United States

Securities and Exchange

Commission

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange

Act of 1934 (Amendment No. )

Filed

by the Registrant

Filed

by the Registrant

|

Filed

by a Party other than the Registrant

Filed

by a Party other than the Registrant

|

|

|

|

|

Check the appropriate

box:

|

|

Preliminary Proxy Statement

|

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2))

|

|

Definitive Proxy Statement

|

|

Definitive Additional Materials

|

|

Soliciting Material Pursuant to Section 240.14a-12

|

JETBLUE

AIRWAYS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

|

Payment of Filing Fee (check

the appropriate box):

|

|

No fee required.

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

(1) Title of each class of securities to

which transaction applies:

|

|

(2) Aggregate number of securities to which

transaction applies:

|

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

(4) Proposed maximum aggregate value of

transaction:

|

|

(5) Total fee

paid:

|

|

Fee

paid previously with preliminary materials.

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

|

MESSAGE FROM OUR

CHIEF EXECUTIVE OFFICER

JETBLUE AIRWAYS CORPORATION

27-01 Queens Plaza North

Long Island City, New York 11101

______ __, 2020

To our Stockholders:

It is our pleasure to invite you to attend

our 2020 annual meeting of stockholders of JetBlue Airways Corporation, on Thursday, May 14, 2020 at 9 a.m., Eastern Daylight

Time. This year’s annual meeting will be conducted virtually, via

live audio webcast. You will be able to attend the annual meeting of stockholders online and submit questions during the meeting

by visiting www.virtualshareholdermeeting.com/jblu2020. You will be able to vote your shares electronically during

the meeting by logging in using the 16-digit control number included in your Notice of Internet Availability of the proxy materials,

on your proxy card or on the voting instructions form accompanying these proxy materials.

We continue to embrace the latest technology

to provide expanded access, improved communication and cost savings for our stockholders and the Company. As we’ve learned,

hosting a virtual meeting enables increased stockholder attendance and participation from locations around the world. In addition,

the online format allows us to communicate more effectively via a pre-meeting forum that you can enter by visiting www.proxyvote.com

with your control number. We encourage you to log on and ask any questions you may have, which we will try to answer during

the meeting. We recommend that you log in a few minutes before the meeting on May 14 to ensure you are logged in when the

meeting starts. Finally, the safety of our crewmembers, customers and stockholders is important to us. In light of the recommendations

issued by the CDC against public gatherings due to Covid-19, we think a virtual only meeting is advisable.

The following notice of annual meeting of

stockholders outlines the business to be conducted at the virtual annual meeting. Only stockholders of record at the close of business

on March 19, 2020 will be entitled to notice of and to vote at the virtual annual meeting. Further details about how to attend

the meeting online and the business to be conducted at the annual meeting are included in the accompanying Notice of Annual Meeting

and Proxy Statement.

We are again providing access to our proxy

materials online under the U.S. Securities and Exchange Commission’s (the “SEC”) “notice and access” rules. As a result,

we are mailing to many of our stockholders a notice instead of a paper copy of this proxy statement and our 2019 Annual Report

on Form 10-K. The notice contains instructions on how to access documents online. The notice also contains instructions on how

stockholders can receive a paper copy of our materials, including this proxy statement, our 2019 Annual Report, and a form of proxy

card or voting instruction card. If you received the Notice of Internet Availability by mail and would like to receive a printed

copy of our proxy materials, please follow the instructions for requesting such materials included in the Notice of Internet Availability.

Your vote is important. Regardless of whether

you attend the annual meeting, we hope you vote as soon as possible. You may vote by proxy online or by phone, or, if you received

paper copies of the proxy materials by mail, you may also vote by mail by following the instructions on the proxy card or voting

instruction card. Additionally, if you attend the virtual annual meeting, you may vote your shares at the meeting via the Internet

even if you previously voted your proxy. Voting online or by phone, by written proxy or by voting instruction card ensures your

representation at the annual meeting regardless of whether you attend the virtual meeting.

Very truly yours,

Robin Hayes

Chief Executive Officer and Director

On behalf of the Board of Directors of JetBlue

Airways Corporation

TABLE OF CONTENTS

|

|

|

|

www.jetblue.com

|

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 2

|

TO BE HELD ON

MAY 14, 2020

9:00 a.m. (Eastern Daylight Time)

via the Internet at

www.virtualshareholdermeeting.com/jblu2020.

JETBLUE AIRWAYS CORPORATION

27-01 Queens Plaza North

Long Island City, New York 11101

|

|

NOTICE

of Annual Meeting

of Stockholders

|

This notice of annual meeting, proxy statement

and form of proxy for JetBlue Airways Corporation (“JetBlue” or the “Company”) are being distributed and

made available on or about ______ __, 2020.

TIME AND DATE

9 a.m., Eastern Daylight Time, on Thursday, May 14, 2020

PLACE

Online at www.virtualshareholdermeeting.com/jblu2020

ITEMS OF BUSINESS

|

1.

|

To elect the ten directors named in this proxy statement;

|

|

2.

|

To approve, on an advisory basis, the Company’s executive compensation (“say on pay” vote);

|

|

3.

|

To approve the JetBlue Airways Corporation 2020 Omnibus Equity Incentive Plan

|

|

4.

|

To approve the JetBlue Airways Corporation 2020 Crewmember Stock Purchase Plan

|

|

5.

|

To ratify the appointment of the independent registered public accounting firm for the fiscal year ending December 31, 2020;

|

|

6.

|

To approve an amendment to the Company’s amended and restated certificate of incorporation to provide stockholders with the right to request that the company call a special meeting

|

|

7.

|

To approve an amendment to the Company’s amended and restated certificate of incorporation to provide stockholders with the right to act by written consent

|

|

8.

|

To vote on a stockholder proposal, if properly presented at the meeting; and

|

|

9.

|

Such other business as may properly come before the meeting.

|

|

ADJOURNMENTS AND POSTPONEMENTS

Any action on the items of business described above may be considered

at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly

adjourned or postponed.

RECORD DATE

You are entitled to vote only if you were a JetBlue stockholder

as of the close of business on March 19, 2020.

By order of the Board of Directors

Brandon Nelson

General Counsel and Corporate Secretary

|

|

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 14, 2020

The notice of annual meeting, the proxy statement and our fiscal

year 2019 annual report are available on our website at http://investor.jetblue.com. Additionally, in accordance with the SEC rules, you may access our proxy materials at www.proxyvote.com.

|

|

VOTE IN ADVANCE OF THE MEETING:

|

|

|

|

|

|

|

|

If your shares are held in the name of

a broker, bank or other holder of record, follow the voting instructions you receive from the holder of record to vote your

shares.

|

|

BY INTERNET

Go to www.proxyvote.com

|

|

BY TELEPHONE

call 1-800-690-6903 (toll free)

|

|

BY MAIL

mark, sign, date and promptly mail the enclosed proxy card in the postage-paid envelope

|

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 3

VOTING

Your vote

is very important. Regardless of whether you plan to virtually attend the annual meeting, we hope you will vote as soon as

possible. You may vote your shares over the Internet or via a toll-free telephone number. If you received a paper copy of a proxy

or voting instruction card by mail, you may submit your proxy or voting instruction card for the annual meeting by completing,

signing, dating and returning your proxy or voting instruction card in the pre-addressed envelope provided. Stockholders of record

and beneficial owners will be able to vote their shares electronically at the annual meeting. For specific instructions on how

to vote your shares, please refer to the section entitled Questions and Answers about the Annual Meeting and Voting beginning

on page 87 of the proxy statement.

