KANZHUN LIMITED (“BOSS Zhipin” or “the Company”) (Nasdaq: BZ), a

leading online recruitment platform in China, today announced its

unaudited financial results for the third quarter ended September

30, 2021.

Third Quarter 2021 Highlights

• Revenues for the quarter were RMB1,211.8

million (US$188.1 million), an increase of 105.4% from RMB590.1

million for the same quarter of 2020.

• Calculated cash

billings1 for the quarter were RMB1,221.0

million (US$189.5 million), an increase of 61.8% from RMB754.8

million for the same quarter of 2020.

• Average monthly active users

(MAUs)2 for the quarter were 28.8

million, an increase of 28.6% from 22.4 million for the same

quarter of 2020.

• Total paid enterprise

customers3 in the twelve months ended

September 30, 2021 increased by 110.5% to 4.0 million from 1.9

million in the twelve months ended September 30, 2020.

• Net income for the quarter was RMB286.2

million (US$44.4 million), compared to net income of RMB33.8

million for the same quarter of 2020. Adjusted net

income4 for the quarter was RMB385.1

million (US$59.8 million), compared to RMB52.3 million for the same

quarter last year.

Mr. Jonathan Peng Zhao, Founder, Chairman and Chief Executive

Officer of the Company, commented, “It is inspiring to see the

effectiveness of our business model continuing to be validated. In

the third quarter, we focused on improving our service for existing

users and enhancing our core competencies, continually investing in

both platform and data security enhancements. We believe this is a

key factor in driving the sustainable growth of our business and

creating long-term value. Staying true to our mission and

commitments as a public company, we will continue to make valuable

contributions to the development of individuals, and to the

prosperity of the enterprises we serve, by leveraging the power of

technology.”

Mr. Phil Yu Zhang, Chief Financial Officer, further commented,

“Our revenues increased by 105.4% year on year to RMB1,211.8

million in the third quarter. Our net income reached RMB286.2

million and our adjusted net income achieved RMB385.1 million,

demonstrating the type of healthy and robust margin-profile, that

we believe our core online recruitment business can achieve as our

business matures. We are firmly committed to continuing investment

in talents with headcount of R&D and sales personnel growing

sequentially.”

Third Quarter 2021 Unaudited Financial

Results

Revenues

Revenues were RMB1,211.8 million (US$188.1 million) in the third

quarter of 2021, an increase of 105.4% from RMB590.1 million for

the same period in 2020. The increase was primarily due to the

growth in revenues from online recruitment services.

• Revenues from online recruitment services were RMB1,197.1

million (US$185.8 million) in the third quarter of 2021,

representing an increase of 104.4% from RMB585.6 million for the

same period in 2020. The increase was mainly due to the rapid

growth in our paid enterprise customer numbers following the

expansion of our user base. Total paid enterprise customers

increased by 110.5% from 1.9 million in the twelve months ended

September 30, 2020 to 4.0 million in the twelve months ended

September 30, 2021.

• Revenues from other services, which mainly comprise of

paid value-added services offered to job seekers, were RMB14.6

million (US$2.3 million) in the third quarter of 2021, representing

an increase of 217.4% from RMB4.6 million for the same period in

2020, benefiting from our continued overall growth in user

base.

Operating cost and expenses

Total operating cost and expenses were RMB903.9 million

(US$140.3 million) in the third quarter of 2021, representing an

increase of 61.7% from RMB559.1 million in the same period of 2020.

Total share-based compensation expenses were RMB98.9 million

(US$15.4 million) in the third quarter of 2021, compared with

RMB18.5 million in the same period of 2020.

• Cost of revenues were RMB154.8 million

(US$24.0 million) in the third quarter of 2021, representing an

increase of 124.7% from RMB68.9 million in the same period of 2020,

primarily driven by payroll and other employee-related costs, as

well as increases in third-party payment processing costs and

server and bandwidth costs, resulting from expanded user base and

increased transaction volume.

