FALSE000175802100017580212024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 9, 2024

Karat Packaging Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-40336 | 83-2237832 |

| (State or other jurisdiction of incorporation | (Commission File Number | (IRS Employer Identification No.) |

6185 Kimball Avenue, Chino, CA 91708

(Address of principal executive offices) (Zip Code)

(626) 965-8882

Registrant’s telephone number, including area code:

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | KRT | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b -2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.o

Item 2.02. Results of Operations and Financial Condition.

On May 9, 2024, Karat Packaging Inc. (the "Company”) issued a press release reporting its financial results for the quarter ended March 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed "filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act”), or otherwise subject to the liabilities under that section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: May 9, 2024 | KARAT PACKAGING INC. |

| |

| |

| By: | /s/ Jian Guo |

| | Jian Guo |

| | Chief Financial Officer |

Karat Packaging Reports 2024 First Quarter Financial Results

CHINO, Calif, May 9, 2024 – Karat Packaging Inc. (Nasdaq: KRT) (“Karat” or the “Company”), a specialty distributor and manufacturer of environmentally friendly, disposable foodservice products and related items, today announced financial results for its 2024 first quarter ended March 31, 2024.

First Quarter 2024 Highlights

•Net sales of $95.6 million, versus $95.8 million in the prior-year quarter.

•Gross profit of $37.6 million, versus $38.1 million in the prior-year quarter.

•Gross margin of 39.3 percent versus 39.8 percent in the prior-year quarter.

•Net income of $6.5 million, including a negative tax-effected impact of $1.5 million from a non-cash impairment of an operating right-of-use asset, versus $9.2 million in the prior-year quarter.

•Net income margin of 6.8 percent, including a negative impact of the non-cash impairment of 1.6 percent, versus 9.6 percent in the prior-year quarter.

•Adjusted EBITDA of $13.5 million, versus $15.3 million in the prior-year quarter.

•Adjusted EBITDA margin of 14.2 percent, versus 15.9 percent in the prior-year quarter.

Guidance

•Net sales for the 2024 second quarter expected to increase by mid-single digits from the prior-year quarter.

•Gross margin for the 2024 second quarter expected to be 38 to 40 percent versus 38.5 percent for the prior-year quarter.

•Net sales for the 2024 full year expected to increase 8 to 15 percent from the prior year.

•Gross margin goal for the 2024 full year to be 37 to 40 percent versus 37.7 percent from the previous year.

“The strategic growth initiatives we implemented last year are coming to fruition,” said Alan Yu, Chief Executive Officer. “Our new business pipeline continues to grow, as we are adding new customers and gaining wallet share with existing accounts. We are encouraged by our performance in the first quarter, with sales volume growth, and sustained near record high gross margin.

“Demand for Karat’s eco-friendly products continues to show strong momentum. Sales in this category grew 5.6 percent in the first quarter and comprised approximately 34.5 percent of total sales, up from 32.6 percent a year ago. Eco-friendly products remain a priority for Karat, as we continue to develop new and innovative products and build inventory to meet growing demand from customers.

“Our newly established distribution center in Arizona is now fully operational, providing meaningful operating efficiencies and allowing us to optimize our warehouse footprint in the Southwest region. The move to Arizona from California will reduce our rent expense and enable us to further penetrate new markets,” Yu added.

First Quarter 2024 Financial Results

Net sales for the 2024 first quarter were $95.6 million compared with $95.8 million for the same quarter last year. Current quarter net sales were understated by $0.7 million from products shipped and recognized as revenue in 2023 and not delivered until 2024. The amount of revenue deferred for products shipped in March 2024 but not delivered until April 2024 was $1.9 million. The decrease in 2024 first quarter net sales also reflected unfavorable year-over-year pricing comparison, partially offset by an increase from volume and product mix and the inclusion of online sales platform fees.

