Current Report Filing (8-k)

February 27 2019 - 4:50PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 21, 2019

Liberty Global plc

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

England and Wales

|

|

001-35961

|

|

98-1112770

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification #)

|

Griffin House, 161 Hammersmith Rd, London, United Kingdom

W6 8BS

(Address of Principal Executive Office)

+44.208.483.6449 or 303.220.6600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

(e) Compensatory Arrangements of Certain Officers

Pursuant to the Liberty Global, Inc. 2014 Incentive Plan, as amended (the “

Incentive Plan

”), on February 21, 2019, the Compensation Committee (the “

Committee

”) of Liberty Global plc’s Board of Directors approved performance goals for the fiscal year ending December 31, 2019, for annual performance awards to its executive officers (the “

2019 Performance Awards

”). In the following text, the terms “we”, “our”, “our company” and “us” refers to Liberty Global plc.

The target 2019 Performance Award will be split among the following performance metrics for the fiscal year ending December 31, 2019: the achievement of budgeted growth in revenue and operating free cash flow, the achievement of a target average customer relationship net promoter score and the achievement of respective department goals and objectives. Based on the achievement of these performance metrics, a payout of up to 150% of the target bonus amount is available for over-performance against budget/target, except the maximum payout for the department metric will be limited to 100% of its weighted portion. Individual performance against personal performance objectives approved by the Committee could increase the maximum 2019 Performance Award to up to 210% of the target bonus amount.

The terms of the 2019 Performance Award allow executive officers to elect to receive up to 100% of their 2019 Performance Awards in Class A and Class C ordinary shares of our company or, for the Chief Executive Officer (“

CEO

”), any combination of Class A, B or C ordinary shares of our company. An employee who elects to receive shares will receive an illiquidity premium in restricted shares units of 12.5% of the gross number of bonus shares earned under the 2019 Performance Award. The restricted share units will vest after 12 months if the employee holds the bonus shares for the 12 month period.

Our CEO and the four executive officers of our company who we currently anticipate will be among our five most highly compensated executive officers for fiscal 2019 (the “

2019 NEOs

”) will participate in the 2019 Performance Awards. The personal performance objectives for the 2019 NEOs consist of qualitative measures, which include individual strategic, financial, transactional, organizational and/or operational goals for each officer. The target 2019 Performance Award is $10.5 million for our CEO, Michael T. Fries, and range from $2.0 million to $2.5 million for each of the other 2019 NEOs.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

LIBERTY GLOBAL PLC

|

|

|

|

|

|

By:

|

/s/ MICHELLE L. KEIST

|

|

|

|

Michelle L. Keist

|

|

|

|

Vice President

|

Date: February 27, 2019

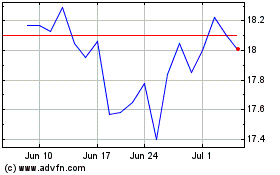

Liberty Global (NASDAQ:LBTYK)

Historical Stock Chart

From Mar 2024 to Apr 2024

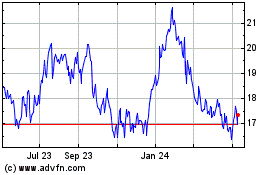

Liberty Global (NASDAQ:LBTYK)

Historical Stock Chart

From Apr 2023 to Apr 2024