0001418135FALSE00014181352024-10-232024-10-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 23, 2024

Keurig Dr Pepper Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-33829 | | 98-0517725 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

53 South Avenue, Burlington, Massachusetts 01803

(Address of principal executive offices, including zip code)

781-418-7000

(Registrant’s telephone number including area code)

Not Applicable

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-14(c) under the Exchange Act (17 CFR 240.13e-14(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock | | KDP | | Nasdaq Stock Market LLC |

Item 1.01. Entry into a Material Definitive Agreement.

Contribution and Merger Agreement

On October 23, 2024, The American Bottling Company (“Buyer”), a Delaware corporation and wholly owned subsidiary of Keurig Dr Pepper Inc. (the “Company”), and Phantom Merger Sub I LLC, a Delaware limited liability company and wholly owned subsidiary of Buyer (“GHOST Lifestyle Merger Sub”) entered into a Contribution and Merger Agreement (the “Contribution and Merger Agreement”) with GHOST Lifestyle LLC, a Delaware limited liability company (“GHOST Lifestyle”), and certain other parties named therein, to acquire a controlling interest in GHOST Lifestyle.

The Contribution and Merger Agreement provides that, prior to the closing of the transactions contemplated thereunder (the “Closing”), Buyer and GHOST Lifestyle will consummate a series of transactions (collectively, the "Reorganization Transactions") pursuant to which, among other things, Buyer will acquire the outstanding equity interests of GHOST Beverages, LLC (“GHOST Beverages”) in a merger (the "GHOST Beverages Merger") pursuant to a merger agreement (the "GHOST Beverages Merger Agreement"). Following the Reorganization Transactions, upon the terms and subject to the conditions set forth in the Contribution and Merger Agreement, (i) Buyer will contribute 100% of the outstanding equity interests of GHOST Beverages to GHOST Lifestyle in exchange for equity interests in GHOST Lifestyle (the "GHOST Beverages Contribution") and (ii) immediately thereafter, GHOST Lifestyle Merger Sub will be merged with and into GHOST Lifestyle (the “GHOST Lifestyle Merger”), with GHOST Lifestyle as the surviving company in the GHOST Lifestyle Merger.

Immediately after the Closing and after giving effect to the Reorganization Transactions (including the GHOST Beverages Merger), and the transactions contemplated by the Contribution and Merger Agreement (including the GHOST Beverages Contribution and the GHOST Lifestyle Merger) (collectively, the “Transactions”), (i) Buyer will hold 60% of the issued and outstanding equity interests of GHOST Lifestyle in the form of Class A units and (ii) the equityholders of GHOST Lifestyle immediately prior to the Closing (the “Sellers”) will hold in the aggregate 40% of the issued and outstanding equity interests of GHOST Lifestyle in the form of Class B units (such units, the “Minority Units”, and such Sellers, the “Minority Members”).

Transaction Consideration

In connection with the Transactions and subject to the terms and conditions of the Contribution and Merger Agreement and GHOST Beverages Merger Agreement, Buyer will pay aggregate consideration at the Closing of approximately $990 million, subject to customary adjustments, for net debt, unpaid transaction expenses and net working capital (the “Closing Consideration”). At the Closing, Buyer will deposit a portion of the Closing Consideration in escrow to secure certain indemnification obligations of sellers and any post-closing adjustments to the Closing Consideration, in each case under the Contribution and Merger Agreement and the GHOST Beverages Merger Agreement.

Conditions to Closing

Consummation of the Closing is subject to (i) the expiration or early termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, (ii) the absence of any injunction, writ, temporary restraining order or other binding order issued by a governmental authority enjoining, prohibiting or making illegal the consummation of the Transactions, (iii) the consummation of the Reorganization Transactions, (iv) the accuracy of the parties’ respective representations and warranties, (v) compliance by the parties with their respective covenants in all material respects, (vi) the absence of a material adverse effect, (vii) the continued effectiveness of employment arrangements and restrictive covenant agreements of certain key employees entered into in connection with the Contribution and Merger Agreement and (viii) the delivery of other closing deliverables.

Representations, Warranties and Covenants

The Contribution and Merger Agreement contains representations and warranties of the parties customary for a transaction of this type.