Gross profit for the 2024 first quarter decreased to $37.6 million from $38.1 million for the same quarter last year. Gross margin for the 2024 first quarter was 39.3 percent versus 39.8 percent for the same quarter last year. Gross profit for the current quarter was understated by $0.3 million related to the timing of revenue recognition, as discussed above. The amount of gross margin deferred for products shipped in March 2024 but not delivered until April 2024 was $0.8 million. Gross margin for the current quarter included a net favorable impact of 80 basis points from the inclusion of online platform fees in net sales and production expenses in cost of goods sold. Gross margin for the current quarter also benefited from the strengthening of the United States Dollar against Taiwan New Dollar. These favorable impacts were offset by an increase in freight and duty costs as a result of increased import volume following the strategy to scale back domestic manufacturing coupled with higher freight and container rates.

Operating expenses in the 2024 first quarter were $29.5 million, compared with $25.4 million in the same quarter last year. The increase was primarily due to a non-cash impairment charge of the operating right-of-use asset related to the sublease of a distribution center in California, the inclusion of online sales platform fees in operating expenses, and higher rent and warehouse expense from workforce expansion and additional leased warehouses, partially offset by a decrease in shipping and transportation costs and the inclusion of production costs in cost of goods sold.

Net income for the 2024 first quarter decreased to $6.5 million, from $9.2 million for the same quarter last year. Net income margin was 6.8 percent in the 2024 first quarter, compared with 9.6 percent a year ago.

Net income attributable to Karat for the 2024 first quarter was $6.2 million, or $0.31 per diluted share, compared with $9.0 million, or $0.45 per diluted share in the prior-year quarter.

Adjusted EBITDA, a non-GAAP measure defined below, totaled $13.5 million for the 2024 first quarter, compared with $15.3 million for the same quarter last year. Adjusted EBITDA margin, a non-GAAP measure defined below, was 14.2 percent of net sales, compared with 15.9 percent for the same quarter last year.

Adjusted diluted earnings per common share, a non-GAAP measure defined below, was $0.40 per share, compared with $0.46 per share in the prior-year quarter.

Dividend

On May 7, 2024, Karat’s board of directors approved an increase in the quarterly cash dividend to $0.35 per share, from the previous quarterly dividend of $0.30 per share, payable on May 24, 2024, to stockholders of record as of May 17, 2024.

Investor Conference Call

The Company will host an investor conference call today, May 9, 2024, at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time).

Phone: 646-307-1963 (domestic); 800-715-9871 (international)

Conference ID: 4383878

Webcast: Accessible at http://irkarat.com/; archive available for approximately one year

About Karat Packaging Inc.

Karat Packaging Inc. is a specialty distributor and manufacturer of a wide range of disposable foodservice products and related items, primarily used by national and regional restaurants and in foodservice settings throughout the United States. Its products include food and take-out containers, bags, tableware, cups, lids, cutlery, straws, specialty beverage ingredients, equipment, gloves and other products. The company’s eco-friendly Karat Earth® line offers quality, sustainably focused products that are made from renewable resources. Karat Packaging also offers customized solutions, including new product development and design, printing, and logistics services. To learn more about Karat Packaging, please visit the company’s website at www.karatpackaging.com.

Caution Concerning Forward-Looking Statements

Statements made in this release that are not statements of historical or current facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We caution readers that forward-looking statements are predictions based on our current expectations about future events. These forward-looking statements, including, but not limited to, achieving our financial guidance, are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Our actual results, performance, or achievements could differ materially from those expressed or implied by the forward-looking statements as a result of a number of factors, including the risks discussed under the heading “Risk Factors” discussed under the caption “Item 1A. Risk Factors” in Part I of our most recent Annual Report on Form 10-K or any updates discussed under the caption “Item 1A. Risk Factors” in Part II of our Quarterly Reports on Form 10-Q and in our other filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law.

Investor Relations and Media Contacts:

PondelWilkinson Inc.

