Delivers results ahead of

expectations

Gaining traction to address inflation,

advance strategy

Raises full year outlook

The Kraft Heinz Company (Nasdaq: KHC) (“Kraft Heinz” or the

“Company”) today reported financial results for the third quarter

of 2021, which reflected gains in Organic Net Sales on top of

exceptionally strong growth in 2020. The Company also reported

better-than-expected results, enabled by improvements in its

operating model and an agile approach to managing supply and

services through volatile markets.

"I am incredibly proud of our Kraft Heinz team for delivering

another quarter of results that exceed our expectations, even as we

face the ongoing challenges of the pandemic and, now, escalating

inflation,” said Kraft Heinz CEO Miguel Patricio. “We are

effectively adapting to near-term challenges while transforming our

business and rejuvenating our iconic brands to better serve

consumers for the long term. We still have much to do, but our

momentum is strong and our strategy to bring agility to our scale

is working, which is why we are increasing full-year

expectations."

Net Sales

In millions

Net Sales

Organic Net Sales(1)

Growth

September 25,

2021

September 26,

2020

% Chg vs PY

YoY Growth

Rate

Price

Volume/Mix

For the Three Months Ended

United States

$

4,521

$

4,710

(4.0)%

1.3%

1.4 pp

(0.1) pp

International

1,383

1,325

4.4%

2.2%

2.2 pp

0.0 pp

Canada

420

406

3.4%

(1.9)%

0.2 pp

(2.1) pp

Kraft Heinz

$

6,324

$

6,441

(1.8)%

1.3%

1.5 pp

(0.2) pp

For the Nine Months Ended

United States

$

13,867

$

14,122

(1.8)%

0.3%

1.3 pp

(1.0) pp

International

4,190

3,931

6.6%

1.8%

2.1 pp

(0.3) pp

Canada

1,276

1,193

7.0%

(1.2)%

2.2 pp

(3.4) pp

Kraft Heinz

$

19,333

$

19,246

0.5%

0.5%

1.5 pp

(1.0) pp

Net Income/(Loss) and Diluted

EPS

In millions, except per share

data

For the Three Months

Ended

For the Nine Months

Ended

September 25,

2021

September 26,

2020

% Chg vs PY

September 25,

2021

September 26,

2020

% Chg vs PY

Gross profit

$

2,028

$

2,344

(13.5)%

$

6,520

$

6,654

(2.0)%

Operating income/(loss)

1,156

1,147

0.8%

3,480

578

502.3%

Net income/(loss)

736

598

23.2%

1,279

(673)

289.9%

Net income/(loss) attributable to common

shareholders

733

597

23.0%

1,269

(676)

287.6%

Diluted EPS

$

0.59

$

0.49

20.4%

$

1.03

$

(0.55)

287.3%

Adjusted EPS(1)

0.65

0.70

(7.1)%

2.15

2.09

2.9%

Adjusted EBITDA(1)

$

1,479

$

1,667

(11.3)%

$

4,765

$

4,881

(2.4)%

Q3 2021 Financial Summary

- Net sales decreased 1.8 percent versus the year-ago

period to $6.3 billion, including a negative 4.0 percentage point

impact from the divestiture of the Company's nuts business, which

closed in the second quarter of 2021, and a favorable 0.9

percentage point impact from currency. Net sales versus the

comparable 2019 period increased 4.1 percent, including a favorable

0.8 percentage point impact from currency and despite a negative

4.3 percentage point impact from divestitures. Organic Net

Sales(1) increased 1.3 percent versus the prior year period and

7.6 percent versus the comparable 2019 period, with growth versus

2019 negatively impacted by 1.4 percentage points from exiting the

McCafé licensing agreement. Pricing was up 1.5 percentage points

versus the prior year period with growth across each reporting

segment that primarily reflected inflation-justified price

increases in foodservice and retail channels across all

geographies. These gains came despite more normalized promotional

activities with retailers versus the year-ago period, especially in

the United States. Volume/mix declined 0.2 percentage points versus

the year-ago period reflecting declines versus extraordinary

COVID-19-related retail demand in 2020, that were partially offset

by a recovery in foodservice channels.

- Net income/(loss) increased 23.2 percent to $736

million, primarily driven by a $300 million non-cash goodwill

impairment loss in the prior year period related to the Cheese

Transaction, a lower effective tax rate versus the prior year

period, and favorable changes in other expense/(income). These

factors were partially offset by lower Adjusted EBITDA, higher

interest expense due to debt extinguishment costs, as well as

unrealized losses on commodity hedges in the current year period

compared to unrealized gains on commodity hedges in the prior year

period. Net income/(loss) decreased 18.1 percent versus the

comparable 2019 period. Adjusted EBITDA(1) decreased 11.3

percent versus the year-ago period to $1.5 billion and increased

0.7 percent versus the comparable 2019 period, with performance

against each period including an unfavorable impact from

divestitures of approximately 3 percentage points. Excluding a

favorable 0.6 percentage point impact from currency, year-over-year

Adjusted EBITDA benefited from efficiency gains, higher Organic Net

Sales, and lower general corporate expenses. These increases were

more than offset by unfavorable supply chain, key commodity(2), and

packaging costs.