The Contribution and Merger Agreement also contains customary covenants and agreements, including, among others, (i) certain limitations regarding the conduct of GHOST Lifestyle’s and its subsidiaries’ businesses prior to the Closing, (ii) regulatory matters, including the parties’ efforts to obtain approvals from governmental agencies, (iii) certain employee and tax matters, (iv) certain cooperation commitments between the parties and (v) certain other matters.

Master Distribution Agreement

In connection with the termination of a master distributor agreement between GHOST Lifestyle and one of its distributors, Buyer has agreed to bear the cost of up to $250 million of any termination fees payable to the distributor under such master distribution agreement in connection with such termination (the “Distributor Termination Fee”). Following the termination of such master distribution agreement, GHOST Lifestyle plans to enter into a new master distribution agreement with Buyer.

Indemnification

The Contribution and Merger Agreement and GHOST Beverages Merger Agreement contain certain indemnification obligations of sellers thereunder for certain specified matters. The indemnification obligations of such sellers in respect of the aforementioned matters is limited to the amount received by such sellers in connection with the Transactions and the mandatory redemption described below.

Termination Rights

The Contribution and Merger Agreement provides for customary termination rights for the parties, including if the Closing has not been consummated within 90 days of the date of the Contribution and Merger Agreement, subject to extension for up to nine months following the date of the Contribution and Merger Agreement, under certain circumstances, at the option of either party.

Reverse Termination Fee

If the Contribution and Merger Agreement is terminated due to a failure to obtain antitrust approval and Buyer has entered into a binding contract to acquire a business engaged in the production, manufacturing and selling of energy drinks after the date of the Contribution and Merger Agreement, then in certain circumstances, Buyer will be required to pay GHOST Lifestyle a reverse termination fee of $39.6 million.

Second Amended and Restated Limited Liability Company Agreement

In connection with the Closing, Buyer, GHOST Lifestyle and Sellers will adopt the Second Amended and Restated Limited Liability Company Agreement of GHOST Lifestyle (the “Second A&R LLC Agreement” and, together with the Contribution and Merger Agreement, the "Transaction Agreements"). The Second A&R LLC Agreement will govern the management and control of GHOST Lifestyle following the Closing, and will contain certain provisions that are customary for a controlled entity, including, among others, with respect to governance, tax treatment, distributions, ownership and transfer of equity.

Under the Second A&R LLC Agreement, subject to limited exceptions, Buyer will have sole authority and discretion over the management, control and operation of GHOST Lifestyle. The Minority Members will be granted limited consent rights over certain affiliate transactions and issuances of additional equity interests in GHOST Lifestyle. Buyer and the Minority Members will be subject to lock-up restrictions, subject to limited exceptions. The Minority Units held by certain Minority Members will be subject to a repurchase right in favor of Sellers under certain circumstances.

The Second A&R LLC Agreement will also contain mandatory redemption provisions that will require the Minority Members to sell all of their Minority Units to Buyer (or an affiliate of Buyer) within a certain period following the date on which the Company’s annual consolidated financial statements for fiscal year 2027 are reported, at a purchase price that will be based on an enterprise value derived from a multiple of Adjusted EBITDA (as defined therein) of GHOST Lifestyle for fiscal year 2027, subject to customary adjustments, for net debt, unpaid transaction expenses and net working capital.

The foregoing summaries of the Transaction Agreements and the transactions contemplated thereby do not purport to be complete and are subject to, and qualified in their entirety by, the full text of the Transaction Agreements, each of which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ending December 31, 2024 (the “Annual Report”). The Transaction Agreements will be attached as exhibits to the Annual Report to provide investors and security holders with information regarding their terms. They are not intended to provide any other factual information about the parties to the Transaction Agreements or any of their respective affiliates. The representations, warranties and covenants contained in the Transaction Agreements were made only for the purposes of such Transaction Agreements and as of specified dates, were solely for the benefit of the parties to such Transaction Agreements and are subject to limitations agreed upon by such parties. The representations and warranties may have been made for the purposes of allocating contractual risk between the parties to the Transaction Agreements instead of establishing these matters as facts and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors are not third-party beneficiaries under the Transaction Agreements. In addition, certain of the assertions embodied in the representations and warranties contained in the Transaction Agreements may be qualified by information in a confidential disclosure schedule that the parties have exchanged. Accordingly, investors should not rely on the representations, warranties and covenants contained in the Transaction Agreements or any descriptions thereof as characterizations of the actual state of facts or condition of either of the parties or any of their respective affiliates.