Judy Lin /Roger Pondel

310-279-5980; ir@karatpackaging.com

KARAT PACKAGING INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(In thousands, except share and per share data)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Net sales | $ | 95,613 | | | $ | 95,801 | |

| Cost of goods sold | 58,011 | | | 57,657 | |

| Gross profit | 37,602 | | | 38,144 | |

| Operating expenses: | | | |

| Selling expenses | 10,763 | | | 8,701 | |

General and administrative expenses (including $556 and $671 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | 16,769 | | | 16,629 | |

Impairment expense and loss, net, on disposal of machinery | 1,994 | | | 82 | |

| Total operating expenses | 29,526 | | | 25,412 | |

| Operating income | 8,076 | | | 12,732 | |

| Other income (expenses) | | | |

Rental income (including $255 and $247 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | 291 | | | 247 | |

Other income (expense), net | 55 | | | (208) | |

Gain (loss) on foreign currency transactions | 122 | | | (427) | |

Interest income (including $213 and $16 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | 431 | | | 67 | |

Interest expense (including $517 and $406 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | (524) | | | (407) | |

Total other income (expenses), net | 375 | | | (728) | |

| Income before provision for income taxes | 8,451 | | | 12,004 | |

| Provision for income taxes | 1,975 | | | 2,818 | |

| Net income | 6,476 | | | 9,186 | |

| Net income attributable to noncontrolling interest | 310 | | | 181 | |

| Net income attributable to Karat Packaging Inc. | $ | 6,166 | | | $ | 9,005 | |

| Basic and diluted earnings per share: | | | |

| Basic | $ | 0.31 | | | $ | 0.45 | |

| Diluted | $ | 0.31 | | | $ | 0.45 | |

| Weighted average common shares outstanding, basic | 19,969,606 | | | 19,886,585 | |

| Weighted average common shares outstanding, diluted | 20,075,485 | | | 19,939,923 | |

KARAT PACKAGING INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(In thousands, except share and per share data)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets | | | |

Cash and cash equivalents (including $4,327 and $13,566 associated with variable interest entity at March 31, 2024 and December 31, 2023, respectively) | $ | 13,144 | | | $ | 23,076 | |

Short-term investments (including $7,038 and $0 associated with variable interest entity at March 31, 2024 and December 31, 2023, respectively) | 33,515 | | | 26,343 | |

Accounts receivable, net of allowance for bad debt of $342 and $392 at March 31, 2024 and December 31, 2023, respectively | 30,111 | | | 27,763 | |

| Inventories | 79,272 | | | 71,528 | |

Prepaid expenses and other current assets (including $78 and $82 associated with variable interest entity at March 31, 2024 and December 31, 2023, respectively) | 4,492 | | | 6,219 | |

| Total current assets | 160,534 | | | 154,929 | |

Property and equipment, net (including $43,882 and $44,185 associated with variable interest entity at March 31, 2024 and December 31, 2023, respectively) | 93,853 | | | 95,226 | |

| Deposits | 229 | | | 1,047 | |

| Goodwill | 3,510 | | | 3,510 | |

| Intangible assets, net | 320 | | | 327 | |

| Operating right-of-use assets | 19,360 | | | 20,739 | |

Other non-current assets (including $67 and $53 associated with variable interest entity at March 31, 2024 and December 31, 2023, respectively) | 1,232 | | | 619 | |

| Total assets | $ | 279,038 | | | $ | 276,397 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities | | | |

Accounts payable (including $68 and $63 associated with variable interest entity at March 31, 2024 and December 31, 2023, respectively) | $ | 21,394 | | | $ | 18,446 | |

Accrued expenses (including $171 and $591 associated with variable interest entity at March 31, 2024 and December 31, 2023, respectively) | 11,318 | | | 10,576 | |

| Related party payable | 5,300 | | | 5,306 | |

Customer deposits (including $0 and $116 associated with variable interest entity at March 31, 2024 and December 31, 2023) | 725 | | | 951 | |

