Filed pursuant to Rule 424(b)(5)

Registration No. 333-248763

PROSPECTUS SUPPLEMENT (TO PROSPECTUS DATED SEPTEMBER 23,

2020)

JAGUAR HEALTH, INC.

4,437,870 Shares of Common Stock

We are offering 4,437,870 shares of our

voting common stock, par value $0.0001 per share (“Common Stock”), pursuant to this prospectus supplement and the accompanying

prospectus and a securities purchase agreement at a price of $3.38 per share.

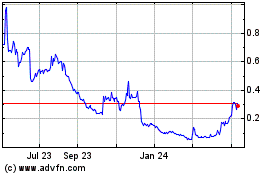

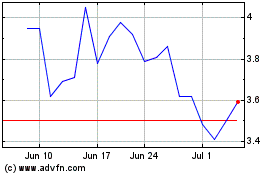

Our Common Stock is listed on the Nasdaq

Capital Market under the symbol “JAGX.” On January 12, 2021, the last reported sale price of our Common Stock

on the Nasdaq Capital Market was $3.38 per share.

Investing in our Common Stock involves

a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks that we have

described on page S-9 of this prospectus supplement under the caption “Risk Factors” and in the documents incorporated

by reference into this prospectus supplement and the accompanying prospectus.

We have retained Ladenburg Thalmann & Co. Inc.

to act as our exclusive placement agent in connection with this offering. The placement agent has agreed to use its reasonable

best efforts to place the securities offered by this prospectus supplement. We have agreed to pay the placement agent the fee set

forth in the table below. The placement agent is not purchasing or selling any shares offered by this prospectus supplement and

the accompanying base prospectus. See “Plan of Distribution” beginning on page S-19 of this prospectus

supplement for more information regarding these arrangements.

|

|

Per Share

|

Total

|

|

Public offering price

|

$3.3800

|

$15,000,000.60

|

|

Placement agent fees(1)

|

$0.2704

|

$1,200,000.05

|

|

Proceeds, before expenses

|

$3.1096

|

$13,800,000.55

|

|

|

(1)

|

We have agreed to pay the placement agent a cash commission fee equal to 8% of the aggregate gross proceeds to us from

the sale of the securities in the offering as reflected in the table above. See “Plan of Distribution” for more

information regarding fees and expenses to be paid to the placement agent.

|

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement

is truthful or complete. Any representation to the contrary is a criminal offense.

We expect that delivery of the shares of

our Common Stock being offered pursuant to this prospectus supplement and the accompanying prospectus will be made to purchasers

through the facilities of The Depository Trust Company on or about January 15, 2021.

LADENBURG THALMANN

The date of this prospectus supplement is

January 13, 2021

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying

prospectus dated September 23, 2020 are part of a registration statement that we filed with the Securities and Exchange Commission

(the “SEC”) using a “shelf” registration process.

This prospectus supplement and the accompanying

prospectus relate to the offer by us of shares of our Common Stock to certain investors. We provide information to you about this

offering of shares of our Common Stock in two separate documents that are bound together: (1) this prospectus supplement,

which describes the specific details regarding this offering; and (2) the accompanying prospectus, which provides general

information, some of which may not apply to this offering. Generally, when we refer to this “prospectus,” we are referring

to both documents combined. If information in this prospectus supplement is inconsistent with the accompanying prospectus, you

should rely on this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement

in another document having a later date—for example, a document incorporated by reference in this prospectus supplement or

the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement

as our business, financial condition, results of operations and prospects may have changed since the earlier dates. You should

not assume that the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus

or any free-writing prospectus is accurate as of any date other than as of the date of this prospectus supplement, the accompanying

prospectus or any related free-writing prospectus, as the case may be, or in the case of the documents incorporated by reference,

the date of such documents regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or

any sale of our securities. You should read this prospectus supplement, the accompanying prospectus, the documents and information

incorporated by reference in this prospectus supplement and the accompanying prospectus and any free writing prospectus that we

have authorized for use in connection with this offering when making your investment decision. You should also read and consider

the information in the documents to which we have referred you under the captions “Where You Can Find More Information”

and “Incorporation of Information by Reference” in this prospectus supplement. We have not authorized anyone to provide

you with information that is in addition to, or different from, that contained or incorporated by reference in this prospectus

supplement, the accompanying prospectus or in any free writing prospectuses we have prepared. If anyone provides you with different

or inconsistent information, you should not rely on it. We are not offering to sell securities in any jurisdiction where the offer

or sale is not permitted.

Unless the context otherwise requires, references

in this prospectus supplement to “Jaguar,” the “Company,” “we,” “us,” and “our”

refer to Jaguar Health, Inc.

Jaguar Health, our logo, Napo Pharmaceuticals,

Mytesi, Canalevia, Equilevia and Neonorm are our trademarks that are used in this prospectus supplement. This prospectus supplement

also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks

and tradenames referred to in this prospectus appear without the ©, ® or ™ symbols, but those references are not

intended to indicate that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner

will not assert its rights, to these trademarks and tradenames.

PROSPECTUS SUPPLEMENT SUMMARY

The following is a summary of what we

believe to be the most important aspects of our business and the offering of our securities under this prospectus supplement and

in the accompanying prospectus. We urge you to read this entire prospectus supplement, the accompanying prospectus and any free

writing prospectus that we have authorized for use in connection with this offering, including the section entitled “Risk

Factors” and the more detailed financial statements, notes to the financial statements and other information incorporated

by reference from our other filings with the SEC.

Overview

Jaguar is a commercial stage pharmaceuticals

company focused on developing novel, plant-based, non-opioid, and sustainably derived prescription medicines for people and animals

with GI distress, specifically chronic, debilitating diarrhea. Our wholly owned subsidiary, Napo Pharmaceuticals, Inc. (“Napo”),

focuses on developing and commercializing proprietary plant-based human gastrointestinal pharmaceuticals from plants used traditionally

in rainforest areas. Our Mytesi (“crofelemer”) product is approved by the U.S. Food and Drug Administration for the

symptomatic relief of noninfectious diarrhea in adults with HIV/AIDS on antiretroviral therapy and is the only oral plant-based

prescription medicine approved under FDA Botanical Guidance. In the animal health space, we focus on developing and commercializing

first-in-class gastrointestinal products for companion and production animals, foals, and high value horses.

Jaguar was founded in San Francisco, California

as a Delaware corporation on June 6, 2013. Napo formed Jaguar to develop and commercialize animal health products. Effective

as of December 31, 2013, Jaguar was a wholly owned subsidiary of Napo, and Jaguar was a majority-owned subsidiary of Napo

until the close of the Company’s initial public offering on May 18, 2015. On July 31, 2017, the merger of Jaguar

Animal Health, Inc. and Napo became effective, at which point Jaguar Animal Health’s name changed to Jaguar Health, Inc.

and Napo began operating as a wholly-owned subsidiary of Jaguar focused on human health and the ongoing commercialization of, and

development of potential follow-on indications for, Mytesi. Most of the activities of the Company are now focused on the commercialization

of Mytesi and development of follow-on indications for crofelemer and a second-generation anti-secretory product candidate, lechlemer

that has yet to be approved by the FDA. In the field of animal health, we have limited activities which are focused on developing

and commercializing first-in-class gastrointestinal products for dogs, dairy calves, foals, and high value horses.