Item 7.01. Regulation FD Disclosure.

On October 24, 2024, the Company issued a press release in connection with the transactions described in Item 1.01. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information presented in this Item 7.01 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act or specifically incorporates it by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 8.01. Other Events.

Anticipated Financing Transactions

The Company expects that the Closing Consideration will be financed in whole or in part by a new term loan. The receipt of financing by Buyer is not a condition to the Closing.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of applicable securities laws and regulations. These forward-looking statements can generally be identified by the use of words such as “outlook,” “guidance,” “anticipate,” “expect,” “believe,” “could,” “estimate,” “feel,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “target,” “will,” “would,” and similar words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements regarding the estimated or anticipated future results following the proposed Transactions, the anticipated benefits of the proposed Transactions, including estimated synergies, the expected timing of completion of the proposed Transactions and related transactions and other statements that are not historical facts. These statements are based on the current expectations of our management, are not predictions of actual performance, and actual results may differ materially. Forward-looking statements are subject to a number of risks and uncertainties, including the factors disclosed in our Annual Report on Form 10-K for the year ending December 31, 2023 and subsequent filings with the Securities and Exchange Commission. The Company is under no obligation to update, modify or withdraw any forward-looking statements, except as required by applicable law.

These forward-looking statements are subject to a number of risks and uncertainties regarding the proposed Transactions and the business of the Company, GHOST Lifestyle and its affiliates, and actual results may differ materially. These risks and uncertainties include, but are not limited to: (i) the ability of the parties to successfully complete the proposed Transactions on anticipated terms and timing, including obtaining required regulatory approvals and the satisfaction of other conditions to the completion of the proposed Transactions, (ii) the Company’s access to significant debt financing for the proposed Transactions on a timely basis and reasonable terms and the impact such significant additional debt may have on the Company’s ability to operate its business following the proposed Transactions, (iii) risks relating to the integration of GHOST Lifestyle’s operations, products and employees into the Company and its subsidiaries and the possibility that the anticipated synergies and other benefits of the proposed Transactions will not be realized or will not be realized within the expected timeframe and (iv) risks relating to the businesses of the Company, GHOST Lifestyle and their subsidiaries and the industries in which they operate and will operate following the proposed Transactions. While the list of factors presented here is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Any forward-looking statement made herein speaks only as of the date of this document. The Company is not under any obligation to, and expressly disclaims any obligation to, update or alter any forward-looking statements, whether as a result of new information, subsequent events or otherwise, except as required by applicable laws or regulations.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | Keurig Dr Pepper Inc. Press Release dated October 24, 2024 - "Keurig Dr Pepper to Acquire Disruptive Energy Drink Business GHOST" |

| 104 | | Cover Page Interactive Data File, formatted in Inline XBRL and included as Exhibit 101 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | | |

| | KEURIG DR PEPPER INC. | |

| Dated: October 24, 2024 | | |

| | By: | /s/ Anthony Shoemaker |

| | | Name: | Anthony Shoemaker |

| | | Title: | Chief Legal Officer, General Counsel and Secretary |

Keurig Dr Pepper to Acquire Disruptive Energy Drink Business GHOST

Addition of fast-growing brand accelerates KDP’s portfolio evolution towards consumer-preferred spaces

Disciplined transaction creates win-win alignment between GHOST and KDP

BURLINGTON, Mass., FRISCO, Tex., LAS VEGAS and CHICAGO (October 24, 2024) – Keurig Dr Pepper (NASDAQ: KDP) today announced that it has entered into a definitive agreement to acquire GHOST Lifestyle LLC and GHOST Beverages LLC (collectively “GHOST”). Founded in 2016, GHOST® is a lifestyle sports nutrition business with a portfolio anchored by GHOST® Energy, a leading ready-to-drink energy brand. GHOST’s net sales have more than quadrupled over the past three years, and GHOST Energy is one of the fastest-growing brands in the energy category, characterized by its unique identity, distinctive flavors and packaging, and strong consumer appeal.