Long-term debt, current portion (including $1,139 and $1,122 associated with variable interest entity at March 31, 2024 and December 31, 2023, respectively) | 1,139 | | | 1,122 | |

| Operating lease liabilities, current portion | 4,439 | | | 4,800 | |

Other current liabilities (including $2,186 and $1,302 associated with variable interest entity at March 31, 2024 and December 31, 2023, respectively) | 3,875 | | | 3,200 | |

| Total current liabilities | 48,190 | | | 44,401 | |

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Deferred tax liability | 4,197 | | | 4,197 | |

Long-term debt, net of current portion and debt discount of $187 and $203 at March 31, 2024 and December 31, 2023, respectively (including $48,116 and $48,396 associated with variable interest entity at March 31, 2024 and December 31, 2023, respectively, and debt discount of $187 and $203 associated with variable interest entity at March 31, 2024 and December 31, 2023, respectively) | 48,116 | | | 48,396 | |

| Operating lease liabilities, net of current portion | 17,754 | | | 16,687 | |

Other non-current liabilities | 389 | | | 26 | |

| Total liabilities | 118,646 | | | 113,707 | |

| | | |

| Karat Packaging Inc. stockholders’ equity | | | |

Preferred stock, $0.001 par value, 10,000,000 shares authorized, no shares issued and outstanding, as of March 31, 2024 and December 31, 2023 | — | | | — | |

Common stock, $0.001 par value, 100,000,000 shares authorized, 19,995,032 and 19,972,032 shares issued and outstanding, respectively, as of March 31, 2024 and 19,988,482 and 19,965,482 shares issued and outstanding, respectively, as of December 31, 2023 | 20 | | | 20 | |

| Additional paid in capital | 87,094 | | | 86,667 | |

Treasury stock, $0.001 par value, 23,000 shares as of both March 31, 2024 and December 31, 2023 | (248) | | | (248) | |

| Retained earnings | 67,537 | | | 67,679 | |

| Total Karat Packaging Inc. stockholders’ equity | 154,403 | | | 154,118 | |

| Noncontrolling interest | 5,989 | | | 8,572 | |

| Total stockholders’ equity | 160,392 | | | 162,690 | |

| Total liabilities and stockholders’ equity | $ | 279,038 | | | $ | 276,397 | |

KARAT PACKAGING, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(In thousands)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net income | $ | 6,476 | | | $ | 9,186 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Depreciation and amortization (including $303 and $304 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | 2,629 | | | 2,633 | |

Adjustments to allowance for bad debt | (12) | | | (652) | |

| Adjustments to inventory reserve | 40 | | | 288 | |

| Write-off of inventory | 293 | | | 216 | |

Impairment of operating right-of-use asset | 1,993 | | | — | |

Loss, net, on disposal of machinery and equipment | 1 | | | 82 | |

Amortization of loan fees (including $15 and $16 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | 23 | | | 17 | |

Accrued interest on certificates of deposit (including $38 and $0 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | (126) | | | — | |

| Stock-based compensation | 375 | | | 277 | |

| Amortization of operating right-of-use assets | 1,466 | | | 997 | |

| (Increase) decrease in operating assets | | | |

Accounts receivable (including $0 and $7 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | (2,336) | | | (2,409) | |

| Inventories | (8,077) | | | (207) | |

Prepaid expenses and other current assets (including $4 and $52 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | 1,727 | | | 1,023 | |

Other non-current assets (including $14 and $88 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | (190) | | | 9 | |

| Increase (decrease) in operating liabilities | | | |

Accounts payable (including $5 and $1 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | 3,367 | | | (1,978) | |

Accrued expenses (including $420 and $415 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | 742 | | | (1,127) | |

| Related party payable | (6) | | | 4,967 | |

| Income taxes payable | — | | | 1,782 | |

Customer deposits (including $0 and $17 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | (507) | | | (326) | |

Operating lease liabilities | (1,474) | | | (1,067) | |

Other non-current liabilities | 155 | | | 474 | |

| Net cash provided by operating activities | $ | 6,559 | | | $ | 14,185 | |

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (163) | | | (1,042) | |

| Proceeds on disposal of property and equipment | 23 | | | 25 | |

| Deposits paid for joint venture investment | — | | | (2,900) | |

| Deposits refunded from joint venture investment | — | | | 950 | |

| Deposits paid for property and equipment | (761) | | | (1,718) | |

Purchases of short-term investments (including $7,000 and $0 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | (12,190) | | | (10,000) | |