We believe Jaguar is poised to realize a

number of synergistic, value adding benefits—an expanded pipeline of potential blockbuster human follow-on indications, a

second-generation anti-secretory agent, as well as a pipeline of important animal indications for crofelemer—upon which to

build global partnerships. As previously announced, Jaguar, through Napo, now holds extensive global rights for Mytesi, and crofelemer

manufacturing is being conducted at a multimillion-dollar commercial manufacturing facility that has been FDA-inspected and approved.

Additionally, several of the drug product candidates in Jaguar’s Mytesi pipeline are backed by what we believe are strong

Phase 2 and proof of concept evidence from completed human clinical trials.

Mytesi is a novel, first-in-class anti-secretory

agent which has a basic normalizing effect locally on the gut, and this mechanism of action has the potential to benefit multiple

disorders. Mytesi is in development for multiple possible follow-on indications, including cancer therapy-related diarrhea; an

orphan-drug indication for infants and children with congenital diarrheal disorders; short bowel syndrome (SBS); supportive care

for inflammatory bowel disease (IBD); irritable bowel syndrome (IBS); and for idiopathic/functional diarrhea and is exploring the

possibility of obtaining conditional marketing authorization in Europe to support development of Mytesi for the prophylaxis and/or

symptomatic relief of inflammatory diarrhea. In addition, a second-generation anti-secretory agent, lechlemer, is in development

for cholera. Napo previously received orphan-drug designation for the use of crofelemer in the treatment of SBS.

In October 2020, Napo initiated its

pivotal Phase 3 clinical trial of Mytesi for prophylaxis of diarrhea in adult cancer patients receiving targeted therapy. The Phase

3 pivotal clinical trial is a 24-week (two 12-week stages), randomized, placebo-controlled, double-blind study to evaluate the

safety and efficacy of Mytesi in providing prophylaxis of diarrhea in adult cancer patients with solid tumors receiving targeted

cancer therapy-containing treatment regimens. Mytesi or placebo treatment will start concurrently with the targeted cancer therapy

regimen. The primary endpoint will be assessed at the end of the initial (Stage I) 12-week double-blind placebo-controlled primary

treatment phase. After completing the Stage I treatment phase, the subjects will have the option to remain on their assigned treatment

arm and reconsent to enter into the Stage II 12-week extension phase. The safety and efficacy of orally administered Mytesi will

be evaluated for the prophylaxis of diarrhea in adult cancer patients receiving targeted cancer therapies with or without standard

chemotherapy regimens. The assessment of the frequency of diarrhea will be measured by the number of loose and/or watery stools

for the Stage I treatment period.

In September 2020, Jaguar launched

the Entheogen Therapeutics (ETI) initiative to support the discovery and development of novel, natural medicines derived from psychoactive

plant compounds for treatment of mood disorders, neuro-degenerative diseases, addiction, and other mental health disorders. The

initiative is initially focused on plants with the potential to treat depression and leverages Napo’s proprietary library

of approximately 2,300 plants with medicinal properties. According to statistics available from the National Institute of Mental

Health Disorders, part of the National Institutes of Health, approximately 9.5% of American adults ages 18 and over will suffer

from a depressive illness (major depression, bipolar disorder, or dysthymia) each year. Field research collaborations conducted

in the past by members of the scientific strategy team (SST) of Jaguar’s predecessor company Shaman Pharmaceuticals, who

are also members of the ETI SST, yielded possible applications for a compound called alstonine. Alstonine is derived from a plant

used by traditional healers in Nigeria, and has demonstrated a potential novel mechanism of action for the treatment of difficult

to manage conditions such as schizophrenia.

While Jaguar and Napo remain steadfastly

focused on the commercial success of Mytesi and on the development of potential crofelemer follow-on indications in the area of

gastrointestinal health, the Company believes the same competencies and multi-disciplinary scientific strategy that led to the

development of crofelemer will support collaborative efforts with potential partners to develop novel first-in-class prescription

medicines derived from psychoactive plants.

Our management team has significant experience

in gastrointestinal product development for both humans and animals. Napo was founded 30 years ago to perform drug discovery and

development by leveraging the knowledge of traditional healers working in rainforest areas. Ten members of the Jaguar and Napo

team have been together for more than 15 years. Dr. Steven King, our chief sustainable supply, ethnobotanical research and

intellectual property officer, and Lisa Conte, our founder, president and CEO, have worked together for more than 30 years. Together,

these dedicated personnel successfully transformed crofelemer, which is extracted from trees growing in the rainforest, to Mytesi,

which is a natural, sustainably harvested, FDA-approved drug available from essentially any pharmacy in the United States.

Recent Developments

Secured Debt Issuance

On January 12, 2021, the Company entered

into a binding term sheet (the “Term Sheet”) with Streeterville Capital, LLC (“Investor”), an affiliate

of Chicago Venture Partners, L.P. (“CVP”), pursuant to which the Company agreed to issue Investor a secured promissory

note (the “Note”) in the aggregate principal amount of $6 million (the “Note Offering”). The Note will

bear interest at prime per annum and will be prepaid each 12 months at the beginning of the period. The Company will use the proceeds

for the development of SB-300 (lechlemer) and other general corporate purposes, including the company’s product pipeline

activities. The Note will mature 48 months after the issue date and will be secured by a first priority security interest in all

existing and future lechlemer technology. While the Note is outstanding, Investor will be entitled to receive 18% of the gross

proceeds from the sale of partial rights to a possible tropical disease priority review voucher (“TDPRV”) (to the extent

that a TDPRV is granted to the Company by the U.S. Food & Drug Administration (“FDA”) in connection with the

Company’s development of lechlemer for the symptomatic relief of diarrhea from cholera), which proceeds will decrease to

1% in perpetuity once the Note is paid in full.

In addition, beginning on the earlier of

(i) six months following the closing of the Note Offering and (ii) the initiation of human clinical trials with lechlemer,

(the “Optional Prepayment Period”), the Company will have the right, from time to time at in its sole discretion, to

prepay all or any portion of the Note (such amount, the “Principal Prepayment Amount”) at a price equal to 112.5% multiplied

by the Principal Prepayment Amount (the “Optional Prepayment Amount”). If the Company meets all primary endpoints in

the pivotal trial(s) with statistical significance, the Company must receive Investor approval before prepaying the Note.