VIRTUAL MEETING ADMISSION

Stockholders of record as

of March 19, 2020, will be able to participate in the annual meeting by visiting our annual meeting website www.virtualshareholdermeeting.com/jblu2020.

To participate in the annual meeting, you will need the 16-digit control number included on your Notice of Internet Availability

of the proxy materials, on your proxy card or on the instructions that accompanied your proxy materials.

The annual meeting will begin

promptly at 9:00 a.m., Eastern Daylight Time. Online check-in will begin at 8:50 a.m., Eastern Daylight Time. Please allow ample

time for the online check-in procedures.

ANNUAL MEETING WEBSITE AND PRE-MEETING

FORUM

The online format used by

JetBlue for the annual meeting also allows us to communicate more effectively with you. Stockholders can access our pre-meeting

forum, where you can submit questions in advance of the annual meeting, by visiting our annual meeting website at www.proxyvote.com.

Stockholders can also access copies of our proxy statement and 2019 Annual Report on Form 10-K at the annual meeting website.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 4

PROXY STATEMENT SUMMARY

THIS SUMMARY HIGHLIGHTS INFORMATION CONTAINED ELSEWHERE IN THIS

PROXY STATEMENT. THIS SUMMARY DOES NOT CONTAIN ALL OF THE INFORMATION YOU SHOULD CONSIDER. PLEASE READ THE ENTIRE

PROXY STATEMENT CAREFULLY BEFORE YOU VOTE.

Annual Stockholders Meeting (see pages 87-91)

|

Date

May 14, 2020

|

Time

9:00 a.m. (Eastern Daylight Time)

|

Place

Via the Internet at

www.virtualshareholdermeeting.com/jblu2020

|

Record Date: March 19,

2020

Mailing Date: This Proxy

Statement was first mailed to stockholders on or about ________, 2020

Meeting Agenda: The meeting

will cover the proposals listed under voting matters and vote recommendations below, and any other business that may properly come

before the meeting.

Voting: Stockholders as

of the record date are entitled to vote. Each share of common stock of JetBlue Airways Corporation (the “Company”)

is entitled to one vote for each director nominee and one vote for each of the proposals.

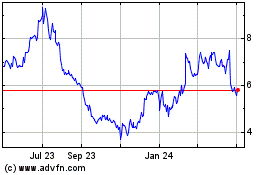

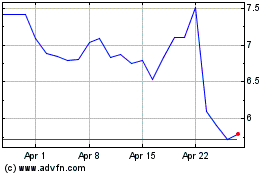

Stock Symbol: JBLU

Exchange:

Nasdaq

Common Stock Outstanding as

of Record Date: 269,707,459

Registrar & Transfer

Agent: Computershare Trust Company, N.A.

State of Incorporation: Delaware

Corporate Headquarters: 27-01

Queens Plaza North, Long Island City, NY 11101

Corporate Website: www.jetblue.com

Investor Relations Website: http://investor.jetblue.com

Voting Matters and Vote Recommendations

|

Proposals

|

|

Board

Recommends

|

|

Reasons for Recommendation

|

|

See Page

|

|

1.

|

To elect ten directors named

in the proxy statement

|

|

Vote FOR

|

|

The Board and its Governance and Nominating

Committee believe the ten director nominees possess the skills and experience to effectively monitor performance, provide

oversight and advise management on the Company’s long term strategy.

|

|

|

|

2.

|

To approve, on an advisory basis, the Company’s executive compensation “say on pay”

|

|

Vote FOR

|

|

Our executive compensation programs demonstrate our execution

on our pay for performance philosophy.

|

|

|

|

3.

|

To approve the JetBlue Airways Corporation 2020

Omnibus Equity Incentive Plan

|

|

Vote FOR

|

|

The Board believes having the stockholders approve the JetBlue Airways

Corporation 2020 Omnibus Equity Incentive Plan is in the Company’s best

interests.

|

|

|

|

4.

|

To approve the JetBlue Airways Corporation 2020

Crewmember Stock Purchase Plan

|

|

Vote FOR

|

|

The Board believes having the stockholders approve the JetBlue Airways

Corporation 2020 Crewmember Stock Purchase Plan is in the Company’s

best interests.

|

|

|

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 5

|

Proposals

|

|

Board

Recommends

|

|

Reasons for Recommendation

|

|

See Page

|

|

5.

|

To ratify the appointment

of Ernst & Young LLP as

the Company’s Independent

Registered Public Accounting

Firm for fiscal year 2020

|

|

Vote FOR

|

|

Based on the Audit Committee’s assessment of Ernst & Young’s

qualifications and performance, the Board and Audit committee believe

EY’s retention for fiscal year 2020 is in the best interest of the Company

|

|

|

|

6.

|

To approve an amendment to the Company’s amended and restated certificate of incorporation to provide stockholders with the right to request that the Company call a special meeting

|

|

Vote FOR

|

|

The Board and its Governance and Nominating Committee believe that

having stockholders vote on an amendment to the amended and restated

certificate of incorporation to provide stockholders with the right to

request that the Company call a special meeting is in the Company’s best

interests.

|

|

|

|

7.

|

To approve an amendment of the Company’s amended and restated certificate of incorporation to provide stockholders with the right to act by written consent

|

|

Vote FOR

|

|

The Board and its Governance and Nominating Committee believe that

having stockholders vote on an amendment to the amended and restated

certificate of incorporation to provide stockholders with the right to act

by written consent is in the Company’s best interests.

|

|

|

|

8.

|

To

vote on a Stockholder proposal, if properly presented at the Annual Meeting

|

|

Vote AGAINST

|

|

The Company believes

that the stockholder proposal is not in the best interests of the Company.

|

|

|

|

VOTE IN ADVANCE

OF THE MEETING

|

|

|

|

|

|

|

|

|

|

|

|

BY INTERNET

Vote your shares at www.proxyvote.com

Have your Notice of Internet Availability or proxy card in hand for the 16 digit control number needed to vote.

|

|

BY TELEPHONE

Call 1-800-690-6903

(toll free)

|

|

BY MAIL

Sign, date and return the enclosed proxy

card or voting instruction form. If your shares are held in the name of

a broker, bank or other holder of record, follow the voting instructions you receive from the holder of record to vote

your shares.

|

|

IN PERSON

Vote online during the meeting

See P. 87 “Questions and answers

about the Annual Meeting” for details about voting at the meeting.

|

Our Director Nominees(1)

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 6

Chair

Chair

Member

Member

Financial Expert

Financial Expert

|

(1)

|

Reflects committee and committee Chair assignments to be implemented following the 2020 Annual Meeting, as Mr. Joel Peterson and Mr. Frank Sica are not standing for re-election and Mr. Stephan Gemkow resigned earlier this year.

|

|

(2)

|

Upon Mr. Peterson’s

departure from the Board in May 2020, Mr. Boneparth will assume the role of independent Board Chair.

|

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 7

Executive Compensation Advisory Vote

We are executing on our pay for performance philosophy

We aim to design our executive compensation program

to reward our named executive officers for the Company’s success without incentivizing undue risk.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 8

Business Overview

How

Did We Do in 2019?