Redemption of short-term investments | 5,144 | | | — | |

| Net cash used in investing activities | $ | (7,947) | | | $ | (14,685) | |

| Cash flows from financing activities | | | |

Proceeds from long-term debt (including $0 and $8,000 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | — | | | 8,000 | |

| Payments for lender fees | — | | | (61) | |

Payments on long-term debt (including 278 and $241 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | (278) | | | (241) | |

| Tax withholding on vesting of restricted stock units | — | | | (14) | |

| Proceeds from exercise of common stock options | 52 | | | — | |

| Dividends paid to shareholders | (5,992) | | | — | |

Payment for Global Wells noncontrolling membership interest redemption (including $2,010 and $0 associated with variable interest entity for the three months ended March 31, 2024 and 2023, respectively) | (2,326) | | | — | |

Net cash (used in) provided by financing activities | $ | (8,544) | | | $ | 7,684 | |

Net (decrease) increase in cash and cash equivalents | $ | (9,932) | | | $ | 7,184 | |

| Cash and cash equivalents | | | |

| Beginning of year | $ | 23,076 | | | $ | 16,041 | |

| End of year | $ | 13,144 | | | $ | 23,225 | |

| Supplemental disclosures of non-cash investing and financing activities: | | | |

| Transfers from deposit to property and equipment | $ | 1,148 | | | $ | 4,381 | |

| Non-cash purchases of property and equipment | $ | 159 | | | $ | 1,159 | |

| Supplemental disclosures of cash flow information: | | | |

Income tax refund | $ | 13 | | | $ | — | |

| Cash paid for interest | $ | 502 | | | $ | 421 | |

KARAT PACKAGING INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (UNAUDITED)

| | |

| (In thousands, except per share amounts) |

| | | | | | | | | | | | | | |

| Reconciliation of Adjusted EBITDA and Adjusted EBITDA margin: | Three Months Ended March 31, |

| 2024 | 2023 |

| Amounts | % of Net Sales | Amounts | % of Net Sales |

| Net income: | $ | 6,476 | | 6.8 | % | $ | 9,186 | | 9.6 | % |

| Add (deduct): | | | |

|

| Interest income | (431) | (0.5) | (67) | (0.1) |

| Interest expense | 524 | 0.6 | 407 | 0.4 |

| Provision for income taxes | 1,975 | 2.1 | 2,818 | 2.9 |

| Depreciation and amortization | 2,629 | 2.7 | 2,633 | 2.8 |

| Stock-based compensation expense | 375 | 0.4 | 277 | 0.3 |

| Operating right-of-use asset impairment | 1,993 | 2.1 | — | — |

| Adjusted EBITDA | $ | 13,541 | | 14.2 | % | $ | 15,254 | | 15.9 | % |

| | | | | | | | | | | |

| Reconciliation of Adjusted Diluted Earnings Per Common Share | Three Months Ended March 31, |

| | 2024 | | 2023 |

| Diluted earnings per common share: | $ | 0.31 | | $ | 0.45 |

| Add (deduct): | | | |

| Stock-based compensation expense | 0.02 | | 0.01 |

Operating right-of-use asset impairment | 0.10 | | — |

| Tax impact | (0.03) | | — |

| Adjusted diluted earnings per common shares | $ | 0.40 | | $ | 0.46 |

| | | | | | | | | | | | | | |

Reconciliation of Adjusted EBITDA by Entity: | Three Months Ended March 31, 2024 |

