Survey, and the U.S. projected to have a significant

shortfall of licensed physicians by 2030, we believe the U.S. healthcare infrastructure must change to accommodate patients. Timely and

convenient access to healthcare and prescription medications is a critical factor in improving quality of care and patient outcomes.

Our mission is to radically change healthcare with our portfolio of direct-to-patient telemedicine technology brands that encompass on-demand

medical treatment, online pharmacy and over-the-counter products. We want our brands to be top-of-mind for consumers considering telehealth.

In

the United States, healthcare spending is currently $4.0 trillion and is expected to grow to $6.2 trillion by 2028, according to the

Centers for Medicare and Medicaid Services. Physician services and prescription medications account for approximately 30% of healthcare

spending, or over $1 trillion annually, and we believe that we have the infrastructure, medical expertise, and technical know-how to

shift a substantial portion of this market to an online, virtual format. Our telemedicine platforms are fast and convenient, and we believe

the adoption of our services has increased rapidly because of these features, including lower out-of-pocket costs for a provider’s

patients and the satisfaction of a simple healthcare process. We believe the opportunities are immense and that we are well positioned

to capitalize on these large scale economic shifts in healthcare.

We

believe that brand innovation, customer acquisition and service excellence form the heart of our business. As is exemplified with our

first brand, Shapiro MD, we have built a full line of proprietary OTC products for male and female hair loss, FDA approved OTC minoxidil,

an FDA-cleared medical device, and now a personalized telemedicine platform offering that gives consumers access to virtual medical treatment

from their providers and, when appropriate, a full line of oral and topical prescription medications for hair loss. Our men’s brand,

Rex MD, offers access to provider-based treatment through telehealth for men’s health conditions, currently providing prescription

medications and OTC products for chronic conditions such as sexual health and hair loss. Rex MD has recently expanded its services to

provide access to primary care and will soon offer treatments for additional chronic indications present in men’s health. We have

built a platform that allows us to efficiently aid the provision of telehealth and provide wellness product lines wherever we determine

there is a market need. Our platform is supported by a driven team of digital marketing and branding experts, data analysts, designers,

and engineers focused on building enduring brands.

Our

Brand Portfolio

We

have built a strategic portfolio of wholly-owned telemedicine platform brands that address large unmet needs in men’s health, hair

loss and dermatology. LifeMD is also preparing to offer administrative support to various professional entities that will provide a direct

concierge medicine offering to patients under the LifeMD brand. We continue to scale our offerings in a calculated manner, ensuring that

each brand or indication we launch will enhance current and future patients’ experiences with our platform.

Our

process across each brand and condition that we treat is to guide the provider’s patient through an intake process and product

selection, after which a licensed U.S. physician within our contracted network conducts a virtual consultation and, if appropriate, prescribes

necessary prescription medications and/or recommends over-the-counter products. Prescription and over the counter products are filled

by pharmacy fulfillment partners and shipped directly to the patient. The number of patients and customers we serve across the nation

continues to increase at a robust pace, with more than 300,000 individuals having purchased our products and services to date.

Hair

Loss: Shapiro MD

Launched

in 2017, Shapiro MD offers access to virtual medical treatment, prescription medications, patented over-the-counter products, and an

FDA approved medical device for male and female hair loss through our telemedicine platform. Shapiro MD has emerged as a leading destination

for hair loss treatment across the U.S. and has had more than 200,000 customers and patients since inception. In Q1 2021, Shapiro MD

greatly enhanced its offerings for female hair loss treatment with the addition of topical compounded medications to its product portfolio.

On

February 21, 2020, ConsumersAdvocate.org ranked ShapiroMD as the third best hair loss treatment provider in the United States, ahead

of other household brands such as Bosley, Keeps and Rogaine.

Men’s

Health: Rex MD

Launched

in 2019, Rex MD is a men’s telehealth platform brand offering access to virtual medical treatment from licensed providers for a

variety of men’s health needs. After consultation with a physician, if appropriate, we dispense and ship prescription medications

and over-the-counter products directly to a provider’s patients. Since our initial launch in the erectile dysfunction treatment

market, we have expanded our offerings to cover categories such as sexual health and hair loss in the first quarter of 2021. We intend

to continue expanding our offerings to cover many other chronic indications present in the men’s health market. Our vision for

Rex MD is to become a leading telehealth destination for men.