2019 Financial and Operational Performance

On a GAAP basis, our full year results were as follows:

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 9

2019 Highlights

We believe our differentiated product and culture,

competitive costs, and high-value geography relative to other airlines contributed to our continued success in 2019. Our 2019 operational

highlights include:

Product Enhancements

Throughout 2019, we continued to invest in industry-leading

products which we believe will continue to differentiate our offerings from the other airlines.

|

■

|

Cabin Restyle - We made significant

progress on our cabin restyle program which includes two iterations. Phase 1 of the program introduced our popular Airbus

A321 interior to our Airbus A320 aircraft. Phase 2, which began in early 2019, includes enhancements to provide our customers

with a cabin experience of the future. It features a new seat design with memory foam cushion comfort and adjustable headrests,

a next generation inflight entertainment system with an expanded collection of on demand movies, television shows including

full seasons and video content, plus new gaming features, and expanded Fly-Fi® coverage over water to support

our growing network.

|

|

■

|

Mobile Application - We updated our mobile application to include an in-app chat functionality. With the added in-app functionality, customers will have even more options for connecting with our customer support crewmembers.

|

|

■

|

Fare Options 2.0

- Since launching our first fare options platform in 2015, we have gained deep insights into what customers want when

they select a fare. In November 2019, we launched fare options 2.0 to offer the choices that today’s customers want, including

a new low fare for price sensitive travelers which we call Blue Basic, and an updated option for customers who value

additional benefits like flexibility and speed, which we refer to as Blue Extra. Blue Basic is designed to help

customers save while still offering the full JetBlue experience. Customers choosing the Blue Basic option will enjoy

the same great experience with the most legroom in coach, free brand-name snacks and drinks, free high-speed wi-fi, DIRECTV®

and movies at every seat, and our award-winning customer service. Blue Extra offers customers full change flexibility,

early boarding, and Even More® Speed at a significant discount over the cost of purchasing these services as

add-ons.

|

Network

We continued to gain relevance in our high-value

geography by building out our focus cities to establish a position of strength. Our network growth in 2019 was primarily aimed

at adding more connect-the-dot routes in Boston and Fort Lauderdale. In Boston, we added more flights on 12 of our most popular

routes and adjusted schedules to offer up to 18 and 14 hourly flights per day to New York and Washington D.C., respectively. In

Fort Lauderdale, we launched daily flights to St. Maarten and Phoenix. In addition to strengthening our transcon market, the new

Fort Lauderdale - Phoenix flights will not only give Arizona customers a direct link to South Florida, but also onward connections

to the Caribbean and Latin America.

In February 2019, we began daily round trip service

from Fort Lauderdale to Guayaquil, Ecuador. Guayaquil joined Quito as our second BlueCity in Ecuador, highlighting our success

in this South American country.

In April 2019, we announced plans to launch multiple

daily flights from Boston and JFK to London beginning in 2021. London will be our first BlueCity in Europe.

In June 2019, we announced plans to start winter

seasonal service between JFK and Guadeloupe with three times weekly service which launched in February 2020. The new service grows

our already expansive footprint in the Caribbean and Latin America, and caters to leisure travelers in the Northeast looking to

experience a unique island getaway during the cold winter months.

In September 2019, we announced plans to launch

daily nonstop service between JFK and Georgetown, Guyana beginning in April 2020.

In October 2019, we relocated our operations

in Houston from William P. Hobby Airport to George Bush Intercontinental Airport to better serve our customers.

In December 2019, we launched daily nonstop services

between JFK and Guayaquil, our first route enabled by the capabilities of the Airbus A321 new engine option (“neo”) aircraft.

This route is the longest in our network, stretching beyond our previous longest route by more than 200 nautical miles.

We continued to examine our network to ensure

we are making the best use of our aircraft and in 2019 we announced our plans to discontinue operations in Anchorage, La Romana

in the Dominican Republic, and Mexico City. We believe these adjustments will promote healthy growth and improve the profitability

of our network.

As a result of the decision by the U.S. Government

to no longer permit air carriers to operate scheduled services to Cuban cities except for Havana, we ended our operations in Camagüey,

Holguín and Santa Clara in December 2019.

Fleet

During 2019, we took delivery of six Airbus A321neo

aircraft and bought out the lease of one of our aircraft. In connection with our plans to launch flights to London in 2021, we

amended our purchase agreement with Airbus in April 2019 to convert 13 Airbus A321neo deliveries into A321 Long Range (“A321LR”)

deliveries. The A321LR aircraft offers higher fuel capacity with a range of about 4,000 nautical miles.

In June 2019, we further amended our purchase

agreement with Airbus to convert an additional 13 Airbus A321neo deliveries into the A321 Xtra Long Range (“A321XLR”)

deliveries. We believe the range of the Airbus A321XLR will allow us to expand our relevance in Boston and New York by adding more

destinations into Europe. In addition, we also converted 10 of our options for the Airbus A220-300 aircraft into firm orders.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 10

We anticipate that we will take delivery of a

maximum of eleven Airbus A321neo aircraft and our first Airbus A220 aircraft in 2020.

Customer Service

JetBlue and our crewmembers were recognized in

2019 for industry leading customer service.

|

■

|

J.D. Power and Associates named JetBlue its Top Low Cost Airline for Customer Satisfaction

for 2019. Within the J.D. Power study, we led in four of the seven categories: aircraft, inflight services, flight crew, and

reservations. This is our 13th J.D. Power and Associates award.

|

|

■

|

Airline Ratings awarded JetBlue 7 out of 7 stars for safety, and 5 out of 5 stars for our

product offerings. It also named us the Best Low Cost Airline in the Americas.

|

|

■

|

We were recognized in the 2019 TripAdvisor Travelers’ Choice®

Awards for the Best Regional Business Class and Best in Passenger Comfort in North America.

|

|

■

|

At The Points Guy Awards, JetBlue took top honors in both Best Domestic Business

Class Product and Best Domestic Economy Product for a second year in a row. We were also recognized by The Points Guy as the

Best Airline for Families.

|

|

■

|

We are the number one domestic airline in Travel + Leisure’s World’s Best Awards 2019.

|

Our crewmembers

During 2019, our crewmembers recognized JetBlue as one of America’s

“Best Large Employers” by Forbes. JetBlue ranked #11 through a survey that asked individuals how likely they would be

to recommend their employer to someone else. We were also ranked #15 in the list of Top 50 Top-Rated Workplaces by Indeed. Indeed

compiled this list by including companies that are members of the Fortune 500 Index with at least 100 reviews between June 2017

and June 2019. These companies are the most highly rated on overall employee experience.

JetBlue’s Approach to Environmental,

Social and Governance Matters (“ESG”)

JetBlue’s mission is to Inspire Humanity.

We strongly believe that strong corporate governance, informed by engagement directly with our stakeholders, creates the foundation

that allows us to pursue our mission.

At JetBlue, we strive to conduct our business

in ways that are principled, transparent, and accountable to key stakeholders. We have safeguarded our values of Safety, Caring,

Integrity, Passion and Fun since our first flight.