• Sales and marketing expenses were

RMB416.4 million (US$64.6 million) in the third quarter of 2021,

representing an increase of 46.8% from RMB283.6 million in the same

period of 2020, primarily due to increased headcount in sales and

marketing personnel and enhanced brand advertising activities.

• Research and development expenses were

RMB209.3 million (US$32.5 million) in the third quarter of 2021,

representing an increase of 49.9% from RMB139.6 million in the same

period of 2020, primarily due to increased headcount in research

and development personnel as well as increased share-based

compensation expenses.

• General and administrative expenses were

RMB123.3 million (US$19.1 million) in the third quarter of 2021,

representing an increase of 83.8% from RMB67.1 million in the same

period of 2020, primarily due to increased headcount in general and

administrative personnel and increased share-based compensation

expenses.

Income from operations

Income from operations was RMB311.1 million (US$48.3 million) in

the third quarter of 2021, compared to RMB34.4 million in the same

period of 2020.

Net income and adjusted net income

Net income was RMB286.2 million (US$44.4 million) in the third

quarter of 2021, compared to RMB33.8 million in the same period of

2020.

Adjusted net income was RMB385.1 million (US$59.8 million) in

the third quarter of 2021, compared to RMB52.3 million in the same

quarter of 2020.

Basic and diluted net income per ADS and adjusted basic

and diluted net income per ADS

Basic and diluted net income per ADS attributable to ordinary

shareholders were RMB0.66 (US$0.10) and RMB0.62 (US$0.10),

respectively, in the third quarter of 2021, compared to basic and

diluted net loss per ADS of RMB0.55 in the same period of 2020.

Adjusted basic and diluted net income per ADS attributable to

ordinary shareholders4 were RMB0.89 (US$0.14) and RMB0.83

(US$0.13), respectively, in the third quarter of 2021, compared to

adjusted basic and diluted net loss per ADS of RMB0.21 in the same

period of 2020.

Net cash generated from operating

activities

Net cash generated from operating activities was RMB269.9

million (US$41.9 million) in the third quarter of 2021,

representing an increase of 13.8% from RMB237.1 million in the same

period of 2020.

Cash position

Balance of cash and cash equivalents and short-term investments

was RMB11,941.1 million (US$1,853.2 million) as of September 30,

2021, compared to RMB4,534.6 million as of December 31, 2020. The

increase was primarily attributable to net proceeds from the

initial public offering completed in June 2021 as well as net cash

generated from operating activities.

Recent Development

As stated in the press release announced on July 5, 2021, the

Company is subject to cybersecurity review by the Cyberspace

Administration of China. To facilitate the process, during the

review period, the “BOSS Zhipin” app has been required to suspend

new user registration in China. The process is still ongoing and

the Company is fully cooperating with the regulator in respect of

its review.

Outlook

For the fourth quarter of 2021, the Company currently expects

its total revenues to be between RMB1.02 billion and RMB1.05

billion, representing a year-on-year increase of 58.1% to 62.8%.

This forecast reflects the Company’s current views on the market,

operational conditions and the impact of the on-going cybersecurity

review, which are subject to change and cannot be predicted with

reasonable accuracy as of the date hereof.

_____________________________1 Calculated cash billings is a

non-GAAP financial measure, derived by adding the change in

deferred revenue to revenues. For more information on the non-GAAP

financial measures, please see the section of “Use of Non-GAAP

Financial Measures.”2 MAUs refer to the number of verified user

accounts, including both job seekers and enterprise users, that

logged on to our mobile applications in a given month at least

once.3 Paid enterprise customers are defined as enterprise users

and company accounts from which we recognize revenues for our

online recruitment services.4 Adjusted net income/(loss) and

adjusted basic and diluted net income/(loss) per ADS attributable

to ordinary shareholders are non-GAAP financial measures, excluding

the impact of share-based compensation expenses. For more

information on the non-GAAP financial measures, please see the

section of “Use of Non-GAAP Financial Measures.”

