U.S. Airlines Face Test as Epidemic Spreads

March 02 2020 - 9:26AM

Dow Jones News

By Alison Sider

U.S. airlines retooled their businesses over the past decade in

ways they said would generate profits even during an economic

shock.

The coronavirus epidemic rippling around the world is providing

the biggest test yet of those efforts.

The biggest operational impact for U.S. carriers has been mass

cancellations into April of flights to and from Asia. American

Airlines Group Inc. and Delta Air Lines Inc. suspended flights to

Milan after the U.S. State Department issued its highest-level

warning against travel there on Saturday.

Now there are mounting signs of softening travel demand in the

U.S., as people skip trips and businesses instruct employees to

stay put. American Airlines, JetBlue Airways Corp. and Alaska Air

Group Inc. have all suspended flight-change and cancellation fees

to accommodate travelers who may be anxious about making firm plans

amid uncertainty about the outbreak.

Pete Erickson, whose company organizes events for big tech

companies, said some employees had backed away from plans to attend

a staff meeting on Monday in Washington DC. "They don't want to get

on a plane -- domestically," Mr. Erickson said. The company decided

not to hold the meeting in-person, and on Sunday told everyone to

stay put.

The financial toll from the epidemic is already expected to far

surpass the $7 billion sales hit to the global airline industry

during the SARS outbreak in 2003. Some analysts have estimated $100

billion in lost revenue to airlines and related industries if

traffic growth that was already slowing turns negative for the

first time in a decade.

"I've never seen anything like this -- it's unprecedented," said

John Grant, an analyst at OAG, which publishes airline schedules

and data.

Hunter Keay at Wolfe Research LLC on Friday cut his 2019 profit

forecast for U.S. airlines by 23% despite a tailwind from lower

fuel prices, which have fallen by a fifth since the start of the

year. U.S. carriers have reported annual profits in each of the

last 10 years -- a record streak for an industry long been

characterized by booms and busts.

The NYSE Arca Airline Index fell 23% last week, outpacing the

broader market's 11.5% decline. Airlines with a lot of debt and

more exposure to international routes have fallen even more. Shares

in American Airlines Group., for instance, dropped 31.5% last week,

making the airline the worst performer in the S&P 500.

United Airlines Holdings Inc., the biggest U.S. carrier on

trans-Pacific routes, has cut back on flying to parts of Asia. The

airline postponed an investor day scheduled in New York this week,

saying discussion of the epidemic would have overwhelmed any other

topics. United is postponing training to bring on some new pilots,

and is offering some of its pilots the option to take April off

with partial pay as a result of its diminished flying to Asia.

Carriers have redeployed wide-body jets from Asian routes into

the domestic market. That could put pressure on fares as they offer

discounts to fill the bigger planes, analysts said.

Airline executives have told investors for years that they have

fortified their businesses against economic downturns by taking

steps like bolstering credit-card partnerships that encourage

customer loyalty and bring in revenue even when consumers cut back

on travel, as well as segmenting their most price-sensitive

customers in basic economy.

Delta Chief Executive Ed Bastian said last year that the airline

has more tools available to manage periods of weak demand, and has

focused on strengthening its balance sheet.

"We spent years doing that in an effort to, as I frequently say,

study for this final exam that is a recession, whenever it might

happen," he said.

Travel-agency ticket sales for domestic trips declined 1.3% in

dollar terms last week from a year ago. That drop wasn't as steep

as the 16% drop for international sales, but it reversed weeks of

annual growth, according to data analyzed by Vertical Research

Partners analyst Darryl Genovesi. Those figures don't include

tickets that airlines sell through their own websites.

Some executives are concerned the epidemic could affect the peak

travel season this summer.

Willie Walsh, CEO of British Airways' parent International

Consolidated Airlines Group SA, said last week that summer bookings

started deviating from expected levels on Feb. 24. Mr. Walsh said

airlines' response to this crisis would differ from the SARS

outbreak and the 2008 recession, when carriers made big capacity

cuts that left them struggling to catch up when demand

returned.

"We're not going to repeat the mistakes we made," he said.

Doug Cameron and Sebastian Herrera contributed to this

article.

Write to Alison Sider at alison.sider@wsj.com

(END) Dow Jones Newswires

March 02, 2020 09:11 ET (14:11 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

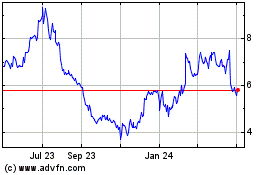

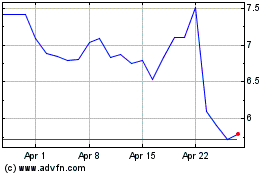

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Mar 2024 to Apr 2024

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Apr 2023 to Apr 2024