We believe pursuing our mission generates long-term

value. We focus our efforts where we can have the most positive impact on our business and the communities we serve, including

issues related to environmental sustainability, youth and education, the community, culture and human capital. As a reflection

of the importance of these matters, our Governance and Nominating Committee oversees responsibility for ESG initiatives and reporting.

We have more information about our efforts in these areas on our website.

Governance

Board and Committee Structure and Composition

|

■

|

Independent Chairman of the Board; Chairman and CEO positions have been separated since

2008.

|

|

■

|

9 of 10 director nominees are independent, with Robin Hayes, our CEO, as our sole non-independent

director nominees

|

|

■

|

All members of each of the Audit, Compensation and Governance and Nominating Committee (the

“Governance Committees”) are independent and these committees regularly meet in executive session.

|

|

■

|

40% of all director nominees are female

|

|

■

|

Independent directors regularly meet in executive session.

|

|

■

|

We have a robust orientation program for new directors and ongoing training for continuing

directors.

|

|

■

|

All Audit Committee members are financially literate, and

a majority are audit committee financial experts.

|

|

■

|

The Compensation Committee uses an independent compensation consultant.

|

BOARD INDEPENDENCE

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 11

Advanced Shareholder Rights

|

■

|

A robust, ongoing stockholder engagement program

|

|

■

|

Annual elections of all Directors

|

|

■

|

A majority vote standard in director elections

|

|

■

|

A thoughtful approach to board composition and refreshment

|

|

■

|

Annual board and committee evaluations

|

|

■

|

Limitation on the number of public company boards on which Directors may serve

|

|

■

|

Stockholders’ right to call a special meeting (to be voted on at this Meeting)

|

|

■

|

Stockholders’ right to act by written consent (to be voted on at this Meeting)

|

|

■

|

Proxy access

|

Strong Stockholder Support on Say on Pay

Our stockholders supported say on pay at 98.4%

at our 2019 Annual Meeting. Our Compensation Committee believes the vote indicates support for our program.

See “Corporate Governance at JetBlue” at page 10 for

more information.

Environmental/Sustainability Initiatives and Reporting

We believe it is our responsibility to manage

our environmental footprint and explore associated risks and opportunities. Our Board established an ESG subcommittee to oversee

this area. We employ a dedicated Sustainability and ESG crewleader to oversee the efforts of our entire airline and keep our management

team and Board aware of climate-related risks and opportunities when developing strategy, performance, and budgets. Our Sustainability

and ESG group leads climate change risk and opportunity assessment efforts and performs risk assessment related to possible emissions

regulations on an on-going basis. In 2019, the Governance and Nominating Committee discussed efforts by the Company to use ESG

efforts to mitigate macro risks and best position JetBlue to be a leader in this area. The Governance and Nominating Committee

determined to establish a subcommittee to assist it in these efforts. The Governance and Nominating Committee evaluated the impact

of the CORSIA regulatory regime and the Company’s efforts on its Sustainability Accounting Standards Board (SASB) and Task

Force on Climate- Related Financial Disclosure reporting. The Governance and Nominating Committee expects to be more focused on

the costs associated with the cost of carbon offsetting compliance. More information on these efforts is available on our website.

In January 2020, JetBlue announced plans to become

carbon neutral on domestic flights by July 2020 with offsetting up to 17 billion pounds of carbon by investing in projects focused

on initiatives like forest conservation.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 12

Diversity and Inclusion

We cultivate and measure the visual and non-visual

diversity of our workforce and leadership teams, recognizing that both

aspects support enhanced organizational decision-making. Thematically, diversity and inclusion falls under the social focus of ESG. The

work itself is done cross functionally over multiple teams including throughout our People Department and managed by a dedicated

ESG crewleader. We have ongoing programs to encourage a diverse talent pipeline specifically for technical roles, like pilots.

We are taking measured and organic steps toward

building a leadership pipeline that is reflective of our crewmember and customer base. This also includes our Board of Directors.

New guidelines include limits on tenure and an age-based retirement threshold. In 2019, we made changes to the Board that bring

new perspectives and diversity (in age, background, as well as visual diversity). We have improved gender diversity on the board.

The Board in May, assuming all nominees are elected/reelected, will have four female directors out of ten directors. We have also

increased age diversity with 2 directors in their 40s. The average Board tenure is 9 years as of March, 2020.

This and other ESG topics will be covered in

our 2019 annual SASB and TCFD report.

Corporate Social Responsibility

General JetBlue For Good/CSR

JetBlue For Good is JetBlue’s platform

for social impact and corporate responsibility. Giving back is part of JetBlue’s DNA and is core to its mission of inspiring

humanity. Centered around volunteerism and service, JetBlue For Good focuses on the areas that are most important to the airline’s

customers and crewmembers - community, youth/education and the environment. Combining JetBlue’s corporate efforts with its

customers’ and crewmembers’ passions, the common theme is Good – JetBlue For Good.

CSR – Youth/Education & Community-focused

JetBlue’s core programs and partnerships

directly impact the areas where its customers and crewmembers live and work by enhancing education and providing access to those

that are traditionally underserved. Signature programs include the award-winning Soar with Reading initiative which has provided

more than $3.75 million worth of books to date to kids who need them most; Blue Horizons For Autism which helps introduce air travel

in a realistic environment to families and children affected by autism; and Swing For Good which raises funds for education and

youth focused non-profits. The below graphic speaks to our CSR initiatives since our inception or since the date as indicated.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 13

Political Contributions

Recognizing the interest of stockholders in

establishing greater transparency about corporate political contributions, we disclose any political contributions to support

candidates and ballot measures and how certain of our trade association membership dues are used for political activities in our

annual SASB and TCFD reporting. As part of our commitment to transparency, we developed the Political Contributions Policy, which

discusses how we engage in the political process. The policy is available at on the investor relations page of www.JetBlue.com.

Human Trafficking

The issue of human trafficking is one that hits

close to home in our industry. Victims of this crime are often hidden in plain sight, including on aircraft and in airports. We

work with the U.S. Department of Homeland Security and the U.S. Department of Transportation to support the Blue Lightning initiative,

an initiative aimed at stopping human trafficking. We educate our crewmembers on the issue and how to report suspicious activities.

We established a cross-team working group to assess what additional policies and practices we can use to help combat this problem.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 14

CORPORATE GOVERNANCE AT JETBLUE

JetBlue’s mission is to Inspire Humanity.

We strongly believe that strong corporate governance that is informed by engagement directly with our stakeholders creates the

foundation that allows us to pursue our mission. Corporate governance at JetBlue is designed to promote the long-term interests

of our stockholders, maintain internal checks and balances, strengthen management accountability, and foster responsible decision

making and accountability.

