Current Report Filing (8-k)

June 15 2020 - 4:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 10, 2020

|

|

|

|

|

Iterum Therapeutics plc

|

|

(Exact name of registrant as specified in its charter)

|

|

Ireland

|

001-38503

|

98-1283148

|

|

(State or other jurisdiction

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

of incorporation)

|

|

|

|

|

|

|

|

|

|

Block 2 Floor 3, Harcourt Centre,

Harcourt Street,

Dublin 2, Ireland

|

Not Applicable

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code: +353 1 903 8920

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on Which Registered

|

|

Ordinary Shares, par value $0.01 per share

|

ITRM

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

|

Item 3.03 Material Modification to Rights of Security Holders.

The information contained in Item 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

|

|

|

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) 2018 Equity Incentive Plan

On June 10, 2020, Iterum Therapeutics plc (the “Company”) held its annual general meeting of shareholders, during which the Company’s shareholders approved an amendment to the Company’s 2018 Equity Incentive Plan (the “2018 Plan”), to increase the number of ordinary shares of the Company, par value $0.01 per share authorized for issuance under the plan by 2,250,000; to remove the “evergreen” provision; to prohibit payment or accrual of dividend equivalents on options or stock appreciation rights; to provide that any dividends or dividend equivalents paid with respect to awards of restricted stock, performance stock awards, performance cash awards and other stock awards will be subject to the same terms and conditions as apply to the award to which they relate; and to extend the term during which incentive stock options may be granted to June 10, 2030.

The description of the 2018 Plan contained on pages 34 to 42 of the Company’s definitive proxy statement filed with the Securities and Exchange Commission on May 7, 2020 is incorporated herein by reference. A complete copy of the 2018 Plan, as amended and restated, is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

|

|

|

|

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

Amendment and Restatement of Constitution

Effective as of June 10, 2020, the Company amended its constitution (the “Amended and Restated Constitution”) following approval by its shareholders at its annual general meeting of a proposal to increase the Company’s authorized share capital from $1,500,000 to $2,500,000 by the creation of an additional 100,000,000 ordinary shares.

A copy of the Amended and Restated Constitution is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

Item 5.07. Submission of Matters to a Vote of Security Holders.

On June 10, 2020, the Company held its annual general meeting of shareholders, at which the Company’s shareholders voted on the following proposals, each of which is described in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on May 7, 2020.

Proposal No. 1: Election of Directors. The shareholders re-elected, by separate resolutions, Patrick J. Heron, Shahzad Malik, M.D., and Brenton K. Ahrens to the Company’s board of directors as Class II directors, each to serve for a three-year term expiring at the 2023 annual general meeting of shareholders. The results of the shareholders’ vote for the re-election of such Class II directors were as follows:

|

|

|

|

|

|

|

Nominee

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

Patrick J. Heron

|

6,813,507

|

191,361

|

10,150

|

2,183,940

|

|

Shahzad Malik, M.D.

|

6,867,893

|

138,070

|

9,055

|

2,183,940

|

|

Brenton K. Ahrens

|

6,869,445

|

134,924

|

10,649

|

2,183,940

|

Proposal No. 2: Changes to 2018 Equity Incentive Plan. The shareholders approved an amendment and restatement of the Company’s 2018 Equity Incentive Plan increasing by 2,250,000 to 4,437,298 the number of ordinary shares of the Company, par value $0.01 per share authorized for issuance under the plan and certain other amendments. The results of the shareholders’ vote were as follows:

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

6,762,993

|

243,046

|

8,979

|

2,183,940

|

Proposal No. 3: Ratification of Appointment of the Company’s Independent Registered Public Accounting Firm for 2020 and Authorization of the Board of Directors to Approve the Remuneration of the Independent Registered Public Accounting Firm. The shareholders ratified, in a non-binding vote, the appointment of KPMG as the Company’s independent registered public accounting firm for its fiscal year ended December 31, 2020 and authorized the Company’s board of directors, acting through its audit committee, to set the independent registered public accounting firm’s remuneration. The results of the shareholders’ vote were as follows:

|

|

|

|

|

For

|

Against

|

Abstain

|

|

9,022,950

|

155,405

|

20,603

|

Proposal No. 4: Increase in Authorized Share Capital. The shareholders approved an increase in the authorized share capital of the Company from $1,500,000 to $2,500,000 by the creation of an additional 100,000,000 ordinary shares. The results of the shareholders’ vote were as follows:

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

6,846,128

|

162,730

|

6,160

|

2,183,940

|

Proposal No. 5: Authority to Allot. The shareholders granted the board of directors an updated authority under Irish law to allot and issue shares, warrants, convertible instruments and options. The results of the shareholders’ vote were as follows:

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

6,830,224

|

179,580

|

5,214

|

2,183,940

|

Proposal No. 6: Dis-application of Statutory Pre-emption Rights. The shareholders granted the board of directors an updated authority under Irish law to issue shares for cash without first offering those shares to existing shareholders under pre-emptive rights that would otherwise apply to the issuance. The results of the shareholders’ vote were as follows:

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

6,831,682

|

174,045

|

9,291

|

2,183,940

|

Proposal No. 7: Share Issuance. The shareholders approved, in accordance with applicable rules of the Nasdaq Stock Market, the issuance by the Company of ordinary shares in settlement of the potential future exchange in full of $51.6 million aggregate principal amount of, plus accrued and unpaid interest on, 6.500% Exchangeable Senior Subordinated Notes due 2025 issued pursuant to the Exchangeable Notes Indenture, dated as of January 21, 2020, among the Company, Iterum Therapeutics Bermuda Limited, Iterum Therapeutics International Limited, Iterum Therapeutics US Limited, Iterum Therapeutics US Holding Limited and U.S. Bank National Association as trustee and the Securities Purchase Agreement, dated as of January 16, 2020, among the Company, Iterum Therapeutics Bermuda Limited, Iterum Therapeutics International Limited, Iterum Therapeutics US Limited and Iterum Therapeutics US Holding Limited and the accredited investors named therein. The results of the shareholders’ vote were as follows:

|

|

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

6,835,273

|

172,931

|

6,814

|

2,183,940

|

Proposal No. 8: Acquisition of Ordinary Shares. The shareholders approved an acquisition by investment funds managed and controlled by Sarissa Capital Management LP of up to 60% of the Company’s issued ordinary share capital solely as a result of the potential future exchange of the 15,000 6.500% Exchangeable Senior Subordinated Notes due 2025 held by such funds without incurring a mandatory offer obligation under Rule 9 of the Irish Takeover Panel Act, 1997, Takeover Rules, 2013. The results of the shareholders’ vote were as follows:

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

6,808,330

|

199,749

|

6,939

|

2,183,940

|

Item 7.01 Regulation FD Disclosure

On June 15, 2020, the Company issued a press release announcing the results of the annual general meeting, including the results of Resolution No. 8. The full text of the press release issued by the Company is attached as Exhibit 99.2 to this Current Report on Form 8-K.

In accordance with General Instruction B-2 of Form 8-K, the information set forth in or incorporated by reference into this Item 7.01 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Iterum Therapeutics plc

|

|

|

|

|

|

Dated: June 15, 2020

|

|

|

|

|

|

By:

|

/s/ Corey N. Fishman

|

|

|

|

|

|

Corey N. Fishman

|

|

|

|

|

Chief Executive Officer

|

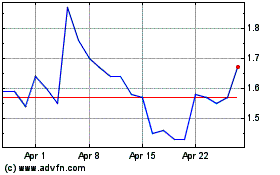

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Apr 2023 to Apr 2024