- Diluted EPS increased to $0.59, up 20.4 percent versus

the prior year, driven by the net income/(loss) factors discussed

above. Adjusted EPS(1) decreased to $0.65, down 7.1 percent

versus the prior year, primarily driven by lower Adjusted EBITDA,

higher equity award compensation expense, and unfavorable changes

in other expense/(income) that more than offset lower taxes on

adjusted earnings and lower interest expense versus the prior year

period.

- Year-to-date net cash provided by operating activities

was $2.4 billion, down 26.4 percent versus the year-ago period,

primarily driven by higher cash tax payments on divestitures in

2021 related to the divestiture of the Company's nuts business,

higher cash outflows for variable compensation in 2021 compared to

2020, higher cash outflows from increased promotional activity

versus the prior year period, and lower Adjusted EBITDA. These

impacts were partially offset by lower cash outflows for

inventories and favorable changes in accounts payable compared to

the prior year, largely due to the timing of purchases and

favorable payment terms. Free Cash Flow(1) in the first nine

months of 2021 was $1.8 billion, down 38.8 percent versus the

comparable prior year period due to lower net cash provided by

operating activities and higher capital expenditures versus the

prior year period.

Outlook

Based on strong performance to date, the Company expects Organic

Net Sales(3) growth in 2021 to be flat compared to an exceptionally

strong 2020 period. In addition, the Company has increased its

expectations for 2021 Adjusted EBITDA(3) from at least $6.1 billion

to more than $6.2 billion. This reflects a combination of

greater-than-expected Organic Net Sales as well as the Company's

ongoing efforts to manage inflationary pressures as it continues to

invest in long-term growth. This outlook includes the impact of the

sale of the Company’s nuts business completed in June, but does not

include an impact from the pending sale of its natural cheese

business.

End Notes

(1)

Organic Net Sales, Adjusted

EBITDA, Adjusted EPS, Constant Currency Adjusted EBITDA, and Free

Cash Flow are non-GAAP financial measures. Please see discussion of

non-GAAP financial measures and the reconciliations at the end of

this press release for more information.

(2)

The Company's key commodities in

the United States and Canada are dairy, meat, and coffee.

(3)

Full year 2021 guidance for

Organic Net Sales and Adjusted EBITDA is provided on a non-GAAP

basis only because certain information necessary to calculate the

most comparable GAAP measure is unavailable due to the uncertainty

and inherent difficulty of predicting the occurrence and the future

financial statement impact of such items impacting comparability,

including, but not limited to, the impact of currency, acquisitions

and divestitures, restructuring expenses, deal costs, unrealized

losses/(gains) on commodity hedges, impairment losses, certain

non-ordinary course legal and regulatory matters, and equity award

compensation expense, among other items. Therefore, as a result of

the uncertainty and variability of the nature and amount of future

adjustments, which could be significant, the Company is unable to

provide a reconciliation of these measures without unreasonable

effort.

Earnings Discussion and Webcast Information

A pre-recorded management discussion of The Kraft Heinz

Company's third quarter 2021 earnings is available at

ir.kraftheinzcompany.com. The Company will host a live question and

answer session beginning today at 9:00 a.m. Eastern Daylight Time.

A webcast of the session will also be accessible at

ir.kraftheinzcompany.com.

ABOUT THE KRAFT HEINZ COMPANY

We are driving transformation at The Kraft Heinz Company

(Nasdaq: KHC), inspired by our Purpose, Let’s Make Life Delicious.

Consumers are at the center of everything we do. With 2020 net

sales of approximately $26 billion, we are committed to growing our

iconic and emerging food and beverage brands on a global scale. We

leverage our scale and agility to unleash the full power of Kraft

Heinz across a portfolio of six consumer-driven product platforms.

As global citizens, we’re dedicated to making a sustainable,

ethical impact while helping feed the world in healthy, responsible

ways. Learn more about our journey by visiting

www.kraftheinzcompany.com or following us on LinkedIn and

Twitter.

Forward-Looking Statements

This press release contains a number of forward-looking

statements. Words such as “plan,” "believe," "anticipate,"

"reflect," "invest," "see," "make," "expect," "deliver," "drive,"

“improve,” “intend,” "assess," "remain," "evaluate," “establish,”

“focus,” “build,” “turn,” “expand,” “leverage,” "grow," "will,"

"maintain," "manage," and variations of such words and similar

future or conditional expressions are intended to identify

forward-looking statements. Examples of forward-looking statements

include, but are not limited to, statements regarding the Company's

plans, impacts of accounting standards and guidance, growth, legal

matters, taxes, costs and cost savings, impairments, dividends,

expectations, investments, innovations, opportunities,

capabilities, execution, initiatives, and pipeline. These

forward-looking statements reflect management's current

expectations and are not guarantees of future performance and are

subject to a number of risks and uncertainties, many of which are

difficult to predict and beyond the Company's control.