Under the terms of the agreement, KDP will initially purchase a 60% stake in GHOST, which will be followed by the acquisition of the remaining 40% stake in 2028. The transaction is subject to customary closing conditions, with the initial step expected to close in late 2024 or early 2025. GHOST will continue to be led by co-founders, Dan Lourenco and Ryan Hughes, and will operate as part of KDP’s U.S. Refreshment Beverages segment.

The proposed transaction will substantially enhance KDP’s presence in the energy drink category, extending its reach to new consumers. KDP’s energy portfolio will now include multiple, powerful brands spanning lifestyle, performance, and other major occasions in the category. In addition to ready-to-drink energy, GHOST also has a presence in supplements and emerging positions in other liquid refreshment beverages.

Commenting on the announcement, Tim Cofer, KDP Chief Executive Officer, stated, “GHOST is a differentiated brand with significant growth potential, and we are excited to partner with its founders to take the business to the next level. This acquisition strengthens our position in the attractive energy drink category, accelerating our portfolio evolution toward consumer-preferred, growth-accretive spaces through a disciplined deal structure.”

Cofer continued, “The energy category is poised for continued long-term growth, which KDP expects to increasingly capture through our platform-based approach. KDP’s portfolio of complementary energy brands is aligned against distinctive consumer need states, and, together, these offerings will unlock significant growth and scale benefits across our entire DSD portfolio.”

GHOST CEO and Co-Founder Dan Lourenco added, “We could not be more excited to build the future of GHOST together with KDP. As we thought about our company’s next chapter, KDP’s track record of cultivating disruptive brands, similar challenger mindset, and shared vision for the energy category and beyond made it the right home for our brand and team. We are excited to pair KDP’s insights and capabilities with our products and people and know that together we will continue to scale and build GHOST towards our vision of a 100 year brand.”

The Company will fully consolidate GHOST into its financial results upon close and expects the transaction to be neutral to modestly accretive to adjusted EPS starting in 2025. In the first stage of the transaction, the Company will make an initial cash investment of approximately $990 million in exchange for a 60% ownership stake in GHOST. Net of anticipated cash tax benefits with a net present value of approximately $140 million, the enterprise valuation at this step represents an approximate 3x net revenue multiple on a projected 2024 basis.

In the second stage of the transaction, KDP will purchase the outstanding 40% stake in 2028 at a pre-negotiated valuation scale that will reflect GHOST’s 2027 financial performance. Starting in mid-2025, KDP also expects to invest up to $250 million to transition GHOST Energy’s existing distribution agreements ahead of beginning to sell and distribute the brand through the Company’s direct store delivery network.

KDP plans to discuss the acquisition in greater detail on its third quarter 2024 results conference call to be held later this morning, Thursday, October 24, at 8:00 a.m. (ET).

BofA Securities served as financial advisor to Keurig Dr Pepper, with Cleary Gottlieb Steen & Hamilton LLP acting as legal advisor. Morgan Stanley & Co. LLC served as financial advisor to GHOST, with Winston & Strawn LLP acting as legal advisor.

Investors:

Investor Relations

Keurig Dr Pepper

T: 888-340-5287 / IR@kdrp.com

Keurig Dr Pepper Media:

Katie Gilroy

Keurig Dr Pepper

T: 781-418-3345 / katie.gilroy@kdrp.com

GHOST Media:

Carissa Bass

Startr Co.

T : 909-263-8083 / cizquierdo@startrco.com

Jillian Kwasizur

Startr Co.