Dermatology:

Nava MD

Launching

in the first quarter of 2021, Nava MD is a female-oriented tele-dermatology and skincare brand that will offer access to virtual medical

treatment from dermatologists and other providers, and, if appropriate, prescription oral and compounded topical medications to treat

many common dermatological conditions. In addition to the brand’s telemedicine platform offerings, Nava MD’s proprietary

products leverage intellectual property and proprietary formulations licensed from Restorsea, a leading medical grade skincare technology

platform.

Restorsea’s

clinically proven skincare technology platform is the result of more than $50 million invested in R&D and intellectual property development

and has received 35 patents along with broad industry and academic acclaim, with its breakthrough clinical results having been published

in the peer-reviewed Journal of Drugs in Dermatology and Journal of Clinical and Aesthetic Dermatology. Nava MD will be one of the first

direct-to-consumer product lines to offer this advanced skincare technology. Nava MD will be positioned as an online skincare and telehealth

platform brand that will offer access to tele-dermatology services to a provider’s patients in 47 states.

Immune

Health: iNR Wellness MD

Launched

in 2018, iNR Wellness MD is a supplement for immune and digestive support. The iNR Wellness product line is a daily nutritional supplement

that contains yeast, oat, and mushroom beta glucans.

Majority

Owned Subsidiary: PDFSimpli

PDFSimpli

is an online software-as-a-service (SAAS) platform that allows users to create, edit, convert, sign and share PDF documents. PDFSimpli

was acquired through the purchase of 51% of the membership interests of LegalSimpli Software, LLC, a Puerto Rico limited liability company,

which operates a marketing-driven software solutions business. As of December 30, 2020, PDFSimpli was ranked in the top 4,339 websites

globally, in which it was also ranked in the top 1,200 for specific countries with more than 9.5 million registrants globally. Since

its launch, PDFSimpli has converted or edited over 9 terabytes of documents for customers from the legal, financial, real-estate and

academic sectors. PDFSimpli had over 62,600 active subscriptions as of December 30, 2020.

Customers

Our

customer base includes men and women seeking hair loss treatment and men’s health issues. In 2021, we expect to broaden this customer

base to also include skincare and dermatology products for men and women. LifeMD is also preparing to offer administrative support to

various professional entities that will provide a direct concierge medicine offering to patients under the LifeMD brand. No single customer

accounted for more than 10% of net sales for the years ended December 31, 2020 and 2019.

Corporate

Information

LifeMD,

Inc. was formed in the State of Delaware on June 21, 1994, under its prior name, Immudyne, Inc. The Company changed its name to Conversion

Labs, Inc. on June 15, 2018 and then subsequently, on February 18, 2021, it changed its name to LifeMD, Inc. Effective February 22, 2021,

the trading symbol for the Company’s common stock, par value $0.01 per share on The Nasdaq Stock Market LLC changed from “CVLB”

to “LFMD”.

On

April 1, 2016, the original operating agreement of Immudyne PR LLC (“Immudyne PR”), a joint venture to market the Company’s

skincare products, was amended and restated and the Company increased its ownership and voting interest in Immudyne PR to 78.2%. Concurrent

with the name change of the parent company to Conversion Labs, Inc., Immudyne PR was renamed to Conversion Labs PR LLC. On April 25,

2019, the operating agreement of Conversion Labs PR was amended and restated in its entirety to increase the Company’s ownership

and voting interest in Conversion Labs PR to 100%. On February 22, 2021, concurrent with the name of the parent company to LifeMD, Inc.,

Conversion Labs PR LLC was renamed to LifeMD PR, LLC.

Recent

Developments

Appointment

of President

On

June 10, 2021 (the “Effective Date”), the Board appointed Mr. Alexander Mironov as the Company’s President (the “Appointment”).

Mr.

Mironov, age 41, brings a wealth of knowledge from his over 20 years of experience leading business development, mergers, and acquisitions,

as well as corporate strategy in the pharmaceutical space, most recently at Covis Pharma, a global private pharmaceutical company backed

by Apollo Global Management, Inc., an investment manager with nearly half a trillion of total assets under management. Over his career,

Mr. Mironov has led transactions in the pharmaceutical space totaling over $5 billion in value including M&A, licensing, and equity

and debt financings. At Covis, he served as Chief Business Officer from 2016 to 2021, leading global business development and M&A,

corporate strategy, and life-cycle management, and taking responsibility for over half a dozen transformational transactions, which significantly

contributed to the accelerated growth and expansion of Covis to over 50 global markets and new therapeutic segments. His contributions

at Covis directly led to revenues increasing over 10x during his tenure. Prior to Covis, Mr. Mironov held similar roles focusing on a

buy and build strategy at Alvogen, Pernix Pharma, Esprit Pharma, EKR Therapeutics, and Valera Pharma.