Corporate Governance

The Board of Directors Provides Operational and Strategic

Oversight

The Board oversees management, business affairs

and integrity, works with management to determine the Company’s mission and long-term strategy, oversees risk management,

performs the annual CEO evaluation, oversees CEO succession planning, and oversees internal control over financial reporting

and external audit. In addition, Board committees focus on the following:

|

Audit

|

|

Financial reporting; internal and external audit; cybersecurity, including in support of the Board’s role in risk oversight of cybersecurity risks; certain other risks not otherwise assigned; certain legal, regulatory, compliance and business continuity matters

|

|

Compensation

|

|

Compensation and benefits; succession planning at the officer level, including with the Governance and Nominating Committee

|

|

Governance and Nominating

|

|

Board effectiveness, director qualifications, on boarding and continuing education of directors, political contribution and PAC matters, shareholder engagement, governance framework

|

|

ESG Subcommittee

|

|

Environmental and sustainability initiatives, social and governance issues, including diversity and inclusion

|

|

Airline Safety

|

|

Monitor promotion of operational safety culture, flight operations safety and overview of aspects of airline safety

|

|

Finance

|

|

Oversight of the Company’s financial condition, financing activities, capital plan, budget and related activities

|

Management Drives Our Strategy and Operations

Led by the CEO, the senior leadership team

is responsible for achieving our mission, establishing and delivering on our strategy, maintaining and inspiring our culture

and crewmembers, inspiring and creating innovative and disruptive products, establishing accountability, and controlling

risk. The senior leadership team also aligns our structure, operations, people, policies, and compliance efforts to our

mission and strategy. The senior leadership team consists of those leading the operation, the commercial team, as well as

those leading central functions like Finance, Legal and People (which is how we refer to Human Resources). Members of the

senior leadership team appear before the Board regularly, with most attending a Board or committee session each quarter, and

also interact with the directors outside the boardroom.

Representatives from the Company’s Legal

and Government Affairs groups address public policy, regulatory, government affairs, compliance, legal risk, and other issues.

The Company’s internal audit function provides objective audit, investigative, and advisory services aimed at providing assurance

to senior leadership and the Board that the Company is anticipating, identifying, assessing, and prioritizing risks. Our Tax and

Treasury departments report regularly to the Board. Our Infrastructure team, along with others, assists the Board in its governance

of major real estate transactions. Our Board and its committees also work closely with representatives from the Company’s

People department, the Cybersecurity team and the Information Technology department. Members of the Board have access to all of

our crewmembers outside of Board meetings.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 15

The Board of Directors

Board Structure

Our Board has determined that it is in the

best interests of the Company and its stockholders to maintain a separate Independent Board Chair and Chief Executive

Officer. Mr. Joel Peterson has served as our independent Chair of the Board since 2008 and will not be standing for

re-election at the upcoming Annual Meeting of Stockholders. The Board has selected Mr. Peter Boneparth to assume the

independent Chair of the Board position after our Annual Meeting of Stockholders in May 2020. Our Board believes that our

current structure, with an independent Chair, who is well-versed in the needs of a complex business and has strong,

well-defined governance duties, gives our Board a strong independent leadership and corporate governance structure that best

serves the needs of JetBlue and its stockholders. In our independent Chair, our CEO has a counterpart who can be a thought

partner. We believe this corporate structure also permits the Board of Directors to have a healthy dynamic that enables its

members to function to the best of their abilities, individually and as a unit. The Board expects to continue to evaluate its

leadership structure on an ongoing basis and may make changes as appropriate to JetBlue and its future needs. Our Board

believes its leadership structure is appropriate because it effectively allocates authority, responsibility, and oversight

between management and the independent members of our Board.

|

Independent Chairman of the Board

|

|

Independent Board

|

|

Key responsibilities of the Chair

include:

■

Calling meetings of the Board and executive sessions with independent directors

■

Setting the agenda for Board meetings in consultation with other directors,

the CEO, and the corporate secretary

■

Chairing executive sessions of the independent directors

■

Working with the Chairs of the Compensation Committee and the Governance and Nominating Committee with regard to the annual

CEO performance evaluation

■

Working with the Governance and Nominating Committee to (1) oversee assessments of the Board and its committees and (2) recommend

changes to enhance Board, committee and director effectiveness

■

Engaging with stockholders

■

Acting as an advisor to Mr. Hayes on strategic aspects of the CEO role

with regular consultations on major developments and decisions likely to be of interest to the Board

■

Performing the other duties specified in the Corporate Governance Guidelines

or assigned by the Board

■

Setting and maintaining Board culture

|

|

■

9 of 10 director nominees

are independent – We are committed to maintaining a substantial

majority of directors who are independent of the Company and management.

Except for our CEO Robin Hayes, all directors are independent.

■

Quarterly executive sessions of independent directors – At each

quarterly Board meeting, the independent directors meet in executive session without Company management present. Additional

executive sessions are held as needed.

■

Strategy – The Independent directors meet in executive session

at the annual strategy session.

■

Independent compensation consultant – The compensation consultant

retained by the Compensation Committee is independent of the Company and management.

|

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 16

Board Composition

Ensuring the Board is composed of directors who

bring diverse viewpoints and perspectives, exhibit a variety of skills, professional experience and backgrounds, and effectively

represent the long-term interests of stockholders, is a top priority of the Board and the Governance and Nominating Committee.

The Board and the Governance and Nominating Committee believe that different perspectives are critical to a forward-looking and

strategic Board as is the ability to benefit from the valuable experience and familiarity that longer-serving directors bring.

When recommending to the Board the slate of director nominees for election at the Annual Meeting of Stockholders, the Governance

and Nominating Committee strives to maintain an appropriate balance of diversity, skills, and tenure on the Board. The below tables

reflect our Board nominees for election.

Board Structure: Committees

To support effective corporate governance, the

Board delegates certain responsibilities to its committees, who report on their activities to the Board.

|

■

|

Five Standing Committees – Our Board has an Audit Committee, a Compensation

Committee, a Governance and Nominating Committee, an Airline Safety Committee and a Finance Committee. Each Committee has

a charter describing its specific responsibilities, which can be found on our investor relations page on our website. The

table below provides current membership for each Board Committee. In 2019, our Board established an ESG subcommittee to the

Governance and Nominating Committee, to address Environmental, Social and Governance issues pertinent to our business.

|

|

|

|

|

■

|

Committees are Independent – Our Governance Committees (Audit, Compensation

and Governance and Nominating) and our Finance Committee are staffed by independent directors. Our CEO serves on the Airline

Safety Committee.

|

|

|

|

|

■

|

Regular Committee Executive Sessions of Independent Directors – Members

of the Audit, Compensation and Governance and Nominating Committees regularly meet in executive session.

|

|

|

|

|

■

|

Committees have authority to engage legal counsel or other advisors or consultants –

Each committee can retain advisors or consultants as it deems appropriate to carry out its responsibilities.

|

|

|

|

|

■

|

Independent compensation consultant – The

Compensation Committee retains Pay Governance LLC (“Pay Governance”)

|

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 17

|

|

to advise the Committee on marketplace trends in executive compensation,

management proposals for compensation programs, and executive officer compensation decisions. Pay Governance also evaluates compensation

for non-employee directors, the next levels of senior management, and equity compensation programs generally. Pay Governance

consults with the Committee about its recommendations to the Board on chief executive officer compensation. Pay Governance is

directly accountable to the Committee. To maintain the independence of the firm’s advice, Pay Governance does not provide

any services for JetBlue other than those described above.

