Credit Karma in Talks to Sell Tax-Preparation Business to Square

October 30 2020 - 10:44AM

Dow Jones News

By Peter Rudegeair and Cara Lombardo

Credit Karma Inc. is in talks to sell its tax-preparation

business to Square Inc., according to people familiar with the

matter, a move meant to head off potential antitrust objections to

the personal-finance portal's pending $7.1 billion sale to TurboTax

maker Intuit Inc.

Terms of the potential deal couldn't be learned. A sale of the

unit would require approval from the Justice Department, which is

concerned that bringing together Credit Karma's small but growing

tax-preparation business with industry-leading TurboTax would leave

taxpayers with fewer, and potentially pricier, e-filing options,

the people said.

Credit Karma, best known for its website and app where more than

100 million users look up their credit scores for free, expanded

into tax services via a 2016 acquisition. The San Francisco-based

company doesn't charge anything for the e-filing service; rather,

the income information Credit Karma gleans from users' taxes helps

it fine-tune its main business of recommending credit cards and

loans.

Square, the financial-technology company run by Twitter Inc.

Chief Executive Jack Dorsey, helps small businesses accept credit-

and debit-card payments. Credit Karma's tax business would augment

Square's Cash App offering, a bank-account alternative that lets

consumers transfer money and buy bitcoin from their

smartphones.

Do-it-yourself software has displaced accountants for many

American tax-filers. Nearly 72 million individuals prepared their

own taxes and filed them online for the 2020 season, a 25% increase

from 2019, according to Internal Revenue Service figures. The

number of returns prepared by tax professionals and filed online

fell slightly to about 80 million.

But online tax preparers have been criticized for not acting in

consumers' best interests. In a series of articles last year that

drew the attention of lawmakers, ProPublica reported that TurboTax

steered low-income taxpayers, who would have been eligible to file

their federal tax returns for free, into paid versions of its

software. An outside review commissioned by the IRS found that some

of the companies that participated in a program to prepare taxes

for millions of filers at no charge used coding that hid free

offerings from online searches.

The Justice Department's antitrust enforcers have focused their

attention on financial and technology companies. In recent weeks,

federal prosecutors filed a blockbuster antitrust lawsuit against

Google over its search-engine practices and lined up witnesses for

a potential lawsuit to block Visa Inc.'s $5.3 billion acquisition

of startup Plaid Inc.

The department needs to "take a fresh look at how new

technologies are changing the competitive dynamics in these

industries, particularly the financial-services industry that is

key to every American consumer and small business," Assistant

Attorney General Makan Delrahim told The Wall Street Journal in

August.

Credit Karma has spent recent months looking to find a buyer for

the tax business. Based on feedback from the government, Credit

Karma targeted potential bidders that have the financial

wherewithal and strategic vision to grow tax businesses, people

familiar with the matter said. Square appears to satisfy those

conditions.

Intuit executives have said that Credit Karma's large user base

and its tools to manage consumer borrowing and saving were the big

drivers of its takeover offer, not Credit Karma's tax-prep

business. Intuit's two personal-financial management offerings,

Mint and Turbo, have less than half as many users as Credit

Karma.

Brent Kendall contributed to this article.

(END) Dow Jones Newswires

October 30, 2020 10:29 ET (14:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

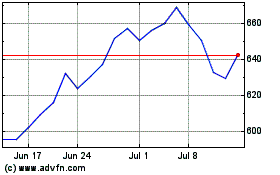

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Apr 2023 to Apr 2024