false

0001433607

0001433607

2024-12-10

2024-12-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 10, 2024

InspireMD,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35731

|

|

26-2123838 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification No.) |

6303

Waterford District Drive, Suite 215

Miami,

Florida 33126 |

|

6744832 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (888) 776-6804

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

NSPR |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02 Departure of Directors or Certain Officers; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On

December 12, 2024, InspireMD, Inc. (the “Company”) announced that Craig Shore has decided to retire from his role

as Chief Financial Officer of the Company, effective upon the appointment of his successor. Mr. Shore will continue to serve as the Company’s

Chief Financial Officer until a successor is appointed, after which he will assist with the transition to his successor to ensure a smooth

handover of responsibilities.

The

Company has initiated a search to identify its next Chief Financial Officer.

On

December 10, 2024, the Company and Mr. Shore entered into the ninth amendment (the “Shore Amendment”) to that certain

Amended and Restated Employment Agreement dated as of May 5, 2014, as amended on January 5, 2015, July 25, 2016, March 25, 2019, August

14, 2020, November 4, 2021, January 17, 2022, January 18, 2023 and April 1, 2024 (as amended, the “Shore Agreement”), in

order to amend certain terms relating to the termination of Mr. Shore’s employment in the event of a termination without Cause

(as defined in the Shore Agreement).

As

set forth in the Shore Amendment, in the event of a termination without Cause, Mr. Shore shall be entitled to (i) payments related

to any and all social, pension, retirement, profit-sharing, severance or similar compensatory benefits owed to and/or previously deposited

into the relevant accounts of or for the benefit of, Mr. Shore as of the date of termination plus (ii) a one-time lump sum severance

payment that shall include an amount equal to the sum of (A) 200% of Mr. Shore’s annual base salary, (B)

two times the annual cost of providing an automobile to Mr. Shore and (C) payments related to any and all social, pension, retirement,

profit-sharing, severance or similar compensatory benefits that the Company would have been obligated to pay had Mr. Shore remained employed

in the same position and at the same base salary for the 24 months immediately following the date of termination, as were in effect for

the 24 months immediately preceding the date of termination. In addition, to the fullest extent permitted by the Company’s

then-current benefit plans, Mr. Shore shall be entitled to continuation of health, dental, vision and life insurance coverage, (but not

pension, retirement, profit-sharing, severance or similar compensatory benefits), for Mr. Shore and his eligible dependents substantially

similar to coverage they were receiving or which they were entitled to immediately prior to the termination of Mr. Shore’s employment

for the lesser of twenty four months after termination or until Mr. Shore secures coverage from new employment.

Except

as amended by the Shore Amendment, all other provisions of the Shore Agreement remain in full force and effect.

The

forgoing descriptions of the Shore Amendment does not purport to be complete and is qualified in its entirety by the full text of the

Shore Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

This

Current Report on Form 8-K contains statements which constitute forward looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995 and other securities laws. These forward looking statements are based upon the Company’s present

intent, beliefs or expectations, but forward looking statements are not guaranteed to occur and may not occur for various reasons, including

some reasons which are beyond the Company’s control. For this reason, among others, you should not place undue reliance upon the

Company’s forward looking statements. Except as required by law, the Company undertakes no obligation to revise or update any forward

looking statements in order to reflect any event or circumstance that may arise after the date of this Current Report on Form 8-K.

Item

7.01. Regulation FD Disclosure.

On

December 12, 2024, the Company issued a press release titled “InspireMD Announces Expected Retirement of its CFO Craig Shore

and CFO Transition in 2025”. A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K

and incorporated by reference in this Item 7.01.

In

accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K that is furnished pursuant to

this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and

shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

INSPIREMD,

INC. |

| |

|

|

| Date:

December 12, 2024 |

By: |

/s/

Marvin Slosman |

| |

Name: |

Marvin Slosman |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.1

NINTH

AMENDMENT TO EMPLOYMENT AGREEMENT

This

NINTH AMENDMENT TO AMENDED AND RESTATED EMPLOYMENT AGREEMENT (this “Amendment”), is made and entered into as

of December 10, 2024, by and between Craig Shore (the “Executive”) and InspireMD, Inc., a Delaware Corporation

(the “Company”) for purposes of amending that certain Amended and Restated Employment Agreement dated as of

May 5, 2014, as amended on January 5, 2015, July 25, 2016, March 25, 2019, August 14, 2020, November 4, 2021, January 17, 2022, January

18, 2023, and April 1, 2024, by and between the Company and the Executive (the “Agreement”). Terms used in this Amendment

with initial capital letters that are not otherwise defined herein shall have the meanings ascribed to such terms in the Agreement.

WHEREAS,

section 7.5 of the Agreement provides that the parties to the Agreement may amend the Agreement in a writing signed by the parties; and

WHEREAS,

the Parties desire to amend the Agreement in certain respects;

NOW,

THEREFORE, pursuant to Section 7.5 of the Agreement, and for good and valuable consideration, the sufficiency of which is hereby

acknowledged, the Company and the Executive agree as follows:

1.