In

connection with the Appointment, Mr. Mironov entered into an Employment Agreement (the “Employment Agreement”) with the Company.

The Employment Agreement is for an indefinite term and may be terminated with or without cause. Pursuant to the Employment Agreement,

Mr. Mironov will receive an annual base salary of $500,000.00 and shall be eligible to earn a performance bonus in such amount, if any,

as determined in the sole discretion of the Board, with a target amount of 20% of the base salary. To induce Mr. Mironov to enter into

the Employment Agreement, he was granted a performance-based grant of up to 300,000 restricted shares of the Company’s common stock

(the “Restricted Shares”), subject to, inter alia, his sourcing, and material contribution to, the consummation of

pharmaceutical deals, as set forth in more detail in the Employment Agreement. As a further inducement to enter into the Employment Agreement,

Mr. Mironov received stock options (the “Stock Options”) to purchase up to 200,000 shares of the Company’s common stock.

The Stock Options have a term of five years and shall vest in equal monthly tranches, based on the passage of time, over the 36 months,

beginning on the Effective Date.

Upon

termination of Mr. Mironov without cause, or upon his resignation for good reason, the Company shall pay or provide to Mr. Mironov severance

pay equal to his then current monthly base salary for twelve months from the date of termination, during which time Mr. Mironov shall

continue to receive all employee benefits and employee benefit plans as described in the Employment Agreement. As a full-time employee

of the Company, Mr. Mironov will be eligible to participate in all of the Company’s benefit programs.

June

2021 Securities Purchase Agreement

On

June 1, 2021, we entered into a securities purchase agreement (the “Purchase Agreement”) with BRF Finance Co., LLC(the

“BRF”), pursuant to which the Company sold and issued: (i) a senior secured redeemable debenture (the “Debenture”)

in the aggregate principal amount of $15,000,000.00 (the “Aggregate Principal Amount”), and (ii) warrants to purchase

up to an aggregate of 1,500,000 shares of the Company’s common stock at an exercise price of $12.00 per share (the “Warrant”).

However, the amount of shares exercisable pursuant to the Warrant is directly connected to how long the Debenture remains outstanding.

If the Debenture is repaid on or before the one year anniversary date of the Initial Exercise Date (as defined herein), BRF shall be

entitled to exercise up to 500,000 shares of common stock. Thereafter so long as the Debenture has not been repaid, beginning on the

date that is 366 days from the Initial Exercise Date, the Warrant may be exercised for up to an additional 500,000 shares of common stock.

Should the Debenture remain outstanding, beginning on the date that is 732 days from the Initial Exercise Date, the Warrant may be exercised

for up to an additional further 500,000 shares of common stock. The Warrant is immediately exercisable upon issuance (the “Initial

Exercise Date”) at an exercise price of $12.00 per share, subject to adjustment as provided therein. The Warrant has a term

of three years.

Subject

to limited exceptions, BRF will not have the right to exercise any portion of the Warrant if BRF, together with its affiliates, would

exceed the Beneficial Ownership Limitation; provided, however, that upon 61 days’ prior notice to us, the holder may increase the

Beneficial Ownership Limitation, provided that in no event will the Beneficial Ownership Limitation exceed 9.99%.

We

received gross proceeds of $15,000,000 and intend to use such proceeds for working capital and general corporate purposes. The Purchase

Agreement contains customary representations, warranties and agreements by us and customary conditions to closing.

The

Debenture was assigned from BRF to B. Riley Principal Investments, LLC (hereinafter referred to as “B. Riley” or “Holder”)

on June 22, 2021.

The

Aggregate Principal Amount of the Debenture, together with interest, shall be due and payable on June 1, 2024. The Debenture bears interest

as follows as follows: (i) for the period beginning on June 1, 2021 and ending on the date that is six (6) months thereafter (the “Initial

Interest Rate Period”) shall be six percent (6%), (ii) for the period beginning the date following the Initial Interest Rate

Period and ending on the date that is three (3) months thereafter (the “Second Interest Rate Period”), nine percent

(9%), and (iii) for the period beginning the date following the Second Interest Rate Period and ending on June 1, 2024, twelve percent

(12%). The Debenture contains redemption provisions which require the Company to redeem the principal amount outstanding on the Debenture,

as set forth in the Debenture. Until such time as the Debenture shall have been paid in full, the Company shall apply thirty-five

percent (35%) of the gross proceeds received by the Company from At-The-Market offerings of its common stock to partial redemptions of

the Debenture.

