By Annie Gasparro

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 27, 2020).

Kraft Heinz Co.'s chief executive wants to create the kind of

hit new products that have eluded the company for years, leading to

a sales drought and multibillion-dollar markdown on the value of

some top brands.

Miguel Patricio, who took over as chief executive in June, has

hired executives experienced in food to lead Kraft Heinz's

operations and its U.S. business. Last year, he created a new

C-suite role -- chief growth officer -- and this year plans to cut

the number of new-product introductions in half.

"My role is to simplify this business. Fewer, bigger bets," he

said in a recent interview.

He declined to say specifically what those bets would be. He

discussed winning and losing brands with directors at a board

meeting last week.

Kraft Heinz has struggled to generate interest in the

decades-old brands on its roster that recall a bygone dining era

and now face competition from store brands. Sales of Kraft Heinz

products including Miracle Whip, Oscar Mayer lunch meat, Jell-O,

Cool Whip and Velveeta are falling.

Kraft Heinz's $26 billion in annual revenue for 2018 declined

roughly 10% versus the combined revenue of Kraft Foods Group Inc.

and H.J. Heinz in 2014, the year before they merged to form Kraft

Heinz. The company plans to report 2019 earnings on Feb. 13.

Last year, the company wrote down the value of brands including

Kraft, Oscar Mayer and Miracle Whip by nearly $17 billion.

Lower-priced competition and consumers' waning appetite for

processed foods have hurt the outlook for those brands and others,

the company said.

Mr. Patricio said some low-selling or unprofitable products

would be discontinued, while other brands would be chosen to

receive more funding for development and marketing.

Part of the problem, Mr. Patricio said, is Kraft Heinz's

variety. The company's products are sold in 56 different sections

of the supermarket.

"If you try to innovate in 56 different categories every year,

you can't execute on all of them," Mr. Patricio said. "We need to

be more selective."

Rivals including Campbell Soup Co. and Kellogg Co. also are

struggling to figure out what to do with brands left on the wrong

side of consumers' shift to more healthful and less processed

foods.

Still, shares of Kraft Heinz have fallen more than its rivals.

The stock is down 35% over the past year, while the S&P 500

Packaged Foods & Meats index is up 22%.

Kraft Heinz is partly owned by 3G Capital, a Brazilian

investment firm that, along with Warren Buffett's Berkshire

Hathaway Inc., bought Heinz in 2013.

Two years later, 3G and Mr. Buffett orchestrated Heinz's merger

with Kraft. Mr. Patricio came to Kraft Heinz from Anheuser-Busch

InBev SA, another company in which partners of 3G are invested.

At each of those companies, 3G has implemented a method called

zero-base budgeting to cut costs by scrutinizing every expense. 3G

saved money at Kraft Heinz by cutting jobs, renegotiating contracts

with suppliers and promoting younger employees to replace

veterans.

Those budget measures also spread product-development and

promotion spending more thinly across dozens of brands. Kraft

Heinz's spending on research and development in 2018 was less than

a third that of Oreo-maker Mondelez International Inc., a rival

with roughly the same revenue.

Many products Kraft Heinz introduced in recent years either

didn't find an audience or hurt profit margins. MAX by Maxwell

House iced coffee, pouches of Kraft ranch dressing and

banana-sundae flavored Planters nut mix were all discontinued.

Such misplaced bets ate into sales of existing Kraft Heinz

products, according to former employees familiar with that work.

After the merger, Kraft Heinz introduced Heinz mayonnaise -- even

though it was already selling Kraft mayonnaise and Miracle

Whip.

"We tried to tell them that people don't eat that much mayo.

You're just going to convert more people from Miracle Whip," said

Marla Grossberg, a former director of consumer insights who was

working on condiments at the time of the merger.

Heinz mayonnaise did take market share from Miracle Whip after

its debut in 2018. The company added new varieties to try to boost

sales such as a mayo-ketchup combination called Mayochup and a

mayo-barbecue version, Mayocue.

But Kraft Heinz's total share of mayonnaise sales among all its

brands rose half a percentage point in both 2018 and in 2019.

Nina Barton, Kraft Heinz's chief growth officer, said she is

pushing employees to think up new products that solve a broader

problem for consumers. As an example, she praised new snack packs

that combine Philadelphia cream cheese with bagel chips. "It's a

very different mind-set," she said in an interview.

Such successes, though, have had other consequences: lower

profit margins than older products.

Kraft Heinz wrote down the value of its Philadelphia brand last

year primarily because of higher costs, such as switching to more

expensive ingredients to entice health-conscious consumers.

Ms. Barton and Mr. Patricio said they are willing to sacrifice

some profit to boost promising brands. Kraft Heinz has the

second-highest profit margin before interest, taxes and other

exclusions among 20 publicly traded food companies, according to

JPMorgan Chase & Co.

Kraft Heinz's third-quarter results beat expectations, sending

shares up 13% on the day they were released -- the first time

investors reacted positively to the company's earnings since the

summer of 2018.

"First, we had to stabilize the business," Mr. Patricio said.

"Now, we are building a strategy for the future."

--Heather Haddon contributed to this article.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

January 27, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

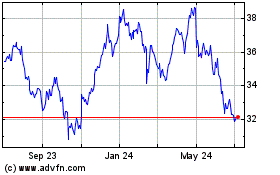

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

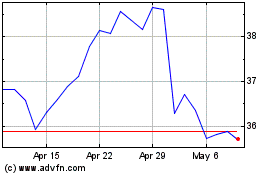

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Apr 2023 to Apr 2024