Important factors that may affect the Company's business and

operations and that may cause actual results to differ materially

from those in the forward-looking statements include, but are not

limited to, the impacts of COVID-19 and government and consumer

responses; operating in a highly competitive industry; the

Company’s ability to correctly predict, identify, and interpret

changes in consumer preferences and demand, to offer new products

to meet those changes, and to respond to competitive innovation;

changes in the retail landscape or the loss of key retail

customers; changes in the Company's relationships with significant

customers or suppliers, or in other business relationships; the

Company’s ability to maintain, extend, and expand its reputation

and brand image; the Company’s ability to leverage its brand value

to compete against private label products; the Company’s ability to

drive revenue growth in its key product categories or platforms,

increase its market share, or add products that are in

faster-growing and more profitable categories; product recalls or

other product liability claims; the Company’s ability to identify,

complete, or realize the benefits from strategic acquisitions,

alliances, divestitures, joint ventures, or other investments; the

Company's ability to successfully execute its strategic

initiatives; the impacts of the Company's international operations;

the Company's ability to protect intellectual property rights; the

Company's ownership structure; the Company’s ability to realize the

anticipated benefits from prior or future streamlining actions to

reduce fixed costs, simplify or improve processes, and improve its

competitiveness; the Company's level of indebtedness, as well as

our ability to comply with covenants under our debt instruments;

additional impairments of the carrying amounts of goodwill or other

indefinite-lived intangible assets; foreign exchange rate

fluctuations; volatility in commodity, energy, and other input

costs; volatility in the market value of all or a portion of the

commodity derivatives we use; compliance with laws and regulations

and related legal claims or regulatory enforcement actions; failure

to maintain an effective system of internal controls; a downgrade

in the Company's credit rating; the impact of future sales of the

Company's common stock in the public market; the Company’s ability

to continue to pay a regular dividend and the amounts of any such

dividends; unanticipated business disruptions and natural events in

the locations in which the Company or the Company's customers,

suppliers, distributors, or regulators operate; economic and

political conditions in the United States and in various other

nations where the Company does business; changes in the Company's

management team or other key personnel and the Company's ability to

hire or retain key personnel or a highly skilled and diverse global

workforce; risks associated with information technology and

systems, including service interruptions, misappropriation of data,

or breaches of security; increased pension, labor, and

people-related expenses; changes in tax laws and interpretations;

volatility of capital markets and other macroeconomic factors; and

other factors. For additional information on these and other

factors that could affect the Company's forward-looking statements,

see the Company's risk factors, as they may be amended from time to

time, set forth in its filings with the SEC. The Company disclaims

and does not undertake any obligation to update, revise, or

withdraw any forward-looking statement in this press release,

except as required by applicable law or regulation.

Non-GAAP Financial Measures

The non-GAAP financial measures provided should be viewed in

addition to, and not as an alternative for, results prepared in

accordance with accounting principles generally accepted in the

United States of America (“GAAP”) that are presented in this press

release.

To supplement the financial information provided, the Company

has presented Organic Net Sales, Adjusted EBITDA, Constant Currency

Adjusted EBITDA, Adjusted EPS, and Free Cash Flow, which are

considered non-GAAP financial measures. The non-GAAP financial

measures presented may differ from similarly titled non-GAAP

financial measures presented by other companies, and other

companies may not define these non-GAAP financial measures in the

same way. These measures are not substitutes for their comparable

GAAP financial measures, such as net sales, net income/(loss),

diluted earnings per share ("EPS"), net cash provided by/(used for)

operating activities, or other measures prescribed by GAAP, and

there are limitations to using non-GAAP financial measures.

Management uses these non-GAAP financial measures to assist in

comparing the Company's performance on a consistent basis for

purposes of business decision making by removing the impact of

certain items that management believes do not directly reflect the

Company's underlying operations. Management believes that

presenting the Company's non-GAAP financial measures (i.e., Organic

Net Sales, Adjusted EBITDA, Constant Currency Adjusted EBITDA,

Adjusted EPS, and Free Cash Flow) is useful to investors because it

(i) provides investors with meaningful supplemental information

regarding financial performance by excluding certain items, (ii)

permits investors to view performance using the same tools that

management uses to budget, make operating and strategic decisions,

and evaluate historical performance, and (iii) otherwise provides

supplemental information that may be useful to investors in

evaluating the Company's results. The Company believes that the

presentation of these non-GAAP financial measures, when considered

together with the corresponding GAAP financial measures and the

reconciliations to those measures, provides investors with

additional understanding of the factors and trends affecting the

Company's business than could be obtained absent these

disclosures.

Organic Net Sales is defined as net sales excluding, when they

occur, the impact of currency, acquisitions and divestitures, and a

53rd week of shipments. The Company calculates the impact of

currency on net sales by holding exchange rates constant at the

previous year's exchange rate, with the exception of highly

inflationary subsidiaries, for which the Company calculates the

previous year's results using the current year's exchange rate.

Organic Net Sales is a tool that can assist management and

investors in comparing the Company's performance on a consistent

basis by removing the impact of certain items that management

believes do not directly reflect the Company's underlying

operations.

Adjusted EBITDA is defined as net income/(loss) from continuing

operations before interest expense, other expense/(income),

provision for/(benefit from) income taxes, and depreciation and

amortization (excluding restructuring activities); in addition to

these adjustments, the Company excludes, when they occur, the

impacts of restructuring activities, deal costs, unrealized

losses/(gains) on commodity hedges, impairment losses, certain

non-ordinary course legal and regulatory matters, and equity award

compensation expense (excluding restructuring activities). The

Company also presents Adjusted EBITDA on a constant currency basis.

