Current Report Filing (8-k)

February 26 2021 - 5:17PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 26, 2021 (February 22, 2021)

ISUN,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-37707

|

|

47-2150172

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

|

400

Avenue D, Suite 10, Williston, Vermont 05495

|

|

(Address

of Principal Executive Offices) (Zip Code)

|

|

(802)

658-3378

|

|

(Registrant’s

telephone number, including area code)

|

|

THE

PECK COMPANY HOLDINGS, INC.

4050

Williston Road, Suite 511, South Burlington, Vermont 05403

|

|

(Former

name or former address, if changed since last report)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $0.0001 par value per share

|

|

ISUN

|

|

Nasdaq

Capital Market

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

Item

3.01.

|

Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

As

previously reported, on January 5, 2021 iSun, Inc. (formerly known as The Peck Company Holdings, Inc.), a Delaware corporation

(the “Company”), received a written notice (the “Notice”) from the

Listing Qualifications Department of The Nasdaq Stock Market (“Nasdaq”) indicating that the Company was

not in compliance with Listing Rule 5620(a) (the “Annual Meeting Rule”), which required the Company to

hold an annual meeting of shareholders no later than one year after the end of the Company’s fiscal year-end for continued

listing on the NASDAQ Capital Market. The Notice was only a notification of deficiency, not of imminent delisting, and

had no current effect on the listing or trading of the Company’s securities on the NASDAQ Capital Market.

The

Notice stated that the Company had 45 calendar days to submit a plan to regain compliance with the Annual Meeting

Rule. The Company submitted a plan to regain compliance with the Annual Meeting Rule on February 22, 2021 by Letter dated February

22, 2021 from Merritt & Merritt to Ms. Una Hahn, Listing Analyst. By Letter dated February 23, 2021 to Mr. Jeffrey

Peck, CEO of the Company, Nasdaq granted the Company an extension until May 11, 2021 to regain compliance with the

Annual Meeting Rule by the Company holding its 2020 Annual Meeting on May 11, 2021, as currently anticipated. Copies of

the foregoing letters are filed as Exhibit 99.1 hereto.

|

ITEM

5.03

|

AMENDMENTS

TO ARTICLES OF INCORPORATION OR BYLAWS; CHANGE IN FISCAL YEAR

|

Certificate

of Designation - On February 22, 2021, the Board of Directors of iSun, Inc. (the “Company”) and the holders of

a majority of the Company’s Series A Convertible Preferred Stock, approved the First Amended and Restated Certificate of

Designation of Preferred Stock of iSun Inc. Series A Convertible Preferred Stock (the “First Amended Certificate of Designation”)

that amends and replaces in its entirety the Certificate of Designation of Preferred Stock of iSun Inc. Series A Convertible

Preferred Stock dated April 28, 2020. The First Amended Certificate of Designation was filed with the Delaware Secretary of State

on February22, 2021.

The

First Amended Certificate of Designation designates two hundred thousand (200,000) shares of the Company’s authorized preferred

share capital as Series A Convertible Preferred Stock (the “Series A”) and provides for certain preferences to holders

of Series A. The Series A is convertible on a mandatory basis into shares of the Company’s Common Stock as soon as practicable

after the date on which the closing price of the Company’s Common Stock is equal to or greater than $15.00 per share for

any twenty (20) days within a thirty (30) days trading window. The Series A conversion rate is 1.851852. Pursuant to the First

Amended Certificate of Designation, on February 22, 2021 the Company notified all holders of the Series

A of the mandatory conversion of the Series A. A total of 370,370 shares of Common Stock have been issued pursuant to the conversion.

The

foregoing summary of the First Amended Certificate of Designations qualified in its entirety by reference to

the First Amended Certificate of Designation which is filed as Exhibit 3.1 hereto.

|

ITEM

5.07

|

SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS.

|

On

February 25, 2021, the Company held a Special Meeting of Stockholders (the “Special Meeting’) to approve the

Company’s 2020 Equity Incentive Plan, as amended (the “Plan”) The Company had previously provided Notice of

the Special Meeting and a Proxy Statement dated February 2, 2021. At the Special Meeting a total of 2,845,153 shares of Common

Stock were present in person or represented by proxy, constituting a quorum. A total of 2,800,601 shares of Common Stock voted

in favor of the proposal to adopt the Plan, 19,470 shares voted against the proposal and 25,082 shares abstained. As a

majority of the shares representing a quorum voted in favor of the proposal, the proposal was approved.

|

Item

9.01.

|

Financial

Statements and Exhibits.

|

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated:

February 26, 2021

|

|

iSun,

Inc.

|

|

|

|

|

|

By:

|

/s/

Jeffrey Peck

|

|

|

Name:

|

Jeffrey

Peck

|

|

|

Title:

|

Chief

Executive Officer

|

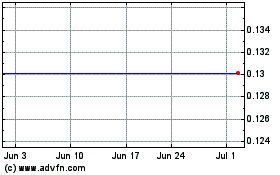

iSun (NASDAQ:ISUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

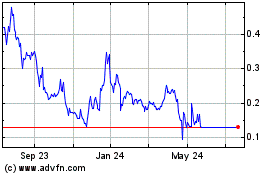

iSun (NASDAQ:ISUN)

Historical Stock Chart

From Apr 2023 to Apr 2024