In

connection with the Purchase Agreement, the Company has agreed to secure all of the Company’s Obligations (as defined in the Purchase

Agreement) to the Purchaser under the Debenture, Company Security Agreement (as defined below) and all other Transaction Documents (as

defined in the Purchase Agreement) by granting to the Purchaser an unconditional and continuing security interest in all of the assets

and properties of the Company, whether now existing or hereafter acquired, pursuant to that certain Security Agreement, dated as of June

1, 2021 (the “Company Security Agreement”). Moreover, the subsidiaries of the Company, LifeMD PR, LLC, a limited liability

company organized and existing under the laws of Puerto Rico, and LegalSimpli Software, LLC, a limited liability company organized and

existing under the laws of Puerto Rico (each, a “Guarantor” and together, the “Guarantors”), have

agreed to deliver a guaranty agreement in favor of the Purchaser, dated as of June 1, 2021 (the “Guaranty Agreement”).

Furthermore, the Company entered into an Intellectual Property Security Agreement with the Holder dated as of June 1, 2021, granting

the Purchaser a security interest in certain intellectual property of the Company (“IP Security Agreement”).

In

connection with the Purchase Agreement, the Company and the Purchaser also entered into a Registration Rights Agreement (the “Registration

Rights Agreement”) under which the Company agreed to register the shares underlying the Warrant within sixty (60) days (the

“Resale Registration Statement”), but in no event later than ninety (90) days following the filing deadline (the “Effectiveness

Deadline”); provided, that the Effectiveness Deadline shall be extended to one hundred twenty (120) days after the filing deadline

if the Resale Registration Statement is reviewed by, and receives comments from, the SEC.

Background of the Offering

See – “Recent

Developments- June 2021 Securities Purchase Agreement

THE

OFFERING

|

Issuer

|

|

LifeMD,

Inc.

|

|

|

|

|

|

Shares

of Common Stock offered by us

|

|

None

|

|

|

|

|

|

Shares

of Common Stock offered by the Selling Stockholder

|

|

1,500,000

Shares (1)

|

|

|

|

|

|

Shares

of Common Stock outstanding before the Offering

|

|

26,665,840 shares

(2)

|

|

|

|

|

|

Shares

of Common Stock outstanding after completion of this offering, assuming the sale of all shares offered hereby

|

|

28,165,840

shares

|

|

|

|

|

|

Use

of proceeds

|

|

We

will receive proceeds from any warrants that are exercised through the payment of the exercise price in cash.

|

|

|

|

|

|

Market

for Common Stock

|

|

Our

common stock is listed on The Nasdaq Capital Market under the symbol “LFMD.”

|

|

|

|

|

|

Risk

Factors

|

|

Investing

in our securities involves a high degree of risk. See the “Risk Factors” section of this prospectus on page 12 and in

the documents we incorporate by reference in this prospectus for a discussion of factors you should consider carefully before deciding

to invest in our securities.

|

|

(1)

|

1,500,000

shares of Common Stock underlying the Warrants, issued to the Selling Stockholder in the June 2021 Financing.

|

|

(2)

|

The

number of shares of Common Stock outstanding before and after the Offering is based on 26,665,840 shares outstanding as of

July 23, 2021 and excludes the following:

|

|

|

●

|

4,113,400 shares

of Common Stock issuable upon the exercise of outstanding stock options having a weighted average exercise price of $6.88

per share;

|

|

|

|

|

|

|

●

|

3,984,787

shares of common stock issuable upon the exercise of outstanding

warrants having a weighted average exercise price of $5.48 per share;

|

|

|

|

|

|

|

●

|

1,076,923

shares of the Company’s common stock upon conversion of the Company’s

Series B Preferred Stock;

|

|

|

|

|

|

|

●

|

659,375 shares

of outstanding and exercisable Restricted Stock Units with a weighted-average exercise price

of $12.47 per share; and

|

|

|

|

|

|

|

●

|

1,131,750

shares of common stock reserved for future issuance under the Company’s

2020 Equity and Incentive Plan (the “2020 Plan”)

|

RISK

FACTORS

Our

business, financial condition, results of operations, and cash flows may be impacted by a number of factors, many of which are beyond

our control, including those set forth in our most recent Annual Report on Form 10-K for the year ended December 31, 2020, the occurrence

of any one of which could have a material adverse effect on our actual results. There have been no material changes to the Risk Factors

previously disclosed in our Annual Report on Form 10-K for the year ended December 31, 2020.

USE

OF PROCEEDS

All

proceeds from the resale of the shares of our Common Stock offered by this prospectus will belong to the Selling Stockholder.