|

|

■

|

The Compensation Committee consultant maintains its independence –

Annually, the Compensation Committee assesses the independence of its compensation consultant. A consultant satisfying

the following requirements will be considered independent. The consultant (including each individual employee of the consultant

providing services):

|

|

|

–

|

Is retained and terminated by, has its compensation fixed

by, and reports solely to, the Compensation Committee

|

|

|

–

|

Is independent of the Company

|

|

|

–

|

Maintains and adheres to the Pay Governance independence policy to

prevent conflicts of interest

|

|

|

–

|

Does not directly own JetBlue common stock

|

|

|

–

|

Will not perform any work for Company management except at the request

of the Compensation Committee Chair and in the capacity of the Compensation Committee’s agent

|

|

|

–

|

Does not provide any unrelated services or products to the Company,

its affiliates, or management, except for surveys purchased from the consultant firm

|

|

|

–

|

Do not have any business or personal relationship with a Committee

member or with an executive officer of JetBlue

|

|

|

–

|

In 2019, the fees received for the JetBlue engagement were less

than 1% of PG’s annual revenues

|

In assessing the consultant’s independence,

the Compensation Committee also considers the nature and amount of work performed for the Compensation Committee during the year,

the nature of any unrelated services performed by the consultant for the Company, and the fees paid for those services in relation

to the firm’s total revenues. Every year, the consultant prepares for the Compensation Committee an independence letter providing

assurances and confirmation of the consultant’s independent status under the noted standards. The Compensation Committee

believes that Pay Governance has been independent during its engagement as a consultant to the Compensation Committee.

|

■

|

Audit Committee Financial Experts – The Board

has determined that each Audit Committee member has sufficient knowledge in financial and auditing matters to serve on the

Audit Committee. The members of the Audit Committee meet the Nasdaq Stock Market (“Nasdaq”) listing standard of

financial sophistication and a majority are “audit committee financial experts” under SEC rules (Ms. Gambale, Ms.

Jewett and Messrs. Baldanza and Boneparth).

|

Responsibilities

|

AUDIT

|

|

|

Members*:

Ben Baldanza

Peter Boneparth (Chair)

Virginia Gambale

Ellen Jewett

Teri McClure

Sarah Robb O’Hagan

Vivek Sharma

Meetings held in 2019: 9

|

Pursuant to its charter, on behalf of the Board of Directors, the Audit Committee oversees:

■ the integrity of our financial statements,

■ the appointment, compensation, qualifications, independence and performance of our independent registered

public accounting firm,

■ compliance with ethics policies and legal and regulatory requirements,

■ the performance of our internal audit function,

■ our financial reporting process and systems of internal accounting and financial controls and

■ other items including risk assessment and compliance.

The Audit Committee is also responsible for review and approval of any related party transactions

required to be disclosed pursuant to Item 404(a) of Regulation S-K. The responsibilities and activities of the Audit Committee

are further described in “Report of the Audit Committee” and the Audit Committee charter.

Each member is an independent director within the meaning of the applicable rules and regulations

of the SEC and Nasdaq. The Board has determined that each member of the Audit Committee is financially literate within

the meaning of the Nasdaq listing standards. In addition, the Board of Directors determined that Mr.

Boneparth, Ms. Gambale, Ms. Jewett and Mr. Baldanza each is an “audit committee financial expert” as

defined under applicable SEC rules. The Audit Committee meets a minimum of four times a year, and holds such additional

meetings as it deems necessary to perform its responsibilities. A report of the Audit Committee is set forth elsewhere

in this proxy statement.

At the 2020 Annual Meeting, Mr. Boneparth will assume the position of Board Chair. Mr. Baldanza will

serve as Chair of the Audit Committee and we anticipate the Audit Committee will consist of Virginia Gambale, Ellen Jewett,

Robert Leduc and Vivek Sharma.

The Audit Committee operates under a written charter, which was adopted by the Board and is available

on our website at http://investor.jetblue.com.

|

* Memberships as of December 31,

2019.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 18

|

COMPENSATION

|

|

|

Members*:

Virginia Gambale (Chair)

Stephan Gemkow

Sarah Robb O’Hagan

Thomas Winkelmann

Meetings held in 2019: 9

|

The Compensation Committee:

■ determines our compensation policies and the level and forms of compensation provided to our Board

members and executive officers (as discussed more fully under “Compensation Discussion and Analysis” beginning

on page 28 of this proxy statement),

■ evaluates the performance of named executive officers, including the CEO, CFO, President and COO,

GC and Corporate Secretary,

■ reviews and recommends to the Board compensation for our non-employee directors,

■ reviews and approves stock-based compensation for our directors, officers and crewmembers,

■ oversees the administration of our Amended and Restated 2011 Incentive Compensation Plan, and Amended

and Restated 2011 Crewmember Stock Purchase Plan (and successor plans), and

■ prepares and recommends to the full Board for inclusion in this proxy statement a Compensation Committee

report. The Compensation Committee report for this proxy statement is on page XX.

The Compensation Committee is authorized to retain and terminate compensation consultants, legal

counsel or other advisors to the Committee and to approve the engagement of any such consultant, counsel or advisor, to

the extent it deems necessary or appropriate after specifically analyzing the independence of any such consultant retained

by the Committee. Each member is an independent director within the meaning of the applicable Nasdaq rules, including

the enhanced independence requirements applicable to members of compensation committees. The Compensation Committee meets

a minimum of four times a year, and holds such additional meetings as it deems necessary to perform its responsibilities.

A report of the Compensation Committee is set forth elsewhere in this proxy statement.

At the 2020 Annual Meeting, assuming all director nominees are (re) elected, we anticipate the Compensation

Committee will consist of Virginia Gambale (Chair), Teri McClure, Sarah Robb O’Hagan and Thomas Winkelmann.

The charter of the Compensation Committee is available on our website at http://investor.jetblue.com.

|

|

GOVERNANCE AND NOMINATING

|

|

Members*:

Ellen Jewett (Chair)

Joel Peterson

Frank Sica

Thomas Winkelmann

Meetings held in 2019: 4

|

The Governance and Nominating Committee is responsible for:

■ developing our corporate governance policies and procedures, and for recommending those policies

and procedures to the Board for adoption,

■ making recommendations to the Board regarding the size, structure and functions of the Board and

its committees, identifying and recommending new director nominees in accordance with selection criteria established by

the Board.

■ conducting the annual evaluation of the performance of the Board, its committees and each director,

ensuring that the Audit, Compensation, and Governance and Nominating Committees of the Board and all other Board committees

are comprised of qualified directors, developing and recommending a succession plan for the CEO, and

■ developing and recommending corporate governance policies and procedures appropriate to the Company.

Each member is an independent director within the meaning of the applicable Nasdaq rules. The Governance

and Nominating Committee meets a minimum of four times a year, and holds such additional meetings as it deems necessary

to perform its responsibilities.

At the 2020 Annual Meeting, Messrs. Peterson and Sica will be stepping down from the Board. Assuming

all director nominees are (re) elected, we anticipate the Governance and Nominating Committee will consist of Ellen Jewett

(Chair), Peter Boneparth, Teri McClure and Thomas Winkelmann.

The charter of the Governance and Nominating Committee is available on our website at http://investor.jetblue.com.

|

* Memberships as of December 31,

2019.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 19

|

AIRLINE SAFETY

|

|

|

Members*:

Ben Baldanza

Robin Hayes

Frank Sica

Thomas Winkelmann (Chair)

Meetings held in 2019: 4

|

The Airline Safety Committee is responsible for:

■ monitoring and review of our flight operations and safety management system and reports to the Board

on such topics.

