Current Report Filing (8-k)

June 04 2021 - 5:01PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 1, 2021

JAGUAR HEALTH, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36714

|

|

46-2956775

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

200 Pine Street, Suite 400

San Francisco, California

|

|

94104

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (415) 371-8300

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, Par Value $0.0001 Per Share

|

JAGX

|

The Nasdaq Capital Market

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On June 1, 2021, Napo Pharmaceuticals, Inc. (“Napo”), the

wholly-owned subsidiary of Jaguar Health, Inc. (“Jaguar” or the “Company”), entered into a subscription agreement

(the “Subscription Agreement”) with privately held Dragon SPAC S.p.A. (the “SPAC”) and Joshua Mailman, the sponsor

of the SPAC (the “Sponsor”), pursuant to which the SPAC agreed to issue and sell, in a private placement by the SPAC directly

to Napo, units of the SPAC (“Units”), with each Unit consisting of one ordinary share of the SPAC (“Share”) and

a warrant to purchase a Share (“Warrant”), for gross proceeds of approximately €8,830,000. The SPAC is an Italy special

purpose acquisition company formed for the purpose of entering into a business combination (the “Business Combination”) with

Napo EU S.p.A., an Italy joint stock company and wholly-owned subsidiary of Napo (“Napo EU”), with the aim of developing the

pharmaceutical activities of the SPAC/Napo EU combined entity (the “Combined Company”) in Europe.

The

SPAC intends to offer Units for sale to accredited investors in the U.S. and non-U.S. persons outside the U.S. (together with the private

placement of Units to Napo, the “Offering) until immediately prior to the consummation of the Business Combination, subject to regulatory

requirements relating to Business Combination (the “Subscription Period”). The SPAC is relying upon Rule 506(c)

of Regulation D under the Securities Act of 1933, as amended (the “Securities Act”) in issuing these Units. The exact number

of Units that the SPAC will issue to Napo and any other purchasers at the closing of the Offering will be calculated based upon the aggregate

amount of binding commitments for the Offering that the SPAC receives from purchasers during the Subscription Period. The aggregate equity

ownership in the Combined Company by purchasers in the Offering other than Napo is expected to be a minority of the outstanding share

capital of the Combined Company following the closing of Offering and the Business Combination, excluding any exercises of Warrants.

The

Offering is expected to close promptly following the end of the Subscription Period, subject to the satisfaction of certain conditions

including the consummation of the Business Combination on or before September 30, 2021, the

execution of a license agreement between Napo and Napo EU for the development, manufacture and commercialization of all planned crofelemer

and lechlemer indications in Europe (excluding Russia) and customary closing conditions. If any of the closing conditions for the

Offering are not met or waived, the SPAC is required to promptly return to each purchaser in the Offering, including Napo, the amounts

collected in the Offering, excluding the reimbursement of up to €350,000 for legal expenses incurred by Sponsor since May 31, 2021

and up to US$200,000 in fees due to the Sponsor’s financial advisor. The SPAC intends to use the net proceeds from the Offering

for purposes of funding the Business Combination and the activities of the Combined Company.

Each

Warrant will entitle the holder thereof to purchase one Share at an exercise price of €10 per Share at any time prior to the

earlier of (i) the 10-year anniversary of the consummation of the Business Combination and (ii) the five-year anniversary of the listing

of the Combined Company on a public exchange.

The foregoing summary of the Subscription Agreement does not purport

to be complete and are subject to, and qualified in its entirety by, the Subscription Agreement attached as Exhibit 10.1 to this Current

Report on Form 8-K and incorporated herein by reference.

This Current Report on Form 8-K does not constitute an offer to

sell any securities or a solicitation of an offer to buy any securities, nor shall there be any sale of any securities in any state or

jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such state or jurisdiction.

On

June 1, 2021, the Company and the SPAC issued a joint press release announcing Napo’s initial funding of the Offering, refinements

to Napo EU’s business plan, and the SPAC’s decision to complete a private financing rather than a public financing, as

a general solicitation offering under Regulation D, Rule 506(c) of the Securities Act. A copy of the press release is filed as Exhibit

99.1 hereto and incorporated herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits

|

# Portions of this exhibit have been omitted pursuant to Item 601 of Regulation S-K promulgated under the Securities Act because the information (i) is not material and (ii) would be competitively harmful if publicly disclosed.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

|

|

JAGUAR HEALTH, INC.

|

|

|

|

|

|

|

|

|

Date: June 4, 2021

|

By:

|

/s/ Lisa A. Conte

|

|

|

Name: Lisa A. Conte

|

|

|

Title: Chief Executive Officer & President

|

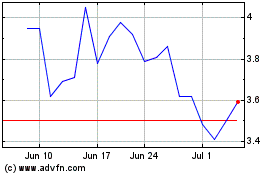

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

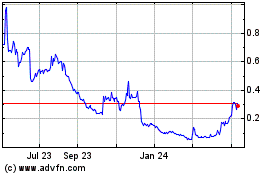

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Apr 2023 to Apr 2024