Kraft Heinz Reports Weaker Sales -- Update

February 13 2020 - 10:57AM

Dow Jones News

By Annie Gasparro

Kraft Heinz Co.'s revenue fell in the fourth quarter, rounding

out a year of torpid sales for the food maker's biggest brands.

The maker of Oscar Mayer meats and Jell-O desserts reported

$6.54 billion in quarterly sales, short of analyst expectations and

down 5.1% from a year earlier. Shares fell 7% on Thursday to

$27.99.

"Our turnaround will take time," Chief Executive Miguel Patricio

said on a call. "But we are seeing the beginning of

stabilization."

Mr. Patricio, who took over last June, has shaken up Kraft

Heinz's executive ranks and has said he would substantially reduce

the number of products the company develops this year.

Kraft Heinz will spend more on marketing for its flagship

brands, especially those that are big drivers of the company's

profitability, Mr. Patricio said.

To help fund these investments in its most promising brands, he

aims to make its supply chain more efficient and reduce the

complexity of its sprawling operations.

"We are sweating the budget," he said.

Mr. Patricio came to Kraft Heinz last year after the company

disclosed accounting errors and a misjudgment of the value of its

brands that caused it to write down some $17 billion in value from

some of the company's best-known brands.

On Thursday, Kraft Heinz lowered the value of its Maxwell House

coffee by $213 million. The company also recorded noncash charges

tied to international businesses, including one in Latin America

focused on exports.

Kraft Heinz products including Maxwell House are battling an

influx of cheaper store brands that are enticing cost-conscious

shoppers, while newer and trendier brands steal more shelf

space.

Higher prices deterred some shoppers from buying Kraft Heinz's

items in the fourth quarter, the company said. It also lost some

distribution and ran fewer promotions than the prior year. Kraft

Heinz's market share in cheese, cold cuts and coffee declined. But

its condiment sales remained strong.

3G Capital, the private-equity firm that controls the company,

has stripped out nearly $2 billion in annual spending since the

2015 merger of Kraft Foods and H.J. Heinz. But the company has

fallen short of its sales goals and big new deals haven't

materialized.

"We cannot have a culture of cutting," Mr. Patricio said. "We

have to change that culture."

Mr. Patricio has a new leadership team, including executives he

tapped from Campbell Soup Co. and his former company with ties to

3G, Anheuser-Busch InBev SA. He said the top jobs are filled with

more experienced people, but that Kraft Heinz still has a people

problem.

"The turnover is still a big problem for us, especially on the

lower levels of the pyramid, and we have to stop that," Mr.

Patricio said.

Comparable sales, which exclude currency fluctuations, mergers

and divestitures, declined 2.2% globally in the latest quarter,

including a 2.7% drop in the U.S., its biggest market.

For the fourth quarter, Kraft Heinz reported an overall profit

of $182 million, or 15 cents a share, compared with a loss of

$12.57 billion the year earlier. Excluding certain items affecting

comparability, its adjusted profit of 72 cents per share beat

analyst estimates by 4 cents

Micah Maidenberg

contributed to this article.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

February 13, 2020 10:42 ET (15:42 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

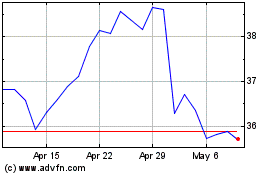

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

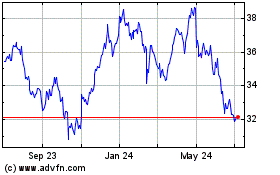

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Apr 2023 to Apr 2024