The Airline Safety Committee meets a minimum of four times a year, and holds such additional meetings

as it deems necessary to perform its responsibilities.

At the 2020 Annual Meeting, Mr. Frank Sica will be stepping down from the Board. Assuming all director

nominees are (re) elected, we anticipate the Airline Safety Committee will consist of Thomas Winkelmann (Chair), Ben Baldanza,

Robert Leduc and Robin Hayes.

The charter of the Airline Safety Committee is available on our website at http://investor.jetblue.com.

|

|

FINANCE

|

|

|

Members*:

Ben Baldanza

Peter Boneparth

Stephan Gemkow

Ellen Jewett

Frank Sica (Chair)

Meetings

held in 2019: 7

|

The Finance Committee is responsible for:

■ providing management with advice and counsel regarding the Company’s financial condition, financing

activities, capital plan and budget and related matters.

Established in 2018, the Finance Committee views itself as a consultative resource for management,

and it is currently uncompensated.

At the 2020 Annual Meeting, Mr. Frank Sica will be stepping down from the Board. Assuming all director

nominees are (re) elected, we anticipate the Finance Committee will consist of Ben Baldanza, Peter Boneparth (Chair) and

Ellen Jewett.

The charter of the Finance Committee is available on our website at http://investor.jetblue.com.

|

* Memberships as of December 31,

2019.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 20

Compensation Committee Interlocks and Insider Participation

None of the current members of

our Compensation Committee (whose names appear under “— Report of the Compensation Committee”) is, or has

ever been, an officer or employee of the Company or any of its subsidiaries. In addition, during the last fiscal year,

no executive officer of the Company served as a member of the Board or the compensation committee of any other entity that

has one or more executive officers serving on our Board or our Compensation Committee.

Board Oversight

Stockholders elect the Board to oversee management

and to serve stockholders’ long-term interests. Management is responsible for achieving our mission, delivering on our strategy,

creating our culture, inspiring and creating innovative products, establishing accountability, and controlling risk. The Board

and its committees work closely with management to balance and align strategy, risk, ESG, and other areas while considering feedback

from stakeholders. Essential to the Board’s oversight role is a transparent and active dialogue between the Board and its

committees, and management. To support that dialogue, the Board and its committees have access to, receive presentations from,

and conduct regular meetings with the Senior Leadership Team, other business and function leaders, subject matter experts, the

Company’s enterprise risk management and internal audit functions, and external experts and advisors.

Through oversight, review, and counsel, our Board

works with management to establish and promote business goals, organizational objectives, and a strategy that is mindful of how

our business affects and is affected by the broader environment.

Board Oversight of Strategy

One of the Board’s primary responsibilities

is overseeing management’s establishment and execution of the Company’s strategy. As JetBlue looks to innovate along

the travel ribbon, the Board works with management to respond to a dynamically changing environment. At least quarterly, the CEO,

the Senior Leadership Team, and leaders from across JetBlue provide detailed business and strategy updates to the Board. At least

annually, the Board conducts an even more in-depth review of the Company’s overall strategy. At all of these reviews, the

Board engages with the Senior Leadership Team and other business leaders regarding business objectives, technology updates, the

competitive landscape, economic trends, and public policy and regulatory developments. At meetings occurring throughout the year,

the Board also assesses the competitive landscape, the Company’s budget and capital plan, and performance for alignment to

our strategy. The Board looks to the focused expertise of its committees to inform strategic oversight in their areas of focus.

Board Oversight of Risk

Our Board oversees the management of risk inherent in the operation

of the Company’s businesses and the implementation of its strategic plan by relying on several different levels of review.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 21

In connection with its reviews of the

operations of the Company’s business and corporate functions, the Board addresses the primary risks associated with

those business and corporate functions. In addition, the Board reviews the risks associated with the Company’s

strategic plan at an annual strategic planning session and periodically throughout the year as part of its consideration of

the strategic direction of the Company. The Board also reviews certain entity level type

risks, including cybersecurity.

The Board appreciates the rapidly evolving nature of threats presented by cybersecurity incidents

and is committed to the prevention, timely detection, and mitigation of the effects of any such incidents on the Company. With

respect to cybersecurity, the Board receives regular reports from Company management, including updates on the internal and external

cybersecurity threat landscape, incident response, assessment and training activities, and relevant legislative, regulatory, and

technical developments.

Each of the Board’s committees oversees

the management of Company risks that fall within that committee’s areas of responsibility. In performing this function, each

committee has full access to management, as well as the ability to engage advisors. In addition, the Board monitors the ways in

which the Company attempts to prudently mitigate risks, to the extent reasonably practicable and consistent with the Company’s

long-term strategy.

The Audit Committee oversees the operation of

the Company’s ethics and compliance program. The Audit Committee oversees the operation of the Company’s enterprise

risk management program, including the identification of the primary risks to the Company’s business, such as financial,

operational, privacy, cybersecurity, business continuity, legal and regulatory, and reputational risks, and reviews the steps

management has taken to monitor and control these exposures. It also periodically monitors and evaluates the primary risks associated

with particular business units and functions. The Audit Committee may, in its business judgment, escalate certain risks to the

Board as a whole. The Company’s Corporate Audit team assists management in identifying, evaluating and implementing risk

management controls and methodologies to address identified risks. In connection with its risk management role, at each of its

meetings the Audit Committee meets privately with representatives from the Company’s independent registered public accounting

firm, the head of Corporate Audit and may meet with other members of management. The Audit Committee provides reports to the Board

which describe these activities and related conclusions.

Management reviews the compensation practices

and programs annually to determine if they present a risk to materially adversely affect the Company and presents the review annually

to the Compensation Committee. We believe that for the substantial majority of our crewmembers the incentive for risk taking is

low, because their compensation consists largely of fixed cash salary and a cash bonus that has a capped payout. Furthermore, the

majority of these crewmembers do not have the authority to take action on our behalf that could expose us to significant business

risks.

Compensation Risk Analysis

In early 2020, the Compensation Committee reviewed

the 2019 cash and equity incentive programs for senior executives and concluded that certain aspects of the programs actually reduce

the likelihood of excessive risk taking. These aspects include (i) the use of long-term equity awards to create incentives for

senior executives to promote long-term growth of the Company, (ii) clawback policy, (iii) limiting the incentive to take excessive

risk for short-term gains by imposing caps on annual cash incentive awards, and (iv) vesting the Compensation Committee with authority

to exercise discretion to reduce payouts under our annual cash incentive awards program.

For these reasons, we believe that our compensation

policies and practices do not create risks that are reasonably likely to have a material adverse effect on us.

Stockholder Interests

Stock Retention and Ownership Guidelines

Our directors hold their equity

compensation until their retirement or separation from our Board. For 2019, our executives had the following holding

requirements: 6x base salary for our CEO and 2x base salary for our senior executives. The policy has post-tax vesting

holding requirements to provide executives with some liquidity options while they are on track to meet the guidelines. As of

December 2019, each of Mr. Hayes, Ms. Geraghty, Mr. Priest and Mr. Sundaram met or exceeded our stock ownership

guidelines, including common stock, and unvested restricted stock units but excluding unvested performance stock units and

vested underwater stock options. As Mr. Nelson is new to his role, he is making progress towards achieving the ownership

guidelines, in accordance with our policy. We anticipate periodically reviewing, and may revise our executive stock ownership

guidelines from time to time.