The Company calculates the impact of currency on Adjusted EBITDA by

holding exchange rates constant at the previous year's exchange

rate, with the exception of highly inflationary subsidiaries, for

which it calculates the previous year's results using the current

year's exchange rate. Adjusted EBITDA and Constant Currency

Adjusted EBITDA are tools that can assist management and investors

in comparing the Company's performance on a consistent basis by

removing the impact of certain items that management believes do

not directly reflect the Company's underlying operations. In the

second quarter of 2021, the Company revised the definition of

Adjusted EBITDA to adjust for the impact of certain legal and

regulatory matters arising outside the ordinary course of its

business, as management believes such matters, when they occur, do

not directly reflect the Company's underlying operations.

Adjusted EPS is defined as diluted earnings per share excluding,

when they occur, the impacts of restructuring activities, deal

costs, unrealized losses/(gains) on commodity hedges, impairment

losses, certain non-ordinary course legal and regulatory matters,

losses/(gains) on the sale of a business, other losses/(gains)

related to acquisitions and divestitures (e.g., tax and hedging

impacts), nonmonetary currency devaluation (e.g., remeasurement

gains and losses), debt prepayment and extinguishment costs, and

certain significant discrete income tax items (e.g., U.S. and

non-U.S. tax reform), and including when they occur, adjustments to

reflect preferred stock dividend payments on an accrual basis. The

Company believes Adjusted EPS provides important comparability of

underlying operating results, allowing investors and management to

assess operating performance on a consistent basis. In the second

quarter of 2021, the Company revised the definition of Adjusted EPS

to adjust for the impact of certain legal and regulatory matters

arising outside the ordinary course of its business and certain

significant discrete income tax items beyond U.S. tax reform, as

management believes such matters, when they occur, do not directly

reflect the Company's underlying operations.

Free Cash Flow is defined as net cash provided by/(used for)

operating activities less capital expenditures. The Company

believes Free Cash Flow provides a measure of the Company's core

operating performance, the cash-generating capabilities of the

Company's business operations, and is one factor used in

determining the amount of cash available for debt repayments,

dividends, acquisitions, share repurchases, and other corporate

purposes. The use of this non-GAAP measure does not imply or

represent the residual cash flow for discretionary expenditures

since the Company has certain non-discretionary obligations such as

debt service that are not deducted from the measure.

See the attached schedules for supplemental financial data,

which includes the financial information, the non-GAAP financial

measures and corresponding reconciliations to the comparable GAAP

financial measures for the relevant periods.

Schedule

1

The Kraft Heinz Company

Condensed Consolidated Statements

of Income

(in millions, except per share

data)

(Unaudited)

For the Three Months

Ended

For the Nine Months

Ended

September 25,

2021

September 26,

2020

September 25,

2021

September 26,

2020

Net sales

$

6,324

$

6,441

$

19,333

$

19,246

Cost of products sold

4,296

4,097

12,813

12,592

Gross profit

2,028

2,344

6,520

6,654

Selling, general and administrative

expenses, excluding impairment losses

872

897

2,697

2,677

Goodwill impairment losses

—

300

265

2,343

Intangible asset impairment losses

—

—

78

1,056

Selling, general and administrative

expenses

872

1,197

3,040

6,076

Operating income/(loss)

1,156

1,147

3,480

578

Interest expense

415

314

1,443

1,066

Other expense/(income)

(138)

(73)

(191)

(232)

Income/(loss) before income taxes

879

906

2,228

(256)

Provision for/(benefit from) income

taxes

143

308

949

417

Net income/(loss)

736

598

1,279

(673)

Net income/(loss) attributable to

noncontrolling interest

3

1

10

3

Net income/(loss) attributable to common

shareholders

$

733

$

597

$

1,269

$

(676)

Basic shares outstanding

1,225

1,223

1,224

1,222

Diluted shares outstanding

1,236

1,229

1,235

1,222

Per share data applicable to common

shareholders:

Basic earnings/(loss) per share

$

0.60

$

0.49

$

1.04

$

(0.55)

Diluted earnings/(loss) per share

0.59

0.49

1.03

(0.55)

Schedule

2

The Kraft Heinz Company

Reconciliation of Net Sales to

Organic Net Sales

For the Three Months Ended

(dollars in millions)

(Unaudited)

Net Sales

Currency

Acquisitions

and

Divestitures

Organic Net

Sales

Price

Volume/Mix

September 25, 2021

United States

$

4,521

$

—

$

—

$

4,521

International

1,383

39

—

1,344

Canada

420

25

—

395

Kraft Heinz

$

6,324

$

64

$

—

$

6,260

September 26, 2020

United States

$

4,710

$

—

$

246

$

4,464

International

1,325

6

5

1,314

Canada

406

—

2

404

Kraft Heinz

$

6,441

$

6

$

253

$

6,182

Year-over-year growth rates

United States

(4.0)%

0.0 pp

(5.3) pp

1.3%

1.4 pp

(0.1) pp

International

4.4%

2.6 pp

(0.4) pp

2.2%

2.2 pp

0.0 pp

Canada

3.4%

5.7 pp

(0.4) pp

(1.9)%

0.2 pp

(2.1) pp

Kraft Heinz

(1.8)%

0.9 pp

(4.0) pp

1.3%

1.5 pp

(0.2) pp

Schedule

3

The Kraft Heinz Company

Reconciliation of Net Sales to

Organic Net Sales

For the Nine Months Ended

(dollars in millions)

(Unaudited)