Conference Call Information

The Company will host a conference call at 7:00 AM U.S. Eastern

Time on Tuesday, November 23, 2021 (8:00 PM Beijing/Hong Kong Time

on November 23, 2021) to discuss the financial results. Details for

the conference call are as follows:

|

Event Title: |

KANZHUN LIMITED Third Quarter 2021 Earnings Conference Call |

| Conference ID: |

9759978 |

| Registration Link: |

http://apac.directeventreg.com/registration/event/9759978 |

Upon registration, participants will receive an email containing

conference call dial-in details, a passcode, and a unique

registrant ID. This information will allow you to gain immediate

access to the call. Participants may pre-register at any time,

including up to and after the call start time.

Additionally, a live and archived webcast of the conference call

will be available on the Company's investor relations website at

https://ir.zhipin.com.

A replay of the conference call will be accessible approximately

two hours after the conclusion of the live call and will be

available until November 30, 2021, via the following details:

|

International: |

+61-2-8199-0299 |

| China (Mandarin) Toll Free: |

800-870-0206 |

| China Toll Free: |

400-632-2162 |

| United States Toll Free: |

+1-855-452-5696 |

| Hong Kong Toll Free: |

800-963-117 |

| Singapore Toll Free: |

800-616-2305 |

| Conference ID: |

9759978 |

Exchange Rate

This announcement contains translation of certain RMB amounts

into U.S. dollar amounts at specified rates solely for the

convenience of the reader. Unless otherwise stated, all

translations from RMB to U.S. dollar were made at the rate of

RMB6.4434 to US$1.00, the noon buying rate on September 30, 2021 of

RMB as set forth in the H.10 statistical release of the Federal

Reserve Board. The Company makes no representation that the RMB or

U.S. dollar amounts referred could be converted into U.S. dollar or

RMB, as the case may be, at any particular rate or at all.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company considers and uses

non-GAAP measures, such as calculated cash billings, adjusted net

income/(loss), adjusted net income/(loss) attributable to ordinary

shareholders, adjusted basic and diluted net income/(loss) per

ordinary share attributable to ordinary shareholders and adjusted

basic and diluted net income/(loss) per ADS attributable to

ordinary shareholders as supplemental measures to review and assess

operating performance. The Company derives calculated cash billings

by adding the change in deferred revenue to revenues. The Company

uses calculated cash billings to measure and monitor sales growth

because the Company generally bills its paid enterprise customers

at the time of sales, but may recognize a portion of the related

revenue ratably over time. The Company believes calculated cash

billings provide valuable insights into the cash that will be

generated from sales and is a valuable measure for monitoring

service demand and financial performance. The Company defines

adjusted net income/(loss) and adjusted net income/(loss)

attributable to ordinary shareholders by excluding the impact of

share-based compensation expenses, which are non-cash expenses,

from the related GAAP measures. The Company believes that these

non-GAAP measures help identify underlying trends in the business

that could otherwise be distorted by the effect of certain expenses

that are included in net income/(loss) and facilitate investors’

assessment of the Company’s operating performance.

The non-GAAP financial measures are not defined under U.S. GAAP

and are not presented in accordance with U.S. GAAP. The

presentation of non-GAAP financial measures should not be

considered in isolation from, or as a substitute for most directly

comparable financial measures prepared in accordance with GAAP. The

non-GAAP measures have material limitations as an analytical metric

and may not be calculated in the same manner by all companies, and

may not be comparable to other similarly titled measures used by

other companies. The Company encourages investors and others to

review its financial information in its entirety and not rely on a

single financial measure.

A reconciliation of the historical non-GAAP financial measures

to the most directly comparable GAAP measures has been provided in

the financial statement tables captioned “Unaudited Reconciliation

of GAAP and Non-GAAP results” at the end of this press release.