In the event that, prior to redeeming the

Note, the Company abandons the clinical trial with lechlemer for an indication for the symptomatic relief of diarrhea from cholera

(such event, which is deemed to cover (i) failure to start the Phase 1 clinical trial by July 1, 2022 and (ii) failure

to meet all primary endpoints in the pivotal trial with statistical significance, “Trial Default”), then, at Investor’s

sole election, the Company will immediately pay to Investor an amount equal to 125% multiplied by all outstanding principal and

accrued and unpaid interest on the Note as of the date of the Trial Default. The final terms of the Note Offering are subject to

the negotiation and finalization of the definitive agreement relating to the Note Offering, and the material terms of the Note

Offering may differ from those set forth in the Term Sheet.

Exchange Transactions

Preferred Stock

Between October 1, 2020 and December 28,

2020, the Company entered into privately negotiated exchange agreements with Iliad Research and Trading, L.P. (“Iliad”),

the holder of 842,500 shares of the Series C Preferred Stock (the “Series C Preferred Shares”) and (ii) 842,500

shares (the “Series D Preferred Shares” and, together with the Series C Preferred Shares, the “Preferred

Shares”) of our Series D Perpetual Preferred Stock, par value $0.0001 per share (the “Series D Preferred

Stock”), pursuant to which the Company issued 24,343,751 shares of Common Stock and pre-funded warrants to purchase 7,057,692

shares of Common Stock in the aggregate at an effective price per share equal to the market price (defined as the Minimum Price

under Nasdaq Listing Rule 5635(d)) in exchange for 1,718,158 Preferred Shares (collectively, the “Preferred Exchange

Transactions”). As a result of the Preferred Exchange Transactions, no Series C Preferred Shares or Series D Preferred

Shares remain outstanding.

On December 23, 2020, the Company issued

1,246,210 shares of Common Stock upon conversion of 6,559 shares of Series B-2 Preferred Stock with a conversion price of

$190.00 per share. As a result, no Series B-2 Preferred Stock remain outstanding as of January 11, 2021.

CVP Notes

Between October 1, 2020 and January 4,

2021, the Company entered into privately negotiated exchange agreements with CVP, the holder of the Company’s secured promissory

notes, dated May 28, 2019 (the “CVP Notes”), pursuant to which we issued 18,123,426 shares of Common Stock in

the aggregate at an effective price per share equal to the market price (defined as the Minimum Price under Nasdaq Listing Rule 5635(d))

in exchange for a $6,291,619 reduction in the outstanding balance of the CVP Notes (collectively, the “Note Exchange Transactions”).

As a result of the Note Exchange Transactions, as of January 4, 2021, the CVP Notes have been repaid in full and are no longer

outstanding.

Nasdaq Compliance

On December 30, 2019, the Company received

a letter from the Listing Qualifications Staff (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”)

indicating that the closing bid price for Common Stock for the last 30 consecutive business days was below the $1.00 per share

minimum required for continued listing under Nasdaq Listing Rule 5550(a)(2) (the “Rule”). The Company had

a 180 calendar day grace period to regain compliance with the minimum bid price requirement. The minimum bid price requirement

will be met if the Common Stock has a minimum closing bid price of at least $1.00 per share for a minimum of 10 consecutive business

days during the 180-calendar day grace period.

On April 16, 2020, Nasdaq announced

it was providing relief from the minimum bid price requirement through June 30, 2020. Under the relief, the Company’s

grace period to regain compliance with the minimum bid was tolled until July 1, 2020. As such, the Company’s grace period

was effectively extended until September 10, 2020.

On September 11, 2020, the Company

received written notice from the Staff indicating that, based upon the Company’s continued non-compliance with the minimum

bid price requirement for continued listing on The Nasdaq Capital Market as set forth in the Rule, as of September 11, 2020,

and notwithstanding the Company’s compliance with the quantitative criteria necessary to obtain a second 180-day period within

which to evidence compliance with the Rule, as set forth in Nasdaq Listing Rule 5810(c)(3)(A), the Staff had determined

to delist the Company’s securities from Nasdaq unless the Company timely request a hearing before the Nasdaq Hearings Panel

(the “Panel”).

The Company made a timely request for a

hearing before the Panel. The hearing was held on October 22, 2020. On October 28, 2020, the Company received formal

notice that the Panel granted the Company an extension through December 23, 2020 to evidence compliance with the minimum bid

price requirement under the Rule.

On December 2, 2020, the Company received

an unsolicited letter (the “Letter”) from the Office of Appeals and Review of Nasdaq staying the stipulation for the

Company to comply with the minimum bid price requirement by December 23, 2020 set forth in the October 28, 2020 decision

of the Panel. The Letter indicated that the Nasdaq Listing and Hearing Review Council (the “Listing Council”) had exercised

its discretion to call for review the October 28, 2020 decision of the Panel. By its decision, the Panel granted the Company

an extension to remedy the bid price deficiency, but only through December 23, 2020. Pursuant to the Nasdaq Listing Rules,

the Panel had the discretion to grant the Company an extension through March 10, 2021.

The Listing Council stated that it will

consider whether the Panel should have granted the Company a longer period to regain compliance with the bid price requirement

and that, during the pendency of the Listing Council’s review, the terms of the Panel’s October 28, 2020 decision

had been stayed.

Risks Related to Our Business

Our business, and our ability to execute

our business strategy, is subject to a number of risks as more fully described in the section titled “Risk Factors.”

These risks include, among others, the following:

|

|

·

|

We have a limited operating history, expect to continue to incur significant research and development and other expenses, and may never become profitable. Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

|

|

|

·

|

Our failure to meet the continued listing requirements of The Nasdaq Capital Market could result in a delisting of our Common Stock. Nasdaq has determined to delist our securities from Nasdaq pending a hearing before the Nasdaq Hearings Panel.

|

|

|

·

|

We are substantially dependent on the success of our current lead human prescription drug product, Mytesi and Canalevia, our prescription drug product candidate for dogs with chemotherapy induced diarrhea (CID) and exercise-induced diarrhea (EID), and cannot be certain that necessary approvals will be received for planned Mytesi follow-on indications or Canalevia or that these product candidates will be successfully commercialized, either by us or any of our partners.

|

|

|

·

|

The results of earlier studies may not be predictive of the results of our pivotal trials or other future studies, and we may be unable to obtain any necessary regulatory approvals for our existing or future prescription drug product candidates under applicable regulatory requirements.

|

|

|

·

|

Development of prescription drug products, and, to a lesser extent, non-prescription products, for the human health and animal health market is inherently expensive, time-consuming and uncertain, and any delay or discontinuance of our current or future pivotal trials, or dosage or formulation studies, would harm our business and prospects.

|

|

|

·

|

Even if we obtain any required regulatory approvals for our current or future prescription drug product candidates, they may never achieve market acceptance or commercial success.

|

|

|

·

|

We are dependent upon imported active pharmaceutical ingredients and contract manufacturers for supplies of our current prescription drug product candidates and non-prescription products and intend to rely on contract manufacturers for commercial quantities of any of our commercialized products.

|

|

|

·

|

If we are not successful in identifying, developing and commercializing additional prescription drug product candidates and non-prescription products, our ability to expand our business and achieve our strategic objectives may be impaired.

|

|

|

·

|

We have material weaknesses in our internal control over financial reporting related to staff turnover in our accounting department and our financial statement preparation and review process. We did not maintain a sufficient complement of internal personnel with appropriate knowledge, experience and/or training commensurate with our financial reporting requirements, and we did not have adequate policies and procedures in place to ensure the timely and effective preparation and review of the financial statements. If we fail to remediate the material weaknesses, or experience any additional material weaknesses in the future or otherwise fail to maintain an effective system of internal controls in the future, we may not be able to accurately report our financial condition or results of operations which may adversely affect investor confidence in us and, as a result, the value of our Common Stock.

|

Corporate Information

We were incorporated in the State of Delaware

on June 6, 2013. Our principal executive offices are located at 200 Pine Street, Suite 400, San Francisco, CA 94014 and

our telephone number is (415) 371-8300. Our website address is https://jaguar.health. The information contained on, or that

can be accessed through, our website is not part of this prospectus supplement. Our Common Stock is listed on the Nasdaq Capital

Market and trades under the symbol “JAGX.”

