JD.com Readies Hong Kong Listing -- WSJ

April 30 2020 - 3:02AM

Dow Jones News

By Joanne Chiu

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 30, 2020).

Chinese e-commerce giant JD.com Inc. filed a confidential

application to list in Hong Kong, moving a step closer to a stock

sale as early as June, according to people familiar with the

matter.

The Beijing-based online retailer, already listed on the Nasdaq

Stock Market, is targeting a $2 billion share sale for its

secondary listing in Hong Kong, one of the people said. JD.com

declined to comment.

JD.com's American depositary shares have climbed around 24% this

year, defying the broad coronavirus-driven slump. The company has

benefited from surging online sales during the pandemic -- in China

especially -- as the closing of many physical stores and curtailing

of domestic and international travel left people shopping at

home.

The company, whose wares range from appliances and computers to

apparel and food, said in March that it expected first-quarter

sales to be up at least 10% from the year-earlier $18 billion. For

2019 as a whole, revenue topped $82.9 billion, with net income of

$1.8 billion.

JD.com is likely to report first-quarter results in May.

The plan to list in Hong Kong follows larger rival Alibaba Group

Holding Ltd.'s listing there last November, which raised $13

billion. Alibaba's shares surged in the days and weeks that

followed, benefiting investors in both Hong Kong and New York.

JD.com went public in the U.S. in 2014, a few months before

Alibaba, and its shares have more than doubled since then, making

its market capitalization as of Tuesday about $64 billion.

The size of the company's Hong Kong stock sale will depend on

market conditions and its U.S. share price as the secondary listing

nears. The shares Alibaba sold in Hong Kong represented less than

3% of its U.S. market capitalization at the time.

JD.com's secondary stock sale is being led by Bank of America

Corp. and UBS Group AG.

A Hong Kong listing would bring JD.com closer to its home market

and attract more investors familiar with its business. It would

also be a win for Hong Kong's stock exchange in these turbulent

times.

In 2018 the exchange operator changed its rules to admit

companies with unequal voting rights, and said it would also allow

large Chinese companies listed in the U.S. or London to add a

secondary listing in the city. The changes have drawn the initial

public offerings of some of China's most prominent technology

companies, including Meituan Dianping and Xiaomi Corp., and

investment bankers say more businesses already listed abroad may

look to follow in Alibaba's footsteps.

In addition to JD.com, the U.S.-listed Chinese tech companies

that market participants expect will seek secondary listings in

Hong Kong include search-engine operator Baidu Inc., online travel

agency Trip.com and NetEase Inc., China's second-biggest gaming

firm.

Write to Joanne Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

April 30, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

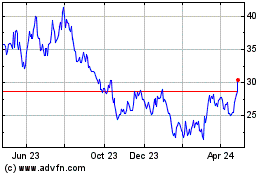

JD com (NASDAQ:JD)

Historical Stock Chart

From Mar 2024 to Apr 2024

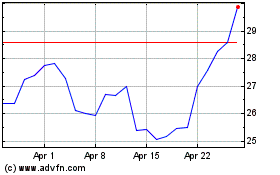

JD com (NASDAQ:JD)

Historical Stock Chart

From Apr 2023 to Apr 2024