| Karat Packaging | Global Wells | Eliminations | Consolidated |

| Net income: | $ | 5,850 | | $ | 360 | | $ | 266 | | $ | 6,476 | |

| Add | | | | |

| Interest income | (218) | (213) | — | | (431) | |

| Interest expense | 7 | | 517 | | — | | 524 | |

| Provision for income taxes | 1,975 | | — | | — | | 1,975 | |

| Depreciation and amortization | 2,326 | | 303 | | — | | 2,629 | |

| Stock-based compensation expense | 375 | | — | | — | | 375 | |

| Operating right-of-use asset impairment | 1,993 | | — | | — | | 1,993 | |

| Adjusted EBITDA | $ | 12,308 | | $ | 967 | | $ | 266 | | $ | 13,541 | |

| | | | | | | | | | | | | | |

Reconciliation of Adjusted EBITDA by Entity: | Three Months Ended March 31, 2023 |

| Karat Packaging | Global Wells | Eliminations | Consolidated |

| Net income (loss): | $ | 9,040 | | $ | 209 | | $ | (63) | | $ | 9,186 | |

| Add | | | | |

| Interest income | (51) | (33) | 17 | (67) |

| Interest expense | 18 | | 406 | | (17) | | 407 | |

| Provision for income taxes | 2,818 | | — | | — | | 2,818 | |

| Depreciation and amortization | 2,330 | | 303 | | — | | 2,633 | |

| Stock-based compensation expense | 277 | | — | | — | | 277 | |

| Adjusted EBITDA | $ | 14,432 | | $ | 885 | | $ | (63) | | $ | 15,254 | |

Use of Non-GAAP Financial Measures

Karat utilizes certain financial measures and key performance indicators that are not defined by, or calculated in accordance with, GAAP to assess our financial and operating performance. A non-GAAP financial measure is defined as a numerical measure of a company’s financial performance that (i) excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the comparable measure calculated and presented in accordance with GAAP in the statement of operations; or (ii) includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the comparable GAAP measure so calculated and presented. The following non-GAAP measures are presented in this press release:

•Adjusted EBITDA is a financial measure calculated as net income excluding (i) interest income, (ii) interest expense, (iii) provision for income taxes, (iv) depreciation and amortization, (v) stock-based compensation expense, and (vi) operating right-of-use asset impairment.

•Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA by net sales.

•Adjusted diluted earnings per common share is calculated as diluted earnings per common share, plus the per share impact of stock-based compensation, operating right-of-use asset impairment, and adjusted for the related tax effects of these adjustments.

We believe the above-mentioned non-GAAP measures, which are used by management to assess the core performance of Karat, provide useful information and additional clarity of our operating results to our investors in their own evaluation of the core performance of Karat and facilitate a comparison of such performance from period to period. These are not measurements of financial performance or liquidity under GAAP and should not be considered in isolation or construed as substitutes for net income or other cash flow data prepared in accordance with GAAP for purposes of analyzing our profitability or liquidity. These measures should be considered in addition to, and not as a substitute for, revenue, net income, earnings per share, cash flows or other measures of financial performance prepared in accordance with GAAP. In addition, these non-GAAP financial measures may not provide information that is directly comparable to that provided by other companies, as other companies may calculate such financial results differently.

KARAT PACKAGING INC. AND SUBSIDIARIES

NET SALES BY CATEGORY (UNAUDITED)

(In thousands)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| (in thousands) |

| National and regional chains | $ | 21,470 | | | $ | 21,368 | |

| Distributors | 52,827 | | 54,647 |

| Online | 14,879 | | 13,655 |

| Retail | 6,437 | | 6,131 |

| $ | 95,613 | | | $ | 95,801 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

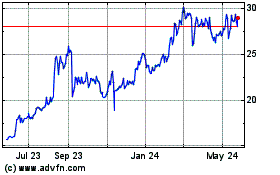

Karat Packaging (NASDAQ:KRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

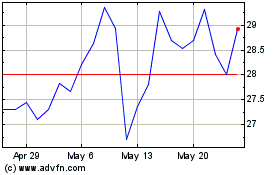

Karat Packaging (NASDAQ:KRT)

Historical Stock Chart

From Nov 2023 to Nov 2024