We

will receive proceeds from any cash exercise of the Warrants. If all such Warrants are fully exercised on a cash basis, we will receive

gross cash proceeds of approximately $12.00 per Warrant exercised. We expect to use the proceeds from the exercise of such warrants,

if any, for general corporate purposes. General corporate purposes may include providing working capital, funding capital expenditures,

or paying for acquisitions. We currently do not have any arrangements or agreements for any acquisitions. We cannot precisely estimate

the allocation of the net proceeds from any exercise of the warrants for cash. Accordingly, in the event the Warrants are exercised for

cash, our management will have broad discretion in the application of the net proceeds of such exercises. There is no assurance that

the Warrants will ever be exercised for cash.

PRIVATE

PLACEMENT

On

June 1, 2021, we entered into the Purchase Agreement with BRF, pursuant to which the Company sold and issued: (i) the Debenture Warrants

to BRF. However, the amount of shares exercisable pursuant to the Warrants is directly connected to how long the Debenture remains outstanding.

If the Debenture is repaid on or before the one year anniversary date of the Initial Exercise Date (as defined herein), the BRF shall

be entitled to exercise up to 500,000 shares of common stock. Thereafter so long as the Debenture has not been repaid, beginning on the

date that is 366 days from the Initial Exercise Date, the Warrant may be exercised for up to an additional 500,000 shares of common stock.

Should the Debenture remain outstanding, beginning on the date that is 732 days from the Initial Exercise Date, the Warrant may be exercised

for up to an additional further 500,000 shares of common stock. The Warrant is immediately exercisable upon issuance (the “Initial

Exercise Date”) at an exercise price of $12.00 per share, subject to adjustment as provided therein. The Warrant has a term

of three years.

Subject

to limited exceptions, BRF will not have the right to exercise any portion of the Warrant if the BRF, together with its affiliates, would

exceed the Beneficial Ownership Limitation; provided, however, that upon 61 days’ prior notice to us, the holder may increase the

Beneficial Ownership Limitation, provided that in no event will the Beneficial Ownership Limitation exceed 9.99%.

The

Debenture was assigned from BRF to B. Riley Principal Investments, LLC (hereinafter referred to as “B. Riley” or “Holder”)

on June 22, 2021.

The

Aggregate Principal Amount of the Debenture, together with interest, shall be due and payable on June 1, 2024. The Debenture bears interest

as follows as follows: (i) for the period beginning on June 1, 2021 and ending on the the Initial Interest Rate Period shall be six percent

(6%), (ii) for the period beginning the date following the Initial Interest Rate Period and ending on the date that is the Second Interest

Rate Period, nine percent (9%), and (iii) for the period beginning the date following the Second Interest Rate Period and ending on June

1, 2024, twelve percent (12%). The Debenture contains redemption provisions which require the Company to redeem the principal amount

outstanding on the Debenture, as set forth in the Debenture. Until such time as the Debenture shall have been paid in full, the Company

shall apply thirty-five percent (35%) of the gross proceeds received by the Company from At-The-Market offerings of its common stock

to partial redemptions of the Debenture.

In

connection with the Purchase Agreement, the Company has agreed to secure all of the Company’s Obligations (as defined in the Purchase

Agreement) to the Purchaser under the Debenture, Company Security Agreement (as defined below) and all other Transaction Documents (as

defined in the Purchase Agreement) by granting to Holder an unconditional and continuing security interest in all of the assets and properties

of the Company, whether now existing or hereafter acquired, pursuant to the Company Security Agreement. Moreover, the subsidiaries of

the Company, each, a Guarantor, have agreed to deliver the Guaranty Agreement. Furthermore, the Company entered into the I.P Security

Agreement granting the Holder a security interest in certain intellectual property of the Company.

In

connection with the Purchase Agreement, the Company and the Holder also entered into a Registration Rights Agreement under which the

Company agreed to register the shares underlying the Warrant within sixty (60) days but in no event later than the Effectiveness Deadline;

provided, that the Effectiveness Deadline shall be extended to one hundred twenty (120) days after the filing deadline if the Resale

Registration Statement is reviewed by, and receives comments from, the SEC.

