Current Report Filing (8-k)

October 25 2019 - 4:56PM

Edgar (US Regulatory)

false0001570585

0001570585

2019-10-22

2019-10-22

0001570585

us-gaap:CommonClassCMember

2019-10-22

2019-10-22

0001570585

us-gaap:CommonClassBMember

2019-10-22

2019-10-22

0001570585

us-gaap:CommonClassAMember

2019-10-22

2019-10-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 22, 2019

Liberty Global plc

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

England and Wales

|

|

001-35961

|

|

98-1112770

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification #)

|

Griffin House, 161 Hammersmith Rd, London, United Kingdom

W6 8BS

(Address of Principal Executive Office)

+44.208.483.6449 or 303.220.6600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

|

|

Class A ordinary shares

|

LBTYA

|

Nasdaq Global Select Market

|

|

Class B ordinary shares

|

LBTYB

|

Nasdaq Global Select Market

|

|

Class C ordinary shares

|

LBTYK

|

Nasdaq Global Select Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On October 22, 2019, Liberty Global plc (“we” or the “Company”), as guarantor, together with our wholly-owned subsidiary Liberty Global CE Holding BV (“Liberty CE”), as seller, and Sunrise Communications Group AG (“Sunrise”) entered into an amendment (the “Amendment”) to the Share Purchase Agreement among the same parties, dated as of February 27, 2019 (the “SPA”). The SPA, which was described in our Current Report on Form 8-K filed on March 1, 2019, relates to the sale to Sunrise of our operations in Switzerland.

Sunrise EGM

Pursuant to the SPA, Sunrise was required to convene an extraordinary general meeting of its shareholders (the “EGM”) to vote on a capital increase to secure funding for a portion of the consideration payable in the sale. The EGM was required to be held no later than 30 calendar days after receipt of specified regulatory clearance for the sale. Following that clearance, Sunrise scheduled the EGM for October 23, 2019. Prior to the EGM, Sunrise reviewed the vote tally with us. Freenet, a 24.5% Sunrise shareholder, indicated its intent to vote against the capital increase. Although a majority of votes from other shareholders appeared to be in favor of the capital increase as of that time taking into account the total number of votes expected, without Freenet’s vote, the capital increase was expected to not be approved. Accordingly, Sunrise requested consent from us under the SPA terms to cancel the EGM and we agreed, subject to certain amendments.

Requirement to Convene an EGM; Additional Termination Rights

The Amendment provides that Sunrise is obligated to convene a new EGM at our written request. The SPA also includes certain termination provisions, which remain in effect. In addition, the amended SPA provides Liberty CE the right to terminate the SPA at any time, except if we have requested Sunrise to convene a new EGM. The amended SPA also entitles Sunrise to terminate the SPA at any time after November 11, 2019, except if Liberty CE has requested Sunrise to convene a new EGM.

Termination Fee

The SPA obligates Sunrise to pay Liberty CE a termination fee of CHF 50 million ($50.7 million at the October 22, 2019 exchange rate) upon termination of the SPA for certain events. Under the amended SPA, these events are preserved, and it is agreed that this termination fee is payable by Sunrise if Liberty CE or Sunrise exercise their additional termination rights described in the preceding paragraph.

Other Amendments

The Amendment also made a clarifying change to the confidentiality provision of the SPA.

The summary of the Amendment in this Current Report on Form 8-K does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, which is included as Exhibit 2.1 and incorporated herein by reference. The SPA was previously filed as Exhibit 2.1 to a Current Report on Form 8-K filed by Liberty Global on March 3, 2019.

Item 1.02 Termination of Material Definitive Agreement

In light of the cancellation of the EGM, pursuant to the Amendment, the parties also terminated the Conditional Rights Purchase Agreement (“CRPA”) that the parties entered into on October 14, 2019, except that the waiver of the SPA’s standstill provision contained in the CRPA will continue to be effective.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Name

|

|

|

|

|

|

2.1

|

|

|

|

101.SCH

|

|

Inline XBRL Taxonomy Extension Schema Document

|

|

|

|

|

|

101.CAL

|

|

Inline XBRL Taxonomy Extension Calculation Linkbase Document

|

|

|

|

|

|

101.DEF

|

|

Inline XBRL Taxonomy Extension Definition Linkbase Document

|

|

|

|

|

|

101.LAB

|

|

Inline XBRL Taxonomy Extension Label Linkbase Document

|

|

|

|

|

|

101.PRE

|

|

Inline XBRL Taxonomy Extension Presentation Linkbase Document

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

LIBERTY GLOBAL PLC

|

|

|

|

|

|

By:

|

/s/ RANDY L. LAZZELL

|

|

|

|

Randy L. Lazzell

|

|

|

|

Vice President

|

Date: October 25, 2019

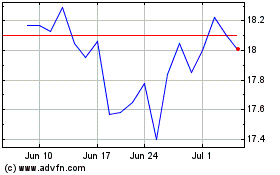

Liberty Global (NASDAQ:LBTYK)

Historical Stock Chart

From Mar 2024 to Apr 2024

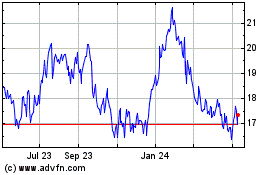

Liberty Global (NASDAQ:LBTYK)

Historical Stock Chart

From Apr 2023 to Apr 2024