Safe Harbor Statement

This press release contains statements that may constitute

“forward-looking” statements which are made pursuant to the “safe

harbor” provisions of the U.S. Private Securities Litigation Reform

Act of 1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “likely to,”

and similar statements. Statements that are not historical facts,

including statements about the Company’s beliefs, plans, and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. Further

information regarding these and other risks is included in the

Company’s filings with the SEC. All information provided in this

press release is as of the date of this press release, and the

Company does not undertake any obligation to update any

forward-looking statement, except as required under applicable

law.

About KANZHUN LIMITED

KANZHUN LIMITED (Nasdaq: BZ) operates the largest online

recruitment platform BOSS Zhipin in China in terms of average MAU

in 2020. Established seven years ago, the Company connects job

seekers and enterprise users in an efficient and seamless manner

through its highly interactive mobile app, a transformative product

that promotes two-way communication, focuses on intelligent

recommendations, and creates new scenarios in the online recruiting

process. Benefiting from its large and diverse user base, BOSS

Zhipin has developed powerful network effects to deliver higher

recruitment efficiency and drive rapid expansion.

For more information, please visit https://ir.zhipin.com.

For investor and media inquiries, please

contact:

KANZHUN LIMITEDInvestor RelationsEmail: ir@kanzhun.com

THE PIACENTE GROUP, INC.Email: kanzhun@tpg-ir.com

| |

|

KANZHUN LIMITEDUNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS)/INCOME(All

amounts in thousands, except for share and per share data, unless

otherwise noted) |

| |

| |

|

For the three months ended September 30, |

|

|

For the nine months ended September

30, |

|

| |

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

| |

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Online recruitment services to enterprise customers |

