By William Watts, MarketWatch , Chris Matthews

U.S. stocks fell modestly Monday as global growth concerns

dogged investors, offsetting a strong rally in Chinese equity

markets, and as investors looked ahead to this week's deluge of

third-quarter earnings reports.

What are major indexes doing?

The Dow Jones Industrial Average fell 67 points, or 0.3%, to

25,371, while S&P 500 was down 9 points, or 0.3% to 2758. The

Nasdaq Composite Index was down 6 points to 7441.

What's driving markets?

Stocks are trying to find direction after bulls and bears fought

each other to a stalemate last week, leaving the benchmark S&P

500 to eke out a weekly rise of less than 0.1%. The tech-heavy

Nasdaq Composite suffered a 0.6% fall for its third straight weekly

decline as once-popular technology shares continued to take a

beating, while the Dow Jones Industrial Average broke a three-week

losing streak with a 0.4% rise.

Increased volatility has left investors nervous in what's been a

rough October. The S&P 500 is down 5% in the month-to-date,

while the Dow is off 3.8% and the Nasdaq has shed 7.4%. That's left

the S&P 500 5.9% off its record high set in late September,

while the Dow is down 5.6% from its early October peak.

Chinese stocks surged for a second day Monday on reassuring

comments by leaders and regulators

(http://www.marketwatch.com/story/big-stock-rally-in-china-bolsters-markets-across-asia-2018-10-21)in

the wake of last week's market rout and disappointing economic

data. The Shanghai closed 4.1% higher, while the smaller Shenzhen

Composite soared more than 5%.

Over the weekend, China President Xi Jinping emphasized China's

support for the private sector, according to the Xinhua News

Agency, following concerted moves Friday by Vice Premier Liu He,

Xi's top economic official, and the head of the central bank and

financial regulators to reassure investors.

Investors will be wading through a flood of earnings this week

as the third-quarter reporting season hits its stride.

What are analysts saying?

Eric Wiegand, senior portfolio manager at U.S. Bank Wealth

Management, told MarketWatch that "we have seen the narrative begin

to shift," to a more cautious one, citing fears over slowing global

growth and whether U.S. companies can maintain their recent strong

earnings growth in the quarters to come.

"Investors are anxious for more information," he said, adding

that while he believes the current backdrop is supportive of

stocks, it will all some down to earnings. "With so many bellwether

names across so many industries reporting this week, things should

get interesting."

U.S.-listed Chinese companies are set to surge out of the gate

this morning, said Joel Kulina, analyst with Wedbush Securities.

It's a "risk on start of the week as investors position

[themselves] ahead of an EPS [earnings per share] ramp," he wrote

in a note to clients.

"Reassurance from the Chinese leadership that they will support

the economy have triggered the biggest one-day increase in equity

indices since 2015 and has given markets everywhere a risk-friendly

bias to start the week," said Kit Juckes, global macro strategist

at Société Générale, in a note.

What stocks are in focus?

Shares of Hasbro Inc.(HAS) were down 5.5% in early morning

action, after the toy maker missed third-quarter profit and revenue

expectations

(http://www.marketwatch.com/story/hasbros-stock-set-for-selloff-after-profit-and-revenue-fall-miss-expectations-2018-10-22)

and announced a restructuring that will cut jobs.

Kimberly-Clark Corp. (KMB) posted lower profits and a management

shuffle

(http://www.marketwatch.com/story/kimberly-clark-names-new-ceo-as-earnings-fall-2018-10-22),

with current COO Michael Hsu taking over as CEO from Thomas Falk,

effective Jan. 1. Despite beating analysts earnings and revenue

estimates, the stock was down 0.6% Monday morning.

Energy services company Halliburton Co.(HAL) on Monday topped

third-quarter profit

(http://www.marketwatch.com/story/halliburton-beats-estimates-despite-weak-demand-2018-10-22)

and revenue estimates, though shares fell 2.2%

Shares of Chinese e-retailer JD.com, Inc. (JD) surged in

premarket trading, after a strong showing on Chinese markets

Monday. The stock is up 4% in early morning trading.

Another beneficiary of the Chinese rally was Ctrip.com

International, Ltd. (CTRP), China's largest online travel agency.

Shares in the company rose 3.4% Monday morning.

Shares of American Railcar Industries Inc.(ARII) soared more

than 50% after it announced a deal that would see it acquired by a

fund managed by investment firm ITE Managment L.P. Under the terms

of the deal, valued at $1.75 billion, ITE will pay $70 for each

share of the company

(http://www.marketwatch.com/story/american-railcar-to-by-bought-in-a-175-billion-deal-by-ite-giving-icahn-a-757-million-profit-2018-10-22),

51% above Friday's closing price of $46.29. Billionaire activist

investor Carl Icahn's Icahn Enterprises L.P. (IEP) is the majority

owner of American Railcar, with 11.9 million shares, or 62.2% of

the shares outstanding, according to FactSet data.

What data are in store?

In a light day on the economic calendar, the Chicago Fed

National Activity Index decreased to +0.17 in September from +0.27

in August.

How are other markets trading?

The Shanghai Composite Index closed 4.1% higher

(http://www.marketwatch.com/story/big-stock-rally-in-china-bolsters-markets-across-asia-2018-10-21),

it's best day in more than 2 years, according to FactSet, while the

smaller Shenzhen Composite soared more than 5%.

European stock markets rose modestly

(http://www.marketwatch.com/story/europe-picks-up-on-global-gains-with-italian-stocks-in-the-lead-2018-10-22),

with the Stoxx Europe up 0.1% during trading Monday. In London, the

FTSE was also up

(http://www.marketwatch.com/story/banks-miners-led-the-way-higher-for-ftse-100-2018-10-22),

0.5%.

Oil futures fell slightly Monday

(http://www.marketwatch.com/story/oil-pauses-for-direction-as-traders-monitor-us-saudi-tensions-2018-10-22),

while gold prices dropped 0.6%. The U.S. dollar rose

moderately.

(END) Dow Jones Newswires

October 22, 2018 10:18 ET (14:18 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

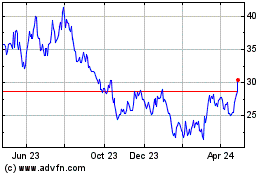

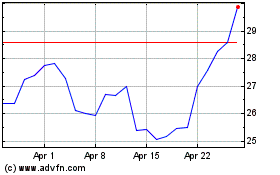

JD com (NASDAQ:JD)

Historical Stock Chart

From Mar 2024 to Apr 2024

JD com (NASDAQ:JD)

Historical Stock Chart

From Apr 2023 to Apr 2024