LendingTree, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware |

|

26-2414818 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification Number) |

| |

1415 Vantage Park Dr., Suite 700

Charlotte, North Carolina 28203

(704) 541-5351

|

|

| (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) |

| |

Lisa M. Young, Esq.

General Counsel

LendingTree, Inc.

1415 Vantage Park Dr., Suite 700

Charlotte, North Carolina 28203

(704) 541-5351

|

|

| (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service) |

| |

Copy to: |

|

| |

Shane Tintle, Esq.

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, New York 10017

(212) 450-4000

|

|

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ |

Accelerated filer ☐ |

| Non-accelerated filer ☐ |

Smaller reporting company ☐ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PROSPECTUS

LendingTree, Inc.

Common Stock

Preferred Stock

Debt Securities

Warrants

Subscription Rights

Units

We may from time to time offer and sell any of

the securities described in this prospectus, either individually or in combination. In addition, any selling stockholders identified in

this prospectus, or any of their transferees, donees, pledgees or other successors, may offer and sell from time to time shares of common

stock.

This prospectus provides a general description

of the securities we may offer. Each time we or any selling stockholders sell securities under this prospectus, we will provide specific

terms related to such sales in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses

to be provided to you in connection with these offerings.

The prospectus supplement, and any documents incorporated

by reference, may also add, update or change information contained in this prospectus. Before you invest, you should carefully read this

prospectus, the applicable prospectus supplement, any documents incorporated by reference and any related free writing prospectus before

buying any of the securities being offered. This prospectus may not be used to consummate a sale of securities unless accompanied by the

applicable prospectus supplement.

We or any selling stockholders may sell these

securities directly, through underwriters, dealers or agents as designated from time to time, or through a combination of these methods.

If any underwriters, dealers or agents are involved in the sale of these securities, the applicable prospectus supplement will set forth

the names of the agents, dealers or underwriters and any applicable fees, commissions or discounts. We will not receive any proceeds from

the sale of common stock by the selling stockholders.

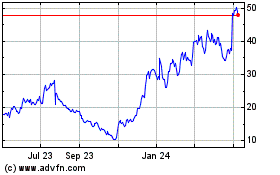

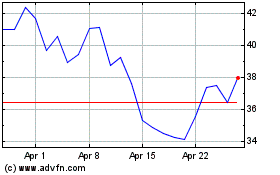

Our common stock is currently quoted on the Nasdaq

Global Select Market under the ticker symbol “TREE.” The applicable prospectus supplement will contain information, where

applicable, as to any other listing of the securities covered by the applicable prospectus supplement. On July 14, 2022, the last reported

sale price per share of our common stock on the Nasdaq Global Select Market was $41.21.

An investment in our securities involves a high

degree of risk. See the section entitled “Risk Factors” commencing on page 2 of this prospectus and the discussion

of these risks in the sections entitled “Risk Factors” in our most recent annual report on Form 10-K and in the quarterly

reports on Form 10-Q, in each case, incorporated by reference in this prospectus, as well as in any applicable prospectus supplement.

We may amend or supplement this prospectus from

time to time by filing amendments or supplements as required. We urge you to read the entire prospectus, any amendments or supplements,

any free writing prospectuses, and any documents incorporated by reference carefully before you make your investment decision.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this

prospectus is July 15, 2022

table

of contents

Page

About This Prospectus

This prospectus is part of a registration statement

on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under

this shelf registration process, we may from time to time offer and sell, either individually or in combination, in one or more offerings,

any combination of the securities described in this prospectus. Each time we offer securities under this prospectus, we will provide a

prospectus supplement that will contain more specific information about the terms of that offering. We may also authorize one or more

free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement

and any related free writing prospectus that we may authorize to be provided to you may also add, update or change any of the information

contained in this prospectus or in the documents that we have incorporated by reference into this prospectus.

In addition, selling stockholders may use this

shelf registration statement to sell shares of our common stock from time to time. We will not receive any proceeds from the sale of shares

by any selling stockholders. The selling stockholders may deliver a supplement with this prospectus, if required, to update the information

contained in this prospectus. The selling stockholders may sell their shares of common stock through any means described in the section

entitled “Plan of Distribution” or described in any accompanying prospectus supplement. As used herein, the term “selling

stockholders” includes the selling stockholders and any of their transferees, donees, pledgees or other successors.

You should read this prospectus, any applicable

prospectus supplement and any free writing prospectuses we have authorized for use in connection with a specific offering together with

additional information described under the headings “Cautionary Note Regarding Forward-Looking Statements,” “Where You

Can Find More Information,” and “Information Incorporated by Reference” below before investing in any of the securities

being offered. The information appearing in this prospectus, any applicable prospectus supplement or any free writing prospectus is accurate

only as of the date of such document and any information we have incorporated by reference is accurate only as of the date of the document

incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any related

free writing prospectus, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed

since those dates. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should

rely on the information contained in that prospectus supplement. This prospectus may not be used to consummate a sale of securities

unless it is accompanied by a prospectus supplement.

You should rely only on the information we have

provided or incorporated by reference in this prospectus and any prospectus supplement. We have not authorized anyone to provide you with

different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making

an offer to sell securities in any jurisdiction where the offer or sale is not permitted.

This prospectus contains summaries of certain

provisions of documents. All of the summaries are qualified in their entirety by the actual documents. Copies of some of these documents

have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus

is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More Information.”

We further note that the representations, warranties

and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus

were made solely for the benefit of the parties to such agreement, including, in some cases, for the purposes of allocating risk among

the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations,

warranties and covenants should not be relied on as accurately representing the current state of our affairs.

In this prospectus, unless otherwise indicated,

“our company,” “we,” “us,” “LendingTree,” or “our” refer to LendingTree, Inc.,

a Delaware corporation, and its consolidated subsidiaries.

Prospectus Summary

This prospectus summary highlights certain

information about our company and other information contained elsewhere in this prospectus or in documents incorporated by reference.

This summary does not contain all of the information that you should consider before making an investment decision. You should carefully

read the entire prospectus, any prospectus supplement, including the section entitled “Risk Factors,” and the documents incorporated

by reference into this prospectus, before making an investment decision.

OUR BUSINESS

LendingTree, Inc. (“LendingTree” or

the “Company”) is the parent of LT Intermediate Company, LLC, which holds all of the outstanding ownership interests of LendingTree,

LLC, and LendingTree, LLC owns several companies.