Section 5.1 of the Agreement, paragraphs (b) and (c), are hereby amended by deleting said paragraphs (b) and

(c) in their entirety and substituting in lieu thereof the following new Section 5.1, paragraphs (b) and (c):

(b)

(i) payments related to any and all social, pension, retirement, profit-sharing, severance or similar compensatory benefits, including

payments pursuant to the Policy (as defined in Section 3.5) and the Education Fund (as defined in Section 3.6), owed to and/or previously

deposited into the relevant accounts of or for the benefit of, the Executive as of the date of termination plus (ii) a one-time lump

sum severance payment that shall include an amount equal to the sum of (A) 200% of the Executive’s annual base

salary and (B) two times the annual cost to the Company of providing the automobile to the Executive (i.e. car allowance)

and (C) payments related to any and all social, pension, retirement, profit-sharing, severance or similar compensatory benefits, including

payments pursuant to the Policy and the Education Fund, which the Company would have been obligated to pay had the Executive remained

employed in the same position and at the same base salary for the 24 months immediately following the date of termination, as were in

effect for the 24 months immediately preceding the date of termination. The lump sum severance payment shall be paid on the Company’s

first payroll date after the Executive’s signing the release described in Section 5.4 and the expiration of any applicable revocation

period, subject, in the case of termination other than as a result of the Executive’s death, to Section 7.16; provided, however,

that in the event that the time period for return of the release and expiration of the applicable revocation period begins in one taxable

year and ends in a second taxable year, such payment shall not be made until the second taxable year if necessary to comply with Section

409A of the Code.

(c)

to the fullest extent permitted by the Company’s then-current benefit plans, continuation of health, dental, vision and life insurance

coverage, (but not pension, retirement, profit-sharing, severance or similar compensatory benefits), for the Executive and the Executive’s

eligible dependents substantially similar to coverage they were receiving or which they were entitled to immediately prior to the termination

of the Executive’s employment for the lesser of 24 months after termination or until the Executive secures coverage from new employment.

The period of COBRA health care continuation coverage provided under Section 4980B of the Code shall run concurrently with the foregoing

24-month period. In order to receive such benefits, the Executive or his eligible dependents must continue to make any required co-payments,

deductibles, premium sharing or other cost-splitting arrangements the Executive was otherwise paying immediately prior to the date of

termination and nothing herein shall require the Company to be responsible for such items. If the Executive is a “specified employee”

under Section 409A, the full cost of the continuation or provision of employee group welfare benefits (other than medical or dental benefits)

shall be paid by the Executive until the earliest to occur of (i) the Executive’s death or (ii) the first day of the seventh month

following the Executive’s termination of employment, and such cost shall be reimbursed by the Company to, or on behalf of, the

Executive in a lump sum cash payment on the earlier to occur of the Executive’s death or the first day of the seventh month following

the Executive’s termination of employment, except that, as provided above, the Executive shall not receive reimbursement for any

required co-payments, deductibles, premium sharing or other cost-splitting arrangements the Executive was otherwise paying immediately

prior to the date of termination.

[Remainder

of Page Intentionally Left Blank;

Signature

Page Follows.]

IN

WITNESS WHEREOF, the Parties have executed this Amendment to Employment Agreement as of the date first set forth above.

| THE

COMPANY: |

|

| |

|

| INSPIREMD,

INC. |

|

| |

|

|

| By: |

/s/

Paul Stuka |

|

| Name: |

Paul

Stuka |

|

| Title: |

Chairman

of the Board |

|

| |

|

|

THE

EXECUTIVE:

|

|

| |

|

| /s/

Craig Shore |

|

| Craig

Shore, an individual |

|

Exhibit 99.1

InspireMD

Announces Expected Retirement of its CFO Craig Shore

and CFO Transition in 2025

Miami,

Florida — December 12, 2024 – InspireMD, Inc. (Nasdaq: NSPR), developer of the CGuard™ Embolic Prevention

Stent System (EPS) for the prevention of stroke, today announced that Craig Shore, Chief Financial Officer, has decided to retire from

the Company after a successor CFO is identified and appointed. Mr. Shore will remain as CFO until his successor is appointed and will

assist in a smooth and orderly transition.

Marvin

Slosman, Chief Executive Officer of InspireMD, commented, “Craig has served the company for 15 years with a tireless commitment

to building our business as a global leader in carotid interventions. As we advance our priorities, including potential

U.S. FDA approval in the first half of 2025, along with a heightened focus on the investment community, Craig made this decision confident

in the future of the company and understanding the needs of a growing global business. On behalf of the entire InspireMD organization

and Board of Directors, I would like to thank Craig for his contribution to our success for the past 15 years. It has been a pleasure

working alongside Craig for the past five of those years, and I look forward to him continuing to be a part of our team during this important

transition.”