The

foregoing descriptions of the Debenture, Warrant, Purchase Agreement, Registration Rights Agreement, Company Security Agreement, Guarantor

Security Agreement, Guarantee Agreement, and Intellectual Property Security Agreement are qualified in their entirety by reference to

the full text of the Form of Debenture, Form of Warrant, Form of Securities Purchase Agreement, Form of Registration Rights Agreement,

Form of Company Security Agreement, Form of Guarantor Security Agreement, Form of Guarantee Agreement, and Form of Intellectual Property

Security Agreement, which are attached to the Company’s Current Report on Form 8-k filed with the SEC on June 1, 2021 as Exhibits

4.1, 4.2, 10.1, 10.2, 10.3, 10.4, 10.5, and 10.6 respectively, and incorporated herein by reference in their entirety.

SELLING

STOCKHOLDERS

The

shares of our Common Stock being offered by the Selling Stockholders are issuable upon the exercise of the Warrants. For additional information

regarding the issuance of Warrants, see “Recent Developments” - “June 2021 Financing” above. We are registering

the shares of our Common Stock in order to permit the Selling Stockholder to offer the shares for resale from time to time. Except as

otherwise described in the footnotes to the table below and for the ownership of the registered shares issued pursuant to the Purchase

Agreement, neither the Selling Stockholder nor any of the persons that control them has had any material relationships with us or our

affiliates within the past three (3) years.

The

table below lists the Selling Stockholder and other information regarding the beneficial ownership (as determined under Section 13(d)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (and the rules and regulations thereunder) of the

shares of our Common Stock held by the Selling Stockholder.

The

second column lists the number of shares of our Common Stock beneficially owned by each Selling Stockholder before this Offering (including

shares which the Selling Stockholder has the right to acquire within 60 days, including upon conversion of any convertible securities)

The

third column lists the shares of our Common Stock being offered by this prospectus by each Selling Stockholder.

The

fourth and fifth columns list the number of shares of Common Stock beneficially owned by each Selling Stockholder and their percentage

ownership after the Offering (including shares which the Selling Stockholder has the right to acquire within 60 days, including upon

conversion of any convertible securities), assuming the sale of all of the shares offered by each Selling Stockholder pursuant to this

prospectus.

Under

the terms of the Warrants, a Selling Stockholder may not exercise the Warrants to the extent such conversion or exercise would cause

such Selling Stockholder, together with any other person with which the Selling Stockholder is considered to be part of a group under

Section 13 of the Exchange Act or with which the Selling Stockholder otherwise files reports under Section 13 and/or 16 of the Exchange

Act, to beneficially own a number of shares of Common Stock which exceeds 4.99% or 9.99%, as applicable, of the common stock that is

registered under the Exchange Act that is outstanding at such time. The number of shares in the third column does not reflect this limitation.

The

amounts and information set forth below are based upon information provided to us by the Selling Stockholder as of July 23, 2021,

except as otherwise noted below. The Selling Stockholder may sell all or some of the shares of Common Stock it is offering, and may sell,

unless indicated otherwise in the footnotes below, shares of our common stock otherwise than pursuant to this prospectus. The tables

below assume the Selling Stockholder sells all of the shares offered by them in offerings pursuant to this prospectus, and do not acquire

any additional shares. We are unable to determine the exact number of shares that will actually be sold or when or if these sales will

occur.

|

Selling Stockholder

|

|

Number of Shares Owned Before Offering(2)

|

|

|

Shares Offered

Hereby

|

|

|

Number of Shares Owned

After Offering

|

|

|

Percentage of

Shares

Beneficially

Owned After

Offering(1)

|

|

|

B. Riley Principal Investments, LLC

|

|

|

1,500,000

|

|

|

|

1,500,000

|

|

|

|

0

|

|

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

%

|

|

(1)

|

Percentages

are calculated based on an aggregate of 26,665,840 shares of Common Stock outstanding as of July 12, 2021. As applicable,

such percentages have been further adjusted to account for outstanding convertible securities of such Selling Stockholder.

|

|

(2)

|

Represents

up to 1,500,000 shares of common stock issuable upon exercise of the Warrants. The amount

of shares exercisable pursuant to the Warrants is directly connected to how long the Debenture

remains outstanding. If the Debenture is repaid on or before the one year anniversary date

of the Initial Exercise Date (as defined herein), the Holder shall be entitled to exercise

up to 500,000 shares of common stock. Thereafter so long as the Debenture has not been repaid,

beginning on the date that is 366 days from the Initial Exercise Date, the Warrant may be

exercised for up to an additional 500,000 shares of common stock. Should the Debenture remain

outstanding, beginning on the date that is 732 days from the Initial Exercise Date, the Warrant

may be exercised for up to an additional further 500,000 shares of common stock. These securities

are owned directly by B. Riley Principal Investments, LLC, is an indirect wholly-owned subsidiary

of B. Riley Financial, Inc. B. Riley Principal Investments, LLC has voting and investment

discretion over these securities. Daniel Shribman in his capacity as the President

of B. Riley Principal Investments, LLC makes voting and investment decisions on behalf of

B. Riley Principal Investments, LLC.

|

LEGAL

MATTERS

Lucosky

Brookman LLP will pass upon certain legal matters relating to the issuance and sale of the securities offered hereby on behalf of LifeMD,

Inc.