On June 3, 2019, we filed an amendment

to our Third Amended and Restated Certificate of Incorporation to effect on June 7, 2019, a 1-for-70 reverse split of our

Common Stock. Accordingly, all of the stock figures and related market, conversion and exercise prices in this prospectus supplement

have been adjusted to reflect the reverse split.

THE OFFERING

|

Common stock offered by us

|

|

4,437,870 shares of our Common Stock

|

|

|

|

|

|

Public offering price

|

|

$3.38 per share.

|

|

|

|

|

|

Common stock outstanding prior to this offering

|

|

117,818,021 shares

|

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

122,255,891 shares

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use net proceeds from this offering for working capital and other general corporate purposes. See “Use of Proceeds” on page S-17.

|

|

|

|

|

|

Risk factors

|

|

You should read the “Risk Factors” section of this prospectus supplement and in the documents incorporated by reference in this prospectus supplement for a discussion of factors to consider before deciding to invest in our securities.

|

|

|

|

|

|

Nasdaq Capital Market symbol

|

|

“JAGX”.

|

|

|

|

|

We have two classes of common stock: (i) voting

common stock, par value $0.0001 per share, and (ii) non-voting common stock, par value $0.0001 per share. The shares offered

by us in this offering are voting common stock.

The

number of shares of our common stock to be outstanding after this offering is based on 117,816,001 shares of our

voting common stock and 2,020 shares of our non-voting common stock outstanding as of January 11, 2021, and excludes the

following:

|

|

·

|

4,825,427 shares of common stock issuable upon exercise of warrants outstanding as of January 11, 2021 with a weighted-average exercise price of $1.03;

|

|

|

·

|

4,456,822 shares of common stock issuable upon exercise of outstanding options as of January 11, 2021 with a weighted-average exercise price of $4.33;

|

|

|

·

|

220,381 shares of common stock remain available for grant under the 2014 Stock Incentive Plan and 378,182 shares of common stock have been issued under the 2020 Employee Inducement Plan;

|

|

|

·

|

121,818 shares of common stock issuable upon exercise of outstanding inducement options as of January 11, 2021, with a weighted-average exercise price of $0.51; and

|

|

|

·

|

5,613 shares of voting common stock issuable upon vesting of outstanding restricted stock unit awards (“RSUs”), as of January 11, 2021.

|

RISK FACTORS

Investing in our Common Stock involves a

high degree of risk. You should carefully consider the risks factor described below. You should also consider the risks, uncertainties

and assumptions discussed under the heading “Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” included in our most recent Annual Report on Form 10-K, as revised or

supplemented by our most recent Quarterly Report on Form 10-Q, each of which are on file with the SEC and are incorporated

herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC

in the future. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could

have material adverse effects on our future results. If any of these risks actually occurs, our business, business prospects, financial

condition or results of operations could be seriously harmed. In such an event, the market price of our Common Stock could decline,

and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently

deem immaterial also may harm our business, financial condition, results of operations and prospects.

Risks Related to Our Common Stock

Our failure to meet the continued listing requirements

of The Nasdaq Capital Market could result in a delisting of our Common Stock.

Our Common Stock is listed on The Nasdaq

Capital Market, which imposes, among other requirements, a minimum bid price requirement. On December 30, 2019, we received

a letter from Nasdaq indicating that we failed to comply with Nasdaq’s minimum bid price for continued listing set forth

in Nasdaq Listing Rule 5110(a)(2). On September 11, 2020, we received written notice from the Staff indicating that,

based upon our continued non-compliance with the minimum bid price requirement, the Staff has determined to delist our securities

from The Nasdaq Capital Market unless we timely request a hearing before a Nasdaq hearings panel.

The Company made a timely request for a

hearing before the Panel. The hearing was held on October 22, 2020. On October 28, 2020, the Company received formal

notice that the Panel granted the Company an extension through December 23, 2020 to evidence compliance with the minimum bid

price requirement under the Rule. On December 2, 2020, the Company received an unsolicited letter from the Office of Appeals

and Review of Nasdaq staying the stipulation for the Company to comply with the minimum bid price requirement by December 23,

2020 set forth in the October 28, 2020 decision of the Panel, which stay will continue until the Nasdaq Listing and Hearing

Review Council (the “Listing Council”) has completed its review of the October 28, 2020 decision of the Panel.

We are diligently working to evidence compliance

with the minimum bid price requirement for continued listing on Nasdaq; however, there can be no assurance that we will be able

to regain compliance with the minimum bid price requirement or maintain compliance with the other continued listing requirements,

or that Nasdaq will grant us a further extension of time to regain compliance, if necessary.

If we fail to maintain compliance with the

minimum bid price requirement or any other of the continued listing requirements of The Nasdaq Capital Market, Nasdaq may take

steps to delist our Common Stock. The delisting of our Common Stock from Nasdaq may make it more difficult for us to raise capital

on favorable terms in the future. Such a delisting would likely have a negative effect on the price of our Common Stock and would

impair your ability to sell or purchase our Common Stock when you wish to do so. Further, if we were to be delisted from The Nasdaq

Capital Market, our Common Stock would cease to be recognized as covered securities and we would be subject to regulation in each

state in which it offers its securities. Moreover, there is no assurance that any actions that we take to restore our compliance

with the Nasdaq minimum bid price requirement would stabilize the market price or improve the liquidity of our Common Stock, prevent

our Common Stock from falling below the Nasdaq minimum bid price required for continued listing again or prevent future non-compliance

with Nasdaq’s listing requirements.

We have material weaknesses in our internal control

over financial reporting related to staff turnover in our accounting department and our financial statement preparation and

review process. We did not maintain a sufficient complement of internal personnel with appropriate knowledge, experience

and/or training commensurate with our financial reporting requirements, and we did not have adequate policies and procedures

in place to ensure the timely and effective preparation and review of the financial statements. If we fail to remediate the

material weaknesses, or experience any additional material weaknesses in the future or otherwise fail to maintain an

effective system of internal controls in the future, we may not be able to accurately report our financial condition or

results of operations which may adversely affect investor confidence in us and, as a result, the value of our Common

Stock.

