Airline Job Cuts Heat Up Aid Discussions

July 16 2020 - 4:43PM

Dow Jones News

By Alison Sider

Airlines are tallying up tens of thousands of job cuts they say

could happen this fall, as Congress gears up to debate offering

more aid to a travel industry crushed by the coronavirus

pandemic.

The $25 billion allocated to U.S. airlines under the $2.2

trillion stimulus package passed in March is set to expire at the

end of September. That money, covering most of airlines' labor

costs for the summer, was intended to be a bridge to better times

by averting an abrupt collapse of the industry.

The problem is the better times haven't arrived. Covid-19

infections are still surging across much of the country, prompting

new restrictions on travel in some cities and states. Air-travel

demand, which had been picking up, shows signs of slumping

again.

And Oct. 1, the date until which carriers had agreed not to lay

off or furlough workers, is fast approaching. American Airlines

Group Inc. and United Airlines Holdings Inc. outlined plans this

week that could result in 61,000 workers being furloughed, though

final numbers could be smaller. Southwest Airlines Co. has also

warned of potential job losses.

"Although furloughs and layoffs remain our very last resort, we

can't rule them out as a possibility obviously in this very bad

environment," Southwest Chief Executive Gary Kelly told employees

earlier this week in an internal message. "We need a significant

recovery by the end of this year -- and that's roughly triple the

number of passengers from where we are today."

Major aviation unions representing pilots, flight attendants and

mechanics are calling for payroll aid to be extended by six months.

Their proposal calls for another $32 billion to be allocated to

passenger airlines, cargo carriers and aviation contractors.

"This is the simplest and fastest way to maintain Congress'

historic commitment to keep aviation workers on payroll," the

unions wrote in a June 25 letter.

Lawmakers will return to Washington next week to begin

negotiations on the fifth coronavirus relief bill, aiming to pass

what would likely be the final aid package before the election in

November. With a federal supplement to unemployment insurance set

to expire July 31 and lawmakers leaving Washington for recess on

Aug. 7, Republicans and Democrats will have just a few weeks to

hash out a host of complicated policy questions.

Among them is whether to offer additional assistance to

industries hammered by the pandemic-induced slowdown. In a $3.5

trillion bill passed by the House in May and immediately rejected

by Senate Republicans, House Democrats sought to extend the

prohibition on involuntary employee furloughs at airline companies

that previously received federal aid. That bill extends the

prohibition until the aid runs out, rather than ending as of Oct.

1. Senate Republicans have said they would consider targeting aid

at troubled industries.

Some lawmakers agree with union leaders that airlines need more

assistance. Rep. Peter DeFazio (D. Ore.) and six other members of

Congress wrote to House and Senate leaders this week urging them to

send more aid for airlines to pay workers.

"While time marches on, so does the pandemic, with hardly any

green shoots sprouting for the airlines," they wrote.

Airlines warned for months that they would have to cut to

survive what is likely to be a yearslong recovery. Some economists

have argued that airlines should be left to retrench rather than

getting another lifeline. Others have suggested it's better to keep

workers tethered to companies as long as possible rather than let

them go, particularly in the event the development of a vaccine

spurs a rapid travel recovery.

Some airline executives have said they're not banking on more

government help. Carriers have raised billions of dollars from

private sources and are also eligible for another $25 billion in

government loans. Those loans don't come with the same restrictions

on job cuts but require airlines to put up more collateral.

Airlines for America, a trade association, said it isn't

actively seeking more aid, though its members support the union

efforts as long as no additional conditions are tacked onto another

round of funds.

Airlines received 70% of the payroll funding as grants. The

other 30% must eventually be repaid, and airlines had to offer

stock warrants to compensate the Treasury. Carriers that have

already taken on large amounts of debt are wary of adding more

while a recovery in demand appears elusive.

Treasury Secretary Steven Mnuchin last week told CNBC that he

considered the payroll aid program a success but said airlines are

among industries that may need more help.

Some airlines are encouraging employees to accept leaves and

early retirements to reduce the number of forced cuts. Under most

union contracts, furloughs start with more recently hired workers

among those let go. Carriers are hoping that employees who are

closer to retirement and more likely to have higher salaries will

take buyout packages to help cut costs.

Some carriers have said they are working with unions on

concessions, such as reductions in guaranteed minimum hours, to

allow more workers to stay on. JetBlue Airways Corp. said earlier

this month that it came to an agreement with its pilots union that

will allow it to avoid furloughs for now in exchange for changes to

their collective bargaining agreement.

Delta Air Lines Inc. has said that 17,000 of its employees have

agreed to leave, but that the company is still asking for more

volunteers.

"We're committed to exhausting every option possible and

harnessing our creativity before we consider involuntary

separations," Delta CEO Ed Bastian wrote in a message to employees

on Thursday.

--Andrew Duehren contributed to this article.

Write to Alison Sider at alison.sider@wsj.com

(END) Dow Jones Newswires

July 16, 2020 16:28 ET (20:28 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

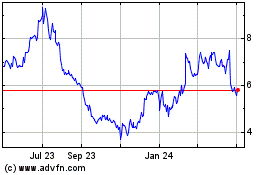

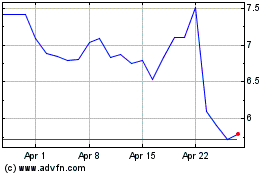

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Mar 2024 to Apr 2024

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Apr 2023 to Apr 2024