EXPERTS

Friedman

LLP, an independent registered public accounting firm, has audited our consolidated balance sheet as of December 31, 2020, and the related

consolidated statements of operations, stockholders’ deficit, and cash flows for the fiscal years ended December 31, 2020, which

report is incorporated by reference in this prospectus. We have incorporated by reference our financial statements in this prospectus

and in this registration statement in reliance on the report of Friedman LLP given on their authority as experts in accounting and auditing.

BF

Borgers CPA PC, an independent registered public accounting firm, has audited our consolidated balance sheet as of December 31, 2019,

and the related consolidated statements of operations, stockholders’ deficit, and cash flows for the fiscal years ended December

31, 2019, which report is incorporated by reference in this prospectus. We have incorporated by reference our financial statements in

this prospectus and in this registration statement in reliance on the report of BF Borgers CPA PC given on their authority as experts

in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

Available

Information

We

file reports, proxy statements and other information with the SEC. Information filed with the SEC by us can be inspected and copied at

the Public Reference Room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may also obtain copies of this information

by mail from the Public Reference Room of the SEC at prescribed rates. Further information on the operation of the SEC’s Public

Reference Room in Washington, D.C. can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a web site that contains

reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The

address of that website is http://www.sec.gov.

Our

website address is https://lifemd.com. The information on our website, however, is not, and should not be deemed to be, a part of this

prospectus.

This

prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the

information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Forms

of the documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement. Statements

in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by

reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant

matters. You may inspect a copy of the registration statement at the SEC’s Public Reference Room in Washington, D.C. or through

the SEC’s website, as provided above.

INCORPORATION

BY REFERENCE

The

SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose

important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference

is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede

that information. Any statement contained in a previously filed document incorporated by reference will be deemed to be modified or superseded

for purposes of this prospectus to the extent that a statement contained in this prospectus modifies or replaces that statement.

We

incorporate by reference our documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or

15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, between

the date of this prospectus and the termination of the offering of the securities described in this prospectus. We are not, however,

incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not

deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits

furnished pursuant to Item 9.01 of Form 8-K.

This

prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been

filed with the SEC:

|

|

●

|

Our

Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on March 30, 2021.

|

|

|

|

|

|

|

●

|

Our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2021, filed with the SEC on May 14, 2021.

|

|

|

|

|

|

|

●

|

Our

Current Reports on Form 8-K filed with the SEC July 22, 2021, July 15, 2021, July

2, 2021, June

29, 2021 June

21, 2021, June

16, 2021, June

3, 2021, June

1, 2021, May

19, 2021, May

13, 2021, April

19, 2021, April

16, 2021, April

15, 2021, April

6, 2021, and April

1, 2021.

|

|

|

●

|

the

description of the Company’s Common Stock contained in the Company’ Registration Statement on Form 8-A (File No. 001-39785)

filed on December 9, 2020, including any amendment or report filed for the purpose of updating such description.

|

All

reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination

of this Offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior

to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will

also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports

and documents.

Pursuant

to Rule 412 under the Securities Act, any statement contained in the documents incorporated or deemed to be incorporated by reference

in this Registration Statement shall be deemed to be modified, superseded or replaced for purposes of this Registration Statement to

the extent that a statement contained herein or in any other subsequently filed document which also is incorporated or deemed to be incorporated

by reference in this Registration Statement modifies, supersedes or replaces such statement. Any such statement so modified, superseded

or replaced shall not be deemed, except as so modified, superseded or replaced, to constitute a part of this Registration Statement.

Upon

written or oral request made to us at the address or telephone number below, we will, at no cost to the requester, provide to each person,

including any beneficial owner, to whom this prospectus is delivered, a copy of any or all of the information that has been incorporated

by reference into this prospectus (other than an exhibit to a filing, unless that exhibit is specifically incorporated by reference into

that filing), but not delivered with this prospectus:

LifeMD,

Inc.

800

Third Avenue, Suite 2800

New

York, NY 10022

(855)

743-6478

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution.