LendingTree operates what we believe to be the

leading online consumer platform that connects consumers with the choices they need to be confident in their financial decisions. Our

online consumer platform provides consumers with access to product offerings from a nationwide network of over 500 partners (which we

refer to as our “Network Partners”), including mortgage loans, home equity loans, reverse mortgage loans, auto loans, credit

cards, deposit accounts, personal loans, student loans, small business loans, insurance quotes and other related offerings. In addition,

we offer tools and resources, including free credit scores, that facilitate comparison shopping for loans, deposit products, insurance

and other offerings. We seek to match consumers with multiple providers, who can offer them competing quotes for the product, or products,

they are seeking. We also serve as a valued partner to lenders and other providers seeking an efficient, scalable and flexible source

of customer acquisition with directly measurable benefits, by matching the consumer inquiries we generate with these Network Partners.

CORPORATE INFORMATION

Our principal executive offices are located at

1415 Vantage Park Dr., Suite 700, Charlotte, North Carolina 28203 and our telephone number at that address is (704) 541-5351. Our corporate

website is www.lendingtree.com and we maintain an investor relations website at investors.lendingtree.com. Information contained

on any of our websites or that can be accessed through our websites are not incorporated by reference in, and do not constitute a part

of, this prospectus.

THE OFFERING

We may offer and sell, from time to time, common

stock, preferred stock, debt securities, warrants, subscription rights or units, in one or more offerings and in any combination thereof.

In addition, the selling stockholders may sell shares of our common stock. This prospectus provides you with a general description of

the securities we may offer and the selling stockholders may offer. Except in the case of certain offers and sales by the selling stockholders

in circumstances described under “Plan of Distribution,” this prospectus may not be used to offer or sell securities unless

accompanied by a prospectus supplement. We will not receive any proceeds from the sale of common stock by the selling stockholders.

LISTING

Our common stock is currently quoted on the Nasdaq

Global Select Market, under the ticker symbol “TREE.”

Risk Factors

An investment in our securities involves a high

degree of risk. Before you make a decision to invest in our securities, you should consider carefully the risks described in the section

entitled “Risk Factors” contained in the applicable prospectus supplement and in our most recent annual report on Form 10-K

and quarterly reports on Form 10-Q filed with the SEC, as well as any amendment or update thereto reflected in subsequent filings with

the SEC or in any current report on Form 8-K and in the other documents that we file with the SEC from time to time. The risks and uncertainties

described in this prospectus, any applicable prospectus supplement and the documents incorporated by reference herein are not the only

ones facing us. Additional risks and uncertainties that we do not presently know about or that we currently believe are not material may

also adversely affect our business. Our business, results of operations or financial condition could be seriously harmed, and the trading

price of our securities may decline, due to any of these or other risks.

Cautionary Note

Regarding Forward-Looking Statements

This prospectus and the documents incorporated

by reference in this prospectus contain “forward-looking statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, which we refer to as the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, which

we refer to as the Exchange Act. These forward-looking statements include statements related to our anticipated financial performance,

business prospects and strategy; anticipated trends and prospects in the various industries in which our businesses operate; new products,

services and related strategies; and other similar matters. These forward-looking statements are based on management’s current expectations

and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult

to predict. The use of words such as “anticipates,” “estimates,” “expects,” “projects,”

“intends,” “plans” and “believes,” among others, generally identify forward-looking statements.

Actual results could differ materially from those

contained in the forward-looking statements. Factors currently known to management that could cause actual results to differ materially

from those in forward-looking statements include those factors listed in “Risk Factors” set forth herein and elsewhere in

this prospectus and the documents incorporated by reference in this prospectus and in other documents that we file with the SEC from time

to time.

Other unknown or unpredictable factors that could

also adversely affect our business, financial condition and results of operations may arise from time to time. In light of these risks

and uncertainties, the forward-looking statements discussed in this prospectus and the documents incorporated by reference in this prospectus

may not prove to be accurate and, accordingly, you should not place undue reliance on these forward-looking statements, which only reflect

the views of LendingTree, Inc.’s management as of the date hereof or thereof (as applicable). We undertake no obligation to update

or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating

results or expectations, except as required by law.

Use of Proceeds

Except as described in any applicable prospectus

supplement, we currently intend to use the net proceeds from the sale of the securities offered hereunder, if any, for general corporate

purposes, which may include working capital, capital expenditures, acquisitions, repurchases of our common stock and refinancing or repayment

of indebtedness.

When specific securities are offered, the prospectus

supplement relating thereto will set forth our intended use of the net proceeds that we receive from the sale of such securities. Pending

the application of the net proceeds, we may invest the proceeds in marketable securities and short-term investments.

We will not receive any proceeds from the sale

of common stock by the selling stockholders pursuant to this prospectus.

Description of

Capital Stock

The following description of our common stock

and preferred stock, together with the additional information we include in any prospectus supplement, summarizes the material terms and

provisions of the common stock and preferred stock that we or any selling stockholders may offer pursuant to this prospectus. While the

terms we have summarized below will apply generally to any future common stock or preferred stock that we may offer, we will describe

the particular terms of any class or series of these securities in more detail in the particular prospectus supplement. For the complete

terms of our common stock and preferred stock, please refer to our current certificate of incorporation, as amended to date, and our by-laws,

as amended to date, which have been filed with the SEC and are incorporated herein by reference. The terms of these securities may also

be affected by the Delaware General Corporation Law, which we refer to as the DGCL. The summary below and any update which may be contained

in any prospectus supplement is qualified in its entirety by reference to our certificate of incorporation, as amended to date, and our

by-laws, as either may be amended from time to time after the date of this prospectus, but before the date of any such prospectus supplement.

Our authorized capital stock consists of

50,000,000 shares of common stock, par value $0.01 per share, and 5,000,000 shares of preferred stock, par value $0.01 per share. As

of July 14, 2022, we had 12,785,991 shares of common stock outstanding, excluding treasury shares, and no shares of preferred stock

outstanding.

Common Stock

Dividends. Subject to prior dividend

rights of the holders of any preferred shares, holders of shares of our common stock are entitled to receive dividends when, as and if

declared by our board of directors out of funds legally available for that purpose.

Voting Rights. Each share of common

stock is entitled to one vote on all matters submitted to a vote of stockholders, except that holders of common stock are not entitled

to vote on any amendment to our certificate of incorporation that relates solely to the terms of one or more outstanding series of preferred

stock if the holders of such affected series are entitled, either separately or together as a class with the holders of one or more other

such series, to vote thereon pursuant to our certificate of incorporation. Holders of shares of common stock do not have cumulative voting

rights. In other words, a holder of a single share of our common stock cannot cast more than one vote for each position to be filled on

our board of directors.

Other Rights. In the event of our

liquidation, dissolution or winding up, after the satisfaction in full of the liquidation preferences of holders of any preferred shares,

holders of shares of our common stock are entitled to ratable distribution of the remaining assets available for distribution to stockholders.

Shares of common stock are not subject to redemption by operation of a sinking fund or otherwise. Holders of shares of common stock are

not currently entitled to preemptive rights.

Fully Paid. The issued and outstanding

shares of our common stock are fully paid and non-assessable. This means the full purchase price for the outstanding shares of common

stock has been paid and the holders of such shares will not be assessed any additional amounts for such shares. Any additional shares

of common stock that we may issue in the future will also be fully paid and non-assessable.

Preferred Stock

We are authorized to issue up to 5,000,000 shares

of preferred stock, par value $0.01 per share. Our board of directors, without further action by the holders of our common stock, may

issue shares of preferred stock. The board of directors is vested with the authority to fix the designations, preferences and relative,

participating, optional or other special rights, and such qualifications, limitations or restrictions thereof, including, without limitation,

redemption rights, dividend rights, liquidation preferences and conversion or exchange rights of any class or series of preferred stock,

and to fix the number of classes or series of preferred stock, the number of shares constituting any such class or series and the voting

powers for each class or series.

The authority possessed by our board of directors

to issue preferred stock could potentially be used to discourage attempts by third parties to obtain control of the company through a

merger, tender offer, proxy contest or otherwise by making such attempts more difficult or more costly. Our board of directors may issue

preferred stock with voting rights or conversion rights that, if exercised, could adversely affect the voting power of the holders of

our common stock.

A prospectus supplement relating to a series of

preferred stock will describe terms of that series of preferred stock, including:

| · | the designation and stated value of that series; |

| · | the number of shares of preferred stock we are offering; |

| · | the initial public offering price at which the shares of preferred stock will be sold; |

| · | the dividend rate of that series, the conditions and dates upon which those dividends will be payable, whether those dividends will

be cumulative or noncumulative, and, if cumulative, the date from which dividends will accumulate; |

| · | the process for any auction and remarketing, if any; |

| · | the relative ranking and preferences of that series as to dividend rights and rights upon any liquidation, dissolution or winding

up of the affairs of our company; |

| · | any redemption, repurchase or sinking fund provisions; |

| · | any conversion or exchange rights of the holder or us; |

| · | any restrictions on transfer, sale or other assignment; |

| · | any restrictions on further issuances; |

| · | whether interests in the preferred stock will be represented by depositary shares; |

| · | a discussion of any material United States federal income tax considerations applicable to the preferred stock; |

| · | any application for listing of that series on any securities exchange or market; |

| · | any limitations on the issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred

stock as to dividend rights and rights upon liquidation, dissolution or winding up of our affairs; and |

| · | any other specific terms, preferences, rights or limitations of, or restrictions on, that series of preferred stock. |

Restrictions on Payment of Dividends

We are incorporated in Delaware and governed by

Delaware law. Delaware law allows a corporation to pay dividends only:

| · | out of surplus, as determined under Delaware law; or |

| · | in case there is no such surplus, out of the corporation’s net profits for the fiscal year in which the dividend is declared

and/or the preceding fiscal year. |

The credit facility we entered into on September

15, 2021, which is described more fully in the documents incorporated herein by reference, also contains contractual restrictions on our

ability to pay dividends.

Section 203 of the Delaware General Corporation Law

Section 203 of the DGCL, which we refer to as

Section 203, prohibits certain transactions between a Delaware corporation and an “interested stockholder.” Generally, an

“interested stockholder” for this purpose is a stockholder who is directly or indirectly a beneficial owner of 15% or more

of the outstanding voting power of a Delaware corporation. This provision, if applicable, prohibits certain business combinations between

an interested stockholder and a corporation for a period of three years after the date on which the stockholder became an interested stockholder,

unless: (1) the transaction which resulted in the stockholder becoming an interested stockholder is approved by the corporation’s

board of directors before the stockholder became an interested stockholder; (2) the interested stockholder acquired at least 85% of the

voting power (as calculated pursuant to Section 203) of the corporation in the transaction in which the stockholder became an interested

stockholder; or (3) the business combination is approved by a majority of the board of directors and the affirmative vote of the holders

of two-thirds of the outstanding voting stock not owned by the interested stockholder at or subsequent to the time that the stockholder

became an interested stockholder. These restrictions do not apply in certain circumstances, including if the corporation’s certificate

of incorporation contains a provision expressly electing not to be governed by Section 203. If such a provision is adopted by an amendment

to the corporation’s certificate of incorporation, the amendment will be effective immediately if, among other requirements, the

corporation has never had a class of voting stock listed on a national securities exchange or held of record by more than 2,000 stockholders.

If this and other requirements are not satisfied, the amendment will not be effective until 12 months after its adoption and will not

apply to any business combination between the corporation and any person who became an interested stockholder on or prior to such adoption.

LendingTree’s certificate of incorporation

contains a provision expressly electing not to be governed by Section 203. Therefore, in accordance with Section 203, the restrictions

on certain business combinations in Section 203 do not currently apply in respect of LendingTree.

Anti-takeover Effects of our Certificate of Incorporation and

By-laws and Delaware Law

Some provisions of our certificate of incorporation

and by-laws and certain provisions of Delaware law could make the following more difficult:

| · | an acquisition of LendingTree by means of a tender offer; |

| · | an acquisition of LendingTree by means of a proxy contest or otherwise; or |

| · | the removal of our incumbent officers and directors. |

Size of Board and Vacancies

Our certificate of incorporation and by-laws provide

that, subject to the rights of the holders of any series of preferred stock to elect additional directors under specified circumstances,

the number of directors on our board of directors will be fixed exclusively by the board of directors. Newly created directorships resulting

from any increase in the authorized number of directors or any vacancies in the board of directors resulting from death, resignation,

retirement, disqualification, removal from office or other cause will be filled generally by the majority vote of the directors then in

office, though less than a quorum.

Elimination of Stockholder Action by Written

Consent

Our certificate of incorporation and by-laws expressly

eliminate the right of stockholders to act by written consent. Stockholder action must take place at the annual or a special meeting of

our stockholders.

Stockholder Meetings

Under our certificate of incorporation and by-laws,

stockholders are not entitled to call special meetings of stockholders. Only a majority of our board of directors or specified individuals

may call such meetings.

Requirements for Advance Notification of Stockholder

Nominations and Proposals

Our by-laws establish advance notice procedures

with respect to stockholder proposals and nomination of candidates for election as directors other than nominations made by or at the

direction of the board of directors or a committee of the board of directors. In particular, stockholders must notify the corporate secretary

in writing prior to the meeting at which the matters are to be acted upon or directors are to be elected. The notice must contain the

information specified in our by-laws. To be timely, the notice must be received at our principal executive office not later than 60 or

more than 90 days prior to the first anniversary of the date for the preceding year’s annual meeting of stockholders. However, if

the date of the annual meeting is advanced more than 30 days prior to or delayed by more than 30 days after the anniversary of the preceding

year’s annual meeting, or if no annual meeting was held during the preceding year, notice by the stockholder, to be timely, must

be delivered no later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the

day on which public announcement of the date of such meeting is first made. Moreover, in the event that the number of directors to be

elected to the board of directors is increased and we make no public announcement naming all of the nominees for director or specifying

the size of the increased board of directors at least 55 days prior to the first anniversary of the date for the preceding year’s

annual meeting of stockholders, the stockholder’s notice will be considered timely, but only with respect to nominees for any new

positions created by such increase, if it is delivered to the corporate secretary at our principal executive offices not later than the

close of business on the 10th day following the day on which we first made such public announcement.

Undesignated Preferred Stock

The authorization in our certificate of incorporation

with respect to the issuance of undesignated preferred stock makes it possible for our board of directors to issue preferred stock with

voting or other rights or preferences that could impede the success of any attempt to change control of the company. The provision in

our certificate of incorporation authorizing such preferred stock may have the effect of deferring hostile takeovers or delaying changes

of control of our management.

Indemnification Provisions

The following provisions of Delaware law and our

certificate of incorporation and by-laws govern the indemnification of our directors and officers.

Section 145 of the DGCL provides that a corporation

may indemnify directors and officers as well as other employees and individuals against expenses (including attorneys’ fees), judgments,

fines and amounts paid in settlement in connection with any threatened, pending or completed action, suit or proceeding, whether civil,

criminal, administrative or investigative, in which such person is made a party by reason of the fact that the person is or was a director,

officer, employee or agent of the corporation (other than an action by or in the right of the corporation – a “derivative

action”), if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best

interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe such person’s

conduct was unlawful. A similar standard is applicable in the case of derivative actions, except that indemnification only extends to

expenses (including attorneys’ fees) incurred in connection with the defense or settlement of such action, and the statute requires

court approval before there can be any indemnification where the person seeking indemnification has been found liable to the corporation.

The statute provides that it is not exclusive of other indemnification that may be granted by a corporation’s by-laws, disinterested

director vote, stockholder vote, agreement or otherwise.

Our certificate of incorporation provides that

no director shall be liable to us or our stockholders for monetary damages for breach of fiduciary duty as a director, except to the extent

such exemption from liability or limitation on liability is not permitted under the DGCL, as now in effect or as amended. Currently, Section

102(b)(7) of the DGCL prohibits provisions in a Delaware corporation’s certificate of incorporation that eliminate the liability

of a director for the following:

| · | any breach of the director’s duty of loyalty to us or our stockholders; |

| · | acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; |

| · | unlawful payments of dividends or unlawful stock purchases or redemptions as provided in Section 174 of the DGCL; and |

| · | any transaction from which the director derived an improper personal benefit. |

Our by-laws provide that, to the fullest extent

authorized by the DGCL, as now in effect or as amended, we will indemnify any person who was or is a party or is threatened to be made

a party to or is otherwise involved in any action, suit or proceeding by reason of the fact that such person, or a person of whom he or

she is the legal representative, is or was a director or officer of our company, or by reason of the fact that such person, or a person

of whom he or she is the legal representative, is or was serving, at our request, as a director, officer or trustee of another corporation

or of a partnership, joint venture, trust or other enterprise, including service with respect to employee benefit plans maintained or

sponsored by us. To the extent authorized by the DGCL, we will indemnify such persons against all expenses, liability and loss (including

attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and amounts paid or to be paid in settlement) reasonably incurred

or suffered by such persons in connection with such service. Any amendment of these provisions will not reduce our indemnification obligations

relating to actions taken before such amendment.

We maintain a directors’ and officers’

liability insurance policy insuring our directors and officers against certain liabilities and expenses incurred by them in their capacities

as such and insuring us, under certain circumstances, in the event that indemnification payments are made by us to such directors and

officers.

Transfer Agent and Registrar

Computershare has been appointed as the transfer

agent and registrar for our common stock.

Description of

Debt Securities

We may issue senior debt securities or subordinated

debt securities (any of which may be convertible or not convertible). We use the term debt securities in this prospectus to refer to both

senior debt securities and subordinated debt securities. No debt securities will be secured by any of our property or assets or the property

or assets of any of our subsidiaries. No debt securities will be guaranteed by any of our subsidiaries or any other person or entity.

Thus, by owning a debt security, you will be an unsecured creditor of LendingTree.

The senior debt securities will be issued under

our senior debt indenture described below and will rank equally with all of our other unsecured and unsubordinated debt. The subordinated

debt securities will be issued under our subordinated debt indenture described below and will be subordinate in right of payment to all

of our “senior debt,” as defined in the subordinated debt indenture, and will rank equally with all of our other general obligations.

We use the term indentures in this prospectus to refer to both the senior debt indenture and the subordinated debt indenture. Neither

indenture limits our ability to incur additional unsecured indebtedness, unless otherwise described in the prospectus supplement relating

to any series of debt securities. The indentures and the debt securities will be governed by New York law, unless otherwise indicated

in the prospectus supplement applicable to a series of debt securities.

We have summarized some of the material provisions

of the indentures on the following pages. The summary does not purport to be complete and is subject to, and is qualified in its entirety

by reference to, all provisions of the indentures, including definitions of various terms contained in the indentures. Copies of the entire

indentures are exhibits to the registration statement of which this prospectus is a part, and are incorporated herein by reference. We

encourage you to read the full text of the indentures, which you can obtain as described under the heading “Where You Can Find More

Information” elsewhere in this prospectus. While the terms we have summarized below will apply generally to any future debt securities

we may offer under this prospectus, the applicable prospectus supplement or free writing prospectus will describe the specific terms of

any debt securities offered through that prospectus supplement or free writing prospectus. The terms of any debt securities we offer under

a prospectus supplement or free writing prospectus may differ from the terms we describe below.

LendingTree is a holding company and a legal entity

separate and distinct from its subsidiaries, through which LendingTree conducts most of its operations and which generate all of LendingTree’s

operating income and cash flow. As a result, LendingTree’s only source of funds to meet its obligations to make payments under any

debt securities as well as its other payment obligations is distributions or advances from LendingTree’s subsidiaries. Contractual

provisions, laws or regulations may limit the ability of LendingTree to obtain the necessary funds from its subsidiaries to satisfy its

obligations. LendingTree’s rights to participate in the distribution of assets of its subsidiaries are effectively subordinate to

the claims of creditors, including trade creditors, of those subsidiaries, except to the extent that LendingTree itself may be a creditor

of a particular subsidiary with recognized claims. Accordingly, except to the extent that LendingTree itself may be a creditor of a subsidiary

with recognized claims, LendingTree’s obligations under its debt securities will be effectively subordinated to all existing and

future indebtedness and liabilities of its subsidiaries.

The Indentures

The senior debt securities and the subordinated

debt securities are each governed by an agreement called an indenture – the senior debt indenture, in the case of the senior debt

securities, and the subordinated debt indenture, in the case of the subordinated debt securities. Each indenture is a contract between

us and the trustee under the indenture. The indentures are substantially identical, except for the provisions relating to subordination,

which are included only in the subordinated debt indenture.

LendingTree has appointed Wilmington Trust, National

Association, as trustee under each of the indentures. If a different trustee is appointed in the future, we will identify such trustee

in the prospectus supplement relating to the offering of the applicable debt securities.

The trustee under each indenture has two principal

roles:

| · | The trustee can enforce the rights of the holders of debt securities against us if we default on our obligations under the terms of

the indenture or the debt securities. There are some limitations on the extent to which the trustee acts on behalf of such holders, described

below under the heading “—Events of Default.” |

| · | The trustee performs administrative duties for us, such as sending interest payments and notices to holders of debt securities, and

transferring a holder’s debt securities to a new buyer if such holder sells such debt securities. |

Reference to the indenture or the trustee with

respect to any debt securities means the indenture under which those debt securities are issued and the trustee under that indenture.

Conversion or Exchange Rights

We will set forth in the applicable prospectus

supplement or free writing prospectus the terms on which a series of debt securities may be convertible into or exchangeable for our common

stock, our preferred stock or other securities (including securities of a third party). We will include provisions as to whether conversion

or exchange is mandatory, at the option of the holder or at our option. We may include provisions pursuant to which the number of shares

of our common stock, our preferred stock or other securities (including securities of a third party) that the holders of the series of

debt securities receive would be subject to adjustment.

Terms

We may issue as many distinct series of debt securities

under either indenture as we wish. The provisions of each indenture allow us not only to issue debt securities with terms different from

those previously issued under that indenture, but also to “reopen” a previous issue of a series of debt securities and issue

additional debt securities of that series. We may issue debt securities in amounts that exceed the total amount specified on the cover

of the prospectus supplement related to debt securities you hold at any time without your consent and without notifying you.

This section summarizes the material terms of

the debt securities that are common to all series, although the prospectus supplement which describes the terms of each series of debt

securities may also describe differences from the material terms summarized here.

Because this section is a summary, it does not

describe every aspect of the debt securities that may be important to our investors. This summary is subject to and qualified in its entirety

by reference to all the provisions of the applicable indenture, including definitions of certain terms used in the indenture, which are

attached as exhibits to this registration statement. In this summary, we describe the meaning of only some of the more important terms.

Whenever we refer to particular sections or defined terms of the indenture in this prospectus or in the prospectus supplement, such sections

or defined terms are incorporated by reference here or in the prospectus supplement. You must look to the indenture for the most complete

description of what we describe in summary form in this prospectus. Investors are cautioned to review the indentures carefully and in

their entirety because the indentures (and not this summary) will be the legal document that will govern the terms of our debt securities

issued hereunder.

This summary also is subject to and qualified

by reference to the description of the particular terms of any series described in the applicable prospectus supplement. Those terms may

vary from the terms described in this prospectus. The prospectus supplement relating to each series of debt securities will be attached

to the front of this prospectus. There may also be a further prospectus supplement, known as a pricing supplement or free writing prospectus,

which contains the precise terms of debt securities we may offer. Investors are encouraged to carefully review any such prospectus supplement,

pricing supplement and/or free writing prospectus before making an investment decision regarding any of our debt securities offered hereunder.

We may issue the debt securities as original issue

discount securities, which will be offered and sold at a substantial discount below their stated principal amount. The prospectus supplement

relating to the original issue discount securities will describe federal income tax consequences and other special considerations applicable

to them. The debt securities may also be issued as indexed securities or securities denominated in foreign currencies or currency units,

as described in more detail in the prospectus supplement relating to any of the particular series of debt securities.

The prospectus supplement relating to a series

of debt securities will describe the following terms of the series:

| · | the title of the series of debt securities; |

| · | whether they are senior debt securities or subordinated debt securities; |

| · | any limit on the aggregate principal amount of the series of debt securities; |

| · | the person to whom interest on a debt security is payable, if other than the holder thereof on the regular record date; |

| · | the specified currency, currencies or currency units for principal and interest, if not U.S. dollars; |

| · | the rate or rates, which may be fixed or variable, per annum at which the series of debt securities will bear interest, if any, and

the date or dates from which that interest, if any, will accrue; |

| · | the place or places where the principal of, premium, if any, and interest on the debt securities will be payable; |

| · | the denominations in which the debt securities will be issuable, if other than denominations of $1,000 and any integral multiple of

$1,000; |

| · | any mandatory or optional sinking funds or similar provisions or provisions for redemption, including any mandatory redemption provisions

or redemption at the option of the issuer; |

| · | the date, if any, after which and the price or prices at which the series of debt securities may, in accordance with any optional

or mandatory redemption provisions, be redeemed and the other detailed terms and provisions of those optional or mandatory redemption

provisions, if any; |

| · | any index or formula used to determine the amount of payments of principal of and any premium and interest on the debt securities; |

| · | if the debt securities may be converted into or exchanged for our common stock, preferred stock or other securities, the terms on

which conversion or exchange may occur, including whether conversion or exchange is mandatory, at the option of the holder or at our option,

the period during which conversion or exchange may occur, the initial conversion or exchange rate and the circumstance or manner in which

the amount of common or preferred stock issuable upon conversion or exchange may be adjusted or calculated according to the market price

of our common stock or preferred stock or such other securities; |

| · | if the debt securities are original issue discount debt securities, the yield to maturity; |

| · | the applicability of any provisions described under the heading “—Defeasance and Covenant Defeasance” below; |

| · | any event of default under the series of debt securities if different from those described under the heading “—Event of

Default” below; |

| · | the names and duties of any co-trustees, authenticating agents, paying agents, transfer agents or registrars for the debt securities; |

| · | if the series of debt securities will be issuable only in the form of a global security, the depositary or its nominee with respect

to the series of debt securities and the circumstances under which the global security may be registered for transfer or exchange in the

name of a person other than depository or the nominee; and |

| · | any other terms of the debt securities, which could be different from or in addition to those described in this prospectus. |

Form, Exchange and Transfer

Unless we indicate otherwise in the prospectus

supplement, the debt securities will be issued:

| · | only in fully registered form; and |

| · | in denominations of $1,000 and integral multiples of $1,000. |

Holders may exchange their debt securities for

debt securities of the same series in any authorized denominations, as long as the total principal amount is not changed.

Holders may exchange or transfer their debt securities

at the office of the trustee. They may also replace lost, stolen or mutilated debt securities at that office. The trustee acts as our

agent for registering debt securities in the names of the holders and transferring debt securities.

Holders will not be required to pay a service

charge to transfer or exchange their debt securities, but they may be required to pay for any tax or other governmental charge associated

with the registration, exchange or transfer. The transfer or exchange, and any replacement, will be made only if our transfer agent is

satisfied with the holder’s proof of legal ownership. We or the transfer agent may require an indemnity and/or a bond before replacing

any debt securities.

If a debt security is issued as a global debt

security, only the depositary will be entitled to transfer and exchange the debt security as described in this subsection, since the depositary

will be the sole holder of the debt security.

If a debt security is issued as a registered global

debt security, only the depositary – such as DTC, Euroclear or Clearstream, each as defined in the section “Legal Ownership

of Securities” below – will be entitled to transfer and exchange the debt security as described in this subsection, since

the depositary will be the sole holder of the debt security. Those who own beneficial interests in a global security do so through participants

in the applicable depositary’s securities clearance system, and the rights of these indirect owners will be governed solely by the

applicable procedures of the depositary and its participants. We describe book-entry procedures in the section “Legal Ownership

of Securities” below.

We will not deposit money on a regular basis into

any separate custodial account to repay the debt securities. In addition, we will not be entitled to redeem a debt security before its

stated maturity unless the prospectus supplement specifies provisions related to mandatory or optional redemption. You will not be entitled

to require us to buy a debt security from you before its stated maturity unless the prospectus supplement applicable to the series of

debt securities acquired by you specifies one or more repayment dates.

If the debt securities are redeemable and we redeem

less than all of the debt securities of a particular series, we may block the transfer or exchange of debt securities during the period

beginning 15 days before the day we mail the notice of redemption and ending on the day of that mailing, in order to freeze the list of

holders to prepare the mailing. We may also refuse to register transfers or exchanges of debt securities selected for redemption, except

that we will continue to permit transfers and exchanges of the unredeemed portion of any debt security being partially redeemed.

The rules for exchange described above apply to

an exchange of debt securities for other debt securities of the same series and kind. If a debt security is convertible, or exchangeable

into or for a different kind of security, the terms governing that type of conversion or exchange will be described in the prospectus

supplement.

Payment and Paying Agents

If interest is due on a debt security on an interest

payment date, we will pay the interest to the person in whose name the debt security is registered at the close of business on the regular

record date relating to the interest payment date as will be specified in the applicable prospectus supplement. If interest is due at

maturity but on a day that is not an interest payment date, we will pay the interest to the person entitled to receive the principal of

the debt security. If principal or another amount besides interest is due on a debt security at the stated maturity, we will pay the amount

to the holder of the debt security against surrender of the debt security at a proper place of payment or, in the case of a global debt

security, in accordance with the applicable policies of the depositary, in each case, on the terms set forth in the applicable prospectus

supplement.

We will make payments on a global security in

accordance with the applicable policies of the applicable depositary as in effect from time to time. Under those policies, we will make

payments directly to the applicable depositary, or its nominee, and not to any indirect owners who own beneficial interests in the global

security.

Book-entry and other indirect holders should consult

their banks, brokers or other financial institutions for information on how they will receive payments.

We will make payments on a debt security in non-global,

registered form as follows. We will pay interest that is due on an interest payment date by check mailed on the interest payment date

to the holder at his or her address shown on the trustee’s records as of the close of business on the regular record date. We will

make all other payments by check or wire transfer of immediately available funds to the paying agent against surrender of the debt security.

All payments will be made in U.S. dollars unless

the prospectus supplement provides otherwise. If payments are to be made in currency other than U.S. dollars, such payments for debt security

in non-global, registered form will be made by wire transfer of immediately available funds to any account that is maintained in the applicable

specified currency at a bank designated by the holder and which is acceptable to us and the trustee. To designate an account for wire

payment, the holder must give the paying agent appropriate wire instructions at least five business days before the requested wire payment

is due. If we are obligated to make a payment in a specified currency other than U.S. dollars, and the specified currency or any successor

currency is not available to us due to circumstances beyond our control we will be entitled to satisfy our obligation to make the payment

by making the payment in U.S. dollars, on the basis of the exchange rate determined by the designated exchange agent, in its discretion.

We may appoint one or more financial institutions

to act as our paying agents, at whose designated offices debt securities in non-global entry form may be surrendered for payment at their

maturity. We call each of those offices a paying agent. We may add, replace or terminate paying agents from time to time. We may also

choose to act as our own paying agent. Initially, the appointed trustee will act as the paying agent.

Regardless of who acts as paying agent, all money

paid by us to a paying agent that remains unclaimed at the end of two years after the amount is due to a holder will be repaid to us.

After that two-year period, subject to applicable unclaimed property laws, the holder may, as an unsecured general creditor, look only

to us for payment and not to the trustee, any other paying agent or anyone else.

Notices

Notices to be given to holders of a global debt

security will be given only to the applicable depositary, in accordance with its policies as in effect from time to time. Notices to be

given to holders of debt securities not in global form will be sent by mail to the respective addresses of the holders of such debt securities

as they appear in the trustee’s records. Neither the failure to give any notice to a particular holder, nor any defect in a notice

given to a particular holder, will affect the sufficiency of any notice given to another holder.

