Chip Stocks Slump but Remain a Big Winner in 2019

September 27 2019 - 2:40PM

Dow Jones News

By Alexander Osipovich

Semiconductor stocks took a beating Friday, dragged down by

disappointing results from Micron Technology Inc.

Analysts generally agree, though, that the sector is poised to

benefit as demand for memory chips recovers and as the U.S. and

China continue talks about a trade deal.

Micron shares fell 9.7% -- their biggest percentage decline this

year -- a day after the company reported a steep drop in revenue

and released a disappointing earnings forecast. That weighed on

stocks like Lam Research Corp., which fell 4.4%, and KLA Corp.,

down 1.5%.

But the sector has still outperformed this year. Even with

Friday's drop, Micron is up 38% since the start of 2019, while Lam

Research has climbed 71% and KLA is up 78%. The iShares PHLX

Semiconductor exchange-traded fund has gained 35%, handily beating

the 18% rise in the S&P 500 over that period.

Semiconductors are a famously cyclical industry, driven by

fluctuating demand for the chips used in everything from computers

to iPhones and smartwatches. That cycle is at a low point: Global

semiconductor sales fell 16% in July from a year ago, according to

the Semiconductor Industry Association. But many analysts expect a

rebound.

"We are optimistic around 2020," Wedbush said in a research note

Friday, projecting that demand for memory chips would pick up next

year with growing adoption of new 5G smartphones and the rollout of

new gaming consoles.

The U.S.-China trade war caused volatile trading in recent

months in chip maker stocks, which often have complex supply chains

extending to China. High-level trade talks are set to resume next

month, which has fueled some optimism that a resolution could be

near.

Write to Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

September 27, 2019 14:25 ET (18:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

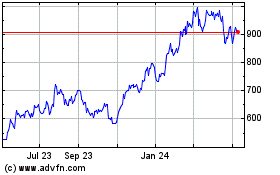

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

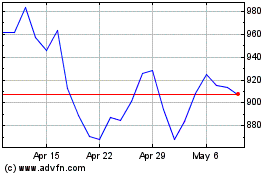

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Apr 2023 to Apr 2024