U.S. Stock Futures Point to Lower Opening After Jobs Report

March 08 2019 - 9:49AM

Dow Jones News

By Will Horner and Shen Hong

U.S. stock futures extended declines, setting major indexes up

for their worst week since December, after data showed hiring

growth slowed significantly in February.

S&P 500 futures were down 0.9% in recent trading, compared

with a 0.5% decline ahead of the latest jobs report from the Labor

Department. Changes in futures don't necessarily reflect moves

after the opening bell.

Friday's data showed U.S. nonfarm payrolls rose a seasonally

adjusted 20,000 in February, missing economists' expectations of

180,000 new jobs and reigniting concerns around the health of the

U.S. economy.

Still, the report wasn't all gloomy. The unemployment rate

ticked down to 3.8% from 4% a month earlier, while wages rose 3.4%

from a year earlier -- the strongest pace since April 2009. The

mixed data likely helped protect stocks against steeper losses,

analysts said, adding that there was some question whether the

government shutdown or a recent major snowstorm contributed to the

weaker-than-expected jobs print.

"You can say this is not consistent with what we've seen from

earnings," said Tony Roth, chief investment officer at Wilmington

Trust.

Major U.S. indexes have been pummeled this week by concerns of

weakening economic growth in Europe and Asia, on top of worries

that a trade deal between the U.S. and China isn't imminent.

Downbeat data from China overnight added to the sense of gloom.

A report Friday showed Chinese exports slid 20.7% in February

from a year earlier -- a much steeper decline than economists had

expected. Imports tumbled 5.2%, also a bigger drop than

expected.

The data pushed shares of Chinese companies lower, with major

indexes suffering their worst day since October. The Shanghai

Composite Index fell 4.4% and its smaller Shenzhen counterpart

dropped 3.8%, their biggest single-day drops in five months.

Elsewhere in the region, Japan's Nikkei Stock Average closed 2%

lower, while South Korea's Kospi lost 1.3%.

Meanwhile, in Europe, plans by the European Central Bank to

deploy additional stimulus helped trigger losses overnight in U.S.

and European stocks, since they suggested policy makers had become

increasingly concerned about the slowdown across the region.

The ECB said Thursday it would hold interest rates months longer

than initially signaled -- at least until the end of 2019 -- and

issued a new batch of cheap long-term loans to banks starting in

September. The central bank also slashed its forecast for gross

domestic product growth for 2019 to 1.1% from 1.7% in December and

cut its inflation projections.

Despite the concerned response from markets, some welcomed the

actions taken by ECB President Mario Draghi as necessary to guard

against a worsening of the global slowdown.

"It seems like Draghi, at least, wanted to be seen as decisive.

Now is better to act, sooner, pre-emptive, rather than later," said

Geoffrey Yu, head of the U.K. investment office of UBS Wealth

Management.

While the ECB's moves showed they were concerned about the

slowdown, their actions should be read as vigilance, rather than

anxiety, he added. "They are erring on the side of caution."

Jim Reid, an analyst at Deutsche Bank, said in a note that

markets interpreted the ECB's stimulus measures as "nowhere near

substantial enough," considering the downward revisions of growth

forecasts.

Investors in Europe were eyeing poor data from Germany that

showed the nation's manufacturing orders plunged 2.6% in January

from December, missing economists' forecasts of 0.5%.

Wall Street closed lower Thursday as growth worries and

lingering questions over the U.S.-China trade dispute weighed on

sentiment. The Dow and S&P 500 both closed down 0.8%.

European investors were taking the cocktail of bad news as a cue

to move back into the safety of government bonds, as the yield on

German bunds fell to 0.058%. The yield on the U.S. benchmark

10-year Treasury note inched up to 2.638% Friday from 2.637% late

Thursday, according to Tradeweb. Yields move inversely to

prices.

Michael Wursthorn contributed to this article.

Write to Shen Hong at hong.shen@wsj.com

(END) Dow Jones Newswires

March 08, 2019 09:34 ET (14:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

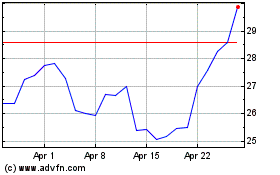

JD com (NASDAQ:JD)

Historical Stock Chart

From Mar 2024 to Apr 2024

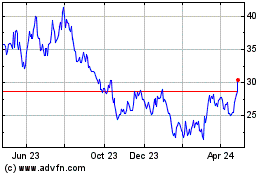

JD com (NASDAQ:JD)

Historical Stock Chart

From Apr 2023 to Apr 2024