Our management is responsible for establishing

and maintaining adequate internal control over our financial reporting, as defined in Rule 13a-15(f) under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”).

Preparing our consolidated financial statements

involves a number of complex manual and automated processes, which are dependent upon individual data input or review and require

significant management judgment. One or more of these elements may result in errors that may not be detected and could result in

a material misstatement of our consolidated financial statements. If we fail to maintain the adequacy of our internal controls

over financial reporting, our business and operating results may be harmed and we may fail to meet our financial reporting obligations.

If material weaknesses in our internal control are discovered or occur, our consolidated financial statements may contain material

misstatements and we could be required to restate our financial results.

In connection with our preparation of our

annual financial statements for the year ended December 31, 2019 and 2018 and for the nine months ended September 30,

2020, we identified material weaknesses in our internal control over financial reporting related to staff turnover in our accounting

department and our financial statement preparation and review process. We did not maintain a sufficient complement of internal

personnel with appropriate knowledge, experience and/or training commensurate with our financial reporting requirements and we

did not have adequate policies and procedures in place to ensure the timely and effective preparation and review of the financial

statements. We relied on outside consulting technical experts and did not maintain adequate internal qualified personnel to properly

supervise and review the information provided by the outside consulting technical experts to ensure certain significant complex

transactions and technical matters were properly accounted for, specifically with respect to assumptions used in measuring the

value of certain financial instruments and contractual covenants in certain financial instruments on the balance sheet at December 31,

2019, and accurately reflecting all potential accrued services on the balance sheet at December 31, 2019. We have concluded

that we must implement and have begun implementing new or improved controls in our financial statement close process and policies

in reviewing information received from our outside consulting technical experts and will continue evaluating ways to improve our

controls and policies.

We have enhanced our internal controls,

processes and related documentation in our efforts to address our material weaknesses. We may not be able to complete our remediation,

evaluation and testing in a timely fashion. If we are unable to remediate these material weaknesses, or if we identify one or more

other material weaknesses in our internal control over financial reporting, we will continue to be unable to conclude that our

internal controls are effective. If we are unable to confirm that our internal control over financial reporting is effective we

could lose investor confidence in the accuracy and completeness of our financial reports, which could cause the price of our Common

Stock to decline.

If our shares become subject to the penny stock rules,

it would become more difficult to trade our shares.

The SEC has adopted rules that regulate

broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price

of less than $5.00, other than securities registered on certain national securities exchanges or authorized for quotation on certain

automated quotation systems, provided that current price and volume information with respect to transactions in such securities

is provided by the exchange or system. If we do not retain a listing on The Nasdaq Capital Market and if the price of our Common

Stock is less than $5.00, our Common Stock will be deemed a penny stock. The penny stock rules require a broker-dealer, before

a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document containing

specified information. In addition, the penny stock rules require that before effecting any transaction in a penny stock not

otherwise exempt from those rules, a broker-dealer must make a special written determination that the penny stock is a suitable

investment for the purchaser and receive (i) the purchaser’s written acknowledgment of the receipt of a risk disclosure

statement; (ii) a written agreement to transactions involving penny stocks and (iii) a signed and dated copy of a written

suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market

for our Common Stock, and therefore stockholders may have difficulty selling their shares.

The price of our Common Stock could be subject to volatility

related or unrelated to our operations, and purchasers of our Common Stock could incur substantial losses.

The trading price of our Common Stock could

be subject to wide fluctuations in response to various factors, some of which are beyond our control. These factors include those

discussed previously in this “Risk Factors” section of this prospectus supplement and the risks, uncertainties and

assumptions discussed under the heading “Risk Factors” included in our most recent Annual Report on Form 10-K,

as revised or supplemented by our most recent Quarterly Report on Form 10-Q, and others, such as:

|

|

·

|

delays in the commercialization of Mytesi, Neonorm, Canalevia, Equilevia or our other current or future prescription drug product candidates and non-prescription products;

|

|

|

·

|

any delays in, or suspension or failure of, our current and future studies;

|

|

|

·

|

announcements of regulatory approval or disapproval of any of our current or future product candidates or of regulatory actions affecting our company or our industry;

|

|

|

·

|

manufacturing and supply issues that affect product candidate or product supply for our studies or commercialization efforts;

|

|

|

·

|

quarterly variations in our results of operations or those of our competitors;

|

|

|

·

|

changes in our earnings estimates or recommendations by securities analysts;

|

|

|

·

|

the payment of licensing fees or royalties in shares of our Common Stock;

|

|

|

·

|

announcements by us or our competitors of new prescription drug products or product candidates or non-prescription products, significant contracts, commercial relationships, acquisitions or capital commitments;

|

|

|

·

|

announcements relating to future development or license agreements including termination of such agreements;

|

|

|

·

|

adverse developments with respect to our intellectual property rights or those of our principal collaborators;

|

|

|

·

|

commencement of litigation involving us or our competitors;

|

|

|

·

|

any major changes in our board of directors or management;

|

|

|

·

|

new legislation in the United States relating to the prescription, sale, distribution or pricing of gastrointestinal health products;

|

|

|

·

|

product liability claims, other litigation or public concern about the safety of our prescription drug product or product candidates and non-prescription products or any such future products;

|

|

|

·

|

market conditions in the human or animal health industry, in general, or in the gastrointestinal health sector, in particular, including performance of our competitors;

|

|

|

·

|

uncertainties related to COVID-19; and

|

|

|

·

|

general economic conditions in the United States and abroad.

|

In addition, the stock market, in general,

or the market for stocks in our industry, in particular, may experience broad market fluctuations, which may adversely affect the

market price or liquidity of our Common Stock. Any sudden decline in the market price of our Common Stock could trigger securities

class-action lawsuits against us. If any of our stockholders were to bring such a lawsuit against us, we could incur substantial

costs defending the lawsuit and the time and attention of our management would be diverted from our business and operations. We

also could be subject to damages claims if we were found to be at fault in connection with a decline in our stock price.

You may not be able to resell our Common Stock when you

wish to sell them or at a price that you consider attractive or satisfactory.

The listing of our Common Stock on The Nasdaq

Capital Market does not assure that a meaningful, consistent and liquid trading market exists. Although our Common Stock is listed

on The Nasdaq Capital Market, trading volume in our Common Stock has been limited and an active trading market for our shares may

never develop or be sustained. If an active market for our Common Stock does not develop, you may be unable to sell your shares

when you wish to sell them or at a price that you consider attractive or satisfactory. The lack of an active market may also adversely

affect our ability to raise capital by selling securities in the future, or impair our ability to license or acquire other product

candidates, businesses or technologies using our shares as consideration.

If securities or industry analysts do not publish research

or reports about our company, or if they issue adverse or misleading opinions regarding us or our stock, our stock price and trading

volume could decline.