Net Sales

Currency

Acquisitions

and

Divestitures

Organic Net

Sales

Price

Volume/Mix

September 25, 2021

United States

$

13,867

$

—

$

446

$

13,421

International

4,190

211

9

3,970

Canada

1,276

100

1

1,175

Kraft Heinz

$

19,333

$

311

$

456

$

18,566

September 26, 2020

United States

$

14,122

$

—

$

745

$

13,377

International

3,931

17

14

3,900

Canada

1,193

—

4

1,189

Kraft Heinz

$

19,246

$

17

$

763

$

18,466

Year-over-year growth rates

United States

(1.8)%

0.0 pp

(2.1) pp

0.3%

1.3 pp

(1.0) pp

International

6.6%

5.0 pp

(0.2) pp

1.8%

2.1 pp

(0.3) pp

Canada

7.0%

8.3 pp

(0.1) pp

(1.2)%

2.2 pp

(3.4) pp

Kraft Heinz

0.5%

1.6 pp

(1.6) pp

0.5%

1.5 pp

(1.0) pp

Schedule

4

The Kraft Heinz Company

Reconciliation of Net Sales to

Organic Net Sales

For the Three Months Ended

(dollars in millions)

(Unaudited)

Net Sales

Currency

Acquisitions

and

Divestitures

Organic Net

Sales

September 25, 2021

United States

$

4,521

$

—

$

—

$

4,521

International

1,383

32

—

1,351

Canada

420

20

—

400

Kraft Heinz

$

6,324

$

52

$

—

$

6,272

September 28, 2019

United States

$

4,385

$

—

$

231

$

4,154

International

1,276

7

5

1,264

Canada

415

—

3

412

Kraft Heinz

$

6,076

$

7

$

239

$

5,830

Year-over-year growth rates

United States

3.1%

0.0 pp

(5.7) pp

8.8%

International

8.4%

1.9 pp

(0.4) pp

6.9%

Canada

1.2%

4.8 pp

(0.5) pp

(3.1)%

Kraft Heinz

4.1%

0.8 pp

(4.3) pp

7.6%

Schedule

5

The Kraft Heinz Company

Reconciliation of Net Sales to

Organic Net Sales

For the Nine Months Ended

(dollars in millions)

(Unaudited)

Net Sales

Currency

Acquisitions

and

Divestitures

Organic Net

Sales

September 25, 2021

United States

$

13,867

$

—

$

446

$

13,421

International

4,190

80

9

4,101

Canada

1,276

77

1

1,198

Kraft Heinz

$

19,333

$

157

$

456

$

18,720

September 28, 2019

United States

$

13,142

$

—

$

681

$

12,461

International

3,874

21

30

3,823

Canada

1,425

—

222

1,203

Kraft Heinz

$

18,441

$

21

$

933

$

17,487

Year-over-year growth rates

United States

5.5%

0.0 pp

(2.2) pp

7.7%

International

8.1%

1.4 pp

(0.6) pp

7.3%

Canada

(10.5)%

5.3 pp

(15.4) pp

(0.4)%

Kraft Heinz

4.8%

0.7 pp

(3.0) pp

7.1%

Schedule

6

The Kraft Heinz Company

Reconciliation of Net

Income/(Loss) to Adjusted EBITDA

(dollars in millions)

(Unaudited)

For the Three Months

Ended

September 25,

2021

September 26,

2020

September 28,

2019

Net income/(loss)

$

736

$

598

$

898

Interest expense

415

314

398

Other expense/(income)

(138)

(73)

(380)

Provision for/(benefit from) income

taxes

143

308

264

Operating income/(loss)

1,156

1,147

1,180

Depreciation and amortization (excluding

restructuring activities)

228

232

243

Restructuring activities

15

8

15

Deal costs

2

9

6

Unrealized losses/(gains) on commodity

hedges

27

(70)

9

Impairment losses

—

300

5

Equity award compensation expense

(excluding restructuring activities)

51

41

11

Adjusted EBITDA

$

1,479

$

1,667

$

1,469

Segment Adjusted EBITDA:

United States

$

1,173

$

1,363

$

1,160

International

252

277

260

Canada

100

103

107

General corporate expenses

(46)

(76)

(58)

Adjusted EBITDA

$

1,479

$

1,667

$

1,469

Schedule

7

The Kraft Heinz Company

Reconciliation of Net

Income/(Loss) to Adjusted EBITDA

(dollars in millions)

(Unaudited)

For the Nine Months

Ended

September 25,

2021

September 26,

2020

September 28,

2019

Net income/(loss)

$

1,279

$

(673)

$

1,750

Interest expense

1,443

1,066

1,035

Other expense/(income)

(191)

(232)

(893)

Provision for/(benefit from) income

taxes

949

417

584

Operating income/(loss)

3,480

578

2,476

Depreciation and amortization (excluding

restructuring activities)

677

722

730

Restructuring activities

52

12

56

Deal costs

8

9

19

Unrealized losses/(gains) on commodity

hedges

(12)

47

(30)

Impairment losses

343

3,399

1,223

Certain non-ordinary course legal and

regulatory matters

62

—

—

Equity award compensation expense

(excluding restructuring activities)

155

114

26

Adjusted EBITDA

$

4,765

$

4,881

$

4,500

Segment Adjusted EBITDA:

