Current Report Filing (8-k)

September 29 2021 - 4:29PM

Edgar (US Regulatory)

0001696558

false

0001696558

2021-09-29

2021-09-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 29, 2021

Jerash Holdings (US), Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-38474

|

|

81-4701719

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

277 Fairfield Road, Suite 338, Fairfield, NJ

|

|

07004

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (214) 906-0065

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common stock, par value $0.001 per share

|

|

JRSH

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2

of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information included in this Current Report

contains forward-looking statements about Jerash Holdings (US), Inc., a Delaware corporation (the “Company”), that involve

substantial risks and uncertainties. The Company intends such statements, and all subsequent forward-looking statements attributable to

the Company, to be expressly qualified in their entirety by these cautionary statements and covered by the safe harbor provisions for

forward-looking statements contained in Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Section

27A of the Securities Act of 1933, as amended, or the Securities Act. All statements included in this Current Report, other than statements

of historical fact, are forward-looking statements for purposes of these provisions, including projections of earnings, revenue, or other

financial items, statements of the plans and objectives of our management for future operations or transactions, and statements of assumptions

underlying any of the foregoing. The Company encourages readers of forward-looking information concerning the Company to refer to its

filings with the U.S. Securities and Exchange Commission, including without limitation, its most recent Annual Report on Form 10-K, its

Quarterly Reports on Form 10-Q, and other filings with the U.S. Securities and Exchange Commission that set forth certain risks and uncertainties

that may have an impact on future results and direction of the Company. Such risks and uncertainties may include, but are not limited

to, the risks that the offering of common stock may not close and that the funds raised may not meet the Company’s needs.

All forward-looking statements included in this

Current Report speak only as of the date made, are based on information available to the Company as of such date, and are subject to change.

The Company assumes no obligation to update or revise any forward-looking statement. If the Company does update or correct one or more

forward-looking statements, readers should not conclude that it will make additional updates or corrections. Although the Company believes

that the assumptions and expectations reflected in the forward-looking statements included or incorporated by reference in this Current

Report are reasonable, its actual results will likely differ, and may differ materially, from anticipated results. Readers should not

unduly rely on any such forward-looking statements.

Item 7.01 Regulation FD Disclosure.

On September 29, 2021, the Company announced

the commencement of an underwritten public offering of its common stock, including shares to be offered by a selling stockholder,

Merlotte Enterprise Limited (“Merlotte”), and the Company and Merlotte expect to grant the underwriters a 30-day

option to purchase additional shares of common stock in connection therewith (the “Offering”). A copy of

the press release announcing the commencement of the Offering is attached as Exhibit 99.1 to this Current Report.

In connection with the Offering, the Company has

provided prospective investors with a prospectus supplement containing the following disclosure noting certain recent developments:

Recent Development

Fiscal 2022 Second Quarter Preliminary

Financial Results

The preliminary

financial information included below is subject to completion of our quarter-end close procedures and further financial review. Actual

results may differ from these estimates as a result of the completion of our quarter-end closing procedures, review adjustments, and other

developments that may arise between now and the time such financial information for the period is finalized. As a result, these estimates

are preliminary, may change, and constitute forward-looking information and, as a result, are subject to risks and uncertainties. These

preliminary estimates should not be viewed as a substitute for full interim financial statements prepared in accordance with United States

generally accepted accounting principles, and they should not be viewed as indicative of our results for any future period. Our independent

registered public accountants have not audited, reviewed, compiled, or performed any procedures with respect to these estimated financial

results and, accordingly, do not express an opinion or any other form of assurance with respect to these preliminary estimates.

Our revenue for

the second quarter ending September 30, 2021 is projected to be between $44 million and $46 million with net income between $3.9 million

and $4.1 million.

The information set forth in this Item 7.01 is

intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act, except as

expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

JERASH HOLDINGS (US), INC.

|

|

|

|

|

|

September 29, 2021

|

By:

|

/s/ Choi Lin Hung

|

|

|

|

Choi Lin Hung

|

|

|

|

Chairman of the Board of Directors,

Chief Executive Officer, President, and Treasurer

|

3

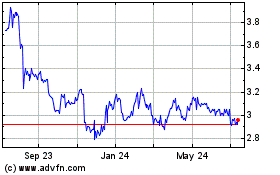

Jerash Holdings US (NASDAQ:JRSH)

Historical Stock Chart

From Mar 2024 to Apr 2024

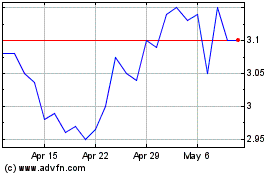

Jerash Holdings US (NASDAQ:JRSH)

Historical Stock Chart

From Apr 2023 to Apr 2024