“It

has been a tremendous opportunity to contribute to the transformation of InspireMD from an early-stage growth company to a maturing leader

in the field of carotid intervention and stroke prevention. The next chapter for the company will be an exciting time as the business

grows and I have full faith in the pathway to success. I look forward to my personal next chapter and proud to have been a part of this

remarkable journey,” noted Mr. Shore.

The

Company has initiated a search to identify its next Chief Financial Officer.

About

InspireMD, Inc.

InspireMD

seeks to utilize its proprietary MicroNet® technology to make its products the industry standard for carotid stenting by providing

outstanding acute results and durable, stroke-free long-term outcomes. InspireMD’s common stock is quoted on the Nasdaq under the

ticker symbol NSPR.

We

routinely post information that may be important to investors on our website. For more information, please visit www.inspiremd.com.

Forward-looking

Statements

This

press release contains “forward-looking statements.” Forward-looking statements include, but are not limited to, statements

regarding InspireMD or its management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. Such

statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,”

“anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,”

“hopes,” “potential”, “scheduled” or similar words. Forward-looking statements include, but are not

limited to, statements regarding InspireMD or its management team’s or directors’ expectations, hopes, beliefs, intentions

or strategies regarding future events, future financial performance, strategies, expectations, competitive environment and regulation,

including potential U.S. commercial launch. Forward-looking statements are not guarantees of future performance, are based on certain

assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the company’s control,

and cannot be predicted or quantified and consequently; actual results may differ materially from those expressed or implied by such

forward-looking statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with our history

of recurring losses and negative cash flows from operating activities, significant future commitments and the uncertainty regarding the

adequacy of our liquidity to pursue our complete business objectives, and substantial doubt regarding our ability to continue as a going

concern; our need to raise additional capital to meet our business requirements in the future and such capital raising may be costly

or difficult to obtain and could dilute our stockholders’ ownership interests; market acceptance of our products; an inability

to secure and maintain regulatory approvals for the sale of our products; negative clinical trial results or lengthy product delays in

key markets; our ability to maintain compliance with the Nasdaq listing standards; our ability to generate revenues from our products

and obtain and maintain regulatory approvals for our products; our ability to adequately protect our intellectual property; our dependence

on a single manufacturing facility and our ability to comply with stringent manufacturing quality standards and to increase production

as necessary; the risk that the data collected from our current and planned clinical trials may not be sufficient to demonstrate that

our technology is an attractive alternative to other procedures and products; intense competition in our industry, with competitors having

substantially greater financial, technological, research and development, regulatory and clinical, manufacturing, marketing and sales,

distribution and personnel resources than we do; entry of new competitors and products and potential technological obsolescence of our

products; inability to carry out research, development and commercialization plans; loss of a key customer or supplier; technical problems

with our research and products and potential product liability claims; product malfunctions; price increases for supplies and components;

insufficient or inadequate reimbursement by governmental and other third-party payers for our products; our efforts to successfully obtain

and maintain intellectual property protection covering our products, which may not be successful; adverse federal, state and local government

regulation, in the United States, Europe or Israel and other foreign jurisdictions; the fact that we conduct business in multiple foreign

jurisdictions, exposing us to foreign currency exchange rate fluctuations, logistical and communications challenges, burdens and costs

of compliance with foreign laws and political and economic instability in each jurisdiction; the escalation of hostilities in Israel,

which could impair our ability to manufacture our products; and current or future unfavorable economic and market conditions and adverse

developments with respect to financial institutions and associated liquidity risk. More detailed information about the Company and the

risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities

and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors

and security holders are urged to read these documents free of charge on the SEC’s web site at http://www.sec.gov. The Company

assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise.

Investor

Contacts:

Craig

Shore

Chief

Financial Officer

InspireMD,

Inc.

888-776-6804

craigs@inspiremd.com

Chuck

Padala, Managing Director

LifeSci

Advisors

646-627-8390

chuck@lifesciadvisors.com

investor-relations@inspiremd.com

v3.24.3

Cover

|

Dec. 10, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 10, 2024

|

| Entity File Number |

001-35731

|

| Entity Registrant Name |

InspireMD,

Inc.

|

| Entity Central Index Key |

0001433607

|

| Entity Tax Identification Number |

26-2123838

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

6303

Waterford District Drive

|

| Entity Address, Address Line Two |

Suite 215

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

6744832

|

| City Area Code |

(888)

|

| Local Phone Number |

776-6804

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

NSPR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

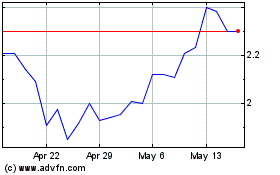

InspireMD (NASDAQ:NSPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

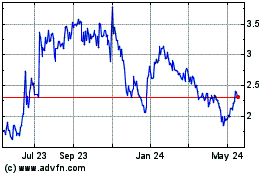

InspireMD (NASDAQ:NSPR)

Historical Stock Chart

From Dec 2023 to Dec 2024