Director Stock Ownership Policy Aligns Interests

with Stockholders

We believe that directors should have a significant

financial stake in JetBlue. In 2019, all director stock units, once vested, are deferred until the director’s departure from

JetBlue. These director stock units are settled as common stock six months following a director’s separation from the Board.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 22

Compensation Clawback

Our Board adopted a policy, often referred

to as a clawback policy, which requires reimbursement of all or a portion of any bonus, incentive payment, or equity-based

award granted to or received by any executive officer and certain other officers after January 1, 2010 where: (a) the payment

was predicated upon the achievement of certain financial results that were subsequently the subject of a restatement, (b) in

the Board’s view the executive engaged in willful misconduct that caused or partially caused the need for the

restatement, and (c) a lower payment would have been made to the executive based upon the restated financial results.

Hedging Practices

Our Insider trading policy prohibits hedging

and pledging of our securities by insiders.

We Have Advanced Stockholder Rights

Majority Voting

In an uncontested election, directors are elected

by the majority of votes cast.

Pursuant to our Bylaws, the Board will not

nominate for election as director any nominee who has not agreed to tender, promptly following the annual meeting at which he

or she is elected as director, an irrevocable resignation that will be effective upon the failure to receive the required

number of votes for reelection at the next annual meeting of stockholders at which he or she faces reelection and acceptance

of such resignation by the Board of Directors. If a nominee fails to receive the required number of votes for reelection, the

Board (excluding the director in question) may either accept such director’s resignation or disclose its reasons for

not doing so in a report filed with the SEC within 90 days of the certification of election results.

Annual Elections

All directors are elected annually. JetBlue does

not have a classified board.

Proxy Access

We have a “Proxy Access” bylaw that permits eligible stockholders

to nominate candidates for election to the JetBlue Board. To be eligible to nominate candidates to be included in the Company’s

proxy statement and ballot, stockholders must meet certain requirements.

PROXY ACCESS

Stockholders holding at least

3% of our common stock

held by up to 20 stockholders

Holding the shares continuously for at least

3 years

Can nominate the greater of two candidates or

20% of the Board

whichever is greater, for election at an annual

stockholders meeting if such nominating

stockholder(s) and nominee(s) satisfy the requirements set forth in our Bylaws

Right to Call a Special Meeting

Our Board has directed that we submit to our

stockholders a proposal to amend our certificate of incorporation to permit stockholders the right to call a special meeting. If

the proposal is approved by our stockholders, we will amend our certificate of incorporation and the corresponding bylaw provisions

and the change will become effective.

Right to Act by Written Consent

Following a vote at our 2019 Annual Meeting,

our Board directed that we submit to our stockholders a proposal to amend our certificate of incorporation to permit stockholders

to act by written consent. If the proposal is approved by our stockholders, we will amend our certificate of incorporation and

the corresponding bylaw provisions and the change will become effective.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 23

Director Onboarding and Education

Directors Receive Robust Orientation and Continuing

Education Resources

|

■

|

Director orientation – Our

enhanced and revised director orientation program familiarizes new directors with JetBlue’s business, operations, strategies

and policies, and assists them in developing company and industry knowledge to optimize their service on the Board. As we

add new Board members, we continue to solicit our Board members’ post-orientation feedback to improve our director orientation

program.

|

|

|

|

|

|

The enhanced orientation process includes directors going to our orientation classes for new

crewmembers and “shadowing” certain operational leaders to help them appreciate the industry’s

complexities. The Board works with management on an ongoing basis to continue to enhance the orientation program with

feedback solicited as directors go through the orientation program.

|

|

|

|

|

■

|

Continuing education – We provide

our directors with educational opportunities to enhance the skills and knowledge they use to perform their responsibilities,

including a membership with the National Association of Corporate Directors (“NACD”). These programs may include

internally developed materials and presentations, programs presented by third parties, and financial and administrative support

to attend qualifying academic or other independent programs.

|

Evaluation Components – Board, Committees,

Directors

Under the leadership of the Committee Chair,

the Governance and Nominating Committee oversees the Board’s annual evaluation process focused on three components: (1) the

Board, (2) Board committees and (3) individual directors. In addition, the Governance and Nominating Committee regularly discusses

Board composition and effectiveness during its committee meetings.

In 2019, to enhance its processes, the Board

performed its own self evaluation, involving individual interviews and feedback provided to the General Counsel for the Board.

The General Counsel provided the Board with themes and feedback, for the Board to discuss and to consider in the future. This process

generated comments and discussion at all levels of the Board, including with respect to Board composition and processes.

Our Corporate Governance Framework

Our governance framework is designed to ensure

our Board has the necessary skills, expertise, authority and practices in place to review and evaluate management and our business

operations in an independent manner. Our goal is to align the interests of directors, management, stockholders and our other stakeholders,

and comply with or exceed the requirements of Nasdaq and applicable law and implement best practices. This framework establishes

the practices our Board follows with respect to, among other things, Board composition and director nomination, Board meetings

and involvement of senior management, director compensation, CEO performance evaluation, management succession planning, and Board

committees.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 24

|

Our Corporate Governance Documents

|

|

|

Amended and Restated Articles of Incorporation

|

Audit Committee Charter

|

|

Amended and Restated Bylaws

|

Compensation Committee Charter

|

|

Corporate Governance Guidelines

|

Governance and Nominating Committee Charter

|

|

JetBlue Code of Conduct

|

Airline Safety Committee Charter

|

|

JetBlue Business Partner Code of Conduct

|

Finance Committee Charter

|

|

JetBlue Code of Ethics

|

ESG Subcommittee Charter

|

How to Communicate with Our Board

Stockholders may communicate with our Board

by sending correspondence to the JetBlue Board of Directors, c/o Corporate Secretary, JetBlue Airways Corporation, 27-01

Queens Plaza North, Long Island City, New York 11101. The name of any specific intended director should be noted in

the correspondence. Our Corporate Secretary will forward such correspondence to the intended recipient or as directed by

such correspondence; however, our Corporate Secretary, prior to forwarding any correspondence, has the authority to disregard

any communications he deems to be inappropriate, or to take any other appropriate actions with respect to such

inappropriate communication.

The Governance and Nominating Committee approved

procedures with respect to the receipt, review and processing of, and any response to, written communications sent by stockholders

and other interested persons to our Board, as set forth in our Governance Guidelines.

Any interested party, including any JetBlue crewmember,

may make confidential, anonymous submissions regarding questionable accounting or auditing matters or internal accounting controls

and may communicate directly with the Chair of the Board by letter to the above address, marked for the attention of the Chair.

Any written communication regarding accounting, internal accounting controls or other financial matters are processed in accordance

with procedures adopted by the Audit Committee.

Additionally, based on past experience, we believe

that the virtual format of the annual meeting will continue to expand Board outreach to stockholders by allowing stockholders from

any location to ask questions of our leaders and directors present at the meeting.

JETBLUE AIRWAYS CORPORATION | 2020 PROXY

STATEMENT 25

THE BOARD OF DIRECTORS

Director Nominee Selection Process

The Governance and Nominating Committee is responsible

for recommending to the Board a slate of nominees for election at each Annual Meeting of Stockholders. In 2019, the Governance