The

following is an estimate of the expenses (all of which are to be paid by the registrant) that we may incur in connection with the securities

being registered hereby.

|

SEC registration fee

|

|

$

|

1590.68

|

|

|

Legal fees and expenses

|

|

$

|

|

*

|

|

Accounting fees and expenses

|

|

|

|

*

|

|

Total

|

|

$

|

|

*

|

Item

15. Indemnification of Directors and Officers.

Section

102(b)(7) of the Delaware General Corporation Law permits a corporation to provide in its certificate of incorporation that a director

of the corporation shall not be personally liable to the corporation or its shareholders for monetary damages for breach of fiduciary

duty as a director, except for liability (i) for any breach of the director’s duty of loyalty to the corporation or its shareholders,

(ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) for unlawful

payments of dividends or unlawful stock repurchases, redemptions or other distributions, or (iv) for any transaction from which the director

derived an improper personal benefit. Our amended certificate of incorporation provides that, to the maximum extent permitted by law,

no director shall be personally liable to us or our shareholders for monetary damages for breach of fiduciary duty as director.

Section

145 of the Delaware General Corporation Law provides that a corporation may indemnify directors and officers as well as other employees

and individuals against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably

incurred by such person in connection with any threatened, pending or completed actions, suits or proceedings in which such person is

made a party by reason of such person being or having been a director, officer, employee or agent to the corporation. The Delaware General

Corporation Law provides that Section 145 is not exclusive of other rights to which those seeking indemnification may be entitled under

any bylaw, agreement, vote of shareholders or disinterested directors or otherwise. Our bylaws provide for indemnification by us of our

directors, officers and employees to the fullest extent permitted by the Delaware General Corporation Law.

Insofar

as indemnification for liabilities arising under the Securities Act may be provided for directors, officers, employees, agents or persons

controlling an issuer pursuant to the foregoing provisions, the opinion of the SEC is that such indemnification is against public policy

as expressed in the Securities Act, and is therefore unenforceable. In the event that a claim for indemnification by such director, officer

or controlling person of us in the successful defense of any action, suit or proceeding is asserted by such director, officer or controlling

person in connection with the securities being offered, we will, unless in the opinion of our counsel the matter has been settled by

controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public

policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

No

pending material litigation or proceeding involving our directors, executive officers, employees or other agents as to which indemnification

is being sought exists, and we are not aware of any pending or threatened material litigation that may result in claims for indemnification

by any of our directors or executive officers.

Item

16. Exhibits.

(a)

Exhibits

A

list of exhibits filed with this registration statement on Form S-3 is set forth on the Exhibit Index and is incorporated herein by reference.

Item

17. Undertakings.

The

undersigned registrant hereby undertakes:

|

|

(1)

|

To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

|

(i)

|

To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

|

To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end

of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b)

if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

|

|

|

(iii)

|

To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement.

|

|

|

(2)

|

That

for the purpose of determining any liability under the Securities Act of 1933 each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof.

|

|

|

(3)

|

To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

|

|

|

(4)

|

That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser, each prospectus filed pursuant to Rule

424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other

than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of

the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus

that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration

statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior

to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the

registration statement or made in any such document immediately prior to such date of first use.

|

|

|

(5)

|

That,

for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities:

The

undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration

statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold

to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and

will be considered to offer or sell such securities to such purchaser:

|

|

|

(i)

|

Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424;

|

|

|

(ii)

|

Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by

the undersigned registrant;

|

|

|

(iii)

|

The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and

|

|

|

(iv)

|

Any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

|

|

|

(6)

|

The

undersigned Registrant hereby undertakes to provide to the underwriters at the closing specified in the underwriting agreement certificates

in such denominations and registered in such names as required by the underwriters to permit prompt delivery to each purchaser.

|

|

|

(7)

|

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the Registrant pursuant to the provisions described in Item 14 above, or otherwise, the Registrant has been advised that in the

opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred

or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will,

unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed

by the final adjudication of such issue.

|

|

|

(8)

|

The

undersigned Registrant hereby undertakes:

|

|

|

(1)

|

That

for purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as

part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the Registrant pursuant

to Rule 424(b)(1) or (4), or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the

time it was declared effective.

|

|

|

(2)

|

That

for the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus

shall be deemed to be a new registration statement relating to the securities offered therein, and this offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

|

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by

the undersigned, thereunto duly authorized, in the City of New York, State of New York, on July 23, 2021.

|

|

LifeMD, Inc.

|

|

|

|

|

|

|

By:

|

/s/

Justin Schreiber

|

|

|

Name:

|

Justin Schreiber

|

|

|

Title: