Good day. Biotechnology startup Expansion Therapeutics Inc. has

collected $80 million to hunt for oral medicines that make a

significant impact on neurodegenerative diseases.

Conventionally, medications have targeted disease proteins.

Boston-based Expansion and some other companies are now also

developing drugs that target RNA involved in producing disease

proteins.

Ionis Pharmaceuticals Inc.'s Tegsedi, for example, treats

patients with nerve damage stemming from hereditary ATTR

amyloidosis, a disease in which the body produces a mutant form of

the TTR protein. Tegsedi, which is injected, targets RNA to reduce

the production of TTR protein, according to Ionis.

Expansion is developing RNA-targeted small-molecule drugs for

diseases with few treatment options. They include myotonic

dystrophy type 1, a disease affecting muscle, cardiac and brain

function; the motor disease amyotrophic lateral sclerosis;

frontotemporal dementia, a severe form of dementia; and

tauopathies, or brain disorders marked by an overabundance of

certain forms of the protein tau.

By going upstream of proteins and targeting RNA, Expansion hopes

to make a profound impact on these diseases, said Chief Executive

Renato Skerlj. Expansion, which raised this Series B funding from

Cormorant Asset Management, and others, plans to use the new

capital to advance its platform and move its initial drugs toward

clinical trials.

And now on to the news...

Top News

Blood storage technology. Hemanext Inc. has secured new

venture-capital funding ahead of plans to seek U.S. regulatory

authorization for a medical device designed to improve blood

storage and help patients who depend heavily on donated blood.

Hemanext has collected $15 million in new funding and has now

raised a total of more than $100 million.

Donated blood is used widely in medical care, including in the

treatment of traumatic injuries and patients with blood disorders

such as sickle cell disease. Hospitals' need for blood is

increasing as they catch up on surgeries following coronavirus

pandemic-related delays.

Hemanext aims to improve the blood supply by increasing the

quality of stored red blood cells. That could lead to benefits such

as less-frequent blood transfusions for patients. The company plans

to study its technology in various types of patients, including

those with burns, sickle cell disease and blood cancers known as

myelodysplastic syndromes.

"We're always living in a state of concern about whether or not

we'll have the supply to meet the [needs] of every American."

-- Biree Andemariam, a professor of medicine at UConn Health,

and a clinical adviser to Hemanext, referring to the nation's

supply of donated blood

Other VC News

Alternative-Milk Company Perfect Day Raises $350 Million

Perfect Day Inc. raised $350 million in a late-stage funding

round, valuing the non-animal dairy startup at roughly $1.5 billion

and setting the stage for an initial public offering, The Wall

Street Journal reports. Singapore's Temasek and Canada Pension Plan

Investment Board led the Series D funding round for the California

company, co-founders Ryan Pandya and Perumal Gandhi told The Wall

Street Journal. Other investors include Walt Disney Co. Executive

Chairman Robert Iger. Since its founding in 2014, Perfect Day,

which uses fermentation technology to produce animal-free dairy

proteins and counts actor Leonardo DiCaprio as an adviser, has

raised $750 million.

Industry News

Funds

Vensana Capital, a venture-capital and growth-equity firm

focused on medical technology, closed its second fund at its hard

cap of $325 million. Vensana Capital II LP will continue to back

startups in the medical devices, diagnostics and data-science,

life-science tools, digital health and tech-enabled services

sectors. With offices in Minneapolis and Vienna, Va., Vensana

Capital raised $225 million for its debut fund two years ago.

Hadean Ventures held the first closing of its second fund at

EUR90 million ($104 million) to continue investing in pharma,

biotech, medtech diagnostics and digital health startups, mostly in

Europe. The new fund is supported by over 30 limited partners

including OPF, Saminvest, Argentum and Investinor. Hadean Ventures

has offices in Oslo and Stockholm.

People

BioAdvance, which makes early-stage life-science investments in

the mid-Atlantic region, said Shahram Hejazi was appointed managing

director and chief executive, replacing Barbara Schilberg, who is

retiring after almost 20 years in that position. Before joining

BioAdvance, Mr. Hejazi was president of Kodak's life-science

division (later known as Carestream Molecular Imaging), and CEO of

Zargis Medical Corp.

Cleerly Inc., a heart disease-care provider, appointed Brandon

Atkinson as chief operating officer and Nick Nieslanik as chief

technology officer. Mr. Atkinson was most recently chief executive

of 46 Summits Consulting. Mr. Nieslanik was vice president of

engineering at Teladoc Health. Earlier this year, Cleerly raised a

$43 million Series B round from investors including Vensana

Capital, LRVHealth, New Leaf Venture Partners, DigiTx Partners and

Cigna Ventures.

Healthcare automation platform Lumeon named Breht Feigh to the

post of chief financial officer. He was most recently CFO of Press

Ganey Associates. Lumeon is based in Boston and London, and is

backed by investors including Optum Ventures, Endeavour Vision, LSP

and Amadeus Capital Partners.

Exits

Kipu, a technology partner for mental health and addiction

service providers, acquired Avea Solutions, whose software helps

treatment centers streamline billing. Terms weren't disclosed. TCV

counts Miami-based Kipu in its portfolio.

New Money

Elligo Health Research Inc., an Austin, Texas-based startup that

provides physician practices with technology and services to help

them participate in clinical trials, completed a $135 million

Series E round. Morgan Stanley Expansion Capital and Ally Bridge

Group led the investment, which included participation from Norwest

Venture Partners, Cerner, Hatteras Venture Partners, Noro-Moseley

Partners, Piper Sandler Merchant Banking, Shumway Capital and

Syneos Health. Along with the funding, Elligo Health Research

acquired ClinEdge for an undisclosed amount. Melissa Daniels,

managing director and general partner at Morgan Stanley Expansion

Capital, joined Elligo's board.

Wayspring, a Nashville, Tenn.-based substance use disorder-care

provider formerly known as axialHealthcare, picked up a $75 million

investment. Valtruis, a newly formed value-based care portfolio

company of Welsh, Carson, Anderson & Stowe, led the round.

Centene Corp., CareSource, HLM Venture Partners, Highmark Ventures,

.406 Ventures, Blue Venture Fund and Oak HC/FT also participated in

the funding.

Anji Pharma, a Cambridge, Mass.- and Shanghai-based biotech

company, landed $70 million in Series B funding from CR Capital.

The company's clinical pipeline includes a provider of glucose

management in patients with Type 2 diabetes and advanced chronic

kidney disease, as well as a treatment for functional

constipation.

Lifebit Biotech Ltd., a biomedical data provider with offices in

London, San Francisco and Hong Kong, raised $60 million in Series B

funding. Tiger Global Management led the round, which included

participation from Eurazeo, Pentech Ventures and Beacon

Capital.

Stellar Health, a New York-based startup whose technology

enables primary-care providers to deliver real-time notifications

and action-based incentives to patients, secured more than $60

million in Series B financing. General Atlantic led the round,

which included additional support from Point72 Ventures, Primary

Venture Partners and others.

MFine, an Indian digital health startup, nabbed $48 million in

Series C funding. Moore Strategic Ventures and Beenext co-led the

round, which included contributions from Stellaris Venture

Partners, SBI Holdings, Heritas Capital, Prime Venture Partners and

Alteria Capital.

Wider Circle, a Redwood City, Calif.-based startup that works

with health plans to deliver hyper-local care programs that connect

neighbors for better health, snagged a $38 million Series B round.

Lead investor AmeriHealth Caritas was joined by Blue Venture Fund,

Chicago Ventures and others in the new funding.

NovaSignal Corp., a Los Angeles-based startup specializing in

the assessment and management of brain health, closed a $37 million

Series C1 round led by Alpha Edison and Reimagined Ventures.

Kytopen Corp., a Cambridge, Mass.-based provider of a scalable

technology for engineered cell therapies, collected $30 million in

an oversubscribed Series A round. Northpond Ventures led the

investment, which saw participation from the Engine, Horizon

Ventures, Mass Ventures and others. Northpond's Adam Wieschhaus and

the Engine's Theresa Tribble will join the board.

Vital, an Atlanta-based provider of software for hospital

emergency departments, snagged $15 million in Series A funding.

Transformation Capital led the round, which included participation

from First Round Capital and Threshold Ventures.

Genetika+, a Jerusalem- and Boston-based startup applying

personalized medicine to behavioral health, fetched a $10 million

Series A round. GreyBird Ventures led the funding, which included

support from Meron Capital, Jumpspeed Ventures and Sapir Venture

Partners.

Tech News

Americans are getting Covid-19 boosters -- no questions

asked

India aims to produce mRNA Covid vaccine this year

What science knows now about the risk of Covid-19 transmission

on planes

Pfizer's Covid-19 vaccine for kids may not be FDA authorized

before November

Around the Web

Mass General Brigham won't offer Biogen's new Alzheimer's drug.

(Boston Globe)

Pharmaceutical CEOs have a new top concern: recruiting and

keeping employees. (Endpoints News)

The tedious process of training computers to think about

medicine. (STAT News)

How exploiting a protective gene mutation might protect the

brain from Alzheimer's disease. (Fierce Biotech)

(END) Dow Jones Newswires

September 30, 2021 10:39 ET (14:39 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

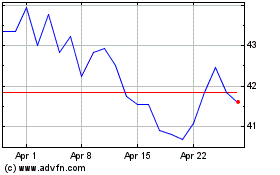

Ionis Pharmaceuticals (NASDAQ:IONS)

Historical Stock Chart

From Mar 2024 to Apr 2024

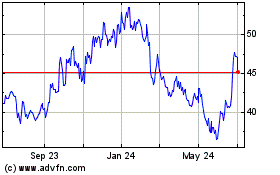

Ionis Pharmaceuticals (NASDAQ:IONS)

Historical Stock Chart

From Apr 2023 to Apr 2024