|

|

585,556 |

|

|

|

1,197,135 |

|

|

|

185,792 |

|

|

|

1,286,141 |

|

|

|

3,137,054 |

|

|

|

486,863 |

|

|

Other services |

|

|

4,576 |

|

|

|

14,626 |

|

|

|

2,270 |

|

|

|

13,085 |

|

|

|

31,424 |

|

|

|

4,877 |

|

| Total

revenues |

|

|

590,132 |

|

|

|

1,211,761 |

|

|

|

188,062 |

|

|

|

1,299,226 |

|

|

|

3,168,478 |

|

|

|

491,740 |

|

| Operating cost and

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues(1) |

|

|

(68,885 |

) |

|

|

(154,834 |

) |

|

|

(24,030 |

) |

|

|

(160,957 |

) |

|

|

(404,863 |

) |

|

|

(62,834 |

) |

|

Sales and marketing expenses(1) |

|

|

(283,595 |

) |

|

|

(416,419 |

) |

|

|

(64,627 |

) |

|

|

(1,026,513 |

) |

|

|

(1,569,199 |

) |

|

|

(243,536 |

) |

|

Research and development expenses(1) |

|

|

(139,592 |

) |

|

|

(209,323 |

) |

|

|

(32,486 |

) |

|

|

(361,407 |

) |

|

|

(623,051 |

) |

|

|

(96,696 |

) |

|

General and administrative expenses(1) |

|

|

(67,052 |

) |

|

|

(123,338 |

) |

|

|

(19,142 |

) |

|

|

(171,343 |

) |

|

|

(1,871,950 |

) |

|

|

(290,522 |

) |

| Total operating cost

and expenses |

|

|

(559,124 |

) |

|

|

(903,914 |

) |

|

|

(140,285 |

) |

|

|

(1,720,220 |

) |

|

|

(4,469,063 |

) |

|

|

(693,588 |

) |

|

Other operating income, net |

|

|

3,400 |

|

|

|

3,291 |

|

|

|

511 |

|

|

|

7,095 |

|

|

|

10,948 |

|

|

|

1,699 |

|

| Income/(loss) from

operations |

|

|

34,408 |

|

|

|

311,138 |

|

|

|

48,288 |

|

|

|

(413,899 |

) |

|

|

(1,289,637 |

) |

|

|

(200,149 |

) |

|

Financial income, net |

|

|

504 |

|

|

|

2,737 |

|

|

|

425 |

|

|

|

966 |

|

|

|

6,754 |

|

|

|

1,048 |

|

|

Foreign exchange (loss)/gain |

|

|

(1,099 |

) |

|

|

269 |

|

|

|

42 |

|

|

|

(2,222 |

) |

|

|

(317 |

) |

|

|

(49 |

) |

|

Investment income |

|

|

734 |

|

|

|

7,162 |

|

|

|

1,112 |

|

|

|

6,321 |

|

|

|

15,791 |

|

|

|

2,451 |

|

|

Other expenses |

|

|

(746 |

) |

|

|

(5,072 |

) |

|

|

(787 |

) |

|

|

(3,580 |

) |

|

|

(6,669 |

) |

|

|

(1,035 |

) |

| Income/(loss) before

income tax expense |

|

|

33,801 |

|

|

|

316,234 |

|

|

|

49,080 |

|

|

|

(412,414 |

) |

|

|

(1,274,078 |

) |

|

|

(197,734 |

) |

|

Income tax expense |

|

|

- |

|

|

|

(30,066 |

) |

|

|

(4,666 |

) |

|

|

- |

|

|

|

(30,066 |

) |

|

|

(4,666 |

) |

| Net

income/(loss) |

|

|

33,801 |

|

|

|

286,168 |

|

|

|

44,414 |

|

|

|

(412,414 |

) |

|

|

(1,304,144 |

) |

|

|

(202,400 |

) |

|

Accretion on convertible redeemable preferred shares to

redemption value |

|

|

(63,805 |

) |

|

|

- |

|

|

|

- |

|

|

|

(193,820 |

) |

|

|

(164,065 |

) |

|

|

(25,462 |

) |

| Net (loss)/income

attributable to ordinary shareholders |

|

|

(30,004 |

) |

|

|

286,168 |

|

|

|

44,414 |

|

|

|

(606,234 |

) |

|

|

(1,468,209 |

) |

|

|

(227,862 |

) |

| Net

income/(loss) |

|

|

33,801 |

|

|

|

286,168 |

|

|

|

44,414 |

|

|

|

(412,414 |

) |

|

|

(1,304,144 |

) |

|

|

(202,400 |

) |

|

Other comprehensive (loss)/income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

(81,662 |

) |

|

|

40,385 |

|

|

|

6,268 |

|

|

|

(53,171 |

) |

|

|

48,269 |

|

|

|

7,491 |

|

| Total comprehensive

(loss)/income |

|

|

(47,861 |

) |

|

|

326,553 |

|

|

|

50,682 |

|

|

|

(465,585 |

) |

|

|

(1,255,875 |

) |

|

|

(194,909 |

) |

| Weighted average number of

ordinary shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

|

109,142,384 |

|

|

|

861,454,878 |

|

|

|

861,454,878 |

|

|

|

107,921,949 |

|

|

|

420,605,543 |

|

|

|

420,605,543 |

|

|

—Diluted |

|

|

109,142,384 |

|

|

|

927,370,444 |

|

|

|

927,370,444 |

|

|

|

107,921,949 |

|

|

|

420,605,543 |

|

|

|

420,605,543 |

|

|

Net (loss)/income per ordinary share attributable to

ordinary shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

|

(0.27 |

) |

|

|

0.33 |

|

|

|

0.05 |

|

|

|

(5.62 |

) |

|

|

(3.49 |

) |

|

|

(0.54 |

) |

|

—Diluted |

|

|

(0.27 |

) |

|

|

0.31 |

|

|

|

0.05 |

|

|

|

(5.62 |

) |

|

|

(3.49 |

) |

|

|

(0.54 |

) |

|

Net (loss)/income per ADS* attributable to ordinary

shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

|

(0.55 |

) |

|

|

0.66 |

|

|

|

0.10 |

|

|

|

(11.23 |

) |

|

|

(6.98 |

) |

|

|

(1.08 |

) |

|

—Diluted |

|

|

(0.55 |

) |

|

|

0.62 |

|

|

|

0.10 |

|

|

|

(11.23 |

) |

|

|

(6.98 |

) |

|

|

(1.08 |

) |

* Each ADS represents two Class A ordinary shares.(1) Includes

share-based compensation expenses as follows:

| |

|

For the three months ended September

30, |

|

|

For the nine months ended September 30, |

|

| |

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

| |

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

Cost of revenues |

|

|

307 |

|

|

|

11,431 |

|

|

|

1,774 |

|

|

|

939 |

|

|

|

24,568 |

|

|

|

3,813 |

|

| Sales and marketing

expenses |

|

|

2,080 |

|

|

|

17,916 |

|

|

|

2,781 |

|

|

|

12,968 |

|

|

|

44,838 |

|

|

|

6,959 |

|

| Research and development

expenses |

|

|

7,451 |

|

|

|

36,688 |

|

|

|

5,694 |

|

|

|

20,391 |

|

|

|

95,321 |

|

|

|

14,794 |

|

| General and administrative

expenses |

|

|

8,661 |

|

|

|

32,888 |

|

|

|

5,104 |

|

|

|

24,449 |

|

|

|

1,643,447 |

|

|

|

255,059 |

|

| |

|

|

18,499 |

|

|

|

98,923 |

|

|

|

15,353 |

|

|

|

58,747 |

|

|

|

1,808,174 |

|

|

|

280,625 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

KANZHUN LIMITEDUNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS(All amounts in thousands,

except for share and per share data, unless otherwise noted) |

| |

| |

|

As of |

|

| |

|

December 31, 2020 |

|

|

September 30, 2021 |

|

| |

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

3,998,203 |

|

|

|

10,756,365 |

|

|

|

1,669,362 |

|

|

Short-term investments |

|

|

536,401 |

|

|

|

1,184,760 |

|

|

|

183,872 |

|

|

Accounts receivable |

|

|

6,999 |

|

|

|

739 |

|

|

|

115 |

|

|

Amounts due from related parties |

|

|

40,799 |

|

|

|

6,987 |

|

|

|

1,084 |

|

|

Prepayments and other current assets |

|

|

164,910 |

|

|

|

602,669 |

|

|

|

93,533 |

|

| Total current

assets |

|

|

4,747,312 |

|

|

|

12,551,520 |

|

|

|

1,947,966 |

|

| Non-current

assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, equipment and software, net |

|

|

191,355 |

|

|

|

272,644 |

|

|

|

42,314 |

|

|

Intangible assets, net |

|

|

549 |

|

|

|

481 |

|

|

|

75 |

|

|

Right-of-use assets, net |

|

|

144,063 |

|

|

|

257,651 |

|

|

|

39,987 |

|

|

Other non-current assets |

|

- |

|

|

|

4,000 |

|

|

|

621 |

|

| Total non-current

assets |

|

|

335,967 |

|

|

|

534,776 |

|

|

|

82,997 |

|

| Total

assets |

|

|

5,083,279 |

|

|

|

13,086,296 |

|

|

|

2,030,963 |

|

| LIABILITIES, MEZZANINE

EQUITY AND SHAREHOLDERS’ (DEFICIT)/EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