Mergers and Similar Transactions

Under the terms of the applicable indenture and

supplemental indenture, we will generally be permitted to merge or consolidate with another entity. We will also generally be permitted

to sell our assets substantially as an entirety to another entity. With regard to any series of debt securities, however, unless otherwise

indicated in the applicable prospectus supplement, we may not take any of these actions unless all of the following conditions are met:

| · | If the successor entity in the transaction is not us, the successor entity must be a corporation, partnership, limited liability company

or trust organized under the laws of the United States, any state in the United States or the District of Columbia and must expressly

assume our obligations under the debt securities of that series and the indenture and supplemental indenture with respect to that series. |

| · | Immediately after giving effect to the transaction, no default under the debt securities of that series has occurred and is continuing.

For this purpose, “default under the debt securities of that series” means an event of default with respect to that series

or any event that would be an event of default with respect to that series if the requirements for giving us a default notice and for

our default having to continue for a specific period of time were disregarded. |

| · | We have delivered to the trustee an officers’ certificate and opinion of counsel, each stating that the transaction complies

in all respects with the indenture. |

If the conditions described above are satisfied

with respect to the debt securities of any series, we will not need to obtain the approval of the holders of those debt securities in

order to merge or consolidate or to sell our assets. Also, these conditions will apply only if we wish to merge or consolidate with another

entity or sell our assets substantially as an entirety to another entity. We will not need to satisfy these conditions if we enter into

other types of transactions, including any transaction in which we acquire stock or assets of another entity, any transaction that involves

a change of control of us but in which we do not merge or consolidate and any transaction in which we sell less than substantially all

of our assets.

Defeasance and Covenant Defeasance

Any series of issued debt securities may be subject

to the defeasance and discharge provisions of the applicable indenture. Under those provisions, the debt securities of any series may

authorize us to elect to:

| · | defease and to discharge us from any and all obligations with respect to those debt securities, except for the rights of holders of

those debt securities to receive payments on the securities solely from the trust fund established pursuant to the applicable indenture

and the obligations to exchange or register the transfer of the securities, to replace temporary or mutilated, destroyed, lost or stolen

securities, to maintain an office or agency with respect to the securities and to hold moneys for payment in trust, which we refer to

as a defeasance; or |

| · | to be released from our obligations with respect to those debt securities to comply with the restrictive covenants which are subject

to covenant defeasance, and the occurrence of certain events of default with respect to those restrictive covenants shall no longer be

an event of default, which we refer to as a covenant defeasance. |

To invoke defeasance or covenant defeasance with

respect to any series of debt securities, we must irrevocably deposit with a trustee, in trust, money or U.S. government obligations,

or both, which will provide money in an amount sufficient to pay all sums due on that series.

As a condition to defeasance or covenant defeasance,

we must deliver to the applicable trustee an officers certificate and an opinion of counsel stating that holders of the applicable debt

securities will not recognize gain or loss for federal income tax purposes as a result of the defeasance or covenant defeasance and will

be subject to federal income tax on the same amounts, in the same manner and at the same times as would have been the case if we did not

elect the defeasance or covenant defeasance. We may exercise our defeasance option with respect to the securities notwithstanding our

prior exercise of our covenant defeasance option. If we exercise our defeasance option, payment of the securities may not be accelerated

by the reference to restrictive covenants which are subject to covenant defeasance. If we do not comply with our remaining obligations

after exercising our covenant defeasance option and the debt securities are declared due and payable because of the occurrence of any

event of default, the amount of money and U.S. government obligations on deposit in the defeasance trust may be insufficient to pay amounts

due on the securities at the time of the acceleration. However, we will remain liable for those payments.

Modification and Waiver of the Debt Securities

We may change or modify either of the indentures

without the consent of the holders of the debt securities so long as such changes are limited to clarifications and/or changes that would

not adversely affect the debt securities of that series in any material respect. We may also make changes that may affect the debt securities

that have yet to be issued under the applicable indentures without the approval of any holders.

If the proposed change will affect the debt securities

of a particular series then we must obtain approval of the holders of a majority in principal amount of the debt securities of that series.

If the proposed change will affect the debt securities of more than one series of debt securities issued under the applicable indenture

then we must obtain approval of the holders of a majority in principal amount of each series affected by the change.

We may not amend the subordinated debt indenture

to alter the subordination of any outstanding subordinated debt securities without the written consent of each holder of senior debt then

outstanding who would be adversely affected. In addition, we may not modify the subordination provisions of the subordinated debt indenture

in a manner that would adversely affect the outstanding subordinated debt securities of any one or more series in any

material respect, without the approval of the holders

of a majority in aggregate principal amount of all affected series, voting together as one class.

In each case, the required approval must be given

by written consent.

Book-entry and other indirect holders should consult

their banks, brokers or other financial institutions for information on how approval may be granted or denied if we seek to change or

modify either indenture or the debt securities or request a waiver.

Subordination Provisions

Holders of subordinated debt securities should

recognize that contractual provisions in the subordinated debt indenture may prohibit us from making payments on those securities. Subordinated

debt securities are subordinate and junior in right of payment, to the extent and in the manner stated in the subordinated debt indenture,

to all of our senior debt, as defined in the subordinated debt indenture, as it may be supplemented from time to time, including all debt

securities we have issued and will issue under the senior debt indenture.

The subordinated debt indenture defines “senior

debt” as the principal of (and premium, if any) and interest (including interest accruing on or after the filing of any petition

in bankruptcy or for reorganization relating to us) on all of our indebtedness (including indebtedness of others guaranteed by us), other

than the subordinated debt securities, whether outstanding on the date of the indenture or thereafter created, incurred or assumed, which

is (i) for money borrowed, (ii) evidenced by a note or similar instrument given in connection with the acquisition of any businesses,

properties or assets of any kind or (iii) obligations of ours as lessee under leases required to be capitalized on the balance sheet of

the lessee under generally accepted accounting principles or leases of property or assets made as part of any sale and lease-back transaction

to which we are a party, including amendments, renewals, extensions, modifications and refundings of any such indebtedness or obligation,

unless in any case in the instrument creating or evidencing any such indebtedness or obligation or pursuant to which the same is outstanding

it is provided that such indebtedness or obligation is not superior in right of payment to the subordinated debt securities.

