Intuit Needs Good Karma -- Heard on the Street

March 20 2021 - 10:29AM

Dow Jones News

By Dan Gallagher

Once again, an extension of tax season will tweak Intuit's

business flow. But the more important question facing the financial

software provider is who needs help -- and how much.

The Internal Revenue Service said Wednesday this year's tax

filing deadline for individuals has been extended to May 17. That

is a month later than normal and will likely push a big chunk of

revenue from TurboTax and the company's other tax-related services

into the fiscal fourth quarter that ends in July. Last year's

even-longer extension of the filing deadline to July 15 resulted in

24% of Intuit's full-fiscal-year revenue coming in the final

quarter, compared with an average of about 15% over the previous

six years.

A timing shift doesn't necessarily mean a loss of business.

Intuit actually raised its fiscal 2021 projection in its latest

earnings report on Feb. 23, when speculation was already swirling

about another filing deadline extension. Intuit's stock -- which

slipped initially on news of the IRS extension -- recovered and is

now up nearly 77% for the past 12 months. That has put the shares

at a historically high multiple of around 41 times forward

earnings.

That means investors still expect a lot from Intuit, regardless

of when taxes come due. The company projected full-year revenue

would grow in a range of 15% to 17% -- an acceleration relative to

the 13% growth posted for the previous two years. But much of that

acceleration appears to be due to Credit Karma, which Intuit

acquired in December. Intuit expects Credit Karma to add between

$545 million and $580 million in revenue this year. Without that

addition, the company's growth for the year would be in the range

of 8% to 10%, its slowest since fiscal 2015.

The Credit Karma deal was more than six times Intuit's

next-largest acquisition and was driven by the company's desire to

expand its financial service offerings to consumers. It also

absorbed a competitor that was providing free tax-preparation

services. Free remains a competitive threat to Intuit --

particularly if the federal government ever gets into the business

of allowing taxpayers to prepare and file directly without use of

middleman software.

But the bigger near-term question is whether Intuit can expand

its nontax business while also growing TurboTax beyond the

do-it-yourself crowd. A new "full-service" version of the TurboTax

Live service launched in December that allows users to connect

online with a tax professional for assistance with their filings.

The explosion of retail investing could give it a surprising lift;

Keith Weiss of Morgan Stanley says the creation of 8 million new

brokerage trading accounts in 2020 should give a boost to Intuit's

revenue per return "as filers with investment portfolios get pushed

to higher-priced [products]." Someone has to add up all those

capital gains on GameStop.

Write to Dan Gallagher at dan.gallagher@wsj.com

(END) Dow Jones Newswires

March 20, 2021 10:14 ET (14:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

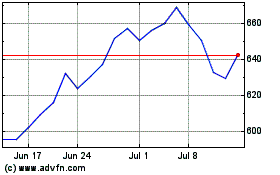

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Apr 2023 to Apr 2024