United States

$

3,827

$

4,050

$

3,556

International

821

797

765

Canada

304

268

371

General corporate expenses

(187)

(234)

(192)

Adjusted EBITDA

$

4,765

$

4,881

$

4,500

Schedule

8

The Kraft Heinz Company

Reconciliation of Adjusted EBITDA

to Constant Currency Adjusted EBITDA

For the Three Months Ended

(dollars in millions)

(Unaudited)

Adjusted EBITDA

Currency

Constant Currency

Adjusted EBITDA

September 25, 2021

United States

$

1,173

$

—

$

1,173

International

252

9

243

Canada

100

5

95

General corporate expenses

(46)

(1)

(45)

Kraft Heinz

$

1,479

$

13

$

1,466

September 26, 2020

United States

$

1,363

$

—

$

1,363

International

277

3

274

Canada

103

—

103

General corporate expenses

(76)

—

(76)

Kraft Heinz

$

1,667

$

3

$

1,664

Year-over-year growth rates

United States

(14.0)%

0.0 pp

(14.0)%

International

(9.1)%

2.2 pp

(11.3)%

Canada

(2.1)%

5.3 pp

(7.4)%

General corporate expenses

(39.5)%

0.2 pp

(39.7)%

Kraft Heinz

(11.3)%

0.6 pp

(11.9)%

Schedule

9

The Kraft Heinz Company

Reconciliation of Adjusted EBITDA

to Constant Currency Adjusted EBITDA

For the Nine Months Ended

(dollars in millions)

(Unaudited)

Adjusted EBITDA

Currency

Constant Currency

Adjusted EBITDA

September 25, 2021

United States

$

3,827

$

—

$

3,827

International

821

48

773

Canada

304

24

280

General corporate expenses

(187)

(3)

(184)

Kraft Heinz

$

4,765

$

69

$

4,696

September 26, 2020

United States

$

4,050

$

—

$

4,050

International

797

8

789

Canada

268

—

268

General corporate expenses

(234)

—

(234)

Kraft Heinz

$

4,881

$

8

$

4,873

Year-over-year growth rates

United States

(5.5)%

0.0 pp

(5.5)%

International

3.0%

5.0 pp

(2.0)%

Canada

13.4%

9.0 pp

4.4%

General corporate expenses

(20.2)%

1.3 pp

(21.5)%

Kraft Heinz

(2.4)%

1.2 pp

(3.6)%

Schedule

10

The Kraft Heinz Company

Reconciliation of Adjusted EBITDA

to Constant Currency Adjusted EBITDA

For the Three Months Ended

(dollars in millions)

(Unaudited)

Adjusted EBITDA

Currency

Constant Currency

Adjusted EBITDA

September 25, 2021

United States

$

1,173

$

—

$

1,173

International

252

11

241

Canada

100

4

96

General corporate expenses

(46)

(1)

(45)

Kraft Heinz

$

1,479

$

14

$

1,465

September 28, 2019

United States

$

1,160

$

—

$

1,160

International

260

2

258

Canada

107

—

107

General corporate expenses

(58)

—

(58)

Kraft Heinz

$

1,469

$

2

$

1,467

Year-over-year growth rates

United States

1.1%

0.0 pp

1.1%

International

(3.1)%

3.2 pp

(6.3)%

Canada

(5.9)%

4.4 pp

(10.3)%

General corporate expenses

(20.4)%

1.7 pp

(22.1)%

Kraft Heinz

0.7%

0.8 pp

(0.1)%

Schedule

11

The Kraft Heinz Company

Reconciliation of Adjusted EBITDA

to Constant Currency Adjusted EBITDA

For the Nine Months Ended

(dollars in millions)

(Unaudited)

Adjusted EBITDA

Currency

Constant Currency

Adjusted EBITDA

September 25, 2021

United States

$

3,827

$

—

$

3,827

International

821

33

788

Canada

304

18

286

General corporate expenses

(187)

(2)

(185)

Kraft Heinz

$

4,765

$

49

$

4,716

September 28, 2019

United States

$

3,556

$

—

$

3,556

International

765

9

756

Canada

371

—

371

General corporate expenses

(192)

—

(192)

Kraft Heinz

$

4,500

$

9

$

4,491

Year-over-year growth rates

United States

7.6%

0.0 pp

7.6%

International

7.2%

3.0 pp

4.2%

Canada

(18.0)%

5.0 pp

(23.0)%

General corporate expenses

(2.7)%

1.3 pp

(4.0)%

Kraft Heinz

5.9%

0.9 pp

5.0%

Schedule

12

The Kraft Heinz Company

Reconciliation of Diluted EPS to

Adjusted EPS

(Unaudited)

For the Three Months

Ended

For the Nine Months

Ended

September 25,

2021

September 26,

2020

September 25,

2021

September 26,

2020

Diluted EPS

$

0.59

$

0.49

$

1.03

$

(0.55)

Restructuring activities(a)

0.01

0.01

0.03

0.01

Unrealized losses/(gains) on commodity

hedges(b)

0.02

(0.04)

(0.01)

0.03

Impairment losses(c)

—

0.24

0.26

2.60

Certain non-ordinary course legal and

regulatory matters(d)

—

—

0.05

—

Losses/(gains) on sale of business(e)

(0.06)