The subordinated debt indenture provides that,

unless all principal of and any premium or interest on the senior debt has been paid in full, no payment or other distribution may be

made in respect of any subordinated debt securities in the following circumstances:

| · | in the event of any insolvency or bankruptcy proceedings, or any receivership, liquidation, reorganization or other similar proceeding

involving us or our assets; |

| · | (a) in the event and during the continuation of any default in the payment of principal, premium or interest on any senior debt beyond

any applicable grace period or if any event of default with respect to any senior debt of ours has occurred and is continuing, permitting

the holders of that senior debt of ours or a trustee to accelerate the maturity of that senior debt, unless the event of default has been

cured or waived or ceased to exist and any related acceleration has been rescinded, or (b) if any judicial proceeding is pending with

respect to a payment default or an event of default described in clause (a); or |

| · | in the event that any subordinated debt securities have been declared due and payable before their stated maturity. |

If the trustee under the subordinated debt indenture

or any holders of the subordinated debt securities receive any payment or distribution that they know is prohibited under the subordination

provisions, then the trustee or the holders will have to repay that money to the holders of the senior debt.

Even if the subordination provisions prevent us

from making any payment when due on the subordinated debt securities of any series, we will be in default on our obligations under that

series if we do not make the payment when due. This means that the trustee under the subordinated debt indenture and the holders of that

series can take action against us, but they will not receive any money until the claims of the holders of senior debt have been fully

satisfied.

Events of Default

Unless the applicable prospectus supplement provides

otherwise, when we refer to an event of default with respect to any series of debt securities, we mean any of the following:

| · | failure to pay interest on any debt security of that series within 30 days after its due date; |

| · | failure to pay the principal of or any premium on any debt security of that series on the due date; |

| · | failure to deposit a sinking fund payment with regard to any debt security of that series on the due date, but only if the payment

is required under the applicable prospectus supplement; |

| · | we remain in breach of any covenant we make in the indenture or the applicable supplemental indenture for the benefit of the relevant

series for 90 days after we receive a written notice of default stating that we are in breach and requiring us to remedy the breach. The

notice must be sent by the trustee or the holders of at least a majority in principal amount of the relevant series of debt securities;

or |

| · | the occurrence of specified bankruptcy, insolvency or reorganization events. |

An event of default for one series of debt securities

does not necessarily constitute an event of default for any other series. The trustee may withhold notice to the debt securities holders

of any default, except a payment default, if it considers such action to be in the holders’ interests.

If the specified bankruptcy, insolvency or reorganization

events occur, the entire principal of all the debt securities of that series, together with all accrued and unpaid interest, will be due

and payable immediately. If any other event of default occurs and continues, the trustee, or the holders of at least a majority in aggregate

principal amount of the outstanding debt securities of the applicable series, may declare the entire principal of all the debt securities

of that series to be due and payable immediately. If this happens, and if we cure the event of default in the manner specified in the

applicable indenture or supplemental indenture, the holders of a majority of the aggregate outstanding principal amount of the debt securities

of that series can void the acceleration of payment.

The indentures provide that the trustee has no

obligation to exercise any of its rights at the direction of any holders of debt securities, unless the holders offer the trustee reasonable

indemnity. If such holders provide this indemnification to the trustee, the holders of a majority in principal amount of any series of

debt securities have the right to direct any proceeding, remedy or power available to the trustee with respect to that series.

Book-entry and other indirect holders should consult

their banks, brokers or other financial institutions for information on how to give notice or direction to or make a request of the trustee

and to make or cancel a declaration of acceleration.

We will provide the trustee every year with a

written statement of certain of our officers certifying that to their knowledge we are in compliance with the applicable indenture and

the debt securities issued under it, or else specifying any default.

The Trustee

If we offer a series of debt securities, we will

identify the banking or financial institution which will act as trustee under the applicable indenture in the prospectus supplement for

that offering. If a single banking or financial institution acts as trustee with respect to both the indentures, and a default occurs

with respect to any series of debt securities, the banking or financial institution would generally be required to resign as trustee under

one of the indentures within 90 days of the default, unless the default were cured, duly waived or otherwise eliminated. We have initially

designated Wilmington Trust, National Association, as the trustee with respect to each of the indentures.

Governing Law

New York law will govern the indentures and the

debt securities.

Description of

Warrants

We may issue warrants for the purchase of shares

of common stock, preferred stock or debt securities in one or more series. We may issue warrants independently or together with shares

of common stock, preferred stock and/or debt securities, and the warrants may be attached to or separate from these securities. While

the terms summarized below will apply generally to any warrants that we may sell, we will describe the particular terms of any series

of warrants in more detail in the applicable prospectus supplement. The terms of any warrants offered under a prospectus supplement may

differ from the terms described below.

We will file as exhibits to the registration statement

of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of warrant agreement,

including a form of warrant certificate, that describes the terms of the particular series of warrants we are offering before the issuance

of the related series of warrants. The following summaries of material provisions of the warrants and the warrant agreements are subject

to, and qualified in their entirety by reference to, all the provisions of the warrant agreement and warrant certificate applicable to

the particular series of warrants that we may offer under this prospectus and the accompanying prospectus supplement. We urge you to read

the applicable prospectus supplements related to the particular series of warrants that we may offer under this prospectus, as well as

any related free writing prospectuses, and the complete warrant agreements and warrant certificates that contain the terms of the warrants.

General

You should review the applicable prospectus supplement

for the specific terms of any warrants that may be offered, including the following:

| · | the title of the warrants; |

| · | the aggregate number of the warrants; |

| · | the price or prices at which the warrants will be issued; |

| · | in the case of warrants to purchase debt securities, the designation, aggregate principal amount, denominations and terms of the debt

securities purchasable upon exercise of a warrant to purchase debt securities and the price at which the debt securities may be purchased

upon exercise; |

| · | in the case of warrants to purchase common stock or preferred stock, the number of shares of common stock or preferred stock, as the

case may be, purchasable upon the exercise of one warrant and the price at which these shares may be purchased upon such exercise; |

| · | if applicable, the date on and after which the warrants and the related securities will be separately transferable; |

| · | the effect of any merger, consolidation, sale or other disposition of our business on the warrant agreements and the warrants; |

| · | the terms of any rights to redeem or call the warrants; |

| · | any provisions for changes to or adjustments in the exercise price or number of securities issuable upon exercise of the warrants; |

| · | the date on which the right to exercise the warrants will commence and the date on which the right will expire; |

| · | if applicable, the minimum or maximum number of warrants that may be exercised at any one time; |

| · | the manner in which the warrant agreements and warrants may be modified; |

| · | information relating to book-entry procedures, if any; |

| · | if applicable, a discussion of material U.S. federal income tax considerations of holding or exercising the warrants; and |

| · | any other terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants. |

Before exercising their warrants, holders of warrants

will not have any of the rights of holders of the securities purchasable upon such exercise, including:

| · | in the case of warrants to purchase debt securities, the right to receive payments of principal of, or premium, if any, or interest