41,856 |

|

|

|

33,286 |

|

|

|

5,166 |

|

|

Deferred revenue |

|

|

1,200,349 |

|

|

|

1,879,719 |

|

|

|

291,728 |

|

|

Other payable and accrued liabilities |

|

|

418,259 |

|

|

|

440,185 |

|

|

|

68,316 |

|

|

Operating lease liabilities, current |

|

|

59,559 |

|

|

|

100,013 |

|

|

|

15,522 |

|

| Total current

liabilities |

|

|

1,720,023 |

|

|

|

2,453,203 |

|

|

|

380,732 |

|

| Non-current

liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating lease liabilities, non-current |

|

|

76,373 |

|

|

|

158,227 |

|

|

|

24,557 |

|

| Total non-current

liabilities |

|

|

76,373 |

|

|

|

158,227 |

|

|

|

24,557 |

|

| Total

liabilities |

|

|

1,796,396 |

|

|

|

2,611,430 |

|

|

|

405,289 |

|

| Mezzanine

equity |

|

|

5,587,000 |

|

|

|

- |

|

|

|

- |

|

| Shareholders’

(deficit)/equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary shares |

|

|

81 |

|

|

|

549 |

|

|

|

85 |

|

|

Treasury shares (3,657,853 shares as of December 31, 2020 and nil

as of September 30, 2021) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

|

452,234 |

|

|

|

14,482,624 |

|

|

|

2,247,668 |

|

|

Accumulated other comprehensive loss |

|

|

(130,387 |

) |

|

|

(82,118 |

) |

|

|

(12,744 |

) |

|

Accumulated deficit |

|

|

(2,622,045 |

) |

|

|

(3,926,189 |

) |

|

|

(609,335 |

) |

| Total shareholders’

(deficit)/equity |

|

|

(2,300,117 |

) |

|

|

10,474,866 |

|

|

|

1,625,674 |

|

| Total liabilities,

mezzanine equity and shareholders’ (deficit)/equity |

|

|

5,083,279 |

|

|

|

13,086,296 |

|

|

|

2,030,963 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

KANZHUN LIMITEDUNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(All amounts in