—

0.23

—

Debt prepayment and extinguishment

costs(f)

0.09

—

0.37

0.07

Certain significant discrete income tax

items(g)

—

—

0.19

(0.07)

Adjusted EPS

$

0.65

$

0.70

$

2.15

$

2.09

(a)

Gross expenses included in

restructuring activities were $15 million ($12 million after-tax)

for the three months and $52 million ($40 million after-tax) for

the nine months ended September 25, 2021 and $9 million ($7 million

after tax) for the three months and $13 million ($10 million

after-tax) for the nine months ended September 26, 2020 and were

recorded in the following income statement line items:

•

Cost of products sold included

expenses of $4 million for the nine months ended September 25, 2021

and income of $3 million for the three months and $4 million for

the nine months ended September 26, 2020; and

•

SG&A included expenses of $15

million for the three months and $48 million for the nine months

ended September 25, 2021 and $11 million for the three months and

$16 million for the nine months ended September 26, 2020.

•

Other expense/(income) included

expenses of $1 million for the three and nine months ended

September 26, 2020.

(b)

Gross expenses/(income) included

in unrealized losses/(gains) on commodity hedges were expenses of

$27 million ($20 million after-tax) for the three months and income

of $12 million ($9 million after-tax) for the nine months ended

September 25, 2021 and income of $70 million ($54 million

after-tax) for the three months and expenses of $47 million ($35

million after-tax) for the nine months ended September 26, 2020 and

were recorded in cost of products sold.

(c)

Gross impairment losses, which

were recorded in SG&A, included the following:

•

Goodwill impairment losses of

$265 million ($265 million after-tax) for the nine months ended

September 25, 2021 and $300 million ($300 million after-tax) for

the three months and $2.3 billion ($2.3 billion after-tax) for the

nine months ended September 26, 2020; and

•

Intangible asset impairment

losses of $78 million ($59 million after-tax) for the nine months

ended September 25, 2021 and $1.1 billion ($829 million after-tax)

for the nine months ended September 26, 2020.

(d)

Gross expenses included in

certain non-ordinary course legal and regulatory matters were $62

million ($62 million after-tax) for the nine months ended September

25, 2021 and were recorded in SG&A.

(e)

Gross expenses/(income) included

in losses/(gains) on sale of business were income of $76 million

($72 million after-tax) for the three months and income of $11

million (expenses of $280 million after-tax) for the nine months

ended September 25, 2021 and expenses of $2 million ($2 million

after-tax) for the nine months ended September 26, 2020 and were

recorded in other expense/(income). The impact in 2021 includes a

gain on the remeasurement of a disposal group, which was

reclassified as held and used in the third quarter of 2021.

(f)

Gross expenses included in debt

prepayment and extinguishment costs were $147 million ($115 million

after-tax) for the three months and $571 million ($450 million

after-tax) for the nine months ended September 25, 2021 and $109

million ($82 million after-tax) for the nine months ended September

26, 2020 and were recorded in interest expense.

(g)

Certain significant discrete

income tax items were a benefit of $1 million for the three months

and an expense of $235 million for the nine months ended September

25, 2021 and a benefit of $81 million for the nine months ended

September 26, 2020. The impact in 2021 relates to the revaluation

of our deferred tax balances due to an increase in U.K. tax rates.

The benefit in 2020 relates to the revaluation of our deferred tax

balances due to changes in state tax laws following U.S. tax reform

and subsequent clarification or interpretation of state tax

laws.

Schedule

13

The Kraft Heinz Company

Key Drivers of Change in Adjusted

EPS

(Unaudited)

For the Three Months

Ended

September 25,

2021

September 26,

2020

$ Change

Key drivers of change in Adjusted EPS:

Results of operations(a)

$

0.72

$

0.81

$

(0.09)

Results of divested operations

—

0.03

(0.03)

Interest expense

(0.17)

(0.19)

0.02

Other expense/(income)(b)

0.04

0.05

(0.01)

Effective tax rate

0.06

—

0.06

Adjusted EPS

$

0.65

$

0.70

$

(0.05)

(a)

Includes non-cash amortization of

definite-lived intangible assets, which accounted for a negative

impact to Adjusted EPS from results of operations of $0.04 for the

three months ended September 25, 2021 and September 26, 2020.

(b)

Includes non-cash amortization of

prior service credits, which accounted for a benefit to Adjusted

EPS from other expense/(income) of $0.02 for the three months ended

September 26, 2020.

Schedule

14

The Kraft Heinz Company

Key Drivers of Change in Adjusted

EPS

(Unaudited)

For the Nine Months

Ended

September 25,

2021

September 26,

2020

$ Change

Key drivers of change in Adjusted EPS:

Results of operations(a)

$

2.41

$

2.44

$

(0.03)

Results of divested operations

0.06

0.10

(0.04)

Interest expense

(0.55)

(0.60)

0.05

Other expense/(income)(b)

0.11

0.15

(0.04)

Effective tax rate

0.14

—

0.14

Effect of dilutive equity awards(c)

(0.02)

—

(0.02)

Adjusted EPS

$

2.15

$

2.09

$

0.06

(a)

Includes non-cash amortization of

definite-lived intangible assets, which accounted for a negative

impact to Adjusted EPS from results of operations of $0.11 for the

nine months ended September 25, 2021 and $0.13 for the nine months

ended September 26, 2020.