T: 909-263-8083 / jkwasizur@startrco.com

About Keurig Dr Pepper

Keurig Dr Pepper (Nasdaq: KDP) is a leading beverage company in North America, with a portfolio of more than 125 owned, licensed and partner brands and powerful distribution capabilities to provide a beverage for every need, anytime, anywhere. With annual revenue of approximately $15 billion, we hold leadership positions in beverage categories including soft drinks, coffee, tea, water, juice and mixers, and have the #1 single serve coffee brewing system in the U.S. and Canada. Our innovative partnership

model builds emerging growth platforms in categories such as premium coffee, energy, sports hydration and ready-to-drink coffee. Our brands include Keurig®, Dr Pepper®, Canada Dry®, Mott’s®, A&W®, Snapple®, Peñafiel®, 7UP®, Green Mountain Coffee Roasters®, Clamato®, Core Hydration® and The Original Donut Shop®. Driven by a purpose to Drink Well. Do Good., our 28,000 employees aim to enhance the experience of every beverage occasion and to make a positive impact for people, communities and the planet. For more information, visit www.keurigdrpepper.com and follow us on LinkedIn.

About GHOST®

GHOST® is a lifestyle brand of sports nutrition products, energy drinks, dietary supplements, and apparel. GHOST® is disrupting the sports nutrition industry by creating a lifestyle movement that includes transparent innovative products, global distribution, immersive content, key influencer partnerships, and authentic collaborations with many of the world's leading flavor brands, including OREO®, Chips Ahoy!®, Sour Patch Kids®, Sonic® Drive-In, Warheads®, Swedish Fish® and Welch's®. GHOST® also entered the food space in 2024 with its launch of high-protein cereals. GHOST® products can be found at GNC, ghostlifestyle.com, and select global retailers in over 40 countries. For more information, visit ghostlifestyle.com or connect with the brand on Instagram, X, TikTok, or Twitch.

FORWARD-LOOKING STATEMENTS

Certain statements contained herein are “forward-looking statements” within the meaning of applicable securities laws and regulations. These forward-looking statements can generally be identified by the use of words such as “outlook,” “guidance,” “anticipate,” “expect,” “believe,” “could,” “estimate,” “feel,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “target,” “will,” “would,” and similar words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements regarding the estimated or anticipated future results following the proposed transactions with GHOST Lifestyle LLC (“GHOST”) and GHOST Beverages LLC, the anticipated benefits of the proposed transactions, including estimated synergies, the expected timing of completion of the proposed transactions and related transactions and other statements that are not historical facts. These statements are based on the current expectations of KDP's management, are not predictions of actual performance, and actual results may differ materially. Forward-looking statements are subject to a number of risks and uncertainties, including the factors disclosed in KDP's Annual Report on Form 10-K for the year ending December 31, 2023 and subsequent filings with the Securities and Exchange Commission. The Company is under no obligation to update, modify or withdraw any forward-looking statements, except as required by applicable law.

These forward-looking statements are subject to a number of risks and uncertainties regarding the proposed transactions and the business of the Company, GHOST and its affiliates, and actual results may differ materially. These risks and uncertainties include, but are not limited to: (i) the ability of the parties to successfully complete the proposed transactions on anticipated terms and timing, including obtaining required regulatory approvals and the satisfaction of other conditions to the completion of the proposed transactions, (ii) the Company's access to significant debt financing for the proposed transactions on a timely basis and reasonable terms and the impact such significant additional debt may have on the Company's ability to operate its business following the proposed transactions, (iii) risks relating to the integration of GHOST’s operations, products and employees into KDP and its subsidiaries and the possibility that the anticipated synergies and other benefits of the proposed transactions will not be realized or will not be realized within the expected timeframe and (iv) risks relating to the businesses of KDP, GHOST and their subsidiaries and the industries in which they operate and will operate following the proposed transactions. While the list of factors presented here is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Any

forward-looking statement made herein speaks only as of the date of this document. KDP is not under any obligation to, and expressly disclaims any obligation to, update or alter any forward-looking statements, whether as a result of new information, subsequent events or otherwise, except as required by applicable laws or regulations.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

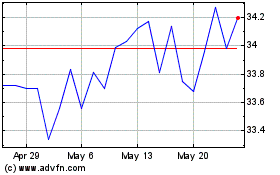

Keurig Dr Pepper (NASDAQ:KDP)

Historical Stock Chart

From Oct 2024 to Nov 2024

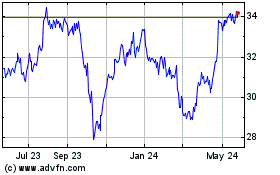

Keurig Dr Pepper (NASDAQ:KDP)

Historical Stock Chart

From Nov 2023 to Nov 2024