The trading market for our Common Stock

depends in part on the research and reports that industry or financial analysts publish about us or our business. We do not influence

or control the reporting of these analysts. If one or more of the analysts who do cover us downgrade or provide a negative outlook

on our company or our industry, or the stock of any of our competitors, the price of our Common Stock could decline. If one or

more of these analysts ceases coverage of our company, we could lose visibility in the market, which in turn could cause the price

of our Common Stock to decline.

You may be diluted by conversions of outstanding shares

of non-voting common stock and exercises of outstanding options and warrants.

As of January 11, 2021, we had (i) outstanding

options to purchase an aggregate of 4,456,822 shares of our Common Stock at a weighted average exercise price of $4.33 per share,

(ii) outstanding options to purchase an aggregate of 121,818 shares of our Common Stock issuable upon exercise of outstanding

inducement options as of January 11, 2021, with a weighted-average exercise price of $0.51 per share, (iii) 4,825,427

shares of Common Stock issuable upon exercise of warrants outstanding as of January 11, 2021, with a weighted-average exercise

price of $1.03, and (v) 5,613 shares of Common Stock issuable upon vesting of outstanding RSUs.

The exercise of such options and warrants

and conversion of the non-voting common stock will result in further dilution of your investment. In addition, you may experience

further dilution if we issue Common Stock in the future. As a result of this dilution, you may receive significantly less in net

tangible book value than the full purchase price you paid for the shares in the event of liquidation.

The sale of our Common Stock under the ATM Agreement may

cause substantial dilution to our stockholders, and such sales, or the anticipation of such sales, may cause the price of our Common

Stock to decline.

In

October 2020, we entered into an At the Market Offering Agreement (“ATM Agreement”) with Ladenburg Thalmann &

Co. Inc. (“Ladenburg”), pursuant to which we may offer and sell, from time to time through Ladenburg, shares

(the “Shares”) of Common Stock, subject to the terms and conditions of the ATM Agreement. We have the right to control

whether we sell any shares, if at all, under the ATM Agreement, and we generally have the right to control the amount and minimum

price at which we conduct sales under the ATM Agreement. To the extent we do sell shares of our Common Stock under the ATM Agreement,

such sales may result in substantial dilution to our existing stockholders, and such sales, or the anticipation of such sales,

may cause the trading price of our Common Stock to decline.

Provisions in our charter documents and under Delaware

law could discourage a takeover that stockholders may consider favorable and may lead to entrenchment of management.

Our third amended and restated certificate

of incorporation and amended and restated bylaws contain provisions that could delay or prevent changes in control or changes in

our management without the consent of our board of directors. These provisions to include the following:

|

|

·

|

a classified board of directors with three-year staggered terms, which may delay the ability of stockholders to change the membership of a majority of our board of directors;

|

|

|

·

|

no cumulative voting in the election of directors, which limits the ability of minority stockholders to elect director candidates;

|

|

|

·

|

the exclusive right of our board of directors to elect a director to fill a vacancy created by the expansion of the board of directors or the resignation, death or removal of a director, which prevents stockholders from being able to fill vacancies on our board of directors;

|

|

|

·

|

the ability of our board of directors to authorize the issuance of shares of preferred stock and to determine the terms of those shares, including preferences and voting rights, without stockholder approval, which could adversely affect the rights of our common stockholders or be used to deter a possible acquisition of our company;

|

|

|

|

|

|

|

·

|

the ability of our board of directors to alter our bylaws without obtaining stockholder approval;

|

|

|

·

|

the required approval of the holders of at least 75% of the shares entitled to vote at an election of directors to adopt, amend or repeal our bylaws or repeal the provisions of our third amended and restated certificate of incorporation regarding the election and removal of directors;

|

|

|

|

|

|

|

·

|

a prohibition on stockholder action by written consent, which forces stockholder action to be taken at an annual or special meeting of our stockholders;

|

|

|

|

|

|

|

·

|

the requirement that a special meeting of stockholders may be called only by the chairman of the board of directors, the chief executive officer, the president or the board of directors, which may delay the ability of our stockholders to force consideration of a proposal or to take action, including the removal of directors; and

|

|

|

·

|

advance notice procedures that stockholders must comply with in order to nominate candidates to our board of directors or to propose matters to be acted upon at a stockholders’ meeting, which may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of us.

|

These provisions could inhibit or prevent

possible transactions that some stockholders may consider attractive.

We are also subject to the anti-takeover

provisions contained in Section 203 of the Delaware General Corporation Law. Under Section 203, a corporation generally

may not engage in a business combination with any holder of 15% or more of its capital stock unless the holder has held the stock

for three years or, among other exceptions, the board of directors has approved the transaction.

Our amended and restated bylaws designate the Court of

Chancery of the State of Delaware as the sole and exclusive forum for certain actions and proceedings that may be initiated by

our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or

our directors, officers or other employees.

Our amended and restated bylaws provide

that, unless we consent in writing to an alternative forum, the Court of Chancery of the State of Delaware will be the sole and

exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting a claim

of breach of a fiduciary duty owed by any director, officer or other employees to us or our stockholders, (iii) any action

asserting a claim arising pursuant to any provision of the Delaware General Corporation Law, (iv) any action asserting a claim

that is governed by the internal affairs doctrine or (v) any action to interpret, apply, enforce or determine the validity

of our certificate of incorporation or bylaws. Any person purchasing or otherwise acquiring any interest in any shares of our capital

stock shall be deemed to have notice of and to have consented to this provision of our amended and restated bylaws. This choice-of-forum

provision may limit our stockholders’ ability to bring a claim in a judicial forum that they find favorable for disputes

with us or our directors, officers or other employees, which may discourage such lawsuits. Alternatively, if a court were to find

this provision of our amended and restated bylaws inapplicable or unenforceable with respect to one or more of the specified types

of actions or proceedings, we may incur additional costs associated with resolving such matters in other jurisdictions, which could

harm our business and financial condition.

We do not intend to pay dividends on our Common Stock,

and your ability to achieve a return on your investment will depend on appreciation in the market price of our Common Stock.

We currently intend to invest our future

earnings, if any, to fund our growth and not to pay any cash dividends on our Common Stock. Moreover, so long as Nantucket Investments

Limited (“Nantucket”) or any of its affiliates owns any shares of our non-voting common stock, we cannot pay dividends

on our voting common stock or non-voting common stock without obtaining the prior written consent of Nantucket. Because we do not

intend to pay dividends and may be required to obtain written consent if we were to do so, your ability to receive a return on

your investment will depend on any future appreciation in the market price of our Common Stock. We cannot be certain that our Common

Stock will appreciate in price.

The requirements of being a public company, including

compliance with the reporting requirements of the Exchange Act and the requirements of the Sarbanes-Oxley Act, may strain our resources,

increase our costs and distract management, and we may be unable to comply with these requirements in a timely or cost-effective

manner.