(b)

Includes non-cash amortization of

prior service credits, which accounted for a benefit to Adjusted

EPS from other expense/(income) of $0.06 for the nine months ended

September 26, 2020.

(c)

Represents the impact of

excluding the dilutive effects of equity awards for the nine months

ended September 26, 2020, as their inclusion would have had an

anti-dilutive effect on EPS due to net losses attributable to

common shareholders for the same period.

Schedule

15

The Kraft Heinz Company

Condensed Consolidated Balance

Sheets

(in millions, except per share

data)

(Unaudited)

September 25, 2021

December 26, 2020

ASSETS

Cash and cash equivalents

$

2,273

$

3,417

Trade receivables, net

1,958

2,063

Inventories

2,839

2,773

Prepaid expenses

158

132

Other current assets

603

574

Assets held for sale

1,726

1,863

Total current assets

9,557

10,822

Property, plant and equipment, net

6,588

6,876

Goodwill

31,386

33,089

Intangible assets, net

44,803

46,667

Other non-current assets

2,563

2,376

TOTAL ASSETS

$

94,897

$

99,830

LIABILITIES AND EQUITY

Commercial paper and other short-term

debt

$

1

$

6

Current portion of long-term debt

1,034

230

Trade payables

4,380

4,304

Accrued marketing

908

946

Interest payable

285

358

Other current liabilities

1,841

2,200

Liabilities held for sale

6

17

Total current liabilities

8,455

8,061

Long-term debt

22,937

28,070

Deferred income taxes

11,389

11,462

Accrued postemployment costs

240

243

Other non-current liabilities

1,638

1,751

TOTAL LIABILITIES

44,659

49,587

Equity:

Common stock, $0.01 par value

12

12

Additional paid-in capital

53,823

55,096

Retained earnings/(deficit)

(1,425)

(2,694)

Accumulated other comprehensive

income/(losses)

(1,858)

(1,967)

Treasury stock, at cost

(463)

(344)

Total shareholders' equity

50,089

50,103

Noncontrolling interest

149

140

TOTAL EQUITY

50,238

50,243

TOTAL LIABILITIES AND EQUITY

$

94,897

$

99,830

Schedule

16

The Kraft Heinz Company

Condensed Consolidated Statements

of Cash Flow

(in millions)

(Unaudited)

For the Nine Months

Ended

September 25,

2021

September 26,

2020

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income/(loss)

$

1,279

$

(673)

Adjustments to reconcile net income/(loss)

to operating cash flows:

Depreciation and amortization

677

722

Amortization of postemployment benefit

plans prior service costs/(credits)

(5)

(92)

Equity award compensation expense

155

114

Deferred income tax

provision/(benefit)

(120)

(343)

Postemployment benefit plan

contributions

(21)

(20)

Goodwill and intangible asset impairment

losses

343

3,399

Nonmonetary currency devaluation

4

6

Loss/(gain) on sale of business

(11)

2

Other items, net

421

132

Changes in current assets and

liabilities:

Trade receivables

92

(6)

Inventories

(264)

(441)

Accounts payable

194

62

Other current assets

(96)

(18)

Other current liabilities

(200)

482

Net cash provided by/(used for) operating

activities

2,448

3,326

CASH FLOWS FROM INVESTING ACTIVITIES:

Capital expenditures

(655)

(397)

Proceeds from sale of business, net of

cash disposed

3,401

—

Other investing activities, net

(2)

35

Net cash provided by/(used for) investing

activities

2,744

(362)

CASH FLOWS FROM FINANCING ACTIVITIES:

Repayments of long-term debt

(4,145)

(4,395)

Proceeds from issuance of long-term

debt

—

3,500

Debt prepayment and extinguishment

costs

(577)

(101)

Proceeds from revolving credit

facility

—

4,000

Repayments of revolving credit

facility

—

(4,000)

Dividends paid

(1,469)

(1,467)

Other financing activities, net

(142)

(46)

Net cash provided by/(used for) financing

activities

(6,333)

(2,509)

Effect of exchange rate changes on cash,

cash equivalents, and restricted cash

(3)

(14)

Cash, cash equivalents, and restricted

cash

Net increase/(decrease)

(1,144)

441

Balance at beginning of period

3,418

2,280

Balance at end of period

$

2,274

$

2,721

Schedule

17

The Kraft Heinz Company

Reconciliation of Net Cash

Provided By/(Used For) Operating Activities to Free Cash Flow

(in millions)

(Unaudited)

For the Nine Months

Ended

September 25,

2021

September 26,

2020

Net cash provided by/(used for) operating

activities

$

2,448

$

3,326

Capital expenditures

(655)

(397)

Free Cash Flow

$

1,793

$

2,929

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211027005216/en/

Alex Abraham (media) Alex.Abraham@kraftheinz.com

Christopher Jakubik, CFA (investors) ir@kraftheinz.com

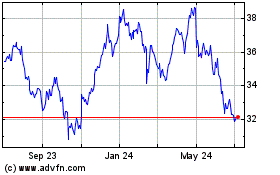

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

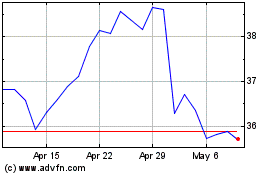

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Apr 2023 to Apr 2024