thousands, except for share and per share data, unless otherwise

noted) |

| |

| |

|

For the three months ended September 30, |

|

|

For the nine months ended September 30, |

|

| |

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

| |

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

Net cash generated from/(used in) operating activities |

|

|

237,128 |

|

|

|

269,928 |

|

|

|

41,892 |

|

|

|

(56,456 |

) |

|

|

1,106,471 |

|

|

|

171,722 |

|

| Net cash (used in)/generated

from investing activities |

|

|

(260,519 |

) |

|

|

(638,386 |

) |

|

|

(99,076 |

) |

|

|

797,570 |

|

|

|

(805,751 |

) |

|

|

(125,051 |

) |

| Net cash generated from/(used

in) financing activities |

|

|

78,998 |

|

|

|

(2,370 |

) |

|

|

(368 |

) |

|

|

1,127,704 |

|

|

|

6,409,844 |

|

|

|

994,792 |

|

| Effect of exchange rate

changes on cash and cash equivalents |

|

|

(82,763 |

) |

|

|

38,234 |

|

|

|

5,934 |

|

|

|

(55,258 |

) |

|

|

47,598 |

|

|

|

7,387 |

|

| Net

(decrease)/increase in cash and cash equivalents |

|

|

(27,156 |

) |

|

|

(332,594 |

) |

|

|

(51,618 |

) |

|

|

1,813,560 |

|

|

|

6,758,162 |

|

|

|

1,048,850 |

|

| Cash and cash equivalents at

beginning of the period |

|

|

2,248,071 |

|

|

|

11,088,959 |

|

|

|

1,720,980 |

|

|

|

407,355 |

|

|

|

3,998,203 |

|

|

|

620,512 |

|

| Cash and cash

equivalents at end of the period |

|

|

2,220,915 |

|

|

|

10,756,365 |

|

|

|

1,669,362 |

|

|

|

2,220,915 |

|

|

|

10,756,365 |

|

|

|

1,669,362 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

KANZHUN LIMITEDUNAUDITED RECONCILIATION OF

GAAP AND NON-GAAP RESULTS (All amounts in thousands,

except for share and per share data, unless otherwise noted) |

| |

| |

|

For the three months ended September 30, |

|

|

For the nine months ended September

30, |

|

| |

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

| |

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

Revenues |

|

|

590,132 |

|

|

|

1,211,761 |

|

|

|

188,062 |

|

|

|

1,299,226 |

|

|

|

3,168,478 |

|

|

|

491,740 |

|

| Add: Change in deferred

revenue |

|

|

164,677 |

|

|

|

9,241 |

|

|

|

1,434 |

|

|

|

290,588 |

|

|

|

679,370 |

|

|

|

105,437 |

|

| Calculated cash

billings |

|

|

754,809 |

|

|

|

1,221,002 |

|

|

|

189,496 |

|

|

|

1,589,814 |

|

|

|

3,847,848 |

|

|

|

597,177 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income/(loss) |

|

|

33,801 |

|

|

|

286,168 |

|

|

|

44,414 |

|

|

|

(412,414 |

) |

|

|

(1,304,144 |

) |

|

|

(202,400 |

) |

| Add: Share-based compensation

expenses |

|

|

18,499 |

|

|

|

98,923 |

|

|

|

15,353 |

|

|

|

58,747 |

|

|

|

1,808,174 |

|

|

|

280,625 |

|

| Adjusted net

income/(loss) |

|

|

52,300 |

|

|

|

385,091 |

|

|

|

59,767 |

|

|

|

(353,667 |

) |

|

|

504,030 |

|

|

|

78,225 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)/income attributable

to ordinary shareholders |

|

|

(30,004 |

) |

|

|

286,168 |

|

|

|

44,414 |

|

|

|

(606,234 |

) |

|

|

(1,468,209 |

) |

|

|

(227,862 |

) |

| Add: Share-based compensation

expenses |

|

|

18,499 |

|

|

|

98,923 |

|

|

|

15,353 |

|

|

|

58,747 |

|

|

|

1,808,174 |

|

|

|

280,625 |

|

|

Adjusted net (loss)/income attributable to ordinary

shareholders |

|

|

(11,505 |

) |

|

|

385,091 |

|

|

|

59,767 |

|

|

|

(547,487 |

) |

|

|

339,965 |

|

|

|

52,763 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

ordinary shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

|

109,142,384 |

|

|

|

861,454,878 |

|

|

|

861,454,878 |

|

|

|

107,921,949 |

|

|

|

420,605,543 |

|

|

|

420,605,543 |

|

| —Diluted |

|

|

109,142,384 |

|

|

|

927,370,444 |

|

|

|

927,370,444 |

|

|

|

107,921,949 |

|

|

|

480,361,688 |

|

|

|

480,361,688 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net (loss)/income per ordinary share attributable to

ordinary shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

|

(0.11 |

) |

|

|

0.45 |

|

|

|

0.07 |

|

|

|

(5.07 |

) |

|

|

0.81 |

|

|

|

0.13 |

|

| —Diluted |

|

|

(0.11 |

) |

|

|

0.42 |

|

|

|

0.06 |

|

|

|

(5.07 |

) |

|

|

0.71 |

|

|

|

0.11 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net (loss)/income per ADS attributable to ordinary

shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

|

(0.21 |

) |

|

|

0.89 |

|

|

|

0.14 |

|

|

|

(10.15 |

) |

|

|

1.62 |

|

|

|

0.25 |

|

| —Diluted |

|

|

(0.21 |

) |

|

|

0.83 |

|

|

|

0.13 |

|

|

|

(10.15 |

) |

|

|

1.42 |

|

|

|

0.22 |

|

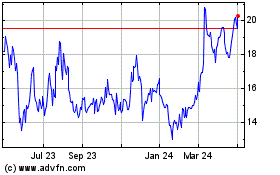

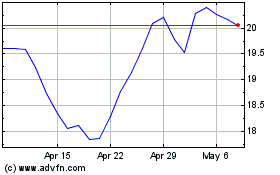

Kanzhun (NASDAQ:BZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kanzhun (NASDAQ:BZ)

Historical Stock Chart

From Apr 2023 to Apr 2024