Our initial public offering had a significant,

transformative effect on us. Prior to our initial public offering, our business operated as a privately-held company, and we were

not required to comply with public reporting, corporate governance and financial accounting practices and policies required of

a publicly-traded company. As a publicly-traded company, we incur significant additional legal, accounting and other expenses compared

to historical levels. In addition, new and changing laws, regulations and standards relating to corporate governance and public

disclosure, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules and regulations thereunder,

as well as under the Sarbanes-Oxley Act, the JOBS Act and the rules and regulations of the SEC and The Nasdaq Capital Market,

may result in an increase in our costs and the time that our board of directors and management must devote to our compliance with

these rules and regulations. These rules and regulations have substantially increased our legal and financial compliance

costs and diverted management time and attention from our product development and other business activities.

The Sarbanes-Oxley Act requires, among other

things, that we assess the effectiveness of our internal control over financial reporting annually and the effectiveness of our

disclosure controls and procedures quarterly. In particular, Section 404 of the Sarbanes-Oxley Act (“Section 404”),

requires us to perform system and process evaluation and testing of our internal control over financial reporting to allow management

to report on, and our independent registered public accounting firm potentially to attest to, the effectiveness of our internal

control over financial reporting. We have needed to expend time and resources on documenting our internal control over financial

reporting so that we are in a position to perform such evaluation when required. As a “smaller reporting company,”

we expect to avail ourselves of the exemption from the requirement that our independent registered public accounting firm attest

to the effectiveness of our internal control over financial reporting under Section 404. However, we may no longer avail ourselves

of this exemption when we cease to be a “smaller reporting company.” When our independent registered public accounting

firm is required to undertake an assessment of our internal control over financial reporting, the cost of our compliance with Section 404

will correspondingly increase. Our compliance with applicable provisions of Section 404 requires that we incur substantial

accounting expense and expend significant management time on compliance-related issues as we implement additional corporate governance

practices and comply with reporting requirements. Moreover, if we are not able to comply with the requirements of Section 404

applicable to us in a timely manner, or if we or our independent registered public accounting firm identifies deficiencies in our

internal control over financial reporting that are deemed to be material weaknesses, the market price of our stock could decline

and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional

financial and management resources.

Issuances of shares of Common Stock or securities convertible

into or exercisable for shares of Common Stock following this offering, as well as the exercise of options and warrants outstanding,

will dilute your ownership interests and may adversely affect the future market price of our Common Stock.

The issuance of additional shares of our

Common Stock or securities convertible into or exchangeable for our Common Stock could be dilutive to stockholders if they do not

invest in future offerings. We intend to use the net proceeds from this offering to continue to fund the development of our business

and for general corporate purposes, which may include capital expenditures and funding our working capital needs. We may seek additional

capital through a combination of private and public equity offerings, debt financings, strategic partnerships and alliances and

licensing arrangements, which may cause your ownership interest to be diluted.

In addition, we have a significant number

of options and warrants to purchase shares of our Common Stock outstanding. If these securities are exercised or converted, you

may incur further dilution. Moreover, to the extent that we issue additional options or warrants to purchase, or securities convertible

into or exchangeable for, shares of our Common Stock in the future and those options, warrants or other securities are exercised,

converted or exchanged, stockholders may experience further dilution.

We have effectuated two reverse stock splits since January 1,

2018 and have received stockholder approval for a third reverse stock split, which if effectuated, may not achieve one or more

of our objectives.

We have effectuated two reverse stock splits

since January 1, 2018 and have received stockholder approval authorizing our board of directors to effectuate a reverse stock

split at a ratio not less than 1-for-2 and not greater than 1-for 20, with the exact ratio, if approved and effected at all, to

be set within that range at the discretion of our board of directors and publicly announced by us on or before December 9,

2021. While we currently have no intentions to effectuate a reverse stock split, we may do so in the future for various reasons,

including to increase the per share market price of our Common Stock to the extent required to remain in compliance with the Nasdaq

minimum bid price requirement.

If we were to effectuate a reverse stock

split, there can be no assurance that the market price per share of our Common Stock after a reverse stock split will remain unchanged

or increase in proportion to the reduction in the number of shares of our Common Stock outstanding before the reverse stock split.

The market price of our shares may fluctuate and potentially decline after a reverse stock split. Accordingly, the total market

capitalization of our Common Stock after a reverse stock split may be lower than the total market capitalization before the reverse

stock split. Moreover, the market price of our Common Stock following a reverse stock split may not exceed or remain higher than

the market price prior to the reverse stock split.

Additionally, there can be no assurance

that a reverse stock split will result in a per-share market price that will attract institutional investors or investment funds

or that such share price will satisfy investing guidelines of institutional investors or investment funds. As a result, the trading

liquidity of our Common Stock may not necessarily improve. Further, if a reverse stock split is effected and the market price of

our Common Stock declines, the percentage decline may be greater than would occur in the absence of a reverse stock split.

Risks Related to this Offering

Management will have broad discretion

as to the use of the net proceeds from this offering, and may not use the proceeds effectively.

We currently anticipate that the net

proceeds from this offering will be used for working capital and general corporate purposes. Our management has broad discretion

over how these proceeds are used and could spend the proceeds in ways with which you may not agree, and the proceeds may not be

invested in a manner that yields a favorable or any return.

As a new investor, you will incur

substantial dilution as a result of this offering and future equity issuances, and as a result, our share price could decline.

The offering price of our Common Stock

will be substantially higher than the net tangible book value per share of our outstanding Common Stock. As a result, based on

our pro forma capitalization as of September 30, 2020, investors purchasing Common Stock in this offering will incur immediate

and substantial dilution of $3.29 per share. In addition to this offering, subject to market conditions and other factors, we could

pursue raising additional funds in the future, as we continue to build our business. Accordingly, we may conduct substantial future

offerings of equity or debt securities. The exercise of outstanding options and warrants and future equity issuances, including

issuances of Common Stock pursuant to the ATM Agreement, future public offerings or future private placements of equity securities

and any additional shares issued in connection with acquisitions, will also result in dilution to investors. In addition, the market

price of our Common Stock could fall as a result of resales of any of these shares of Common Stock due to an increased number of

shares available for sale in the market.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus supplement and the documents

incorporated by reference into it contain forward-looking statements within the meaning of Section 27A of the Securities Act,

and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We have made these statements

in reliance on the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements

of historical facts contained in or incorporated by reference into this prospectus supplement, including statements regarding our

future results of operations and financial position, business strategy, prospective products, product approvals, research and development

costs, timing of receipt of clinical trial, field study and other study data, and likelihood of success, commercialization plans

and timing, other plans and objectives of management for future operations, and future results of current and anticipated products

are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that

may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking

statements by terms such as “may,” “will,” “should,” “expect,” “plan,”

“aim,” “anticipate,” “could,” “intend,” “target,” “project,”

“contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue”

or the negative of these terms or other similar expressions. The forward-looking statements in this prospectus supplement are only

predictions. We have based these forward-looking statements largely on our current expectations and projections about future events

and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking

statements speak only as of the date of this prospectus supplement and are subject to a number of risks, uncertainties and assumptions

including those listed in the “Risk Factors” incorporated by reference into this prospectus supplement from our Annual

Report on Form 10-K, as updated by subsequent reports. Forward-looking statements are subject to inherent risks and uncertainties,

some of which cannot be predicted or quantified and some of which are beyond our control. The events and circumstances reflected

in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected

in the forward-looking statements. Moreover, we operate in a dynamic industry and economy. New risk factors and uncertainties may

emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties that we may face.

Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein,

whether as a result of any new information, future events, changed circumstances or otherwise.

USE OF PROCEEDS

We estimate that we will receive net proceeds

of approximately $13.5 million, after deducting the estimated placement agent fees and before deducting offering costs payable

by us. We intend to use the net proceeds from this offering for general corporate and working capital purposes.

As of the date of this prospectus supplement,

we cannot specify with certainty all of the particular uses of the proceeds from this offering. As a result, our management will

have broad discretion in the allocation and use of the net proceeds from this offering, and investors will be relying on the judgment

of our management regarding the application of the proceeds of this offering. The actual use and allocation of proceeds realized

from this offering will depend upon our operating revenues and cash position and our working capital requirements and may change.

We may also invest the net proceeds temporarily in a variety of capital preservation investments, including short-term, investment-grade,

interest-bearing instruments and U.S. government securities, until we use them for their stated purposes.

DILUTION

If you purchase shares in this offering,

your interest will be diluted to the extent of the difference between the public offering price per share of Common Stock and the

as adjusted net tangible book value per share of our Common Stock after this offering.

Our net tangible book value as of September 30,

2020 was approximately ($17.0) million, or ($0.35) per share of Common Stock (based upon 48,901,352 outstanding shares of Common

Stock). “Net tangible book value” is total assets minus the sum of liabilities and intangible assets. “Net tangible

book value per share” is net tangible book value divided by the total number of shares of common stock outstanding.

Our pro forma net tangible book value as

of September 30, 2020 would have been approximately $(4.2) million, or ($0.04) per share of Common Stock (based upon 102,241,146

outstanding shares of Common Stock), after giving effect to (i) the issuance of 3,814,925 shares of Common Stock through Ladenburg

pursuant to the ATM Agreement, (ii) the issuance of 18,123,426 shares of Common Stock in the Note Exchange Transactions and

(iii) the issuance of 24,343,751 shares of Common Stock and pre-funded warrants to purchase 7,057,692 shares of Common Stock

in the Preferred Exchange Transactions.

After giving effect to (i) the pro

forma adjustments described above and (ii) the sale by us in this offering of 4,437,870 shares for gross proceeds of $15.0

million, and after deducting estimated offering expenses of approximately $1.5 million payable by us, our pro forma as adjusted

net tangible book value as of September 30, 2020 would have been $9.2 million, or $0.09 per share of Common Stock. This represents

an immediate increase in pro forma as adjusted net tangible book value of $0.13 per share to our existing shareholders and an immediate

dilution in pro forma as adjusted net tangible book value of approximately $3.29 per share to investors participating in this offering.

Dilution per share to new investors is determined

by subtracting pro forma as adjusted net tangible book value per share after this offering from the public offering price per share

paid by new investors. The following table illustrates this dilution:

|

Public offering price per share

|

|

|

|

|

$

|

3.38

|

|

|

Historical net tangible book value per share as of September 30, 2020

|

|

$

|

(0.35

|

)

|

|

|

|

|

Pro forma increase in net tangible book value per share attributable to the pro forma transactions described above

|

|

$

|

0.31

|

|

|

|

|

|

Pro forma net tangible book value per share as of September 30, 2020

|

|

$

|

(0.04

|

)

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering

|

|

$

|

0.13

|

|

|

|

|

|

Pro forma as adjusted net tangible book value per share after this offering.

|

|

|

|

|

$

|

0.09

|

|

|

Dilution per share to new investors in this offering

|

|

|

|

|

$

|

3.29

|

|

The information in the table above is based

on 102,241,146 shares of Common Stock outstanding on September 30, 2020 on a pro forma basis, and excludes shares of Common

Stock issuable upon exercise of options, warrants and other rights outstanding on September 30, 2020 on a pro forma basis.

Plan

of Distribution

Ladenburg Thalmann & Co. Inc.,

which we refer to herein as the placement agent, has agreed to act as our exclusive placement agent in connection with this offering

subject to the terms and conditions of the placement agent agreement dated January 13, 2021. The placement agent is not purchasing

or selling any of the shares of our Common Stock offered by this prospectus supplement, nor is it required to arrange the purchase

or sale of any specific number or dollar amount of shares of our Common Stock, but has agreed to use its reasonable best efforts

to arrange for the sale of all of the shares of our Common Stock offered hereby. Therefore, we will enter into a securities purchase

agreement directly with investors in connection with this offering and we may not sell the entire amount of shares of our Common

Stock offered pursuant to this prospectus supplement. We will make offers only to a limited number of qualified institutional buyers

and institutional accredited investors.

We have agreed to indemnify the placement

agent against specified liabilities, including liabilities under the Securities Act, and to contribute to payments the placement

agent may be required to make in respect thereof.

Fees and Expenses

We have agreed to pay the placement agent

a cash commission fee equal to 8% of the aggregate gross proceeds to us from the sale of the securities in the offering.

The following table shows the per share

and total cash placement agent’s fees we will pay to the placement agent in connection with the sale of the shares of our

Common Stock offered pursuant to this prospectus supplement and the accompanying prospectus, assuming the purchase of all of the

shares offered hereby. The table above assumes an 8% fee on all sales.

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

3.3800

|

|

|

$

|

15,000,000.60

|

|

|

Placement agent fees

|

|

$

|

0.2704

|

|

|

$

|

1,200,000.05

|

|

|

Proceeds, before expenses, to us

|

|

$

|

3.1096

|

|

|

$

|

13,800,000.55

|

|

In addition, we have agreed to pay the placement

agent a management fee equal to 1% of the aggregate gross proceeds to us from the sale of the securities in the offering. We have

also agreed to reimburse the placement agent’s actual out-of-pocket expenses up to $75,000 and legal expenses of investors

of up to $35,000. We estimate that the total expenses of the offering payable by us, excluding the placement agent fees, will be

approximately $160,000.

The placement agent may be deemed to be

an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit

realized on the resale of the shares sold by it while acting as principal might be deemed to be underwriting discounts or commissions

under the Securities Act. As an underwriter, the placement agent would be required to comply with the requirements of the Securities

Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5

and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares

by the placement agent acting as principal. Under these rules and regulations, the placement agent:

|

|

·

|

may not engage in any stabilization activity in connection with our securities; and

|

|

|

·

|

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other

than as permitted under the Exchange Act, until it has completed its participation in the distribution.

|

Other Relationships

From time to time,

the placement agent may provide in the future, various advisory, investment and commercial banking and other services to us in

the ordinary course of business, for which it may receive customary fees and commissions. However, except as disclosed in this

prospectus, and except for the placement agent’s service as our sales agent under our At the Market Offering Agreement, we